AleaSoft Energy Forecasting, November 4, 2025. Prices rose in October in most major European electricity markets, exceeding €75/MWh and remaining above September levels. In the Iberian market, the monthly price reached its highest level since March. The increase in electricity demand and the rise in CO2 prices, which registered their highest monthly average since December 2023, drove this upward trend. In contrast, gas and Brent oil futures fell to their lowest monthly averages since May 2024 and March 2021, respectively. Meanwhile, photovoltaic and wind energy reached production records for an October month in most markets.

Solar photovoltaic and wind energy production

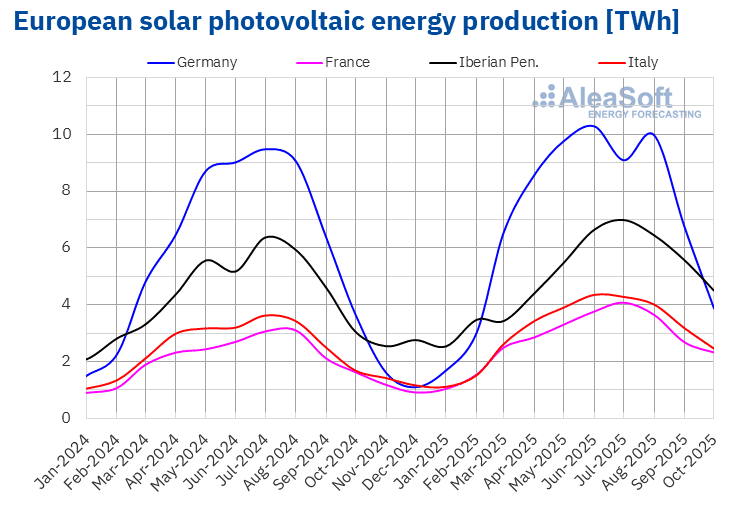

In October 2025, solar photovoltaic energy production increased in the main European markets compared to the same month of the previous year. Portugal registered the largest rise, 56%, followed by Spain with 47%. France and Italy showed year‑on‑year growths of 42% and 46%, respectively. The German market registered the smallest increase, 6.3%.

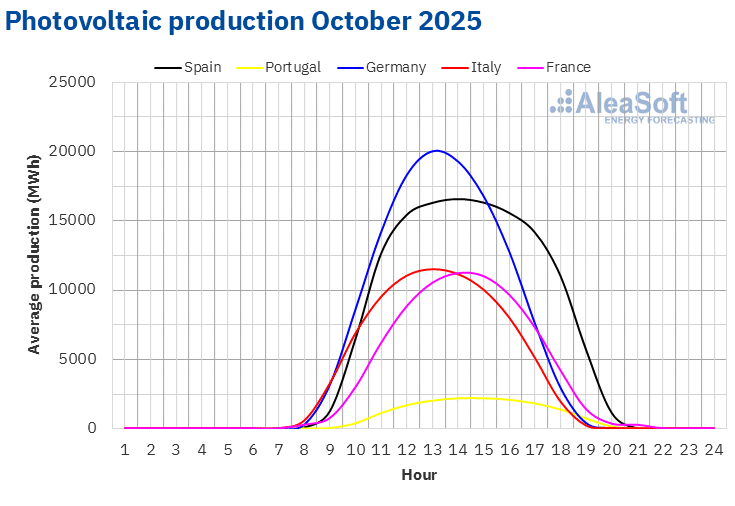

Compared to September 2025, solar photovoltaic energy production decreased in October in the main European electricity markets due to the reduction in sunlight hours and solar irradiation, typical of the autumn months. The German market registered the largest month‑on‑month drop, 44%, while the French market registered the smallest, 16%. In Spain and Portugal, photovoltaic energy generation fell by 22% in both markets, while in Italy it decreased by 25%.

The main European markets registered historical records of solar photovoltaic energy production for an October month. Spain registered the highest production, 3992 GWh, followed by Germany with 3865 GWh. Italy, France and Portugal generated 2464 GWh, 2323 GWh and 497 GWh, respectively.

The year‑on‑year increase in photovoltaic energy generation was associated with greater installed capacity. According to data from Red Eléctrica, between October 2024 and October 2025 the Spanish market added 6635 MW of solar photovoltaic energy capacity. During the same period, the Portuguese market added 998 MW to the system, according to data from REN.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

