AleaSoft, November 2, 2020. The European electricity markets prices of October fell year‑on‑year and compared to September. Since May they were recovering month by month after the falls of the first wave of COVID‑19, but the increase in wind energy production favoured the decrease in October. The CO2 prices also fell in the 10th month of the year. The gas continued to rise, reaching over €15/MWh, but in the last days of the month it fell due to the restrictions of the second wave of the pandemic.

Photovoltaic and solar thermal energy production and wind energy production

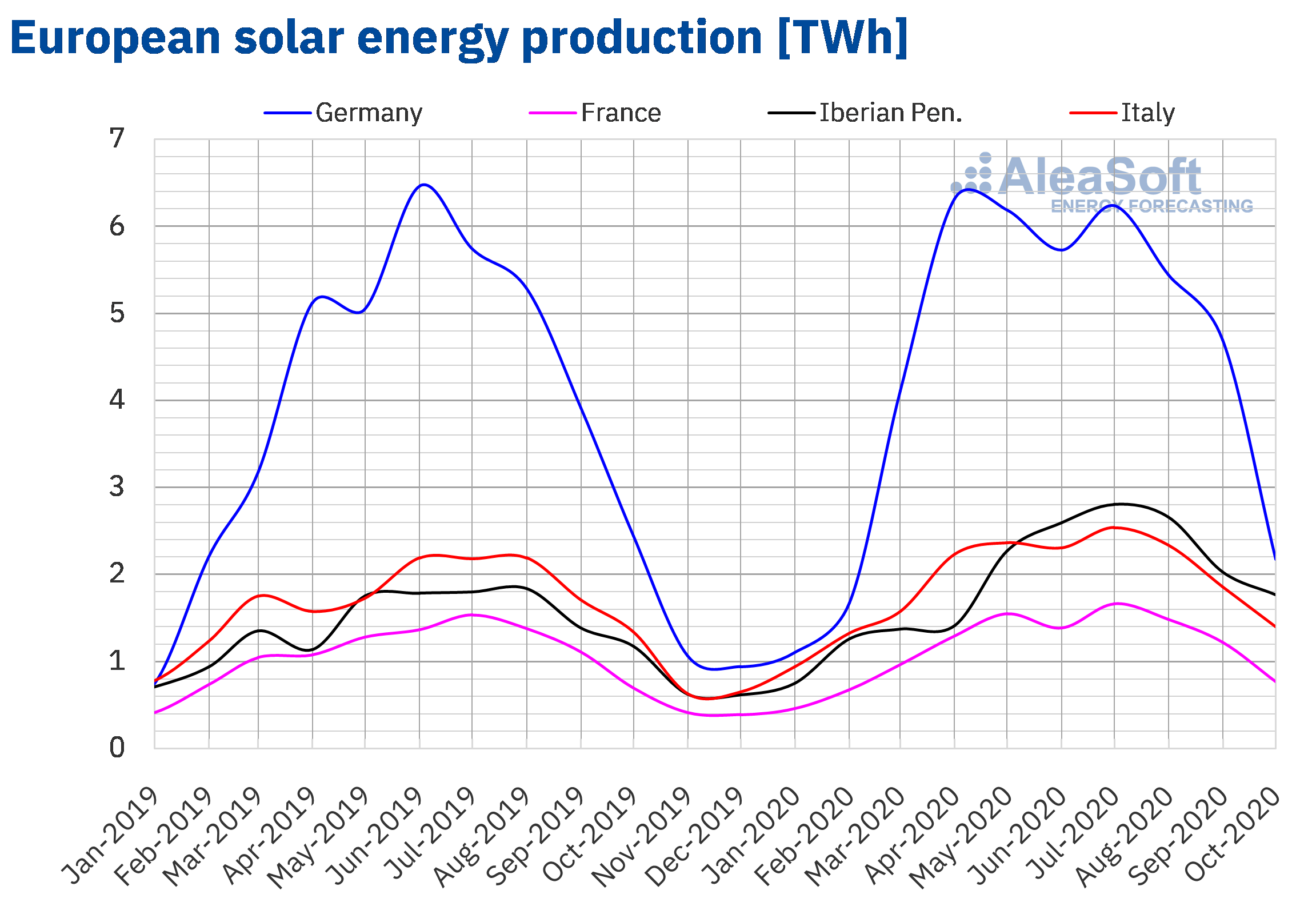

The average solar energy production increased in most of the European markets during the month of October compared to the same month of 2019. In the Iberian Peninsula there was a significant increase of 54%. In the markets of France and Italy the increases were 10% and 4.1% respectively. On the other hand, the German market registered a decrease of 11%.

