AleaSoft, September 3, 2020. The European electricity markets prices continued to recover in the first days of September, which led to the EPEX SPOT markets of Germany, France, Belgium and the Netherlands registering the highest values of this year 2020 so far. The general decline in wind energy production on the continent, as well as the recovery in gas prices, whose futures exceed €11/MWh again, and the high CO2 prices, are factors that favoured this rise.

Photovoltaic and solar thermal energy production and wind energy production

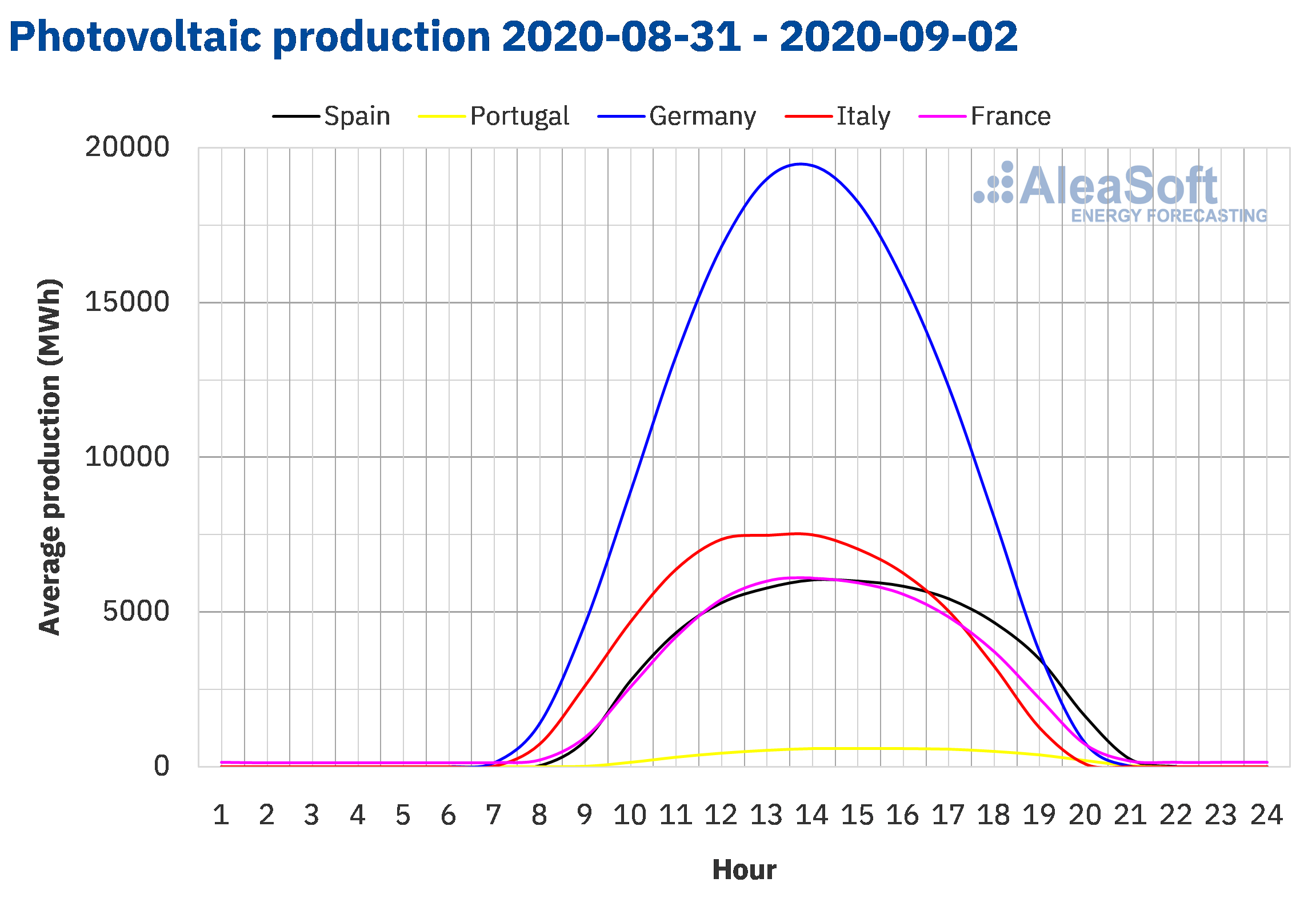

The solar energy production between Monday and Wednesday of the first week of September decreased by 11% in the Iberian Peninsula and by 19% in the Italian market compared to the average registered the previous week. On the contrary, in the markets of Germany and France, the production with this technology increased by 4.4% and 18% respectively.

