AleaSoft, August 30, 2021. The European electricity markets prices rose in a generalised way in the last week of August. In some cases, a record was reached on the last day of the month and August had the highest price in history. The electricity futures prices also increased. All this in a context in which CO2 once again set a historical record and gas prices remain high. The electricity demand increased in most markets and solar and wind energy production decreased in several cases.

Photovoltaic and solar thermal energy production and wind energy production

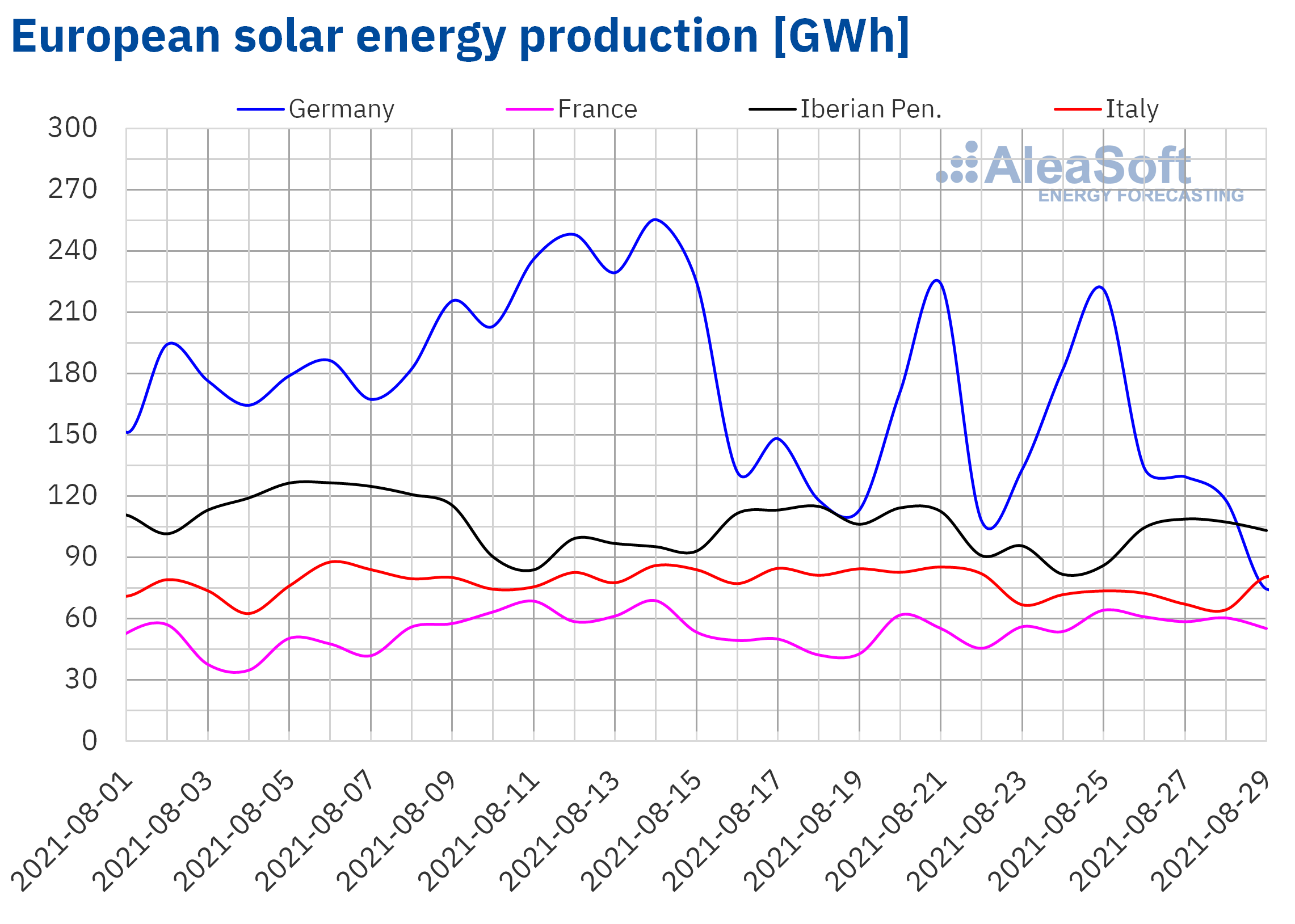

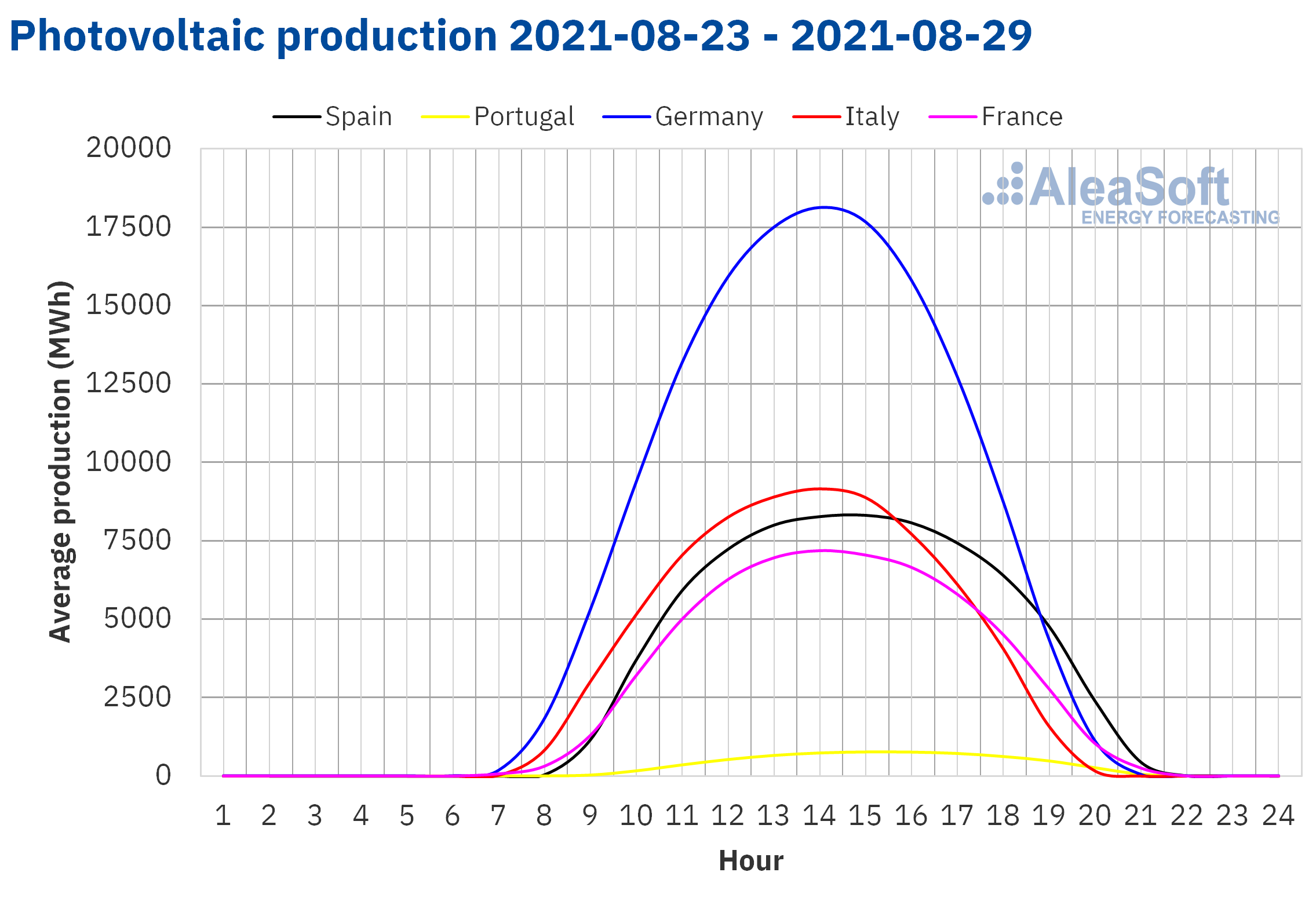

The solar energy production registered falls in most of the European electricity markets during the week of August 23. Among the analysed markets, Portugal and Italy stand out with decreases of 16% and 14%, respectively. In Spain the drop was 10% and in Germany, only 2.2%. On the other hand, France stands out, with an increase in production of 18% compared to the previous week.

