AleaSoft Energy Forecasting, September 30, 2025. The future of energy storage, hybridisation and the keys to renewable energy project financing were the central themes of the 58th edition of AleaSoft Energy Forecasting’s webinars. The session analysed opportunities for the growth of BESS in the Iberian Peninsula, the evolution of self‑consumption and residential storage, as well as the regulatory and financial challenges that condition the bankability of projects and will set the pace of their deployment in the coming years.

The 58th edition of the monthly webinar series organised by AleaSoft Energy Forecasting took place on September 18, providing a meeting point for the analysis of current issues and trends in the energy sector. In the second part of the event in Spanish, an analysis table was held with the participation of Xavier Cugat, BESS Technical Director at Seraphim Solar, Francisco Valverde, independent professional for the renewable energy development, Alejandro Diego Rosell, energy communicator and consultant, Director of Studies at Worldwide Recruitment Energy and Lecturer at Escuela de Organización Industrial, and Oriol Saltó i Bauzà, Associate Partner at AleaSoft. The webinar and the analysis table were moderated by Antonio Delgado Rigal, CEO of AleaSoft.

Growth opportunities in energy storage

The webinar analysed the main challenges and opportunities facing the energy storage sector, with a particular focus on batteries, in a context marked by the increasing penetration of renewable energy. The Iberian Peninsula is at a decisive stage for the development of large‑scale battery energy storage systems (BESS). According to Red Eléctrica, the grid access capacity already granted or under processing for batteries and hybridisation places Spain on the threshold of an investment wave that could transform both the market price curve and the operation of the system in the coming years.

Red Eléctrica puts the grid access capacity currently in service for batteries in Mainland Spain at 10 MW, although most of the volume is concentrated in the project portfolio with access already granted, 9.2 GW, or under processing, 16.1 GW, bringing the total to 25.4 GW. In the case of hybrid plants, capacity amounts to 28 GW for the total of accesses already in service, granted and under processing.

Looking at the installed battery capacity in Mainland Spain, today there are barely 26 MW in operation, but there are 16.9 GW with access granted and a further 17 GW under processing, totalling 33.9 GW in the development pipeline. These figures far exceed the targets set by the NECP for 2030, established at 22.5 GW including batteries, pumped storage and solar thermoelectric energy, although it is expected that only part of this battery capacity will materialise. Even so, even if only half of the portfolio were executed, Spain would remain well above the originally planned targets.

Prospects for battery storage

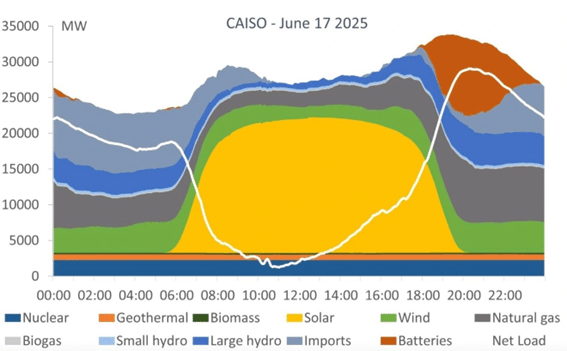

The webinar highlighted the role of battery energy storage as an essential element for progress in the energy transition. An example of this is California, where it is clearly observed how BESS “fill” the evening gap when photovoltaic energy production falls and electricity demand rebounds, displacing fossil generation in peak hours.

In Europe, the profitability of battery projects depends largely on the daily spread of market prices. In Spain, recent months have shown differences in the range of €80‑120/MWh, levels considered sustainable going forward. In Germany, monthly averages of price spreads reach €100‑150/MWh, while in France they have recently been between €80‑100/MWh.

It was underlined that integrating batteries into photovoltaic energy plants can increase revenues by up to 40% with 2‑hour systems, considering only price arbitrage in the day‑ahead market. Participation in ancillary services also represents a significant additional source of income. With 4‑hour batteries, although the initial investment is larger, the increase in revenues and the return on investment are also greater.

This demonstrates the strategic role of batteries in optimising the profitability of solar and wind energy. AleaSoft’s AleaStorage division has worked on real cases of stand‑alone projects, hybrid configurations with solar or wind energy, and even developments combining solar energy, wind energy and batteries. Services offered include estimating the optimal battery capacity in hybrid systems, long‑term revenue forecasts, revenue scenarios for capacity markets, CAPEX and OPEX analysis, as well as financial modelling in Europe and other international markets.