The analysis carried out at AleaSoft indicates that at the end of the first week of September, the solar energy production in the Italian market will be lower than that of the previous week, while an increase is expected in the German market.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

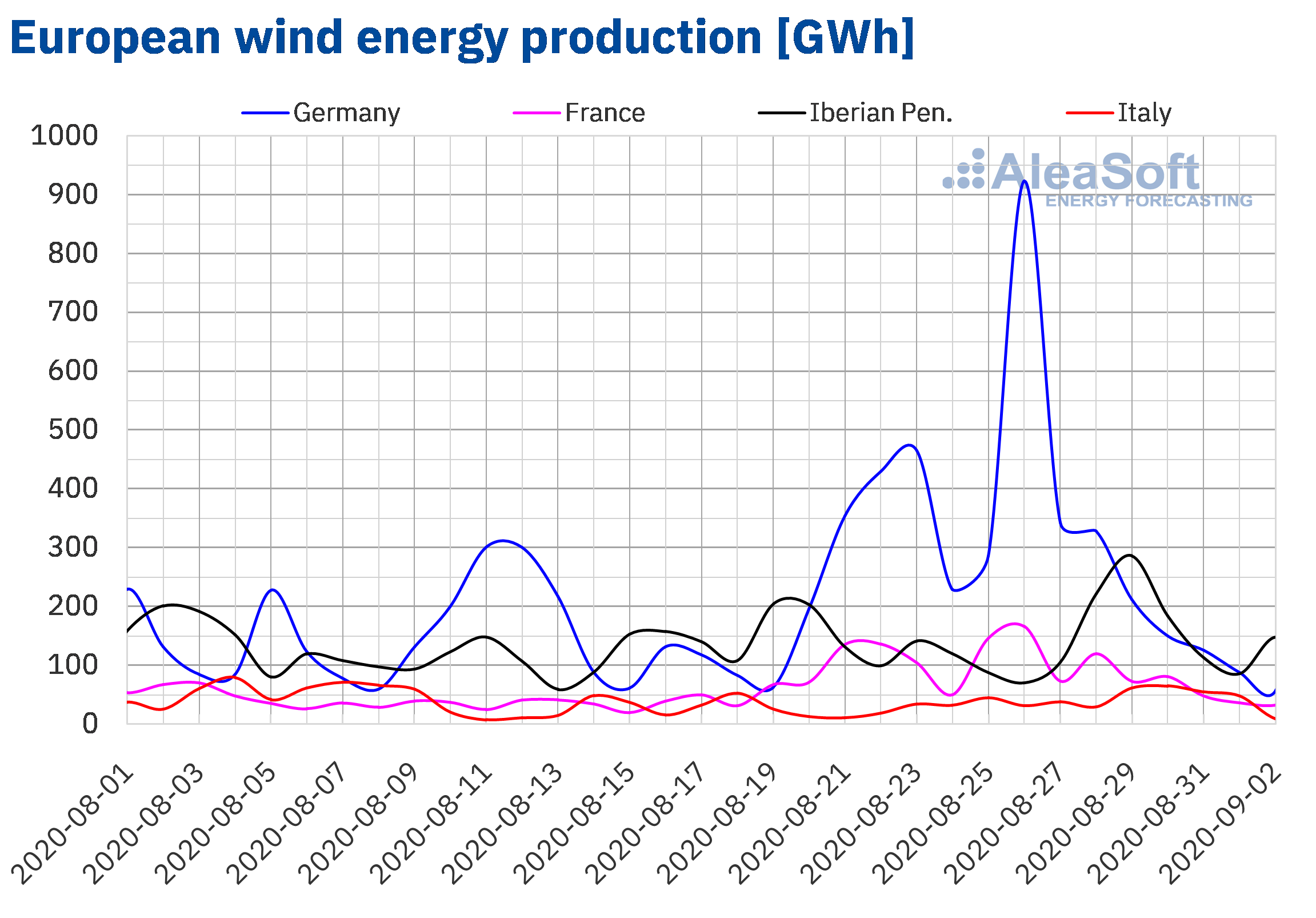

The average wind energy production of the first three days of the week that began on August 31 decreased in all the markets analysed at AleaSoft compared to the last week of August. The greatest variations were registered in the German market and in the French market, in which the production fell by 74% and 61% respectively. In the Iberian Peninsula the drop in production was 25%, while in the Italian market it was 14%.