At the end of the month of August, the solar energy production during this month, compared to August 2020, shows very important increases in countries such as Spain and Portugal with increases of 20% and 44%, respectively, reflecting the increase in solar energy capacity in these markets.

The AleaSoft‘s forecasting indicates that, for this week of August 30, the solar energy production will not recover in the southern part of the European continent, but it may do so strongly in markets further north.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

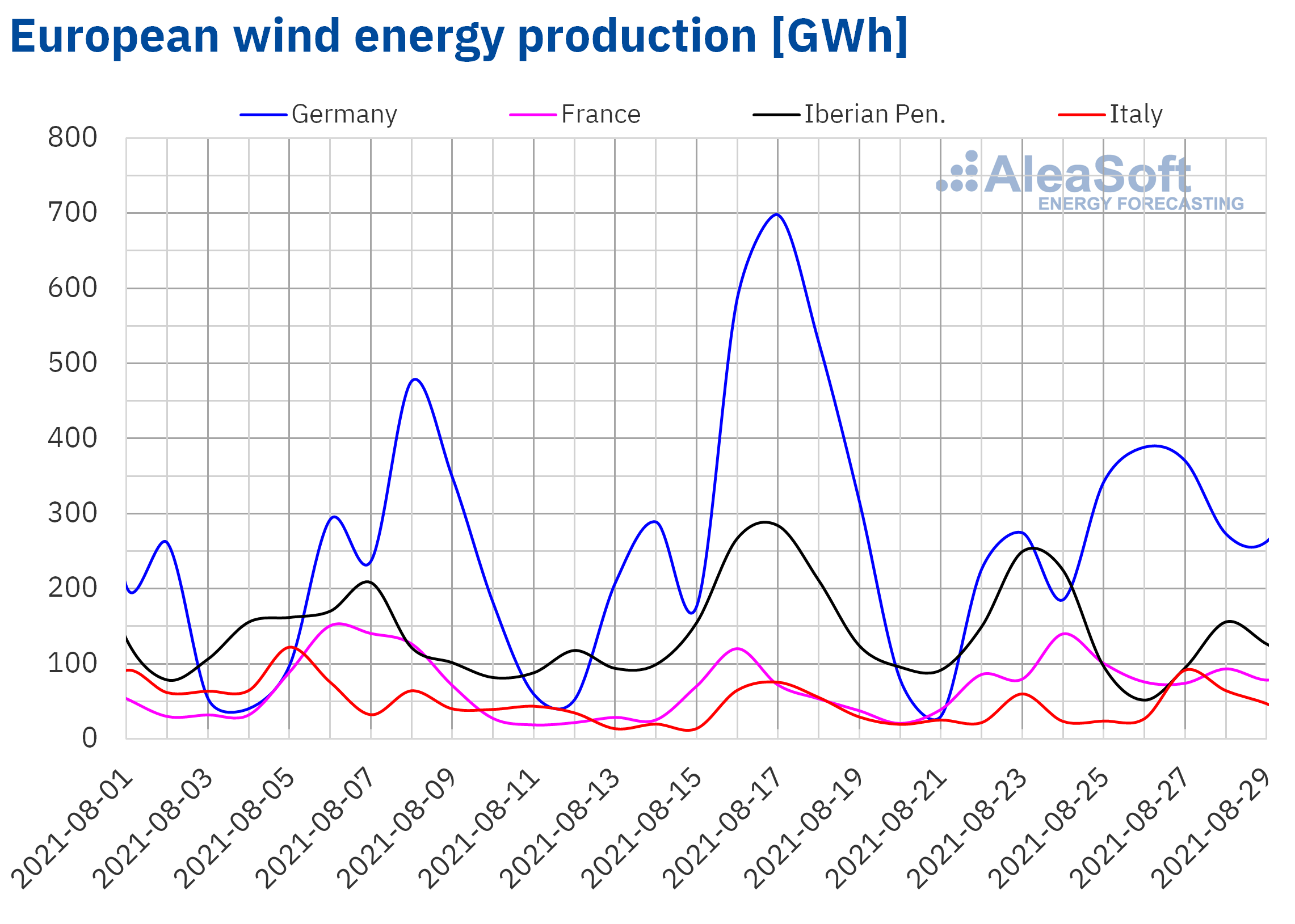

During the fourth week of August, the wind energy production increased considerably compared to the previous week in markets such as the French, by 50%, and the Italian, by 16%. In the rest of the main markets in Europe, the production decreased by around 15%, with the notable case of Portugal, where the wind energy production fell by 43%.

