AleaSoft Energy Forecasting, March 28, 2022. European electricity markets prices fell in the first week of spring, and negative values were registered in the Belgian market, although most exceeded €215/MWh of weekly average. The drop in gas prices and electricity demand, as well as higher solar energy production, favoured the behaviour of the electricity markets. Electricity futures ended the week with values higher than those of the previous Friday. Brent rose and CO2 remained stable.

Photovoltaic and solar thermal energy production and wind energy production

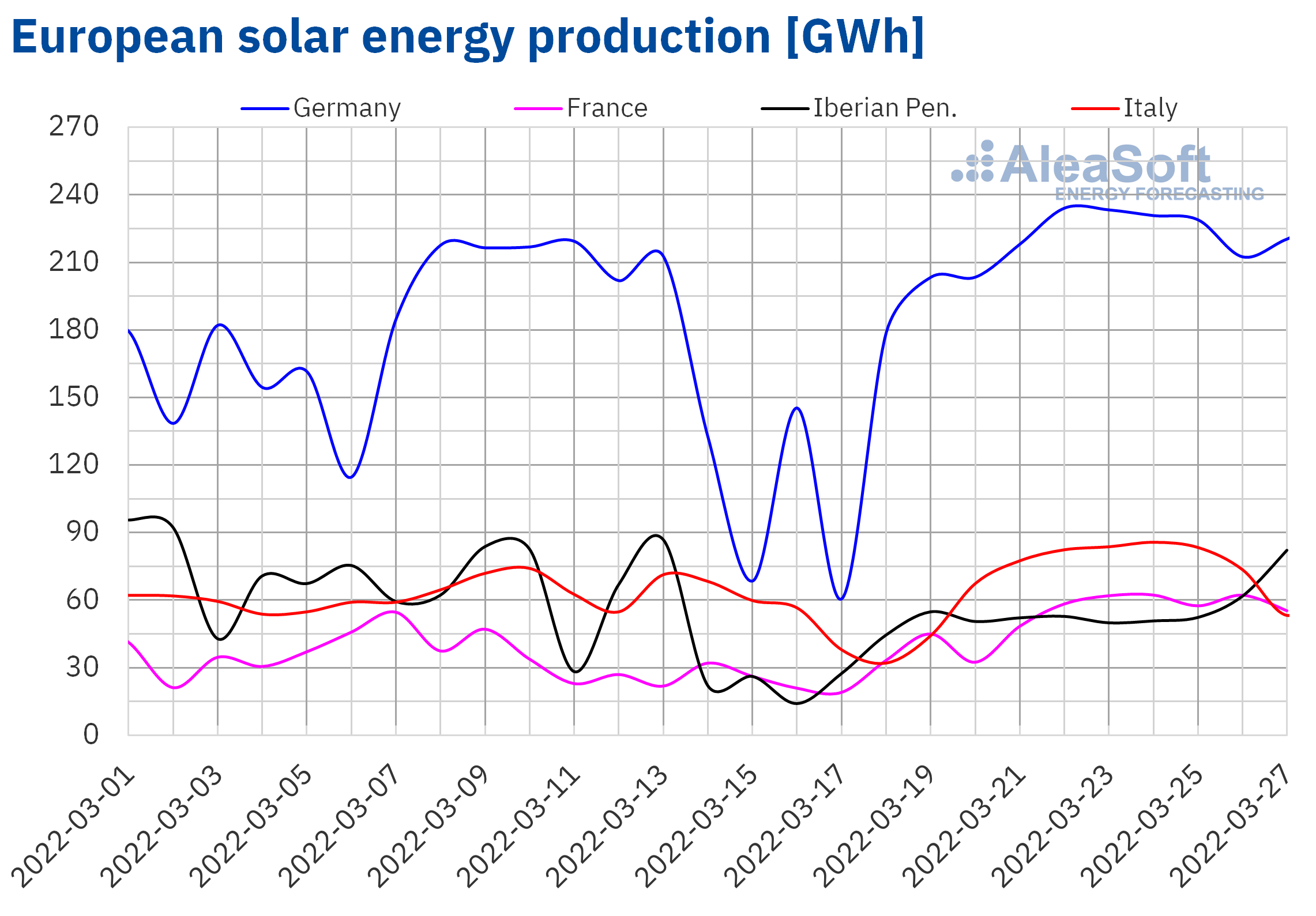

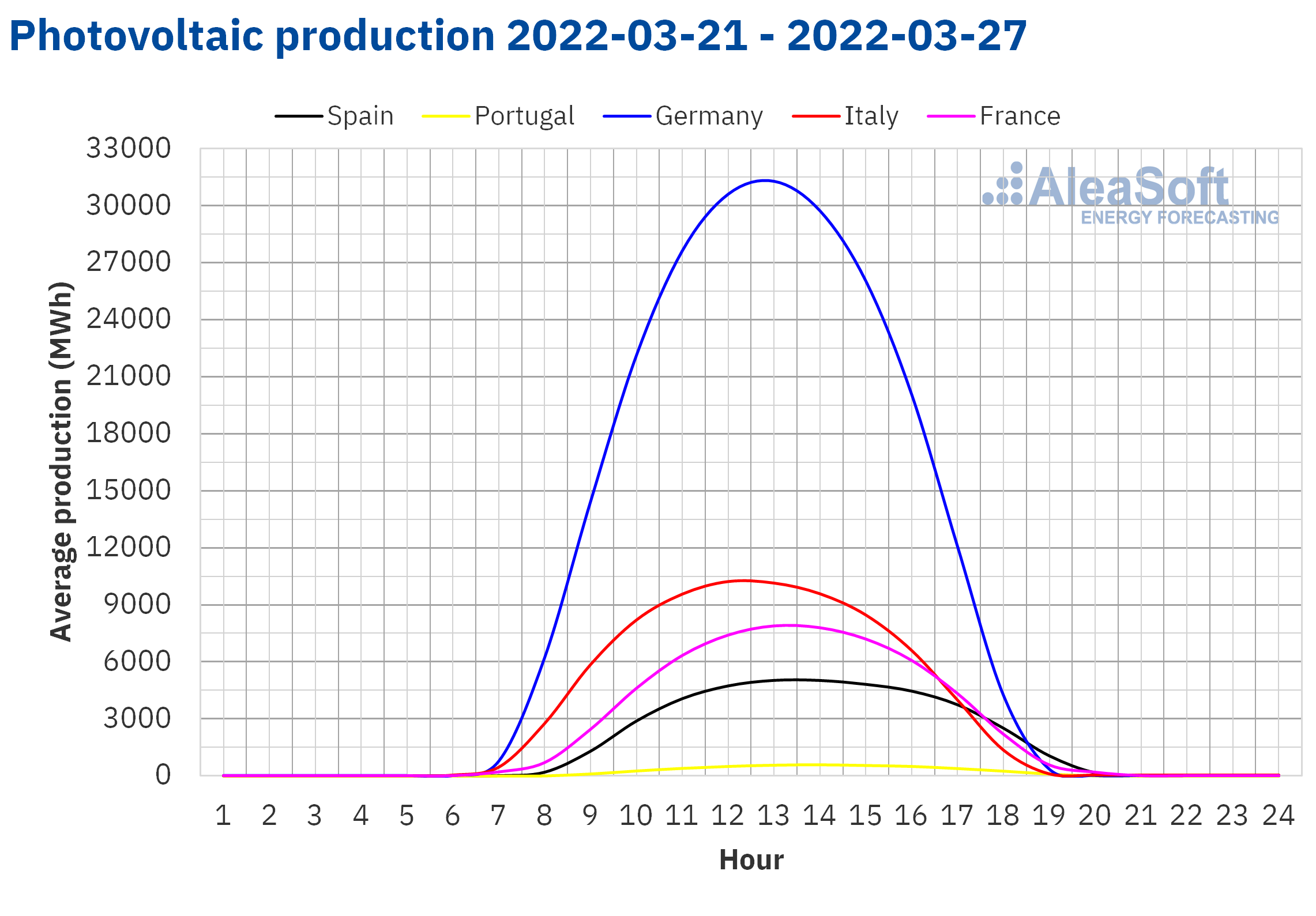

The week of March 21 ended with a general increase in solar energy production compared to the previous week. In the French market, the production was almost double that of the week of March 14, while in the Iberian Peninsula it increased by 69% and in the German market by 60%, once the effect of the time change was corrected. The smallest increase was registered in the Italian market, which was 48%.

For the week that began on March 28, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates a reduction in the production of the markets of Spain, Germany and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