For the end of this week, the AleaSoft‘s analysis indicates that the total wind energy production of the week will be lower than that of the week of August 24 in all the markets analysed at AleaSoft.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

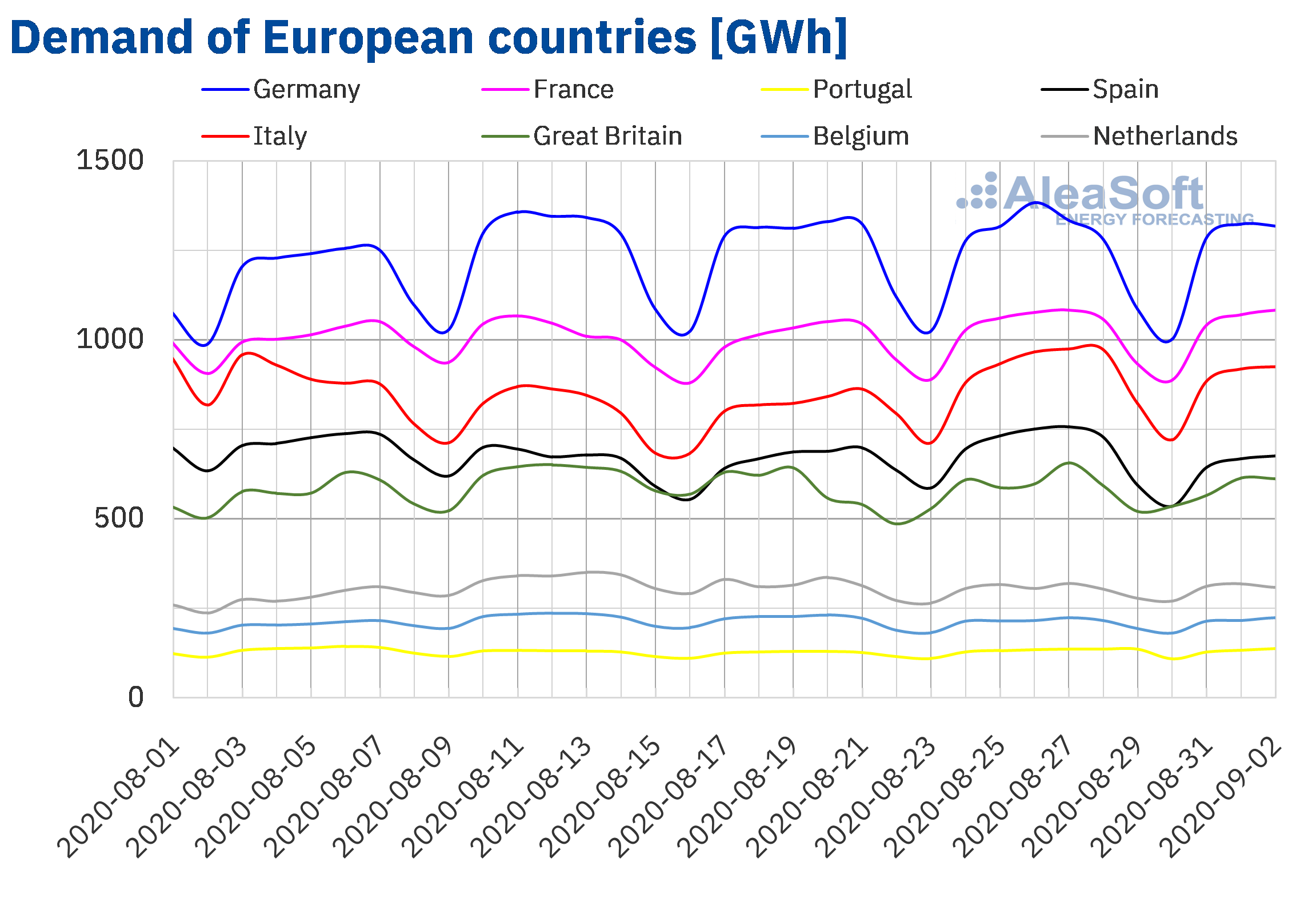

From Monday to Wednesday of the first week of September, the electricity demand of the European markets behaved heterogeneously compared to the same days of the week of August 24. The markets of Portugal, France, the Netherlands and Belgium registered increases of between 0.7% and 1.5%. On the other hand, in the markets of Spain, Italy, Germany and Great Britain, the demand fell between 8.7% and 0.2%. The average temperature during the first three days of the week fell in a generalised way throughout the European continent compared to the same period in the last week of August. In this case, the temperatures dropped between 2.7 °C and 4.9 °C.

