AleaSoft Energy Forecasting, December 2, 2025. In November 2025, the main European electricity markets registered price increases compared to October, except for the Iberian market, which registered its lowest level since June. Photovoltaic energy production reached record levels for a November month and wind energy production increased in most markets. Demand rebounded due to colder temperatures. TTF gas and Brent futures registered their lowest monthly averages in months, while CO2 futures reached their highest level since 2023.

Solar photovoltaic and wind energy production

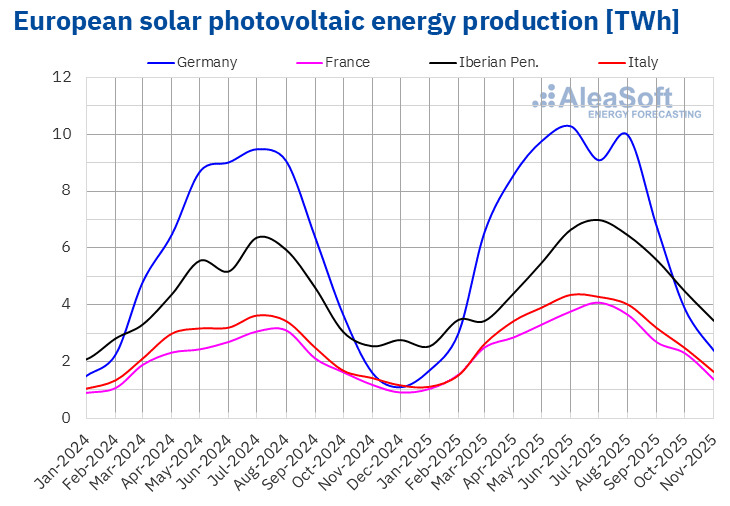

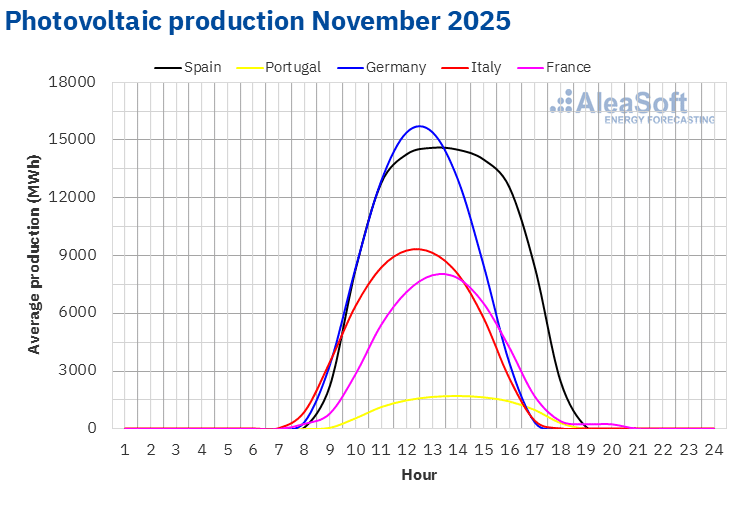

In November 2025, solar photovoltaic energy production increased in the main European markets compared to the same month of the previous year. Germany registered the largest increase, 55%, followed by rises of 36% in Spain and 25% in Portugal. France and Italy registered year on year growth of 15% and 16%, respectively.

Compared to October 2025, solar photovoltaic energy production decreased in the main European electricity markets due to the reduction in daylight hours and solar irradiation, typical of autumn months. In this case, the French and German markets registered the largest month on month decreases, 38% and 36%, respectively. The Spanish market registered the smallest decline, 19%, while Portugal and Italy registered reductions of 31% and 32%, respectively.

The main European markets registered historic records for solar photovoltaic energy production for a November month. Spain registered the highest production, 3095 GWh, followed by Germany with 2384 GWh. Italy, France and Portugal produced 1637 GWh, 1369 GWh and 334 GWh, respectively.

