AleaSoft, May 28, 2020. At the beginning of the last week of May, the European electricity markets prices fell due to the increase in wind energy production. The gas prices, which continue to set lows, also favour the low market prices. In general, the daily prices were below €30/MWh, except for two days in the N2EX market and on May 29 in the Iberian market. In the case of the latter, the price of €33.08/MWh is the highest since the beginning of the state of alarm decreed in Spain due to the COVID‑19.

Photovoltaic and solar thermal energy production and wind energy production

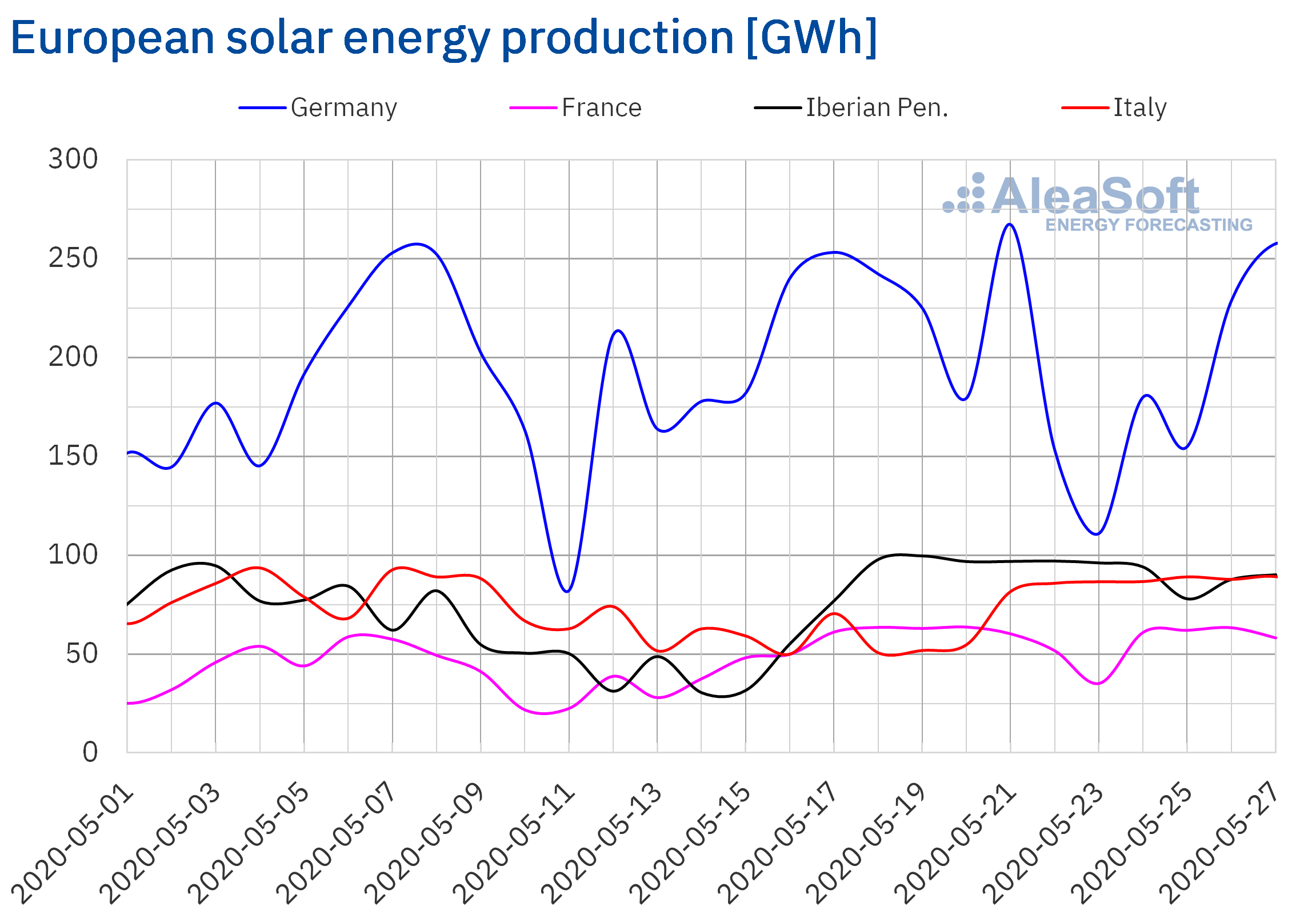

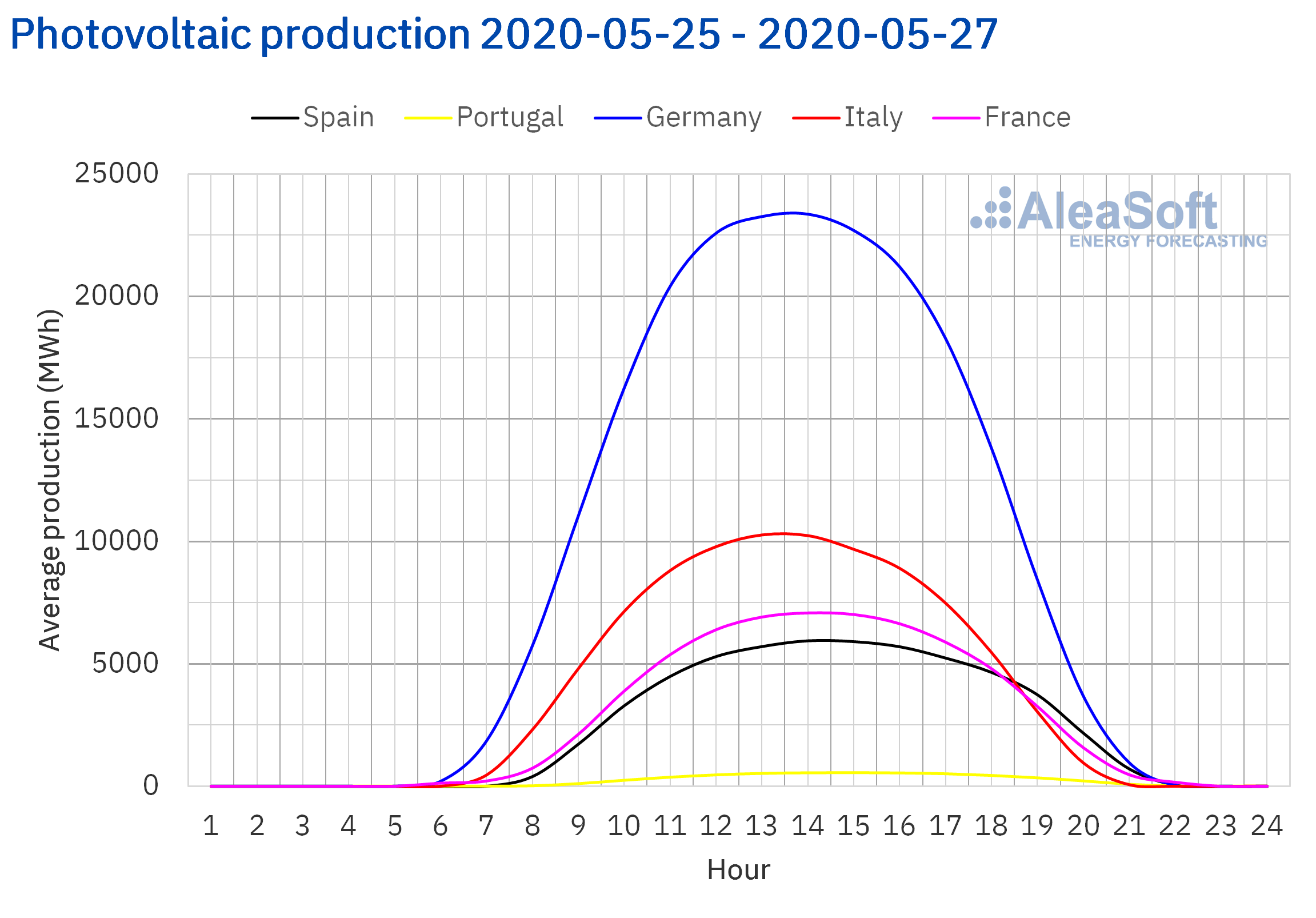

The solar energy production increased by 25% in the Italian market during the period from Monday, May 25, to Wednesday, May 27, compared to the average production of the previous week. Similarly, in the German market it increased by 10% while in the French market the increase was 7.6%. Out of the markets analysed at AleaSoft, the exception was the Iberian Peninsula, where the production fell by 12% during this period.

The production with this technology during the first 27 days of May, compared to the same period of 2019, was higher in all the markets analysed at AleaSoft. In the Iberian Peninsula and Italy it increased by 35% and 34% respectively. In the German and French markets, the production with this technology increased by 19%.

For the current week, the analysis carried out at AleaSoft indicates that total production will increase in the German market and in the Italian market.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

