AleaSoft, March 9, 2020. The Brent oil prices fell to a minimum of the last four years after the failed OPEC+ talks with which it was intended to cut production to counteract the decline in demand due to the coronavirus. The gas prices are also at historic lows with similar values to those of December 2009. In the European electricity markets, the prices of the beginning of March recovered compared to those of the end of February.

Photovoltaic and solar thermal energy production, wind energy production and electricity demand

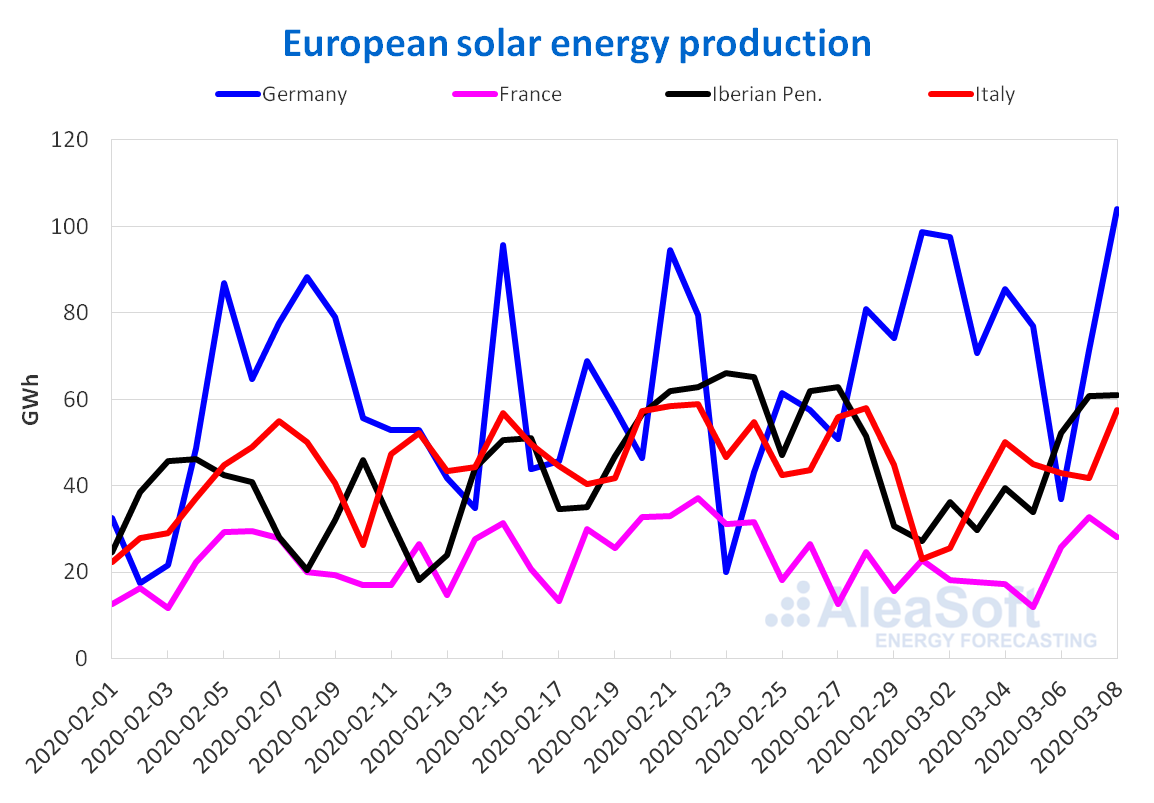

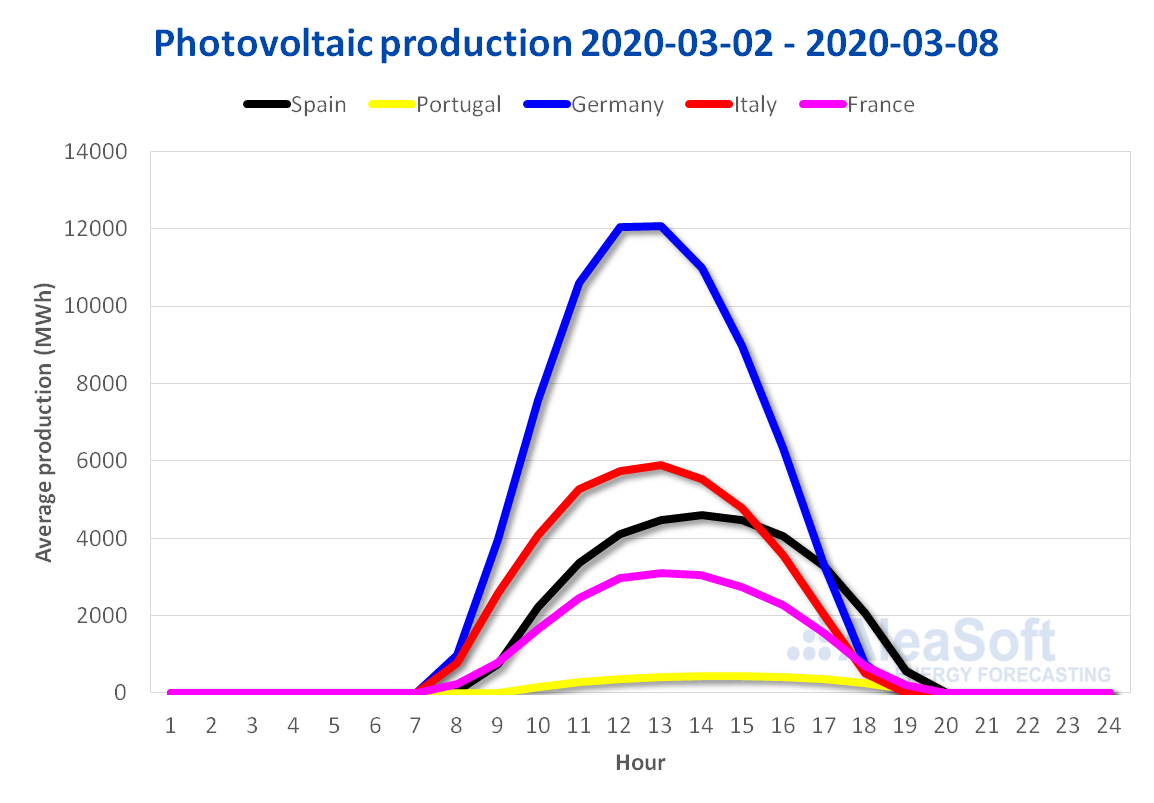

Last week of Monday, March 2, the solar energy production declined in most European electricity markets, as forecasted by AleaSoft since the beginning of last week. There was a fall of about 11% in the generation with this technology in Spain and about 7% in Italy. On the contrary, in Germany there was an increase of 16%. An increase in this production in the Italian market and a decrease in solar energy production in Germany is expected for this week at AleaSoft. In Spain, the production will remain at a similar level to that of last week although slightly higher.

So far this month, until March 8, there were increases in solar energy production of 23%, 40% and 50% in Germany, Portugal and Spain compared to the same period of days of the previous year. On the contrary, in France and Italy the solar energy production was below that registered for the same days of March 2019 by 12% and 18% respectively.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

