AleaSoft, August 9, 2021. In the first week of August, prices rose again in most European spot and futures electricity markets. On August 10, a historical daily price record of €111.88/MWh was reached in the MIBEL market. However, negative values were registered in some markets over the weekend. TTF gas futures set a new all‑time high and CO2 futures exceeded €56/t. Wind and solar energy production fell in most markets, as did electricity demand.

Solar photovoltaic and solar thermal energy production and wind energy production

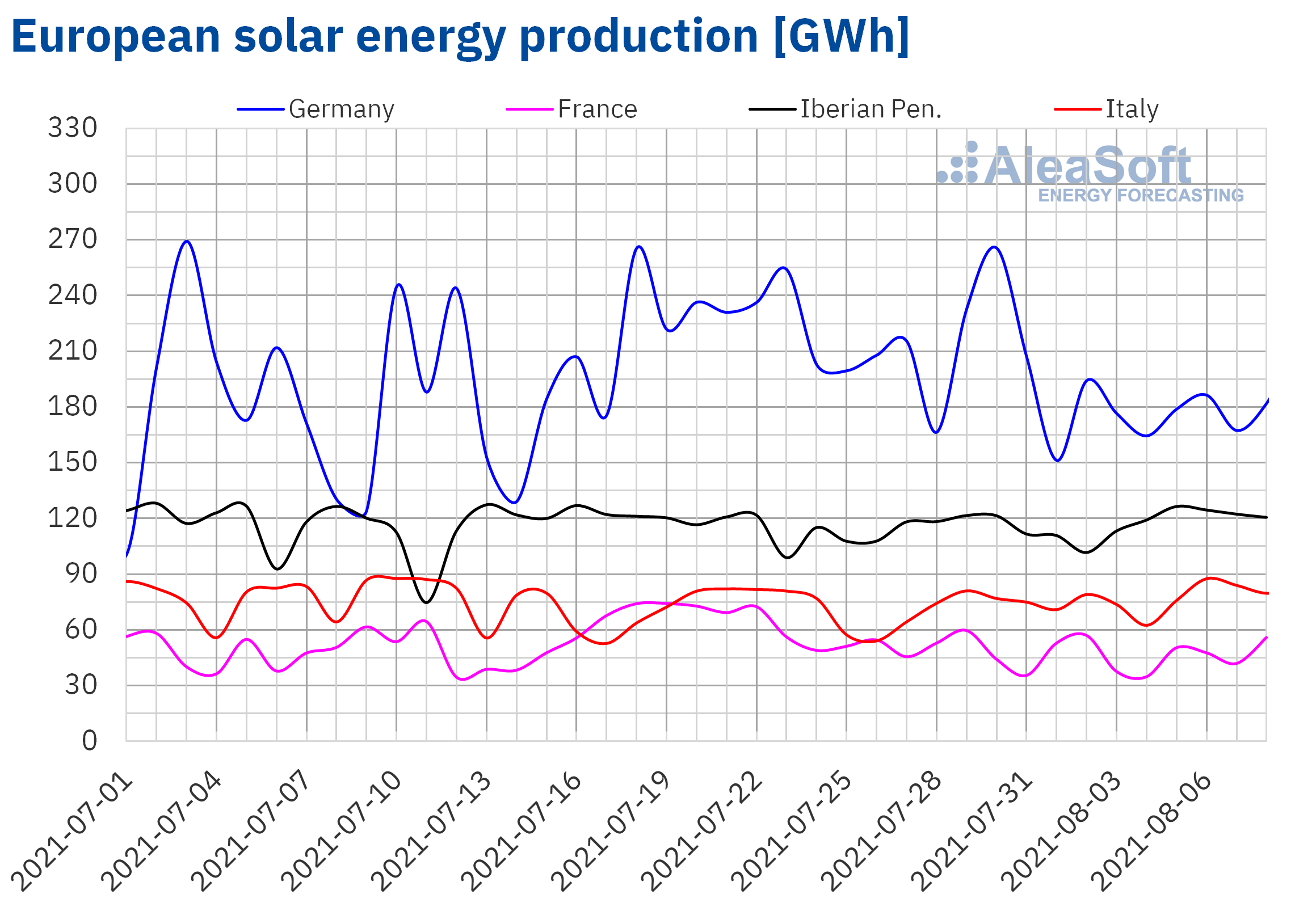

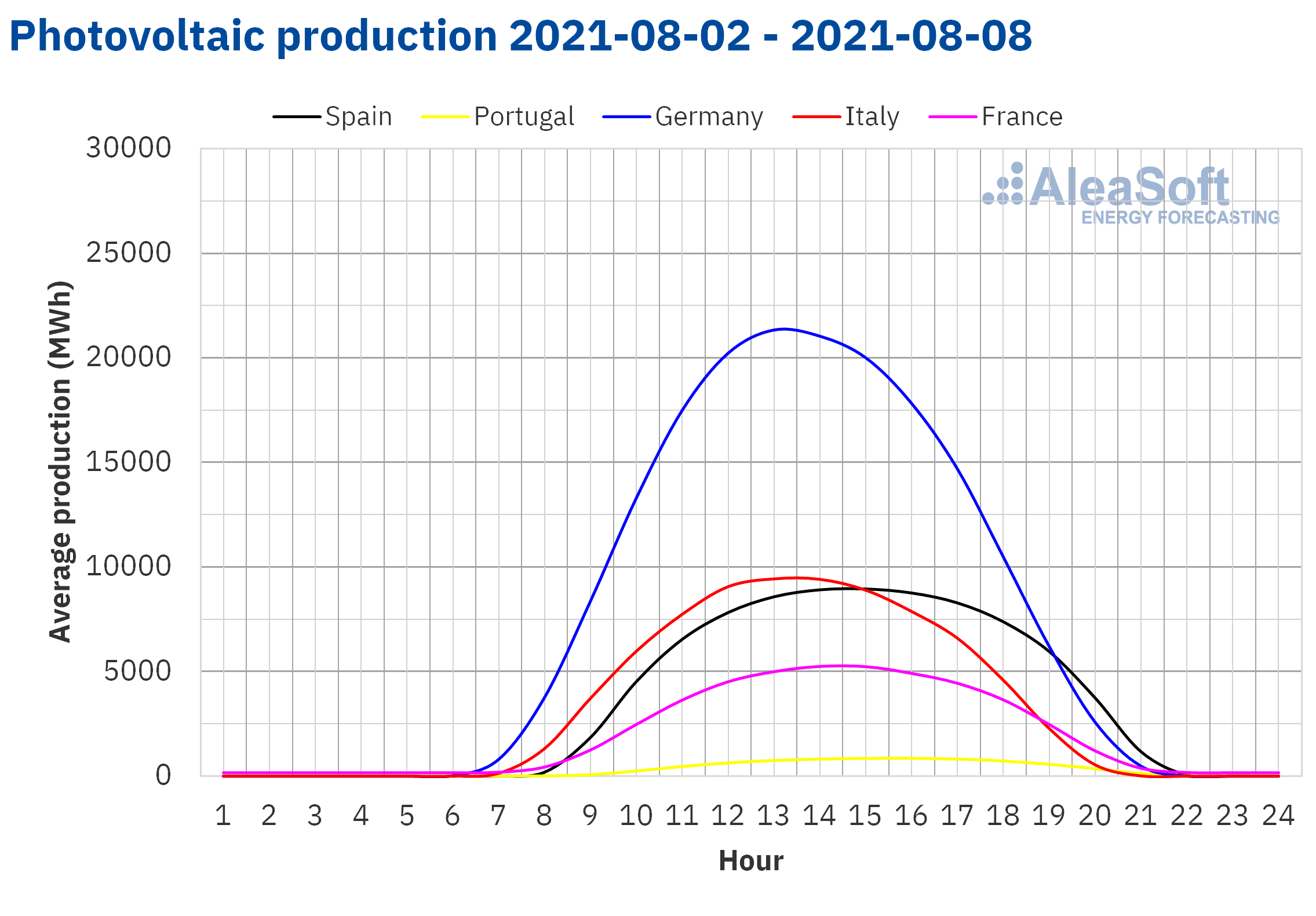

Solar energy production decreased during the week of August 2 in most European markets compared to the previous week. In the markets of Germany, France and Portugal there were falls that were up to 14% in the case of the German market. On the other hand, in Spain and Italy there were increases of 2.5% and 9.2% in this period.