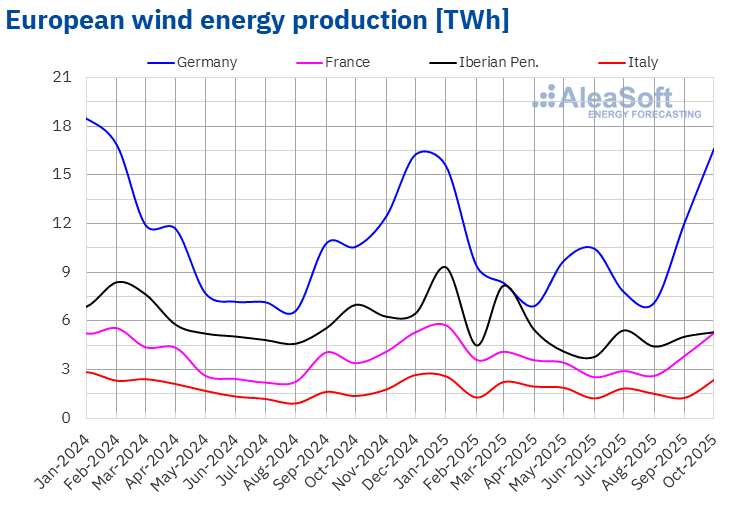

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.Wind energy production increased in October 2025 in most major European markets compared to October 2024. Italy registered the largest increase, 72%, while France and Germany registered growths of 55% and 57%, respectively. The Iberian Peninsula was the exception, with decreases of 22% in Spain and 32% in Portugal.

Compared to the previous month, wind energy production also increased in most major European electricity markets. Italy registered the largest rise, 81%, followed by Germany with 33% and France with 32%. In this comparison, Spain registered the smallest increase, 6.8%, while Portugal registered a 15% drop.

In October 2025, three of the analysed markets registered historical records of wind energy production for an October month. The German market generated 16 630 GWh, the French market 5254 GWh and the Italian market 2351 GWh.

According to data from Red Eléctrica, between October 2024 and October 2025, the Spanish market increased its wind energy capacity by 1192 MW. The Portuguese market added 39 MW to the system during the same period, according to data from REN.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.Electricity demand

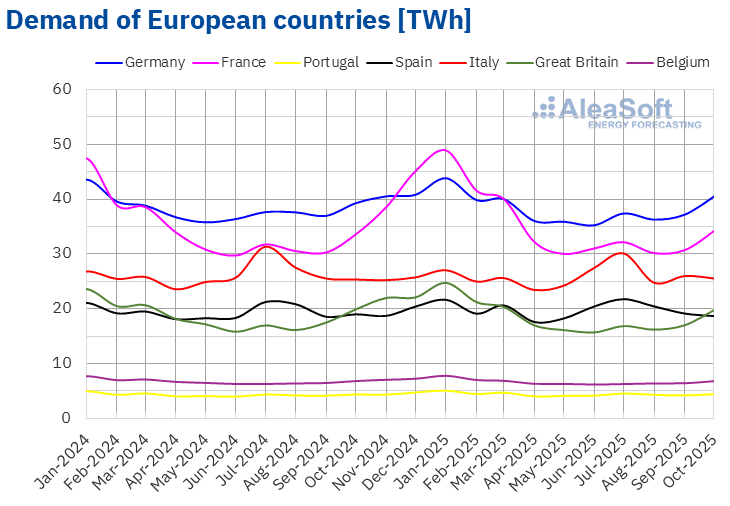

In October 2025, electricity demand increased in most major European electricity markets compared to the same month of the previous year. The German market registered the largest increase, 3.1%, while the Italian market registered the smallest, 0.8%. The Portuguese and French markets registered increases of 1.5% and 1.8%, respectively. On the other hand, demand fell in Spain, Great Britain and Belgium on a year‑on‑year basis. The Spanish market registered the largest decrease, 1.8%, while the British and Belgian markets showed declines of 0.6% and 0.3%, respectively.

Compared to September 2025, demand also increased in most major European electricity markets. Great Britain registered the largest rise, 12%, while Portugal showed the smallest, 1.7%. The Belgian, German and French markets registered increases ranging between 2.7% in Belgium and 7.7% in France. In contrast, demand fell by 4.8% in Italy and by 5.7% in Spain.

Average temperatures decreased compared to the same month of 2024 in Great Britain, Belgium, France, Germany and Italy, with falls ranging from 0.2 °C in Great Britain to 2.0 °C in Italy. In contrast, the Iberian Peninsula registered increases of 0.7 °C in Spain and 1.2 °C in Portugal.

On the other hand, average temperatures in October were lower than the previous month in all analysed markets. Portugal registered the smallest drop, 2.0 °C, and Italy the largest, 5.6°C. In the rest of the markets, the decreases in average temperatures compared to the previous month ranged between 2.4 °C in Great Britain and 5.0 °C in Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.European electricity markets

In October 2025, the monthly average price was above €75/MWh in most major European electricity markets. The exceptions were the Nord Pool market of the Nordic countries and the EPEX SPOT market of France, with averages of €39.00/MWh and €57.47/MWh, respectively. The IPEX market of Italy registered the highest monthly price, €111.04/MWh. In the rest of the European electricity markets analysed at AleaSoft Energy Forecasting, averages ranged between €75.07/MWh in the EPEX SPOT market of Belgium and €84.40/MWh in the EPEX SPOT market of Germany.

