AleaSoft, 5 de octubre de 2020. El mes de octubre comenzó con un aumento de la producción eólica en la mayoría de los mercados eléctricos europeos que hizo bajar los precios en gran parte de ellos. En esta primera semana del mes la demanda eléctrica subió en la mayoría de mercados y los precios del Brent bajaron hasta niveles de mayo. En la segunda semana de octubre se espera un importante incremento de la producción eólica en Alemania y Francia lo que favorecerá que vuelvan a bajar los precios en gran parte de los mercados.

Producción solar fotovoltaica y termosolar y producción eólica

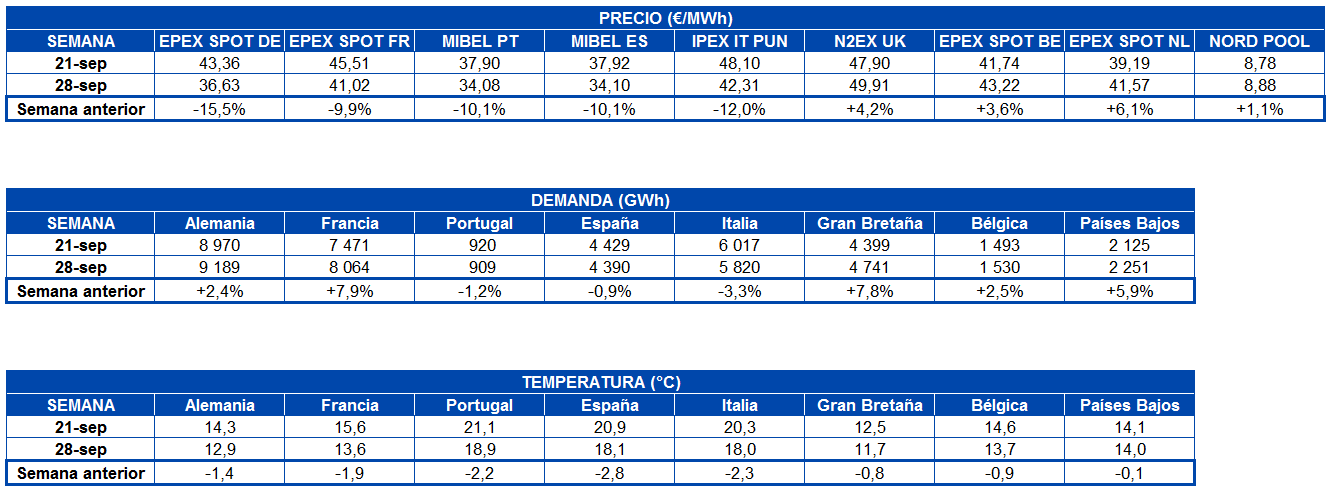

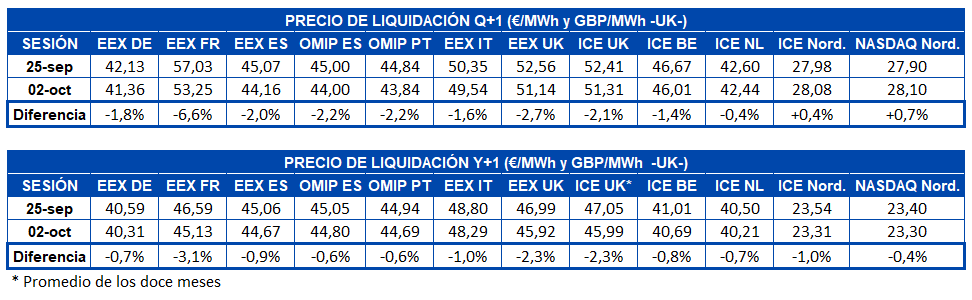

La semana del 28 septiembre al 4 de octubre terminó con una producción solar un 15% más baja que la de la semana que le antecedió en el mercado alemán. Así mismo, en el mercado francés la producción cayó un 7,1%, mientras que en la península ibérica se redujo un 5,8%. La excepción fue el mercado italiano en el que se registró un aumento del 4,0%.

Durante los primeros cuatro días de octubre, la producción solar aumentó un 46% en el mercado alemán con respecto a los mismos días de 2019. En el mercado español se registró un ligero aumento del 1,8%. Por el contrario, en el mercado francés la producción se redujo un 24%, mientras que en los mercados portugués e italiano disminuyó un 12% en cada caso.

Para la semana que comenzó el 5 de octubre, las previsiones de producción solar de AleaSoft indican que la producción solar disminuirá en España, Italia y Alemania.

Fuente: Elaborado por AleaSoft con datos de ENTSO-E, RTE, REN, REE y TERNA.

Fuente: Elaborado por AleaSoft con datos de ENTSO-E, RTE, REN, REE y TERNA. Fuente: Elaborado por AleaSoft con datos de ENTSO-E, RTE, REN, REE y TERNA.

Fuente: Elaborado por AleaSoft con datos de ENTSO-E, RTE, REN, REE y TERNA.

