AleaSoft Energy Forecasting, October 1, 2025. Prices in most major European electricity markets rose in the third quarter of 2025 and exceeded €65/MWh. Higher demand and lower wind energy production compared to the second quarter of the year in most markets, as well as the increase in CO₂ prices, favoured this trend. In the Spanish, French and Portuguese markets, quarterly photovoltaic energy production reached all‑time highs. The average price of TTF gas futures during the quarter was the lowest since the third quarter of 2024.

Solar photovoltaic and wind energy production

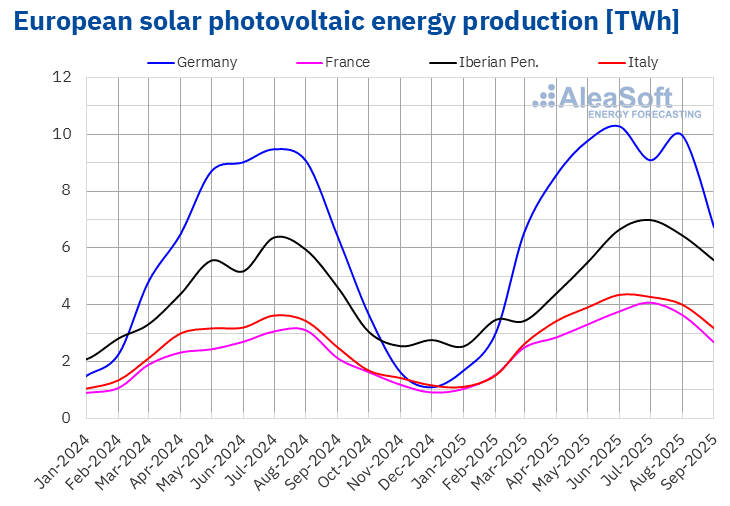

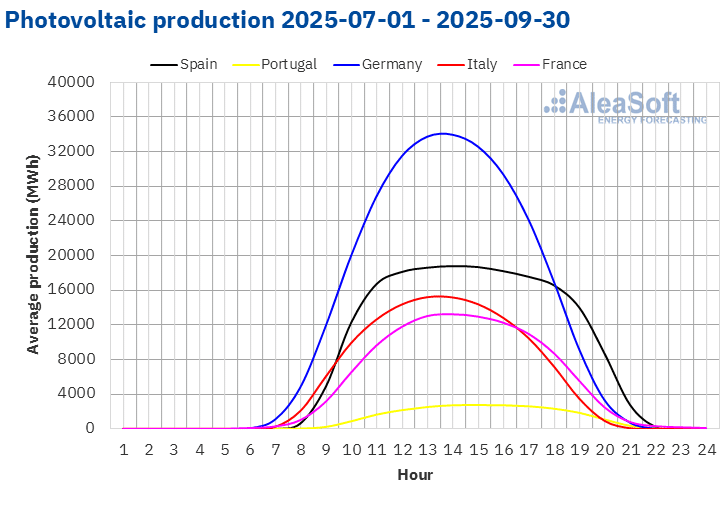

In the third quarter of 2025, solar photovoltaic energy production increased in the main European electricity markets compared to the same period in 2024. The French market registered the largest increase, 26%. The Portuguese, Italian and Spanish markets also registered double‑digit growth, 21%, 20% and 11%, respectively. The German market showed the smallest increase, 3.5%.

Comparing the third and second quarters of 2025, the Portuguese, Spanish and French markets registered an upward trend. The increases in each case were 16%, 13% and 3.6%. Conversely, the German and Italian markets registered quarter‑on‑quarter declines in solar energy production, 11% and 3.0%, respectively.

In the Spanish, French and Portuguese markets, quarterly photovoltaic energy production reached record highs. Spain generated 16 814 GWh using this technology, France 10 393 GWh and Portugal 2140 GWh.

