AleaSoft Energy Forecasting, November 8, 2021. In the first week of November, prices of most European electricity markets registered declines, favoured by the drop in gas prices and the increase in wind energy production in some markets. In the Iberian market, the increase in solar energy production was another factor that favoured that prices fell. On the other hand, the drop in temperatures caused increases in demand in several markets. Brent and CO2 prices fell, slightly in the latter case.

Photovoltaic and solar thermal energy production and wind energy production

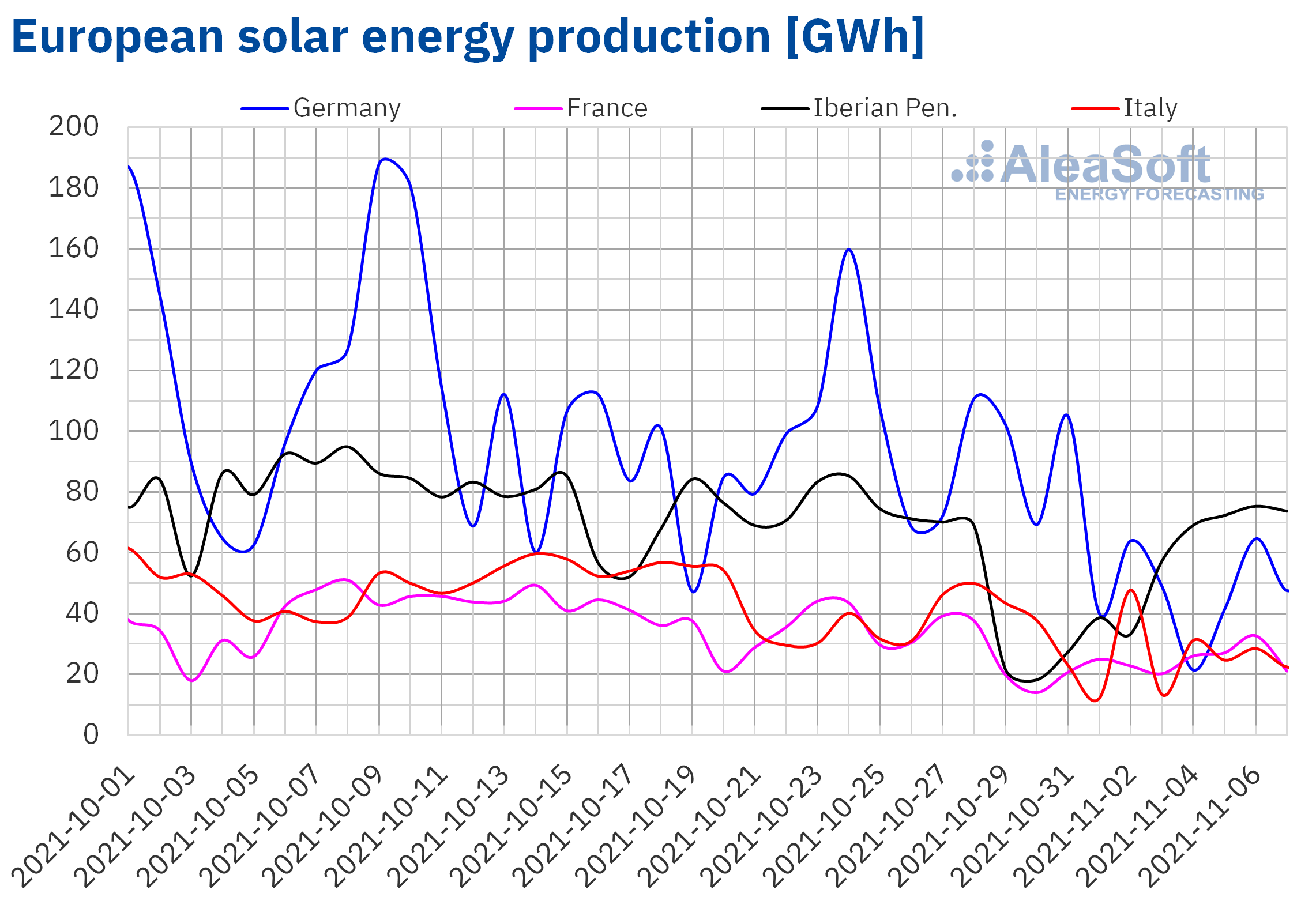

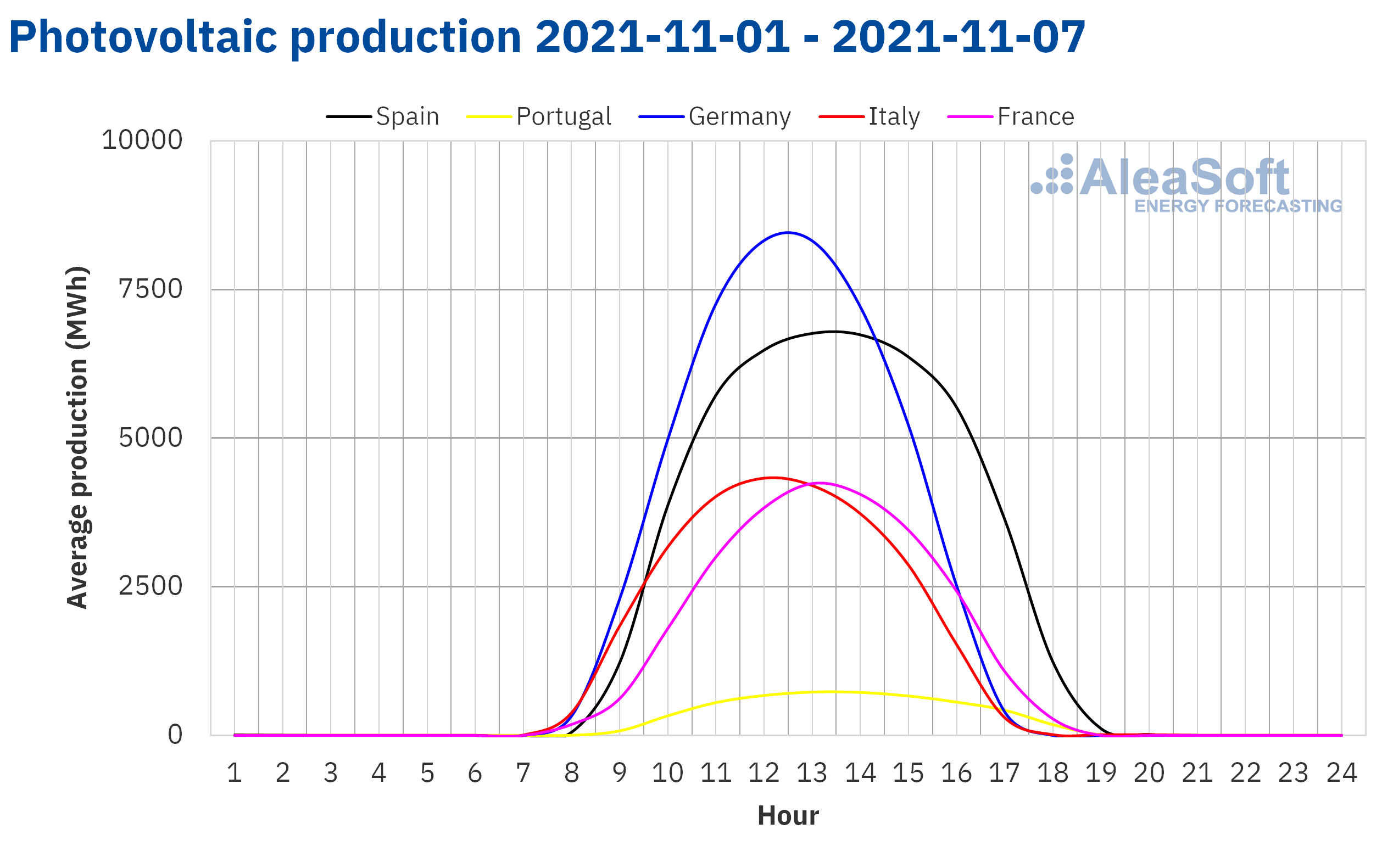

In the first week of November, the solar energy production decreased in most of the analysed markets compared to the production of the week of October 25. In the markets of Germany and Italy, the decreases in production with this technology were 48% and 31%, respectively, while in the French market the decrease was 8.8%. The exception was the Iberian market, where the solar energy generation increased by 19%.

