AleaSoft, September 13, 2021. Interview by Ramón Roca from El Periódico de la Energía with Antonio Delgado Rigal, PhD in Artificial Intelligence, founder and CEO of AleaSoft.

What a busy summer we’ve had: heat waves, record gas and CO2 prices, and also record prices in the electricity markets. What do your models say? Are these events related?

Indeed, the record prices of the electricity markets are related to the record prices of gas and CO2. In hotter periods, with less wind energy and less water in the reservoirs, it is necessary to resort to a greater extent to combined gas cycle gas turbines and this situation of rising prices is exacerbated.

How did you see the CO2 prices in recent months? Is speculation still present in this market or are these prices already those expected to make the energy transition possible?

The CO2 emission rights prices did not stop rising in recent months. They already exceeded €62/t and are close to doubling the values with which they started 2021. Speculation in the market continues, encouraged because Brussels has not given any sign of interest in stopping this escalation.

In the long term, when more progress has been made in the energy transition, prices in this market are expected to be higher as a regulatory factor between gas and green hydrogen. We consider that the current price level is affecting all consumers, with the negative effect that this will have for the industry and the European economy in general, fundamentally in the current situation of recovery from the crisis that created the COVID‑19 pandemic. With CO2 prices in a range between 20 and 30 Euros per ton, it is possible to continue advancing in the energy transition without the consumers being particularly affected. The energy transition, like any transition process, must be gradual so as not to “leave anyone lying on the road”.

Gas prices in Europe have been one of the protagonists this summer. In addition to the records, they were also protagonists of significant falls of more than 10% at certain times. What role did the news about Nord Stream 2 play in these price fluctuations and what impact will the entry into operation of this gas pipeline have on gas prices in Europe in the mid- and long‑term?

The latest information continues to indicate that the gas pipeline will be operational before the end of the year. Being so close to its launch, any news, rumour or even error in the data caused major fluctuations in gas prices in Europe. And this is an indication that, once operational, it will have a significant impact on prices.

The increase in supply will bring a drop in prices in the mid‑term and stability in the long‑term. But it must not be forgotten that gas supply will continue to be subject to geopolitical decisions between producing and consuming countries.

Also related to gas, everything seems to indicate that Algeria will cut the gas supply to Spain through Morocco when the pact between these three countries ends on October 31. If the agreement is not renewed, what consequences would it have for the Spanish electricity market?

Although the entry of gas through Nord Stream 2 will bring a drop in prices, the cut of Algerian gas supplies through Morocco will create uncertainty, since all the gas flow will be through a single gas pipeline that directly connects Algeria with Spain. If this gas pipeline has a problem, it would cause a decrease in supply and an increase in prices, which would put Spain and Europe in a difficult situation in the face of winter due to the low levels of the reserves. This uncertainty is already reflected in gas futures.

What impact is this, already quite long, episode of high prices in the European electricity markets having on your models and the prices in the long‑term?