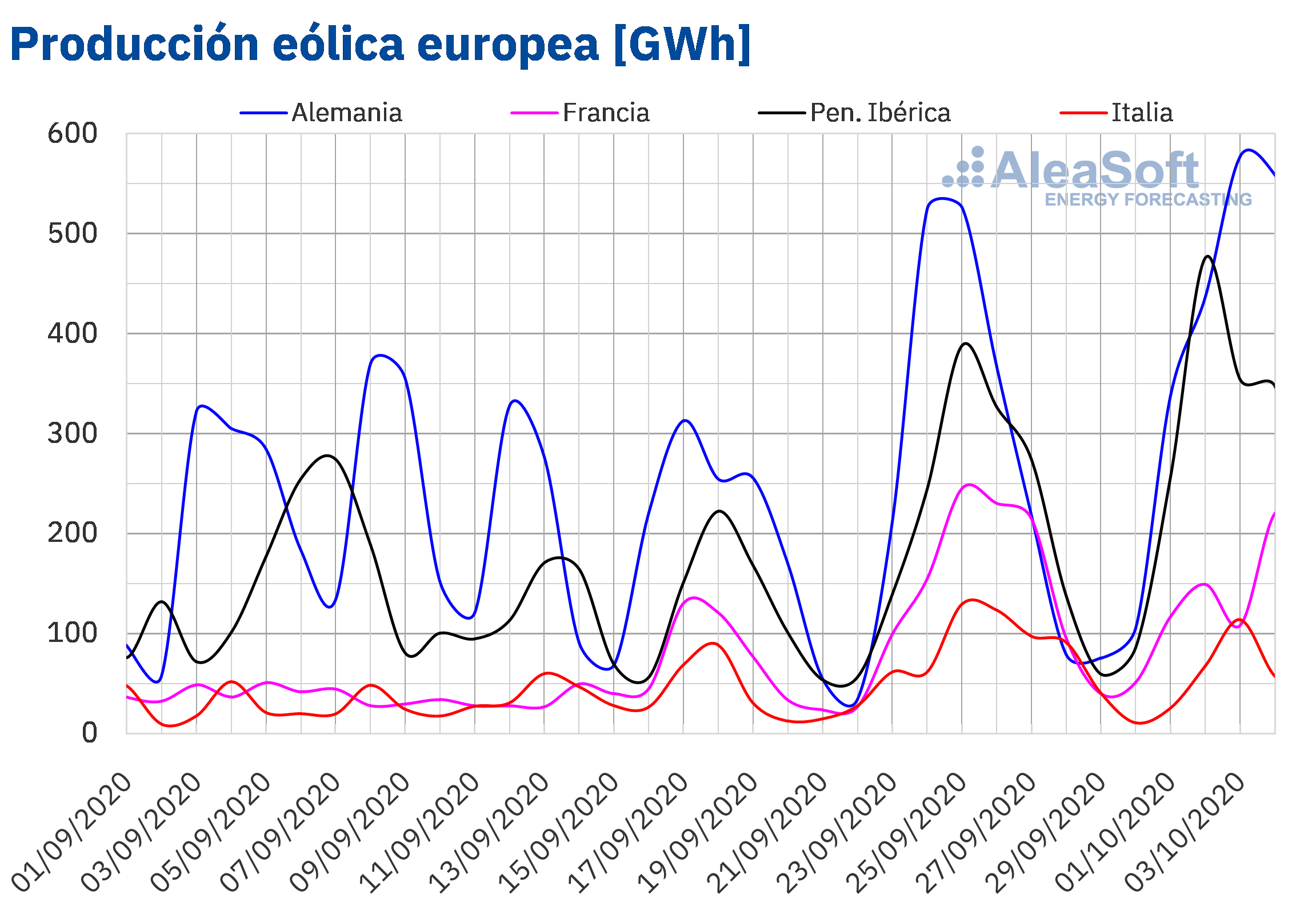

Durante la semana del 28 de septiembre la producción eólica aumentó un 33% en el mercado portugués, un 13% en el mercado español y un 12% en el mercado alemán, en comparación con la cuarta semana de septiembre. Por el contrario, en los mercados de Francia e Italia la producción con esta tecnología se redujo un 21% en ambos casos.

En el análisis interanual se registró un incremento de la producción en la mayoría de los mercados analizados en AleaSoft durante los primeros cuatro días de octubre. En la península ibérica la producción durante ese período fue un 153% mayor que la de los mismos días del año 2019, mientras que en los mercados de Alemania y Francia la producción con esa tecnología creció un 58% y un 33% respectivamente. La excepción fue el mercado italiano en el que la producción eólica disminuyó un 8,6%.

Para la semana que comenzó el 5 de octubre, las previsiones de producción eólica de AleaSoft indican un importante aumento de la producción en Alemania y también se espera un incremento en Francia. Por el contrario se prevé que en el resto de los mercados disminuya en comparación con la semana anterior.

Fuente: Elaborado por AleaSoft con datos de ENTSO-E, RTE, REN, REE y TERNA.

Fuente: Elaborado por AleaSoft con datos de ENTSO-E, RTE, REN, REE y TERNA.

