AleaSoft, June 20, 2019. So far this week of June 17 the MIBEL market has been characterised by stability, with prices that, remained above 46 €/MWh almost every day since June 13, although they slightly increased compared to last week. Futures markets for electricity, fuels and CO2 emission rights were also characterised by stability this week.

The average price of the MIBEL electricity market of Spain and Portugal was 47.34 €/MWh from June 17 to 20, a value that represents an increase of 2.5% compared to the average price of the first four days of the previous week. This week MIBEL stood out for the stability, with prices around 46 €/MWh, as it has been happening since last June 13, with the only exception of Monday, June 17, when prices reached 49.19 €/MWh and the MIBEL market was the one with the highest average daily price in Europe.

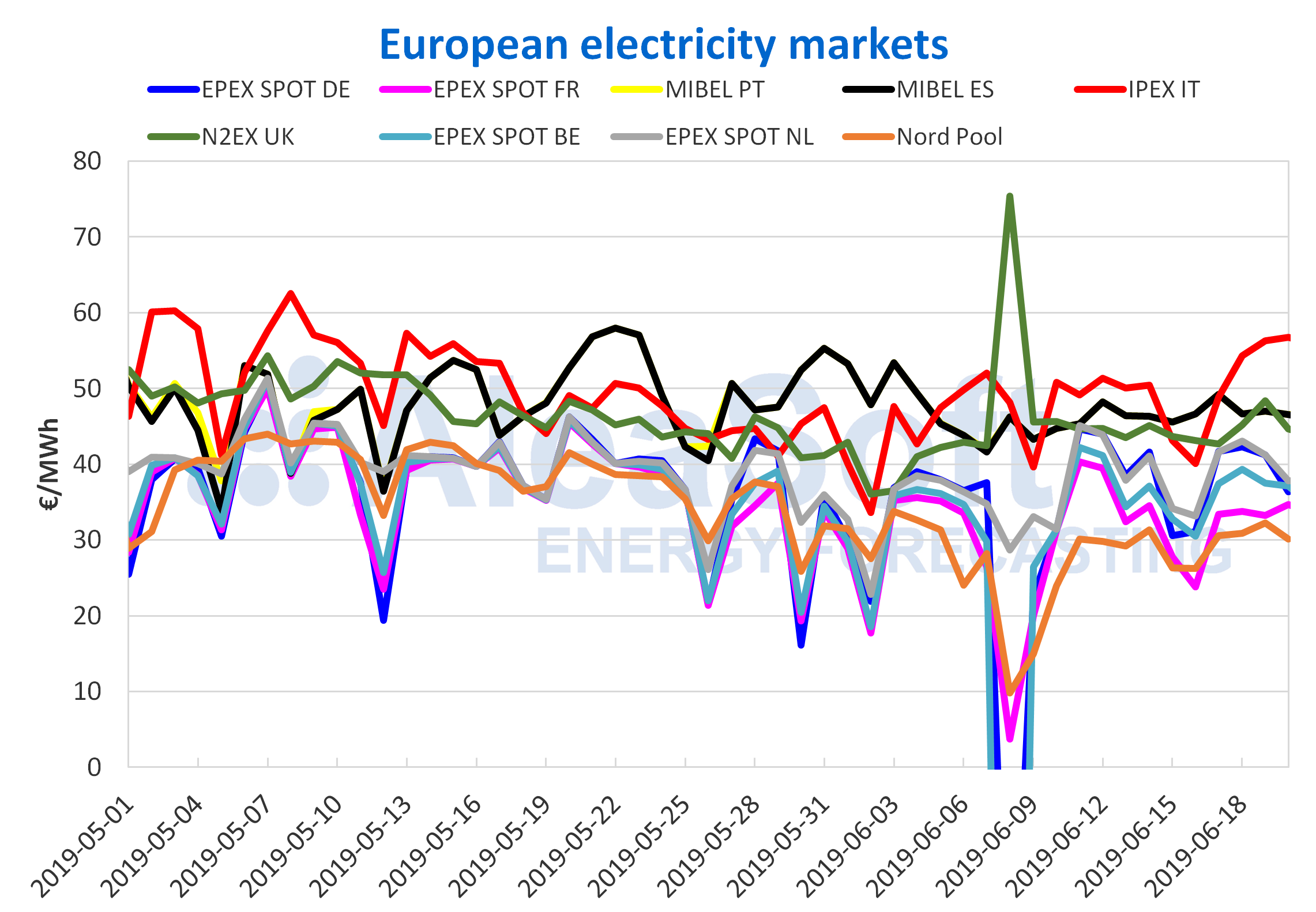

European electricity markets

In the rest of the European markets analysed, with the exception of France, prices also increased so far this week compared to the first four days of last week, with Nord Pool market of the Nordic countries being the greatest growing market, with 9.5%. On the other hand, the EPEX SPOT market of France fell by 5.9% in the analysed period.

At European level, in general, wind energy production fell so far this week compared to the average values of last week, standing out Italy and Germany with a reduction of 57% and 44% respectively. In the analysed countries, wind energy production increased during the first three days of this week compared to the average of last week only in Spain and Portugal, with a slight increase close to 2%. On the other hand, this is a positive week for all solar photovoltaic and solar thermal production, which increased in all the European countries analysed, with Germany being the greatest growing country, 33% above the average values of the last week.

The European markets continue to be divided into two groups according to their price. The group of markets with higher prices this week has been led by the IPEX market of Italy with values around 55 €/MWh most of the week. This group also includes the MIBEL and the British N2EX markets with prices around 45 €/MWh this week. The markets that belong to the group with lower prices, during the month of June were not as synchronised as they were in May, with prices that moved in a range between 30 €/MWh and 40 €/MWh this week. In this group are included the EPEX SPOT markets of Germany, France, Belgium and the Netherlands and the Nord Pool market which is once again the lowest price in Europe so far this week.