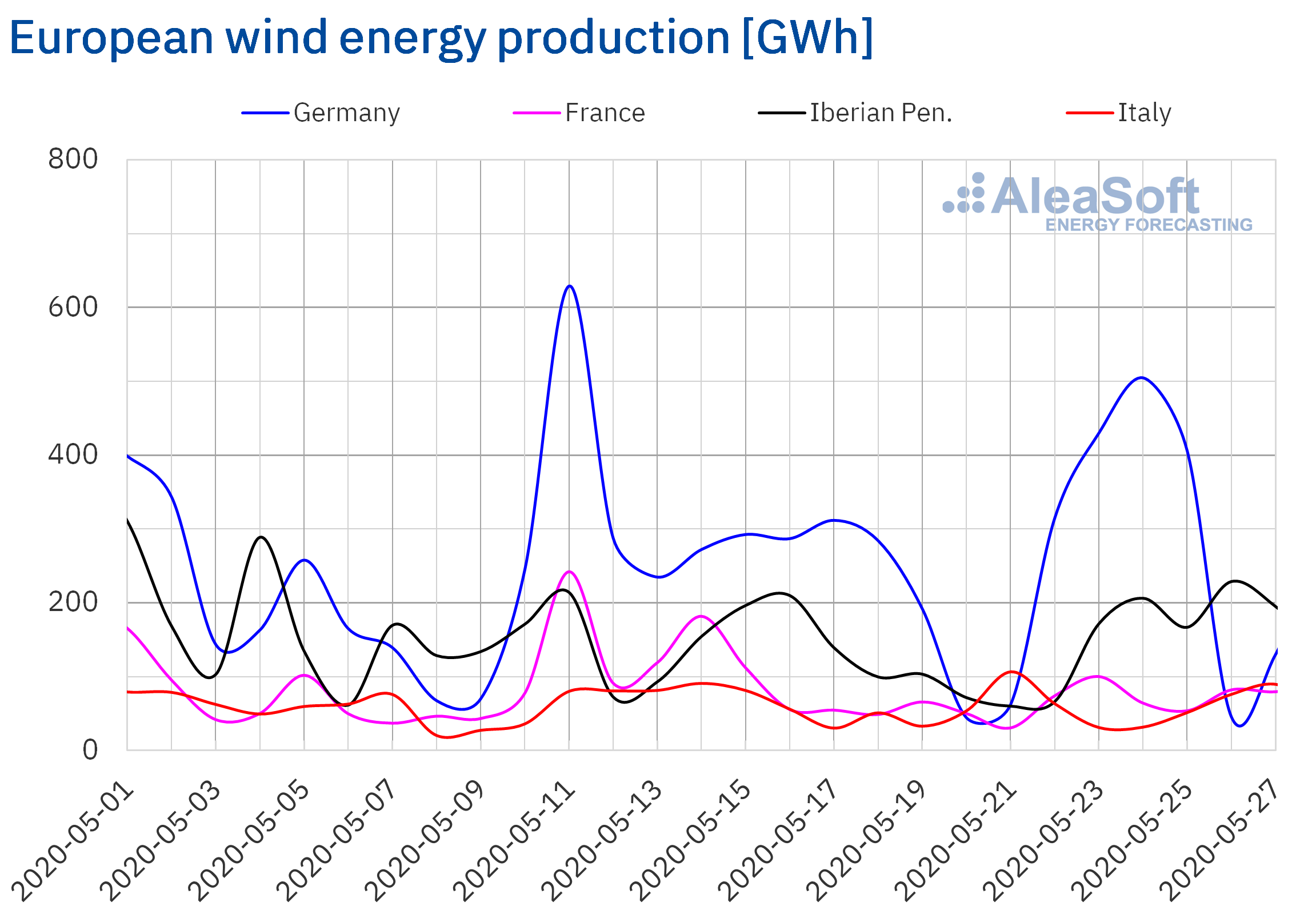

The average wind energy production between Monday and Wednesday of this week was higher than that registered in the same period of the previous week in most of the European markets analysed at AleaSoft. The greatest increase was registered in the Iberian Peninsula and it was 77%. In the Italian and French markets it increased by 37% and 16% respectively. In contrast, the production in the German market during the first three days of this week was 26% lower.

During these first 27 days of May, the wind energy production was lower than the registered in the same period of 2019 in the Iberian Peninsula and in the German market. The steepest decline in production was 37% in Portugal while in Germany it decreased by 10%. On the contrary, during this month the wind energy production in Italy and France increased by 16% and 11% respectively.

For the end of the current week, the AleaSoft‘s analysis indicates that the week’s total wind energy production will increase in the Iberian Peninsula and the French market compared to previous week. On the contrary, a reduction in production is expected in the markets of Germany and Italy.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

