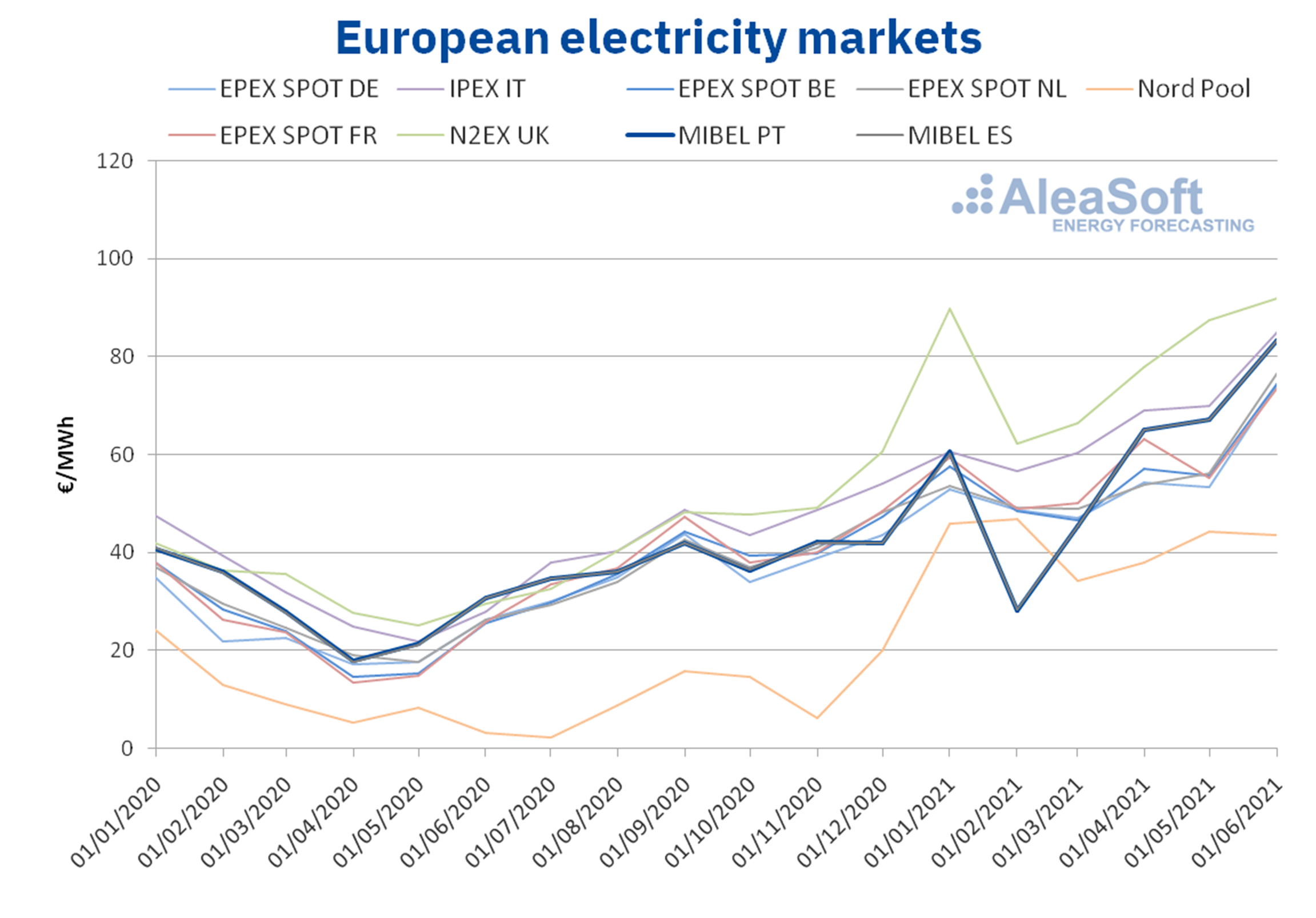

AleaSoft, August 27, 2021. The electricity market of Portugal, coupled with more than 95% of the hours to the Spanish market, followed the same upward price trend as the rest of the European markets during the first half of the year. It should be noted that during this period the electricity demand recovered by 22% compared to the first half of 2020, when it was affected by the restrictions due to the COVID 19 pandemic and, also, that 68% of the production was from renewable energies.

