AleaSoft, September 13, 2021. The European electricity markets prices continued to rise in the second week of September, registering weekly averages between €125/MWh and €226/MWh, and almost all of the markets registered hourly or daily records. Electricity futures prices also rose in a generalised way. Gas and CO2 futures hit record highs again. An increase in demand and lower production with renewable energies were added to the outlook of factors to boost prices.

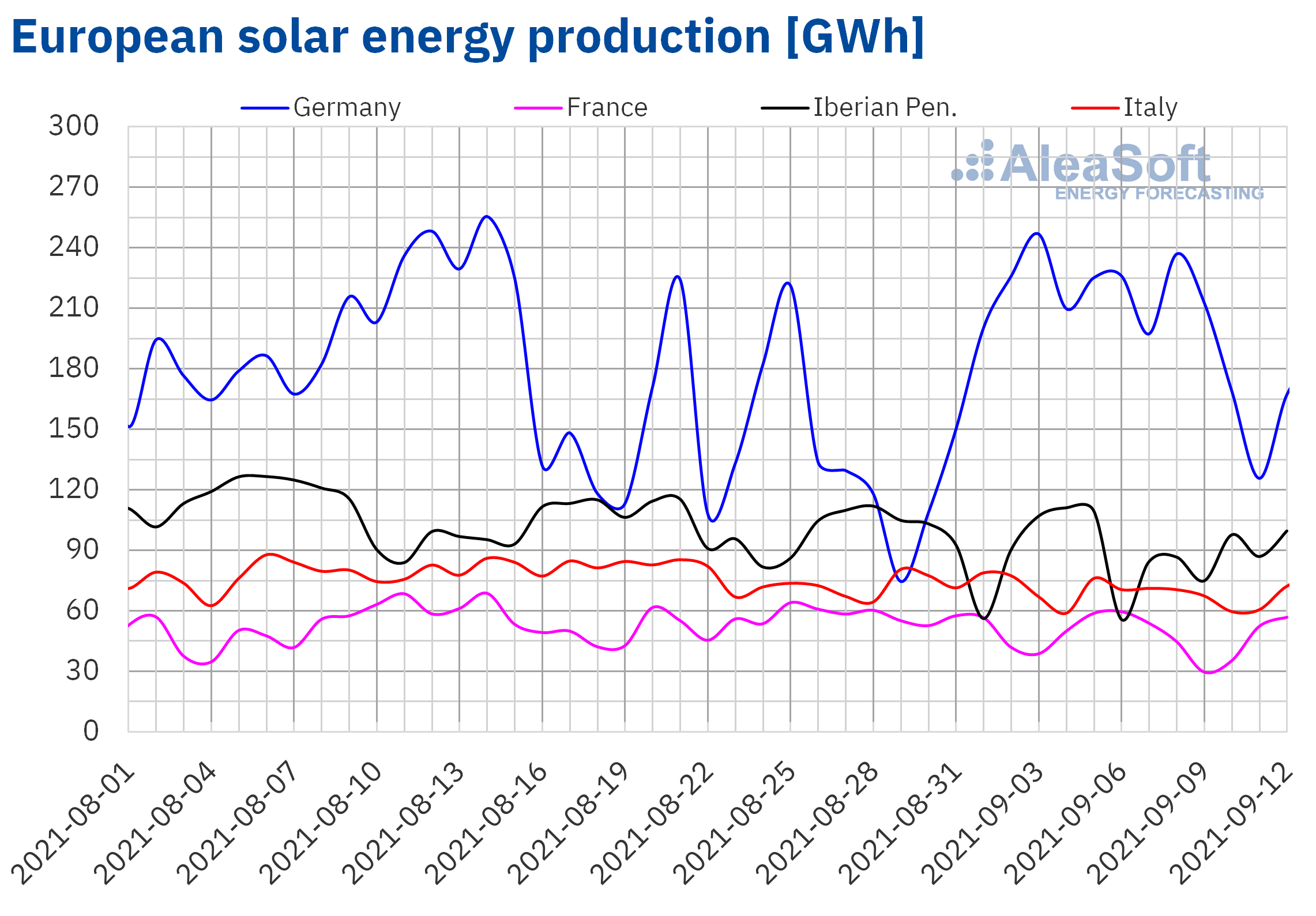

Photovoltaic and solar thermal energy production and wind energy production

The solar energy production decreased in all the markets analysed at AleaSoft during the second week of September compared to the first week of the month. The lowest variation was registered in the German market, with a fall in production of 2.3%. Meanwhile, the largest decrease occurred in the Iberian Peninsula and it was 13%.

