AleaSoft Energy Forecasting, August 4, 2025. In the last week of July, prices in most European electricity markets fell thanks to increased solar photovoltaic and wind energy production, as well as lower demand in several countries. Spain, Italy, Portugal and France broke daily solar energy generation records for an August month. In the fuels and CO₂ markets, futures registered volatility, settling at values close to those of the previous week.

Solar photovoltaic and wind energy production

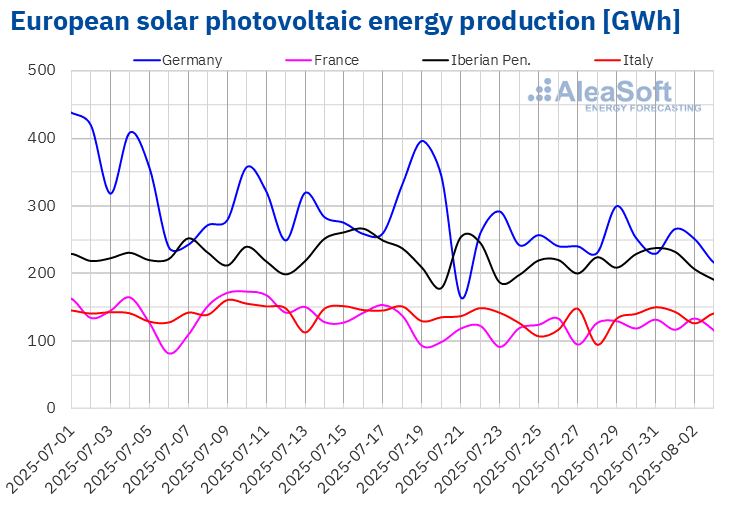

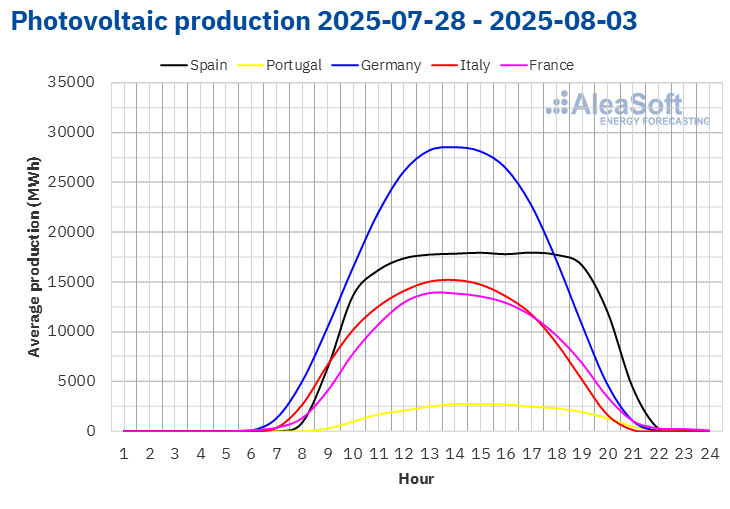

In the week of July 28, solar photovoltaic energy production increased in most major European electricity markets, reversing the negative trend of the previous week. The French market registered the largest increase, 8.6%, while the Italian market registered the smallest, 0.3%. The Spanish and German markets registered increases of 1.3% and 2.9%, respectively. As an exception, the Portuguese market reduced its solar photovoltaic energy production for the second consecutive week, this time by 6.7%.

During the week, the markets broke solar photovoltaic energy generation records for the month of August. On Friday, August 1, the Spanish, Italian and Portuguese markets set new all‑time highs of daily generation for this month, with 196 GWh, 143 GWh and 27 GWh, respectively. The following day, August 2, the French market generated 133 GWh and set its daily generation record for the month of August.

For the week of August 4, according to AleaSoft Energy Forecasting’s solar energy forecasts, solar photovoltaic energy production will increase in the German, Italian and Spanish markets.

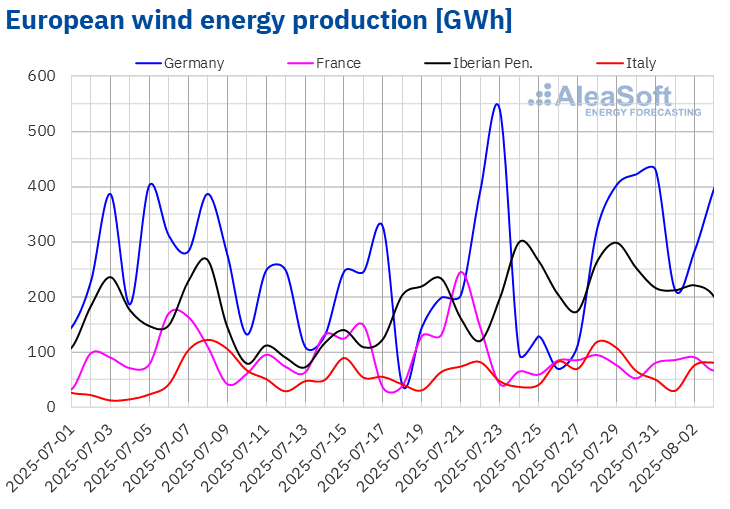

During the week of July 28, wind energy production increased in the Italian, Spanish and German markets by 22%, 26% and 60%, respectively, compared to the previous week. The Spanish market maintained its upward trend for the third consecutive week, while the Italian and German markets repeated it for the second week. In contrast, the Portuguese and French markets reduced their wind energy production by 21% and 25%, respectively. The French market accumulated declines for the second week, while the Portuguese market reversed its trend after two weeks of increases in wind energy production.