At AleaSoft, it is expected that at the end of the week the total demand will remain with the same trend presented at the beginning of the week.

The hourly, daily and weekly behaviour of the demand and other variables of the energy markets can be analysed through the markets observatories published at AleaSoft.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

The electricity demand of Mainland Spain during the first three days of the week of August 31 fell by 8.7% compared to the same period of the previous week. The factor that most influenced this drop was the decrease in average temperatures, registering temperatures 4.9 °C lower than those of the same days of the week of August 24. At AleaSoft, it is expected that at the end of the first week of September the demand of the peninsular territory will register values lower than those of the last week of August.

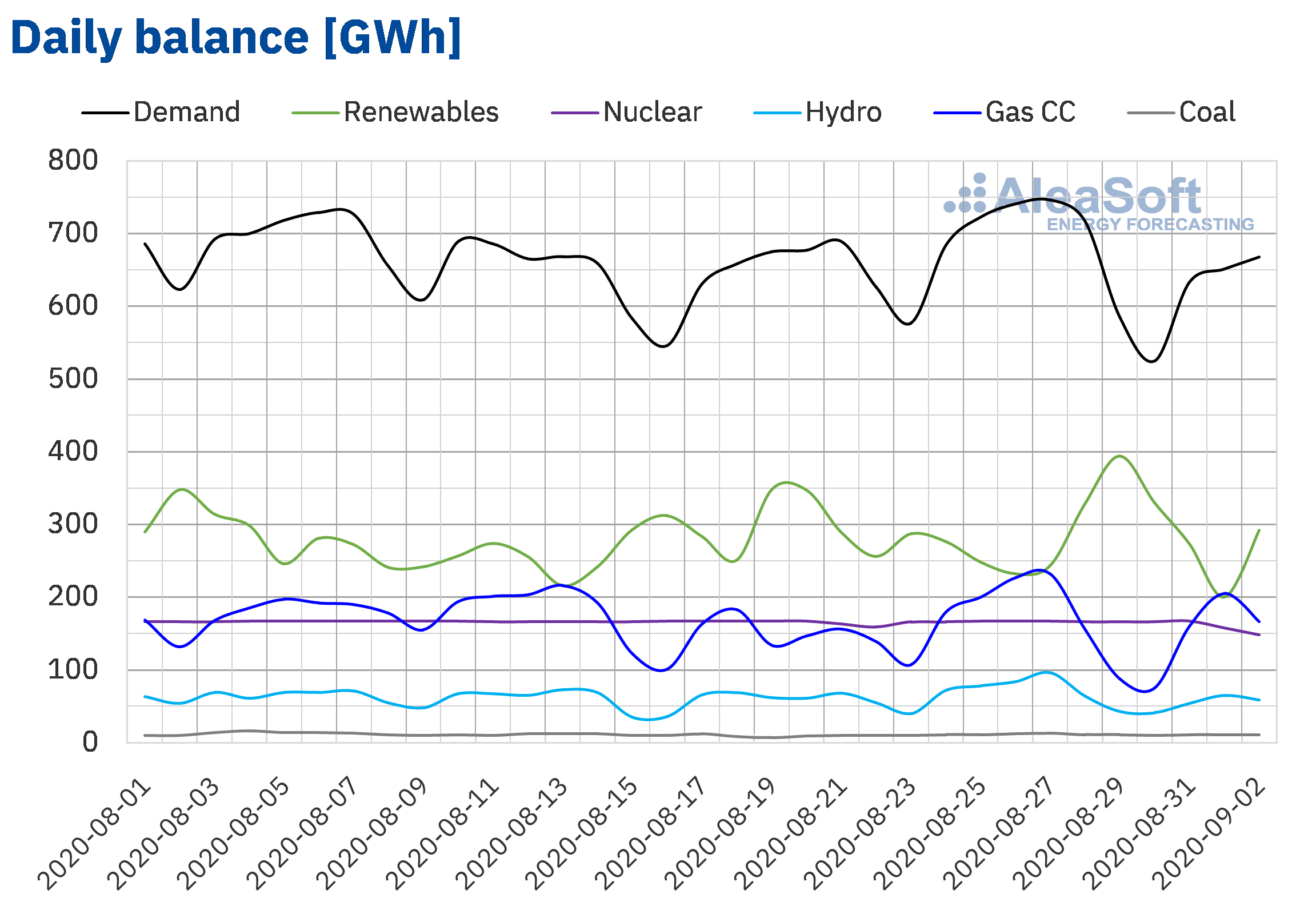

The average solar energy production in Mainland Spain, which includes the photovoltaic and solar thermal technologies, decreased by 12% between Monday, August 31, and Wednesday, September 2, compared to the average of the fourth week of August. For the first week of September, the analysis carried out at AleaSoft indicates that production will decrease compared to that registered the previous week.

