AleaSoft, July 2, 2020. On the first day of July, the settlement price of the CO2 futures for December 2020 was €27.71/t. Since the first half of August 2019, such a high price was not reached. During the first days of the week of the end of June and the beginning of July, the prices in most European electricity markets fell thanks to the increase in wind energy production. However, in southern European countries and in France, the prices rose mainly due to the increase in demand.

Photovoltaic and solar thermal energy production and wind energy production

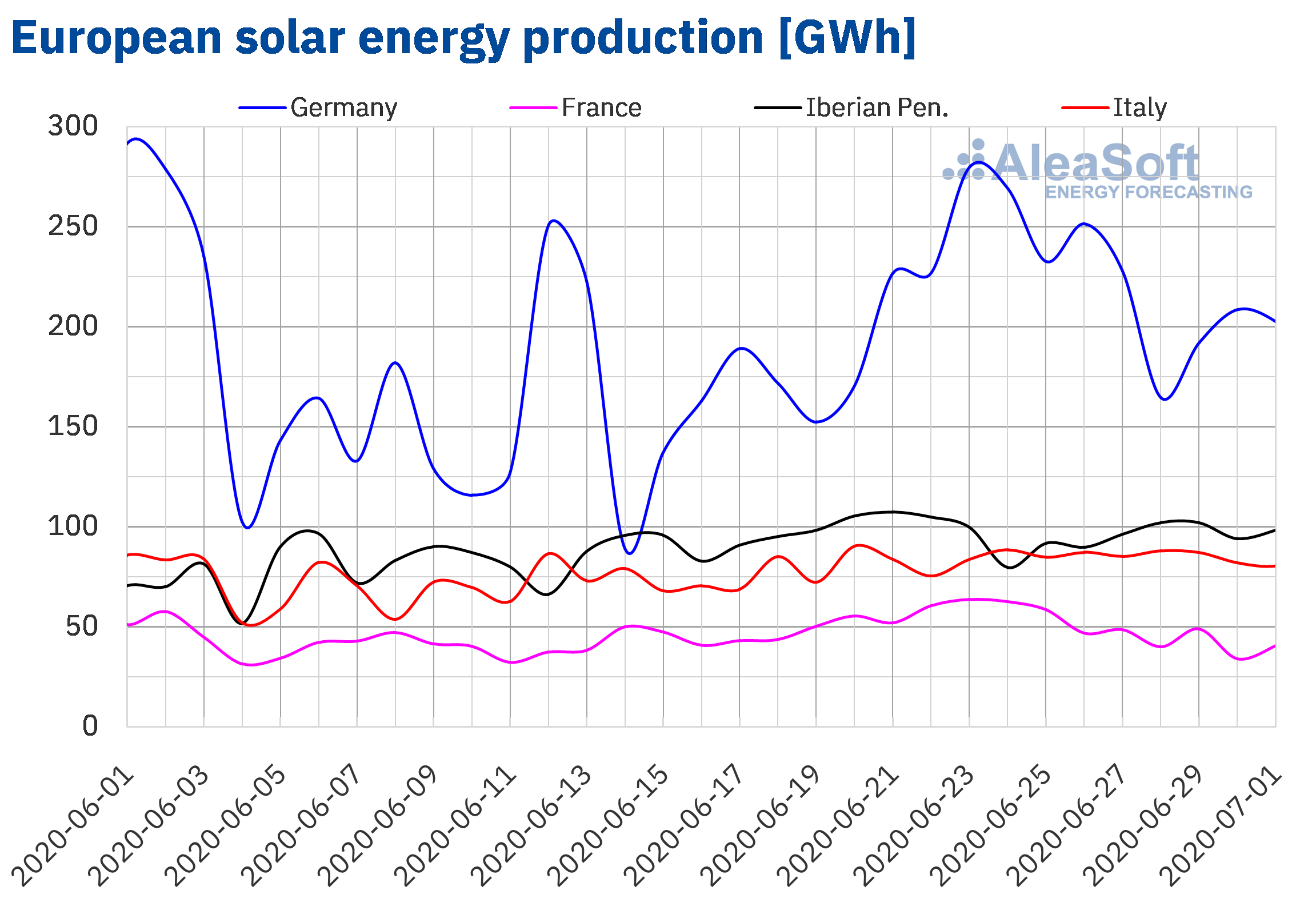

The solar energy production in France, Germany and Italy decreased between last Monday, June 29, and Wednesday, July 1, compared to the average of the previous week. In the French market it decreased by 24%, while in the German and Italian markets it decreased by 15% and 1.7% respectively. On the contrary, in the Iberian Peninsula it increased by 3.4%.