These figures reflect the increase in installed photovoltaic energy capacity. According to data from Red Eléctrica, between the second and third quarters of 2025, installed capacity increased by 834 MW.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

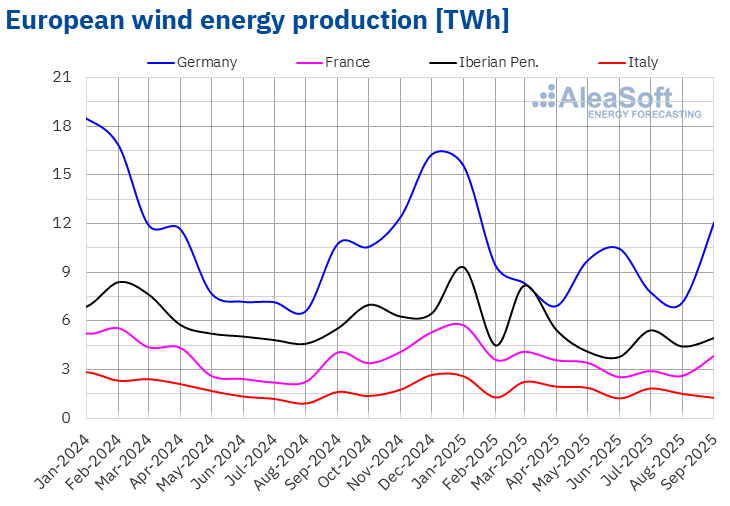

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.In the third quarter of 2025, wind energy production increased year‑on‑year in most major European electricity markets. The Italian market registered the largest increase, 23%. In the French, German and Portuguese markets, wind energy production rose by 10%, 9.8% and 8.8%, respectively. In contrast, in the Spanish market, wind energy production in the third quarter fell by 3.5% compared to the same quarter of the previous year.

In line with the seasonal transition from spring to summer, wind energy production declined in most major European electricity markets between the second and third quarters of 2025. The Italian market led the list with a decrease of 9.9%. In the French and German markets, production with this technology fell by 2.8% and 1.5%, respectively. However, in the Spanish and Portuguese markets, wind energy production increased compared to the previous quarter by 9.7% and 9.3%, respectively.

According to data from Red Eléctrica, installed wind energy capacity in the Spanish market increased by 159 MW between July and September 2025.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.Electricity demand

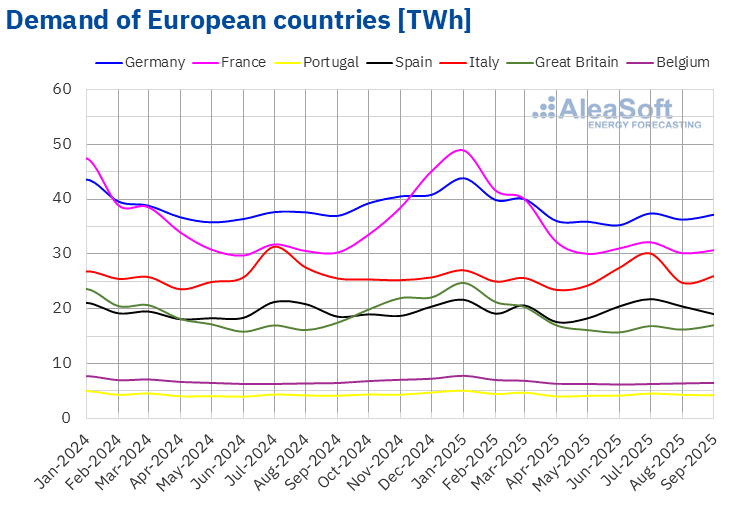

In the third quarter of 2025, electricity demand increased in the Iberian Peninsula and France compared to the same period of the previous year. The Portuguese market registered the largest increase in demand, 2.8%. It was followed by the Spanish and French markets, with increases of 1.0% and 0.5%, respectively. The rest of the markets analysed by AleaSoft Energy Forecasting showed a downward trend. The Italian market registered the largest fall in demand, 4.2%. In the German and British markets, demand fell by 1.2% and 1.0%, respectively. The Belgian market registered the smallest decline, 0.5%.