The average level of the wind energy production in Mainland Spain of the first three days of the analysed week decreased by 18% compared to the average of the previous week. According to the analysis carried out at AleaSoft, at the end of the week the production with this technology will be lower than that of the last week of August.

The nuclear energy production decreased from 167 GWh registered on Monday, August 31, to 141 GWh of Wednesday, September 2, after the forced shutdown that occurred during the afternoon of September 1 at the Vandellós II nuclear power plant. The unscheduled shutdown of the plant was carried out to repair a leak detected in one of the lines of the cooling water system of the stator coils of the main generator, according to the report of the Nuclear Safety Council (CSN) that classified the incident with level 0 on the International Nuclear and Radiological Events Scale (INES).

Sources: Prepared by AleaSoft using data from REE.

Sources: Prepared by AleaSoft using data from REE.

The hydroelectric reserves currently have 11 726 GWh stored, according to data from the Hydrological Bulletin of the Ministry for Ecological Transition and Demographic Challenge number 35, which represents a decrease of 449 GWh compared to the bulletin number 34.

European electricity markets

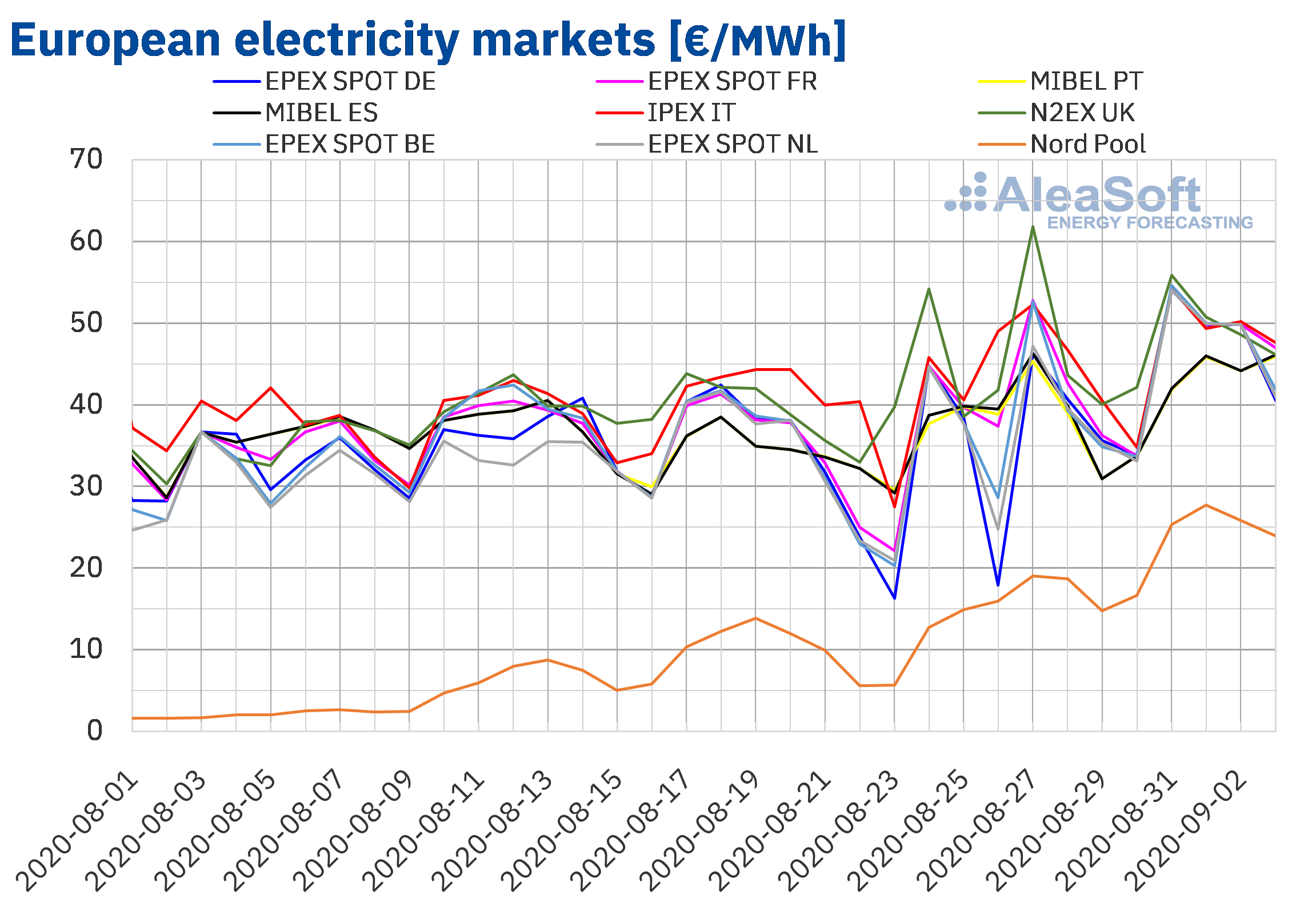

The first four days of the week of August 31, the prices increased in all European electricity markets analysed at AleaSoft, compared to the same period of the previous week. The largest price increase, of 64%, was that of the Nord Pool market of the Nordic countries, followed by the 32% increase of the EPEX SPOT market of Germany. In contrast, the N2EX market of Great Britain had the smallest increase, of 2.5%. In the rest of the markets, the price increases were between 7.3% of the IPEX market of Italy and 26% of the EPEX SPOT market of the Netherlands. As a consequence of these increases, in the EPEX SPOT markets of Germany, France, Belgium and the Netherlands the highest values of 2020 so far were reached in this period.

The average price from Monday to Thursday of the first week of September was above €40/MWh in almost all the analysed European markets, except in the Nord Pool market. This market had the lowest value in this period, of €25.71/MWh. In contrast, the markets of Italy, Great Britain and France registered the highest averages, with prices of €50.36/MWh, €50.34/MWh and €50.25/MWh respectively. In the rest of the electricity markets, the average prices were between €44.46/MWh of the MIBEL market of Portugal and €49.09/MWh of the Belgian market. In general, the markets prices were closely coupled, and only the MIBEL and Nord Pool markets separated from the rest, which, as mentioned, had lower values.