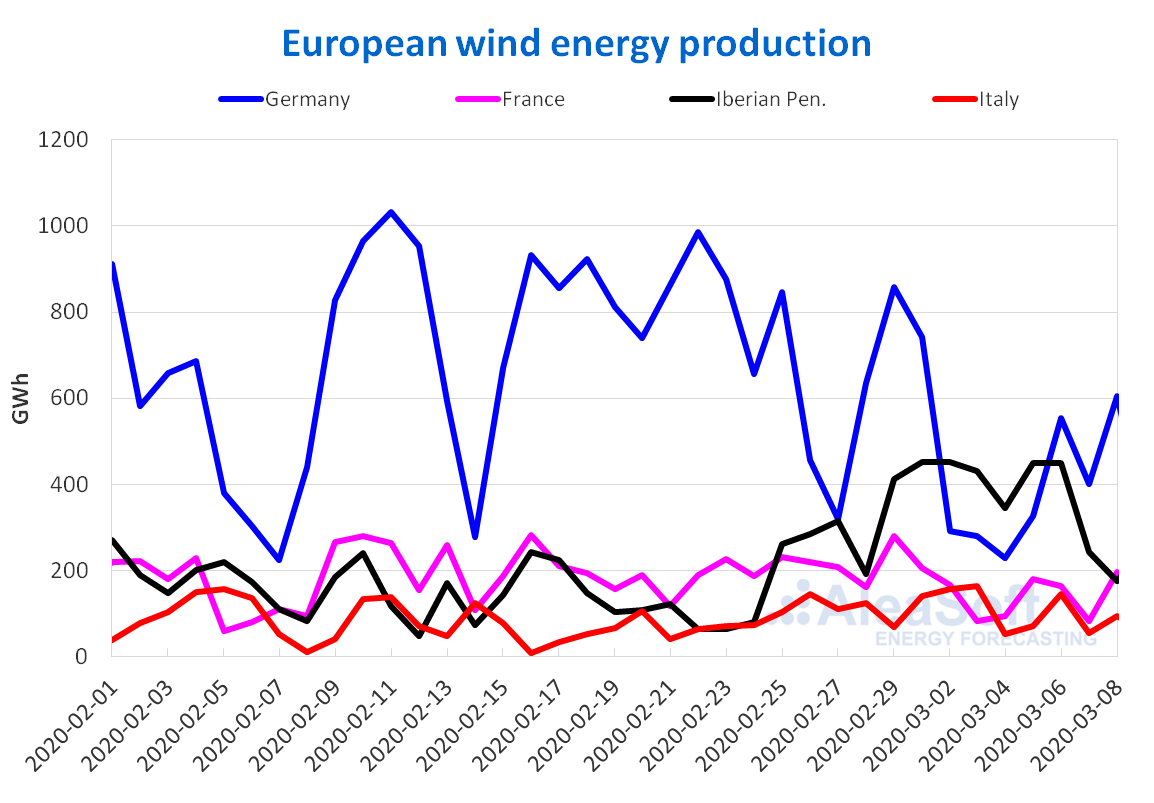

The arrival of the Karine storm in the Iberian Peninsula boosted the wind energy production last week, which ended up exceeding that of the previous week by 27%. In contrast, the production in Germany and France fell by 41% and 36% respectively, while in Italy the variation was much smaller, ‑3.4%.

For this week, at AleaSoft, a decrease in wind energy production in Portugal, Spain and Italy compared to last week is expected. On the contrary, the wind energy generation is expected to increase in France, and in Germany it will increase considerably during this week.

In the year‑on‑year analysis of the wind energy production, so far this month, the increase in production with this technology of 69% in the Iberian Peninsula and 47% in Italy stands out. While in Germany and France the declines are 34% and 17% respectively.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