For the week of November 8, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates an increase in the markets of Germany and Spain, while in the Italian market it will continue to decrease compared to that of the previous week.

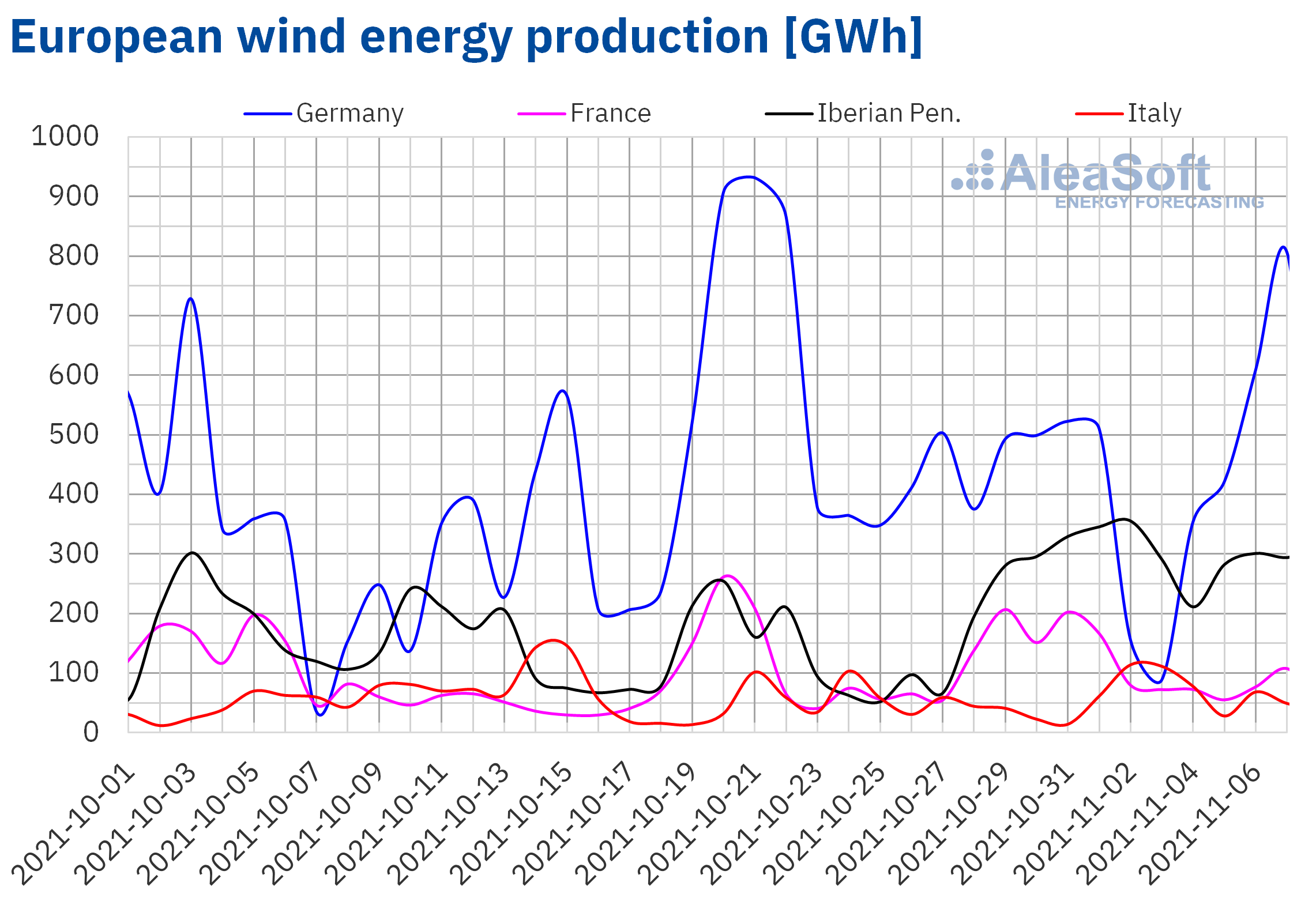

During the week of November 1, the wind energy production increased in the Italian market by 87% and in the Iberian market by 58% compared to that registered during the last week of October. On the contrary, in the French market there was a decrease of 28%, while in the German market the decrease was 6.5%.

For the second week of November, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates a general drop in generation with this technology in the analysed markets.