Sources: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Brent, fuels and CO2

The prices of Brent oil futures for the month of August in the ICE market remain stable this week and settled on Wednesday, June 19, at 61.82 $/bbl. This week, the OPEC and its allies set the date of their next meeting for July 1 and 2 in Vienna. The prospect of an extension of the production reduction of the OPEC countries, together with the current geopolitical tensions, continues to influence prices on the supply side. Even so, prices fell from their April highs above 73 $/bbl, mainly due to concerns related to demand and global economic growth as a result of the commercial tensions between the United States and China.

The futures of TTF gas in the ICE market for the month of July continue trading with historical lows, settling this Wednesday, June 19, at 10.48 €/MWh, the lowest value of the last two years.

The Prices of API 2 coal futures in the ICE market for next July continue to fall in parallel with gas prices and were placed yesterday, Wednesday, June 19, below 50 $/t for the first time also in the last two years. In addition to the downward pressure caused by the more competitive gas prices, this market continues to weigh the excess global supply and lower demand.

The prices of CO2 emission rights futures in the EEX market for the December 2019 reference contract remain stable around 25 €/t from Monday of last week.

Electricity futures

The electricity futures of Spain in the OMIP and EEX markets, as well as those of Portugal in the OMIP market, for the third quarter of 2019 continue with a downward trend, settling on Wednesday, June 19, below 50 €/MWh. This trend is maintained since mid-April, when it reached values close to 60 €/MWh.

Futures for next year, both in the OMIP and EEX markets for Spain and in the OMIP market for Portugal, remain in the range from 55 €/MWh to 56 €/MWh with a slight downward trend since June 7.

The futures of France and Germany in the EEX market for the next quarter also remained with a downward trend and settled yesterday, June 19, at 37.86 €/MWh and 38.21 €/MWh respectively. In the case of futures for next year, the trend was also downward in the two markets. This trend has been maintained since April, settling yesterday at its lowest value in more than two weeks, of 49.98 €/MWh for France and 46.60 €/MWh in Germany.