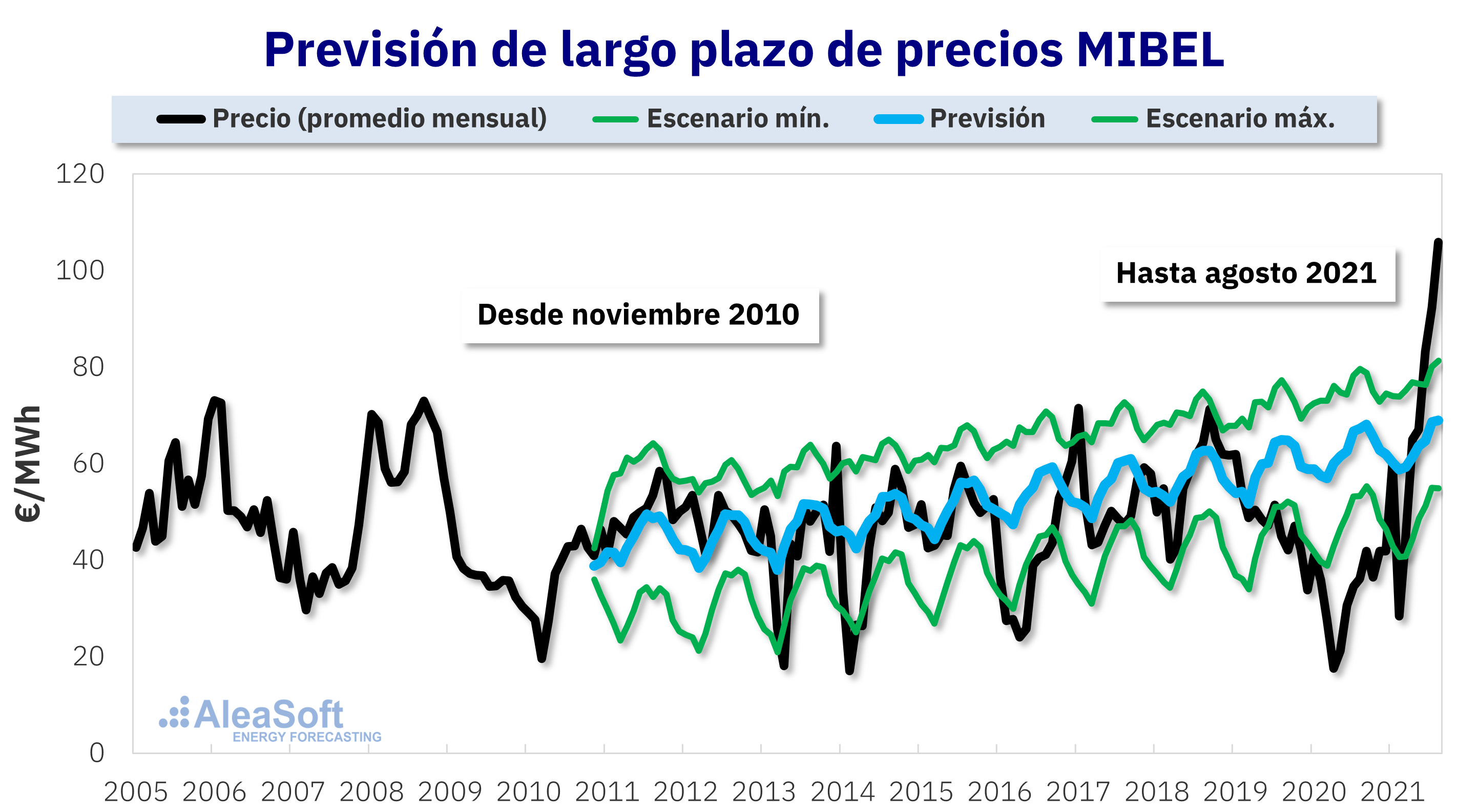

Our models analyse the market based on the balance that exists between supply and demand, between the prices necessary to recover investments and the prices that consumers are willing to pay. In this sense, what the models are telling us is that right now prices are very far from that equilibrium and that, therefore, in the mid‑term prices should fall.

It is the opposite situation to the one we experienced in the second quarter of 2020, when prices were extremely low, and our models showed a rise in the mid‑term.

Our models indicate that, despite the episode of very high prices that we are currently having, the price level is going to be maintained in the long term, showing that equilibrium that must always exist in the market.

Prices will continue to fluctuate in the future. Our models indicate the trend of the average price, but they also provide us with confidence bands that indicate, with a scientific metric, the probability of price fluctuation at each point of the horizon.

What are the measures, according to you, that should be taken so that high market prices do not harm consumers? What would you change of taxation?

In the first place, the Government must urge Brussels to regulate the CO2 emission rights market so that prices fall to a level that continues to favour the energy transition but without weighing down the competitiveness of European industry or affecting all of the consumers. The signing of PPA contracts of electro‑intensive consumers covered by the Statute of electro‑intensive consumers should also be encouraged and bureaucratic obstacles in the development of new renewable energy projects should be reduced. Regarding taxation, we consider that the 7% tax on generation should be definitively eliminated, because in addition to being another cost that consumers end up paying in the end, this tax puts Spanish producers at a disadvantage compared to those of neighbouring countries . If the electricity bill had a VAT of 5%, it would be a respite for domestic consumers.

The Government is studying reforming the PVPC rate so that it is not indexed to the pool and therefore it is not so volatile. What do you think of this measure?

The prices that end consumers pay will always be indexed to the pool in one way or another, because it is the reference, and there is no other. It should be noted that in the not too distant future we will see low monthly prices, as happened in more than 20 years of market history, and commitments will have to be met if we make a long‑term contract or a PPA. As a curious fact, the future markets show yearly prices of €30/MWh for 2031.

What do you think that the Government forces the large electricity companies to auction energy between retailers and industrial consumers?

There are still many doubts about this measure and its consequences. If the main objective is lowering electricity prices, it must be said that surely the level of market prices would not be affected, since it would remove demand, but also supply. But with lower volume, the price volatility might increase.