Compared to September, average prices increased in most European electricity markets analysed at AleaSoft Energy Forecasting. The Nordic market was the exception, with a 0.9% decrease. The German and Italian markets registered the smallest rises, 1.1% and 1.8%, respectively. In contrast, the French market registered the largest percentage price increase, 65%. In the rest of the markets, prices rose between 4.8% in the N2EX market of the United Kingdom and 25% in the MIBEL market of Portugal.

When comparing the average prices of October with those registered in the same month of 2024, prices fell in most markets. The Iberian and Nordic markets were the exceptions, with increases of 10% and 63%, respectively. On the other hand, the British market registered the largest percentage price drop, 20%. In the rest of the markets, price declines ranged between 2.0% in Germany and 7.2% in France.

The Spanish and Portuguese markets reached their highest monthly prices since March.

In October 2025, the increase in CO2 emission allowance prices compared to the previous month, the rise in demand in most markets and the decline in solar energy production contributed to the rise in European electricity market prices.

On the other hand, the fall in gas prices and the increase in solar energy production in October 2025 compared to October 2024 contributed to the year‑on‑year price decreases in most European electricity markets. Moreover, electricity demand fell in some markets and, in the German, French and Italian markets, wind energy production increased compared to October 2024.

Brent, fuels and CO2

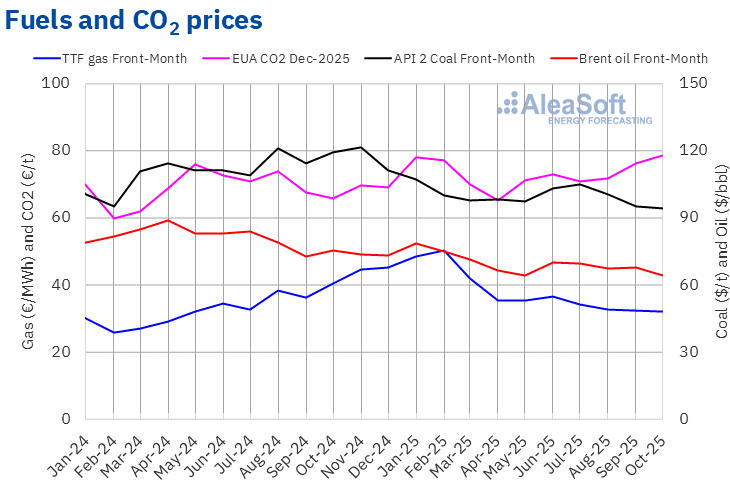

Brent oil futures for the Front‑Month in the ICE market registered a monthly average price of $63.95/bbl in October 2025. According to data analysed at AleaSoft Energy Forecasting, this was the lowest monthly average since March 2021. This value was 5.4% lower than that of the Front‑Month futures in September 2025, $67.58/bbl, and 15% lower than the value of the Front‑Month futures traded in October 2024, $75.38/bbl.

Concerns about demand evolution, as well as OPEC+ production increases, continued to exert downward pressure on Brent oil futures prices in October. The easing of tensions in the Middle East and the resumption of oil exports from Kurdistan also contributed to the decline in prices. However, in the last weeks of the month, the approval of a new European Union sanctions package against Russia, the US sanctions on Russian oil companies, the announcement of the intention to increase US strategic oil reserves and the improvement in relations between China and the United States limited the drop in the monthly average.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during October 2025 was €31.92/MWh. According to data analysed at AleaSoft Energy Forecasting, this was the lowest monthly average since May 2024. Compared to the average of the Front‑Month futures traded in September, €32.33/MWh, the October average fell by 1.3%. Compared to October 2024, when the average price was €40.42/MWh, the average for October 2025 decreased by 21%.

In October, abundant supply and high levels of European reserves led to lower TTF gas futures prices. However, the damage caused by the war to Ukrainian gas infrastructure, which could lead to an increase in European gas exports to Ukraine during the winter, as well as the approval by the European Union of a sanctions package against Russia, including a ban on Russian liquefied natural gas imports from 2027, limited the price decline. In the last week of the month, maintenance work in Norway affected gas flows from this country, which also helped to reduce the fall in the monthly average.

Regarding CO₂ emission allowance futures in the EEX market for the reference contract of December 2025, the average price in October was €78.55/t. According to data analysed at AleaSoft Energy Forecasting, this was the highest monthly average since December 2023. The October average increased by 3.1% compared to September, when the average was €76.20/t. Compared to October 2024, when the average was €65.94/t, the October 2025 average was 19% higher.

AleaSoft Energy Forecasting’s analysis on the prospects for energy storage

AleaSoft Energy Forecasting’s AleaStorage division provides forecasting reports for energy storage projects. AleaStorage services include revenue and profitability calculations, as well as the sizing of optimal storage in hybrid systems. AleaStorage has developed successful cases in long‑term revenue calculation for stand‑alone batteries and hybrid systems, mainly for photovoltaic energy with batteries.

Source: AleaSoft Energy Forecasting.