Electricity market prices

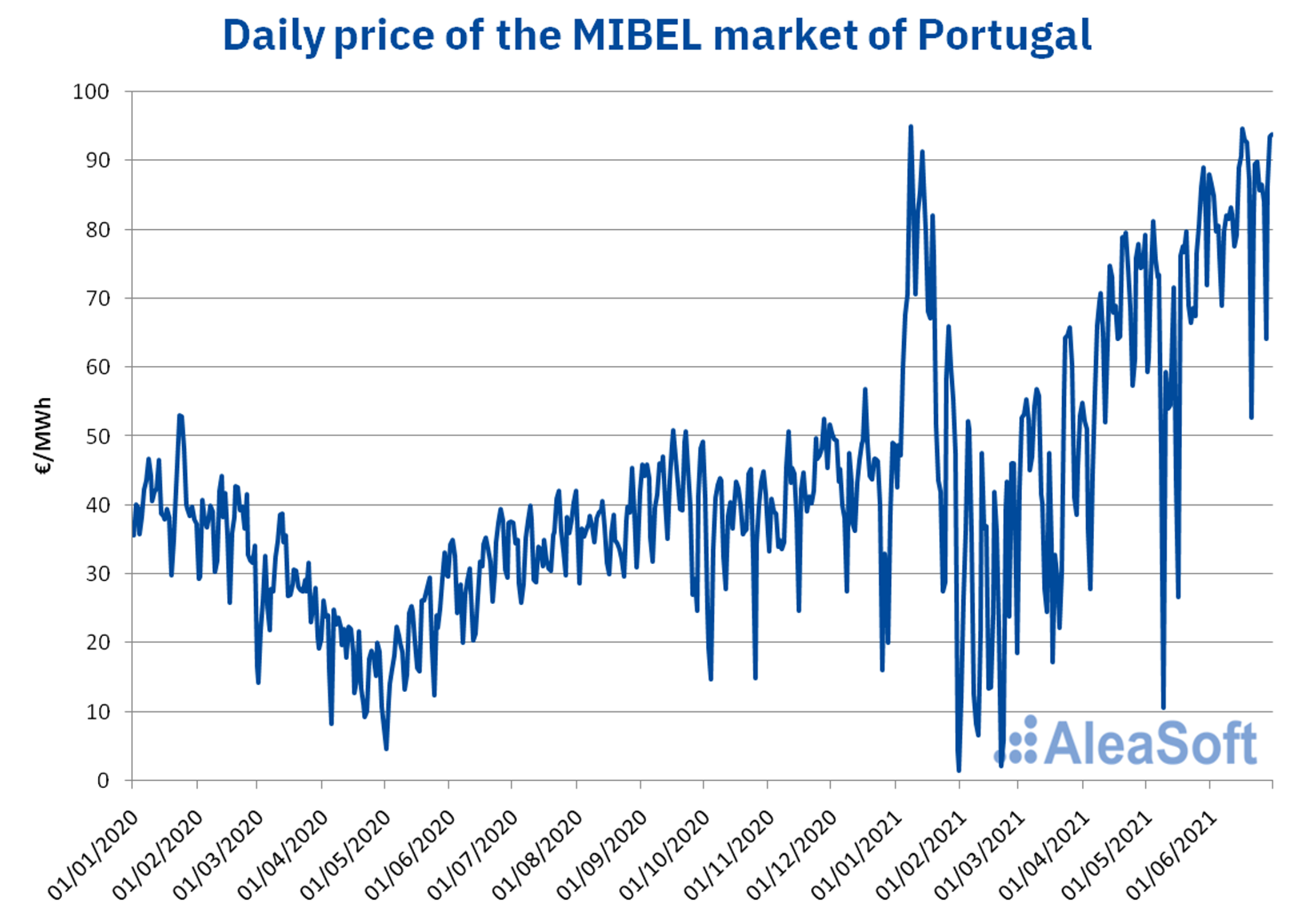

In the MIBEL market of Portugal, the prices during the first half of 2021 had a mostly increasing behaviour. Except for the month of February, when prices fell to a monthly value of €28.19/MWh, 54% lower than the previous month’s price, and which subsequently began to recover to almost quadruple their value. In June an average price of €83.29/MWh was reached, 195% higher than the February’s average and the highest to that date since 2007.