For this week, the analysis carried out at AleaSoft indicates that the production will decrease in most markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

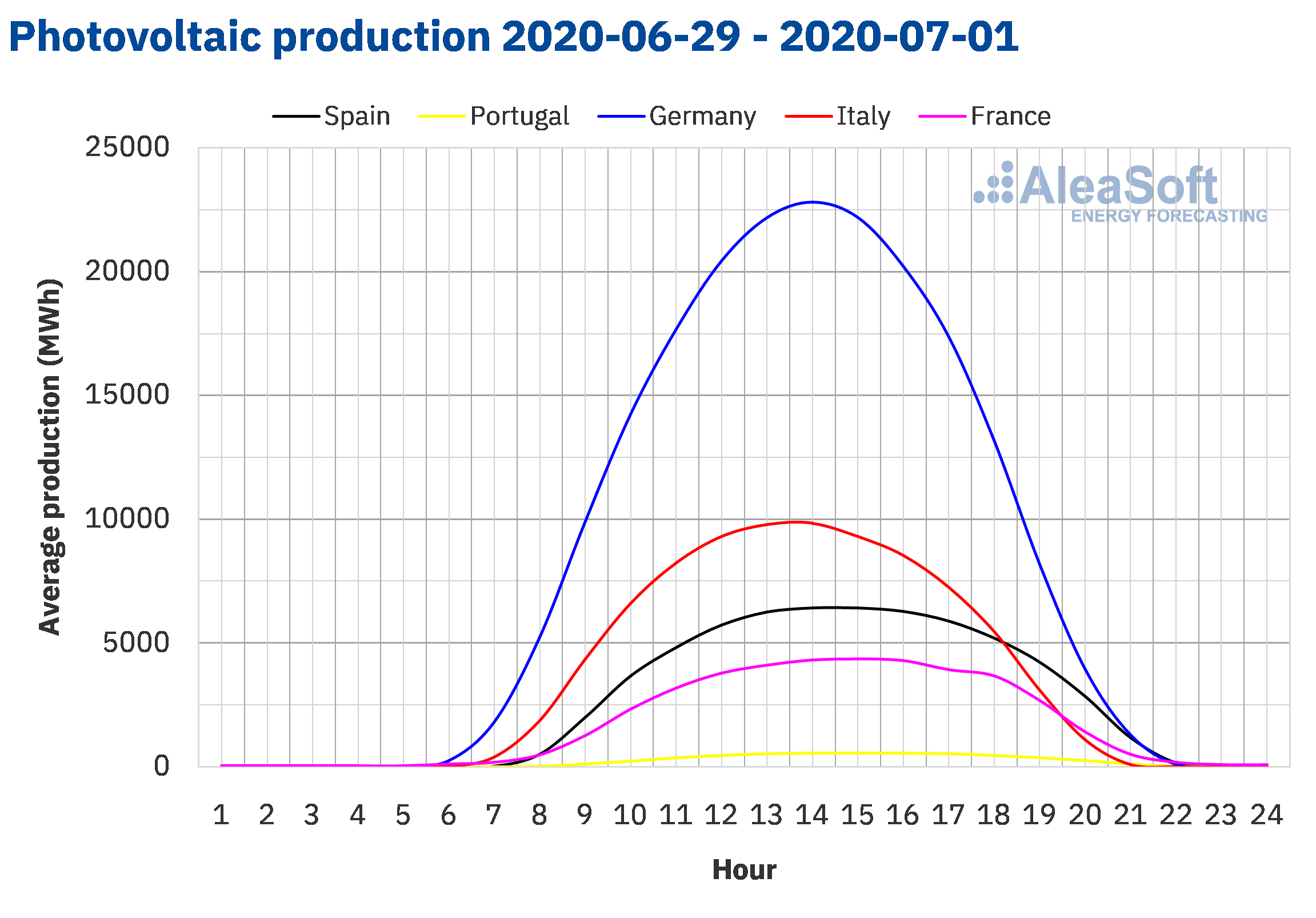

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

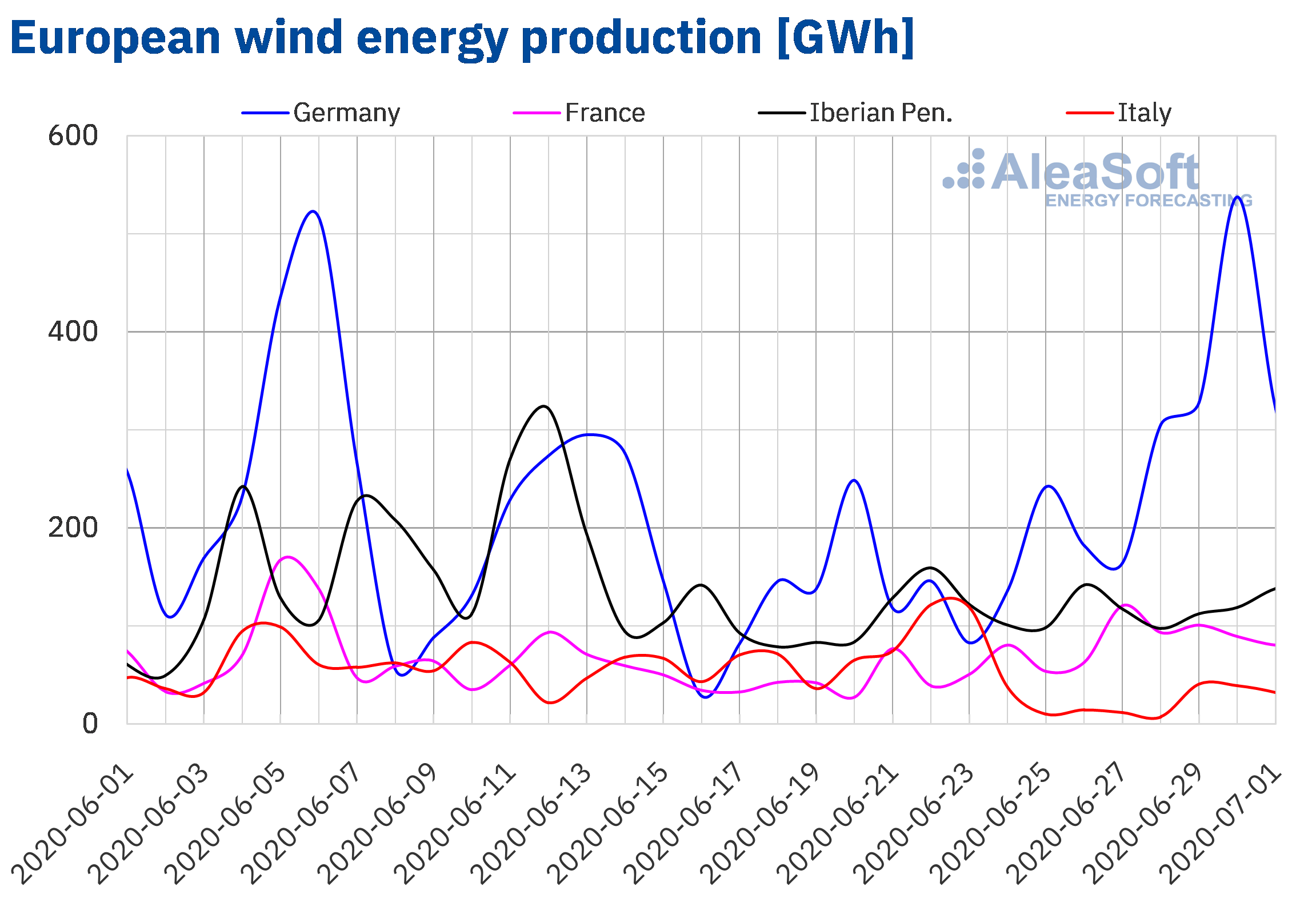

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

The average wind energy production between Monday and Wednesday of the week of June 29 increased compared to the average of the previous week in Germany, France and the Iberian Peninsula. In the German market the average of these three days was 120% higher. In the case of the French market, the production increased by 26%, while in the Iberian Peninsula the increase was 3.2%. The exception was the Italian market, where there was a decrease in production of 19%.

For the end of the week, the AleaSoft’s analysis indicates that the total wind energy production will increase compared to the previous week in the main European markets, except in the Italian market.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