For the third week of September, the AleaSoft‘s solar energy production forecasting indicates that it will decrease in the markets of Spain, Italy and Germany.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

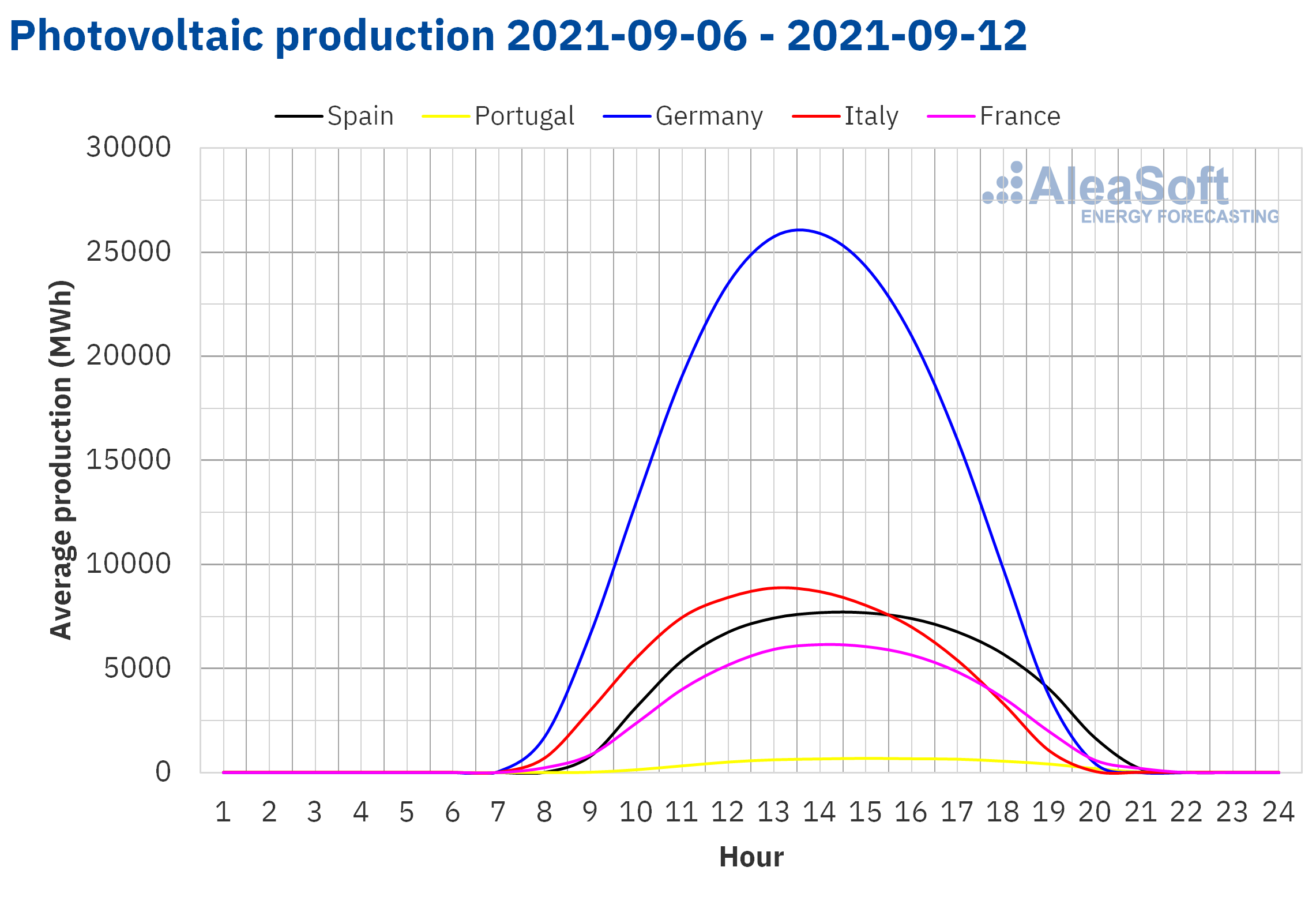

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

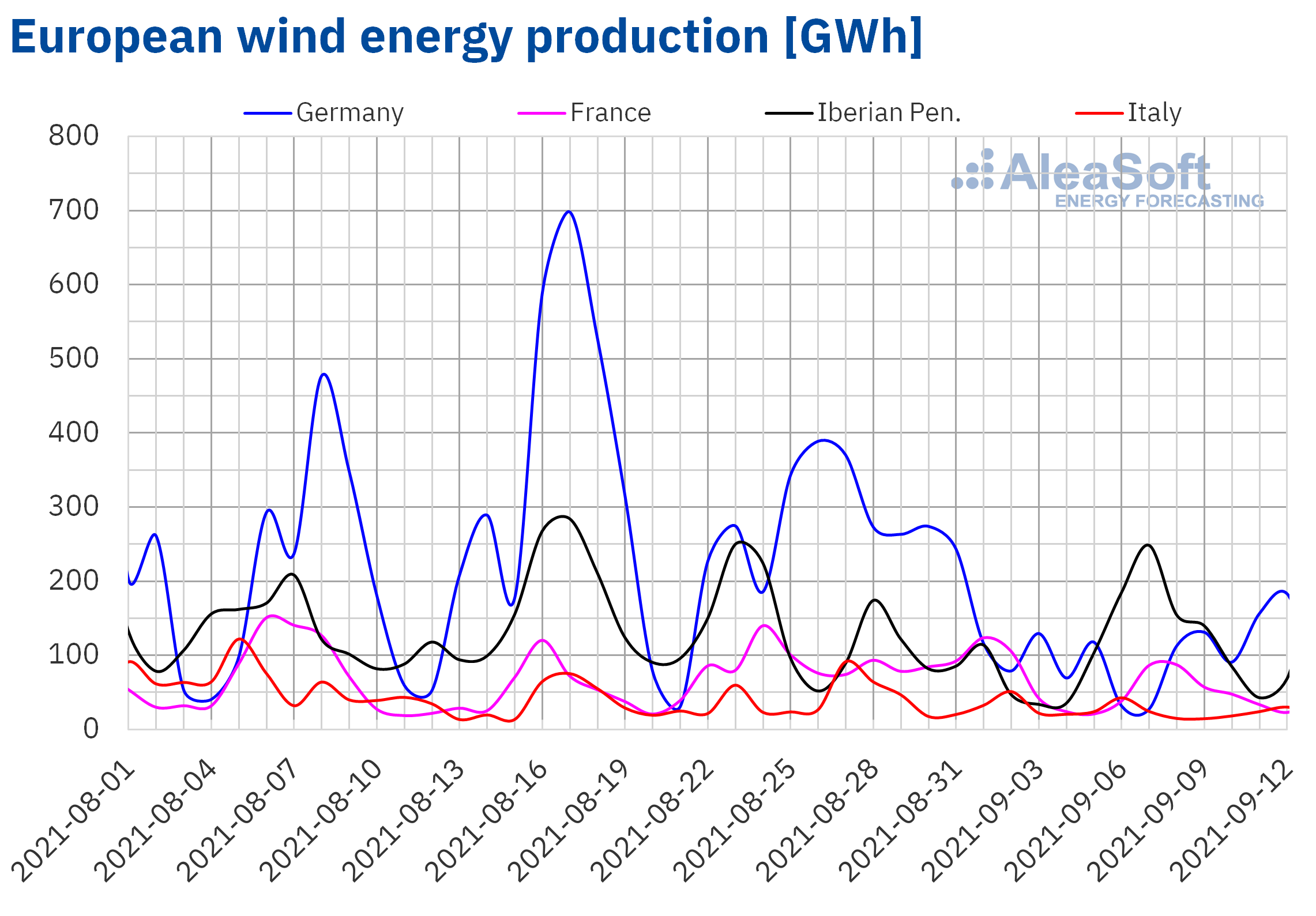

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

During the week of September 6 to 12, the wind energy production increased by 85% in the Iberian Peninsula compared to the previous week. On the contrary, in the German market, the production with this technology reduced by 29%, while in the markets of France and Italy the decrease was 24% and 10% respectively.