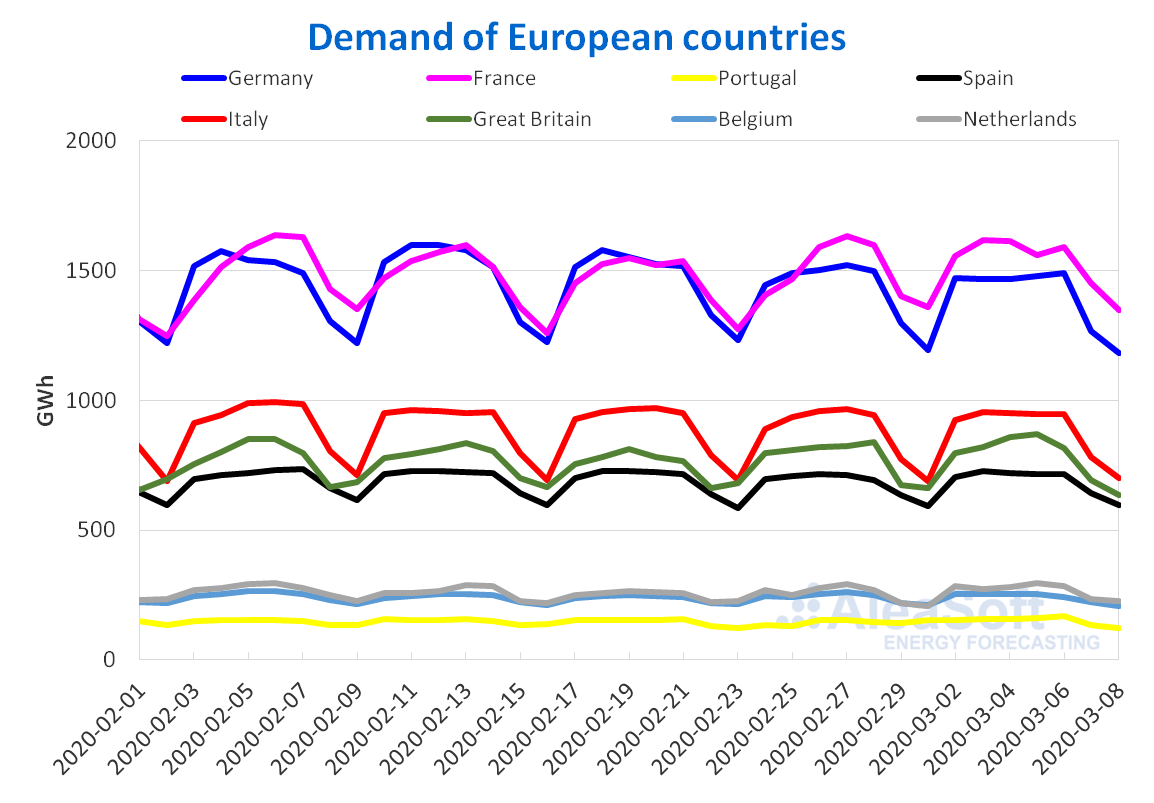

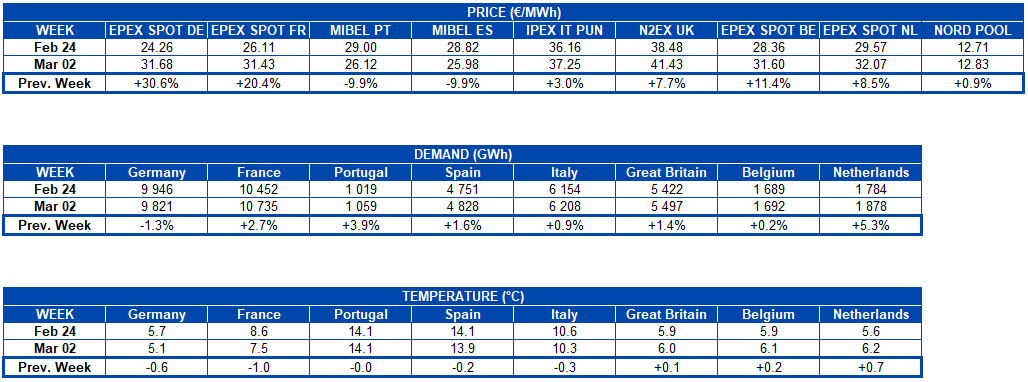

Last week the electricity demand was higher than the one registered during the week of February 24 in most European markets. The increases ranged from 0.2% to 5.3%. The exception was the German market that registered a decrease of 1.3%. For this week, at AleaSoft, a decrease in demand in most of the analysed markets is expected.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