During the first half of the year, the hourly prices of the Portuguese market converged with those of the MIBEL market of Spain 96% of the hours.

The average price of electricity in this market during the first six months of 2021 was €58.60/MWh. This figure represents an increase of 51% compared to the previous six months and, in turn, is more than double the average price of the same period of 2020. The average price for the first half of 2020 was €29.06/MWh, so the year‑on‑year growth of the first half of 2021 was 102%.

Source: Prepared by AleaSoft using data from EPEX SPOT, MIBEL, IPEX, N2EX and Nord Pool.

Source: Prepared by AleaSoft using data from EPEX SPOT, MIBEL, IPEX, N2EX and Nord Pool.

The maximum daily price between January 1 and June 30, 2021, was €94.99/MWh reached on January 8, the highest from July 1, 2007 until the end of the first half of 2021. As in the rest of the European electricity markets, the increase in prices in the Portuguese electricity market since the second quarter of the year was mainly due to high gas and CO2 emission rights prices.

Source: Prepared by AleaSoft using data from OMIE.

Source: Prepared by AleaSoft using data from OMIE.

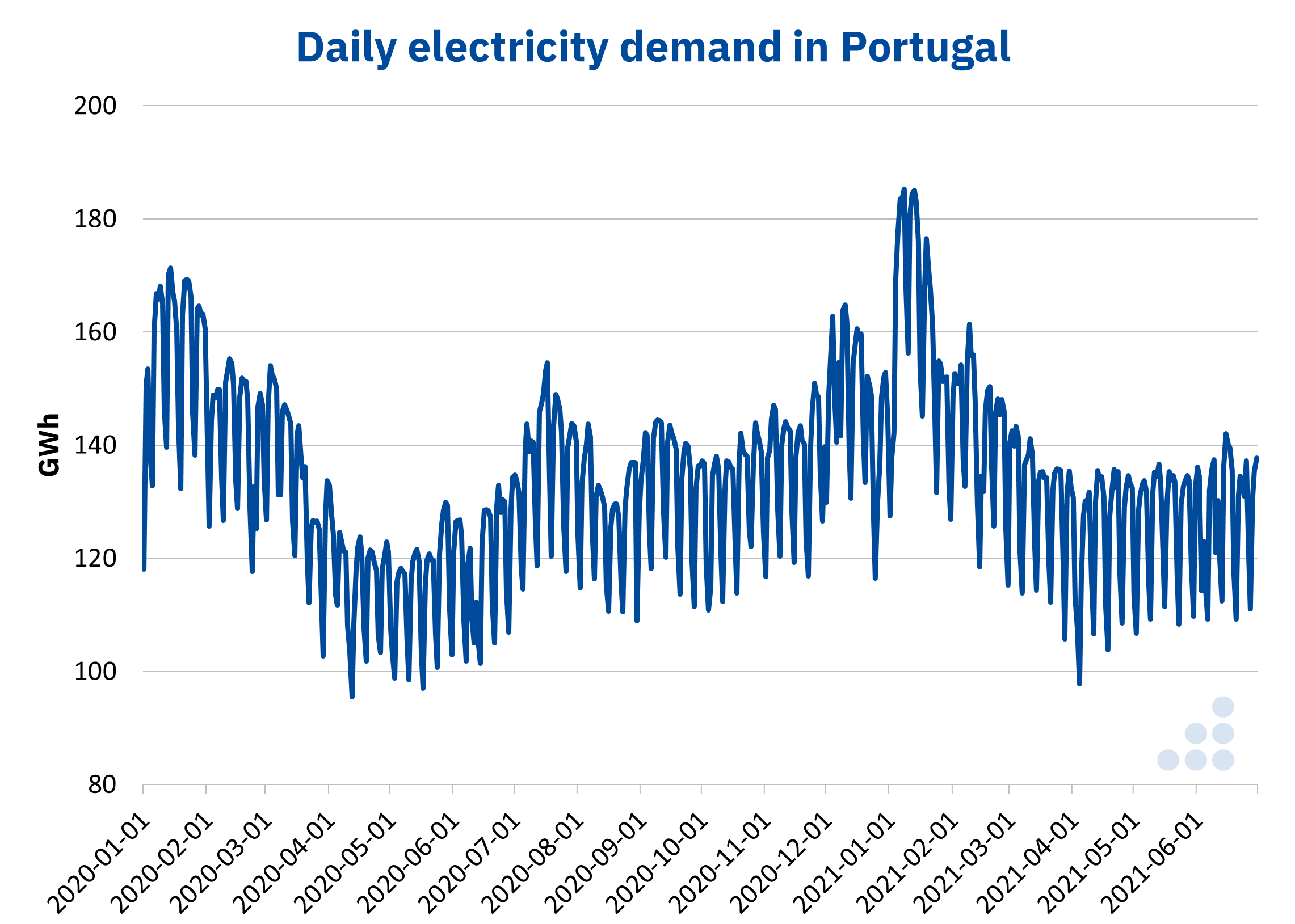

Electricity demand

The electricity demand in Portugal during the first half of 2021 reached 24.6 TWh, which represents an increase of 22% compared to the first half of 2020. Two were the main factors that led to this increase in demand. On the one hand, the main factor is the recovery of the economic and commercial activity, after the confinement and the stricter restrictions due to the COVID‑19 pandemic that occurred precisely during the first half of 2020.

On the other hand, there are the more extreme temperatures that occurred during the winter of 2021. The storm Filomena that crossed the Iberian Peninsula during the month of January left an average temperature in that month 1.7 °C lower than that registered in the same month of 2020, with an increase in demand of 2.8%.

Source: Prepared by AleaSoft using data from REN and ENTSO-e.

Source: Prepared by AleaSoft using data from REN and ENTSO-e.

