AleaSoft, June 30, 2021. Gas and Brent prices are registering an upward trend that led gas to record highs and Brent to values that were not reached since October 2018. Futures points that high prices will remain in the coming months, somewhat which, if it materialises, will have negative consequences for the recovery of the economy and will continue to lead to price rises in the European electricity markets and therefore affect large and electro‑intensive consumers.

The rise in gas and CO2 emission rights prices are the main causes of the increase in prices in the European electricity markets. A few days ago from AleaSoft it was commented that Europe must intervene in the CO2 market to regulate its prices and achieve a balance between the development of renewable energies and the competitiveness of large and electro‑intensive consumers.

What is happening with gas?

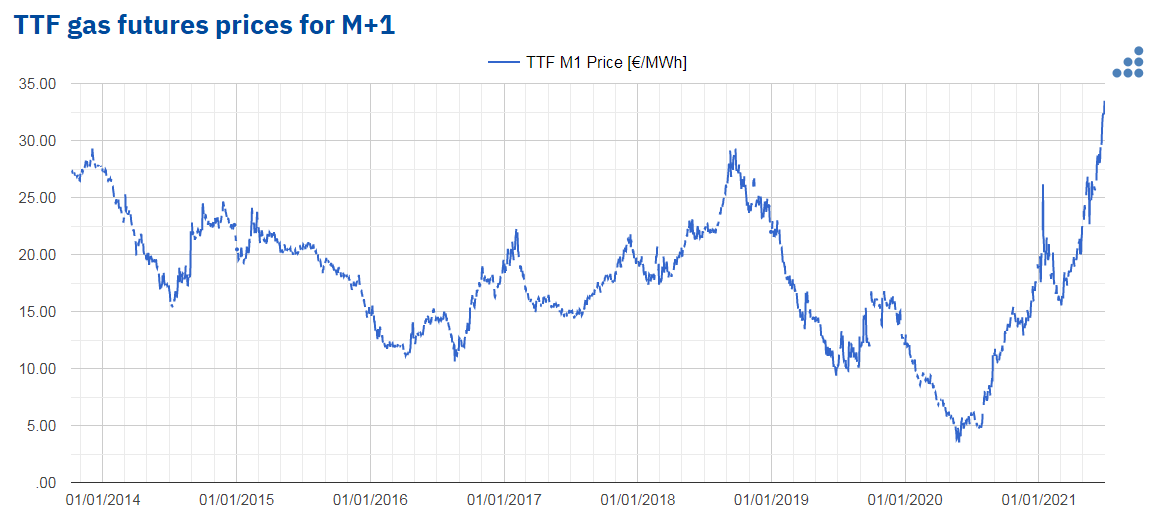

Currently, TTF gas prices are at historical highs, with values above €33/MWh. The futures for the month M+1 in the ICE market had never reached these price levels, at least since October 2013. Something similar happens in the spot market. At least since October 2008 these values had not been exceeded, except in some specific situations of very high prices.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from ICE.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from ICE.

Gas reserves decreased during the winter, which was especially cold in Asia, and gas demand rose, with a big boost from China that is increasing the use of this fuel to boost the economy and reduce the use of more polluting fossil fuels. Another factor that increased the gas demand is the high coal prices, which are at the highest in the last ten years, so that more gas is being used in the electricity generation. However, the supply is insufficient to meet the demand and recover the reserves, which is pushing prices up. If the summer is very hot and the next winter is very cold, the situation will worsen even more.

Futures points that prices might be at these levels and even higher until the first quarter of 2022.

What is happening with Brent oil?

The Brent oil futures prices for the month M+2 in the ICE market, although not at historical highs, are registering values that were not seen since the end of October 2018, above $74/bbl, and even exceeded $76/bbl on June 25.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from ICE.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from ICE.

The optimism about the recovery of the economy caused by the rate of vaccination against COVID‑19, mainly in Europe and the United States, was one of the drivers of the rise in prices in this market. In addition, the OPEC+ was controlling the oil supply to stimulate prices to recover after the lows registered at the beginning of the pandemic.

The OPEC+ meets on July 1 and it is expected to limit the cuts they are making to the production to avoid supply shortages and guarantee affordable energy prices that favour the global recovery of the economy.

According to the futures, a barrel of Brent will continue above 70 dollars during the next few months but with a tendency to recover the breakeven point around 60 dollars.

Complicated situation if the upward trend in gas and Brent prices continues

If this situation of rising gas and Brent oil prices continues, the European electricity markets prices will continue to rise, which would put large and electro‑intensive consumers, which would see their competitiveness affected by the increase in their production costs, in a very critical situation.

But it may also endanger the recovery of the economy, especially in countries that have not yet been able to control the pandemic and that are in the midst of an economic crisis from which there is no way out. If fuel prices do not fall and regain their balance, these countries would be in a very difficult position, but it would also bring negative consequences for the recovery of the global economy.

AleaSoft’s analysis on the prospects for the energy markets in Europe

Taking into account the rise in gas and CO2 prices, AleaSoft launched a special promotion of the long‑term price forecasting reports for the European electricity markets. These forecasts have a 30‑year horizon and hourly detail, include the annual confidence bands and the prices captured by the renewable energy technologies. The following graph shows an example of a long‑term price forecast for the Iberian MIBEL market carried out by AleaSoft in October 2010, which is an example of the coherence and stability of the forecasts based on scientific principles and that take into account the market balance.

Source: Long term price forecast made by AleaSoft in October 2010. The forecast shows monthly data from November 2010 to June 2021

A promotion of the short- and mid‑term European electricity markets forecasts is also available, which are useful, for example, in the operation of wind and photovoltaic energy parks and in the energy management by retailers, large consumers, utilities and traders.

On July 15, the next monthly AleaSoft’s webinar will be held, in which the analysis of the evolution of the energy markets during the first half of 2021 and the prospects for the second half of the year will be carried out. The AleaSoft‘s vision of the future on the role that green hydrogen will have in the energy transition, especially in the decarbonisation of industry and transport, will also be discussed.

Source: AleaSoft Energy Forecasting.