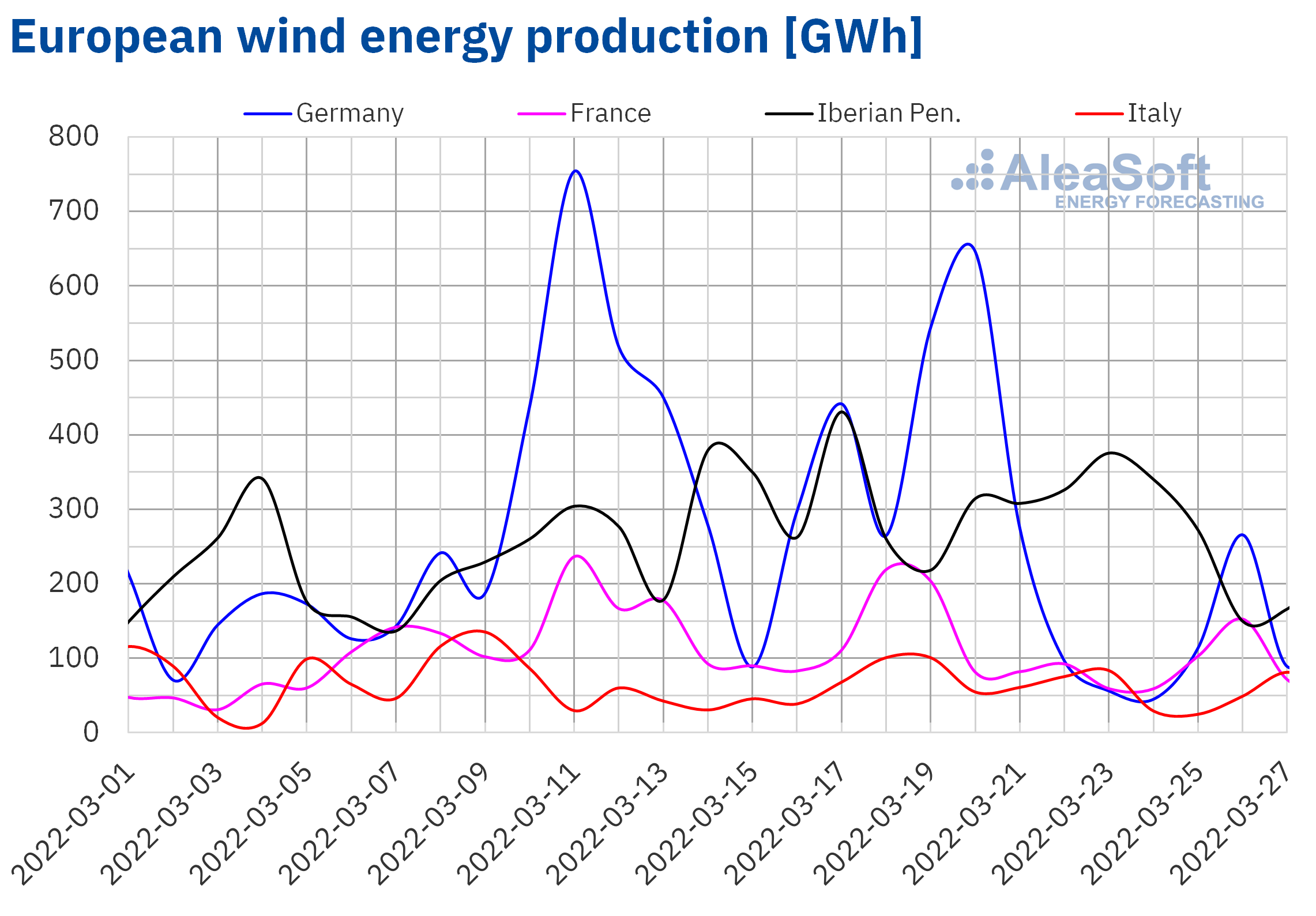

Contrary to the behaviour of the registered solar energy production, in the penultimate week of March the wind energy production fell in all markets analysed at AleaSoft Energy Forecasting compared to the previous week. The largest drop occurred in the German market, which was 63% correcting for the effect of the time change. In the rest of the analysed markets, the reduction was between 7.4% of the Italian market and 29% of the French market.

For the last week of March, AleaSoft Energy Forecasting’s forecasts indicate an increase in production with this technology in the markets of Germany, Italy and France. On the contrary, a reduction is expected in the markets of Spain and Portugal.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