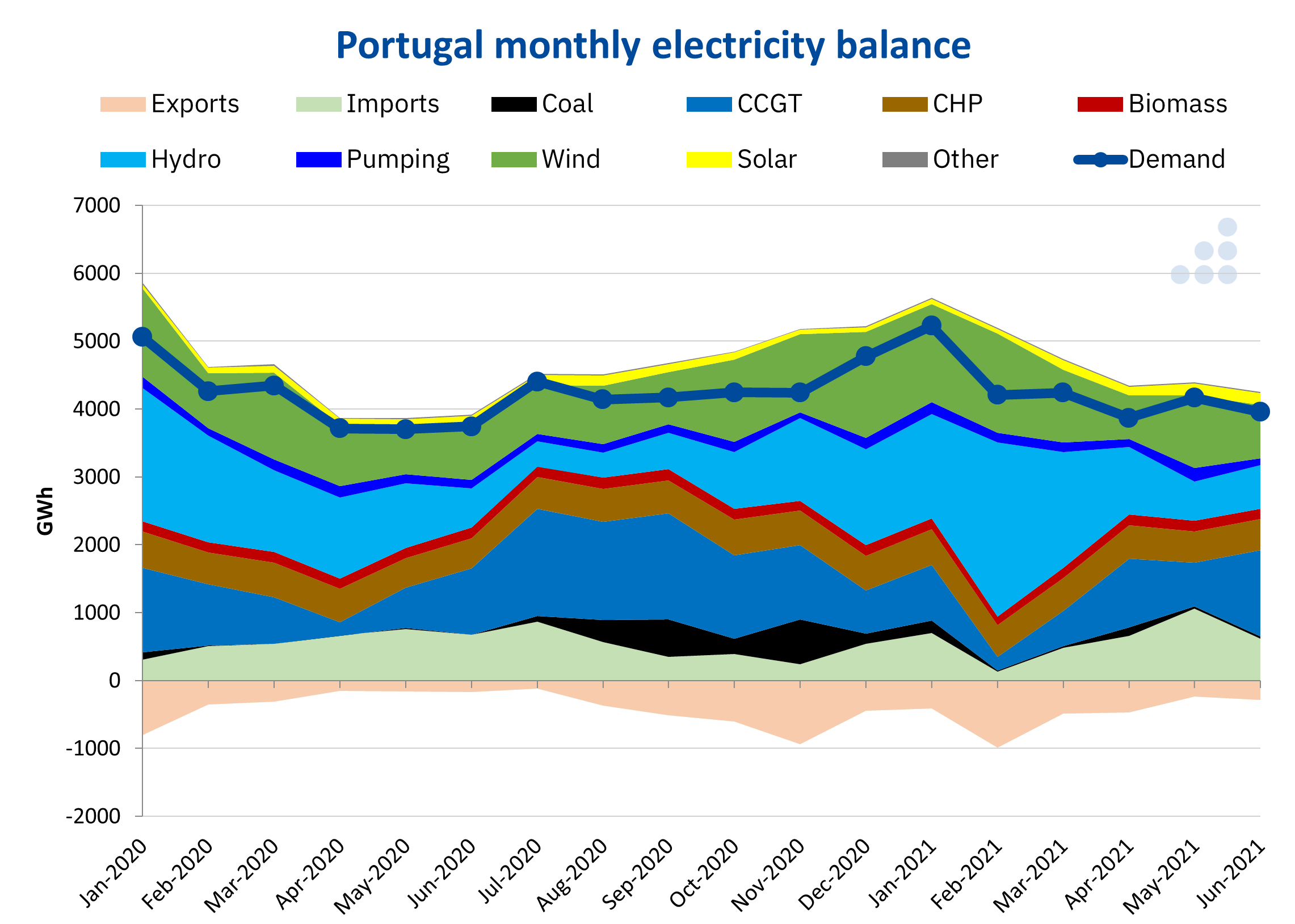

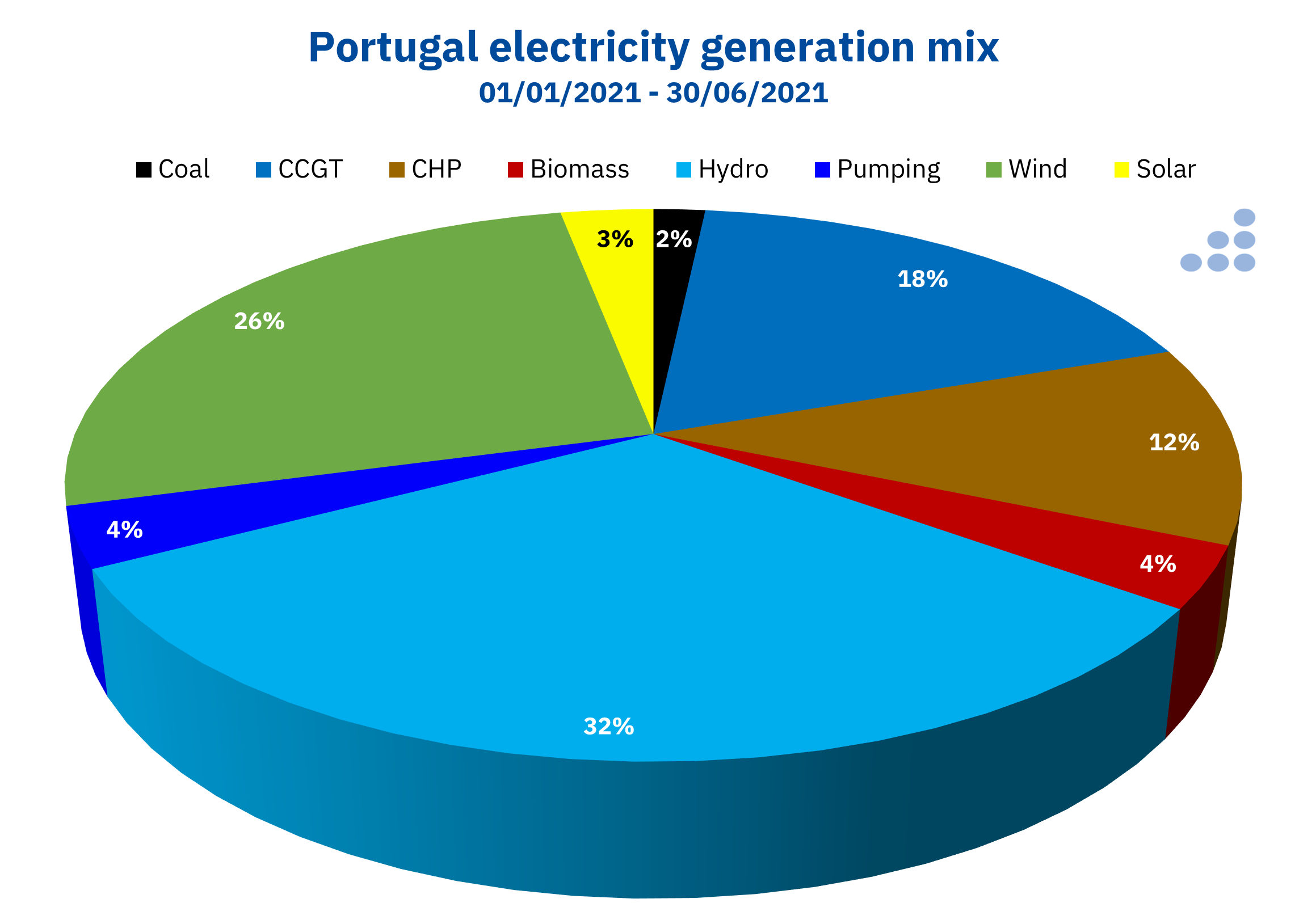

Production by technologies

The hydroelectric energy production was the main source of electricity generation in Portugal during the first half of 2021, accounting for 32% of the total mix. If the production of the pumping stations is added, the whole of hydroelectric technologies accounted for 36% of all electricity generation. This production, which reached 8909 GWh in the first half of this year, was 7.2% higher than that of the first half of 2020.

The wind energy production was positioned in the second place in the share within the mix, with 6472 GWh generated in the first six months of 2021, 12% more than in the first half of the previous year, and which represented 26% of all the production.

The electricity production with biomass was the next renewable energy technology of the mix, although with a much lower share, of 3.6%. Production with this technology decreased in this semester, specifically by 2.4% compared to the first half of 2020 and by 5.3% compared to the second half of 2020.

