AleaSoft Energy Forecasting, July 31, 2023. In the first days of the last week of July, gas and CO2 prices rose, causing most European electricity markets prices to register a higher weekly average than in the previous week, a trend also favored in some cases by the fall in solar or wind energy production. On the 28th, Spain registered the second highest photovoltaic energy production value so far. Demand fell in most markets. Brent registered the highest price since mid‑April.

Solar photovoltaic and thermoelectric energy production and wind energy production

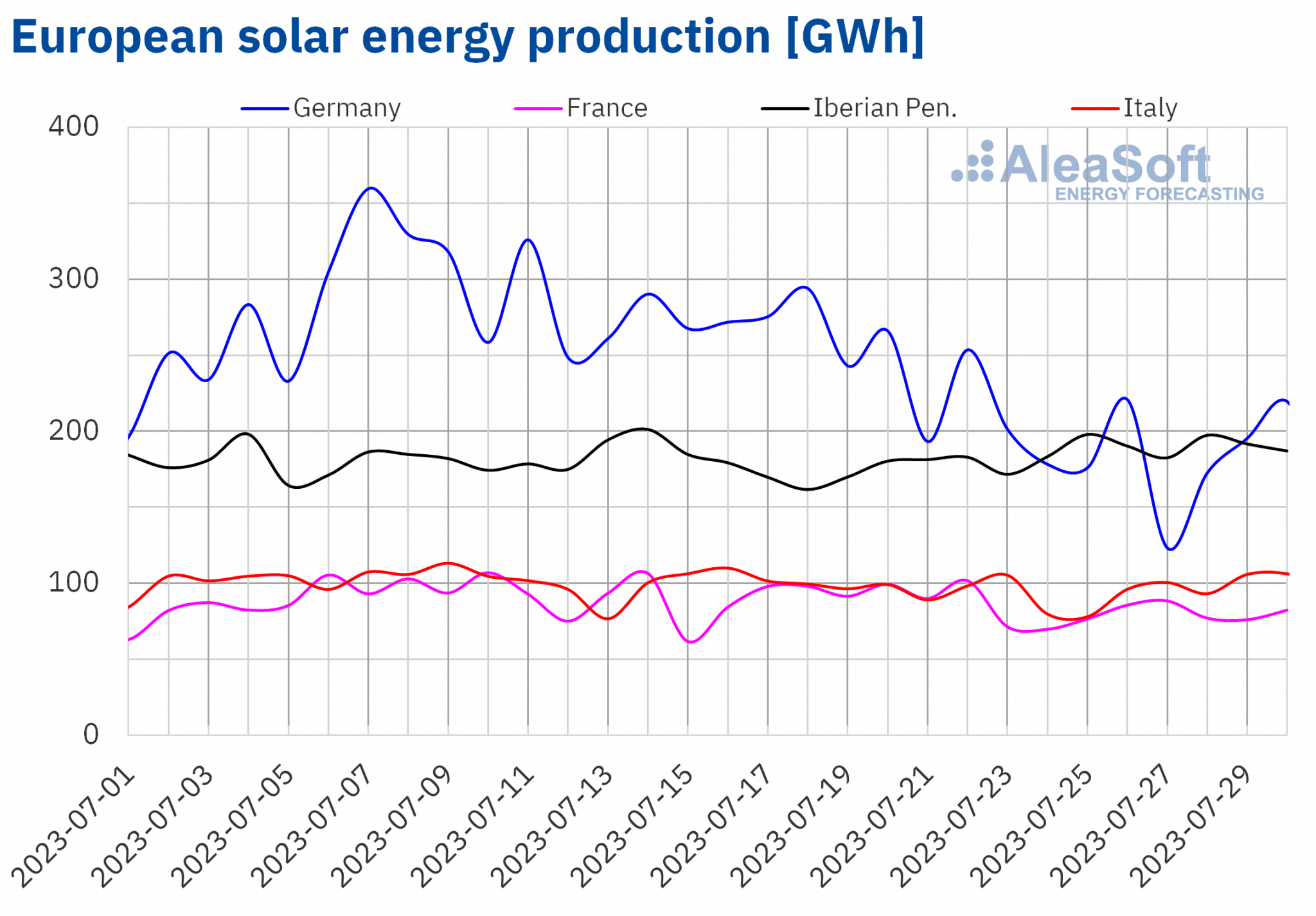

