AleaSoft Energy Forecasting, March 29, 2022. Spain, and the Iberian Peninsula by extension, can be considered an energy island. The capacity to import and export electricity with both France and Morocco represents a very small fraction of the demand and of the generation capacity. This article analyses all data on the interconnections of the Iberian Peninsula to frame its situation as an energy island.

The request of the President of the Spanish Government Pedro Sánchez to the European Union to be allowed to apply exceptional measures to lower energy prices was based on the exceptional nature of the Iberian Peninsula in its situation as an energy island.

The electricity interconnections of the Iberian Peninsula

The concept of energy island is not an official term, so there is no specific definition of what requirements must be met, but it is understood that it must be an isolated territory or one with very little connection to the rest of the territories. The geographical condition of peninsula of the Iberian territory makes the connection with the rest of the European continent a more complicated issue than it could be between two territories that share many kilometres of border.

Spain and Portugal are widely connected to each other. Their two electricity markets are coupled more than 95% of the time and, in general, it is called the Iberian market. Spain is also interconnected with Morocco by two submarine cables that cross the Strait of Gibraltar, each with a capacity of 700 MW. The interconnection with France is the most important with a total capacity of 2.8 GW currently.

The peninsula also has a submarine cable that connects to the Balearic electricity system. But being a dead end, it is not considered an interconnection, rather it makes the Balearic Islands part of the Iberian energy island. There is also an interconnection between Spain and Andorra, with a capacity of just over 100 MW.