But the fact of closing long‑term energy contracts, either with auctions or with PPAs, is a very good practice that is not yet well established in the Spanish electricity market. Long‑term agreements are beneficial for both generators and consumers because they allow both to mitigate market prices risk, allowing long‑term security of income, for generators, and of costs, for consumers. Thus, for the auctions to be really useful they should be long‑term, we are talking about at least five years of duration.

But one of the largest complexities in PPA is guarantees. In the case of these auctions, who will provide the guarantees? In this case, it should be the State that provides guarantees both for consumers, in case the generators do not deliver the committed energy, and for the generators, in the event that consumers cannot acquire all the agreed energy.

And it must be clear that ensuring a long‑term price guarantees that price even if market prices rise, but they guarantee the same price when market prices fall.

The Government started the urgent processing of a draft Law to reduce the income of the oldest non‑CO2‑emitting power plants with the intention of lowering the electricity market prices. Do you think this measure will really have an impact on prices? What other consequences do you see from a measure of this type?

Making these plants have to pay for CO2 emission rights will not lower market prices.

Beyond the short‑term impact that this may have on market prices, there is the legal uncertainty it causes, especially at a time when what is needed is legal certainty to encourage the investment necessary to develop all the renewable energy capacity that is expected in the next few years. The affected plants are the nuclear, hydroelectric and some wind power plants, all of them non‑polluting and very necessary during the energy transition. A sample of the legal uncertainty caused by a measure of this type was the fall in the stock market suffered by the companies that own these plants as soon as the announcement of this measure occurred.

Another consequence might be the early closure of nuclear power plants, which would be counterproductive. If nuclear power plants close before there is sufficient renewable energy capacity, combined cycle gas turbine power plants will be those that will fill the gap left by the nuclear power plants and therefore prices and emissions of polluting gases will increase.

The Government also plans to create the National Fund for the Sustainability of the Electricity System (FNSSE), which has among its objectives avoiding increases in the electricity price. Do you think it will be effective?

In our opinion this will only transfer the problem. By removing the costs associated with the specific remuneration scheme for renewable energies, cogeneration and waste from the bill, the bill will effectively go down. But since the costs will have to be borne by the oil, gas and electricity companies, they will transfer it to the final consumer who will continue to be affected, especially the industry. In addition, it is another measure that generates regulatory uncertainty with all the problems that it brings.

The new renewable energy auctions, what do you think about them? It seems that before the end of the year there will be auctions for cogeneration and other renewable energy technologies such as solar thermal and biomass.

At AleaSoft, we have always warned that it is necessary to be prudent with renewable energy auctions. One of the objectives of these auctions is reducing electricity prices and, as it was seen after the results of the first auction, the impact on markets prices was not perceptible.

Renewable energy auctions may make sense in specific cases, for less competitive regions or for less mature technologies, but if the objective is meeting the NECP goals for 2030, the wind and photovoltaic energy are mature and competitive technologies at markets prices without aids. Therefore, auctions must be carefully designed so as not to distort the market.

There are still people who have doubts about the energy transition: that the reduction of emissions will not be possible up to the expected values, that the electrification of transport will not be possible due to the costs and materials, that green hydrogen will not be able to replace natural gas. What situation do your scenarios pose in 2050 when the EU targets project an economy with zero net CO2 emissions?

The way is not going to be easy at all. There will be bumps and misalignments, like the episode of high prices that we are experiencing now, but the change is inevitable.

On the one hand, as you say, there are those who think that mass electrification is not going to be possible and that it is not going to be possible to generate enough green hydrogen to replace all the fossil fuels that are currently used. But, on the other hand, there are also many voices that claim that the renewable energy capacity objectives of the NECP will bring an excess supply of energy that we will not be able to consume or manage.

As we commented on different occasions, there will be specific imbalances at some point along this path, but both the electrification and the use of green hydrogen and the increase in renewable energy capacity are, at the same time, the need and the response of each other, the two must occur in parallel. The renewable energy revolution already started and we are already seeing how the green hydrogen production projects are taking shape or how the sales of electric vehicles are growing, still very slowly, but they are growing.

The expected increase in renewable energy capacity raises some “ghosts” such as curtailments or a low price factor for the photovoltaic energy due to the fall in prices in the hours in which it produces. According to your models, will these episodes happen very frequently? What role will electric vehicles and batteries play in the issue of curtailments and price factor of the photovoltaic energy?