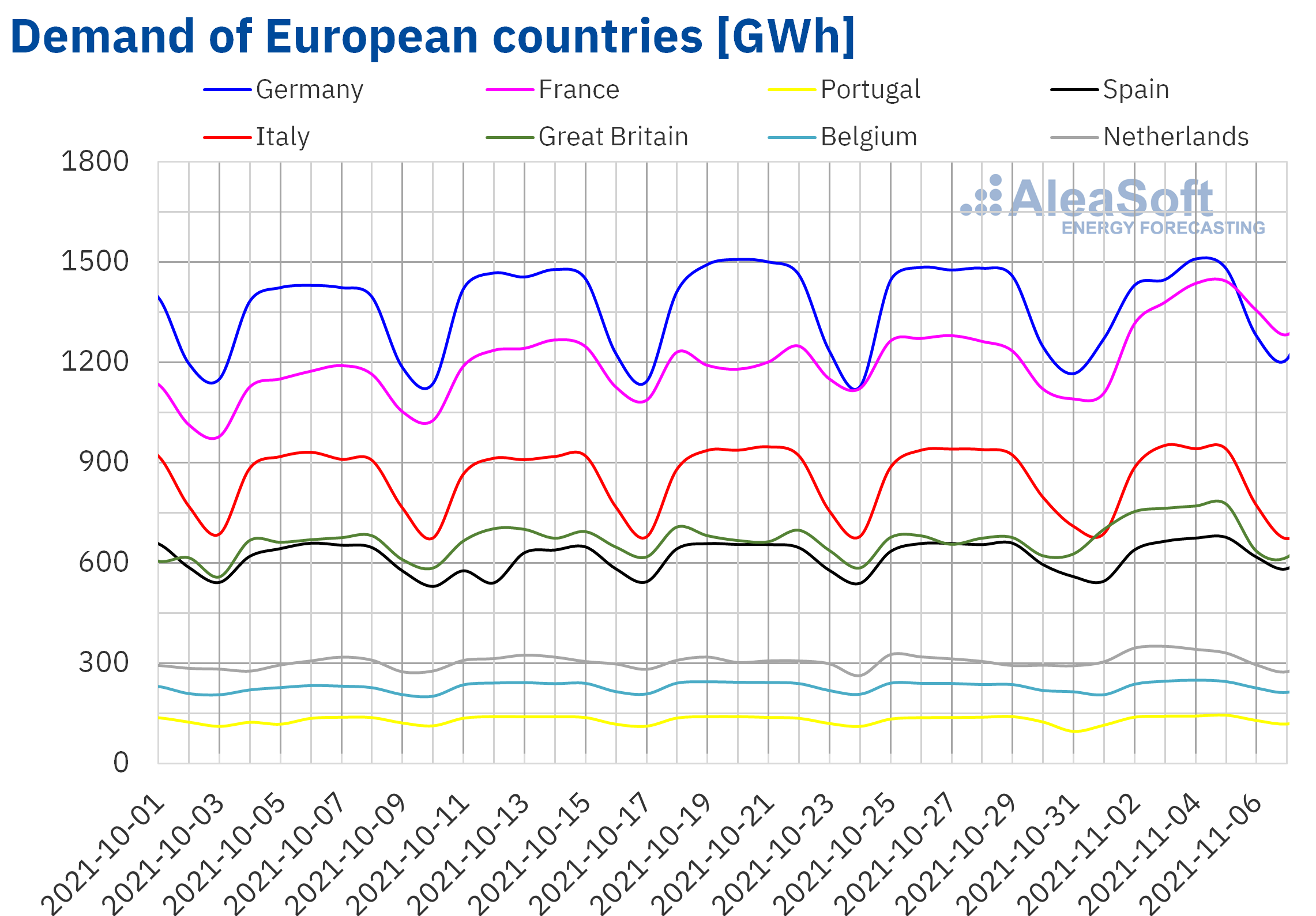

Electricity demand

The electricity demand registered increases in several markets during the week of November 1 compared to the previous one. Average temperatures drops, which were up to 4.5 °C in Belgium, favoured increases in demand. In markets such as those of France and Great Britain, increases in demand were 9.4% and 8.8% and decreases in average temperatures were more than 3.0 °C in both markets.

However, in the markets of Germany, Spain and Belgium, despite decreases in average temperatures, the effect of the holiday of All Saints’ Day on November 1 influenced the decreases in demand, which were less than 1.5%. In the case of the Spanish market, when correcting the effect of this holiday, the increase in demand was 1.8%.

A slight rise in temperature and the effect of the November 1 holiday converged in the Italian market. These causes led to a 4.6% drop in demand in this market, which represented the most significant drop of the week.

For the week of November 8, the forecasts of AleaSoft Energy Forecasting indicate that the demand will continue to increase in most markets. On the other hand, the demand of the British market is expected to register a slight decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