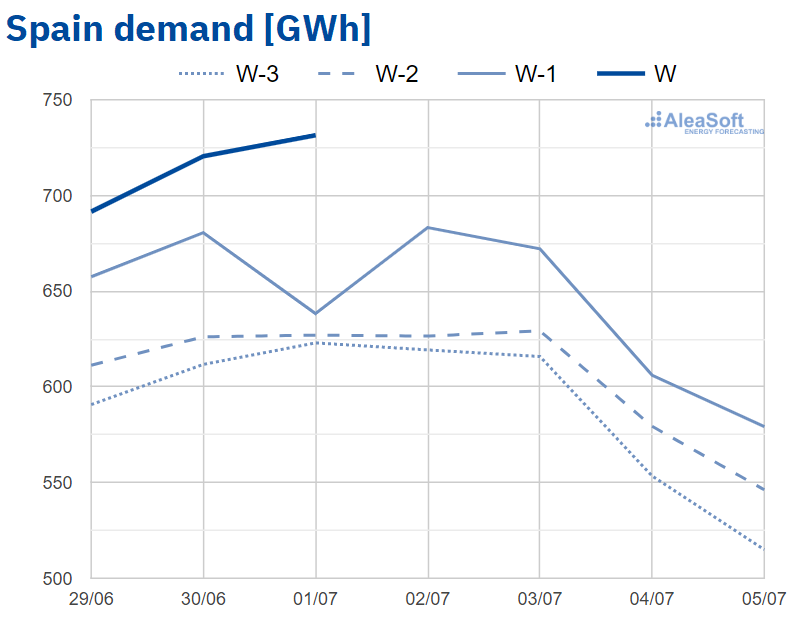

Electricity demand

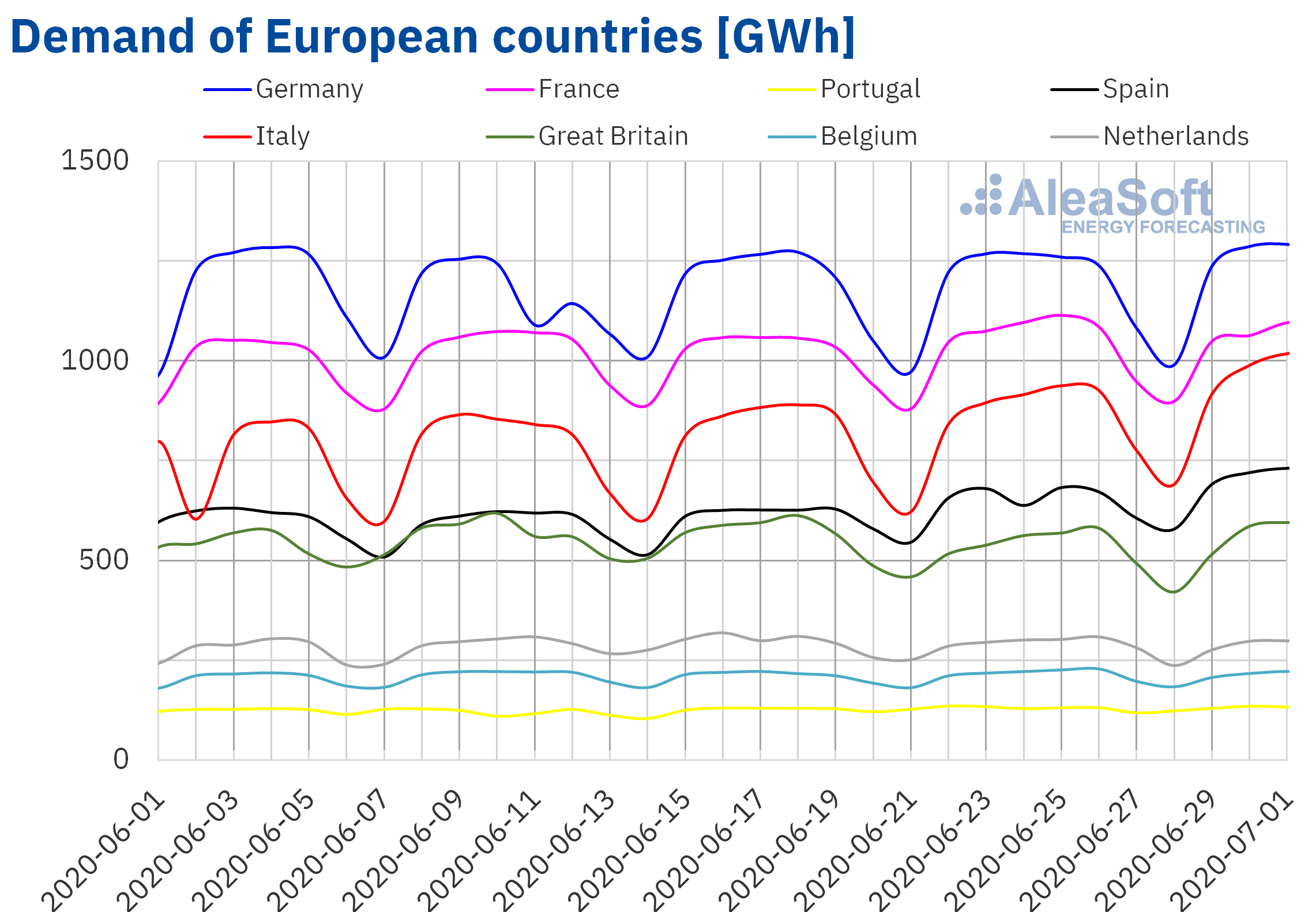

From Monday to Wednesday of the week of June 29, the electricity demand recovered in a large part of the European markets compared to the same period of the previous week. In the analysed markets where the demand fell, the variations were lower than 1%. As for the increases, some markets, such as those of Italy and Spain, registered variations of 10% and 8.5%, respectively. In these markets, this recovery in demand was due to increased activity in sectors that are returning to the new normality. In particular, in Spain the effect of the regional holiday of June 24 of the previous week also influenced. In Great Britain, the increase in demand was 4.8%. The lowest recovery at the beginning of this week was 1.5% registered in Germany.

It is possible to analyse the recovery of the demand in Italy from the AleaSoft‘s observatory of the Italian market, which also has other variables of the electricity market.

The AleaSoft’s electricity demand forecasting indicates that in the week of June 29, the demand will maintain the upward trend in the countries that had increases in the first half of the week.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

During the first 3 days of the week of June 29, the electricity demand of Mainland Spain increased by 8.5% compared to the same days of the fourth week of June. The influence of the increase in the activity of some sectors in the second week of the new normality, after the end of the State of Alarm, was one of the most influential factors. Another cause of this increase was the effect of the festivity of June 24 celebrated in Catalonia, the Valencian Community and Galicia. Taking into account the calculations carried out at AleaSoft, the increase was 6.2% once this effect was corrected. At the end of the week, the total demand is expected to be higher than that of the previous week, according to the forecasting carried out at AleaSoft.

Source: Prepared by AleaSoft using data from REE.

Source: Prepared by AleaSoft using data from REE.