Batteries and hybridisation: regulation and financing as the main obstacles

The future of storage in Spain is seen as inevitable, although there are still obstacles slowing its development. In the analysis table, experts agreed that the main bottlenecks for the take‑off of battery projects continue to be regulation and financing. Despite favourable price spreads and falling technology costs, without a clear regulatory framework and without the backing of banks, deployment will be delayed.

One of the issues discussed in the webinar was Royal Decree‑law 7/2025, which provided legal certainty to energy storage in aspects such as dispatch priority, whether connection points could be shared between renewable energy plants and batteries or whether additional permits were required, and whether or not an environmental impact assessment was necessary for hybrid projects. Its failure to be ratified in the Congress left the sector in a situation of uncertainty. Banks acknowledged that the regulation resolved a large part of the uncertainties holding back financing, but after its fall, no substantial regulatory progress has been made, complicating the transition of many projects from paper to reality.

The consensus was clear: the problem does not lie in the technology or potential profitability, but in bankability. Currently, the MW of operational grid‑connected batteries are few and there are only two relevant pilot projects. Financial institutions show risk aversion, influenced by the low captured prices of photovoltaic energy in the past year and the lack of solid references in battery project financing in Spain. For the market to move forward, experience and stable sources of revenue beyond the spot market are necessary, especially capacity payments, participation in balancing services and other ancillary markets.

Hybridisation and market signals: keys to accelerating storage

Although stand‑alone projects face greater uncertainties, hybridisation, whether photovoltaic energy with batteries or even combinations of solar energy, wind energy and storage, is emerging as the most solid development path. By enabling the storage and shifting of renewable energy generation, this model offers greater confidence to investors and financiers, reducing the exclusive dependence on renewable energy generation profiles.

Another positive factor is the decline in battery prices, which are already approaching €100k/MWh, improving project competitiveness. In addition, Spain has the advantage of learning from international experience in markets such as the United Kingdom, Germany, Italy and Australia, where large‑scale plants and diversified business models are already in operation, supported not only by price arbitrage but also by grid technical services.

Keys to consolidating and accelerating energy storage

The webinar emphasised that storage is already an essential component of the future energy mix, especially given the tens of GW of renewable energy that must come into operation before 2027. With limited margin for new pure photovoltaic energy, hybridisation is emerging as the main development pathway.

From a financial perspective, banks stress that storage projects require recurring and predictable revenues to ensure debt repayment. In this respect, capacity auctions are perceived as the key lever to unlock financing. However, the widespread feeling is that, despite repeated announcements that they are coming soon, the lack of a concrete date continues to generate uncertainty.

Despite these obstacles, experts agreed that falling battery costs, persistent attractive spreads and the greater maturity of hybrid models strengthen the profitability of investments. The conclusion was clear: the question is no longer whether there will be a battery boom in Spain, but when.

Self‑consumption and residential storage in Spain

Another topic addressed in the webinar was self‑consumption. According to APPA, the Spanish Renewable Energy Association, self‑consumption in Spain reached 9.2 GW at the end of the first half of 2025. After the extraordinary growth of 2022, new installations show a certain moderation, although the trend remains positive. In this period, 611 MW were added, 14.6% less than in the same half of 2024. The decline is concentrated in the industrial sector, down 23%, while growth continues in the residential sector. In this case, the advance is closely linked to storage, driven both by the blackout in April, which highlighted the importance of strengthening energy autonomy, and by the fall in surplus prices in solar hours. The latter factor discourages self‑consumption with grid injection, but at the same time strengthens interest in storage solutions that make it possible to maximise the use of energy generated at home.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing of renewable energy and storage projects

On October 9, 2025, AleaSoft Energy Forecasting will hold the 59th webinar of its monthly series. The session will focus on the analysis of the recent evolution and prospects of European energy markets for the winter 2025‑2026, as well as the financing of renewable energy and storage projects. Special emphasis will be placed on the role of batteries and hybridisation as key elements of the energy transition, as well as on the importance of forecasts in audits and portfolio valuation in a context marked by volatility.

The event will once again feature experts from Deloitte, for the sixth time in this webinar series, together with representatives from AleaSoft. The speakers will share their vision of the challenges and opportunities facing the financing of renewable energy and storage projects, as well as of the evolution of the electricity market in Europe.

Source: AleaSoft Energy Forecasting.