AleaSoft, September 10, 2019. AleaSoft analyses the prices in the fuel markets, CO2 emission rights, European electricity markets and renewable energy production in the week of September 2. The week was characterized by the drop in prices in the main electricity markets of the continent compared to the previous week. The electricity demand decreased in some European countries, as did the solar energy production, but the wind energy production increased considerably, favouring the fall in prices.

Brent, fuels and CO2

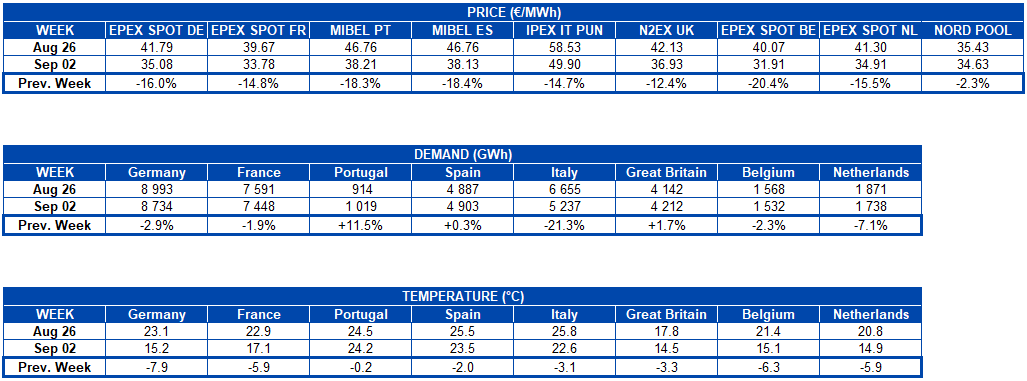

The brent oil futures prices for the month of November in the ICE market increased over the last week. The settling price on Friday, September 6, was $61.54/bbl, 3.9% higher than the price of the Friday of the previous week. This price exceeded the maximum price reached during the past month, $61.32/bbl, on Friday, August 2. The upward trend of last week was reinforced by statements made at the end of last week by the United States Federal Reserve that the economy would continue to grow moderately. Thus, continuing with this trend, the settling price of yesterday Monday was $62.59/bbl.

The price of TTF gas futures in the ICE market for the month of October began the week of September 2 with a value of €11.85/MWh, which is the lowest settling price achieved in the last two years . During the past week, the gas prices gradually increased to €12.35/MWh at the end of the session on Friday, September 6, obtaining a weekly average of €12.10/MWh, which represents a decrease of 2.6% over the average of the previous week.

The prices of API 2 coal futures in the ICE market for the month of October, during the first week of September, experienced an upward trend. At the end of the week, the settling price on Friday, September 6, was $58.75/t, 4.7% above the price obtained on Friday, August 30. The greatest difference between last week’s prices occurred on Tuesday, September 3, with a settling price of $58.05/t, exceeding the price of the previous day by $1.5/t.

The CO2 emission rights futures in the EEX market for the December 2019 reference contract ended last week with a price of €25.09/t. This market remained at around €25/t throughout the week, reaching the maximum price of the week, €25.54/t, on Thursday, September 5, occurring a decrease of €-0.5/t the following Friday. Last week’s average price for CO2 emission rights futures decreased by 2.7% compared to the average price of the previous week. The evolution of this market in these days was conditioned mainly by the decisions made around Brexit and a possible extension to avoid leaving the European Union without agreement.

Sources: Prepared by AleaSoft using data from ICE and EEX.