The latest renewable energy technology, the solar energy, ranked seventh in the mix with 756 GWh generated and a 3.0% share. Even with this timid position in the ranking, the growth compared to the same half of 2020 reached 25%, the highest growth rate among renewable energy technologies and which will increase in the coming years.

The renewable energies as a whole accounted for 68% of all electricity generation in Portugal during the first half of 2021. The growth compared to the same half of 2020 was 9.0% and, compared to the previous half, the growth rate reached 27%.

Source: Prepared by AleaSoft using data from REN.

Source: Prepared by AleaSoft using data from REN.

Regarding the generation with fossil fuels, in the first half of 2021, the production of the combined cycle gas turbines was at the top with 4464 GWh generated and, with a share of 18%, it was the third technology in the generation mix of Portugal. This represented a 3.2% drop in combined cycle gas turbines energy production compared to the first half of 2020 and a 41% drop compared to the second half.

The production with coal was quite marginal with 421 GWh and 1.7%, practically in the last place in the mix. Even so, the coal energy production was more than triple that of the first half of 2020, although compared to the second half of that same year, the production was 80% lower. These very different values of variation in the production of the thermal power plants are due to the fact that coal is already a very marginal fuel in Portugal.

Source: Prepared by AleaSoft using data from REN.

Source: Prepared by AleaSoft using data from REN.

Cogeneration has an important presence in the Portuguese mix. In the first six months of the year, 2890 GWh of electricity were generated with cogeneration, 12% of all electricity generated in the country. This volume is practically the same volume that was generated in the first half of 2020 but it is 3.2% lower than that generated during the second half.