For the first week of September, the AleaSoft‘s wind energy production forecasting indicates a general drop in production with this technology in the main markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

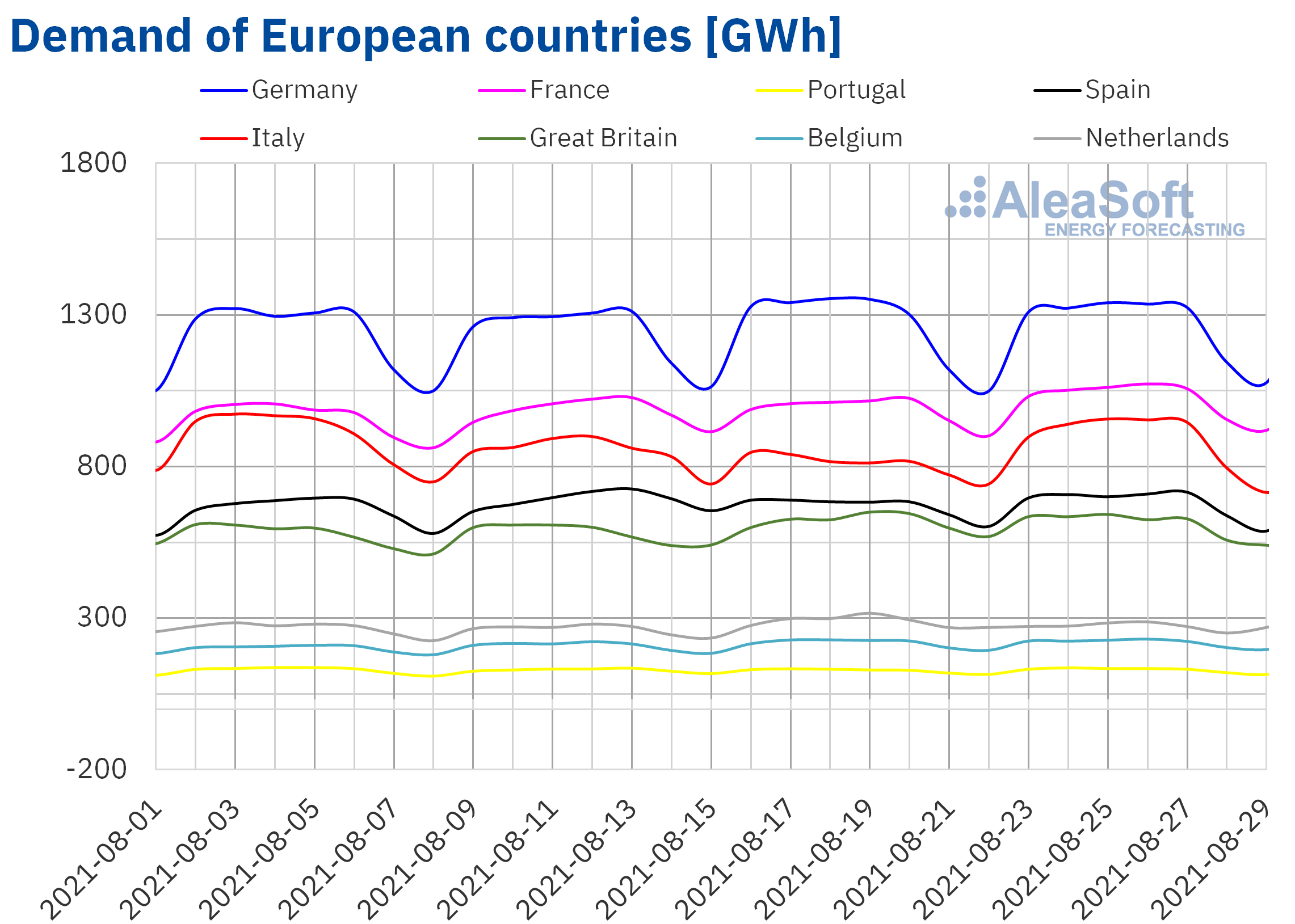

Electricity demand

During the fourth week of August, the electricity demand in the European markets had a mostly upward behaviour. The exceptions were the markets of the Netherlands and Great Britain, where the demand fell by 5.5% and 1.1% respectively. In both cases, a drop in average temperatures compared to the values of the previous week favoured the decrease in demand. In Great Britain, the decreases were more notable between Thursday and Sunday, while in the Netherlands, with the exception of Sunday, August 29, the rest of the days registered values lower than the homogeneous days of the third week of August, as can be seen in the AleaSoft’s demand observatories.

Regarding the increases in demand, the Italian market registered the greatest variation, of 9.9%, while the German market was the one with the smallest increase, of 0.1%. In the rest of the markets the increases were between 0.7% of the Belgian market and 3.6% of the French market.

For the week of August 30, according to the AleaSoft‘s demand forecasting, increases are expected in most of the electricity markets of Europe due to the recovery in demand once the holiday period is over.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