According to our models, there may be curtailments and periods of low prices, but not in a sustained manner, as there will also be periods of high prices. It is true that the supply will increase, but the demand will also increase, for example, with the boom in electric transport. As the market is in equilibrium, a large part of the electricity consumption to charge the vehicles will be moved to the hours of lower prices. Another factor that will increase the demand and will also avoid curtailments is the storage with batteries, but also with green hydrogen. And green hydrogen also has great potential in industry to replace the consumption of hydrogen that is obtained with processes that generate polluting emissions, to replace gas or to obtain other energy vectors such as green ammonia. The response from the demand side cannot be forgotten, which will imply that a part of the consumption moves towards the hours with lower prices.

A few days ago we published that, according to Hydrogen Europe, by 2030 Spain will have more than half of Europe’s planned electrolyser capacity, with a total of 71.8 GW. Is hydrogen so important for the energy transition? Do you see this objective viable and sufficient?

Hydrogen is going to be essential in the energy transition. Just like we talk about the renewable energy revolution, we should talk about the green hydrogen revolution.

Electricity will replace many of today’s uses of fossil fuels: heating, light transportation, small industry, etc. But there is a part of the economy and of the industry that it is not going to be possible to electrify, either due to inefficiencies or technical impossibilities. We are talking about heavy industry, high temperature industrial processes or heavy and long distance transport. In this case, fuels generated from renewable energies and that do not emit CO2 in their production will have to be used and, right now, green hydrogen is the only candidate. In addition, unlike electricity, it can be stored in large quantities for a long time, allowing it to be used for seasonal energy storage.

And with the necessary investments, Spain is going to become the largest producer of green hydrogen in Europe thanks to its great solar energy resource, the largest in the entire continent.

Spain is characterised by relatively low diversion costs for renewable energies compared to other electricity markets further north of the continent. Do you see that these costs could increase with the increase in renewable energy capacity and the share of non‑manageable technologies in the mix?

In the mid‑ and long‑term, in Spain, with the increase in renewable energy penetration and the closure of the nuclear power plants, the costs of diversions may increase slightly, but will remain below the level of the rest of European markets.

In a few weeks you will hold a second webinar with Deloitte and you will discuss audit and project financing issues. How important are coherent and quality forecasting to an audit process? And for the financing of renewable energy projects?

It is essential that the forecasts used in the audit processes are coherent and of quality to correctly value the assets and prepare the financial information used, for example, in restructuring, purchase or IPO processes. In this sense, it is very important that the forecasts have hourly granularity to determine with greater precision the income that the assets are expected to have in the future.

This need to have a reliable estimate of the future income also occurs when financing a new renewable energy project. Hence the importance of having coherent forecasts based on scientific methods and that take into account the market equilibrium also in this area. It is also important that the forecasts have confidence bands based on a probabilistic metric that allows quantifying the risk of assuming a certain price forecast.