In the week of August 4, according to AleaSoft Energy Forecasting’s wind energy forecasts, wind energy production will decrease in all analyzed markets.

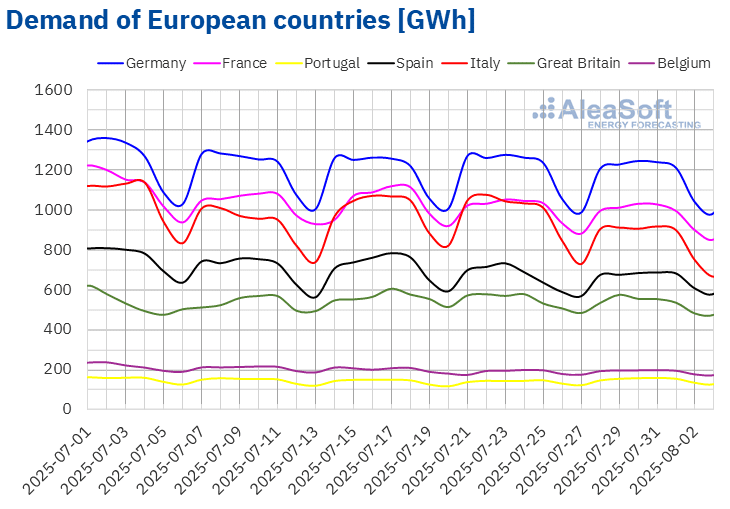

Electricity demand

During the week of July 28, electricity demand decreased in most major European electricity markets compared to the previous week. The Italian market registered the largest decline, 12%, while the Spanish market registered the smallest drop, 0.8%. The German, French and British markets registered declines of 2.3%, 2.7% and 2.8%, respectively. With the exception of the German market, these markets accumulated declines for the second consecutive week. On the other hand, the Portuguese and Belgian markets increased their demand after registering declines during the previous three weeks. In the Portuguese market, it rose by 6.8% and in the Belgian market by 1.2%. In the latter, demand recovered after the celebration of July 21, Belgium’s National Day.

Average temperatures fell in most markets, favoring a reduction in demand in those markets. The declines ranged from 0.4 °C in France to 2.6 °C in Italy. Only in Spain and Portugal average temperatures rose, by 0.8 °C and 1.4 °C, respectively.

For the week of August 4, according to AleaSoft Energy Forecasting’s demand forecasts, demand will increase in the German, British, French, Belgian and Spanish markets. On the contrary, demand will decrease in the Portuguese and Italian markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

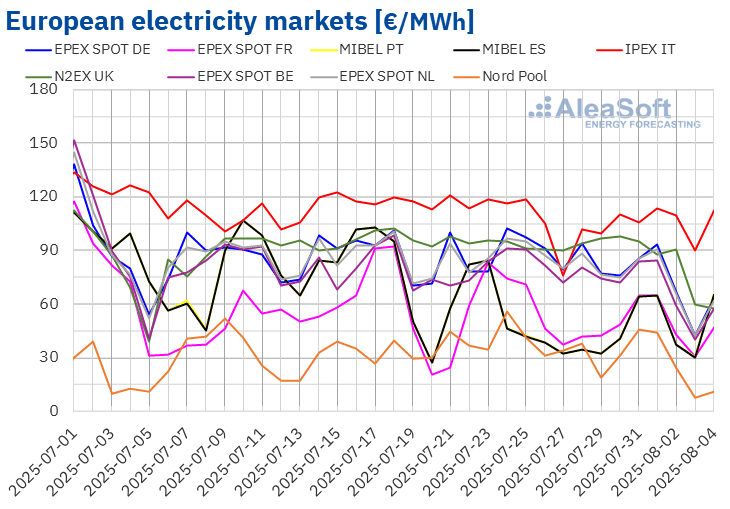

In the last week of July, average prices in the main European electricity markets fell compared to the previous week. The N2EX market of the United Kingdom and the IPEX market of Italy registered the smallest declines, 4.9% and 5.0%, respectively. In contrast, the Nord Pool market of the Nordic countries registered the largest percentage price drop, 24%. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices fell between 12% in the EPEX SPOT market of Belgium and 21% in the MIBEL market of Spain and Portugal.

