AleaSoft, May 26, 2020. We are seeing how the health crisis and the coming economic crisis are impacting practically all economic sectors. Also obviously in the energy sector. But, even with the energy markets prices at historical lows, the experts agree that the financing of new energy projects is still active and are very convinced that the renewable energy has a promising future in the long term.

Evolution of the energy markets

In recent weeks, the prices of a barrel of Brent oil surged and are already above $30 after hovering around $20 since March and even falling below $10, a case that was not seen for more than twenty years. The fall in economic activity around the world caused by the COVID‑19 pandemic sank the demand and filled the reserves, with the consequent drop in prices. But since mid‑May, the signs of recovery in economic activity due to the de‑escalation of the confinement measures in many European countries seem to have had some impact on this slight recovery in Brent prices.

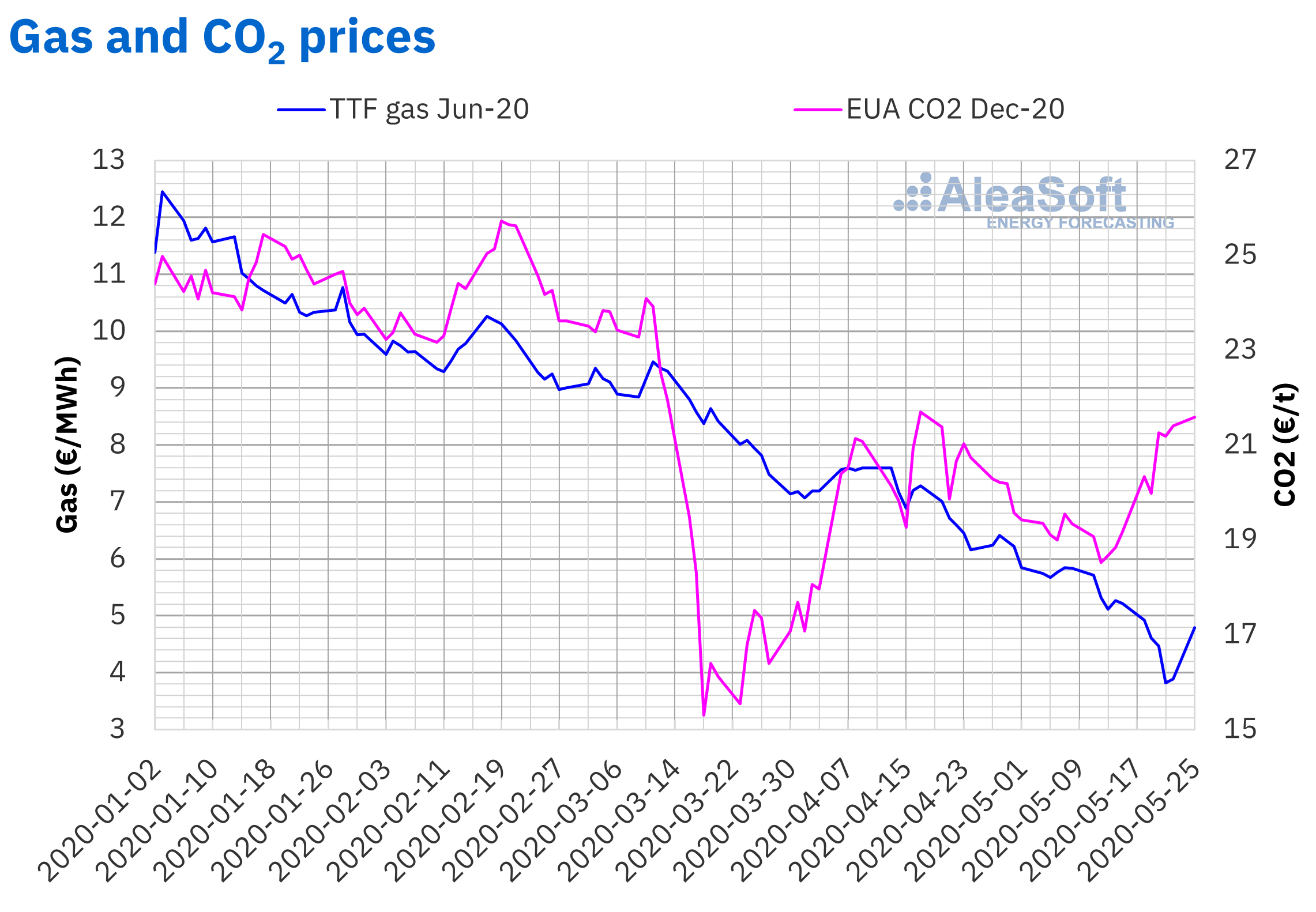

This is not the case of the TTF gas prices. The gas prices in Europe were on a downward trend since the last quarter of 2018, which was accentuated by the drop in demand during the health crisis. At the moment, there is no clear and consistent sign of recovery. In recent days, the futures prices fell from €4/MWh and the spot market prices fell below €3/MWh.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

After the sharp drop in the CO2 emission rights prices in mid‑March, which fell from €25/t to €15/t in just one week, these registered a slight recovery and are hovering around €20 per ton.

Meanwhile, the European electricity markets prices evolved, impacted mainly by the downward trend in gas prices and by the drop in electricity demand, both due to the confinement measures adopted to combat the COVID‑19 and the rising temperatures. In other words, the situation of very low prices continues present in most markets in Europe. The day‑on‑day evolution of the prices, the demands and the main variables of the energy markets throughout Europe, as well as the fuel prices, can be traced at the AleaSoft’s energy markets observatories.