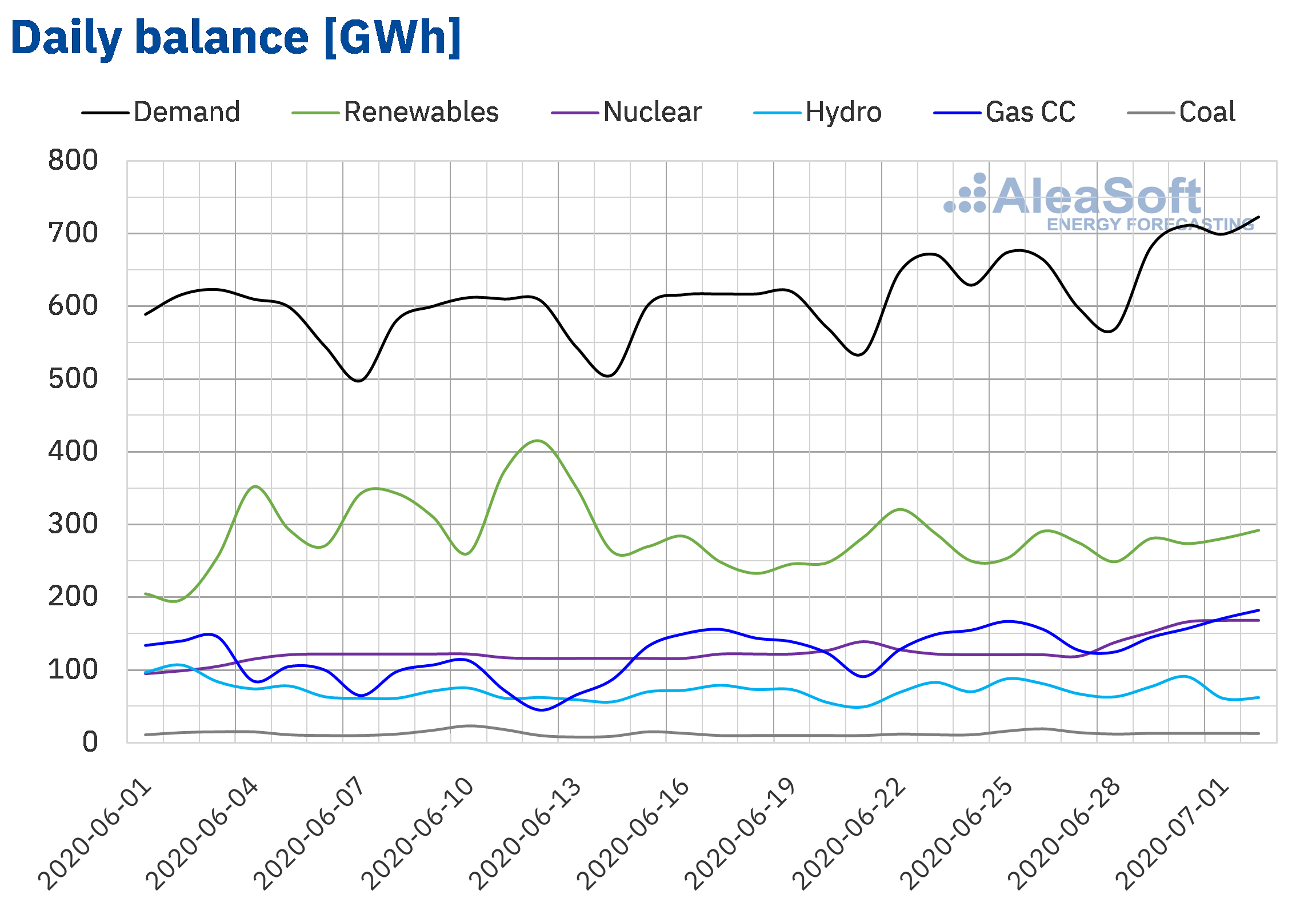

During the first three days of the week of June 29, the average solar energy production of Mainland Spain, which includes the photovoltaic and solar thermal technologies, increased by 3.1% compared to the average of the previous week. For this week, the analysis carried out at AleaSoft indicates that the production with these technologies will decrease compared to the total registered last week.

The average level of the wind energy production in Mainland Spain during the first three days of the week increased by 5.3% compared to the average of the previous week. For the whole of the week, the analysis carried out at AleaSoft indicates that production with this technology will end up being higher than that registered the previous week.

The energy production with coal during the first three days of the week increased by 15% compared to the average of the same period of the previous week. At the end of June, the closure of eight coal‑fired power plants of Spain occurred, which represented 60% of the electricity generation capacity with this fuel.

The nuclear energy production between June 29 and July 1 increased by 31% compared to the average of the same days of the previous week. All the plants are currently in operation after the Trillo and Almaraz I plants began reconnecting to the electricity grid on June 20 and 21, respectively.

Sources: Prepared by AleaSoft using data from REE.

Sources: Prepared by AleaSoft using data from REE.

The hydroelectric reserves currently have 15 364 GWh stored, according to data from the last Hydrological Bulletin of the Ministry for the Ecological Transition and the Demographic Challenge, representing a decrease of 275 GWh compared to the previous bulletin.