As for the daily prices, the first four days of the first week of September, they remained above €40/MWh in almost all the analysed European electricity markets. The exception was the Nord Pool market, whose maximum price, of €27.71/MWh was reached on Tuesday, September 1.

On the other hand, on August 31, the daily prices exceeded €50/MWh in almost all Europe, except in the MIBEL market and the Nord Pool market. On Tuesday, September 1, this situation was repeated in Belgium and Great Britain and on Wednesday, September 2, in Italy. The highest daily price, of €55.87/MWh, was reached on Monday, August 31, in Great Britain.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The price increases in the first days of the week of August 31 were favoured by the recovery in gas and CO2 prices, as well as by the decrease in wind energy production in general and in solar energy production in the markets of the Iberian Peninsula and Italy compared to the average of the previous week.

The AleaSoft‘s price forecasting indicates that at the end of the first week of September, the prices of all European electricity markets will be higher than those of the week of August 24. On the other hand, it is expected that the average prices of the first four days of the week of September 7, in general, will be lower than those of the same period of the first week of September. The increase in wind energy production in most markets will favour these price decreases.

Iberian market

In the MIBEL market of Spain and Portugal, the average price of the first four days of the week of August 31 increased compared to the same period of the previous week. The increase was 8.6% in Spain and 10% in Portugal.

Due to these increases, the average price from August 31 to September 3 was €44.46/MWh in the Portuguese market and €44.59/MWh in the Spanish market.

On the other hand, in this period, the daily prices remained below €50/MWh in the MIBEL market. On Monday, August 31, the lowest daily price, of €41.84/MWh, was reached in Portugal. On the other hand, the highest daily price, of €46.16/MWh, was registered on Thursday, September 3, in Spain.

The decrease in production with renewable energies in the Iberian Peninsula at the beginning of the week of August 31 compared to the average of the previous week and the recovery of the gas and CO2 prices, favoured the increase in prices in the MIBEL market during the considered period.

However, the AleaSoft‘s price forecasting indicates that the average price of the first four days of the week of September 7 will decrease, influenced by a significant increase in wind energy production in the Iberian Peninsula.