The generation from this renewable source registered a general drop in October compared to the previous month in all markets of Europe. The decreases that stood out the most were 55%, 39% and 27% of Germany, France and Italy. In the rest of the markets the decreases were lower than 15%.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

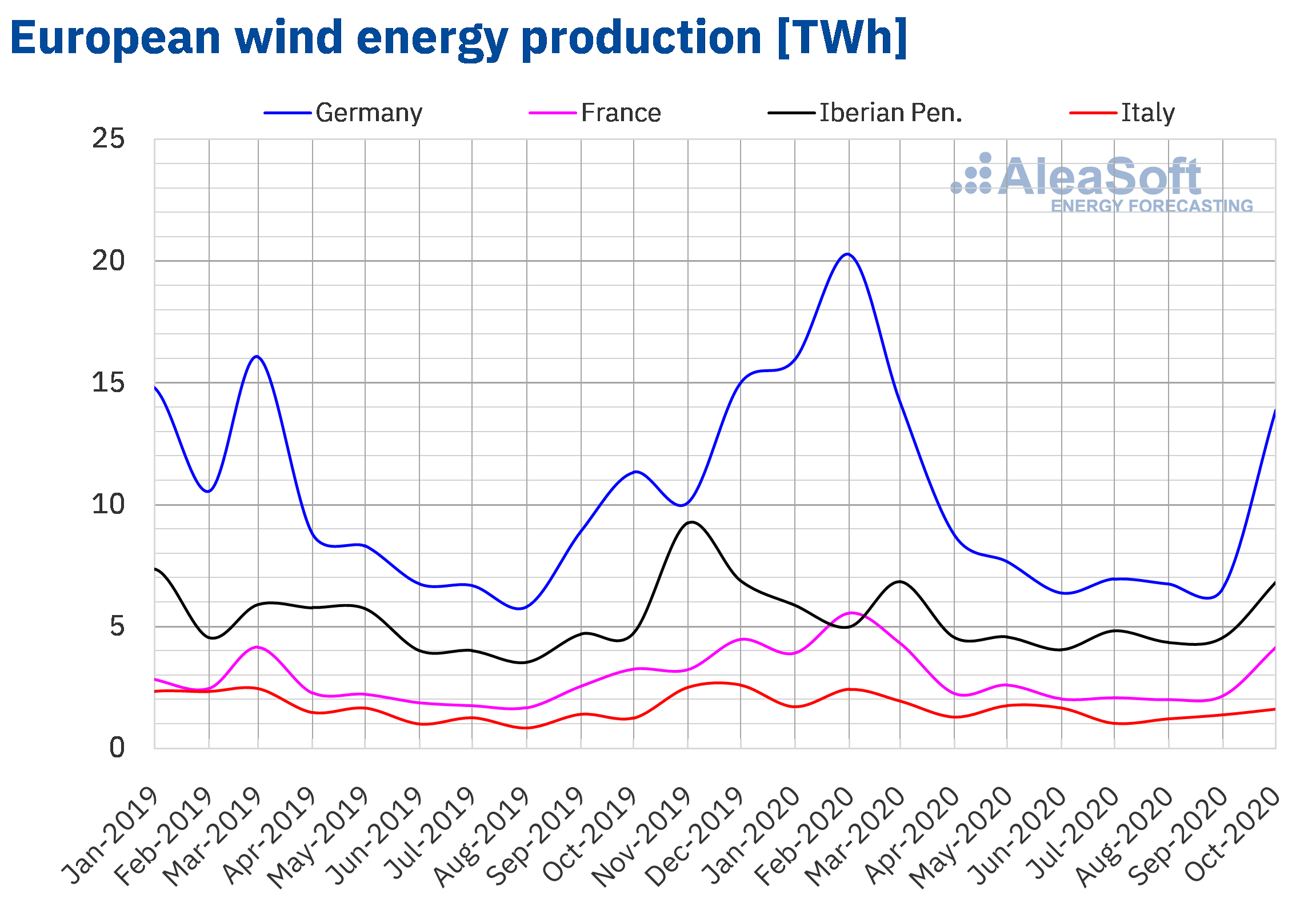

Regarding the wind energy production, year‑on‑year increases were registered in all the analysed electricity markets. The main increases were in the Iberian Peninsula, Italy and France, which were 44%, 29% and 28% respectively.

Comparing the monthly wind energy production of October with the previous month, Germany, where it doubled, and France, where it rose by 87%, stand out. In the Iberian Peninsula the increase compared to September was 44% and in Italy, 14%.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