Demanda eléctrica

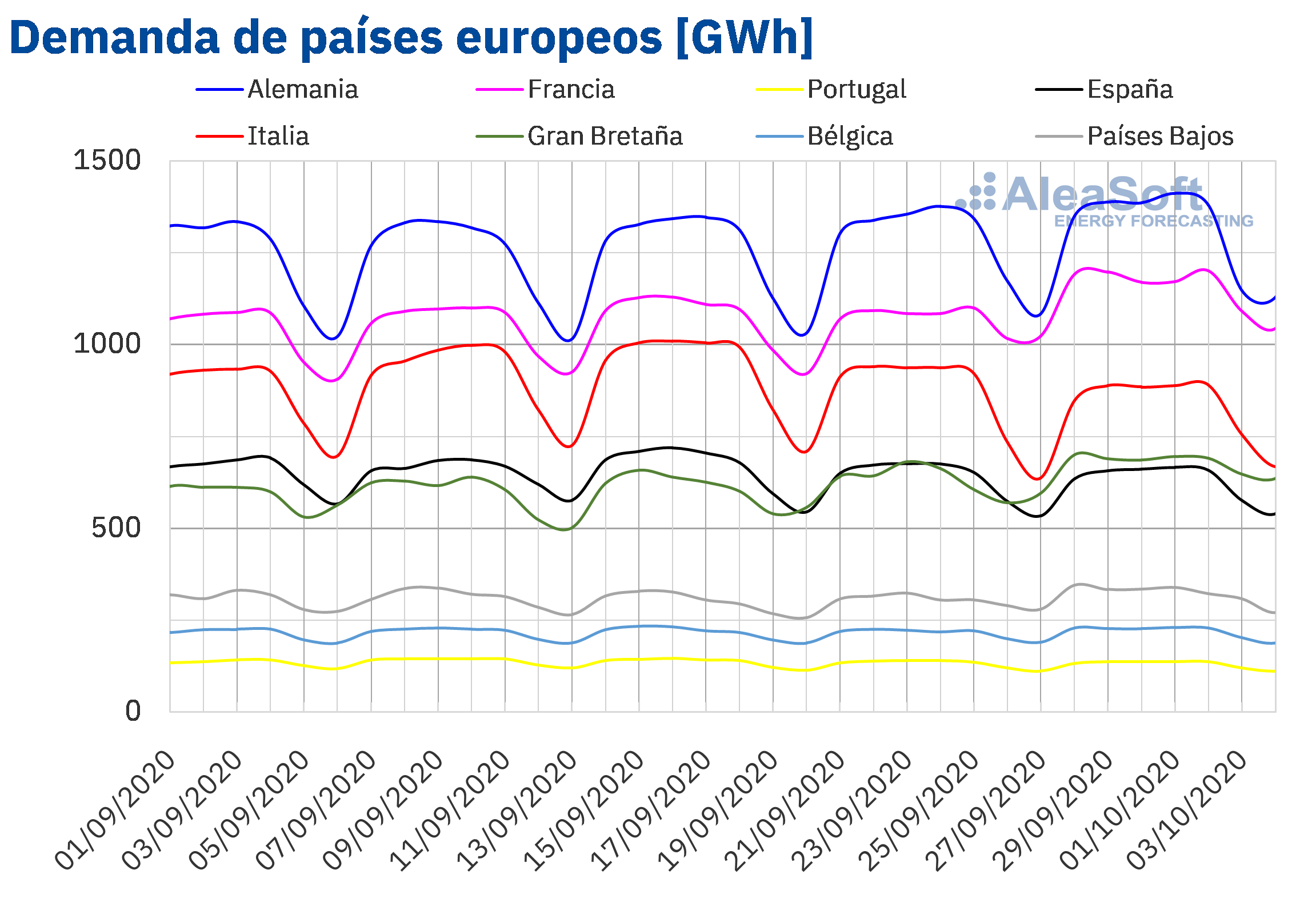

La demanda eléctrica mostró signos de recuperación en la mayoría de los mercados de Europa durante la semana del 28 de septiembre respecto a la semana anterior. Los mayores incrementos se registraron en los mercados de Francia y Gran Bretaña, con ascensos del 7,9% y 7,8% respectivamente. En los mercados de Alemania y Bélgica las subidas porcentuales estuvieron en el orden de los 2,5% en ambos casos. En cambio, se registraron retrocesos en la demanda de Italia del 3,3%, en Portugal del 1,2% y en España del 0,9%.

En los observatorios de mercados eléctricos de AleaSoft se puede analizar el comportamiento de la demanda y otras variables de los mercados a través de visualizaciones con granularidad horaria, diaria y semanal.

Para la segunda semana de octubre, las previsiones de demanda de AleaSoft prevén que aumente la demanda eléctrica en los mercados de Portugal y Gran Bretaña, mientras que en el resto de los mercados analizados se esperan descensos.

Fuente: Elaborado por AleaSoft con datos de ENTSO-E, RTE, REN, REE, TERNA, National Grid y ELIA.

Fuente: Elaborado por AleaSoft con datos de ENTSO-E, RTE, REN, REE, TERNA, National Grid y ELIA.