For the week of September 13, the AleaSoft‘s forecasting indicates that the wind energy production will increase in the German market, while it is expected to be lower in the rest of the analysed markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

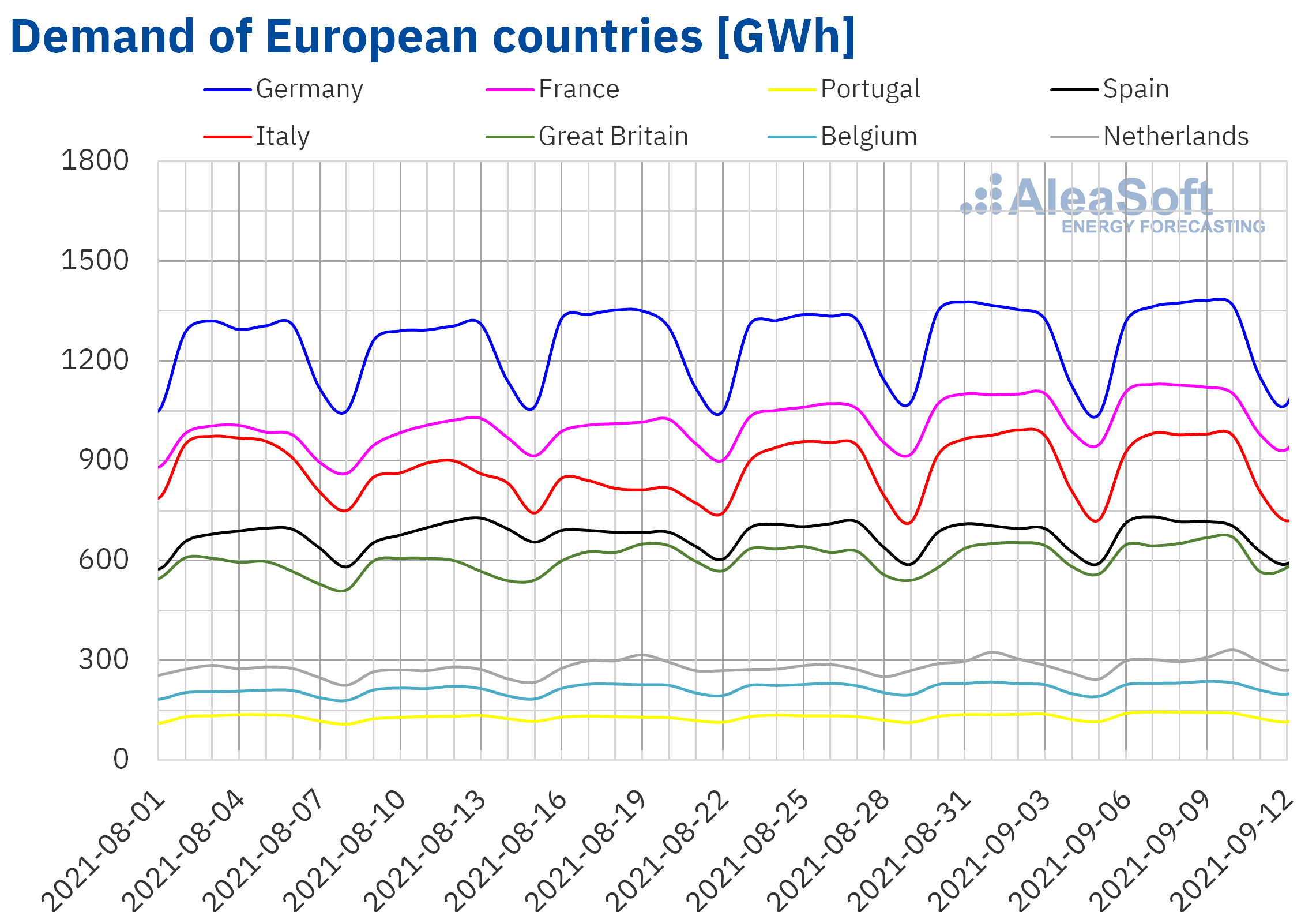

Electricity demand

The electricity demand of the European markets increased in a generalised way in the week of September 6 compared to the previous week. A factor that favoured these rises was the increase in average temperatures compared to the previous week, which was up to 3.4 °C in the British market. Although the increases in most markets were lower than 2.0%, the markets of Portugal and Great Britain registered increases of 3.8% and 2.8% respectively. In the case of Portugal, the demand from Monday to Thursday was higher than that of the same days of the previous week, as can be seen in the AleaSoft’s observatory of Portugal.

For the week of September 13, the demand is expected to maintain values similar to those of the previous week, with a downward trend in some markets, according to the AleaSoft‘s demand forecasting.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