In the week of July 28, weekly averages were below €80/MWh in most European electricity markets. The exceptions were the British and Italian markets, whose averages were €88.77/MWh and €104.28/MWh, respectively. In contrast, the Nordic market reached the lowest weekly average, €29.95/MWh. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices ranged from €43.28/MWh in the Spanish market to €76.44/MWh in the German market.

As for daily prices, on Sunday, August 3, prices remained below €45/MWh in most markets. On that day, the Nordic market reached the lowest average of the week among the markets analyzed, €7.59/MWh. On the other hand, Italian market prices remained above €100/MWh during most of the sessions in the last week of July. On Friday, August 1, the Italian market reached the highest daily average of the week, €113.27/MWh.

During the week of July 28, falling demand and increased solar energy production in most markets led to a drop in European electricity market prices. In addition, wind energy production also increased in Germany, Spain and Italy.

AleaSoft Energy Forecasting’s price forecasts indicate that, in the first week of August, prices will increase in the Iberian, Italian and French markets, influenced by the drop in wind energy production in these markets. In contrast, price declines will continue in the rest of the main European electricity markets, favored by the increase in solar energy production in some cases.

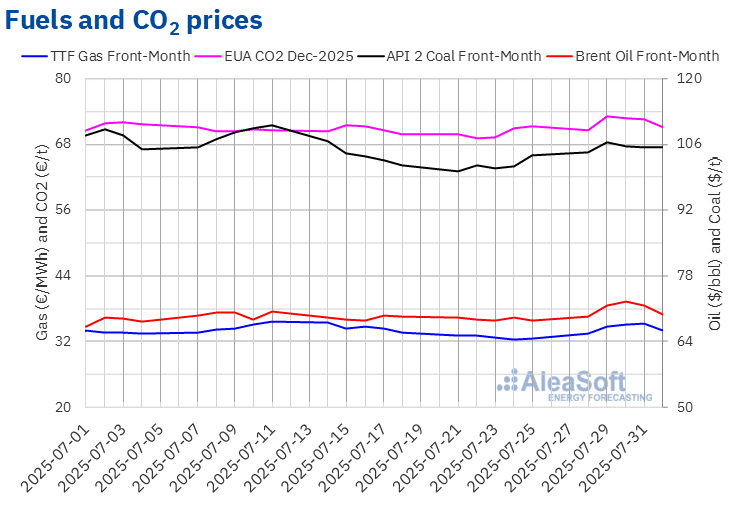

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered their weekly minimum settlement price, $69.32/bbl, on Monday, July 28. Settlement prices maintained an upward trend until July 30. On that day, these futures reached their weekly maximum settlement price, $72.47/bbl. According to data analyzed at AleaSoft Energy Forecasting, this price was the highest since June 21. In the last sessions of the week, prices fell and on Friday, August 1, the settlement price was $69.67/bbl. This price was still 1.8% higher than the previous Friday.

The possibility of sanctions on countries importing Russian oil exerted an upward influence on Brent oil futures prices in the last week of July. However, expectations of an OPEC+ agreement to increase production in September contributed to the decline in prices in the last sessions of the week. Concerns about demand caused by US employment data, as well as the increase in US reserves, also exerted their downward influence on prices.

As for TTF gas futures in the ICE market for the Front‑Month, they registered their weekly minimum settlement price, €33.49/MWh, on Monday, July 28. Settlement prices rose until July 31. On that day, these futures reached their weekly maximum settlement price, €35.28/MWh. However, on Friday, August 1, there was a 3.7% drop compared to the previous day and the settlement price was €33.97/MWh. According to data analyzed at AleaSoft Energy Forecasting, this price was still 4.5% higher than the previous Friday.

The possibility of new sanctions on countries importing Russian gas, which could lead to a decrease in the availability of this fuel globally, as well as interruptions in gas supplies from Norway, contributed to the increase in TTF gas futures prices in the last week of July. However, forecasts of higher wind energy production at the beginning of the first week of August contributed to the fall in prices at the end of the last week of July.

Regarding CO2 emission allowance futures in the EEX market for the reference contract of December 2025, they registered their weekly minimum settlement price, €70.66/t, on Monday, July 28. On Tuesday, July 29, after a 3.4% increase on the previous day, these futures reached their weekly maximum settlement price, €73.08/t. According to data analyzed at AleaSoft Energy Forecasting, this price was the highest since June 25. In the rest of the week’s sessions, settlement prices fell. As a result, on Friday, August 1, the settlement price was €71.06/t, 0.4% lower than the previous Friday.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

On Thursday, September 18, AleaSoft Energy Forecasting will hold the 58th webinar in its monthly webinar series. On this occasion, the webinar will analyze the evolution and prospects of European energy markets, the prospects for battery energy storage, as well as the current situation and prospects for self‑consumption. It will also present AleaSoft services for retailers.

The guest speakers at the analysis table of the webinar in Spanish will be Xavier Cugat, BESS Technical Director at Seraphim, Francisco Valverde, an independent professional for the renewable energy development, and Alejandro Diego Rosell, Professor at EOI and Consultant at Nuvix Consulting.

Source: AleaSoft Energy Forecasting.