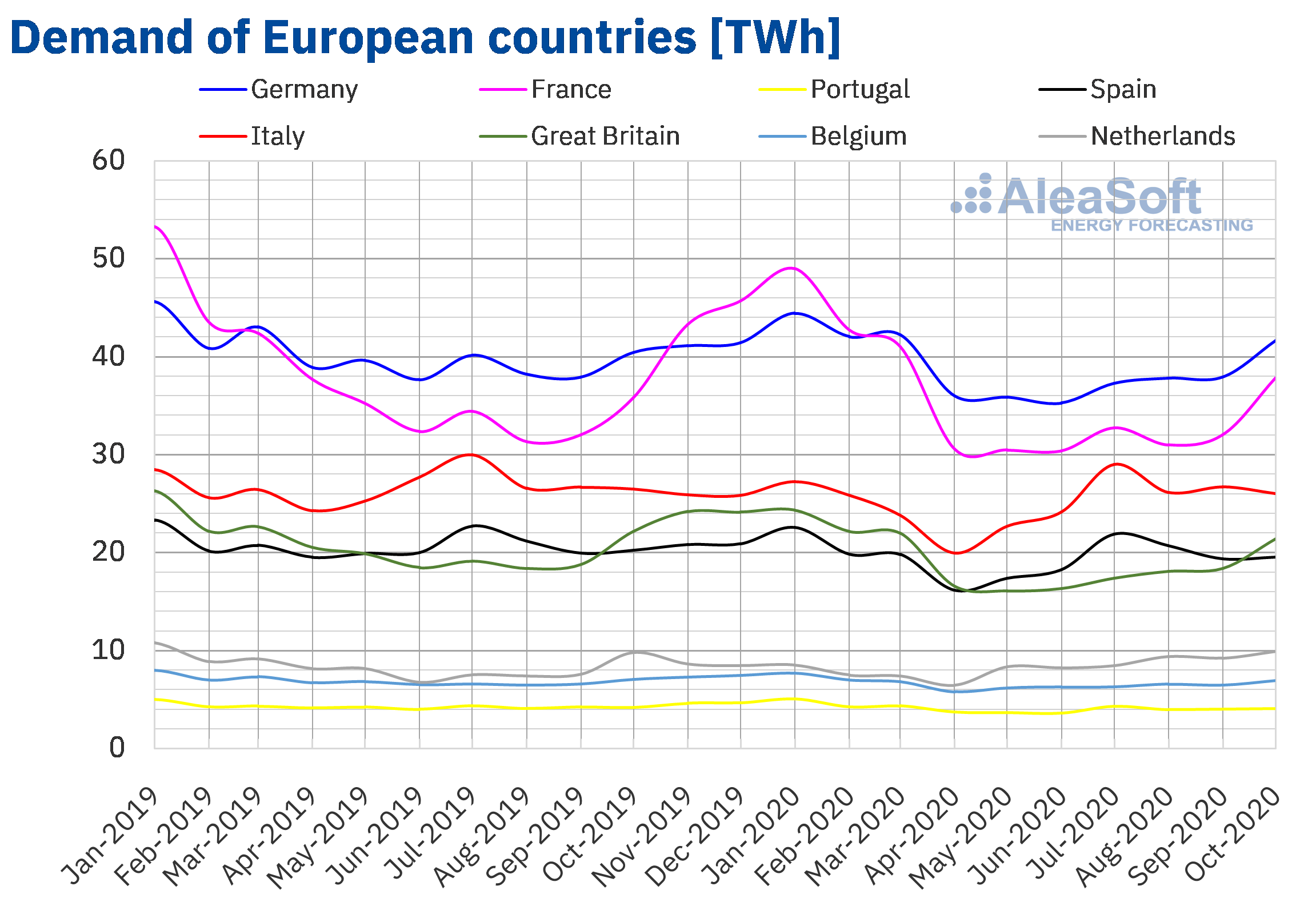

Electricity demand

In Europe, there was a year‑on‑year drop in electricity demand in most markets during the month of October and the average temperatures fell in general. The market of Great Britain registered a 3.3% drop, reaching the lowest demand for a month of October since 2001 in that market. In the Belgian market, the decrease was 2.3%. On the other hand, the Portuguese market had a decline of 2.0%, while in Italy, where the demand remained fairly stable throughout the weeks of October, the decline was 1.7%.

Regarding the increases in year‑on‑year terms, France, Germany and the Netherlands were in this category. The French market registered an increase of 5.8%, despite the downward trend over the last two weeks. In Germany there was an increase of 2.9%, with the behaviour of the demand being quite similar during all the weeks. The Netherlands registered the smallest increase among the analysed markets, which was 1.0%.

The panorama of the electricity demand in Europe was different in the comparison of October 2020 with respect to September of the same year. In most markets, the demand of October increased compared to that of September. The most significant changes were the increases of 15% and 13% in France and Great Britain respectively. The rest of increases were between 3% and 7%. On the other hand, in the markets of Italy and Portugal there were decreases of 5.7% and 2.1% respectively.

The evolution of the demand during November will be closely related to the measures to curb COVID‑19 in the different countries of Europe. The national confinement established in France and Great Britain and the State of Alarm in Spain, as well as the recent restrictions in Germany and Italy, suggest drops in electricity demand. To monitor the demand and other variables of interest, at AleaSoft the electricity markets observatories are available for the most important markets on the European continent.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

