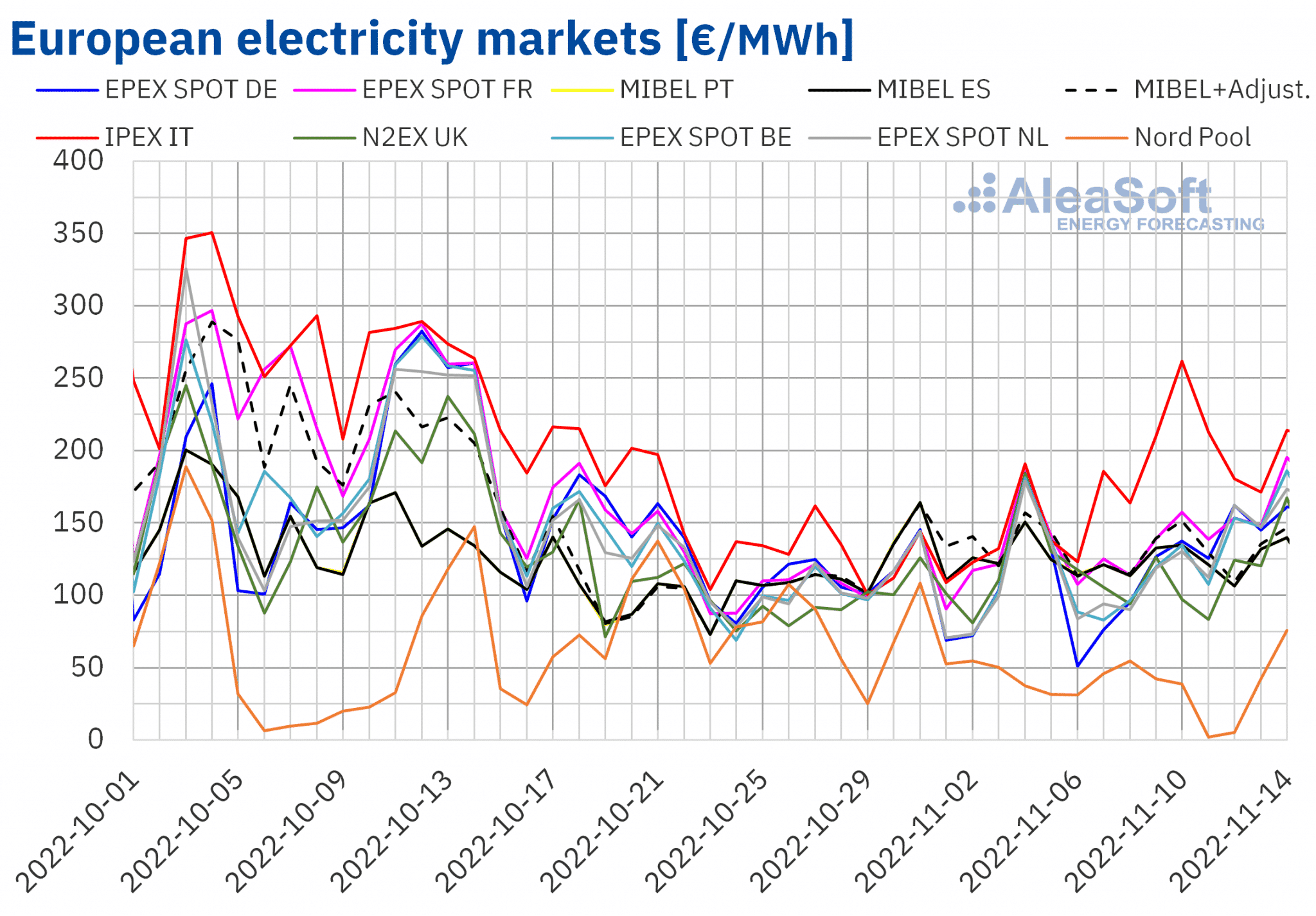

AleaSoft Energy Forecasting, November 14, 2022. In the second week of November, prices of most European electricity markets increased, with the highest rise being that of the IPEX market, of 44%, while decreases were registered in the MIBEL, N2EX and Nord Pool markets, with the largest decrease being that of the Nordic market, of 37%. However, in several markets there were hours with negative or close‑to‑zero prices and in the Nordic market the price of November 11 was the lowest since November 22, 2020.