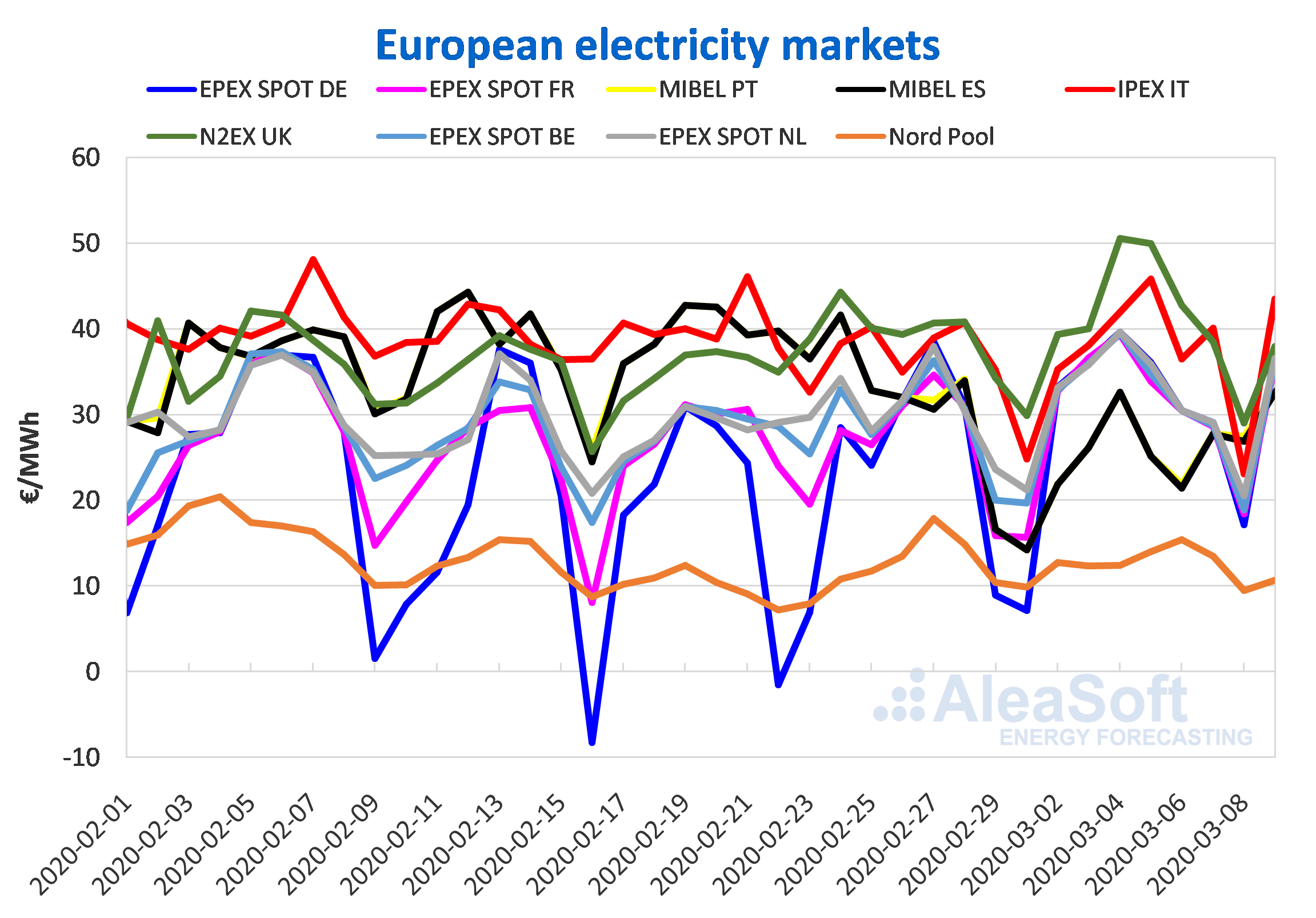

The week of March 2 the average prices of most of the European markets analysed by AleaSoft were higher than those of the week of February 24. The largest increases were registered in the EPEX SPOT market of Germany and France, where the average prices of the week for each market increased by 31% and 20% compared to the previous week. In the EPEX SPOT markets of Belgium and the Netherlands the increases were 11% and 8.5%. Despite these very different increases among all EPEX SPOT markets, the prices were fairly coupled throughout the week and until this Monday, March 9.

The N2EX market of Great Britain and the IPEX market of Italy averaged the highest prices of last week, with increases of 7.7% and 3.0% respectively. The British market remained with the highest prices for most of the week, being replaced by the Italian market this Saturday, March 7. Meanwhile, the Nord Pool market of the Nordic countries was the one with the lowest price during the whole week and the one with the lowest increase compared to the previous week, of 0.9%, with daily prices above €9/MWh and below €16/MWh.

This increase in prices is mainly due to lower wind and solar energy production in most markets during the past week compared to the week of February 24, together with an increase in electricity demand due to colder temperatures in most of the European continent.

On the other hand, the MIBEL market of Spain and Portugal was the exception last week, as the prices decreased by 9.9% in both markets due to the high wind energy generation that was registered during that period, breaking a production record with this technology in the Spanish territory so far this year. The prices of these markets for most of last week remained below €30/MWh and positioned themselves as the second and the third markets with the lowest prices, behind the Nord Pool market.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

For this Monday, March 9, the prices increased in most markets compared to Monday, March 2. The British market and that of the Nordic countries were the exception, where the prices fell 3.4% and 16% respectively, remaining the market of the Nordic countries as the one with the lowest prices on the continent by averaging €10.65/MWh. The EPEX SPOT markets continued to be quite coupled for this day with variations of between 9.6% and 12% and prices close to €36/MWh. The Iberian market, with a daily average price of €32.52/MWh, was the one with the greatest variation, of almost 50%, but despite this increase it was positioned again as the second market with the lowest prices behind the Nord Pool for this day. On the other hand, the Italian market, with an increase of 23% and a daily price of €43.46/MWh, recovers its position as the market with the highest price, after having been replaced this Sunday, March 8, and most of last week by the N2EX market.

In general, at AleaSoft, the markets of the European continent are expected to be more decoupled during this week. In the EPEX SPOT markets of Germany, France and the Netherlands and the N2EX market, the prices will fall, with the decline in the German market being the most significant due to the expected high wind energy production, while the Belgian market will remain with prices similar to those registered last week. On the other hand, in the MIBEL market of Spain and Portugal and the IPEX market of Italy, the prices are expected to increase as a result of a lower wind energy generation in these territories.