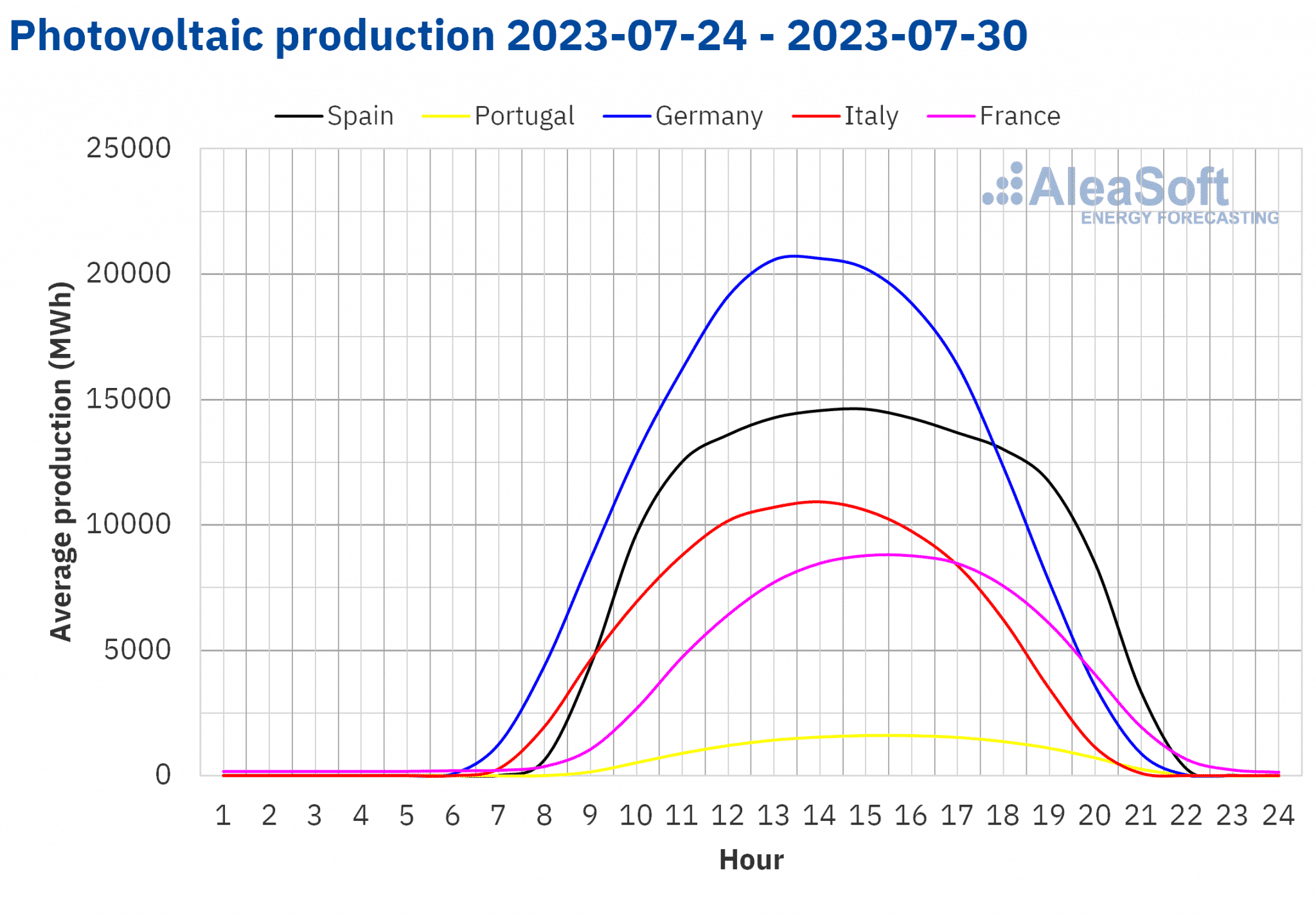

In the week of July 24, solar photovoltaic energy production reached the second highest daily value in the Spanish market, with 156 GWh generated on Friday, July 28, after the record of July 14, when 159 GWh were generated with this technology in Spanish mainland. Moreover, the solar thermoelectric energy production registered on July 26 in Mainland Spain, of 30 GWh, was the second highest in 2023 to date and the highest in July of this year, when there is only one day left to end the month.

In comparison with the previous week, solar energy production rose solely in the Spanish and Portuguese markets, with increases of 10% and 2.7%, respectively. In contrast, in the remaining markets a drop in solar energy production was observed. The highest decrease, of 26%, was registered in the German market and was followed by a drop of 10% in the French market and of 4.3% in the Italian market.

For the week of July 31, AleaSoft Energy Forecasting’s solar energy production forecasting indicates that it will increase in the German market, remain similar to the previous week in the Spanish market and decrease in the Italian market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