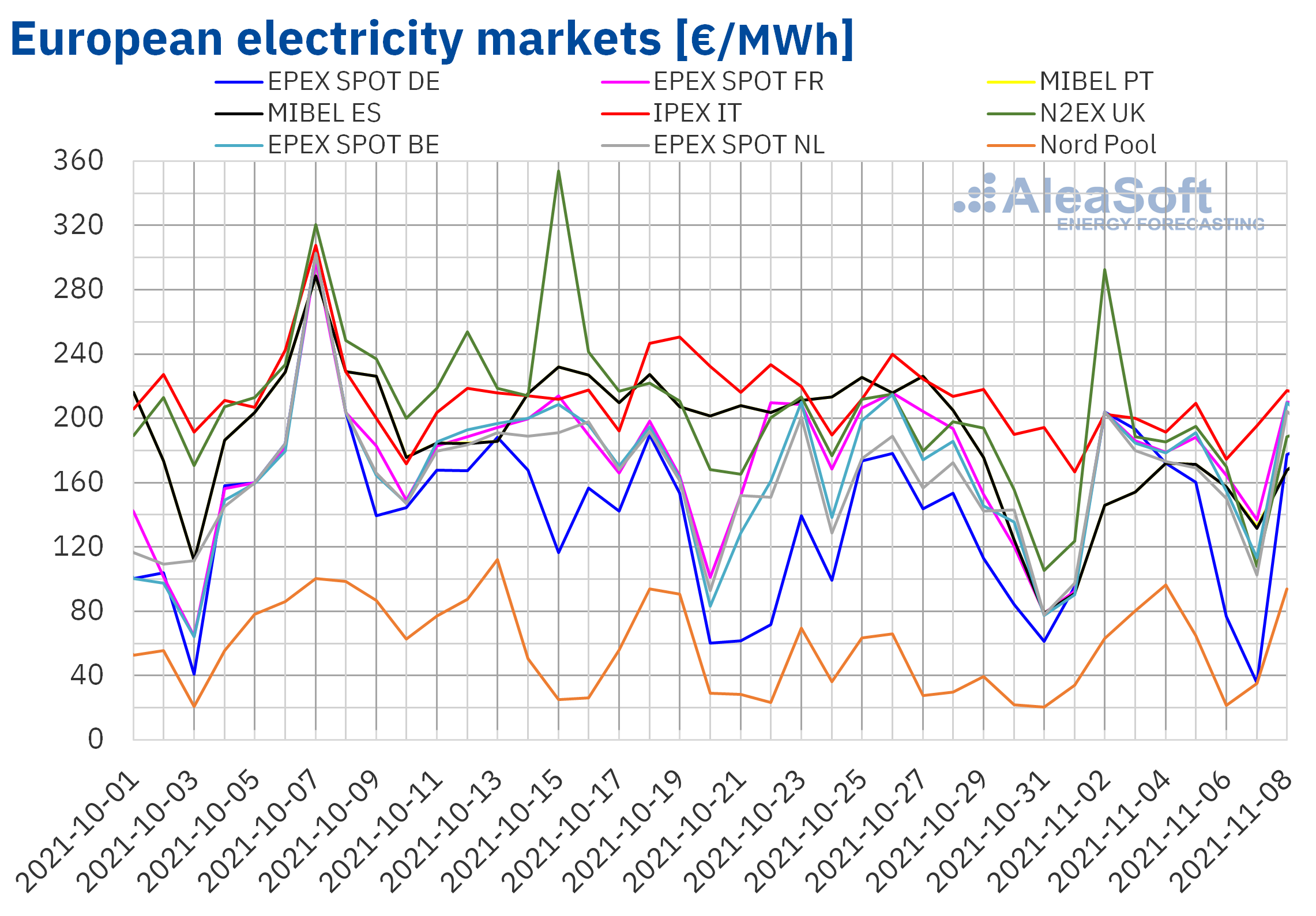

The week of November 1, prices of most European electricity markets analysed at AleaSoft Energy Forecasting decreased compared to the previous week. The largest drop in prices was that of the MIBEL market of Spain and Portugal, of 18%, while the smallest was that of the EPEX SPOT market of Belgium, of 1.3%. However, in some markets prices increased. The Nord Pool market of the Nordic countries registered the largest rise, of 47%, while the smallest increase was that of the N2EX market of the United Kingdom, of 0.3%.

In the first week of November, the highest weekly average price was that of the IPEX market of Italy, of €191.37/MWh, followed by that of the N2EX market, of €180.39/MWh. On the other hand, the lowest average was that of the Nord Pool market, of €56.46/MWh. In the rest of the markets, prices were between €133.87/MWh of the EPEX SPOT market of Germany and €164.42/MWh of the EPEX SPOT market of France.

The highest daily price of the week, of €292.54/MWh, was reached on Tuesday, November 2, in the British market. In contrast, the lowest daily price of the week, of €21.59/MWh, was registered on Saturday, November 6, in the Nord Pool market. On the other hand, on November 1, Italy registered the lowest price since the end of September, of €166.61/MWh. While in Germany, on November 7, there was the lowest price since the first half of August, of €35.41/MWh.

Regarding hourly prices, on November 2, at 3:00, the lowest price since September, of €119.00/MWh, was registered in Italy. While in the United Kingdom, on November 7, at 5:00, a price of ‑£19.37/MWh was reached, the lowest since May 2020. In this market, on November 2, at 18:00, there was a price of £1406.00/MWh, the highest since mid‑September. In the case of the Nord Pool market, on November 8, at 18:00, the highest hourly price since February, of €129.92/MWh, was reached.

During the week of November 1, the increase in wind energy production in southern Europe and the increase in solar energy production in the Iberian Peninsula favoured the decline in prices in countries such as Spain, France, Italy or Portugal. In addition, gas prices fell, being another fundamental factor that led to the decline. However, in markets such as Germany, where the wind energy production decreased, prices increased.

The AleaSoft Energy Forecasting’s price forecasts indicate that in the week of November 8, prices may increase in a generalised way in the European markets, influenced by the increase in demand and the decrease in wind energy production.