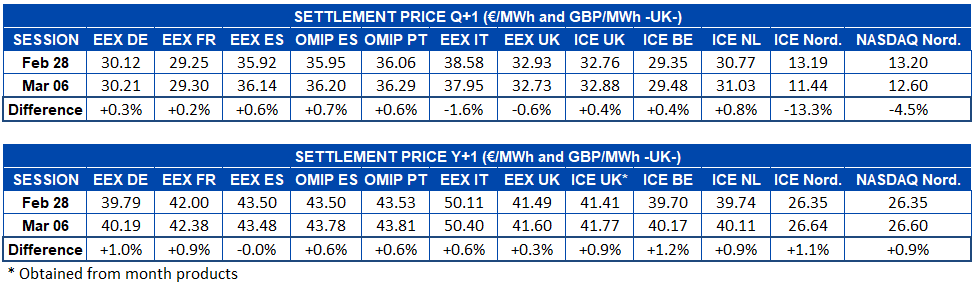

Electricity futures

The European electricity futures prices for the second quarter behaved heterogeneously in the different markets. However, the changes were most noticeable in those markets where the net balance between the settlements of the last two weeks is negative. In the EEX market there were increases in the futures of almost all the analysed countries by AleaSoft, between 0.2% and 0.7%. The exceptions were Italy and Great Britain, which at the end of last week, on March 6 marked a decrease of 1.6% and 0.6% compared to the previous week respectively. The fall of the ICE market of the Nordic countries stands out, which settling last Friday at €11.44/MWh registered a 13% drop compared to the settlement price of Friday, February 28. In general, the Nordic region led the declines once again, since in the NASDAQ market the price also decreased, although to a lesser extent, 4.5% in this case.

On the other hand, the prices for the product of the 2021 calendar year showed an almost general increase in the analysed markets. The price between the settlements of the weeks in the EEX market of Spain fell, which with a variation of only €0.02/MWh is the only market that reduced its price for this product. Even in the same country, in the OMIP market of Spain and Portugal, there were increases of 0.6%. The largest percentage increase in the price was registered by the Belgian ICE market, of 1.2%.