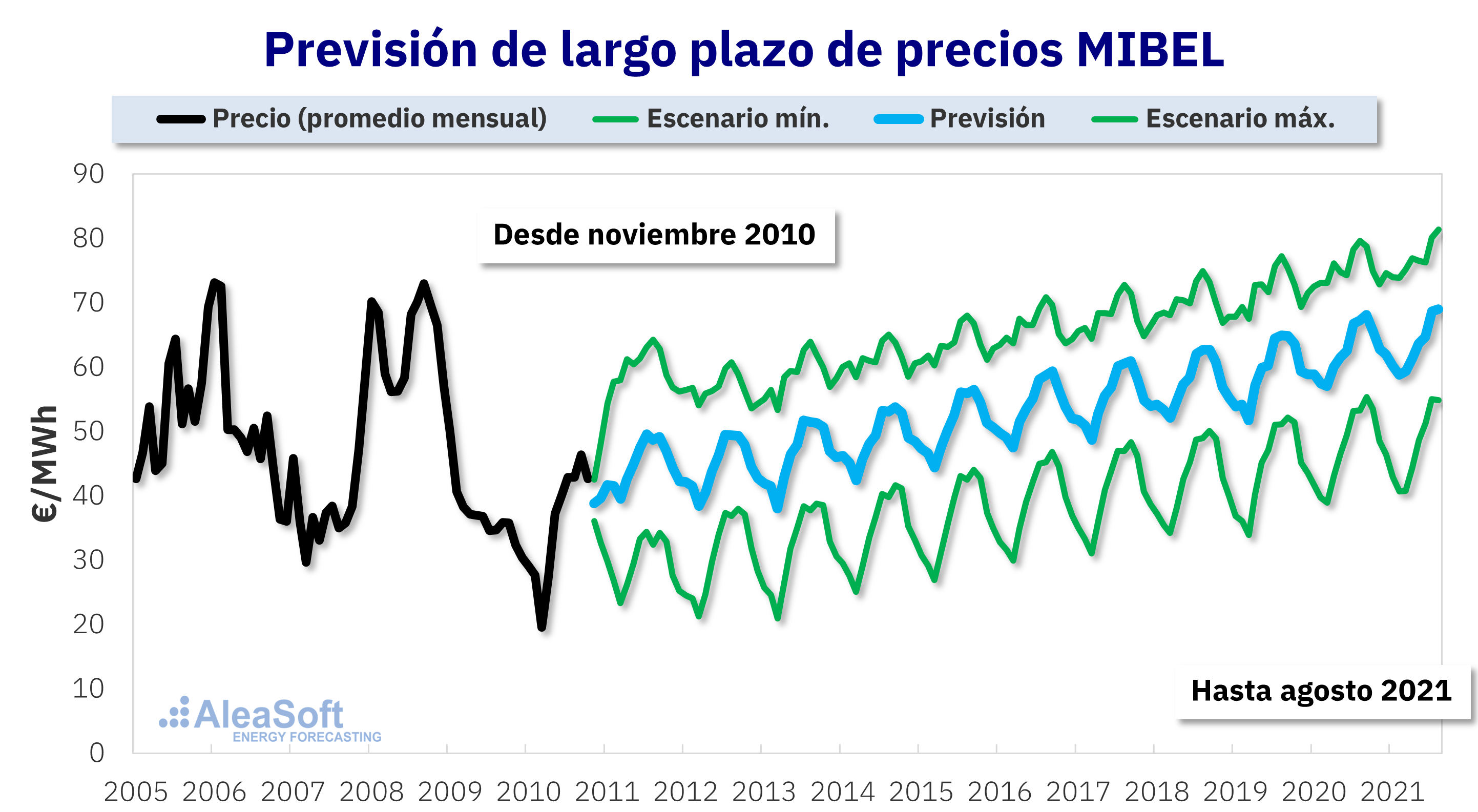

We recently published a news item related to a forecast you made at the end of October 2010. It was news with a lot of impact. Any comment on this? Is the marginalist market the best possible? Is there market equilibrium? Why was the forecast of more than 10 years ago so good?

Well, the truth is that yes, we received many inquiries about that forecast and our models. More than showing a successful forecast, what we wanted to show in this news is how the market works around the equilibrium and that this is maintained in the long term. Our 2010 forecast is illustrative in this regard because that market equilibrium is what our models analyse and project.

It is also a sample of how efficient the marginalist market is, and how it continued to give balanced prices despite all the changes in the mix that occurred in the last decade. For this reason, we are sure that the marginalist market will continue for many years in the European markets.

For more than 20 years, you have been the main reference in terms of forecasting in the Spanish electricity sector. The final question is, taking into account that you work with large generation and retailer companies, with renewable energy developers, large and electro‑intensive consumers, investment funds, banks… are you creating some kind of synergy between these clients? For example, to advise and coordinate a PPA so that all parties use the same reference price.

The truth is that offering services for more than 20 years to practically all the agents in the energy sector provides us with a 360° view of the sector in Spain and in the main markets of Europe. This can be summed up in experience, solutions and relationships.

From the beginning we helped, with our experience, our clients with solutions related to the optimisation of resources in all horizons, for generators, retailers and consumers. In the long‑term future analysis, this experience and this help is essential to draw up the strategy.

In addition to being a reference in the field of the forecasting and the market vision in all time horizons, AleaSoft became a hub for connections and contacts between companies with different needs and potentialities.

For three or four years, with the massive introduction of renewable energies, hundreds of companies were created, without experience and in need of help to obtain financing, to have knowledge of the market and to draw a growth strategy with a vision of the future.

This work as a hub of relations and intermediation has its maximum exponent with the subject of PPA. All companies related to renewable energy need help to carry out a PPA, to seek financing and a solvent counterpart.

In these months of high prices, large and electro‑intensive consumers call us to contract our market price forecasting in all horizons, to know a PPA and to help them find a generating counterpart.

Investment funds also call us, which seek, in addition to the forecasting and the long‑term vision, to buy or sell renewable energy assets.

We work with consultants to jointly tackle larger and more complex projects using our forecasting models and our experience in the energy markets.

Having relationships with the main companies in the sector allows us to better understand the market, the needs, the solutions and as you say, it gives us the opportunity to be a bridge between electricity generation and consumption or retailer companies, providing the same reference price for the future and the same market vision.