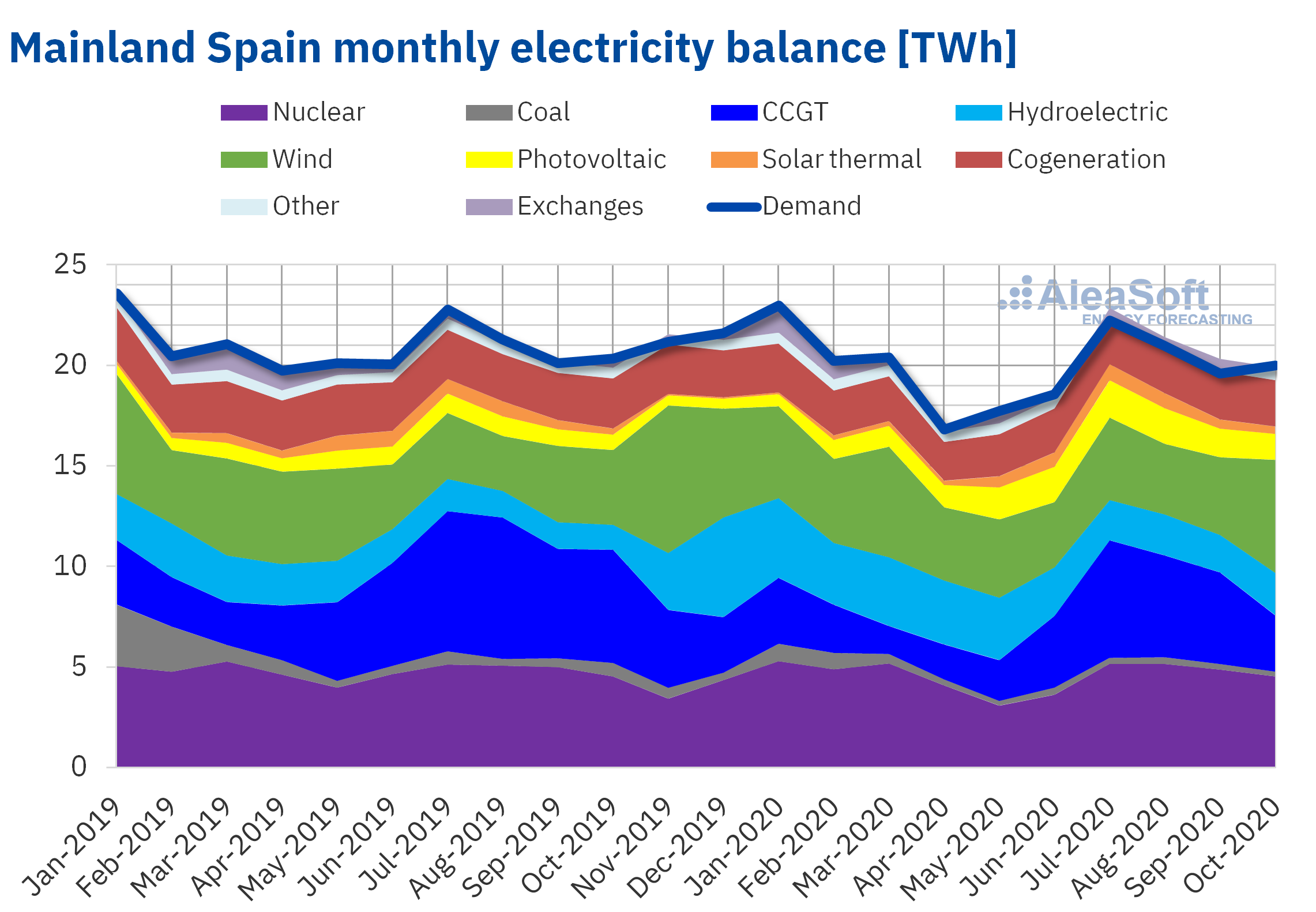

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

The electricity demand of Mainland Spain registered a 2.6% drop from October 1 to October 31 compared to the same period of 2019. According to REE data, once the effects of labour and temperature were corrected, the decrease was 0.5%. The level of the demand remained stable during all the weeks of October, with the exception of the 12th, National Holiday of Spain, when the demand decreased, precisely due to the lower labour of this holiday. Compared to September 2020, last October the demand fell by 1.9%.