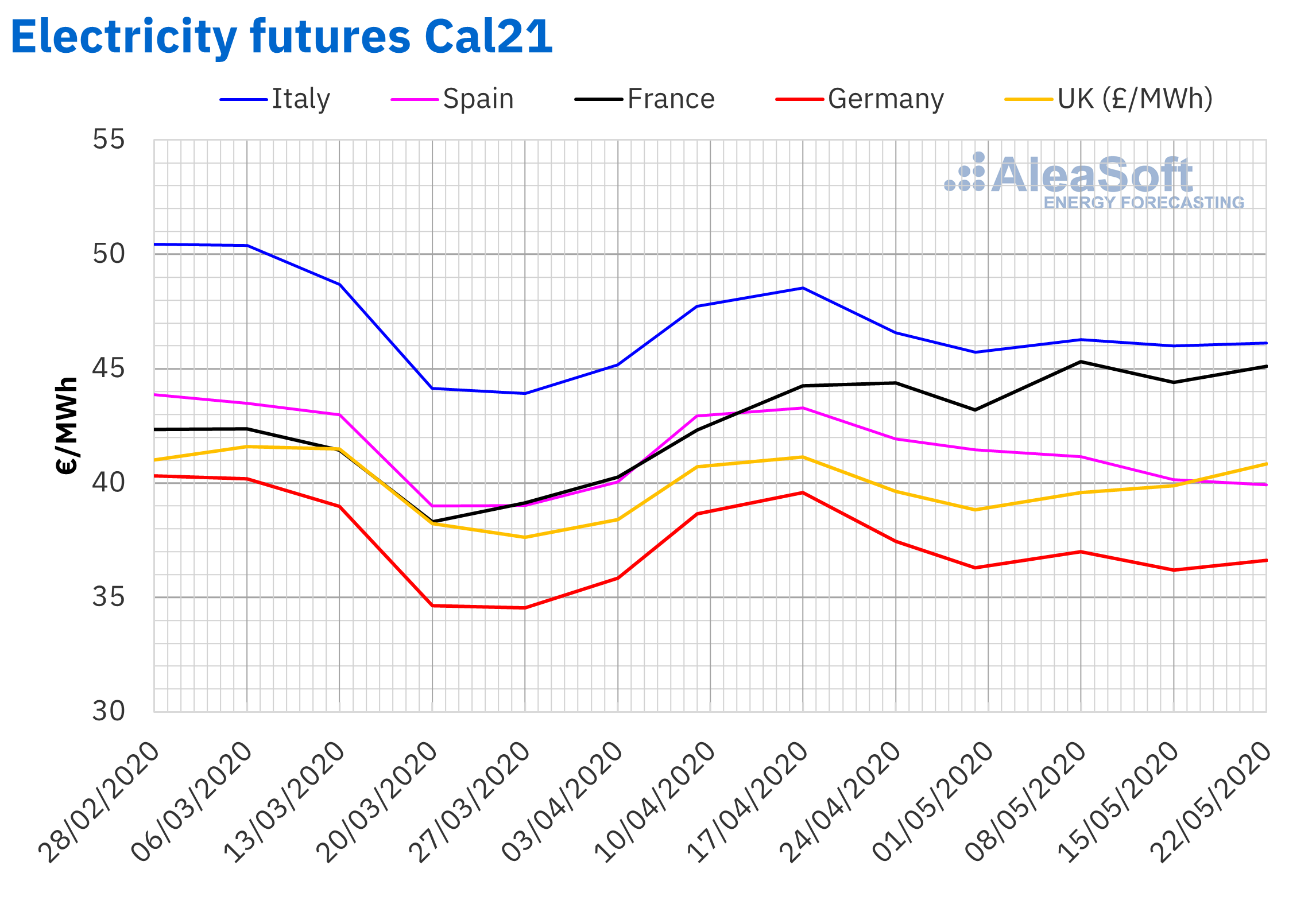

However, such a dramatic situation is not perceived in the electricity futures markets. Although the impact at the start of the health crisis led to a significant drop in prices, they recovered and the prices for the future of the year 2021 are between €35/MWh and €45/MWh for most European markets.

Source: Prepared by AleaSoft using data from EEX.

Source: Prepared by AleaSoft using data from EEX.

The financing of renewable energy projects during the crisis

During this worldwide health crisis, the financing of renewable energy projects was influenced by two factors: on the one hand, the electricity markets prices, which, as mentioned above, are at exceptionally low levels, and, on the other hand, the prices of the PPA contracts.

Low prices in the electricity markets mean less income for the generating facilities and, consequently, less profit and more time necessary to recover the initial investment. As for the prices at which PPA contracts are signed, these are closely related to the prices of the wholesale electricity markets and to the quoted prices of their futures. Like the markets, the PPA prices followed a downward trend in recent quarters, resulting in an unfavourable situation for wind and photovoltaic energy farms seeking to sign a long‑term agreement.

This situation made the renewable energy projects less attractive to the investors and many sponsors prefer to wait for the uncertainty situation to dissipate somewhat more. In any case, the financing of new projects continues, although at a lower pace and intensity, but there are sponsors looking for opportunities and the banks continue to offer financing.

Making a more global analysis, it can be seen how the electricity sector was less impacted by this crisis than other sectors such as the transport or the oil, sectors that registered spectacular falls that will leave a deep signal that will be visible in the medium and long term. On the contrary, the activity of the electricity sector continued, and although the new projects are going to be delayed and the financing is given under less favourable conditions, the developments continue.

Second webinar on the influence of the crisis on the energy markets and on the financing of renewable energy projects