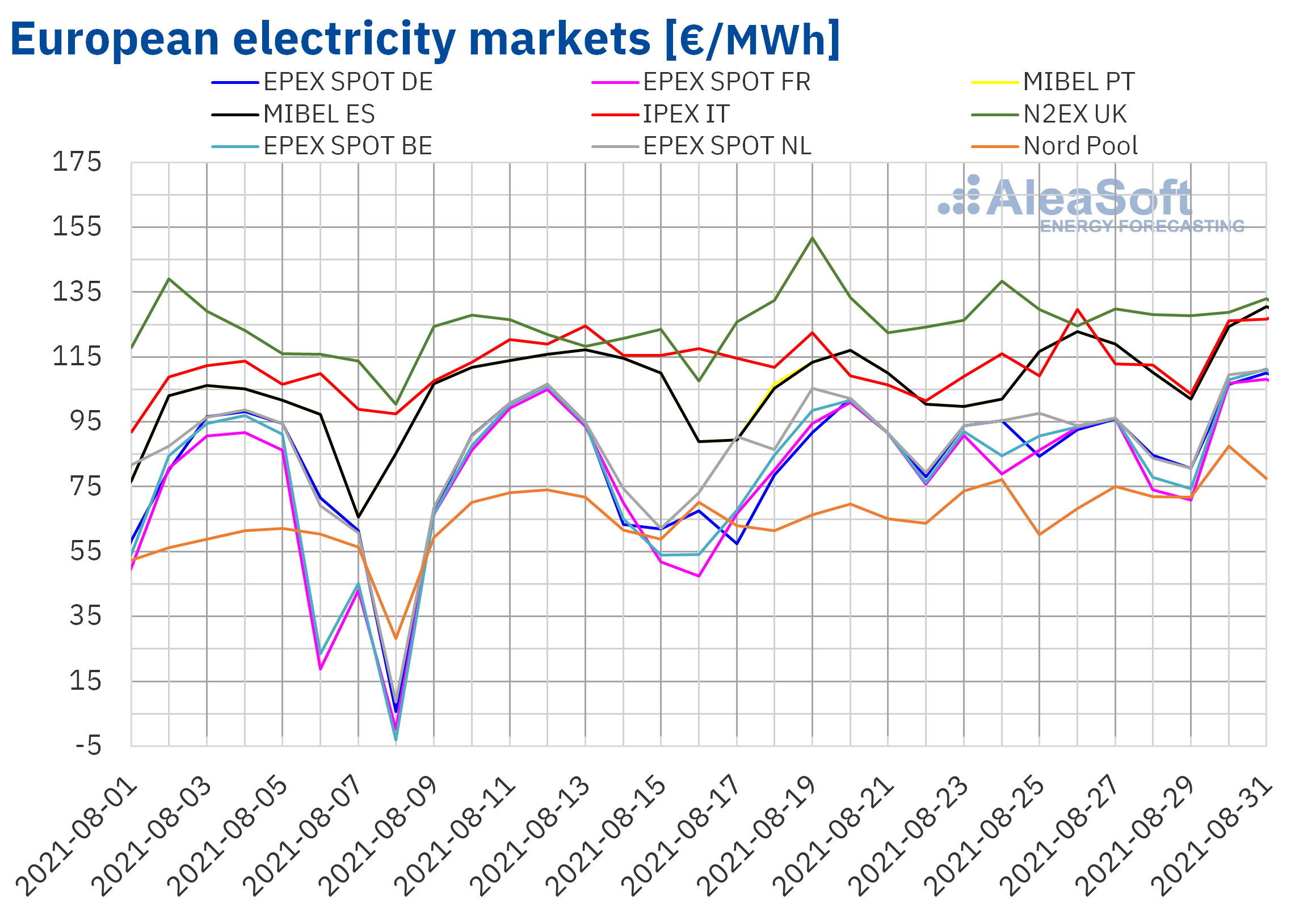

During the week of August 23, the prices of all the European electricity markets analysed at AleaSoft increased. The largest price rise was that of the EPEX SPOT market of Germany, of 11%, followed by that of the Nord Pool market of the Nordic countries, of 8.4%. In contrast, the lowest price increase was that of the N2EX market of the United Kingdom, of 0.8%, followed by that of the IPEX market of Italy, of 1.2%. In the rest of the markets, the increases were between 2.1% of the EPEX SPOT market of the Netherlands and 6.6% of the MIBEL market of Spain.

In the fourth week of August, the highest weekly average price was that of the N2EX market, of €129.22/MWh. On the other hand, the lowest average was that of the Nord Pool market, of €71.14/MWh. In the rest of the markets, the prices were between €84.33/MWh of the EPEX SPOT market of France and €113.25/MWh of the IPEX market.

On the other hand, on Tuesday, August 31, the markets of France and Belgium reached the highest daily prices since November 2018, of €108.17/MWh and €111.20/MWh respectively. In the Netherlands, the daily price of that day, of €110.89/MWh, was the highest since at least April 2011. In the case of the MIBEL market, the price of this day was €130.53/MWh, which is the highest in history so far. In Italy, on the other hand, the price of Thursday, August 26, was higher than that of Tuesday, August 31. On that day, a price of €129.63/MWh was reached, which was the highest since February 2012. In the case of the Nord Pool market, on Monday, August 30, a price of €87.54/MWh was reached, the second highest in history.

Regarding the hourly prices, in most European markets they exceeded €130/MWh for several hours of August 30 and 31. In the case of the MIBEL market, the maximum hourly price of August 31 was registered at 9 p.m. and it was €137.46/MWh. In the MIBEL market of Portugal, such high hourly prices were not reached since January 2010 and, in the MIBEL market of Spain, since December of that year.

During the fourth week of August, the increase in demand in Europe favoured the increase in prices in the European electricity markets. The decline in wind and solar energy production in some markets, as well as the high gas and CO2 emission rights prices, also contributed to this trend.

The AleaSoft‘s price forecasting indicates that in the week of August 30, the prices will continue to increase in most European markets, influenced by the general decline in wind energy production.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, Nord Pool and GME.

The monthly prices of August represented a historical record in the MIBEL, IPEX and N2EX markets and the EPEX SPOT market of the Netherlands. In other cases, although it was not a historical record, it is among the highest, as in the case of the Nord Pool market, where it was the second highest in history.