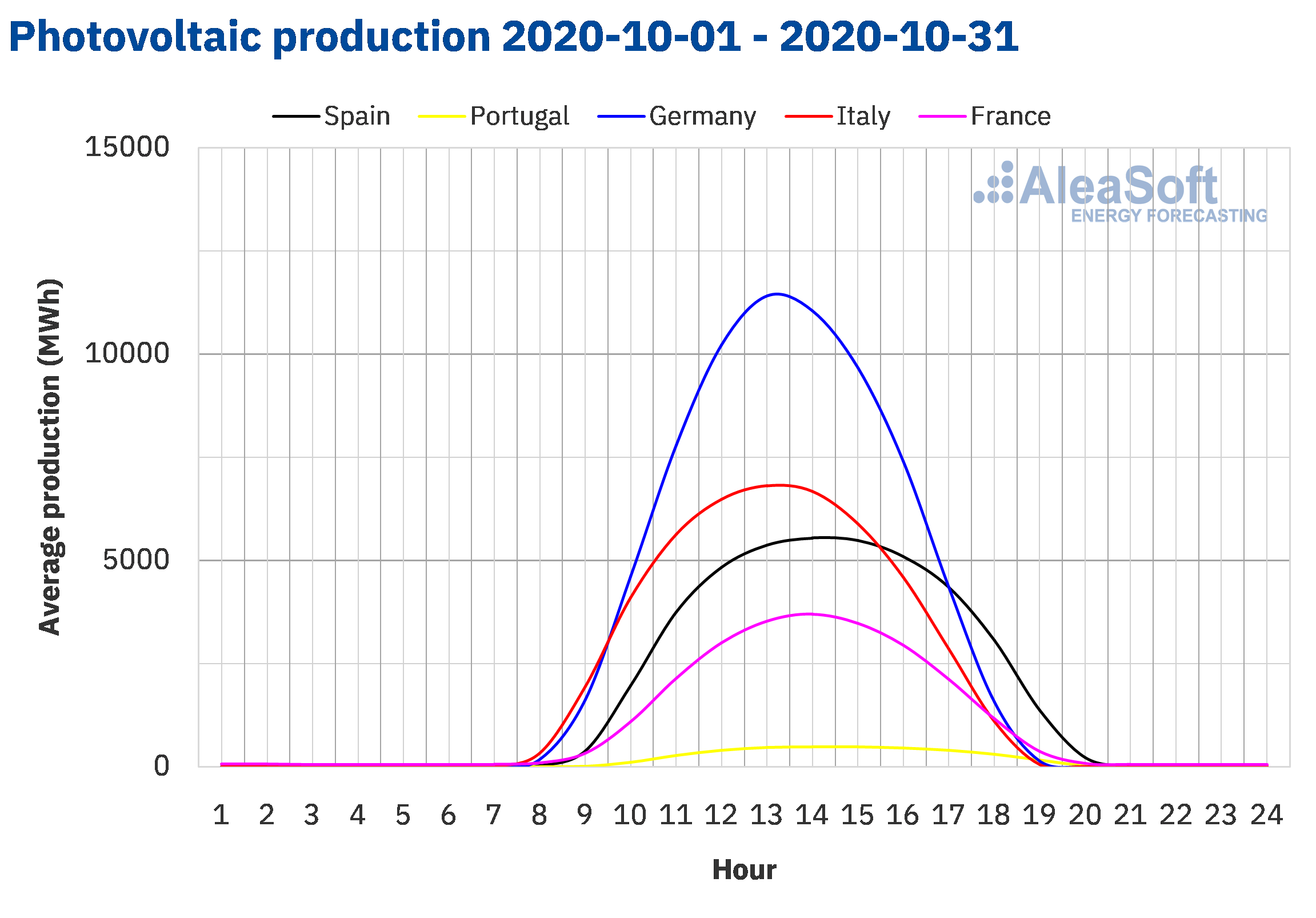

The solar energy production of Mainland Spain continues to exceed marks this year. The whole of the photovoltaic and solar thermal energy production exceeded the historical maximum daily value for a month of October, which was registered on October 4, 2019, during 22 days of the 31 days of the month. In particular, the new record for the tenth month of the year is 73 GWh of October 12. These increases allowed a 55% year‑on‑year increase in solar energy production of October. However, as expected taking into account the decrease in solar radiation, there was a 15% decrease compared to September 2020.

Similarly, the average wind energy production also brought good news, as the record of wind energy production for one day of October rose to 362 GWh on October 2. In general, the generation with this technology had an increase of 51% in October 2020 in year‑on‑year terms. The growing trend of the wind energy during October led to a 41% rise compared to the previous month.

The average nuclear energy production of October was quite similar to that of the same month of 2019, rising only 0.1%. Since October 3, the second reactor of the Ascó nuclear power plant is in a scheduled shutdown due to refuelling. This reactor is expected to start up on November 5. For this reason, the nuclear energy production had a decrease of 10% compared to September 2020.

The thermal energy production with combined cycle gas turbines and coal decreased in October. In year‑on‑year terms, these technologies decreased their production by 50% and 64% respectively. If the comparison is made with respect to September, the production of the combined cycle gas turbines decreased by 41% and that of the coal power plants by 17%.

The hydroelectric energy production increased by 68% in year‑on‑year terms and by 9% when compared to September.

Sources: Prepared by AleaSoft using data from REE.

Sources: Prepared by AleaSoft using data from REE.

The hydroelectric reserves increased during the month of October by 1.0% compared to those accumulated at the end of September, according to data from the Hydrological Bulletin of the Ministry for the Ecological Transition and Demographic Challenge number 43. This increase in the level of the reserves in absolute terms was 105 GWh.

European electricity markets

In October 2020, the monthly average price was higher than €30/MWh in all the analysed European markets, except in the Nord Pool market of the Nordic countries, which registered the lowest average, of €14.63/MWh. In contrast, the N2EX market of Great Britain and the IPEX market of Italy reached the highest monthly average prices, of €47.88/MWh and €43.57/MWh, respectively. In the rest of the markets, the averages were between €33.97/MWh of the EPEX SPOT market of Germany and €39.39/MWh of the Belgian market.

Compared to the month of September, the average prices of all markets decreased in October. The largest drop in prices, of 22%, was registered in the German market, followed by that of the French market, of 20%. While the smallest decreases were those of the N2EX and Nord Pool markets, of 0.6% and 7.0% respectively. On the other hand, in the Belgian and Italian markets there was a decrease of 11%, while in the market of the Netherlands and in the MIBEL market of Spain and Portugal, the decrease was 13%.

If the average prices of last October are compared to those registered in the same month of 2019, there were decreases in most of the markets. The exceptions were the Belgian and British markets, with increases of 4.8% and 14% respectively. On the other hand, the largest drop in prices, of 61%, occurred in the Nord Pool market. In contrast, the markets of France and the Netherlands had the smallest price declines, of 1.8% and 2.2% respectively. In the rest of the markets, the price drops were between 8.0% of Germany and 23% of Portugal.

During the month of October, the European electricity markets prices were, in general, loosely coupled. The markets with the highest daily prices were the British and the Italian. In these markets, the prices exceeded €50/MWh on various occasions. On the other hand, the lowest prices were those of the Nord Pool market, which remained below €25/MWh.

The highest daily price, of €62.05/MWh, was that of Friday, October 16, in the British market, followed by the price of Thursday, October 1, of €61.56/MWh, of this same market. On the other hand, the minimum daily price, of €3.58/MWh, was reached on Saturday, October 3, in the Nord Pool market.