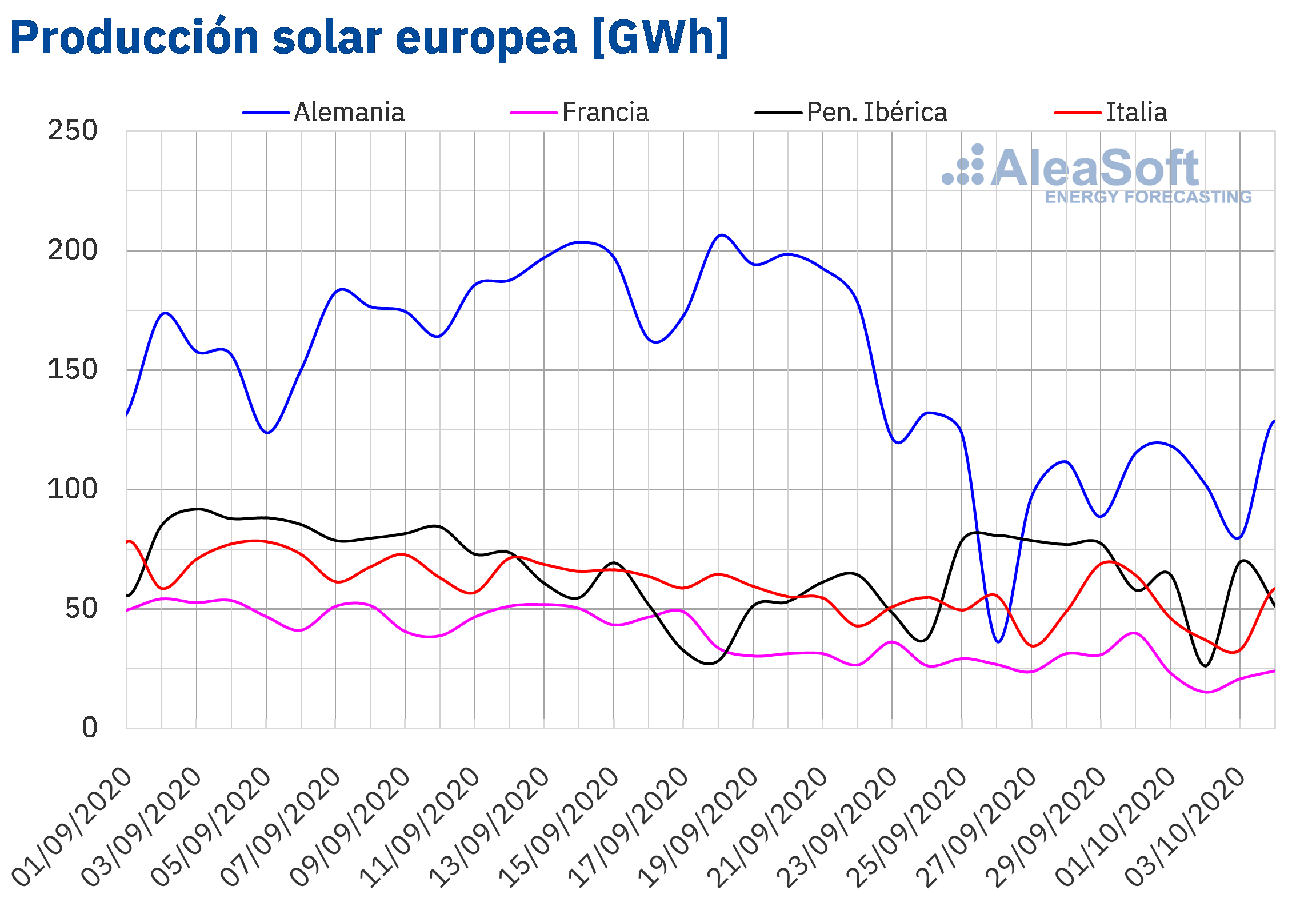

Mercados eléctricos europeos

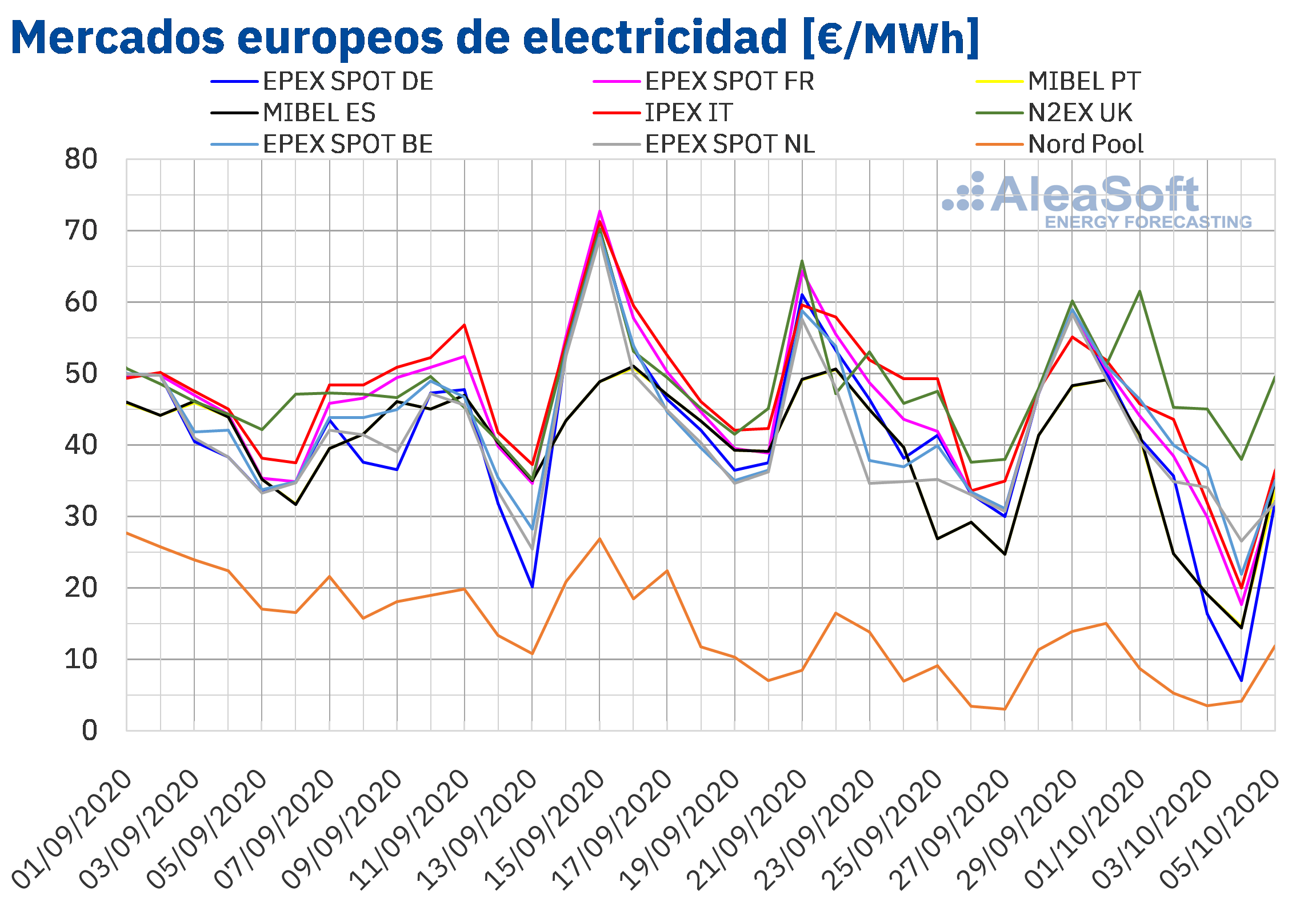

La semana del 28 de septiembre, el comportamiento de los precios fue diferente según el mercado eléctrico. Por una parte, los precios aumentaron respecto a los de la semana anterior en el mercado N2EX de Gran Bretaña, el mercado EPEX SPOT de Bélgica y de los Países Bajos y en el mercado Nord Pool de los países nórdicos. El mercado con la mayor subida de precios, del 6,1%, fue el de los Países Bajos. En cambio, el mercado con el menor incremento de precios, del 1,1%, fue el de los países nórdicos. Por otra parte, los precios descendieron en el mercado MIBEL de España y Portugal, en el mercado IPEX de Italia y en el mercado EPEX SPOT de Alemania y Francia. La mayor caída de precios, del 16%, correspondió al mercado alemán y la menor, del 9,9%, al mercado francés.

En la semana analizada se alcanzaron precios promedio semanales superiores a 40 €/MWh en la mayoría de los mercados eléctricos europeos. El más elevado, de 49,91 €/MWh fue el del mercado N2EX, seguido por el del mercado belga, de 43,22 €/MWh. En cambio, los promedios semanales fueron inferiores a 40 €/MWh en el mercado EPEX SPOT de Alemania y el mercado MIBEL de España y Portugal, con valores de 36,63 €/MWh, 34,10 €/MWh y 34,08 €/MWh respectivamente. En el caso del mercado Nord Pool, tuvo el precio promedio más bajo, de 8,88 €/MWh.

Por otra parte, durante el transcurso de la semana los precios de los mercados eléctricos europeos estuvieron poco acoplados. Los mercados cuyo comportamiento se alejó más al de la mayoría fueron el mercado N2EX, con precio más elevados, y el mercado Nord Pool, con precios muy inferiores.

Por lo que respecta a los precios diarios, los más elevados fueron los de los primeros días de la semana. El día 29 de septiembre los precios de casi todos los mercados europeos superaron los 55 €/MWh, excepto los del mercado MIBEL y el mercado Nord Pool. Pero el precio diario más elevado, 61,56 €/MWh, se alcanzó el jueves 1 de octubre en el mercado británico. En cambio, el domingo 4 de octubre los precios estuvieron, en general, por debajo de los 25 €/MWh, con la excepción de los mercados de Gran Bretaña y de los Países Bajos.

En cuanto a los precios horarios, el fin de semana del 3 y 4 de octubre se alcanzaron precios horarios negativos en el mercado alemán. El precio más bajo, de ‑54,97 €/MWh, fue el de la hora 14 del domingo 4 de octubre. En cambio, el precio horario más elevado, de 164,16 €/MWh, se alcanzó en la hora 21 del día 1 de octubre en el mercado británico.