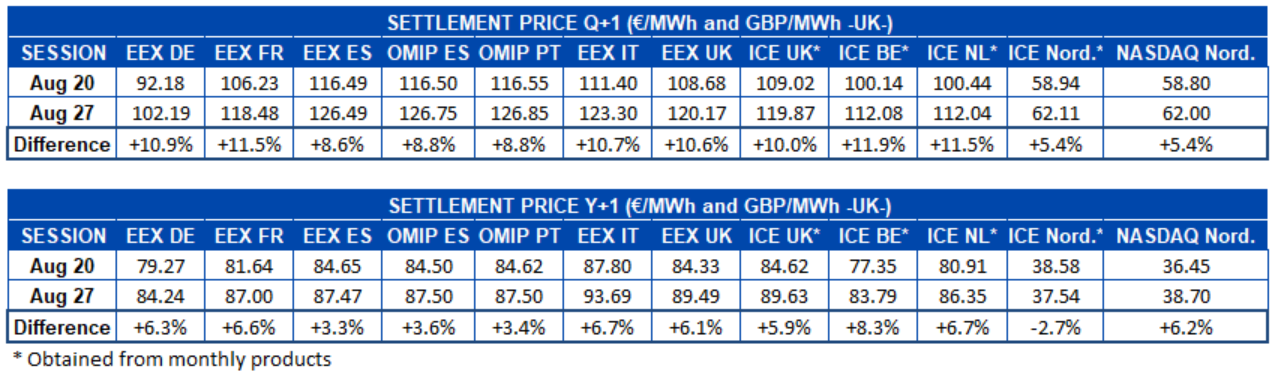

Electricity futures

The European electricity futures prices for the next quarter increased in a generalised way in the session of Friday, August 27, compared to those of the session of the previous Friday in the markets analysed at AleaSoft. The largest increases were registered in the ICE market of Belgium and the Netherlands and in the EEX market of France with rises close to 12%. On the other hand, the ICE and NASDAQ markets of the Nordic countries were those with the lowest increase, of 5.4% in both cases. In the rest of the markets, the increases in the settlement prices of this product ranged between 8.6% of the EEX market of Spain and 11% of the EEX market of Germany. Regarding the price level, the EEX market of Spain and the OMIP market of Spain and Portugal were those with the highest prices, above €126/MWh.

The electricity futures prices for the year 2022 also increased in most of the analysed markets at the settlement of the session on August 27 compared to those of August 20. The exception was the ICE market of the Nordic countries where the prices fell by 2.7%. Regarding the increases, the ICE market of Belgium was also the one with the highest variation, of 8.3%. While the EEX market of Spain and the OMIP market of Portugal and Spain registered the lowest increases in this case, of 3.3%, 3.4% and 3.6% respectively. In the rest of the markets the increases were between 5.9% and 6.7%.