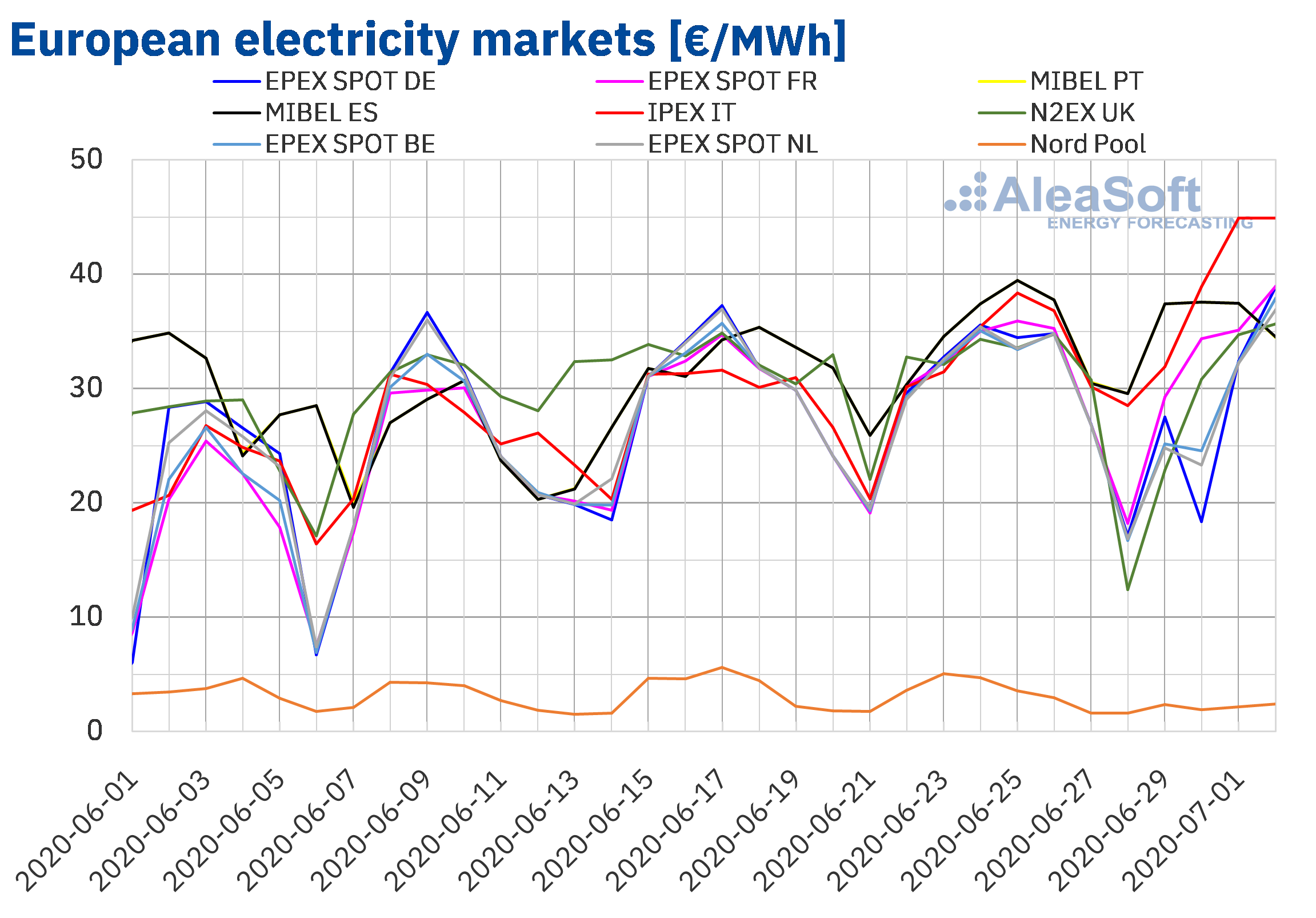

European electricity markets

During the first four days of the week of June 29, there were drops in the prices of most of the analysed electricity markets with respect to the same days of the week of June 22. In contrast, increases occurred in the EPEX SPOT market of France, the MIBEL market of Spain and Portugal and the IPEX market of Italy. The Italian market was the one with the greatest increase, with a variation of 19%, while in the other markets with increases, they were between 3.2% of the French market and 3.7% of the Spanish market. Regarding the decreases in prices, the Nord Pool market of the Nordic countries showed the greatest variation, with a drop of 48%. In the rest of the markets, the price declines were between 6.5% of the N2EX market of Great Britain and 11% of the EPEX SPOT market of Germany.

From Monday to Thursday of this week, the average prices were below €30/MWh in the EPEX SPOT markets of Germany, the Netherlands and Belgium, whose values were between €29.28/MWh and €29.98/MWh. The Nord Pool market of the Nordic countries was well below this level, with an average price of €2.20/MWh. The rest of the markets registered higher average prices, which were between €31.00/MWh of the N2EX market of Great Britain and €40.16/MWh of the IPEX market of Italy.

On the other hand, in the first four days of the week, the daily prices remained below €39/MWh in most of the analysed European electricity markets, but since Wednesday, July 1, they began to show an upward trend. Regarding this, prices close to €45/MWh were reached in the Italian market for the first two days of July, values that were not registered since the first week of March of this year.

The increase in wind energy production, mainly in the German market, caused the drop in prices in some markets. In the case of Spain and Italy, the electricity demand increased and this favoured the rise in prices. The registered increase in CO2 prices may also have helped to increase the prices of these markets.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The AleaSoft’s price forecasting indicates that at the end of the week the weekly average price will be lower than that of the week of June 15 in the markets of Germany, Belgium and the Netherlands. While, in the rest of the markets, the prices are expected to be higher, with the Italian market registering the most notable increase. On the contrary, for the first days of the next week of July 6, the prices are expected to increase compared to this week, since the decrease in renewable energy production expected in some markets may favour this trend.

Iberian market

In the MIBEL market of Spain and Portugal, the average price of the first four days of this week compared to the same days of the previous week increased by 3.7% and 3.6% respectively. In Spain, the recovery of the demand in the second week of the new normality, after the state of alarm due to the COVID‑19, allowed this rise in prices during the first days of the week despite the increases registered in renewable energy production. Another factor that may have favoured the increase in prices is the rise in CO2 prices in recent days.