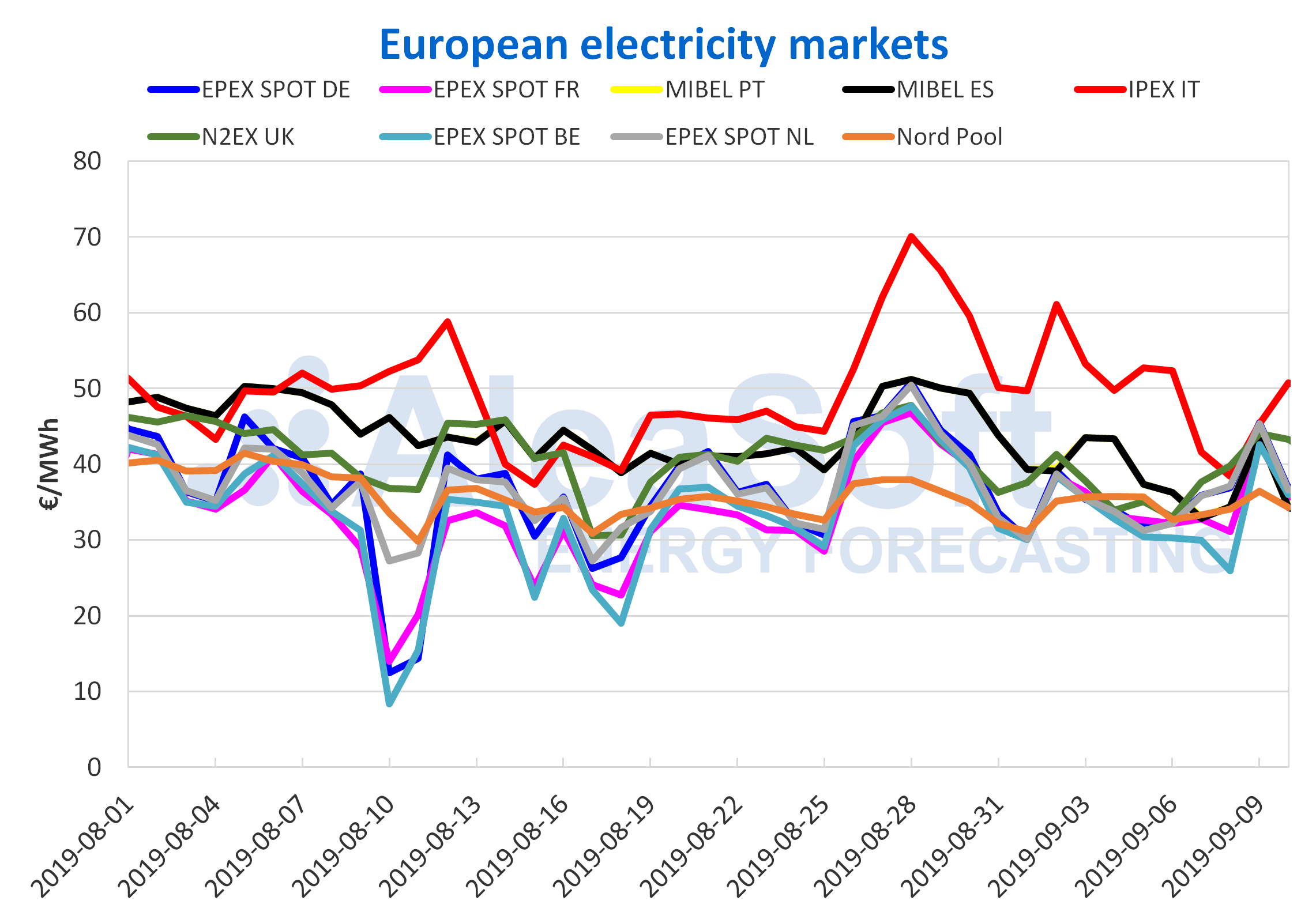

European electricity markets

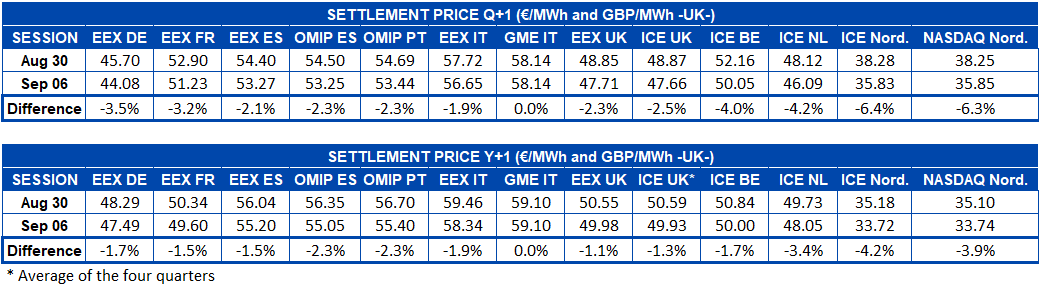

The prices of the main European electricity markets fell last week compared to the week of August 26. The EPEX SPOT market in Belgium experienced the biggest decline, with -20% compared to the average for the week of August 26. At the same time the rest of the markets experienced similar declines of between -18% and -14% compared to the previous week, with the exception of the Nord Pool market in which the reduction was more moderate, of -2.3%.

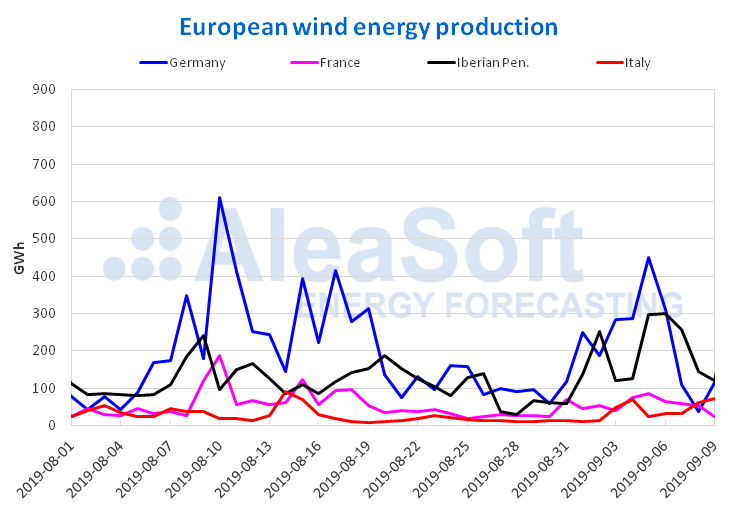

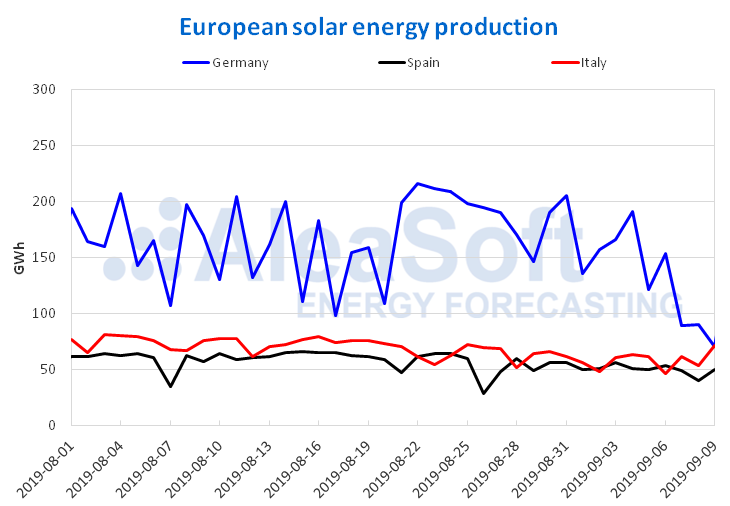

In the week just ended, the electricity demand decreased in most of the countries analyzed, because the temperatures in all countries dropped between -0.2ºC and -7.9ºC. The wind energy production increased considerably in the continent, with an average of 159% compared to the previous week. France was the country with the smallest increase in wind energy production, of 75%, and Italy the fastest growing, with 220%. In contrast, the solar energy production decreased in Germany and Italy by -21% and -9.5%, respectively, and had a slight increase of 0.9% in Spain. The decrease in the electricity demand, caused by the decrease in temperatures, together with the considerable increase in wind energy production, favoured the decrease in prices during the period analyzed.