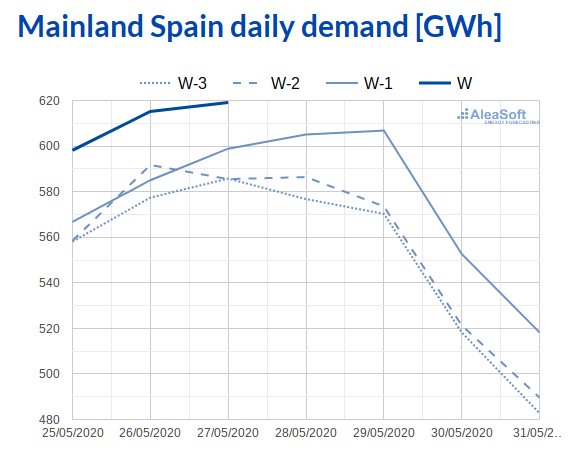

Electricity demand

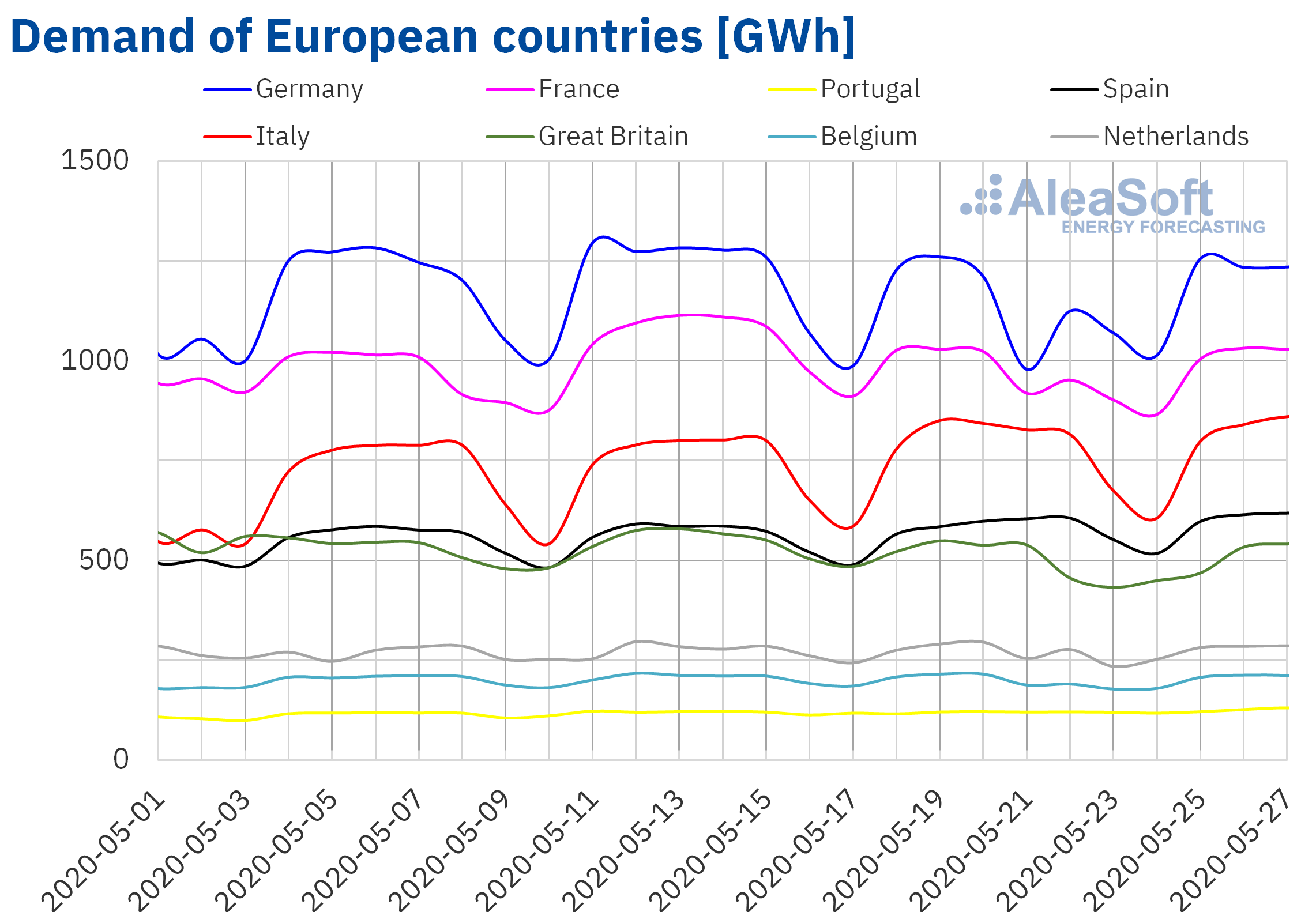

The electricity demand in the European markets behaved unevenly in the first three days of this week of May 25 compared to the same period of the previous week. In the Portuguese market, the advance to the second phase of the de‑escalation contributed to the increase in demand by 6.0%. The entire Spanish territory is currently at least in phase 1 and some autonomous communities moved to phase 2, which allowed a recovery of 4.7%. In Italy, the decrease in confinement restrictions influenced the rise of 1.0%. Another market with an increase in demand from Monday to Wednesday was the German one, registering a slight 0.7% which was favoured by the 1.5 °C drop in average temperatures.

On the other hand, in the rest of the analysed markets there were decreases of up to 1.1% in the cases of France, the Netherlands and Belgium. Great Britain was where the demand fell the most, 4.1%, due to the effect of the holiday of Monday, May 25.

The behaviour of the demand during the current and the previous weeks is available for analysis at the AleaSoft’s electricity demand observatories.

