AleaSoft, October 30, 2020. The low-price situation in the energy markets may put the profitability of the new renewable energy projects at risk. The experts agree that, while it will be difficult to see again the high levels of return of investment that were seen in the past, in the long term the projects remain profitable. This article is the first part of the summary of the content of the webinar organised by AleaSoft with the participation of Deloitte.

On Thursday, October 29, the second part of the webinar organised at AleaSoft “Energy markets in the recovery from the economic crisis” took place. On this occasion, the meeting had the participation of two speakers from the consulting firm Deloitte, Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services and Carlos Milans del Bosch, Partner of Financial Advisory, in addition to Oriol Saltó i Bauzà, Data Analysis and Modelling Manager at AleaSoft. At the subsequent analysis table of the Spanish version of the webinar, Antonio Delgado Rigal, CEO of AleaSoft and Jaume Pujol Benet, also Partner of Financial Advisory at Deloitte, joined.

The meeting was a success in participation and, in addition to analysing the behaviour of the energy markets in Europe during this second wave of COVID-19, the state of the financing of wind and photovoltaic energy projects and the profitability that these projects can obtain in the long term were widely discussed. The recording of the event is available here.

The profitabilityof the renewable energy projects

Given the current situation of uncertainty and generally low prices in the energy markets, the profitability of the new and existing electricity production projects from renewable sources is an issue of concern to the energy sector in Europe. The conclusions of the debate, in which all the speakers agreed, were that, although the conditions changed, the projects continue to be profitable.

Now, where there was also consensus, was that double‑digit returns can no longer be expected as there were in 2018 when the energy prices were double those of today. Currently, in most cases, they are talking about returns below 10%, and always thinking about the exploitation of a long-term project.

The profitability of each specific project will depend on many aspects of the project itself: financing, size of the debt, equivalent hours of energy production, etc. But aspects external to the project will also have an impact and one of the most important is the electricity market prices.

The need for a “proper and educated vision” of the market future

As new projects without aid with feed-in tariff schemes occupy the electricity production market, market price risk becomes the biggest concern for investors and banks when financing new projects. Due to this, the speakers agreed on the need to have a “proper and educated vision” of the future of market prices.

It is not about having an idea of what the trend of the average annual or quarterly market prices will be in the future, it is necessary to have hourly prices forecasting in the long term that allow estimating the captured price of the project with respect to the average market prices, known as price factor. That is the only way to be able to consistently analyse the future cash-flows of the project and establish the expected profitability. If the forecasts also have confidence bands with a probabilistic metric, it will be possible to calculate and quantify the risk associated with assuming a certain price forecast.

Source: Deloitte.

Source: Deloitte.