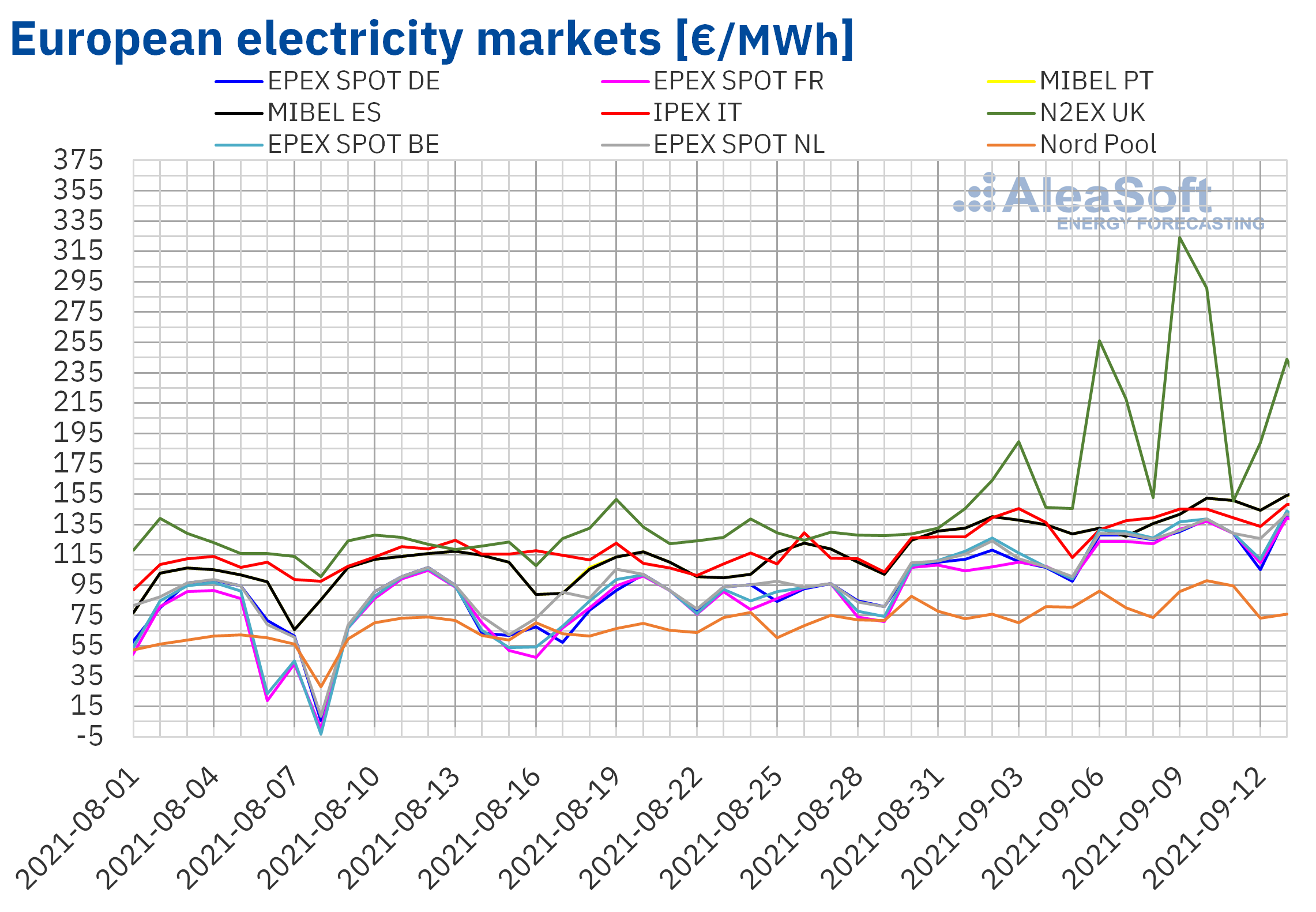

European electricity markets

During the week of September 6, the prices of all the European electricity markets analysed at AleaSoft continued to rise. The N2EX market of the United Kingdom was the one with the highest increase in the weekly average price compared to the previous week, of 50%. The EPEX SPOT markets of France, the Netherlands, Germany and Belgium registered increases of between 15% and 18%. In the Nord Pool market of the Nordic countries, the prices increased by 10%. The MIBEL market of Spain and Portugal was the one with the lowest price increase, of 6.0% in both cases, followed by the IPEX market of Italy, where the prices rose by 6.3%.

The highest weekly average price during the second week of September was that of the N2EX market, of €225.81/MWh. On the other hand, the Nord Pool market of the Nordic countries had the lowest average, of €85.88/MWh. In the rest of the markets, the prices were between €125.40/MWh of the EPEX SPOT market of France and €140.66/MWh of the MIBEL market of Spain and Portugal.

During the second week of September and the beginning of the third, the daily prices broke records several days in most European markets. On Monday, September 13, record prices were registered in almost all the analysed electricity markets. In the MIBEL market, a historical maximum of €154.16/MWh was registered. The markets of Italy and the Netherlands reached €148.18/MWh and €142.22/MWh, respectively, which are also historical maximums, and in Germany and France €141.32/MWh and €139.41/MWh were reached in each case, which although they are not the historical maximums, are among the