For the week of August 9, solar energy production is expected to recover in Germany and Italy and to decrease in Spain, according to AleaSoft’s forecasting.

Regarding wind energy production, there was a decrease in most markets during the week of August 2. In Spain, production fell by 16%. In Germany and Portugal, generation with this renewable energy source also decreased, with falls of 36% and 12% respectively. Italy was the market that registered the largest increase, which was 48%.

For the week of August 9, AleaSoft‘s wind energy production forecasting indicates that there will be decreases in most European markets except Germany.

Electricity demand

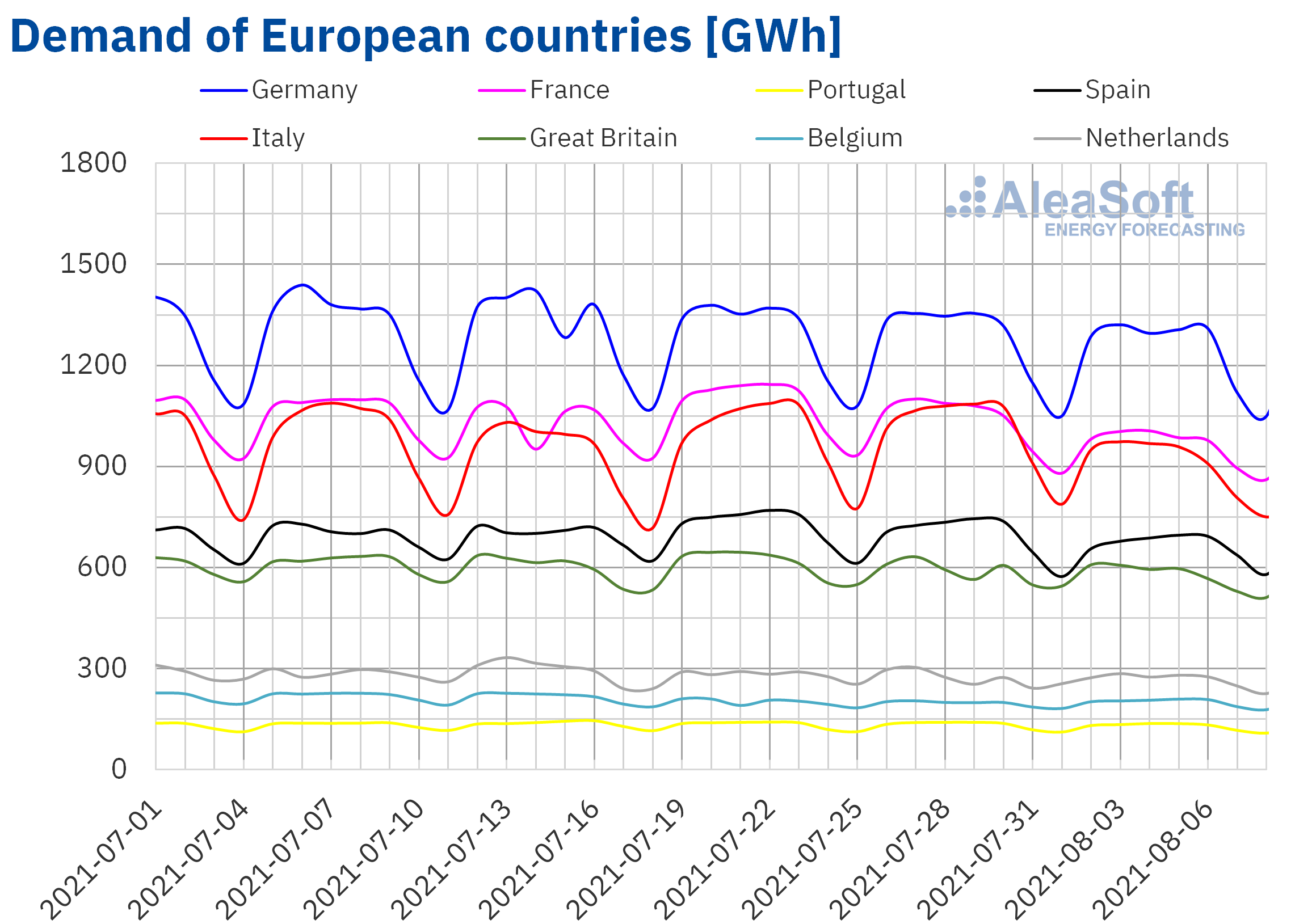

Electricity demand during the week of August 2 fell in most European markets compared to the previous week. There were drops such as 10% in Italy and 7.0% in France, which were favoured by the decrease in average temperatures compared to the previous week, as well as by the decrease in labour activities due to the summer holidays. In the rest of the markets the decreases were between 1.9% and 4.9%, except in the Belgian market where demand increased by 1.6%.

For the second week of August, AleaSoft‘s electricity demand forecasting indicates that recoveries will be registered in most of the European markets.