All these topics were discussed in the second webinar on the coronacrisis organised by AleaSoft. It was the second in a series of webinars about how this health crisis and the subsequent economic crisis is affecting and will affect the energy markets and the financing of the renewable energy projects. On this occasion, there were two presentations on the evolution of the energy markets and on the impact of the COVID‑19 pandemic on the financing of renewable energy projects in Spain.

The impression of the experts is that, in general, the impact on the financing of the renewable energy projects was relative. Although the construction of parks was totally stopped for a few weeks due to the confinement measures and the administrative procedures slowed down, there is still a lot of activity in the sector: the projects continue to be financed, there are investors interested in the Spanish market, and there are interest in buying and selling projects. The feeling is that there is still “appetite” for the renewable energy projects.

Obviously, in a situation like the current one, with a future economic crisis and with very low market prices, the attractiveness of the renewable energy investments decreased due to the lower income and profit expectations, and having, consequently, somewhat less favourable conditions for the financing.

In any case, the renewable energy sector will be little affected by this crisis and it has a very positive future. The future climate change law, the decarbonisation objectives of the NECP, the promotion of the green energy and the sustainability, all these aspects will make the renewable energy come out stronger from this situation as it is a long‑term option.

The conclusion is a positive message, both in the evolution of the markets and the recovery of the prices, and in the viability of the renewable energy projects, which continue to be viable in the long term, and in their financing, which remains active.

Both the recording of this webinar and the registration in the third edition of this series of webinars, which will take place on June 25, can already be requested through the AleaSoft website or through the email webinar@aleasoft.com.

Source: AleaSoft Energy Forecasting.