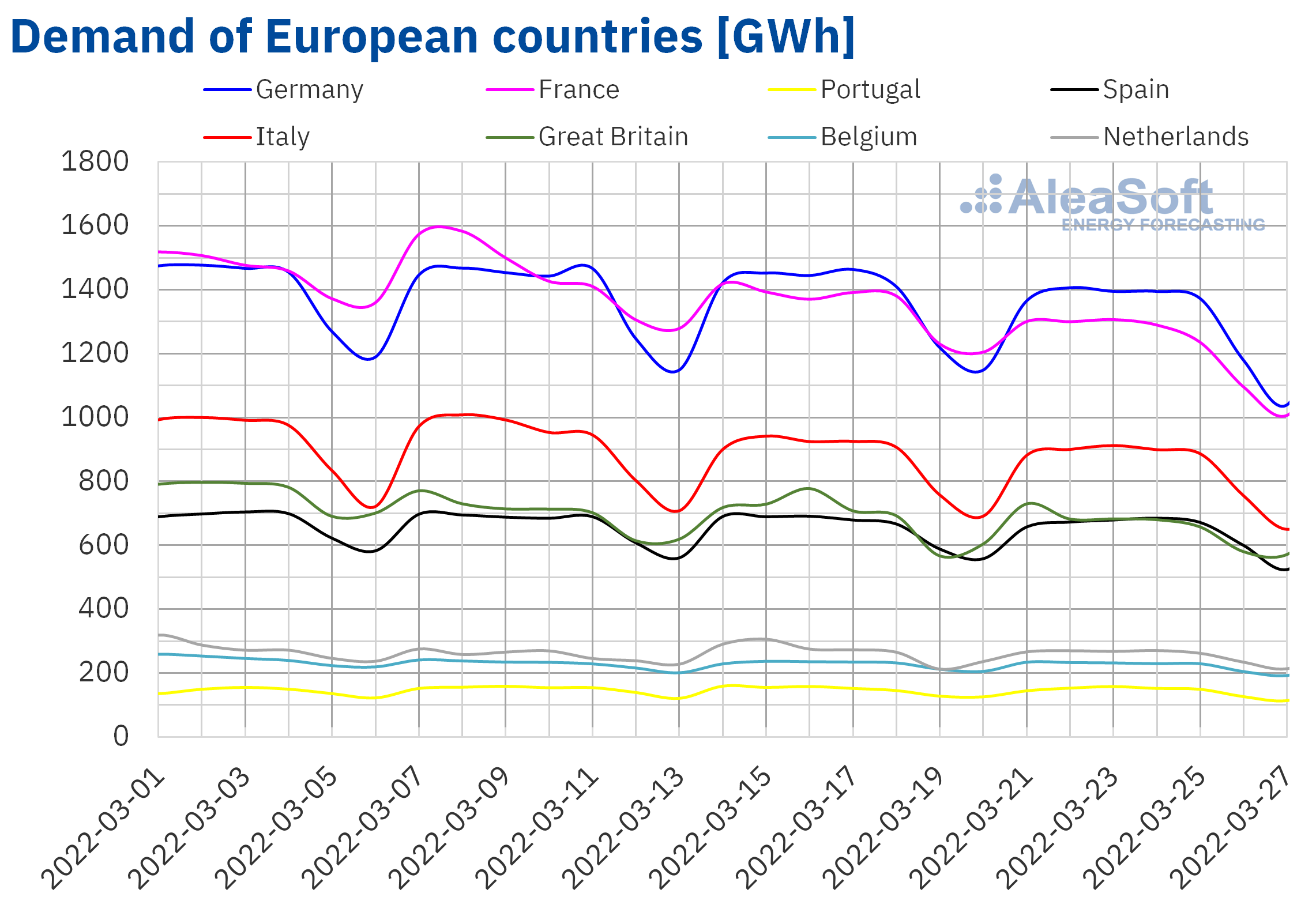

During the week of March 21, the electricity demand fell in all European electricity markets analysed at AleaSoft Energy Forecasting compared to the week that preceded it. Correcting the effect of the time change day, the largest variation, for the second consecutive week, was registered in the French market with a drop of 8.6%, followed by the drops of 3.9%, 3.7% and 3.4% of the markets of Great Britain, Germany and the Netherlands, respectively. In the markets of Portugal and Italy the decreases were 2.1% in each case, while in the Belgian market it was 1.3%. The smallest variation in demand was registered in the Spanish market, with a drop of 1.0%. Since the week of January 24, the demand in this market maintained a downward trend for nine consecutive weeks. The decreases in demand in most markets were favoured by less cold temperatures during this period.

For the last week of March, the AleaSoft Energy Forecasting’s demand forecasting indicates a recovery in most analysed markets as a result of colder temperatures than those registered during the previous week.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