European electricity markets

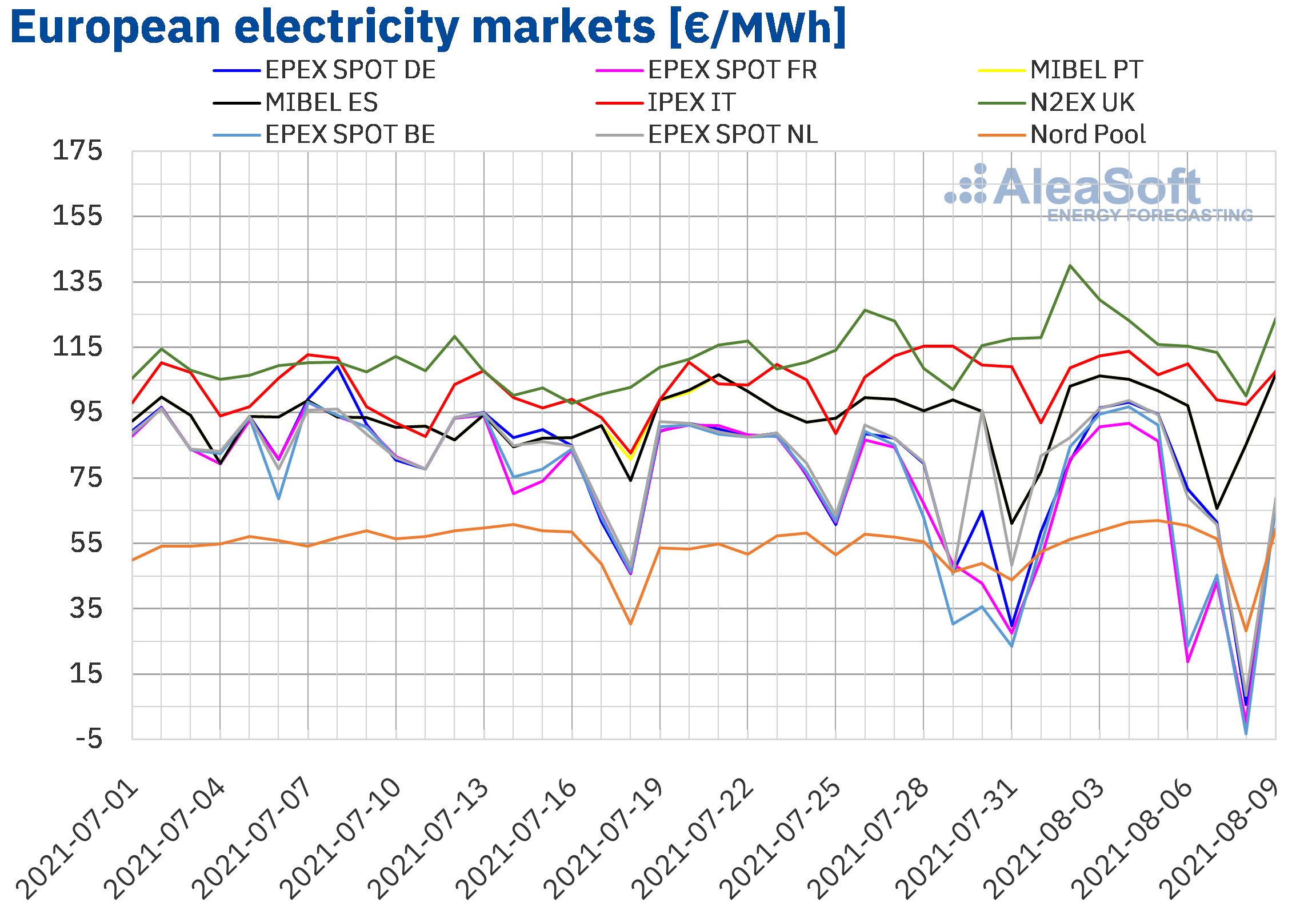

In the first week of August, the average prices of most of the European electricity markets rose compared to the previous week. The largest increase was registered in the EPEX SPOT market of Belgium and was 14%, followed by the increase of the EPEX SPOT market of Germany, of 12%. The only markets where prices fell were the IPEX market of Italy and the EPEX SPOT market of the Netherlands, with drops of 1.6% and 2.6% respectively. In the rest of the markets, prices increased between 1.1% in the EPEX SPOT market of France and 6.1% in the MIBEL market of Spain and Portugal.

In the week of August 2, the highest weekly average price was that of the UK N2EX market, of €119.62/MWh, followed by the Italian IPEX market average of €106.79/MWh. On the other hand, the Nord Pool market of the Nordic countries was the one with the lowest price, at €54.77/MWh, followed by the EPEX SPOT market of France with an average price of €58.77/MWh. In the rest of the markets, prices were between €61.79/MWh in the EPEX SPOT market of Belgium and €94.90/MWh in the MIBEL market of Spain and Portugal.

In the analysed period, daily prices ranged between €3.19/MWh on Sunday, August 8 in the EPEX SPOT market of Belgium and €139.91/MWh on Monday, August 2 in the N2EX market, this being the price highest daily price for this market since the first fortnight of 2021. The EPEX SPOT market of the Netherlands registered the second and third highest daily prices since February 2012, of €98.67/MWh and €96.35/MWh on August 4 and 3 respectively.