The IPEX market in Italy was the one with the highest price in Europe for most of the past week, with an average weekly value of €49.90/MWh, with the exception of Sunday, September 8, when it was surpassed by the British N2EX that reached the highest price for that day of €39.81/MWh. The other two markets of the highest price group, the Iberian MIBEL and the British N2EX, had prices over €37/MWh last week. The Nord Pool and EPEX SPOT markets in Germany, France, Belgium and the Netherlands had values between €31/MWh and €35/MWh. The Belgian market was the one with the lowest price, with a weekly average of €31.91/MWh.

This week has begun with significant increases in most markets. The prices of yesterday Monday, September 9, rose about €10/MWh compared to last week’s average in the EPEX SPOT markets in Germany, France, Belgium and the Netherlands. In the MIBEL and N2EX markets an approximate increase of €6.0/MWh was perceived and in the Nord Pool market the increase was €1.9/MWh, while the IPEX market suffered a decrease of €-4.6/MWh. On the other hand, the settling prices for today, September 10, have fallen again in most markets, with the exception of the IPEX market, which has ended at €50.78/MWh, €5.5/MWh above the price matched the day before.

Sources: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

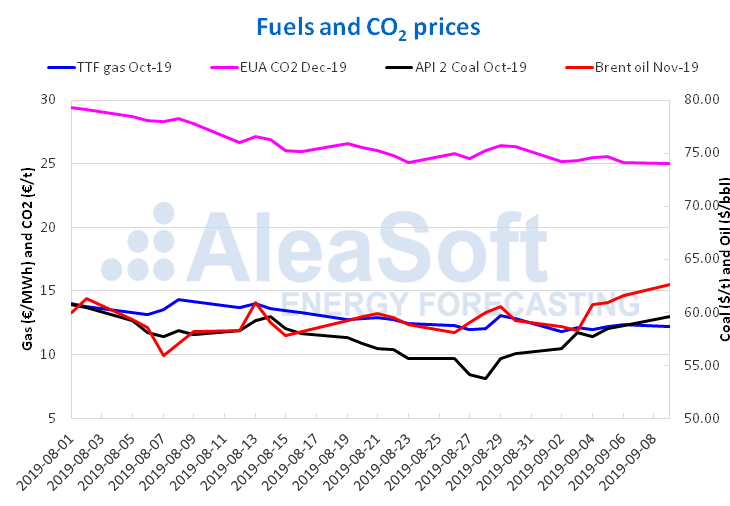

Electricity futures

The prices of electricity futures during the past week remained down for both the next quarter and for the year 2020, except in the case of the GME-operated MTE market where no changes were appreciated. The ICE market in the Nordic countries had the biggest decrease for the last quarter of this year, which was -6.4%. In general, the analyzed markets of ICE and Nasdaq were the ones that fell the most in the last week for the fourth quarter of 2019, followed by the EEX markets in Germany and France.

As for futures prices for next year, the markets of the Nordic countries had the largest decline with ‑4.2% and ‑3.9% in ICE and Nasdaq, respectively.

Wind and solar energy production

Last week, the wind energy production doubled in most European countries analyzed compared to the previous week. It was the second week with the highest rate of increase in the last two years, with an increase of 133% in all the countries analyzed. Among these increases, the 220% increase in Italy stands out. The significant increases in Spain and Portugal were 190% and 179%, respectively.

Last week, in Germany was also generated with this type of technology more than double the production of the week of August 26, obtaining 1668 GWh, which represented an increase of 109%. In contrast, in France the 75% increase in wind energy production was a bit more discreet. During this week, AleaSoft expects a drop in wind energy production in Portugal and France, and values equivalent to those of last week in the rest of the countries analyzed.

Sources: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

In the week just concluded, the solar energy production in Spain, including photovoltaic and solar thermal technologies, was very similar, only 0.9% higher than that recorded in the week of August 26. In the case of Italy and Germany, the generation with this renewable source decreased by ‑9.5% and ‑22%, respectively.

Sources: Prepared by AleaSoft using data from ENTSO-E, REE and TERNA.

Source: AleaSoft Energy Forecasting.