Fuente: Elaborado por AleaSoft con datos de OMIE, EPEX SPOT, N2EX, IPEX y Nord Pool.

Fuente: Elaborado por AleaSoft con datos de OMIE, EPEX SPOT, N2EX, IPEX y Nord Pool.

La última semana de septiembre, el incremento de la producción eólica en Alemania, España y Portugal, la recuperación de la producción nuclear en Francia, así como el descenso de la demanda en el mercado MIBEL y el mercado IPEX, permitieron el descenso de los precios en estos mercados. Pero el incremento de la demanda favoreció los aumentos de precios en el resto de los mercados.

Las previsiones de precios de AleaSoft indican que en la semana del 5 de octubre los precios descenderán en la mayoría de los mercados eléctricos europeos analizados, favorecidos por el aumento de la producción eólica que se espera en algunos casos como Alemania. El mercado MIBEL será la excepción pues se prevé una menor producción renovable.

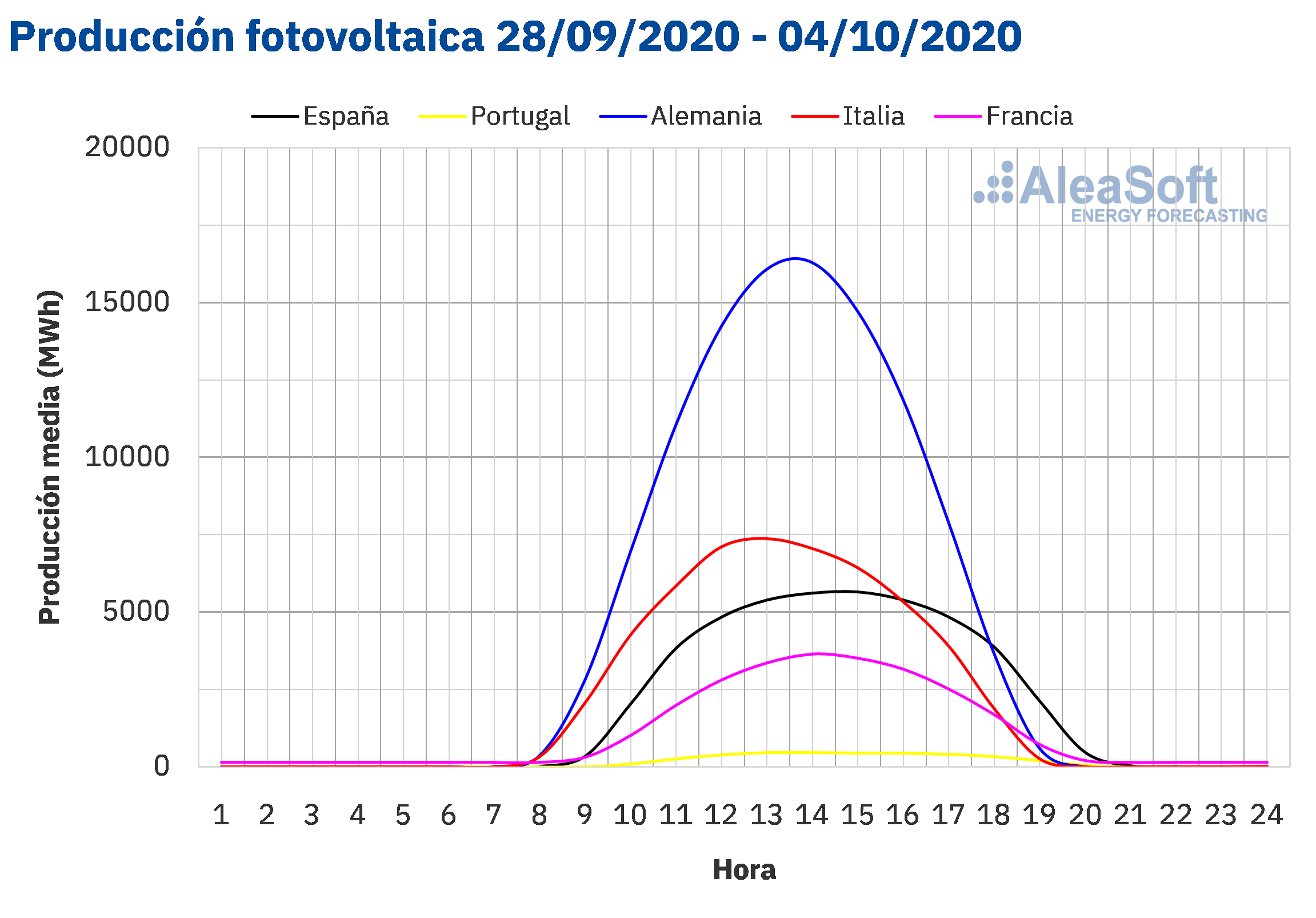

Futuros de electricidad

Durante la semana del 28 de septiembre los mercados de futuros de electricidad europeos presentaron un comportamiento mayoritariamente a la baja para el producto del primer trimestre del 2021. Solamente se incrementaron los precios en el mercado ICE y el mercado NASDAQ de los países nórdicos, con variaciones del 0,4% y 0,7% respectivamente. En el mercado ICE de los Países Bajos la variación fue también del 0,4% al cierre de la semana, aunque en este caso fue negativa, quedando como el de menor descenso. En el resto de mercados las bajadas se situaron entre el 1,4% del mercado ICE de Bélgica y el 6,6% del mercado EEX de Francia.