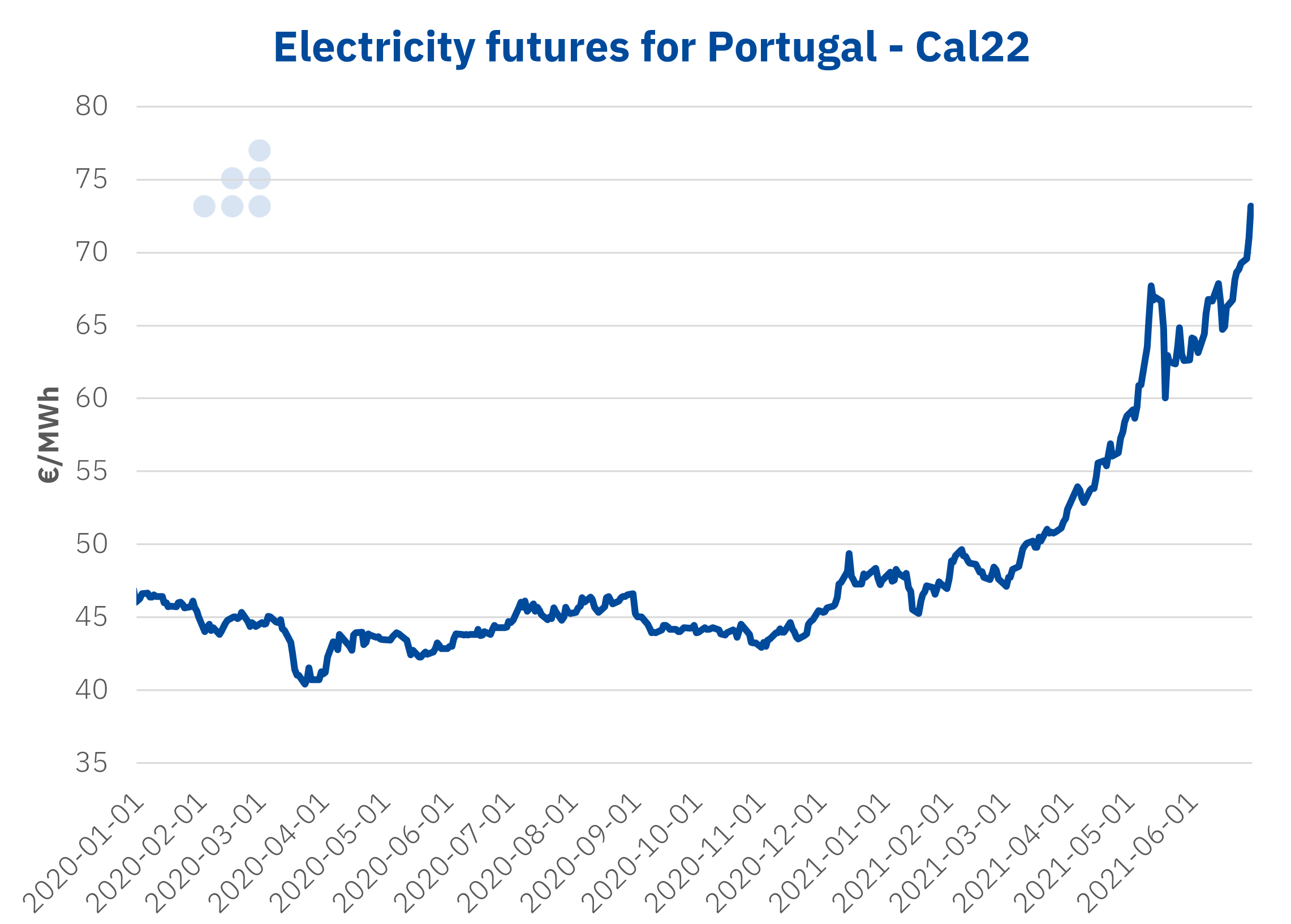

Electricity futures

Like the electricity futures for Spain, the futures for Portugal in the OMIP market had a very aggressive upward trend during the first half of 2021. The futures for the year 2022, on January 4, stood at €48.08/MWh. On the last market day of June, they settled at €73.19/MWh, a 52% rise in just six months.

This upward rally, like the rise in spot market prices, was driven by the rise in gas and CO2 emission rights prices during these months.

Source: Prepared by AleaSoft using data from OMIP.

Source: Prepared by AleaSoft using data from OMIP.