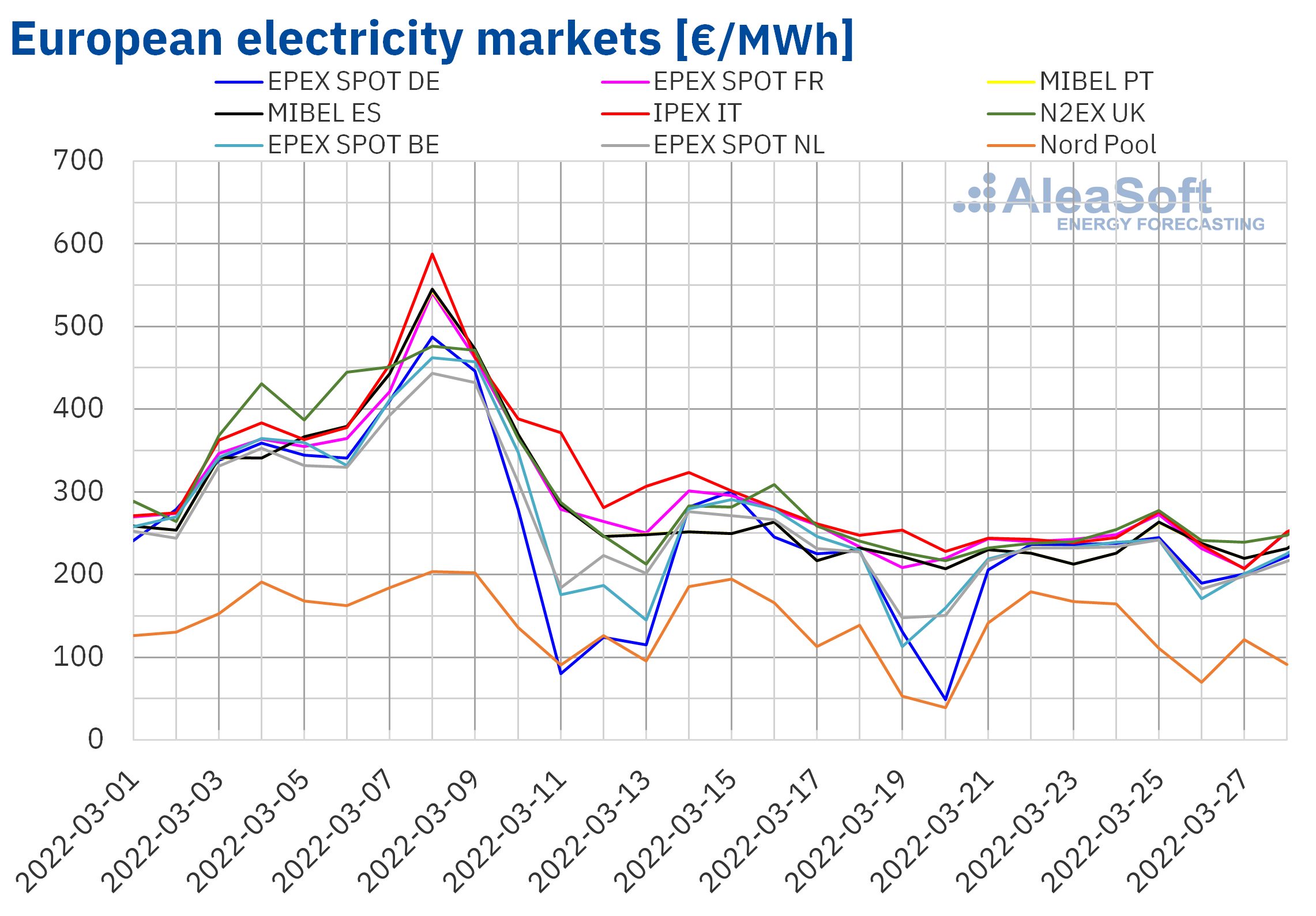

European electricity markets

In the week of March 21, the prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting fell compared to the previous week. The exceptions were the EPEX SPOT market of Germany and the Nord Pool market of the Nordic countries, with price increases of 6.2% and 7.5% respectively. On the other hand, the largest drop in prices was that of the IPEX market of Italy, of 11%. On the other hand, the smallest decreases were those of the MIBEL market of Spain and Portugal, of 1.7% and 1.8% respectively. In the rest of the markets, the price decreases were between 2.0% of the Dutch market and 6.1% of the French market.

In the fourth week of March, the average prices were lower than €250/MWh in all analysed electricity markets, although in almost all cases they exceeded €215/MWh. The exception was the Nord Pool market with a weekly average of €136.47/MWh. On the other hand, the highest average was that of the N2EX market of the United Kingdom, which reached a value of €246.07/MWh. In the rest of the markets, the prices were between €219.52/MWh of the Belgian market and €241.27/MWh of the Italian market.

Regarding hourly prices, on Saturday, March 26, there were negative prices for four hours in the Belgian market and for one hour in the market of the Netherlands. The lowest price, of ‑€41.12/MWh, was registered in the Belgian market from 12:00 to 13:00. On the other hand, in the Italian market, on March 27, at 13:00, a price of €93.99/MWh was registered, the lowest since the early hours of January 5.

During the week of March 21, the decrease in gas prices favoured the decrease in European electricity markets prices. In addition, the general drop in demand and the increase in solar energy production also contributed to the price declines.