The year on year increase in photovoltaic energy generation was associated with higher installed capacity. According to data from Red Eléctrica, between November 2024 and November 2025 the Spanish market added 7032 MW of solar photovoltaic energy capacity. Over the same period, the Portuguese market added 999 MW to the system, according to REN data.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

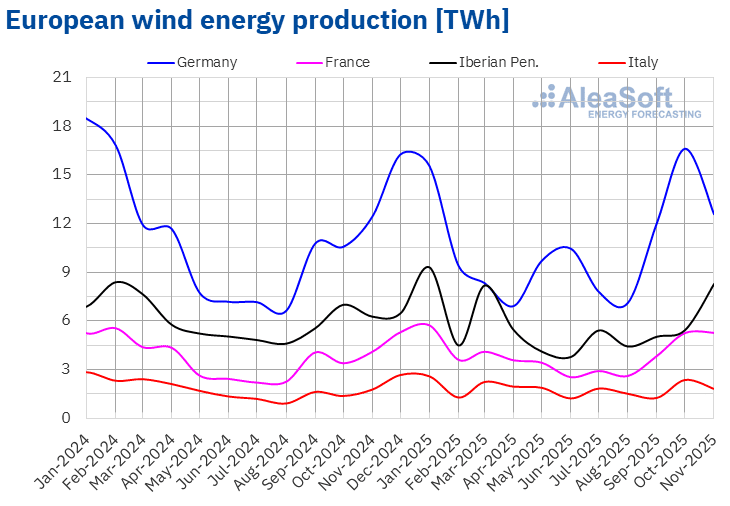

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.Wind energy production increased in November 2025 in most major European electricity markets compared to November 2024. Spain registered the largest increase, 43%, while Germany registered the smallest rise, 0.7%. Italy and France registered increases of 2.2% and 29%, respectively. Portugal was the exception, registering a 3.3% decrease in wind energy generation.

Compared to the previous month, wind energy production also increased in most major European electricity markets. The Iberian Peninsula registered the largest increases, 58% in Spain and 54% in Portugal. In this case, France registered the smallest increase, 3.5%. Conversely, Italy and Germany registered declines of 21% and 22%, respectively.

In November 2025, the French market registered its second‑highest wind energy production for a November month, with 5264 GWh, after the record set in November 2023.

According to data from Red Eléctrica, between November 2024 and November 2025 the Spanish market added 1217 MW of new wind energy capacity. Over the same period, the Portuguese market added 37 MW to the system, according to REN data.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.Electricity demand

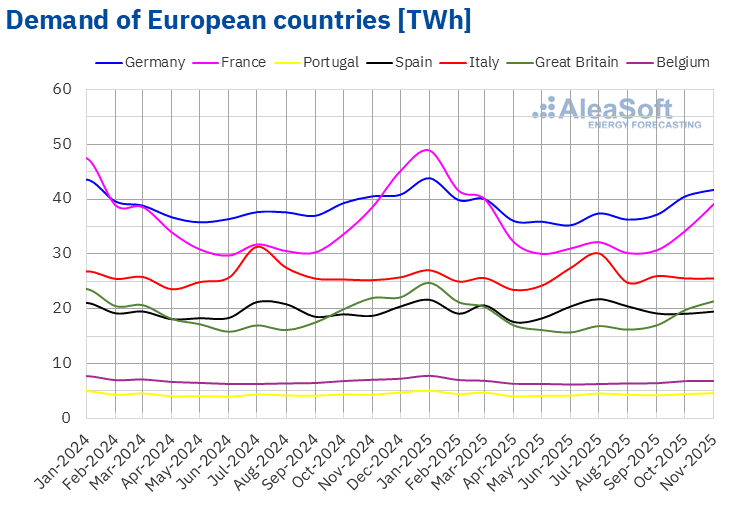

In November 2025, electricity demand increased in most major European markets compared to the same month of the previous year. The Portuguese market registered the largest increase, 6.2%, while the Italian market registered the smallest rise, 1.2%. The French, German and Spanish markets registered increases of 1.6%, 2.9% and 4.2%, respectively. In contrast, demand decreased year on year in the Belgian and British markets. Belgium registered the largest drop, 3.5%, while Great Britain registered the smallest, 2.7%.