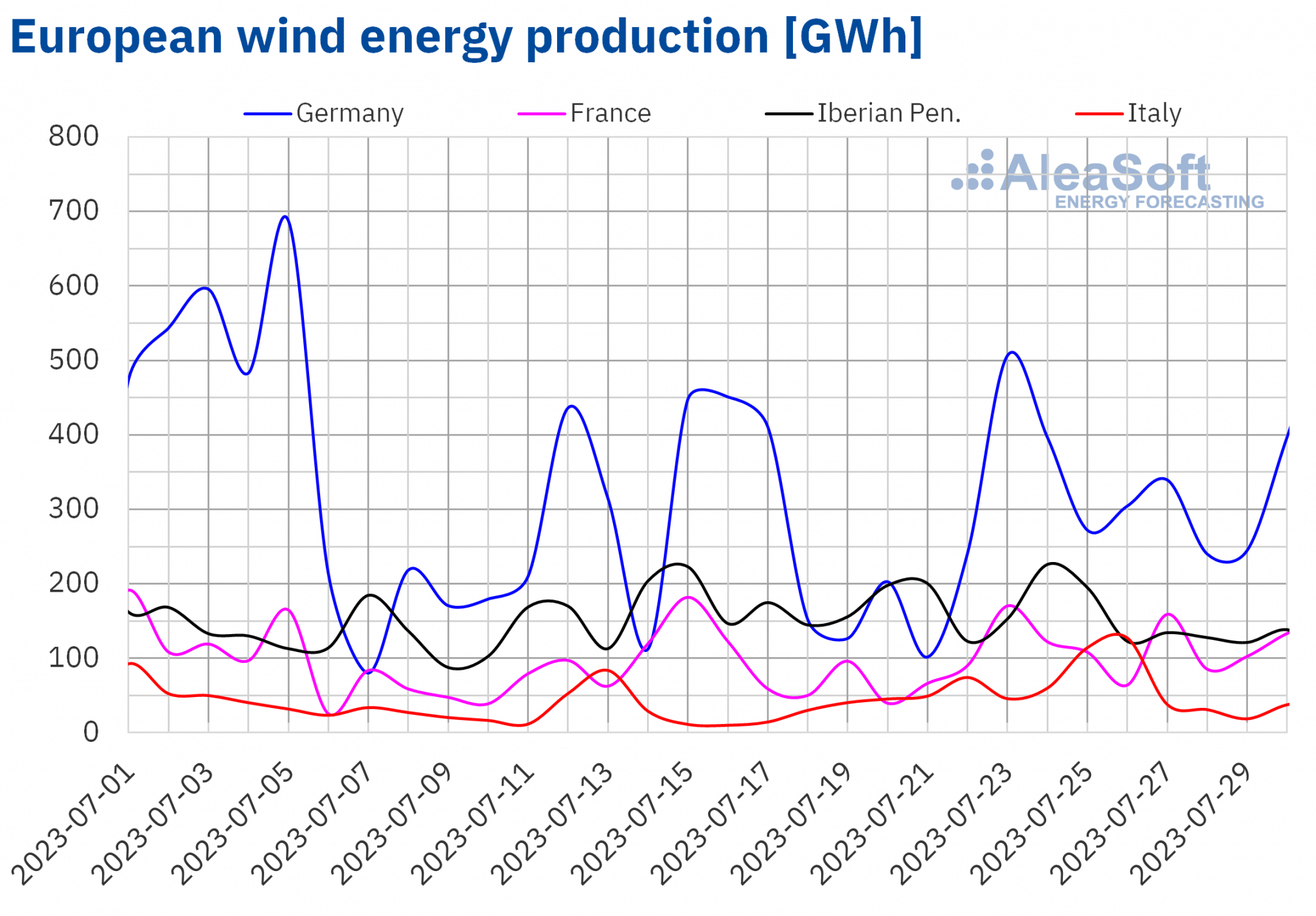

In the last week of July, wind energy production reached the largest daily values since the beginning of July 2023 in the Italian, Portuguese and Spanish markets, with 127 GWh generated on July 26 in Italy, as well as 49 GWh and 179 GWh generated on July 24 in Portugal and Spain, respectively.

In comparison with the previous week, wind energy production rose in all analyzed markets except Spain, where it fell by 13%. In the remaining markets, increases ranged from 20% registered in Portugal to 43% observed in Italy.

For the week of July 31, AleaSoft Energy Forecasting’s wind energy production forecasting indicates an increase in all analyzed markets except the Portuguese market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