The AleaSoft Energy Forecasting’s price forecasting indicates that the week of March 28 prices of most European electricity markets might increase. However, prices might fall in Germany, where an increase in wind energy production is expected.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

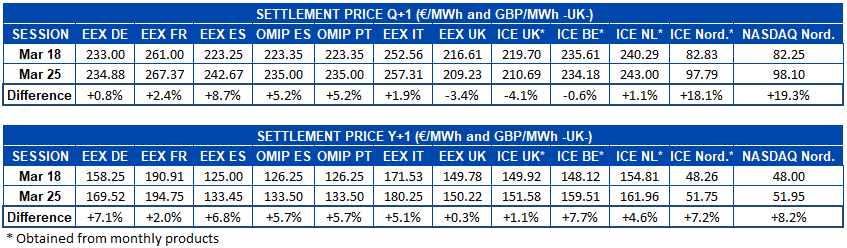

Electricity futures

After the third week of March, electricity futures prices for the next quarter rose in most European markets when comparing the sessions of March 18 and 25. The exceptions were the United Kingdom and Belgium. In the British EEX market, prices fell by 3.4%, while in the ICE market of the United Kingdom and Belgium, decreases of 4.1% and 0.6%, respectively, were registered. In the rest of the markets analysed at AleaSoft Energy Forecasting, prices rose. The increases were between 0.8% of the German EEX market and 19% of the NASDAQ market of the Nordic countries. In the Spanish case, the increases were 5.2% in the OMIP market and 8.7% in the EEX market, settling the session of March 25 with prices of €235.00/MWh and €242.67/MWh, respectively.

Electricity futures for the product of the year 2023 registered a general rise. Spanish futures showed an increase of 5.7% in the OMIP market and 6.8% in the EEX market, after settling the session of last Friday, March 25, with prices of €133.50/MWh and €133.45/MWh respectively. The EEX market of the United Kingdom registered the most modest increase in prices, of 0.3%. At the other extreme, in the NASDAQ market of the Nordic countries, the price increase reached 8.2%. This increase was the largest in percentage terms, due in part to the relatively lower price of this market. If the absolute variations are taken into account, the largest rise occurred in the ICE market of Belgium, with an increase of €11.39/MWh.