En cuanto a los futuros para el próximo año calendario 2021, se registró un comportamiento a la baja en todos los mercados analizados en AleaSoft. En este caso, los precios de Gran Bretaña se redujeron tanto en el mercado EEX como en el mercado ICE un 2,3%. En cuanto a la mayor caída, del 3,1%, se registró en el mercado francés. En el resto de los mercados los descensos estuvieron entre el 1,0% del mercado EEX de Italia y el 0,4% del mercado NASDAQ de los países nórdicos.

Brent, combustibles y CO2

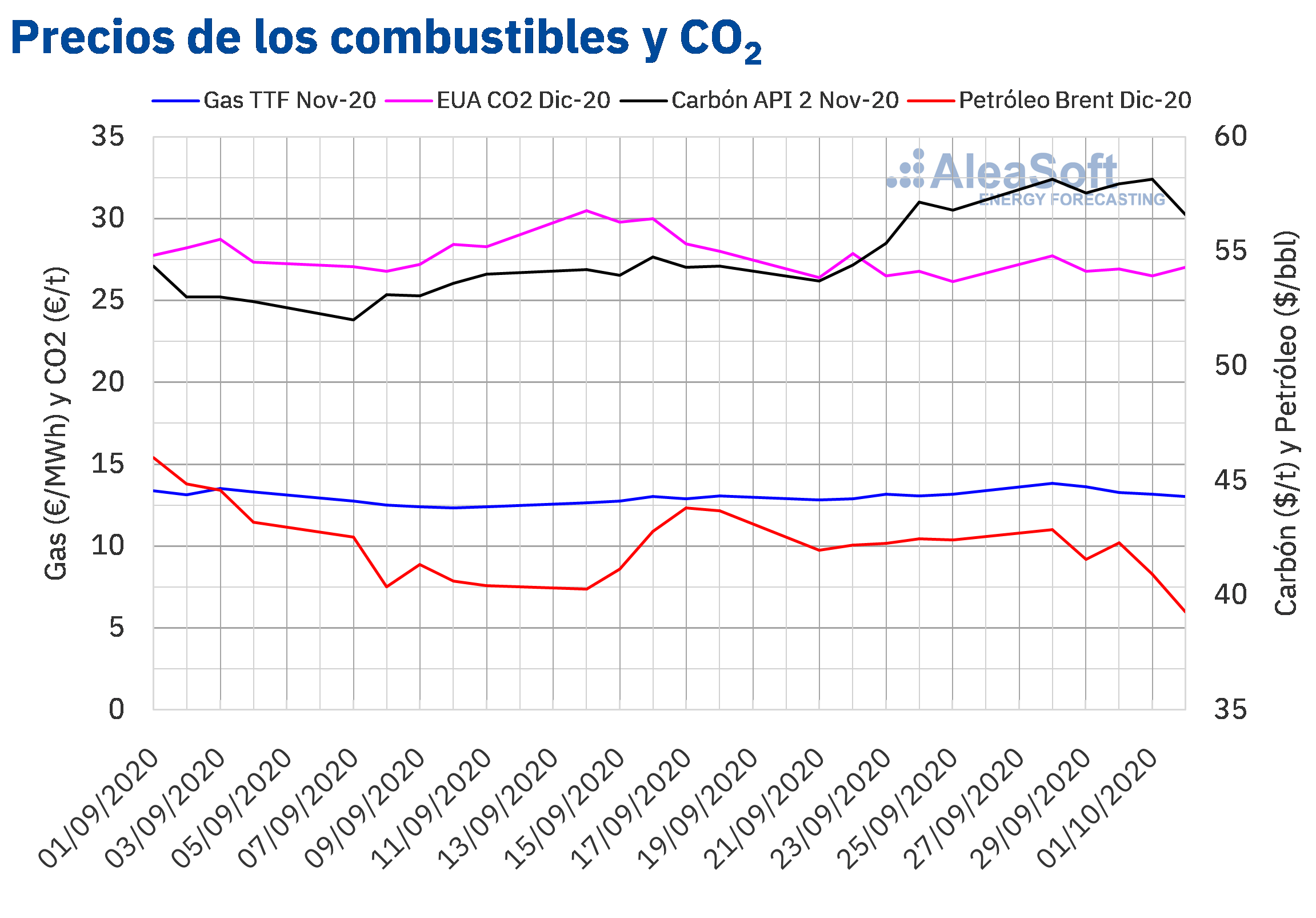

Los precios de los futuros de petróleo Brent para el mes de diciembre de 2020 en el mercado ICE, el lunes 28 de septiembre, alcanzaron un precio de cierre de 42,87 $/bbl, un 2,2% superior al del lunes anterior. El resto de la semana, excepto el miércoles 30 de septiembre, los precios descendieron. Como consecuencia, el precio de cierre del viernes 2 de octubre fue de 39,27 $/bbl. Este precio fue un 7,4% inferior al del viernes anterior y el más bajo desde finales de mayo.