Regarding the daily prices of the MIBEL market of Spain and Portugal, on Monday, August 9, the record for the highest price in the history of the market was broken again with €106.74/MWh, surpassing the one registered on Wednesday, August 21 July €106.57/MWh. But this record was short‑lived, because on Tuesday, August 10, it was surpassed again with an average price of €111.88/MWh.

In the case of hourly prices, negative prices were reached in some hours in the EPEX SPOT markets of Belgium, the Netherlands, France and Germany during the first week of August. In the case of the Belgian market, negative prices were obtained at hours 4, 5, 16 and 17 on Friday, August 6, and during 5 hours on Sunday, August 8, with values between €‑0.17/MWh and €‑70.00/MWh. In the EPEX SPOT market of France, negative prices were between the hours from 4 to 7 and in the 16th hour of Friday, August 6 and between hours 4 and 19 of August 8, with values between €‑0.02/MWh and €‑63.03/MWh. In the German market, negative prices were between 8:00 and 18:00 on Sunday, August 8, and the Netherlands registered the fourth lowest price since 2011, of €‑63.03/MWh at hour 15 of August 8. In this market, 9 hours were registered that day with negative prices, between the hours 9 and 17. In the markets of Spain and Portugal, no negative values were reached, but on Saturday, August 7, a price of €0.90/MWh was registered in the hour 17. These low and negative hourly prices occurred on days where electricity demand was lower as it was a weekend and renewable production was high.