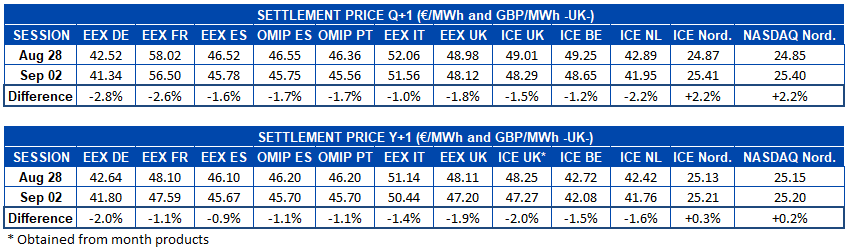

Electricity futures

So far in the first week of September, the prices for the product of the last quarter of 2020 in most of the European electricity futures markets fell compared to those of the session of Friday, August 28. Increases were only registered in the ICE market and the NASDAQ market of the Nordic countries, of 2.2% in both cases. In the rest of the markets, the decreases were between 1.0% and 2.8%. This last value corresponds to the EEX market of Germany, which was the one with the greatest variation in relative terms, since the greatest difference in prices for this product was registered by the French market, of €1.52/MWh.

Regarding the Cal‑21 electricity future, the behaviour of the markets in the first three days of the week of August 31 was very similar to that of the quarterly product. Only the Nordic markets registered increases in prices, while in the rest of European markets there were decreases of between 0.9% of the EEX market of Spain and 2.0% of the EEX market of Germany and the ICE market of Gran Britain. However, in absolute terms, the EEX market of Great Britain was the one with the greatest difference between the price of the session of August 28 and that of September 2, of €0.91/MWh.