Mainland Spain, wind and photovoltaic energy production

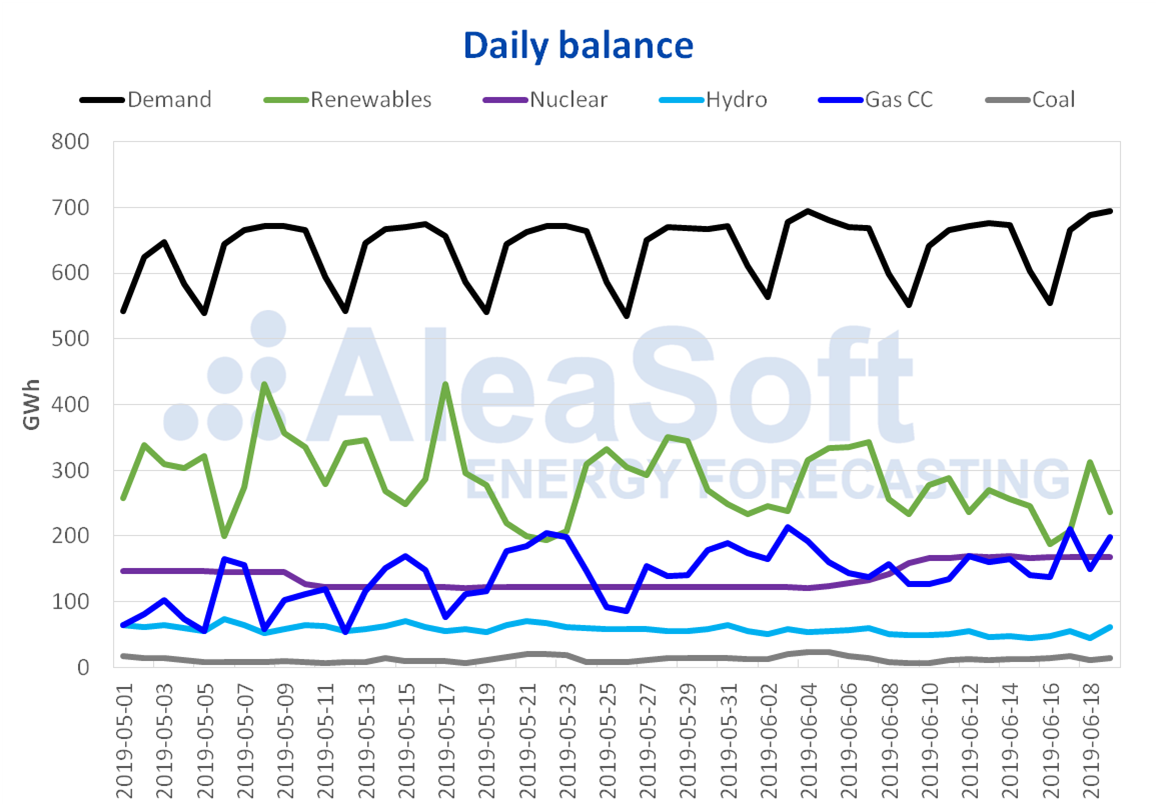

In the first days of this week the electricity demand increased by 3.4% compared to the days of June 10 to 13. The causes of this increase were the growth of almost 4 ºC on average temperatures so far this week and the effect of the June 10 holiday in several regions of Spain. According to the calculations made by AleaSoft, once the effect of this holiday was corrected, the increase was 2.7%.

From June 17 to 19, wind energy production recovered 2.1% compared to the average values of last week. For the week of June 24, a slight increase in production with this technology is also expected.

The solar energy production, which contains photovoltaic and solar thermal, has increased slightly in the first days of this week, reaching 2.3% above the average of last week. At AleaSoft, this type of generation is expected to decrease slightly next week.

So far this week, the nuclear energy production had values similar to those of the days of June 10 to 12. All nuclear power plants are currently working after the Trillo plant completed a scheduled shutdown for refuelling on June 9.

The hydroelectric energy production increased by 4.5% so far this week compared to the average values of the first three days of the previous week. So far in June, the average values decreased by 56% on year-on-year terms.

Sources: Prepared by AleaSoft using data from REE.

Hydroelectric reserves decreased by 111 GWh compared to the previous week. Now the accumulated capacity is 12 189 GWh, which represents 52% of the total, according to data from the Hydrological Bulletin of the Ministry for Ecological Transition. This current capacity represents 75% of that available a year ago, and it should be noted that it has remained 20% below the capacity available last year since the beginning of April of this year.

Source: AleaSoft Energy Forecasting.