Regarding the hourly prices of the month of October, the minimum hourly price, of ‑€54.97/MWh was reached at the hour 14 of Sunday, October 4, in Germany. There were also negative hourly prices in this market on October 3. Furthermore, on Sunday, October 25, negative hourly prices were registered in the markets of Germany, Belgium, France, Great Britain and the Netherlands. On the other hand, the maximum hourly price, of €202.91/MWh, was reached at the hour 20 of October 16 in Great Britain.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

During the month of October, the European electricity markets prices decreased compared to the previous month, influenced by the general increase in wind energy production in Europe and by the decrease in CO2 emission rights prices. Compared to October 2019, the prices were also generally lower. In this case, in addition to the wind energy production, the solar energy production increased in most of Europe. In the markets of Spain, Portugal and Italy, the electricity demand was lower than that of September 2020 and that of October 2019, this being another factor that favoured the decrease in prices.

Iberian market

In October 2020, the average price in the MIBEL market decreased compared to the average of the previous month. The decrease was 13% in both Spain and Portugal. Compared to the month of October 2019, the prices also fell, in this case by 23% in Portugal and 22% in Spain. These were the second and third most important price drops in the European electricity markets after that of the Nord Pool market.

The monthly average price of October was €36.56/MWh in the Spanish market and €36.43/MWh in the Portuguese market. But the daily prices exceeded €40/MWh in the MIBEL market on fourteen days of October. The highest daily price, of €45.22/MWh, was reached on Thursday, October 22, in Spain.

On the other hand, daily prices below €15/MWh were registered on two days of October. The lowest daily price, of €14.40/MWh, was reached on October 4 in the Spanish market.

In October 2020, the decrease in demand, the increase in wind energy production in the Iberian Peninsula and the increase in hydroelectric energy production in Spain favoured the price drops in the MIBEL market both compared to the previous month and the same month of the year 2019. In addition, the Iberian solar energy production increased compared to October 2019, also contributing to the year‑on‑year decrease in prices.

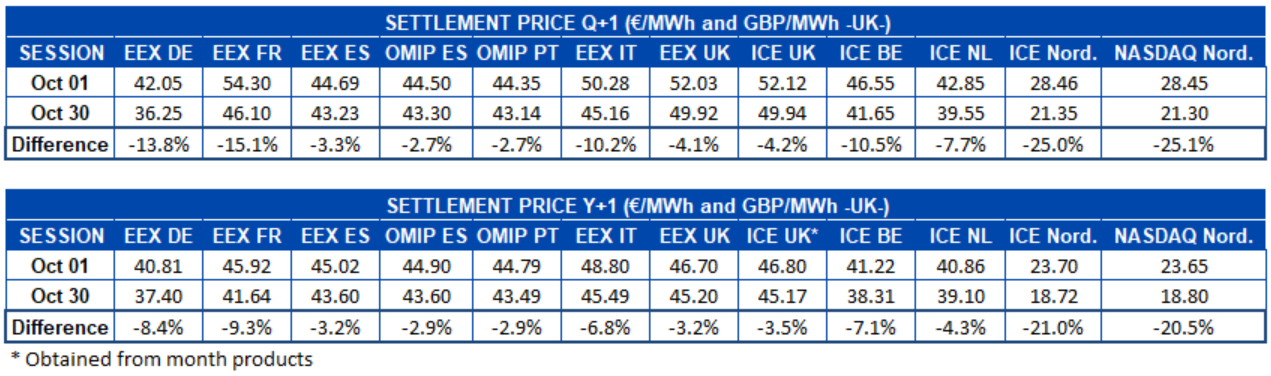

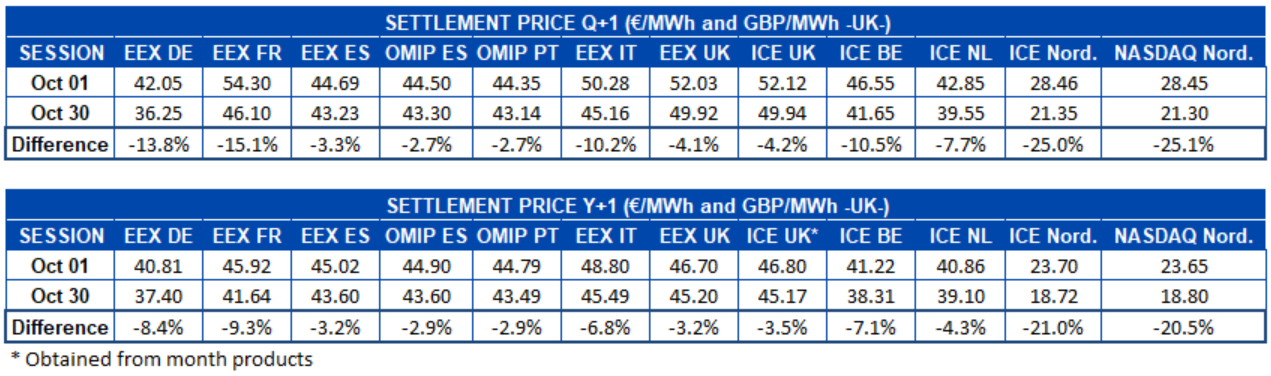

Electricity futures

During the month of October 2020, the electricity futures prices for the first quarter of 2021 registered a general decrease in all the markets analysed at AleaSoft. Due to their low prices compared to the rest of the markets, the percentage variations of the highest proportion were those of the ICE and NASDAQ markets of the Nordic countries, of ‑25%. However, in absolute terms, the EEX market of France was the one with the greatest decrease in prices. The difference between the first and last sessions of October in this market is ‑€8.20/MWh. On the other hand, the OMIP market of Spain and Portugal was the one with the lowest price variation, with a reduction of 2.7% in both cases.