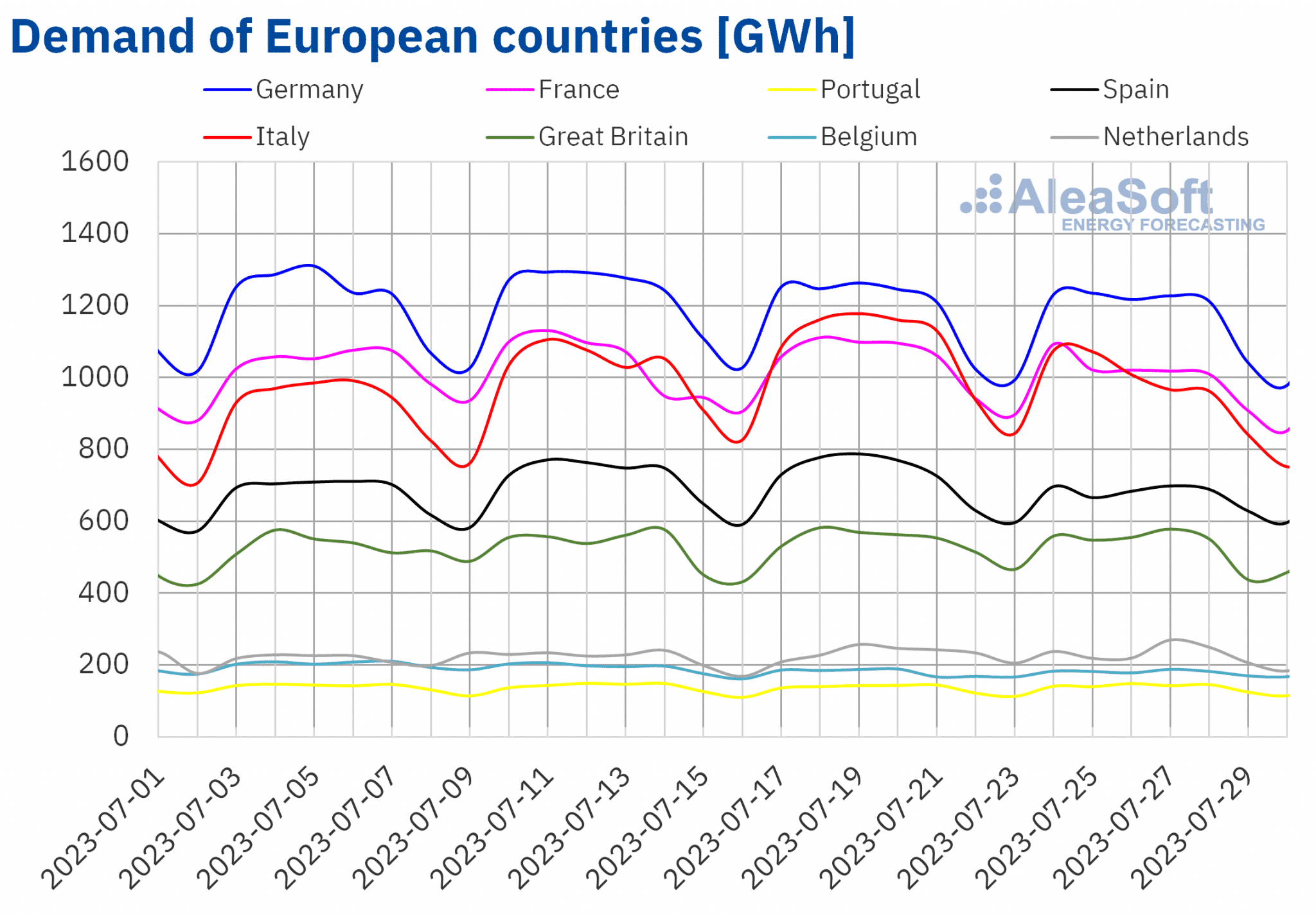

In the week of July 24, electricity demand fell compared to the previous week in most analyzed European markets. The largest drop in demand, of 11%, was registered in the Italian market, where, at the same time, the largest drop in average temperatures, of 2.6 °C, was registered.

In the rest of the markets, electricity demand dropped between 1.1% in the German market and 7.1% in the Spanish market.

In contrast, demand increased in the Portuguese and Belgian markets. The largest increase, of 1.7%, was observed in the Portuguese market, followed by a 0.1% increase in the Belgian market. In the latter case, the increase was favored by the recovery in demand after the celebration of the Belgian National Day on Friday, July 21.

Compared to the previous week, average temperatures increased in the analyzed markets located further north in Europe. The largest increase, of 0.8 °C, was registered in Great Britain, followed by increases of 0.5 °C and 0.3 °C in Belgium and the Netherlands, respectively. The opposite trend was observed in the analyzed markets located towards the center and south of Europe, where average temperatures fell. Excluding the largest decline observed in Italy, the fall in average temperatures ranged from 0.4 °C to 1.0 °C in the Portuguese and Spanish markets, respectively.

For the week of July 31, according to demand forecasts done by AleaSoft Energy Forecasting, electricity demand is expected to increase in the Iberian Peninsula and Belgium, while it is expected to decrease in the rest of the markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