The average price between Monday, June 29, and Thursday, July 2, was €36.73/MWh in the Spanish market and €36.72/MWh in Portuguese. After the Italian market, they were the second and third markets with the highest prices. During the first three days, the daily average prices remained above €37/MWh with a 100% convergence between the prices of both markets, but on Thursday, July 2, they fell to €34.43/MWh in the in the case of Portugal and €34.51/MWh in the case of Spain, unlike the rest of the markets where the trend was upward since the beginning of July. The highest daily price in this period was that of Tuesday, June 30, of €37.58/MWh in both cases.

The AleaSoft‘s price forecasting indicates that the average price at the end of the week will be similar to that of the week of June 22 in both markets. Likewise, the price for the first days of the next week of July 6 is expected to be below that registered between June 29 and July 2. The expected increase in wind energy production for the next few days in Spain will favour this behaviour.

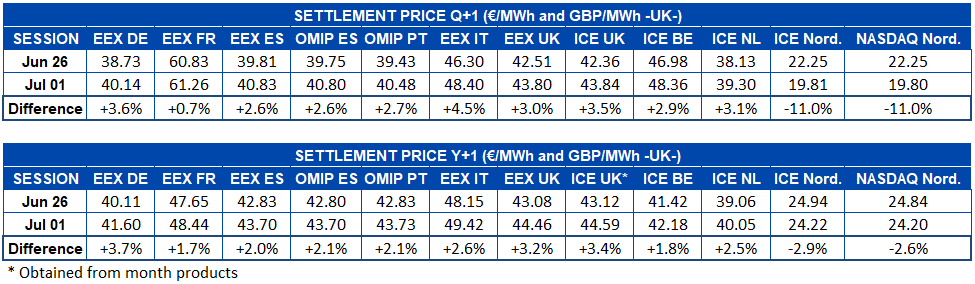

Electricity futures

The electricity futures prices for the last quarter of 2020 registered increases in most of the markets analysed at AleaSoft during the session of July 1 compared to that of Friday, June 26. The ICE and NASDAQ markets of the Nordic countries were the exception, registering drops of 11% in both cases. The EEX market of Italy was the one with the greatest increase in its prices, with a variation of 4.5%. On the other hand, the high prices at which this product is being traded on the EEX market of France, with values above €60/MWh, despite showing the smallest variation of 0.7%, are striking. The rest of the markets registered increases of between 2.6% and 3.6%.

In the case of the futures for the calendar year 2021, the prices behaved similar to the previous product. The price rose in most markets except those of the Nordic countries, whose prices fell in the ICE market by 2.9% and in the NASDAQ market by 2.6%. The market with the highest increase was the EEX in Germany with 3.7%. On the other hand, the one with the highest negotiated price was the IPEX market of Italy, with a value higher than €49/MWh. In this product, the rest of the markets presented variations of between 1.7% of the French market and 3.4% of the ICE market of Great Britain.