The key data to consider the Iberian Peninsula an energy island

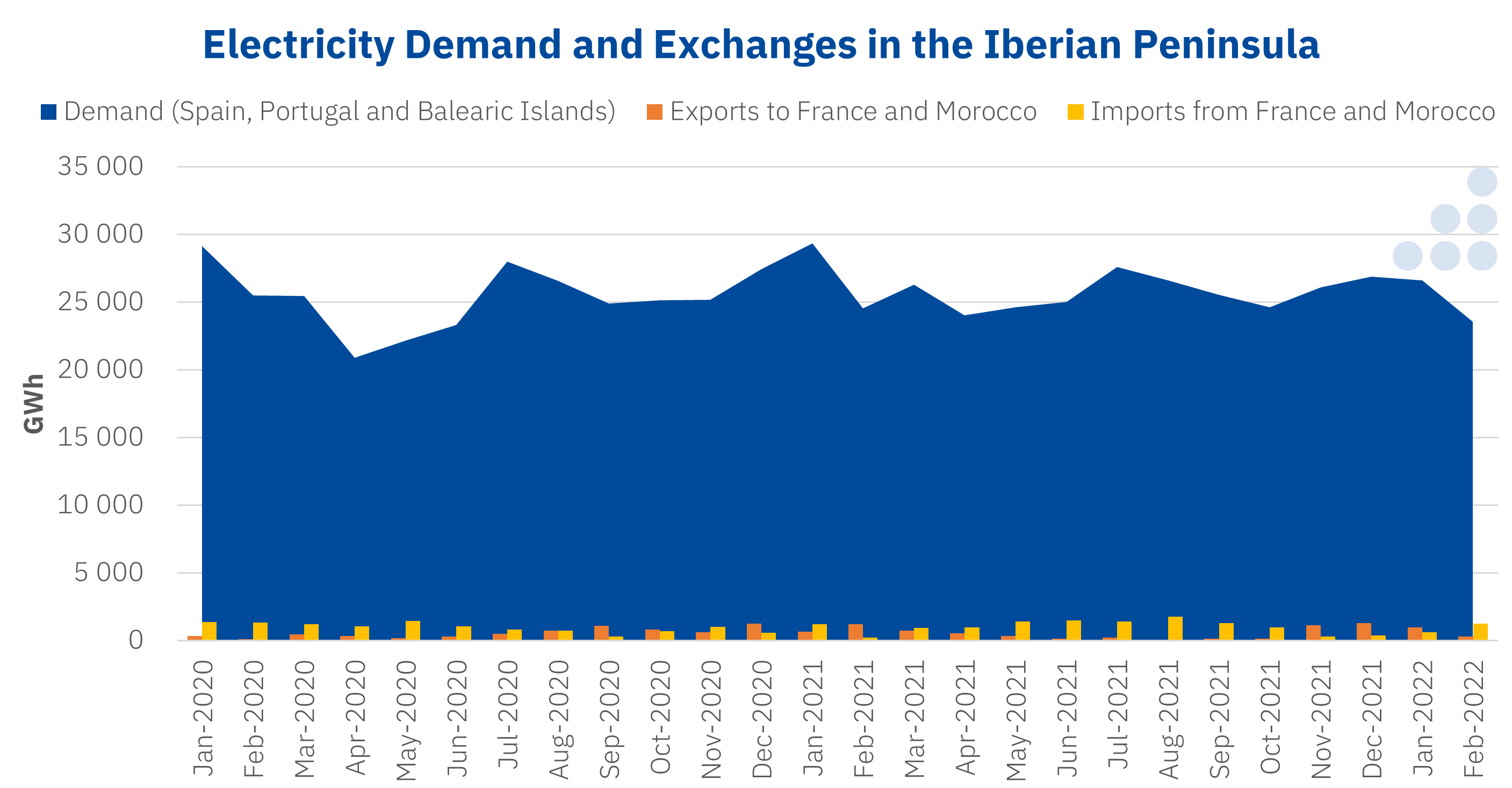

During 2020, the peninsula exported a total of 6.9 TWh to Morocco and France and imported 11.8 TWh. In 2021, the situation was similar with 6.8 TWh exported and 12.6 TWh imported. These values by themselves do not say much, but if they are compared with the combined electricity consumption in Portugal, the Spanish peninsular territory and the Balearic Islands, the clear underconnection of the peninsula can be seen. In the whole of the peninsula plus the Balearic Islands, 303.8 TWh of electricity were consumed in 2020 and 311.4 TWh in 2021, so imports accounted for only 3.9% of the demand in 2020 and 4.0% in 2021. Exports were even less significant, 2.3% of the demand in 2020 and 2.2% in 2021.

Source: Prepared by AleaSoft Energy Forecasting using data from REE and REN.