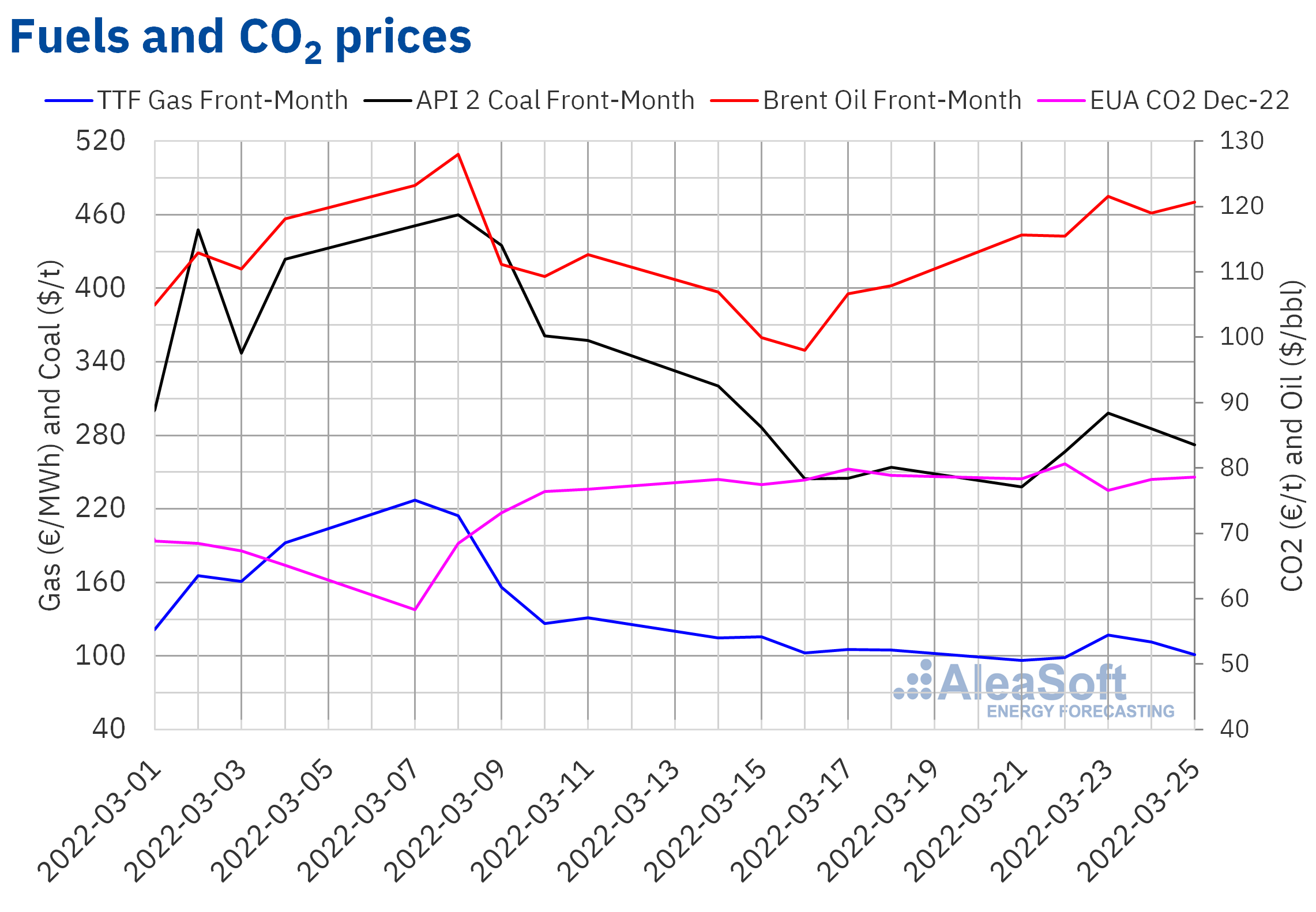

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market, during the fourth week of March, registered settlement prices higher than those of the same days of the previous week. On Tuesday, March 22, the weekly minimum settlement price, of $115.48/bbl, was registered, which was 16% higher than that of the previous Tuesday. While the maximum settlement price of the week, of $121.60/bbl, was reached on Wednesday, March 23, and it was 24% higher than that of the previous Wednesday. In the last session of the week, the settlement price was $120.65/bbl, still 12% higher than that of the previous Friday. However, on Monday, March 28, prices of these futures were traded below $120/bbl, influenced by the news about the confinement of Shanghai due to the increase in coronavirus cases. On the other hand, the next OPEC+ meeting is scheduled for Thursday, March 31. In this meeting, the production increases for the month of May will be discussed.

As for the TTF gas futures in the ICE market for the Front‑Month, on Monday, March 21, they registered a settlement price of €96.30/MWh, 8.3% lower than that of the last session of the previous week. But on Tuesday prices began to recover and on Wednesday the maximum settlement price of the week, of €117.00/MWh, was reached. This price was 14% higher than that of the previous Wednesday. This rise was influenced by the Russian president’s announcement of his intention to force certain countries, including the European Union, to pay for gas exports to them in roubles. Subsequently, prices fell again until registering a settlement price of €101.27/MWh on Friday, March 25. On this day, the commitment of the United States to increase its gas supply to Europe was announced.

Regarding the settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2022, in the fourth week of March, they continued with values around €78.50/t. The maximum settlement price of the week, of €80.66/t, was reached on Tuesday, March 22. This price was 4.2% higher than that of the previous Tuesday and the highest since the end of February.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

At AleaSoft Energy Forecasting, the long‑term European electricity markets prices curves forecasting reports corresponding to the second quarter of 2022 are being updated. These forecasts will take into account the most recent events such as the consequences of the Russian invasion of Ukraine and its effects on prospects in the short‑, mid‑ and long‑term.

The analysis of the effects of the invasion of Ukraine on the European energy markets will be one of the topics to be discussed in the next AleaSoft Energy Forecasting’s webinar, which will take place on April 21. This webinar will also analyse a key aspect of the future: energy storage, which will play a fundamental role during the energy transition. To do this, there will be the participation of guest speakers from ASEALEN, the Spanish Association for Energy Storage.