Performing the same comparison, but this time for the product of the calendar year 2021, very similar results are obtained. The Nordic region leads the declines with a decrease of around 21%. In absolute terms, this time it is the ICE market of the Nordic countries that registered the greatest fall, of €4.98/MWh, closely followed by the NASDAQ market of the same region with a decrease of €4.85/MWh. Once again, the Iberian OMIP market was the one with the lowest variation. For both Spain and Portugal the decrease was €1.30/MWh, which represents a decrease of 2.9%.

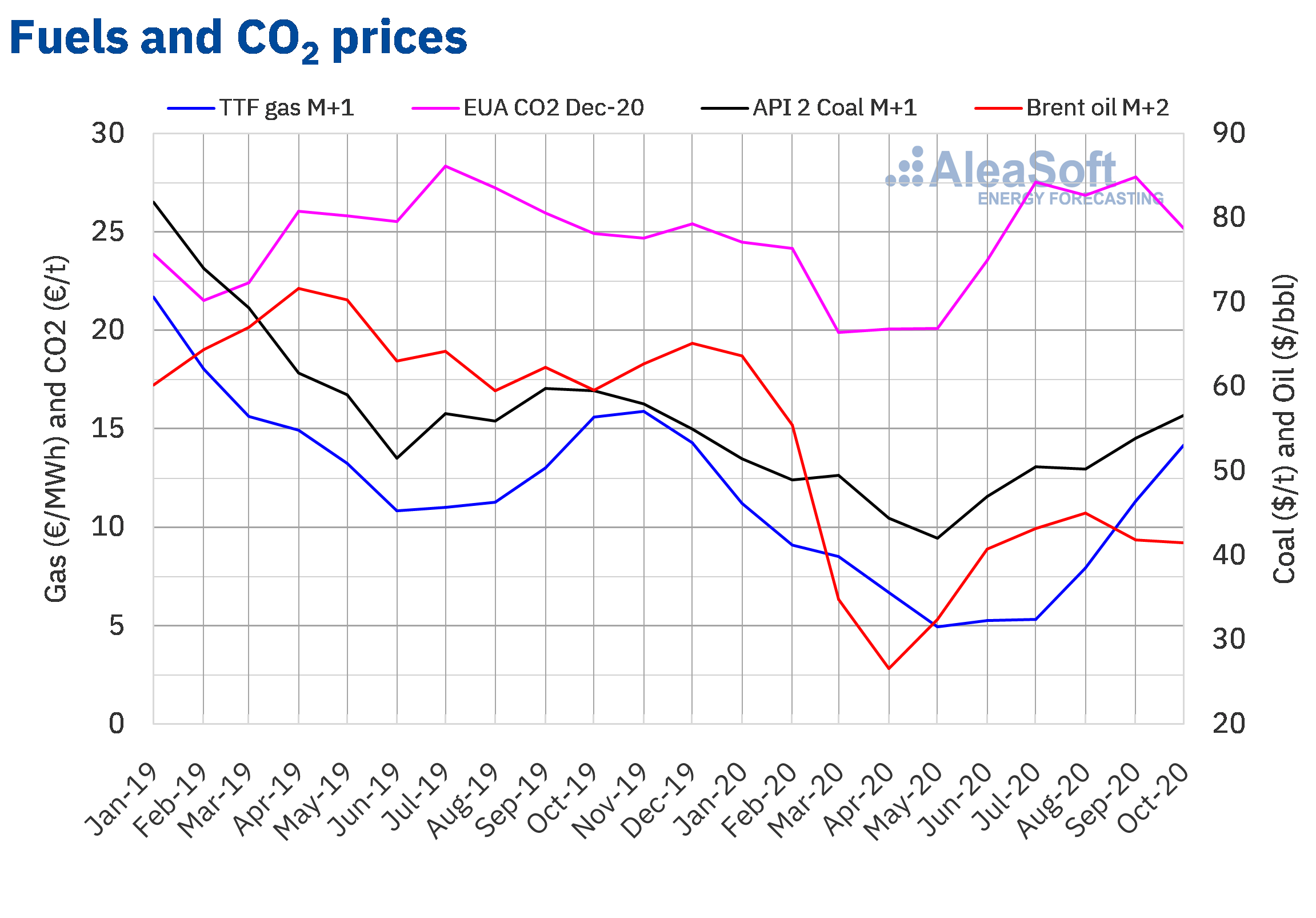

Brent, fuels and CO2

The Brent oil futures prices for December 2020 in the ICE market for most of the month of October remained above $41/bbl. The monthly maximum settlement price, of $43.34/bbl, was reached on Thursday, October 8. Instead, the monthly minimum settlement price, of $37.46/bbl, was reached on Friday, October 30. On the other hand, the monthly average price was $41.52/bbl. This value is 0.8% lower than the one reached by the futures for the month M+2 in September 2020, of $41.87/bbl, and 30% lower than that corresponding to the M+2 futures traded in October 2019, of $59.63/bbl.