Compared to October 2025, demand increased across all major European markets. France and Great Britain registered the largest rises, 18% and 12%, respectively, while Italy and Belgium registered the smallest, 3.2% and 3.3%. The Spanish, German and Portuguese markets registered increases ranging from 5.5% in Spain to 7.3% in Portugal.

Average temperatures fell compared to November 2024 in Italy, France, Portugal and Spain, with decreases ranging from 0.1 °C in Italy to 1.7 °C in Spain. Conversely, Germany, Great Britain and Belgium registered increases of 0.1 °C, 0.7 °C and 1.1 °C, respectively.

On the other hand, average temperatures in November were below those of the previous month across all analysed markets. The Iberian Peninsula registered the largest falls, 6.0 °C in Portugal and 5.9 °C in Spain. In the other markets, average temperatures fell between 3.0 °C in Great Britain and 4.8 °C in Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.European electricity markets

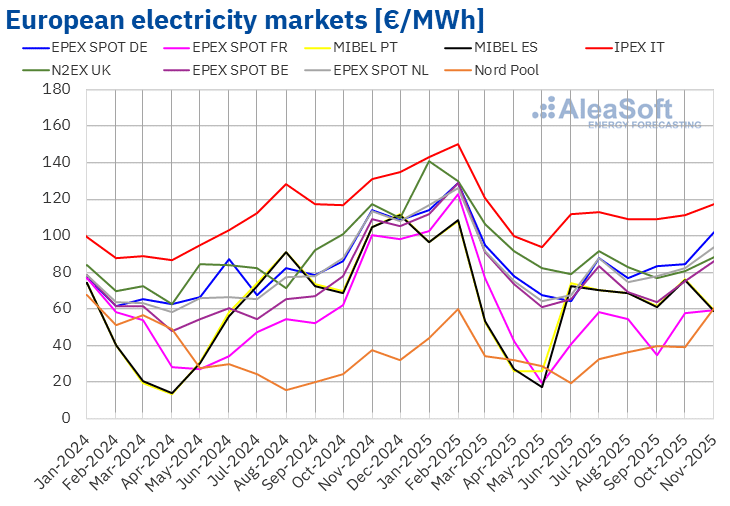

In November 2025, the monthly average price exceeded €85/MWh in most major European electricity markets. Exceptions were the MIBEL market of Spain and Portugal, the EPEX SPOT market of France and the Nord Pool market of the Nordic countries, with averages of €58.65/MWh, €59.09/MWh, €59.13/MWh and €60.58/MWh, respectively. Conversely, the IPEX market of Italy registered the highest monthly price, €117.09/MWh. In the remaining European electricity markets analysed at AleaSoft Energy Forecasting, averages ranged between €86.19/MWh in the EPEX SPOT market of Belgium and €101.88/MWh in the EPEX SPOT market of Germany.

Compared to October, November prices increased in most European electricity markets analysed at AleaSoft Energy Forecasting. The Iberian market was the exception, registering a 23% decrease. The French and Italian markets registered the smallest increases, 2.9% and 5.4%, respectively. In contrast, the Nordic market registered the largest percentage price rise, 55%. In the remaining markets, prices increased between 9.3% in the N2EX market of the United Kingdom and 21% in the German market.

Comparison with November 2024 shows price decreases in most markets. The Nordic market was the exception, registering a 63% rise. Meanwhile, the French and Iberian markets registered the largest percentage price drops, 41% and 44%, respectively. In the other markets, price declines ranged between 11% in the German and Italian markets and 25% in the British market.

The Nordic market, which registered price increases both month on month and year on year, reached its highest monthly price since February 2024. The German and Dutch markets registered their highest monthly averages since March 2025, while the Belgian, French and Italian markets registered their highest averages since April 2025. In the British market, the November average was the highest since August. Conversely, the Spanish and Portuguese markets registered their lowest prices since June.

In November 2025, the rise in CO2 emission allowance prices compared to the previous month, higher demand and lower solar energy production contributed to higher prices in the European electricity markets. In addition, wind energy production decreased in Germany and Italy compared to October. Conversely, the significant increase in wind energy production in the Iberian Peninsula contributed to lower prices in the Spanish and Portuguese markets.