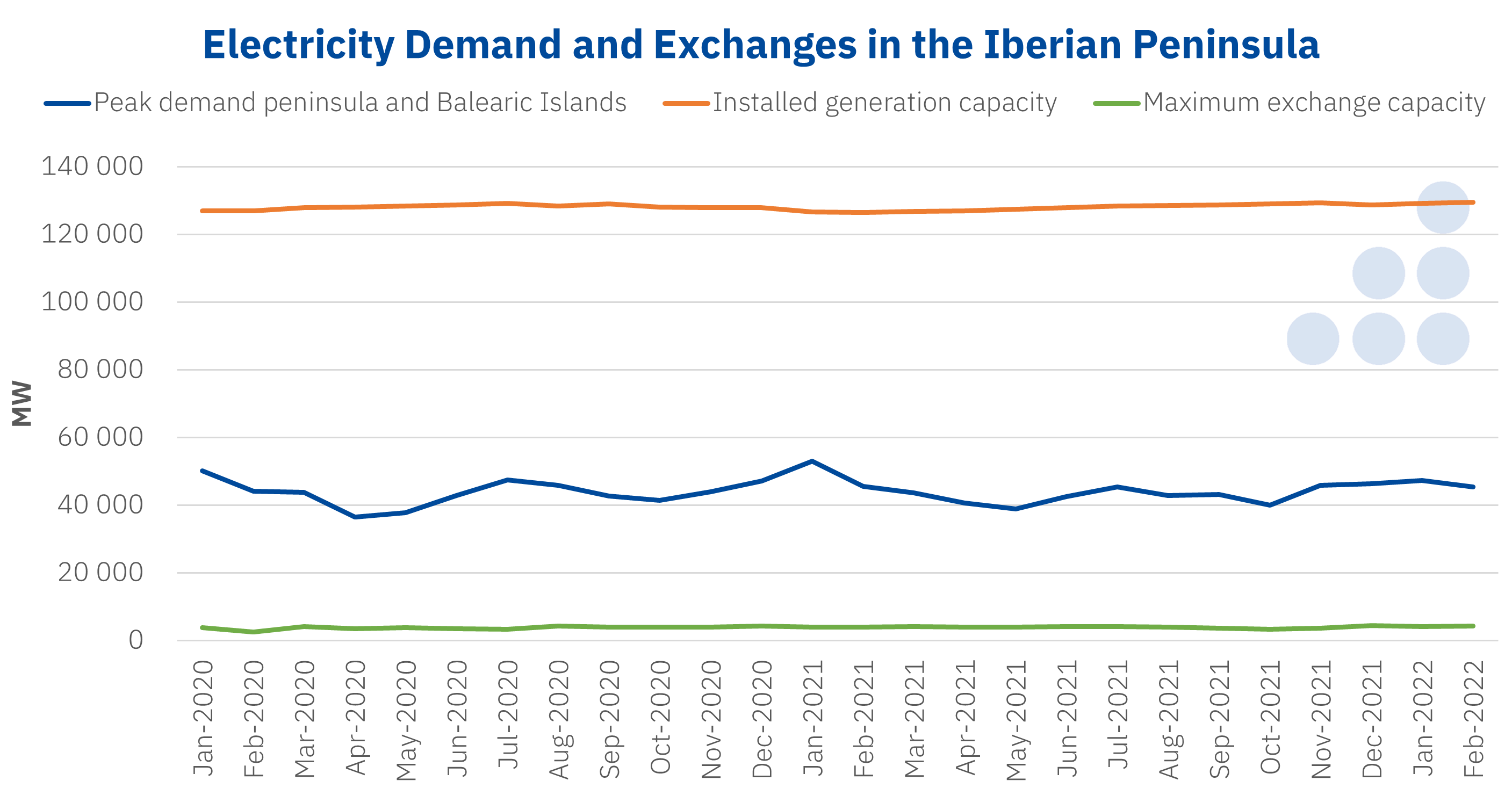

Source: Prepared by AleaSoft Energy Forecasting using data from REE and REN.

The same conclusion is obtained if the values of demand peaks in the peninsula and the Balearic Islands, of installed electricity generation capacity and of capacity of interconnections with France and Morocco are compared. The installed generation capacity in the Iberian Peninsula, including the Balearic Islands, is close to 130 GW, while the maximum capacity of the interconnections since 2020 reached 4.5 GW. Comparing these two values, the interconnection ratio of the peninsula, 3.4%, can be obtained.

To put this value in perspective, the target set by the European Union that all countries should have a minimum interconnection ratio of 10% in 2020 and 15% in 2030 can be used as a reference. Thus, with a ratio of 3.4%, describing the Iberian Peninsula as an energy island is objective.

Source: Prepared by AleaSoft Energy Forecasting using data from REE and REN.

Source: Prepared by AleaSoft Energy Forecasting using data from REE and REN.

Although comparing the interconnection capacity with the generation capacity is the definition of interconnection ratio, it can be a comparison that is not very descriptive of the real situation if, as is the case of the Iberian Peninsula, the peaks in electricity demand remain very far from the total installed capacity.

The peninsular and Balearic demand peaks for each month of the year since January 2020 can be seen in the previous graph and did not exceed 54 GW, nor half of the nearly 130 GW installed. Calculating the ratio between the peak demand and the interconnection capacity, this stands at 8.8% in 2020 and 8.4% in 2021. In other words, not even reinterpreting the interconnection ratio in a slightly more realistic way, it is possible that the Iberian Peninsula can no longer be considered an energy island.

The role of interconnections in the energy transition

Although on this occasion being an energy island maybe was a pretext for Spain and Portugal to have the approval of the European Union to apply exceptional measures in order to lower electricity prices, in the mid‑ and long‑term it is a bad option. The interconnections between the European energy markets are going to be a key point of the energy transition. That electricity can flow as smoothly as possible between countries will allow greater efficiency in markets, production and consumption.

The Iberian Peninsula, moreover, is going to need a broad interconnection with the rest of Europe to be able to export all the renewable energy that is going to be produced with the large amount of solar resource that it has.

There are currently three interconnection projects with France that are planned for before 2030. The project with the largest capacity, 2200 MW, is the submarine cable that will cross the Bay of Biscay to connect Gatika (Spain) and Cubnezais (France). The second project is the Navarra‑Landes interconnection, with 1500 MW of capacity, and the third, also of 1500 MW, will connect Aragon with Marsillon (France) through the Central Pyrenees. In total, if the plans are fulfilled, these new interconnections will mean an increase of 5200 MW of capacity by 2030.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

In addition to interconnections, another key aspect in the energy transition will be energy storage. In the next webinar of the series of monthly webinars organised by AleaSoft Energy Forecasting, which will take place on April 21, this will be the main topic. In addition, the usual analysis of the evolution and prospects for the energy markets in Europe will be carried out.