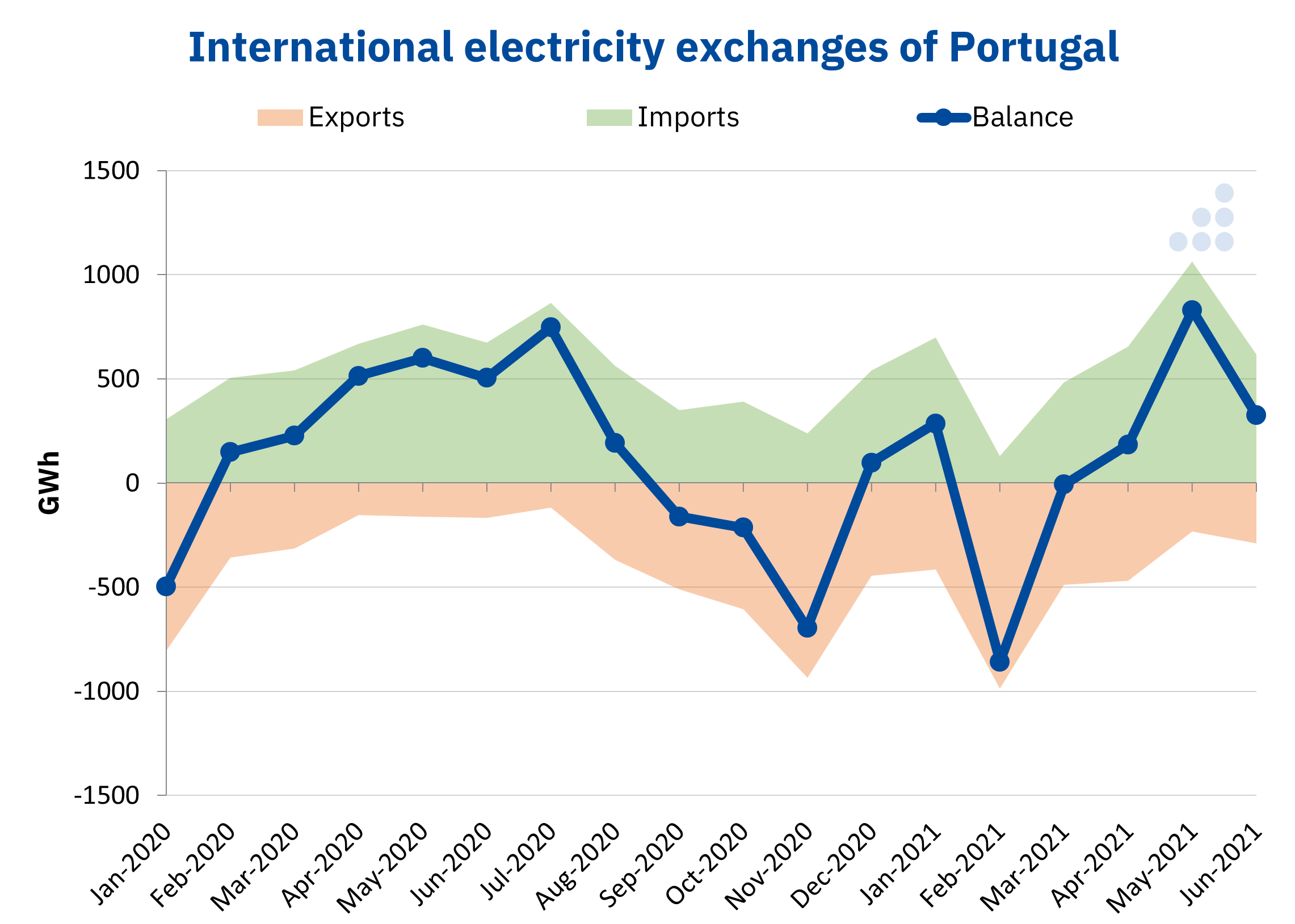

International exchanges

During the first six months of 2021, the balance of the electricity exchanges with Spain placed Portugal as a net importer, with the exception of February. This situation in February was due to the lowest prices on the continent that occurred in the Iberian electricity market, so both Portugal and Spain exported a lot of electricity to the rest of the continent through France.

In the overall six months, Portugal exported 2884 GWh to Spain and imported 3643 GWh, resulting in a net import balance of 759 GWh. Compared to the previous year, compared to the first half, exports increased by 47% while imports only increased by 5.4%, and, compared to the second half, imports increased by 24% and exports fell by 3.4%.

Source: Prepared by AleaSoft using data from REN.

Source: Prepared by AleaSoft using data from REN.

AleaSoft’s analysis on the prospects for the Iberian energy markets

The exceptional situation of the Iberian electricity market, and of all European markets, with very high prices, creates great uncertainty for producers and, above all, for consumers. To understand and have a long‑term vision of the energy markets, it is essential to have markets prices forecasts at all horizons. At AleaSoft, a special promotion of long‑term forecasting reports is in force for most European markets, including the Iberian market.

Additionally, for agents that operate in the spot and futures markets, producers, consumers or traders, AleaSoft organised a workshop to show the importance and usefulness of short‑term price forecasting when operating in the markets.

Also, within the framework of AleaSoft‘s informative activities, on October 7, a new webinar will be held with the participation of speakers from Deloitte where the evolution of the energy markets during the last twelve months will be analysed, in addition to addressing central issues for professionals of the energy sector such as the renewable energy projects financing and the importance of forecasting in audits and portfolio valuation.