On the other hand, the year‑on‑year decline in gas prices, the increase in solar energy production compared to November 2024, as well as the rise in wind energy production in most markets, contributed to the year‑on‑year fall in European electricity market prices in November 2025. In addition, electricity demand decreased in some markets.

Brent, fuels and CO2

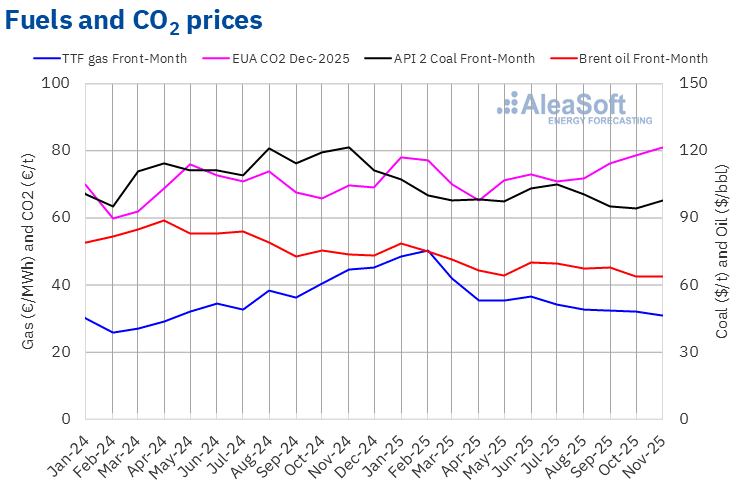

Brent oil futures for the Front‑Month in the ICE market registered a monthly average price of $63.66/bbl in November 2025. According to data analysed at AleaSoft Energy Forecasting, this monthly average was the lowest since March 2021. This value was 0.5% lower than the Front‑Month futures average for October 2025, $63.95/bbl. It was also 13% lower than the average for Front‑Month futures traded in November 2024, $73.40/bbl.

In November, concerns about demand evolution continued to exert downward pressure on Brent oil futures prices. On November 2, OPEC+ agreed to increase its production in December but pause increases in the first quarter of 2026. Meanwhile, in the first half of the month, US sanctions on Russian oil companies and Ukrainian attacks on oil infrastructure in Russia pushed prices upwards. However, in the second half of the month, peace negotiations for Ukraine contributed to the decline in prices, as lifting sanctions on Russia could increase global supply.

In the case of TTF gas futures in the ICE market for the Front‑Month, they registered an average of €30.77/MWh in November 2025. According to data analysed at AleaSoft Energy Forecasting, this was the lowest monthly average since May 2024. Compared to the average of the Front‑Month futures traded in October, €31.92/MWh, the November average fell by 3.6%. Compared to the Front‑Month futures traded in November 2024, when the average price was €44.71/MWh, there was a decrease of 31%.

Abundant liquefied natural gas supply exerted downward pressure on TTF gas futures prices in November. In the first half of the month, availability increased due to mild temperatures in China. Meanwhile, peace talks to end the war in Ukraine, as well as forecasts of milder temperatures at the end of November and early December, contributed to price decreases in the second half of November.

Regarding CO₂ emission allowance futures in the EEX market for the reference contract of December 2025, they reached an average price of €81.14/t in November. According to data analysed at AleaSoft Energy Forecasting, this was the highest monthly average since December 2023. This monthly price registered a 3.3% increase compared to October’s average, €78.55/t. Compared to the average for November 2024, €69.60/t, the November 2025 average was 17% higher.

AleaSoft webinars: strategic vision of European energy markets

For the past six years, AleaSoft Energy Forecasting has been organising monthly webinars on European energy markets, with regular participation of high level collaborators from leading companies in the energy sector. These webinars address the most strategic topics in the sector, such as renewable energy project financing, PPA and energy storage. Recordings of most webinars are available on the company’s YouTube channel (AleaSoft Energy Forecasting), and can also be requested directly.