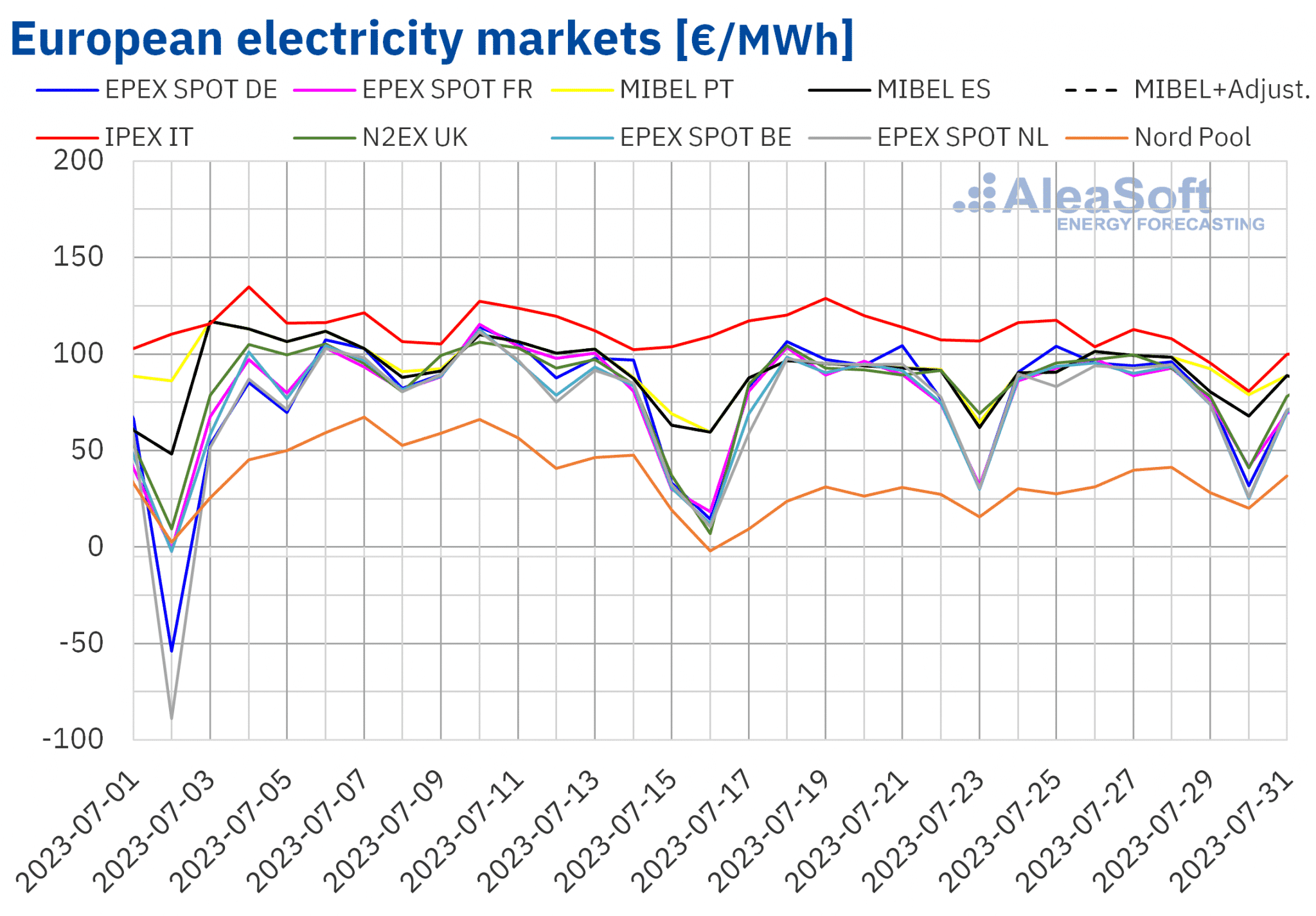

European electricity markets

In the week of July 24, prices in most of European electricity markets analyzed at AleaSoft Energy Forecasting increased with respect to the previous week, although the increases were less than 5%, except in the Nord Pool market of the Nordic countries, where the increase was 33% but it remains the market with the lowest prices among those analyzed. In the remaining markets where prices rose, increases ranged from 1.4% in the MIBEL market of Spain to 4.6% in the MIBEL market of Portugal. The exceptions were the N2EX market of the United Kingdom, down 5.1%, and the IPEX market of Italy, down 9.8%. As for the EPEX SPOT market of Germany and the Netherlands, prices remained stable, with slight variations of ‑0.6% and 0.8%, respectively.