highest. In the market of the United Kingdom, on Thursday, September 9, the record price at least since 2005, of €324.12/MWh, was reached. On the other hand, in the market of the Nordic countries, the historical maximum was reached on Friday, September 10, with a daily price of €98.13/MWh.

Similarly, on Monday, September 13, a price of €170.00/MWh was registered for 9 p.m. in the MIBEL market of Spain and Portugal. This is the highest hourly price in history in the Spanish market, while in the Portuguese market, it is the highest hourly price after the one registered on January 19, 2010, at 8 p.m., of €180.30/MWh. In the case of the Italian market, the highest hourly price since August 21, 2012, of €174.25/MWh, was registered on Monday, September 13, at 8 p.m. In the Netherlands, on Sunday, September 12, in the first hour of the day, the maximum hourly price, of €208.50/MWh, since the one reached at the beginning of February 2012 was reached.

During the week of September 6, the high prices of gas, coal and CO2 emission rights, which set new records during the second week of September, were the main cause of the increase in prices in the electricity markets. The increase in demand in all European markets, the general decline in solar energy production and the drop in wind energy production in countries such as Germany, France and Italy were added to this.

The AleaSoft‘s price forecasting indicates for the third week of September that prices will increase in most European markets, influenced by lower production with renewable energies and by the outlook of high gas and CO2 prices.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, Nord Pool and GME.