Financing renewable energy projects in the energy transition

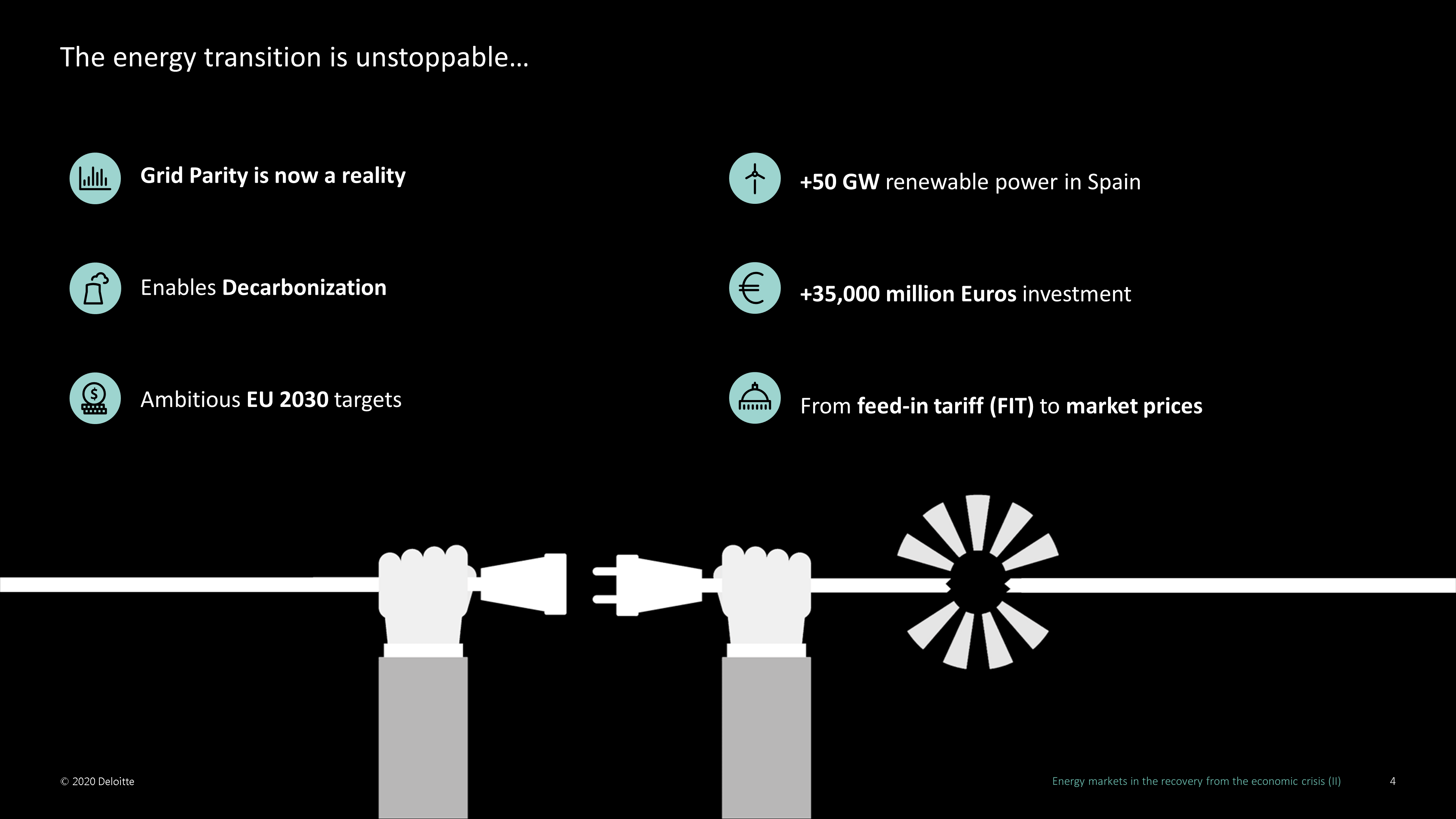

The unstoppable energy transition process to which all of Europe is subjected adds another level of uncertainty to the current situation and in the medium and long term. All the new renewable energy capacity that is going to enter the electricity generation mix will have an impact on the prices of the electricity markets that the prices forecasting must consider.

In the midst of the uncertainty that the global economic crisis is creating, the message conveyed by the webinar speakers is that, although the amount of money that is needed to carry out the renewable energy capacity targets established by the Energy and Climate Plans of the European Union countries is high, the financing of new projects continues to be active, there are agents with an investor appetite and banks feel comfortable lending money for 16 or 18-year projects.

Next AleaSoft’s webinar

The next webinar organised by AleaSoft will take place on November 26, as always in English, at 10:00 CET, and in Spanish, at 12:00 CET. This webinar will be the last of this year 2020, and will be the first of a new series “Prospects for the energy markets in Europe from 2021” that will have at least two parts, the second being already in January, 2021.

Being practically at the beginning of the year 2021, this webinar will analyse the behaviour of the energy markets in Europe during these last months of economic crisis, also with a historical perspective, and will show a vision of what may bring the year 2021 and the next ones. In addition to the energy markets, the investment and financing needs of renewable energy projects, their status and prospects for the next years will also be explored.

Source: AleaSoft Energy Forecasting.