AleaSoft, September 3, 2021. In October 2020, European electricity markets prices were almost a third of current prices and renewable energy projects remained profitable. Since then, prices rose, setting historical records in various markets. The evolution of the energy markets in the last year, the prospects in the mid and long term and the current situation of the renewable energy projects financing will be discussed in an upcoming webinar with speakers from Deloitte and AleaSoft.

After a summer break, AleaSoft will resume the monthly webinars on the European energy markets on October 7. To inaugurate this new cycle, there will be the participation of invited speakers from the consulting firm Deloitte, when almost a year passed since the webinar held with the same speakers in October 2020, which had a great participation success.

In the webinar, the topics discussed on the previous occasion will be analysed and updated: the evolution of the European energy markets, the renewable energy projects financing and the importance of the forecasting in audits and portfolio valuation.

Evolution of the European energy markets

Since the previous webinar, in October 2020, the European electricity markets prices were rising almost continuously and reached all time highs in several markets. These rises also occurred in the electricity futures markets and are caused by the sustained increase in gas and CO2 emission rights prices, which also registered historical records. In the webinar, the evolution of these markets in the last year will be reviewed and the prospects in the mid and long term will be analysed.

Renewable energy projects financing

To meet the objectives of the NECP (National Energy and Climate Plan) a large amount of capital is needed until 2030 in an environment with high volatility and uncertainty. There is diversity among capital providers in terms of their tolerance for risk, especially in market projects. This is why PPA (Power Purchase Agreements) are necessary to mitigate the market prices risk by having certainty regarding the long term income during the years of the contract. In the webinar, the financing conditions of the projects with and without PPA will be discussed and a sensitivity analysis of the returns expected by the shareholders of the projects will be carried out in different scenarios.