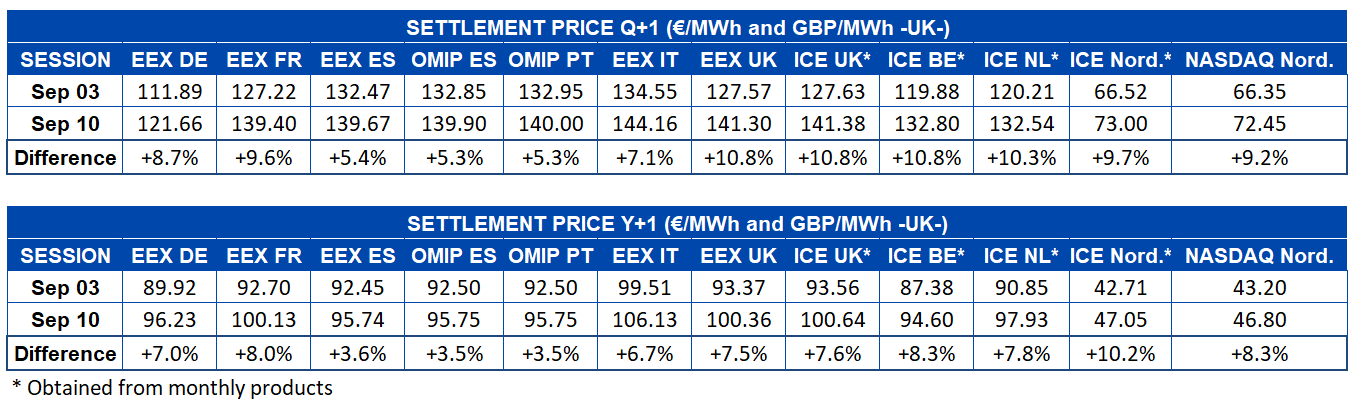

Electricity futures

On Friday, September 10, the settlement prices of the electricity futures for the next quarter increased in all the markets analysed at AleaSoft compared to Friday, September 3. The escalation in prices for these products was led by the EEX market of the United Kingdom and ICE market of the United Kingdom and Belgium, with an increase compared to the settlement of the previous week of close to 11% in all three cases. In the rest of the markets the variation was between 5.3% of the OMIP market of Spain and Portugal and 10% of the ICE markets of the Netherlands and the Nordic countries and the EEX market of France.

The electricity futures for 2022 also increased in a generalised way. In this case, the highest increase in settlement prices was registered in the ICE market of the Nordic countries, on Friday, September 10, being 10% higher than the previous Friday. In the rest of the markets the increase was between 3.5% of the OMIP market of Spain and Portugal and 8.3% of the NASDAQ market of the Nordic countries and the ICE market of Belgium.