In the fourth week of July, weekly averages were below €95/MWh in almost all European electricity markets. The exception was the Italian market, with the highest average price, of €104.89/MWh. On the other hand, the lowest weekly average was that of the Nordic market, of €31.19/MWh. In the rest of the analyzed markets, prices ranged from €79.08/MWh in the Dutch market to €93.04/MWh in the Portuguese market.

Regarding hourly prices, negative prices were registered on Sunday, July 30, in the German, Belgian, British, French, Dutch and Nordic markets. High wind and solar energy production values in some markets on that day, together with lower demand on Sunday, led to these prices. The lowest hourly price, of ‑€88.03/MWh was reached from 14:00 to 15:00 in the Dutch market.

During the week of July 24, the increase in the average price of gas and CO2 emission rights led to higher European electricity markets prices. In addition, wind energy production declined on the Iberian Peninsula and solar energy production fell in Germany, France and Italy.

AleaSoft Energy Forecasting’s price forecasting indicates that in the first week of August prices might decrease in most analyzed European electricity markets, influenced by decreases in electricity demand in most markets and increased wind energy production in markets such as Germany, Spain and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

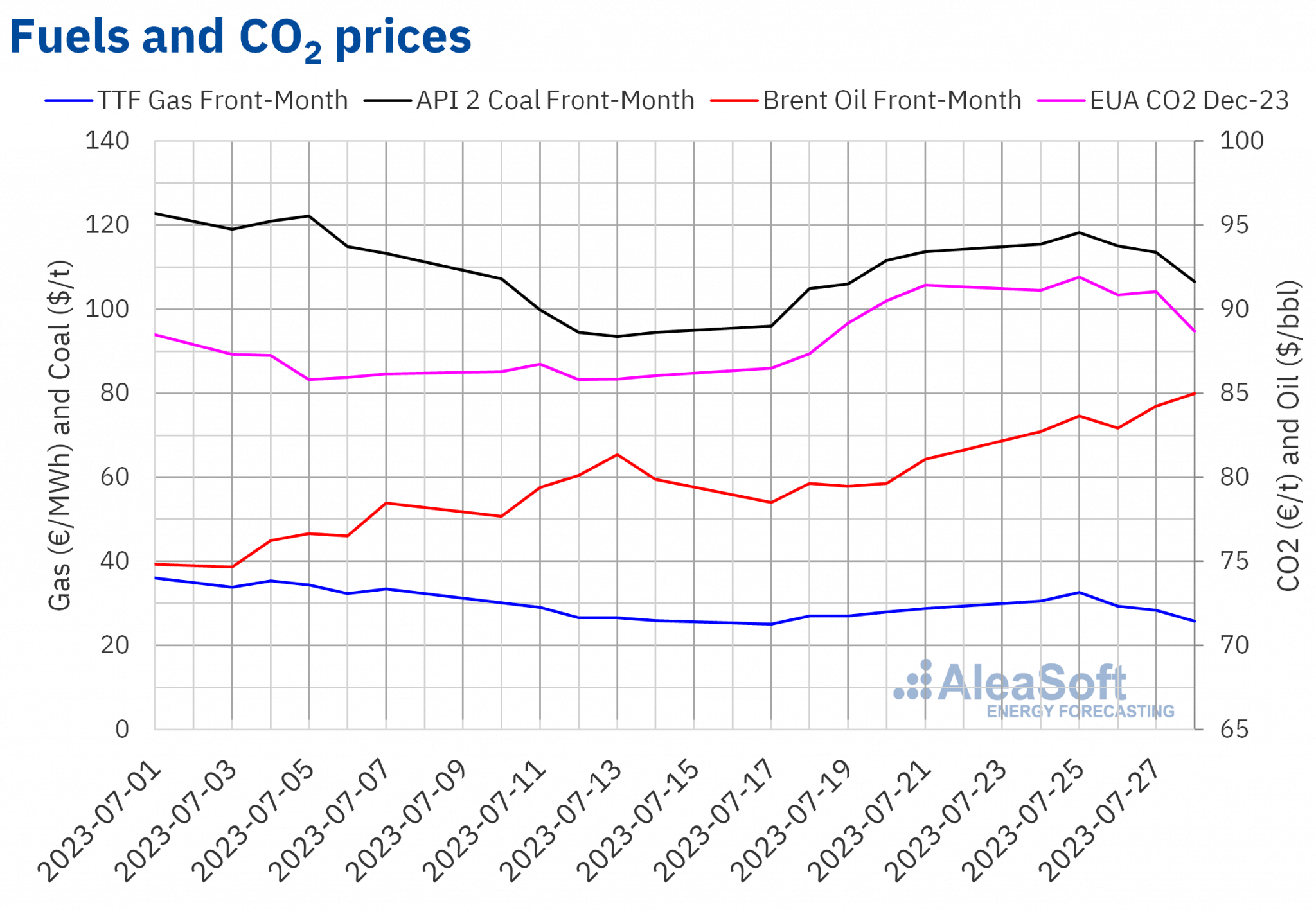

Brent, fuels and CO2

Settlement prices of Brent oil futures for the Front‑Month in the ICE market registered an upward trend during the fourth week of July. On Monday, July 24, they registered the weekly minimum settlement price, of $82.74/bbl, which was already 5.4% higher than the previous Monday. In most of the following sessions of the week, settlement prices increased. As a result, the weekly maximum settlement price, of $84.99/bbl, was reached on Friday, July 28. This price was 4.8% higher than the previous Friday and the highest since April 14.

In the fourth week of July, expectations of economic improvements and increased demand exerted an upward influence on prices. Measures to boost the Chinese economy, as well as positive economic data from the United States and some European countries, contributed to these expectations. On the other hand, supply cuts planned for the coming months also favored to the increase in Brent oil futures prices in the last week of July.