Brent, fuels and CO2

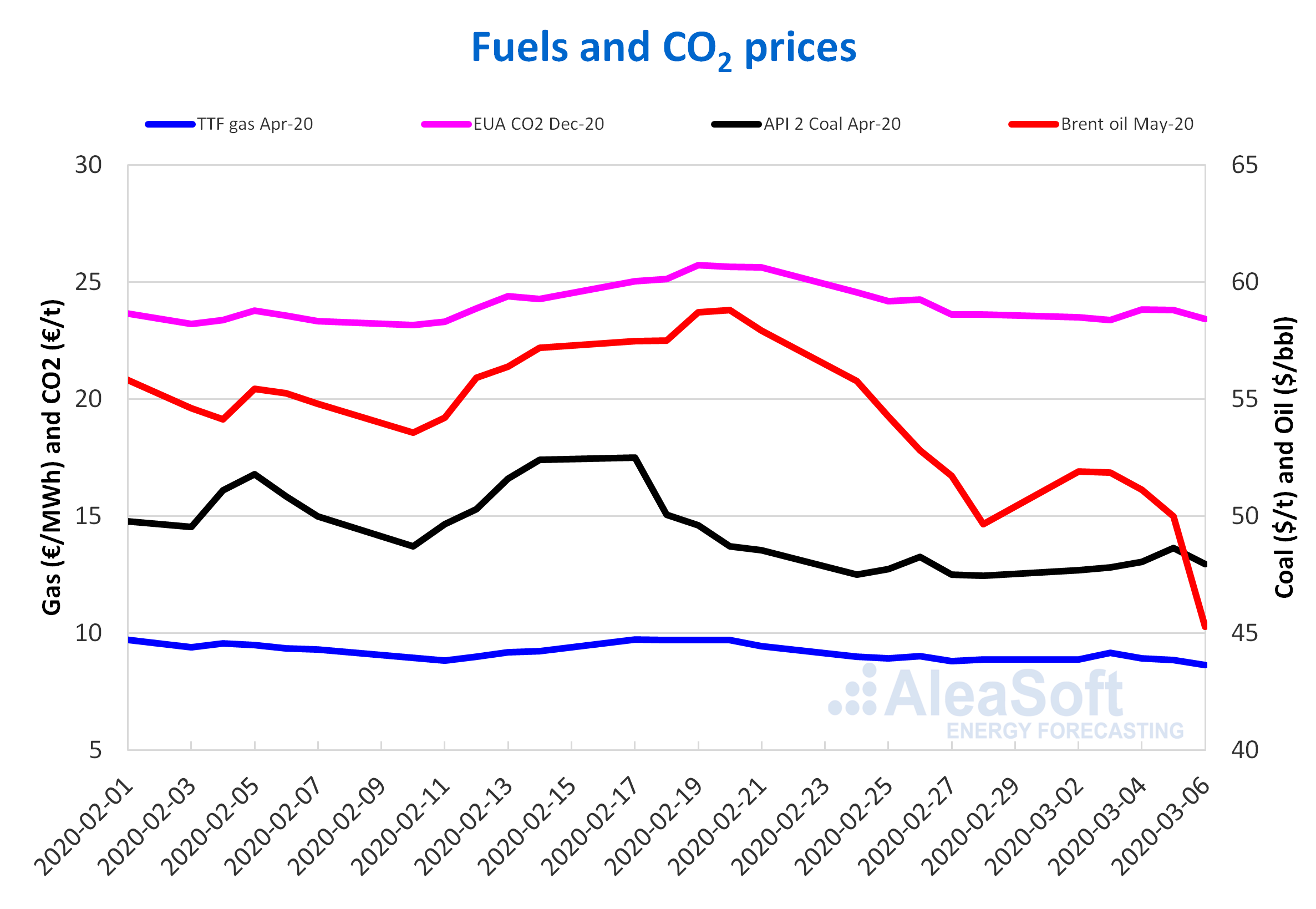

The Brent oil futures prices for the month of May 2020 in the ICE market, on Monday, March 2, registered a settlement price of $51.90/bbl, 4.5% higher than that of the previous Friday. However, the rest of the week the prices followed a downward trend that became more pronounced towards the end of the week, registering a 9.4% decrease compared to the previous day on Friday, March 6. Thus, the settlement price of that day was $45.27/bbl. This value is 8.9% lower than that of the Friday of the previous week and the lowest of the last two years. In the session of March 9 there was a significant decline. The prices were below $38/bbl and the prices were even registered around $31/bbl. There were no such low values in Brent prices since March 2016.

The expectations generated by the OPEC+ meeting allowed a price recovery at the beginning of last week. However, Russia’s refusal of new production cuts caused the price drop of Friday. In response to Russia’s decision, Saudi Arabia announced price declines, especially for its European customers, as well as, as of April, it will significantly increase its production, which caused the price drop of today 9 March. To this is added the decline in demand associated with the expansion of the coronavirus worldwide, so that in the coming days the prices may continue to fall.

The TTF gas futures prices in the ICE market for the month of April 2020 during the first days of last week continued with the increases started last Friday, reaching the maximum settlement price of the week, of €9.17/MWh, on Tuesday, March 3. Subsequently, they fell again and on Friday, March 6, a settlement price of €8.65/MWh was registered, which was 2.6% lower than that of Friday, February 28, and the lowest of the last two years.

Regarding the TTF gas prices in the spot market, they started last week with increases, reaching the maximum index price of the week of €9.39/MWh on Wednesday, March 4. On Thursday, the prices began to decline and, upon reaching the weekend, the index price was €8.94/MWh, practically the same as that of the previous weekend, of €8.95/MWh. Today the price recovered slightly to €8.98/MWh. In October of last year, low prices such as these were already registered and, subsequently, they increased to around €16/MWh at the end of November of that year. Before that date, it is necessary to go back to December 2009 to find values as low as these.

On the other hand, the API 2 coal futures prices in the ICE market for the month of April 2020, after reaching the lowest settlement price of the last two years of $47.45/t on Friday, February 28, during most of last week they registered slight increases. The maximum settlement price of the week was that of Thursday, March 5, of $48.65/t, 2.4% higher than that of the previous Thursday. But on Friday the price fell to $47.95/t.

The evolution of the Brent oil futures prices influenced the behaviour of those of gas and coal, especially in the last days of last week.

As for the settlement prices of the CO2 emission rights futures in the EEX market for the December 2020 reference contract, last week they ranged between €23.38/t of Tuesday, March 3, and €23.83/t of Wednesday, March 4, with daily variations below 2%.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: AleaSoft Energy Forecasting