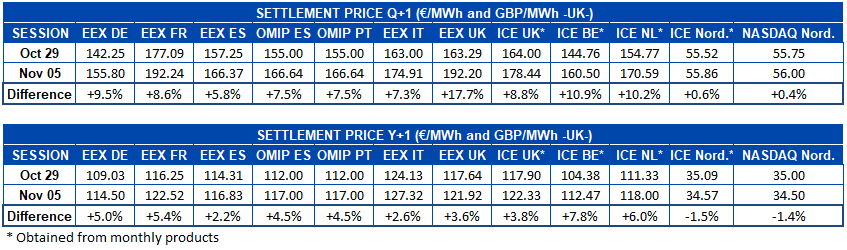

Electricity futures

The first week of November was characterised by a general rise in electricity futures prices for the next quarter, if settlement prices of Friday, November 5, are compared with those of the previous Friday, October 29. The EEX market of the United Kingdom was the one where prices rose the most, with an increase of 18%. The NASDAQ market of the Nordic countries was the one where prices changed the least, with an increase of 0.4%. In the rest of the markets the increases were between 0.6% and 11% of the ICE market of the Nordic countries and Belgium, respectively.

In the case of electricity futures for 2022 they had a partly different behaviour in the same period. In the ICE and NASDAQ markets of the Nordic countries, prices fell by 1.5% and 1.4% respectively. Meanwhile, in the rest of the markets, the increases were between 2.2% registered in the EEX market of Spain and 7.8% of the ICE market of Belgium.