As for TTF gas futures prices in the ICE market for the Front‑Month, in the fourth week of July they continued the upward trend of the previous week until reaching the weekly maximum settlement price, of €32.65/MWh, on Tuesday, July 25. This price was 21% higher than the previous Tuesday. But, subsequently, prices fell. As a consequence, on Friday, July 28, the weekly minimum settlement price, of €25.84/MWh, was registered. This price was 10% lower than that of the previous Friday.

In the fourth week of July, the high temperatures registered in southern Europe favored the increase in demand for electricity generation due to cooling needs, contributing to the increase in prices. But abundant supplies and high European stock levels allowed prices to fall at the end of the week. Forecasts of lower temperatures and increases in wind energy production also contributed to the price declines. However, competition from Asian markets for liquefied natural gas might cause price increases. In addition, in the coming weeks, planned maintenance work in Russia and Norway might also reduce supplies and have an upward influence on prices.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2023, almost every day of the fourth week of July they remained above €90 /t. The weekly maximum settlement price, of €91.93/t, was reached on Tuesday, July 25. This price was 5.2% higher than the previous Tuesday and the highest since June 20. On the other hand, on Friday, July 28, the weekly minimum settlement price, of €88.68/t, was registered, which was 3.0% lower than that of the previous Friday.

In the fourth week of July, the increase in demand due to the high temperatures and a lower offer in the auctions in August favored prices above €90/t. But the behavior of the demand allowed the decrease in prices on Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

In the financing of renewable energy projects, it is essential for developers, investment funds and banks to have long‑term price forecasts for electricity markets that are coherent and of high quality. The long‑term price forecasts of AleaSoft Energy Forecasting and AleaGreen stand out for these characteristics thanks to their scientific basis. These forecasts have a 30‑year horizon, hourly granularity and confidence bands. Long‑term price forecasting reports are available for the main European markets and for some American markets such as Chile.

Source: AleaSoft Energy Forecasting.