At the beginning of October, the strikes in the Norwegian oil sector favoured the recovery of the prices. During the month of October, the production in the Gulf of Mexico also decreased, due to the hurricanes Delta and Zeta. However, Libya began to progressively increase its production, favouring the decline in prices.

On the other hand, the concern about the effects of the evolution of the COVID‑19 pandemic on the demand exerted its downward influence on the prices throughout the month. But its influence was more important in the second half of October, when due to the high number of infections in Europe, new restrictions on mobility began to be imposed on the continent.

As for the TTF gas futures in the ICE market for the month of November 2020, they reached their minimum settlement price, of €13.03/MWh, on October 2. The prices, in general, increased until reaching the monthly maximum settlement price, of €15.41/MWh, on October 23. This price is the highest registered since January. But in the last week of the month, the prices fell, influenced by the confinement measures established by the European governments to stop the advance of the second wave of coronavirus and the settlement price of the last session was €14.22/MWh.

On the other hand, the average value registered during the month was €14.18/MWh. Compared to that of the futures for the month M+1 traded in September 2020, of €11.35/MWh, the average increased by 25%. If compared to the M+1 futures traded in October 2019, when the average price was €15.61/MWh, there was a 9.2% decrease.

In the case of the TTF gas in the spot market, on October 3 and 4, the monthly minimum index price, of €11.59/MWh, was registered. During the month, the prices increased until reaching the monthly maximum index price, of €15.46/MWh, on Monday, October 26. This price is the highest since the beginning of December 2019. But in the last week of October, the prices also fell to €13.53/MWh of Saturday, October 31. On the other hand, the average price for this month of October was €13.79/MWh, which is 25% higher than that of September 2020, of €11.05/MWh. It is also 34% higher than that of October 2019, of €10.27/MWh.

Regarding the API 2 coal futures in the ICE market for the month of November 2020, they reached their monthly maximum settlement price, of $58.45/t, on Wednesday, October 7, which was the highest registered since January. The prices remained above $56/t for most of the month. But in the last week of October, the prices fell until reaching the monthly minimum settlement price, of $51.80/t, on Friday, October 30. The monthly average price in October was $56.59/t, 5.0% higher than the average price of the API 2 coal futures for the month M+1 of September 2020, of $53.88/t, but 5.0% lower than that of October 2019, of $59.56/t.

As for the CO2 emission rights futures in the EEX market for the reference contract of December 2020, they registered the highest prices at the beginning of the month. The maximum settlement price, of €27.04/t, was reached on Friday, October 2. While the monthly minimum settlement price, of €23.03/t, was reached at the end of the month, on Wednesday, October 28. This price was the lowest registered since the beginning of the second half of June. On the other hand, the average price in October was €25.18/t, 9.4% lower than that of September, of €27.80/t. If compared to the average of the month of October 2019 for the same product, of €24.92/t, the average of October 2020 is 1.0% higher.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis of the evolution of the energy markets in the second wave of the pandemic

On October 29, the second part of the AleaSoft webinar “Energy markets in the recovery from the economic crisis” took place. On this occasion the speakers were Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services and Carlos Milans del Bosch, Partner of Financial Advisory, both from the consulting firm Deloitte, as well as Oriol Saltó i Bauzà, Data Analysis and Modelling Manager at AleaSoft. At the subsequent analysis table of the Spanish version of the webinar, Antonio Delgado Rigal, CEO of AleaSoft and Jaume Pujol Benet, also Partner of Financial Advisory at Deloitte, joined. During the meeting, the evolution of the energy markets in recent weeks was analysed, in which Europe is going through the second wave of the COVID‑19 pandemic and the governments are taking measures to try to stop it. The financing of the renewable energy projects was also widely discussed. On this subject, the speakers agreed that, although the return on investment is not expected to reach past levels again, the projects continue to be profitable. The webinar recording request can be made here.

Another topic on which there was consensus among the webinar speakers is the need for a “proper and educated vision” of the future of the market. It is necessary to have long‑term prices hourly forecasting to consistently estimate the future cash‑flows of the project and establish the expected profitability of the project. With the hourly forecasting, the expected price factor can be calculated, that is, the captured price of the project with respect to the average market price. The AleaSoft‘s long‑term forecasting service includes the hourly breakdown of the forecasting, as well as the price captured by the photovoltaic and wind energy, and it is available for the main European electricity markets. These forecasts are updated periodically taking into account the data on the evolution of the economy and the recovery scenarios from the economic crisis.

These topics will continue to be analysed in the next AleaSoft webinar “Prospects for the energy markets in Europe from 2021 (I)”, but this time focusing on the prospects from the year 2021. This webinar will be held on November 26.

In recent days, some European governments decided to confine the population as one of the measures to stop the spread of the coronavirus, including France and the United Kingdom. The AleaSoft‘s energy markets observatories are a useful tool to analyse how these measures affect the demand and the prices of the electricity markets. The observatories include hourly, daily and weekly graphs with data which is updated daily.

Source: AleaSoft Energy Forecasting.