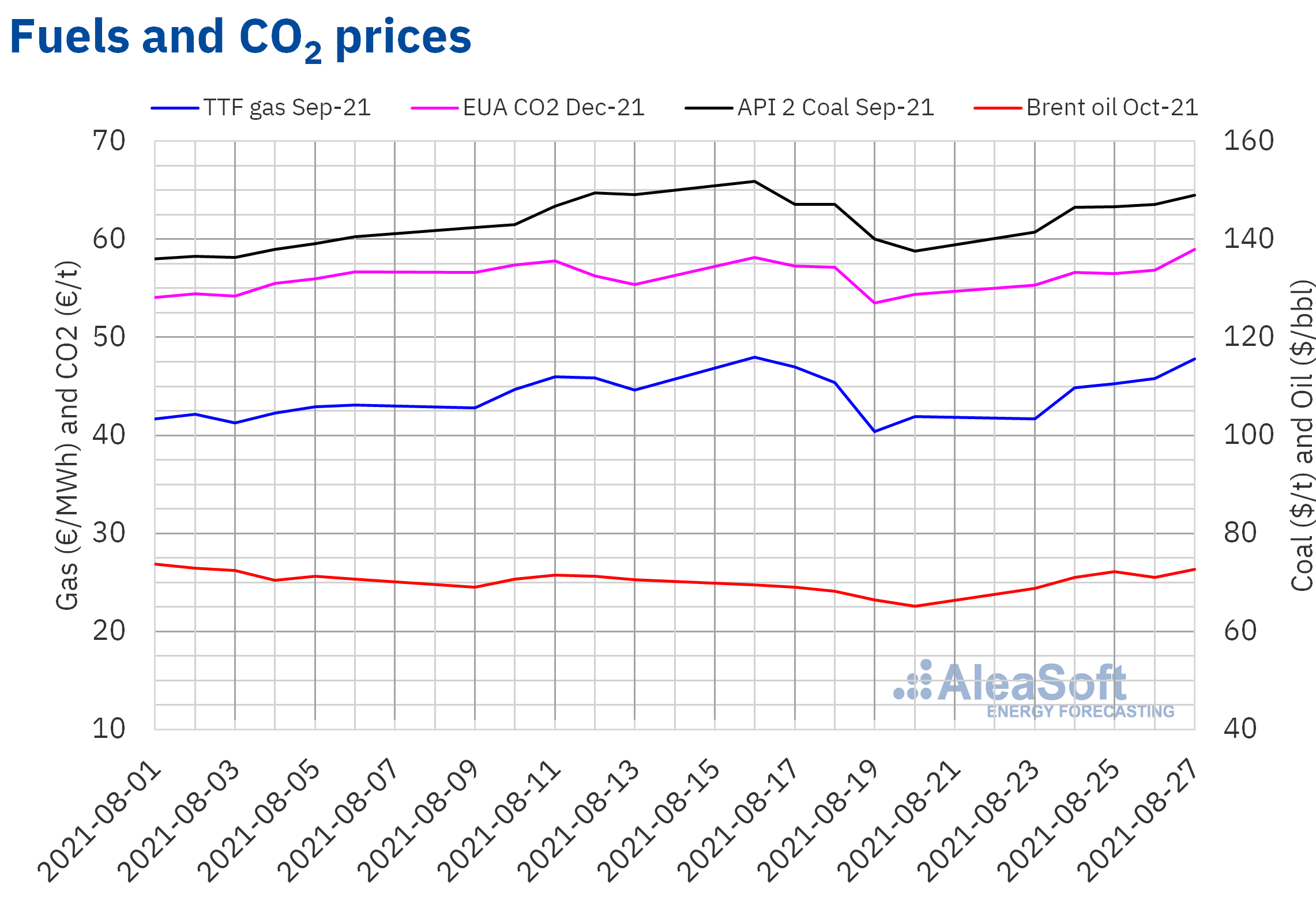

Brent, fuels and CO2

The settlement prices of the Brent oil futures for the month of October 2021 in the ICE market remained above $70/bbl almost the entire fourth week of August. The increases registered during that week allowed a settlement price of $72.70/bbl to be reached on Friday, August 27. This price was 12% higher than that of the previous Friday and the highest since the beginning of August.

The concern about the effects of the expansion of the Delta variant of COVID‑19 on the demand continues due to the increase in the number of cases in Asia and the restrictions imposed in countries such as China and Japan. However, in the week of August 30, the Hurricane Ida is affecting the oil production of the United States. In this context, the next OPEC+ meeting will be held on September 1.

As for the settlement prices of the TTF gas futures in the ICE market for the month of September 2021, during the fourth week of August, they had a generally upward trend, recovering from the fall of the previous week. On Friday, August 27, a settlement price of €47.80/MWh was reached. This price was 14% higher than that of the previous Friday. But it was still €0.19/MWh lower than the maximum registered on Monday, August 16.

Regarding the CO2 emission rights futures prices in the EEX market for the reference contract of December 2021, most of the fourth week of August, they registered increases. As a consequence, on Friday, August 27, a settlement price of €58.96/t was reached. This price was 8.4% higher than that of the previous Friday and surpassed the previous record of August 16 by €0.80/t. The prices might continue to increase in the week of August 30, favoured by the decrease in supply as the number of auctions will decrease during this week.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft’s analysis on the prospects for energy markets in Europe

This week, coinciding with the beginning of September, AleaSoft is updating the long‑term price curves forecasting reports of the main European electricity markets, taking into account the rise in fuels and CO2 prices of July and August. Currently, a special promotion of these reports is being carried out, of which all the details can be consulted in this link.

At AleaSoft the webinar “Energy markets in the recovery from the economic crisis one year later” is being organised, which will be held on October 7. In addition to the speakers from AleaSoft, this time speakers from Deloitte will participate, just one year after their participation in the webinar held in October 2020. The webinar will also coincide with the 22nd anniversary of the founding of AleaSoft. The topics to be addressed are the evolution of the European energy markets, which will have a year‑on‑year perspective, the renewable energy projects financing and the importance of the forecasting in audits and portfolio valuation.