For the current week, the AleaSoft’s demand forecasting shows increases in some electricity markets of Europe, which will depend on the de‑escalation measures in each territory.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

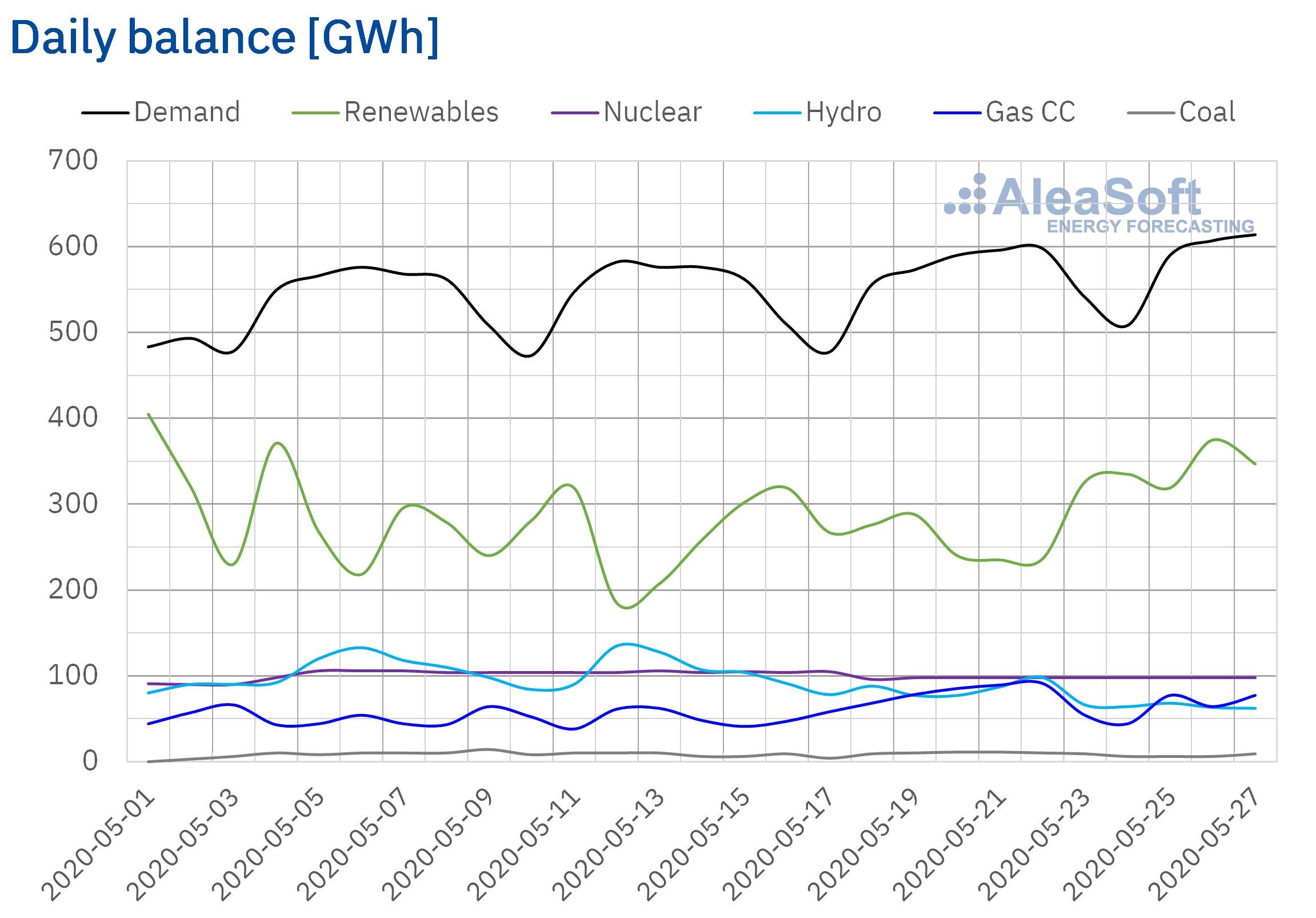

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

The move to phase 1 in the de‑escalation of the confinement due to the COVID‑19 and to phase 2 in some autonomous communities was the main cause of the increase in demand by 4.7% from Monday to Wednesday of this week in Mainland Spain, compared to May 18 to 20. For this reason, at AleaSoft it is expected that at the end of the week the demand will be higher than that of the previous week.

Source: Prepared by AleaSoft using data from REE

Source: Prepared by AleaSoft using data from REE

The average level of the wind energy production for the first three days of this week increased by 77%, compared to the average for the same days of last week in Mainland Spain. In the year‑on‑year analysis, the wind energy production during the first 27 days of May was 13% lower. For this week, the analysis carried out at AleaSoft indicates that the production with this technology will end up being greater than that of the previous week.