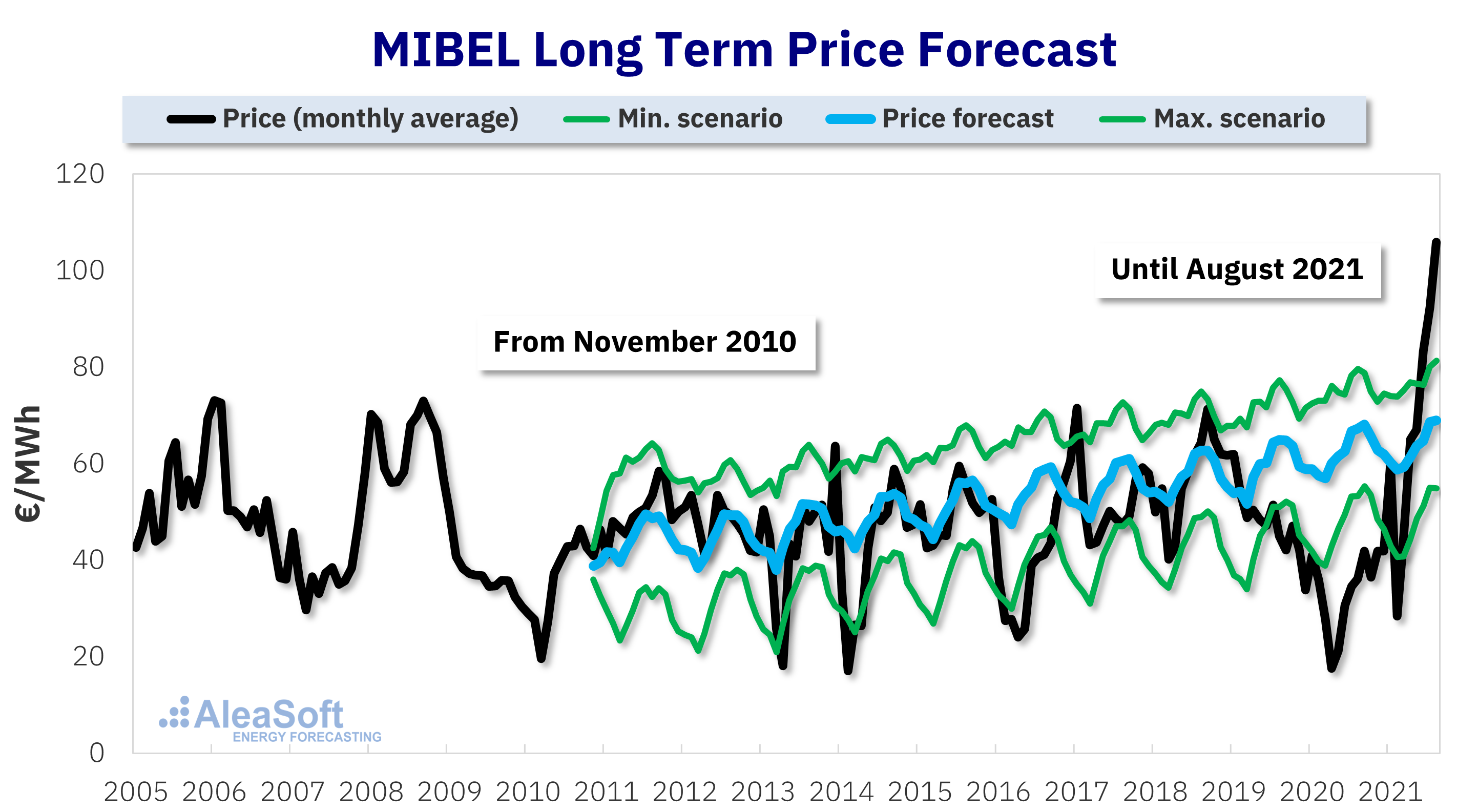

In the October 2020 webinar, when the electricity markets prices were almost a third of the current prices, it was commented that renewable energy projects continued to be profitable, although there was talk of returns below 10%, which depended on the specific characteristics of each project. They also spoke about the need to have a “proper and educated” vision of the future of prices as an input for a financial model to obtain financing for a renewable energy project, highlighting the importance of the hourly forecasting to estimate the future income of the project and of the confidence bands calculated with a probabilistic metric that allow quantifying the risk of assuming a given price forecast. It is important that the forecasts are scientific and coherent and that they take into account the market balance, such as those shown in the following image that were made at AleaSoft at the end of October 2010, where it is shown that, although the price fluctuated between periods of low and high prices, the market balance remained.

Long term price forecast for the Iberian MIBEL electricity market carried out at the end of October 2010 by AleaSoft.

Long term price forecast for the Iberian MIBEL electricity market carried out at the end of October 2010 by AleaSoft.

The forecast values up to August 2021 are shown.

Source: AleaSoft

Another topic discussed in the October 2020 webinar was that the market prices risk is one of the most complex to assume for projects without aid and the importance of PPA to mitigate this risk was highlighted. The PPA as a tool to mitigate the market prices risk are also very important from the point of view of the large and electro intensive consumers. Thanks to the PPA, they can know in advance the prices they are going to pay for electricity in the next five, ten or fifteen years, and be covered in situations of high prices such as those that are occurring in recent months.

Importance of the forecasting in audits and portfolio valuation

In the next webinar, the risks and the difficulty of preparing financial information will be discussed, specifically the complexity in the presentation of financial information on price hedges, the challenges of accounting estimates: impairment test, fair value, and the complexity of the hedge accounting given the diversity of PPA. In addition, the importance of having hourly forecasts in these processes will be explained.

On this subject, in the webinar that was held in October 2020, the importance of the financial information was highlighted, in addition to complying with regulations, as input in processes of restructuring, purchase, IPO, etc. This information is a critical input for the projects financing and should be a true picture of the business. It is not enough to have a future vision of the yearly prices, for example taking the futures markets as a reference. That information can be a reference but accounting requires a lot of granularity, hence the importance of the hourly price forecasting.

AleaSoft’s analysis on the prospects for energy markets

The webinar’s speakers will be Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services and Carlos Milans del Bosch, Partner of Financial Advisory, both from Deloitte, in addition to Oriol Saltó i Bauzà, Manager of Data Analysis and Modelling at AleaSoft. In the second part of the webinar in Spanish there will be an analysis table in which, in addition to the speakers, Antonio Delgado Rigal, CEO of AleaSoft, will participate. The invitation request to the webinar can be made here.

As mentioned above, having a vision of the hourly market prices with confidence bands that covers the entire lifetime of the plant is essential to finance a renewable energy project. Currently, at AleaSoft, the long term price forecasting reports of the European electricity markets are being updated taking into account the rise in gas and CO2 prices of July and August.

On September 9, a workshop on the importance and usefulness of the short term forecasting when operating in the spot and futures electricity markets will be held at AleaSoft, in which the use and advantages of the Alea Energy DataBase (AleaApp) for the compilation, visualisation and analysis of energy markets data will also be explained.