During the week of August 2, the increase in the prices of gas, coal and CO2 emission rights favoured the increase in prices in the European electricity markets, despite a lower electricity demand during this period. This behaviour was also contributed to by the fall in wind and solar energy production for the whole week in most of Europe.

AleaSoft‘s prices forecasting indicates that for the week of August 9, prices will continue to increase in most European markets, favoured by the increase in electricity demand, by lower wind energy production in most of Europe and by the climate high prices in the fuel and CO2 markets.

Electricity futures

European electricity futures prices for the next quarter rose across the board during the first week of August. In the NASDAQ and ICE markets of the Nordic countries, settlement prices rose between the sessions of July 30 and August 6 by 9.6% and 10%, these being the largest increases. In the EEX market of Spain the increase was 8.4% and in the OMIP market of Spain and Portugal it was 7.9%, while in the EEX market of France the price increased 7.2%. In the rest of the markets, the increase in prices ranged between 3.8% and 6.9%.

The settlement prices of the electricity futures for the year 2022 also increased on Friday, August 6 in all the markets analysed at AleaSoft compared to Friday, July 30. As in the case of futures for the next quarter, the greatest increases were registered in the NASDAQ and ICE markets of the Nordic countries, with an increase of 9.3% and 10% respectively. High price increases were also registered for this product in the EEX and ICE markets of the United Kingdom, settling last Friday, August 6, 9.0% above the session of July 30. In the rest of the markets, the increase in prices was between 5.4% and 7.7%.