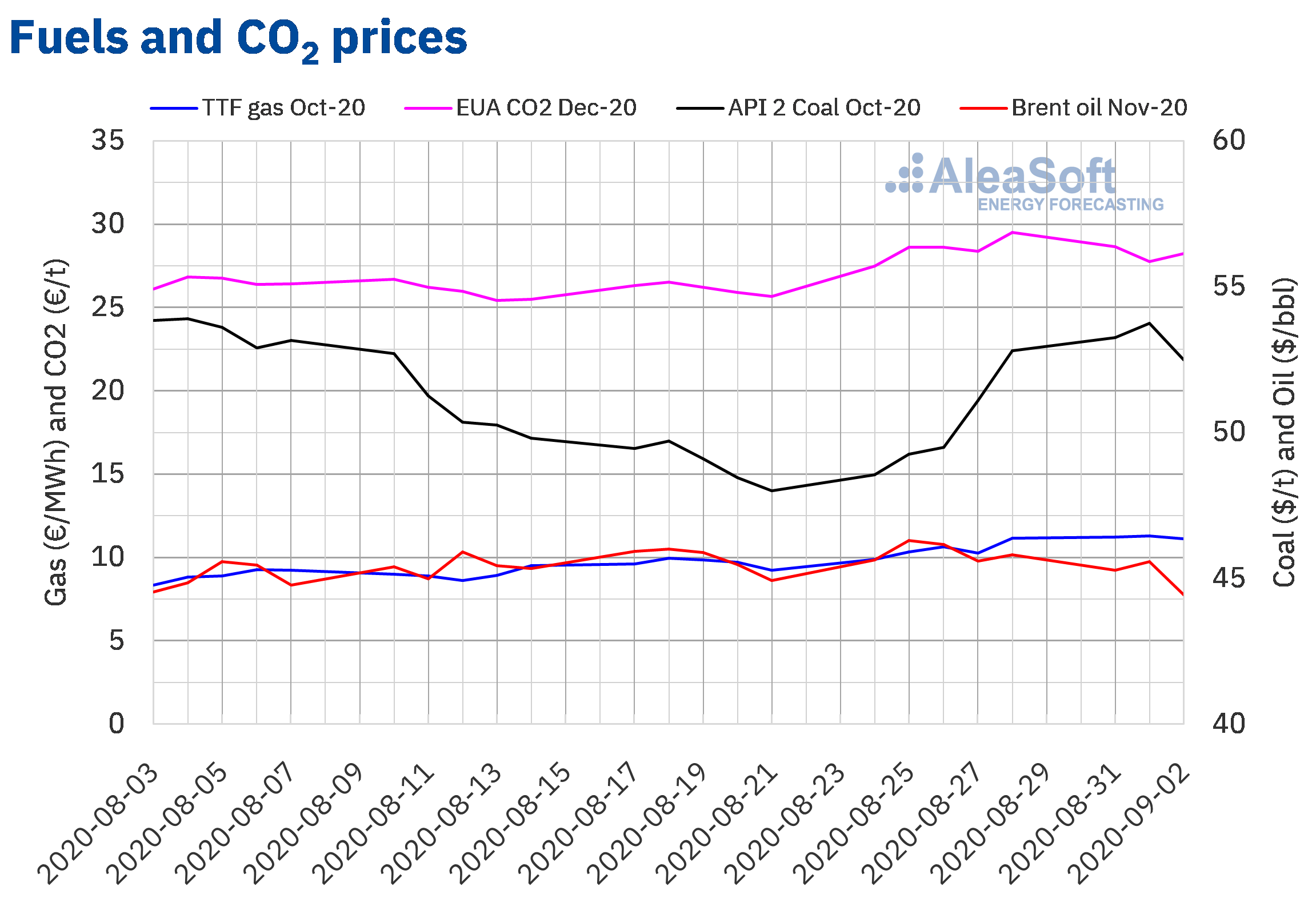

Brent, fuels and CO2

The Brent oil futures prices for the month of November 2020 in the ICE market started the week of August 31 with decreases. The first three days of the week, the settlement prices were lower than those of the same days of the previous week, although they remained above $44/bbl. On Tuesday, September 1, there was a slight recovery of 0.7% and the maximum settlement price of this period, of $45.58/bbl, was reached.

In the first week of September, the concerns about the evolution of the demand due to the increase in COVID‑19 infections continue, despite the fact that the improvement in the economy in countries such as the United States or China favours the recovery of the prices. However, the recent strengthening of the dollar began to exert its downward influence on the Brent oil futures prices. In addition, the recovery of the production levels in America after the passage of Hurricane Laura might favour further price declines.

On the other hand, the TTF gas futures prices in the ICE market for the month of October 2020, the first three days of the first week of September, remained above €11/MWh. The maximum settlement price for this period, €11.30/MWh, was registered on Tuesday, September 1. This price was 9.4% higher than that of the previous Tuesday, August 25, and the highest since the last week of February.

Regarding the TTF gas prices in the spot market, the first three days of the week of August 31, they increased until reaching an index price of €10.72/MWh on Wednesday, September 2. This price is the highest since the last week of January. However, on Thursday, September 3, the index price was slightly lower, of €10.55/MWh.

As for the API 2 coal futures prices in the ICE market for the month of October 2020, they began the week of August 31 with increases until reaching a settlement price of $53.75/ t on Tuesday, September 1. This is 9.1% higher than that of the previous Tuesday, August 25, and the highest since the beginning of August. But on Wednesday, September 2, there was a decrease of 2.3% and the settlement price was $52.50/t.

Regarding the CO2 emission rights futures prices in the EEX market for the December 2020 reference contract, they began the first week of September with decreases until reaching a settlement price of €27.75/t on Tuesday, September 1. This price was 3.0% lower than that of the same day of the previous week. However, on Wednesday, September 2, the settlement price recovered to €28.23/t.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis of the recovery of the energy markets at the end of the economic crisis

Although the energy markets showed signs of recovery in recent weeks, the uncertainty about the impact of the pandemic on the economy remains latent. The new outbreaks of COVID‑19 and the possibility that these increase with the return to schools in person and with the arrival of autumn, generate more uncertainty about the exit from the economic crisis. To analyse the evolution of the energy markets and the financing of the renewable energy projects in this context, the first part of the series of webinars “Energy markets in the recovery of the economic crisis”, which is being organised at AleaSoft, will be held on September 17. At the end of October, on the 29th, a second part will take place. In this series of webinars, the importance of the forecasting in the audits and in the portfolio valuation will also be commented and the webinars will feature speakers from Deloitte, Engie, Banco Sabadell and AleaSoft.

The AleaSoft‘s mid and long‑term European electricity markets prices forecasting is periodically updated, taking into account the evolution of the economy and the recovery scenarios. In the case of the short term, the adaptive scheme of the Artificial Intelligence of the Alea models allows the forecasting to adapt to the evolution of the markets and quickly capture any structural or behavioural change that occurs.

To track the registered data of the main variables of the European electricity, fuels and CO2 markets, the observatories were set up on the AleaSoft website. This tool shows comparative graphs of the last weeks with daily updated data.

Source: AleaSoft Energy Forecasting.