The daily nuclear energy production between May 25 and 27 remained close to 98 GWh due to the fact that unit 1 of the Ascó Nuclear Power Plant, which is expected to return to operation at the beginning of the next week, unit 1 of the Almaraz Nuclear Power Plant, whose shutdown will last until the second week of June, and the Trillo Nuclear Power Plant, which is expected to be operational in the fourth week of June, remain disconnected from the electricity grid.

Sources: Prepared by AleaSoft using data from REE.

Sources: Prepared by AleaSoft using data from REE.

The hydroelectric reserves currently have 16 129 GWh stored, according to data from the last Hydrological Bulletin of the Ministry for the Ecological Transition and the Demographic Challenge, which represents an increase of 88 GWh compared to the previous bulletin.

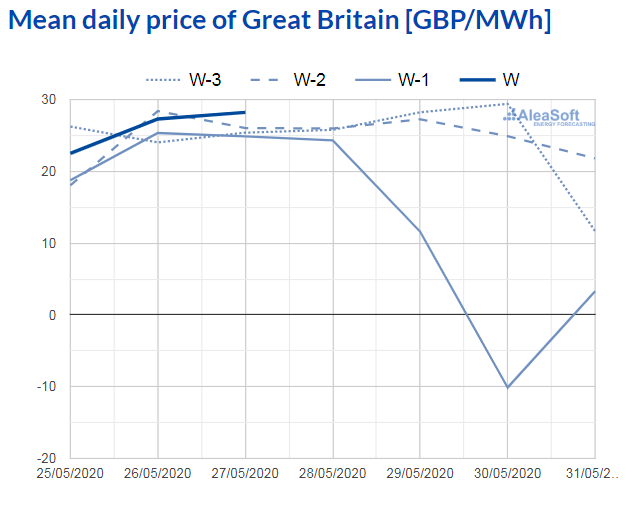

European electricity markets

In the first four days of the week of May 25, the prices declined in most European electricity markets compared to those of the same days of the previous week. The exceptions were the EPEX SPOT market of the Netherlands and the N2EX market of Great Britain, with increases of 1.9% and 11% respectively. On the other hand, the greatest fall in prices, of 60%, occurred in the Nord Pool market of the Nordic countries. While the smallest decline was that of the EPEX SPOT market of Belgium, of 2.1%. In the rest of the markets, the price decreases were between 5.2% of the EPEX SPOT market of France and 11% of the IPEX market of Italy.

The average prices for the first four days of this week of May 25 continued below €30/MWh in the analysed electricity markets. Although, in the case of the British market, daily prices slightly above this amount were reached on Tuesday and Wednesday.

The market with the lowest average price so far this week, of €5.44/MWh, was once again the Nord Pool market. While the market with the highest average, of €28.88/MWh, was the British market, followed by the MIBEL market of Portugal, with a price of €25.13/MWh. The rest of the markets had average prices between €25.08/MWh of Spain and €17.49/MWh of France.

Source: Prepared by AleaSoft using data from N2EX

Source: Prepared by AleaSoft using data from N2EX

The general increase in wind energy production in Europe favoured the decrease in prices in the electricity markets in the first four days of this week of May 25. The low gas prices are another factor that favours the low prices in the electricity markets.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

On the rest of the days of this week, the AleaSoft‘s price forecasting indicates that the prices will fall in most markets, influenced by the drop in demand over the weekend. But the next week, of June 1, the decrease in renewable energy production will cause a price increase in some electricity markets such as the Spanish, the Italian and the Portuguese.

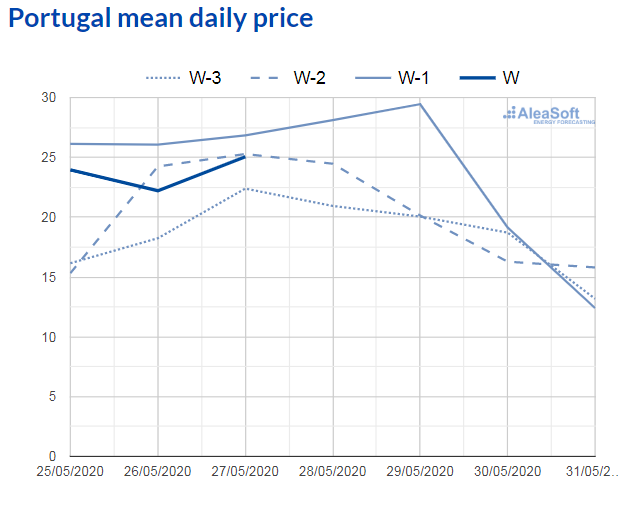

Iberian market

The average price of the first four days of the week of May 25 decreased in the MIBEL market compared to that of the same days of the previous week. The decrease was 6.2% in the case of Portugal and 6.3% in the case of Spain. These price drops in the MIBEL market are related to the increase in wind energy production in Spain and Portugal during the first days of the week.

The average price from May 25 to 28 was €25.08/MWh in the MIBEL market of Spain. In the case of Portugal, the average was €25.13/MWh, which was the second highest among the analysed European electricity markets, only behind the British market.

