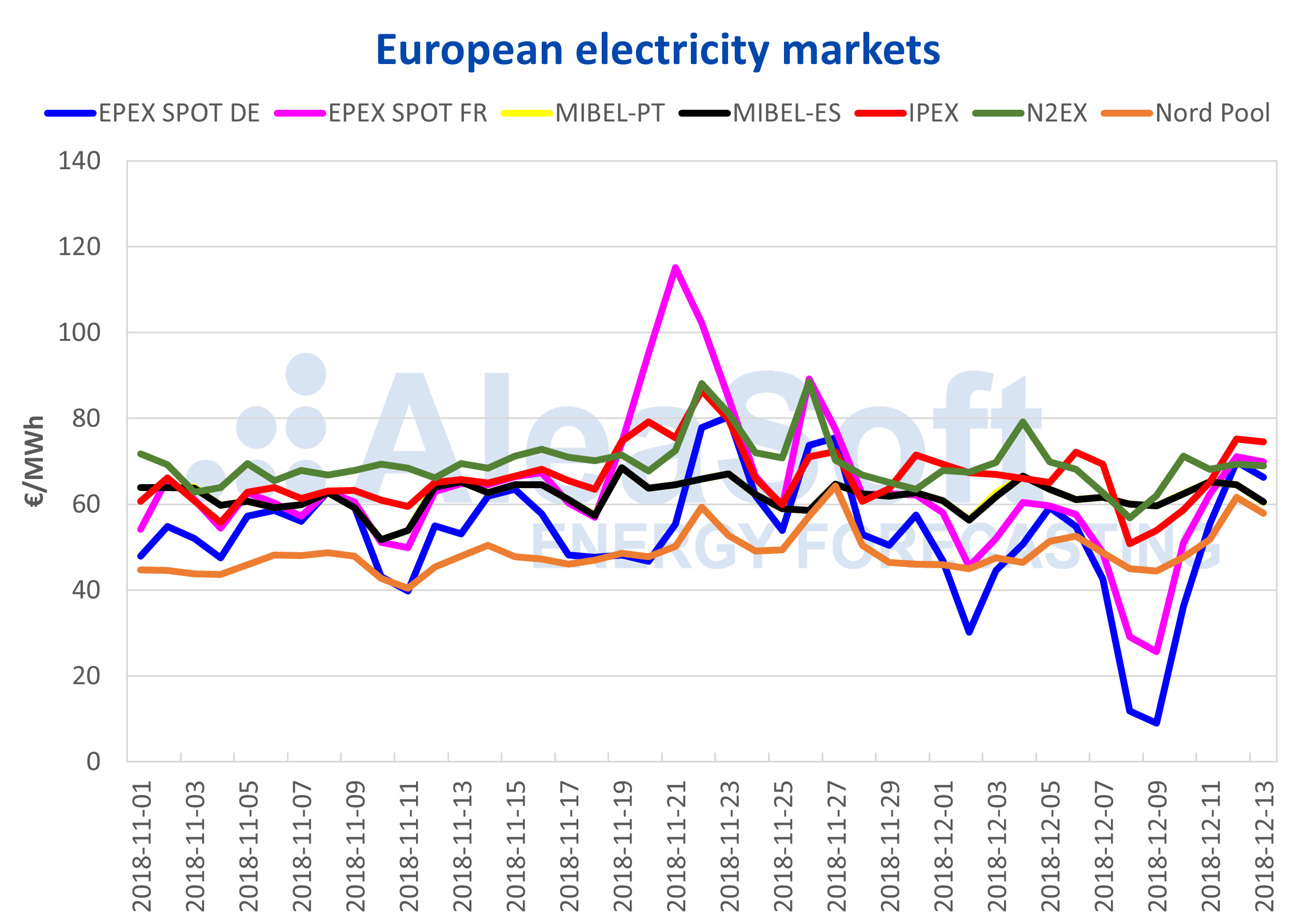

AleaSoft, December 13, 2018. Last Sunday, negative prices were recorded in the early morning hours in the wholesale electricity market in Germany due to record wind energy production. Meanwhile, in the rest of the European markets, except in France and the Nordic countries, prices remained relatively high. In the Iberian Peninsula, the strong winds arrive this Thursday, although the price decrease was very timid.

Last Sunday, December 9, Germany’s EPEX SPOT electricity market recorded negative prices between midnight and 10:00. Prices reached ‑16.62 €/MWh between 6:00 and 7:00; such a low price was not seen since May 21 this year. A typically low electricity demand on a Sunday encountered a record wind energy production of more than 1 TWh on Saturday, and 887 GWh on Sunday. According to data from AleaSoft, wind energy production on Saturday exceeded by 100 GWh the highest value to date registered on January 3 of this year, while the value of Sunday is ranked as the third highest wind energy production of the historical records.

The French market also recorded a significant drop in the price during the weekend, dragged by the German market to which it is very coupled. But in this case, it missed out on negative prices. The lowest price during the weekend was 1.82 €/MWh during the early hours of Sunday. However, since Wednesday, both the French and German markets have been in the high price band of European markets, around 70 €/MWh.

The rest of the European markets remained around 60‑70 €/MWh in the last seven days, with the usual exception of Nord Pool market of Nordic countries that remained around 50 €/MWh, and although since Wednesday 12 it has risen to 60 €/MWh, it has been the market with the lowest price of the main European markets.

Sources: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The stabilization of the price of Brent oil seems increasingly firm, and since the end of November the price of the future for February has been maintained above $59 per barrel. The agreements of producing countries to reduce production from January could bring increases in the price for next year. Although a production above the expected demand for the first quarter may start the year with decreases in the price.

Fossil fuels

After last week’s decline of 3.9% of the price of the European gas TTF future for January, the price is recovering this week due to the forecasts of temperatures below the usual in most of the continent. Although stock is estimated to be more than enough to cover the increase in demand, the arrival of a cold front always puts market agents on alert and is usually reflected in price increases. For its part, the price of the European API2 coal continues its upward trend since the end of November, and rises 1.6% this week, helped also by the gas upturn.

Carbon emission rights

The price of CO2 emission rights has been three weeks fluctuating around 20 €/t. Yesterday, Wednesday 13, the ton of emitted gas was settled above 21 €, specifically 21.47€ in the EEX market. The barrier of 21 €/t was not exceeded since October 8.

Looking ahead, forecasts of the evolution of the price of emission rights are characterised by the uncertainty that accompanies the UK’s withdrawal from the European Union. If the UK finally abandons the European emissions market without an agreement, the price could fall due to an excess of available rights.

Spain

This week is characterised by the high wind energy production in the Iberian Peninsula. On Thursday 13, a production of 280 GWh is expected, which led to a slight decrease in the price of the Iberian market for Spain, which stood at 60.55 €/MWh, the lowest price among the main European markets, with the exception of the Nord Pool. Even so, it was a very timid drop taking into account the amount of expected wind energy production, but it must be taken into account that electricity will be exported to France at full capacity of the interconnection for several hours. With respect to last week, AleaSoft’s forecasts point to an increase in wind energy production of 61.6% for this week.

For next week, from December 17, forecasts show a drop in temperature of up to 5°C, which would set them about 2°C below the typical temperature for this time of year. With this drop in temperatures, AleaSoft’s demand forecasts for next week indicate a 3.0% increase in electricity consumption.

Regarding solar production, which includes both photovoltaic and solar thermal, AleaSoft’s forecasts indicate that for next week, from December 17, production will rise 54.1% compared to this week’s production, which in AleaSoft is estimated to end up with 23.6% less production than the previous week.

Sources: Prepared by AleaSoft using data from REE.