Comparing the second and third quarters of 2025, electricity demand increased in most major European electricity markets. The largest increases were registered in the southern European markets, where hotter days and greater cooling needs are typical in the summer months. The Spanish market registered the largest increase, 8.5%. Meanwhile, demand in the Italian market rose by 6.4% and in the Portuguese market by 5.0%. In the German market, demand grew by 2.3%. In the British and Belgian markets, demand rose by 1.4% and 0.1%, respectively. The French market was the exception, with demand falling by 1.3% compared to the previous quarter.

Average temperatures rose year‑on‑year in most analysed markets, with increases ranging from 0.4 °C in Spain and Belgium to 0.8 °C in Great Britain. In France, average temperatures of the quarter were similar to those of the same period of the previous year. Conversely, Germany and Italy registered falls in average temperatures of 1.0 °C in each case.

As the third quarter largely coincided with the summer, average temperatures rose in all analysed markets compared to the second quarter of 2025. The increases ranged from 2.8 °C in Great Britain to 5.1 °C in Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.European electricity markets

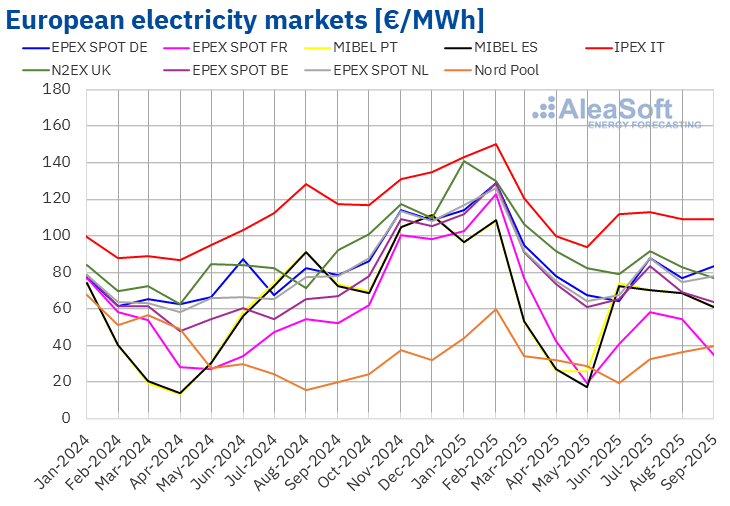

In the third quarter of 2025, the quarterly average price exceeded €65/MWh in most major European electricity markets. The exceptions were the Nord Pool market of the Nordic countries and the EPEX SPOT market of France, with averages of €36.01/MWh and €49.21/MWh, respectively. The IPEX market of Italy registered the highest quarterly price, €110.35/MWh. In the rest of the markets analysed at AleaSoft Energy Forecasting, averages ranged between €66.56/MWh in the MIBEL market of Spain and €83.78/MWh in the N2EX market of the United Kingdom.

Compared to the previous quarter, in the third quarter of 2025 average prices rose in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exception was the British market, with a slight decline of 0.5%. The Iberian market registered the largest increase, 73%. The rest of the markets registered price rises of between 8.2% in the Belgian market and 45% in the French market.

When comparing average prices in the third quarter of 2025 with those of the same quarter of 2024, prices also rose in most markets. In this case, the exceptions were the French, Italian and Iberian markets, with falls of 3.8%, 7.5% and 15%, respectively. Conversely, the Nordic market registered the largest increase, 81%. In the rest of the markets, price rises ranged from 2.5% in the British market to 16% in the Belgian market.

In the third quarter of 2025, the increase in CO₂ emission allowance prices, as well as higher demand compared to the previous quarter, contributed to the rise in European electricity market prices. The fall in wind energy production in most markets also contributed to the price increase. In addition, solar energy production fell in the German and Italian markets.