European electricity markets

In the week of November 7, prices of most European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. However, in the MIBEL market of Spain and Portugal and in the N2EX market of the United Kingdom, decreases of 5.5%, 5.6% and 12%, respectively, were registered. But the largest drop in prices, of 37%, was that of the Nord Pool market of the Nordic countries. On the other hand, the largest increase was that of the IPEX market of Italy, of 44%. In the rest of the markets, the price increases were between 5.5% of the EPEX SPOT market of Belgium and 14% of the EPEX SPOT market of Germany.

In the second week of November, the highest average market price, of €197.95/MWh, was that of the Italian market. On the other hand, the lowest weekly average was that of the Nordic market, of €32.96/MWh. In the rest of the markets, prices were between €107.23/MWh of the British market and €139.29/MWh of the French market.

Regarding hourly prices, on November 11, between 4:00 and 5:00, a price of €0.01/MWh was reached in the Nord Pool market. This hourly price was repeated three times in the early hours of the 12th. But, between 2:00 and 3:00, the Nordic market price was even lower, of €0.00/MWh, a value that was not registered in that market since October 6 of this year. On the other hand, the price for the first three hours of November 7 was €0.09/MWh in the markets of Germany, Belgium and the Netherlands. In this last market, the price of November 11 between 4:00 and 5:00 was even lower, of €0.04/MWh. That day, from 2:00 to 3:00, a price of £0.00/MWh was registered in the British market. In addition, in four hours of the early morning of Friday, November 11, negative prices were reached in the N2EX market. The minimum price, of ‑£17.07/MWh, was registered between 5:00 and 6:00 and was the lowest in that market since January 3, 2022.

In the case of daily prices, in the Nordic market, the price of November 11, of €2.00/MWh, was the lowest since November 22, 2020.

During the week of November 7, the 55% rise in the weekly average price of TTF gas in the spot market compared to the previous week exerted its upward influence on European electricity markets prices. The increase in electricity demand in almost all markets also contributed to the price increases registered in most cases. However, in Great Britain, the electricity demand fell, favouring the decline in N2EX market prices. On the other hand, the decrease in wind energy production in the Italian and French markets contributed to the fact that the highest weekly average prices were registered in these markets, while the increase in Iberian wind energy production favoured the decrease in prices in the MIBEL market. In addition, on November 5, the Almaraz II nuclear power plant was reconnected to the Spanish electricity grid, after its twenty‑seventh refuelling. As a consequence, the nuclear energy production increased by 18% compared to the previous week. This also exerted its downward influence on MIBEL market prices in the second week of November.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the third week of November, prices might increase in most markets, influenced by increases in demand, as well as decreases in solar energy production in markets such as Germany and Italy. However, prices might fall in the MIBEL market, where significant increases in wind energy production are expected.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

On next November 24, the 27th edition of the monthly webinars of AleaSoft Energy Forecasting and AleaGreen will take place. The speakers will be Oriol Saltó i Bauzà, Associate Partner at AleaGreen and Jaime Vázquez, Director, PPA & Finance at Soto Solar. Antonio Delgado Rigal, CEO of AleaSoft, and Tomás García, Senior Director, Energy & Infrastructure Advisory at JLL, will also participate in the analysis table that takes place in the second part of the webinar in Spanish.

The webinar will analyse the evolution of the European energy markets in recent weeks and the outlook for winter 2022‑2023. The current situation and trends in the renewable energy projects financing will also be analysed, comparing PPA with full merchant projects.

Source: AleaSoft Energy Forecasting.