En la última semana de septiembre continuaron las preocupaciones sobre la demanda, la cual se podría ver afectada por nuevas restricciones de movilidad debido al incremento del número de contagios por coronavirus. Mientras, los niveles de producción siguieron incrementándose en Estados Unidos, Irán, Libia y Rusia.

A esta situación se sumó el viernes la noticia del contagio por COVID‑19 del presidente estadounidense, la cual también ejerció su influencia a la baja sobre los precios.

Las noticias sobre la mejora del estado de salud del presidente de Estados Unidos, así como las huelgas en el sector petrolero noruego, pueden favorecer la recuperación de los precios esta semana.

En cuanto a los precios de los futuros de gas TTF en el mercado ICE para el mes de noviembre de 2020, la última semana de septiembre se mantuvieron por encima de los 13 €/MWh. El precio de cierre máximo de la semana, de 13,82 €/MWh, se alcanzó el lunes 28 de septiembre. Este precio fue un 7,9% superior al del mismo día de la semana anterior y el más alto desde finales de febrero. Pero el resto de la semana los precios descendieron y el precio de cierre del viernes 2 de octubre fue de 13,03 €/MWh, un 1,0% inferior al del viernes anterior.

Por lo que respecta a los precios del gas TTF en el mercado spot, empezaron la última semana de septiembre con una tendencia ascendente. El miércoles 30 de septiembre se alcanzó el precio índice máximo de la semana, de 12,49 €/MWh. Este precio fue el más elevado desde diciembre de 2019. Pero, los últimos días de la semana, los precios volvieron a ser inferiores a 12 €/MWh y el precio índice de los días 3 y 4 de octubre fue de 11,59 €/MWh.

Por otra parte, los futuros del carbón API 2 en el mercado ICE para el mes de noviembre de 2020, el lunes 28 de septiembre alcanzaron un precio de cierre de 58,15 $/t, un 8,3% superior al del lunes anterior y el más alto desde finales de enero. Pese al descenso del 1,0% del martes, los precios se recuperaron y el jueves 1 de octubre se repitió el precio de cierre del lunes. Pero el viernes 2 de octubre hubo un descenso del 2,7% y el precio de cierre fue de 56,60 $/t.

En cuanto a los precios de los futuros de derechos de emisión de CO2 en el mercado EEX para el contrato de referencia de diciembre de 2020, en la última semana de septiembre oscilaron, tomando valores entre los 26,52 €/t del jueves 1 de octubre y los 27,71 €/t del lunes 28 de septiembre. Al finalizar la semana, el precio de cierre del viernes 2 de octubre fue de 27,04 €/t, un 3,4% mayor que el del viernes anterior.

Fuente: Elaborado por AleaSoft con datos de ICE y EEX.

Fuente: Elaborado por AleaSoft con datos de ICE y EEX.

Análisis de AleaSoft de la recuperación de los mercados de energía a la salida de la crisis económica

El próximo 8 de octubre APPA Renovables está organizando el webinar “Curvas de precios de mercado eléctrico para financiación de renovables”, con la participación de Antonio Delgado Rigal, CEO de AleaSoft, y moderado por Paloma Rodríguez, Responsable de Proyectos de APPA Renovables. En los próximos años se espera un incremento importante de la capacidad renovable y, para conseguir la financiación necesaria para llevar adelante los proyectos, es importante conocer cómo evolucionarán las curvas de precios de mercados eléctricos a largo plazo. Este webinar se llevará a cabo el mismo día en que AleaSoft cumple 21 años como proveedor de previsiones para el sector de la energía en Europa y trabajando para favorecer el desarrollo de las energías renovables.

Para continuar con la labor divulgativa que se está realizando en AleaSoft desde que comenzó la pandemia de la COVID‑19, el 29 de octubre se realizará la segunda parte del webinar “Los mercados de energía en la salida de la crisis económica” en la que se contará además con la participación de dos ponentes invitados de la consultora Deloitte, Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services y Carlos Milans del Bosch, Partner of Financial Advisory. En esta ocasión se continuará profundizando en los temas analizados en la primera parte del webinar:

- Evolución de los mercados de energía europeos en la recuperación económica

- Financiación de proyectos de energías renovables

- Importancia de las previsiones en las auditorías y en la valoración de carteras

Coincidiendo con el inicio del cuarto trimestre, en AleaSoft se están actualizando las curvas de precio a largo plazo de los mercados eléctricos europeos. En este proceso se incorporan los datos más actualizados sobre la evolución de la economía, así como los escenarios de salida de la crisis económica.

Para hacer un seguimiento periódico de los mercados de energía, en la web de AleaSoft se han habilitado los observatorios, una herramienta que incluye gráficos de las principales variables de los mercados eléctricos europeos, de combustibles y de derechos de emisión de CO2. Los datos que se incluyen son horarios, diarios y semanales y se actualizan diariamente.

Fuente: AleaSoft Energy Forecasting.