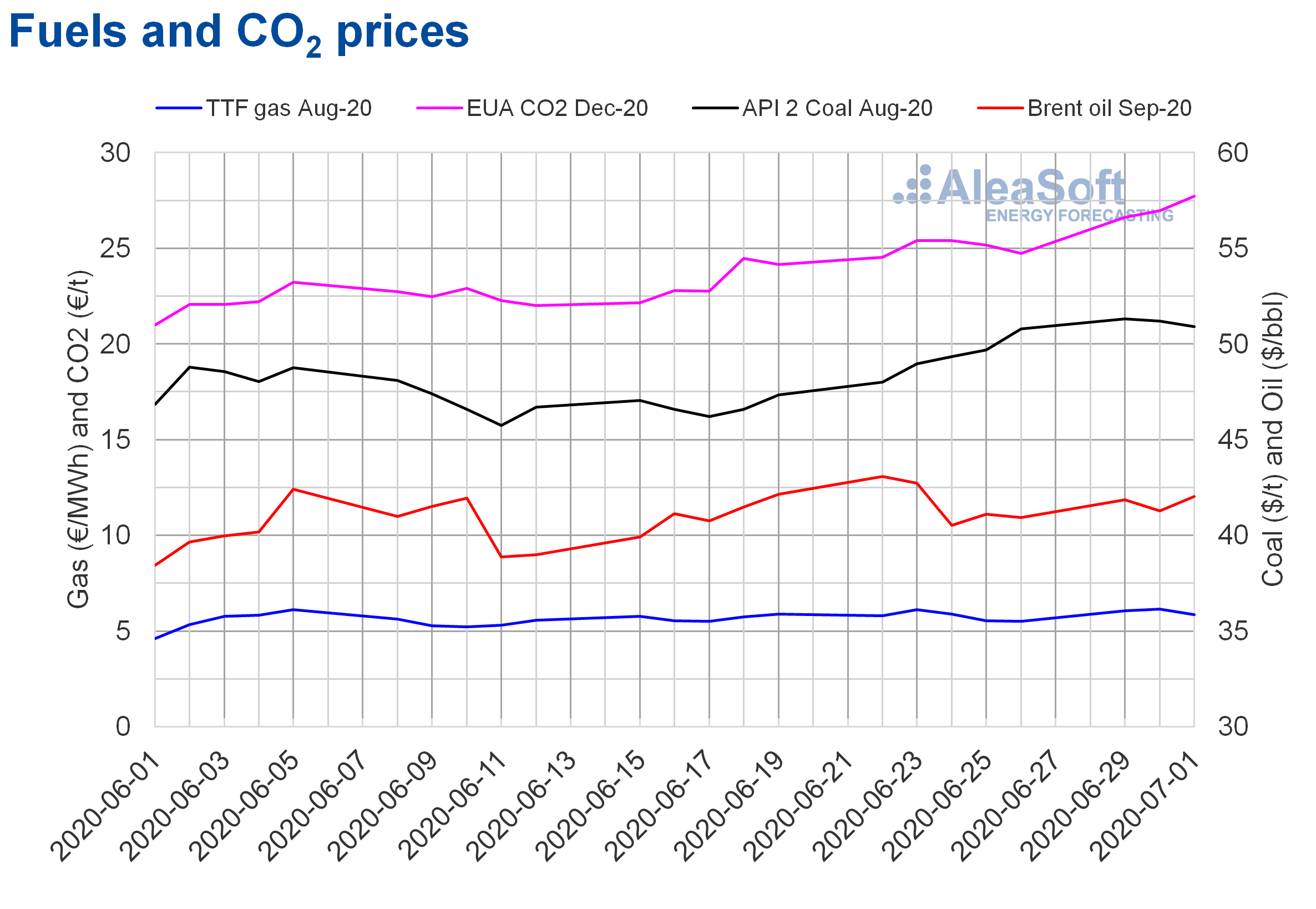

Brent, fuels and CO2

The Brent oil futures prices for the month of September 2020 in the ICE market, the first days of the week of June 29, continued with values above $40/bbl. But on Monday and Tuesday they registered settlement prices lower than those of the same days of the previous week. On the other hand, on Wednesday, July 1, a settlement price of $42.03/bbl was reached, 3.7% higher than that of Wednesday of the fourth week of June. This increase, of 1.8% compared to the previous day, is related to the publication on Wednesday of official data indicating that the United States’ crude oil reserves fell the previous week.

The lifting of the confinement measures imposed to prevent the spread of the coronavirus is allowing the recovery of the demand. This, together with the OPEC+ production cuts, favoured that the prices stayed above $40/bbl in the last two weeks.

However, the emergence of new cases of COVID‑19 raises the concerns about the possibility that new mobility restrictions may be required, causing further declines in demand. This situation may limit the recovery of the Brent oil futures prices.

Regarding the TTF gas futures prices in the ICE market for the month of August 2020, they started the week of June 29 with an upward trend. The first two days of the week, the prices were above €6/MWh. On Tuesday, June 30, the monthly maximum settlement price, of €6.16/MWh, was reached, which is the highest since the first half of May. But on Wednesday, July 1, the settlement price fell by 4.9% to €5.86/MWh.

Concerning the TTF gas prices in the spot market, at last weekend and on Monday of this week of June 29 were below €5/MWh. But, the first days of the week, the prices showed an upward trend and on Wednesday, July 1, the index price was €5.85/MWh, the highest since the end of April.

As for the API 2 coal futures in the ICE market for the month of August 2020, the first days of the week of June 29 reached settlement prices above $50/t. On Monday, a settlement price of $51.30/t was registered, 6.9% higher than that of Monday, June 22, and the highest since the end of March. But then the prices fell slightly to reach $50.90/t on Wednesday, July 1.

On the other hand, the CO2 emission rights futures prices in the EEX market for the reference contract of December 2020, the first days of the week of June 29, registered an upward trend, with values higher than €26/t. As a consequence of these increases, on Wednesday, July 1, a settlement price of €27.71/t was reached, 9.1% higher than that of Wednesday of the 4th week of June and the highest since the first half of August 2019.

The prospects for the economic recovery are favouring the price increases. In addition, the expected decrease in French nuclear energy production compared to July of previous years could favour an increase in production with fossil fuels, mainly gas, increasing the demand for CO2 emission rights. However, this will depend on the evolution of the electricity demand and the renewable energy production.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis on the effects on the electricity markets due to the coronavirus crisis

Since the beginning of the COVID‑19 pandemic, a series of webinars was organised at AleaSoft to analyse how the energy markets were influenced in this context. In addition, the evolution of the financing of the renewable energy projects in this period was analysed. In the Spanish version of the last webinar, which was held on June 25, the Royal Decree‑Law 23/2020 approved by the Spanish Government was also discussed, which includes measures in the field of the energy to reactivate the economy that represent a boost for the renewable energies.

All these topics will continue to be discussed and analysed in the next webinar “Energy markets in the recovery of the economic crisis”, which will take place on September 17. In addition to analysing the behaviour of the markets in recent months, the future prospects will be clarified taking into account the pessimistic forecasts for the economy and the risks of new outbreaks of the epidemic.

The AleaSoft’s observatories are another way to analyse the evolution of the European electricity, fuels and CO2 markets. They include updated information on the main market variables, which can be visualised using comparative charts of the last weeks.

Source: AleaSoft Energy Forecasting.