However, the average price of May 29 of Spain and Portugal was €33.08/MWh, the first value above €30/MWh since March 26 and the highest since March 15, right at the beginning of the state of alarm decreed in Spain to face the COVID‑19 pandemic. For May 29, the Iberian wind energy production is expected to decrease more than 50% compared to that registered in the first days of the week.

The AleaSoft’s price forecasting indicates that the first days of the next week of June 1 the prices will increase in the MIBEL market due to the decrease in renewable energy production in the Iberian Peninsula.

Source: Prepared by AleaSoft using data from OMIE

Source: Prepared by AleaSoft using data from OMIE

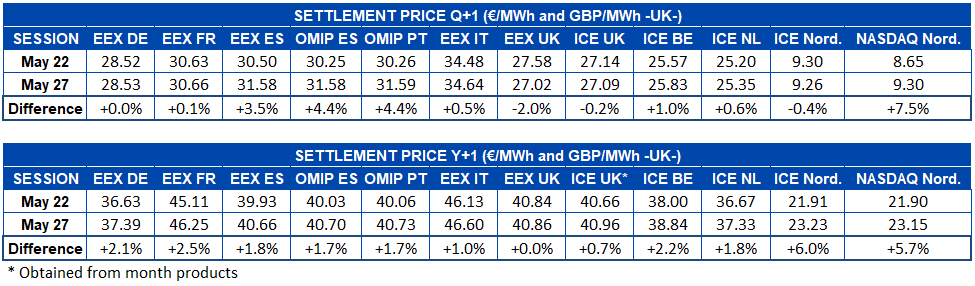

Electricity futures

During the first days of this week, the electricity futures prices for the third quarter of the year, in general, experienced little variation. The exceptions were the NASDAQ market of the Nordic countries with an increase of 7.5% and the markets of the Iberian Peninsula, with increases of 3.5% in the EEX market of Spain and 4.4% in the OMIP market of Spain and Portugal. The drop in prices for this product, of 2.0%, in the EEX market of Great Britain also stands out, while in the rest of the markets the variations did not exceed 1.0%. The EEX market of Germany shows little change compared to Friday, May 22, with an increase of only €0.01/MWh.

Regarding the electricity futures for the calendar year 2021, so far this week the prices increased in all the markets analysed at AleaSoft. The greatest variation was registered in the ICE market of the Nordic countries, where the difference compared to the settlement of last week was 6.0%. It is closely followed by the NASDAQ market of the same region with a rise of 5.7%. In the rest of the markets the increases did not exceed 2.5%. The EEX market of Great Britain hardly changed its price, increasing only by €0.02/MWh.