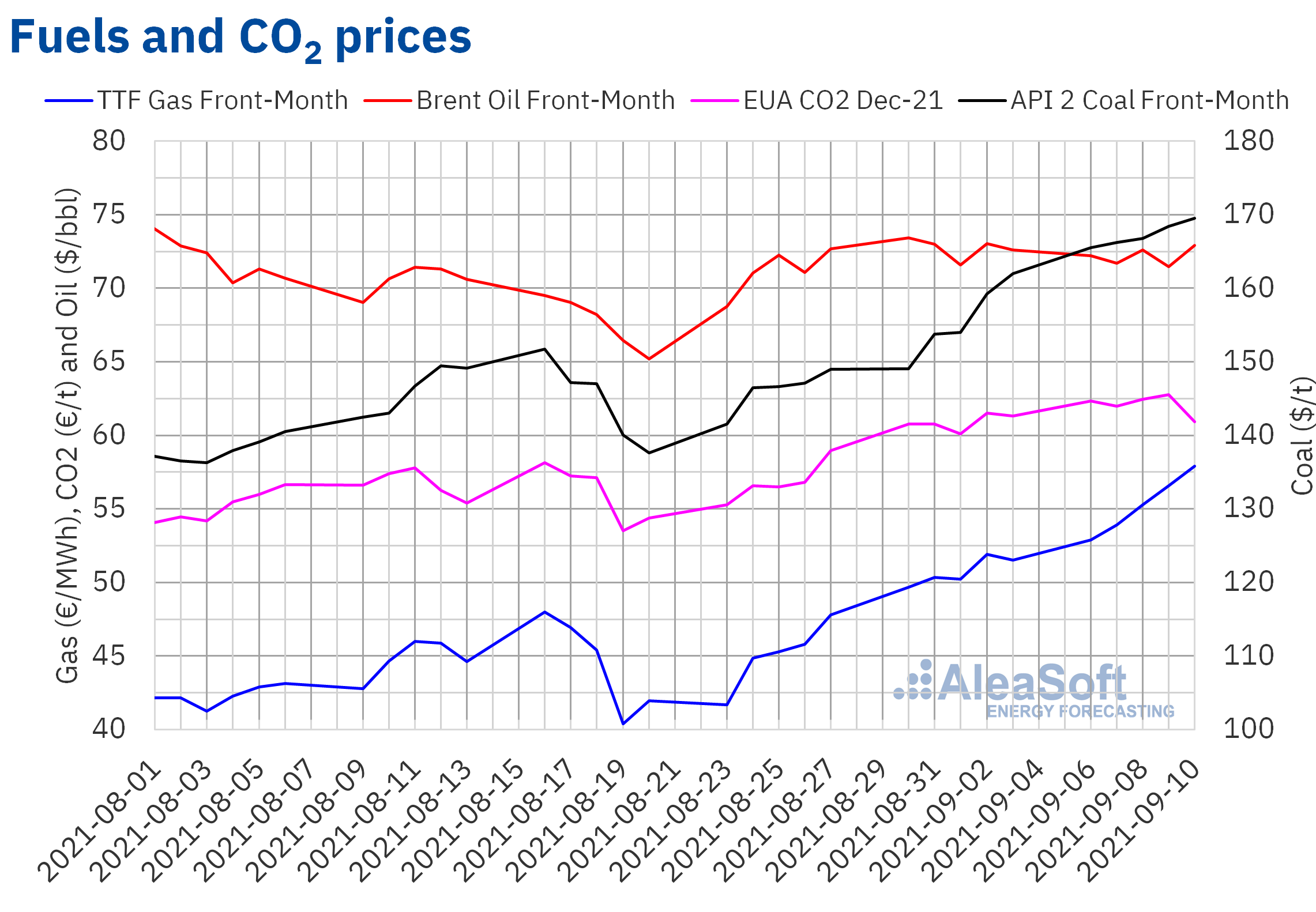

Brent, fuels and CO2

The Brent oil Front‑Month futures prices in the ICE market remained stable during the second week of September around $72 per barrel, with a maximum price of $72.92/bbl on Friday the 10th. The complicated situation of production in the United States due to the consequences of Hurricane Ida and the blockade of part of the exports in Libya indicate that prices will remain at high levels in the coming days.

Regarding the futures of TTF gas, the Dutch hub of reference in Europe, the prices for the Front‑Month in the ICE market continue with a very aggressive upward trend. On Friday, September 10, they settled at €57.92/MWh, which represented an increase of 12% compared to the settlement of the previous week and the highest price in, at least, the last nine years. The situation of the low reserves to face the winter continues to favour the bullish situation in the markets.

In this sense, the Russian giant Gazprom announced last Friday, September 10, the completion of the works of the new Nord Stream 2 gas pipeline that directly connects Russia with Germany, avoiding the geopolitical conflicts with Ukraine, and confirms the plans to start supplying gas before the end of the year. The impact on the European gas markets is expected to be significant. In recent months, every news, rumour or even erroneous data on the gas pipeline caused very important fluctuations in gas prices.

In a similar situation, of upward trend and continuous breaking of records, are the CO2 emission rights futures prices in the EEX market for the reference contract of December 2021.The historical record of this future was broken three times during the week of September 6, the last time was on Thursday the 9th when it reached €62.75 per ton.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft’s analysis on the prospects for energy markets in Europe

Although the prospects for the coming months are that the electricity markets prices will continue to be high, in the mid‑term they will fall and regain the market balance, which will remain in the long‑term.

The evolution and prospects for the energy markets will be one of the topics that will be addressed in the webinar that is being organised at AleaSoft for next October 7. Two speakers from the consulting firm Deloitte will participate in the meeting, Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services and Carlos Milans del Bosch, Partner of Financial Advisory, who repeat almost a year after the webinar in which they participated in October 2020, to talk about renewable energy projects financing and the importance of the forecasting in audits and portfolio valuation. On the AleaSoft side, Oriol Saltó i Bauzà, Manager of Data Analysis and Modelling will be the speaker and Antonio Delgado Rigal, CEO of the company, who will join the speakers at the analysis table that will be held in the second part of the webinar in Spanish.