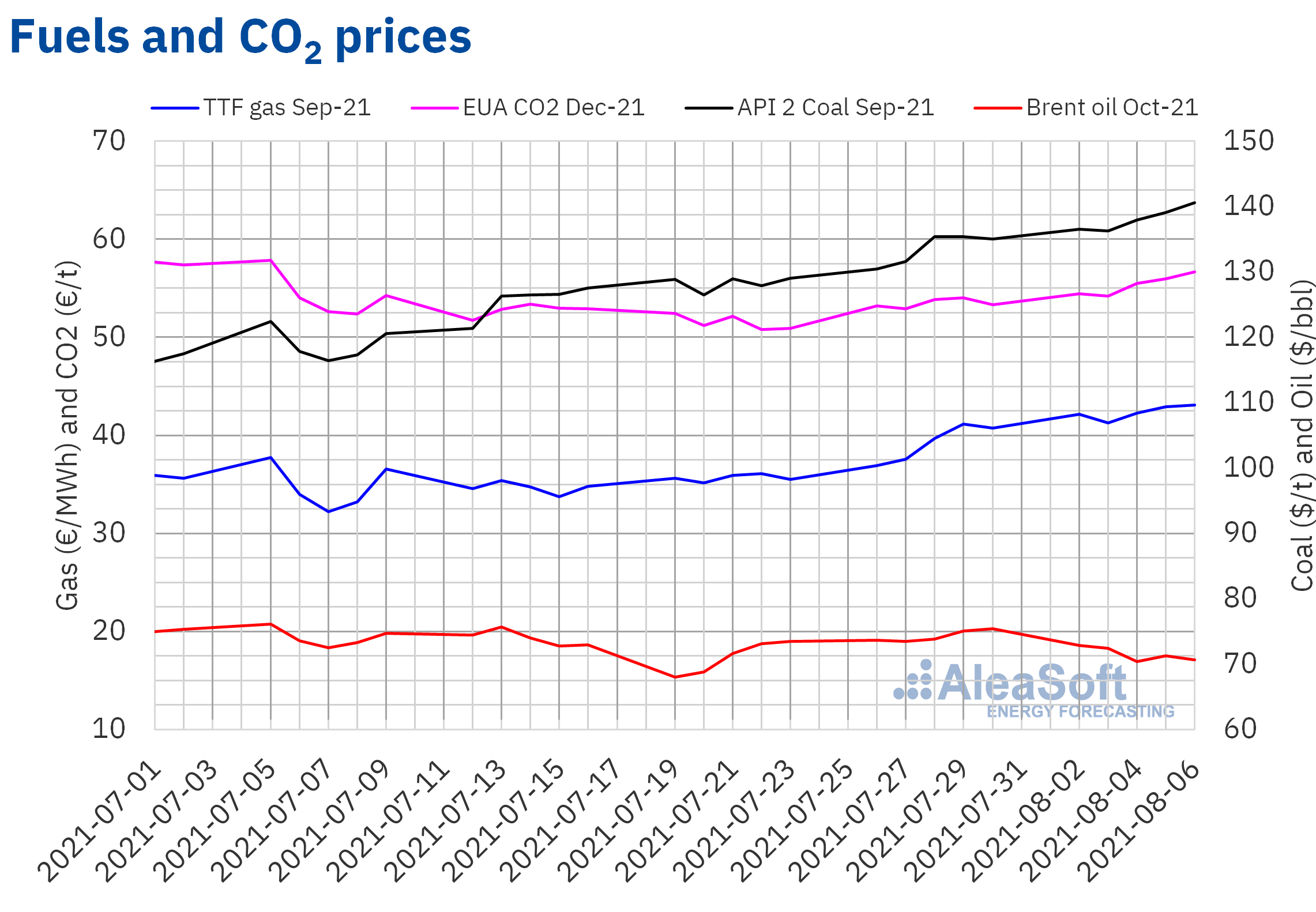

Brent, fuels and CO2

On Monday, August 2, the Brent oil futures for the month of October 2021 in the ICE market registered a settlement price of $72.89/bbl. This price was 1.1% lower than that of the previous Monday. In general, during the rest of the week, prices fell and closed at $70.70/bbl in the session on Friday, August 6.

This drop in Brent prices is largely associated with concerns about a new lockdown in China in the face of a new rebound in the pandemic. China is the second largest consumer of oil in the world and the largest importer, so a reduction in its demand would significantly affect market prices.

Regarding the TTF gas futures in the ICE market for the month of September 2021, on Monday, August 2, they reached a settlement price of €42.15/MWh. This price was 14% higher than the previous Monday. On Tuesday there was a drop and in the rest of the sessions the prices continued to rise until they closed on Friday, August 6 at €43.12/MWh, which is the highest price registered for this product at least since October 2013.

These new rises in gas prices are mainly due to lower supplies from Russia. This decreased flow from Russia occurred because of a reported fire at a gas processing plant.

Regarding the prices of CO2 emission rights futures in the EEX market for the reference contract of December 2021, on Monday, August 2, they reached a settlement price of €54.44/t. This price was 2.4% higher than the previous Monday. During the week, except for Tuesday, price increases continued, although without reaching the highs of early July. On Friday, August 6, the settlement price of the last session of the week was €56.65/t.

API 2 coal prices for September 2021 stood at $136.50/t on Monday, August 2, a price that represents an increase of 6.3% compared to Monday, July 26. As in the rest of the analysed products, on Tuesday it registered a decrease, while the rest of the days of the week had a growth that ended up settling at a price of $140.55/t on Friday, August 6, a figure that represents the maximum for this product since October 2008.

AleaSoft’s analysis of the prospects for energy markets in Europe

The record prices that were reached since spring in the electricity, gas and CO2 markets highlight the need for an energy purchase and sale strategy based on diversification, which makes it possible to cover market prices risks and take advantage of opportunities that arise. To help in this regard, AleaSoft is carrying out special promotions of the price forecasting services of the European electricity markets in the different horizons, short‑, mid‑ and long‑term.

The next webinar organised by AleaSoft will feature the participation of guest speakers from Deloitte. It will be held on October 7 and the topics to be addressed will be the analysis of the evolution of the energy markets with an year‑on‑year perspective, since October 2020 when the previous webinar was held with the presence of speakers from Deloitte, the renewable energy projects financing and the importance of the forecasts in the audits and in the portfolio valuation.