The year‑on‑year rise in prices was also influenced by the increase in CO₂ emission allowance prices. However, the year‑on‑year fall in gas prices, together with the increase in solar energy production, contributed to lower prices in the Spanish, French, Italian and Portuguese markets. In addition, wind energy production rose in France, Italy and Portugal.

Brent, fuels and CO2

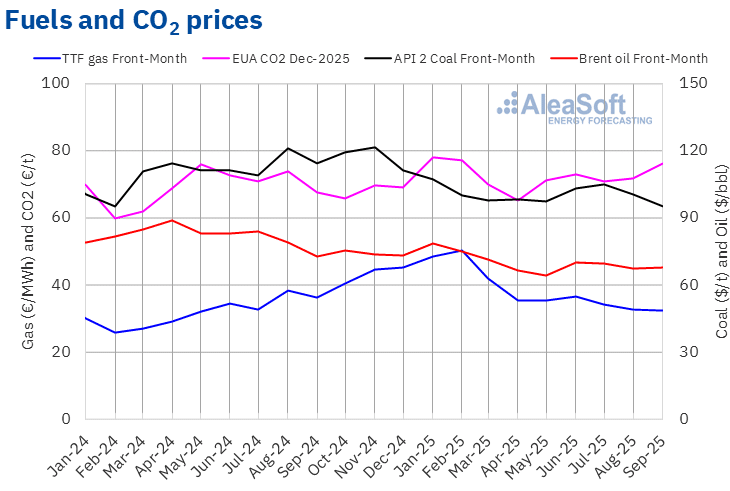

Brent oil futures for the Front‑Month in the ICE market registered a quarterly average price of $68.12/bbl in the third quarter of 2025. This value was 2.1% higher than that of the Front‑Month futures of the previous quarter, $66.71/bbl. However, it was 13% lower than that of the Front‑Month futures traded in the third quarter of 2024, $78.71/bbl.

Concerns about demand trends, as well as OPEC+ production increases, meant that the quarterly average of Brent oil futures prices remained below $70/bbl in the third quarter of 2025. However, the evolution of the conflict between Russia and Ukraine, as well as the threat of sanctions on countries importing Russian oil, exerted upward pressure on prices, leading to a slight increase compared to the previous quarter.

Regarding TTF gas futures in the ICE market for the Front‑Month, the average registered during the third quarter of 2025 was €33.04/MWh. Compared to the average of Front‑Month futures traded in the previous quarter, €35.73/MWh, the average fell by 7.5%. Compared to the Front‑Month futures traded in the same quarter of 2024, when the average price was €35.69/MWh, there was a similar fall, 7.4%. As a result of these price declines, in the third quarter of 2025, the average price was the lowest since the third quarter of 2024.

In the third quarter of 2025, abundant liquefied natural gas supply allowed the quarterly average to fall despite maintenance work affecting gas flows from Norway and the possibility of new sanctions on Russian gas. The gradual increase in European reserves also contributed to the price decline.

As for CO₂ emission allowance futures in the EEX market for the reference contract of December 2025, the average price reached €72.99/t in the third quarter of 2025, 4.3% higher than the average of the previous quarter, €70.00/t. Compared to the average of the same quarter of 2024, €70.80/t, the average for the third quarter of 2025 was 3.1% higher.

AleaSoft Energy Forecasting’s analysis on the prospects for energy storage

The AleaStorage division of AleaSoft Energy Forecasting provides forecasting reports for the optimisation and management of energy storage systems. AleaStorage services include calculating revenues and profitability of energy storage systems, as well as sizing the optimal battery in hybrid systems with renewable energy. AleaStorage has developed success cases in calculating long‑term revenues for stand‑alone batteries, as well as for hybrid systems, especially for photovoltaic energy plus battery projects.

Source: AleaSoft Energy Forecasting.