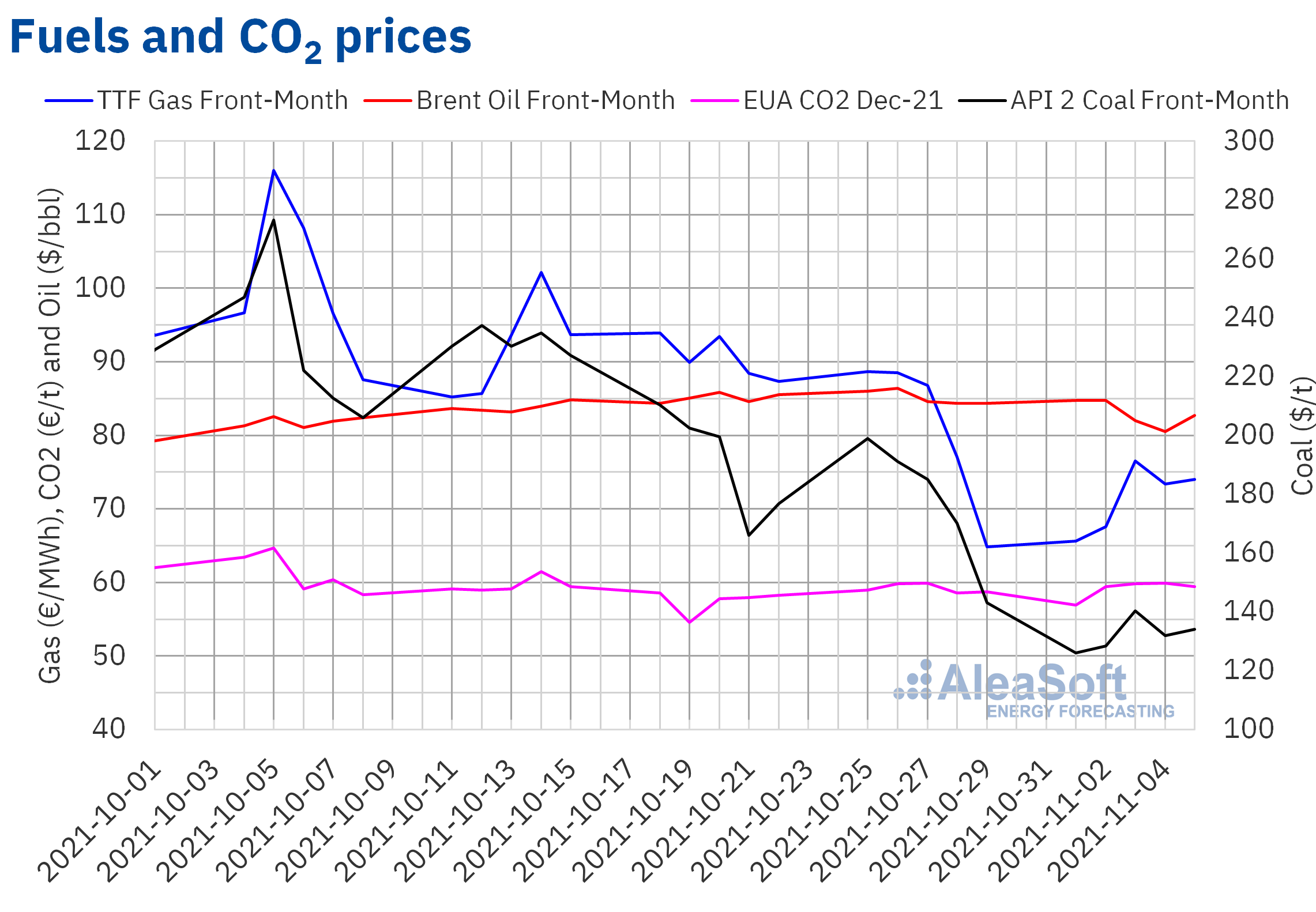

Brent, fuels and CO2

The settlement prices of Brent oil futures for the Front‑Month in the ICE market, the first week of November were lower than those of the same days of the previous week. The minimum settlement price of the week, of $80.54/bbl, was reached on Thursday, November 4. This price was 4.5% lower than that of the previous Thursday and the lowest since the beginning of October. However, on Friday the price recovered to $82.74/bbl, although it was still 1.9% lower than that of the previous Friday.

During the first week of November, fears about the effects on demand of the evolution of the COVID‑19 pandemic exerted their downward influence on prices. Infection levels reached high levels in Russia and other Eastern European countries and measures to reduce them began to be imposed.

On the other hand, despite the pressure from countries such as the United States, at the meeting of Thursday, November 4, OPEC+ agreed to continue with the planned production increases. This pushed Brent oil futures prices higher on Friday, November 5. The recovery of the economy in the United States and concerns about whether some OPEC+ member countries will continue to be unable to meet the assigned production quota also favours this upward trend.

As for settlement prices of TTF gas futures in the ICE market for the Front‑Month, the first week of November they remained below €77/MWh and the average, of €71.43/MWh, was 12% lower than that of the previous week. At the beginning of the week, prices increased until reaching the maximum settlement price of the week, of €76.54/MWh, on Wednesday, November 3. However, this price was still 12% lower than that of the previous Wednesday.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2021, the first week of November they continued below €60/t. The minimum settlement price of the week, of €56.94/t, was reached on Monday, November 1. This price was 3.5% lower than that of the previous Monday. The rest of the days of the week, prices exceeded €59/t. The maximum settlement price of the week, of €59.87/t, was reached on Thursday, November 4, and it was 2.2% higher than that of the previous Thursday.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

Next Thursday, November 11, the webinar “Prospects for European energy markets in the global energy crisis” will be held with the participation of the following speakers from Engie Spain, Daniel Fernández Alonso, Head of Energy Management and New Green Wholesale Business, Raúl Rodríguez Ascaso, Head of Business Development, Ignacio Sáenz Berruga, Head of Origination and PPAs, and from AleaSoft Energy Forecasting, Oriol Saltó i Bauzà, Manager of Data Analysis and Modelling. In the webinar, the evolution of European energy markets in the global energy crisis and the financing of renewable energy projects will be analysed. In the second part of the webinar in Spanish, an analysis table will be held in which Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasting, will also participate.

At AleaSoft Energy Forecasting, studies, analyses and reports are being carried out for hybrid systems of renewable energy and energy storage, with the objective of defining strategies to optimise their operation to maximise their income and estimating them taking into account long‑term hourly market prices forecasts.