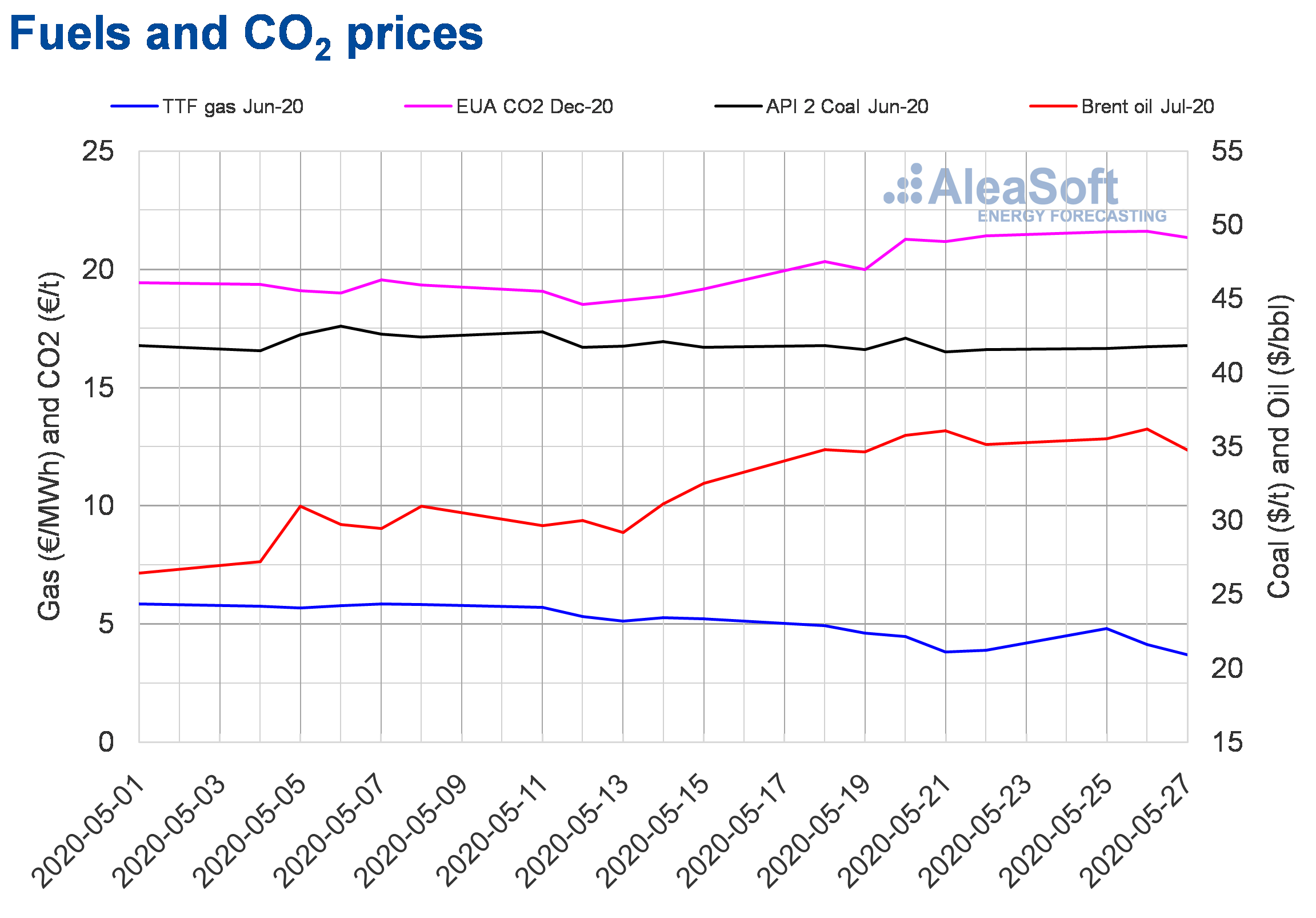

Brent, fuels and CO2

The Brent oil futures for the month of July 2020 in the ICE market started the week of Monday, May 25, with price increases and on Tuesday, May 26, they reached a settlement price of $36.17/bbl. This price was 4.4% higher than that of the same day of the previous week and the highest since the $36.77/bbl registered on March 13. However, on Wednesday, May 27, the prices fell 4.0% and the settlement price was $34.74/bbl.

The increase in demand associated with the deconfinement process in some countries and the cuts in production of the OPEC+ favoured the upward trend with which the week began. But the fact that Russia is considering reducing the production cuts from July had a downward influence on prices. The price drop registered on Wednesday is also related to the intention of the US government to impose new sanctions on China in the event that the country reduces Hong Kong’s autonomy. In the coming days, it is expected that the evolution of the prices will continue to be influenced by the development of the hostilities between these two countries and by the declarations made by the OPEC+ member countries prior to their meeting in the second week of June.

The TTF gas futures in the ICE market for the month of June 2020 on Monday, May 25, reached a settlement price of €4.79/MWh, 23% higher than that of the previous Friday, but still 2.6% lower than that of the same day of the previous week. However, on Tuesday and Wednesday there were daily decreases of 14% and 10% respectively. As a consequence, on Wednesday, May 27, the settlement price was €3.69/MWh, 17% lower than that of the same day of the previous week and the lowest in the last two years.

Regarding the TTF gas prices in the spot market, on Monday, May 25, they repeated the value of the previous weekend, of €2.76/MWh, which is the lowest index price since October 2008. But, on Tuesday and Wednesday, the prices recovered. Yesterday, Wednesday, May 27, the maximum index price so far this week, of €4.20/MWh, was reached. Today, May 28, the price dropped again to €3.58/MWh.

On the other hand, the API 2 coal futures prices in the ICE market for the month of June 2020, the first days of the week of May 25 presented an upward trend, but with very slight daily increases, of 0.2%. On Wednesday, May 27, a settlement price of $41.85/t was reached, which is still 1.2% lower than that of the same day of the previous week.

Regarding the CO2 emission rights futures prices in the EEX market for the reference contract of December 2020, the first days of the week of May 25 remained above €21/t. On Tuesday, May 26, a settlement price of €21.60/t was reached, 8.1% higher than that of the previous Tuesday and the highest since the €21.70/t of April 17.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis on the effects on the electricity markets due to the coronavirus crisis

In recent days, at the AleaSoft’s energy markets observatory, the series of prices of Brent oil and CO2 emission rights were included. These two series join an extensive set of information that is already available in the tool. The evolution of the series in recent weeks can be analysed at the observatory. In this way, the effects of the measures that were taken related to the COVID‑19 crisis can be observed.

The next webinar “Influence of coronavirus on electricity demand and the European electricity markets (III)” will be on June 25. It will carry out an updated analysis of the evolution of the European energy markets during the coronavirus crisis and on the financing of renewable energy projects. These topics were already discussed in the webinar imparted on May 21, in which the experts agreed that the financing of renewable energy projects remained active during the period of health crisis. It is possible to request the registration for the next webinar, as well as the recording of the previous one, through the company’s website or through the email webinar@aleasoft.com.

Source: AleaSoft Energy Forecasting.