AleaSoft, October 27, 2020. Having a clear vision of the future of the electricity market and its prices is a key part of the financial model of any renewable energy project. In times like the current one, of uncertainty in the face of a global economic crisis, an incorrect vision of the future can put the energy transition and the fulfilment of the environmental objectives of greenhouse gas emissions reduction at risk.

For the companies, investors and professionals of the energy sector, the need to have forecasting of the electricity market is something that seems to have an obvious logic: the more precise the current knowledge about the future, the better decisions can be made that report greater benefits in the future. It also makes sense to think that the more “good” the forecasting is, the better, since the decisions will align better with what the future holds and the consequences of these decisions will be more consistent with the estimates made from them.

A small‑scale example, which can be illustrative of the role of good electricity market prices forecasting, is the estimation of the time required to recover the investment in a private self‑consumption facility. In a case like this, the recovery of the investment will be determined, among others, by the evolution of the electricity prices in the market. These prices will establish how much will be saved by not having to buy the electricity that is self‑produced, and even which compensation will be received in the event of producing surpluses. Many times, this evolution of the electricity market prices is done extremely simply, for example, starting from the current prices and applying a growth rate of 5%. The reasoning behind using this simple approximation is that for projects of this small size it does not make sense to use an accurate forecasting that takes into account the expected behaviour of the explanatory variables that influence the market prices.

Well, if instead of that simple extrapolation, an hourly forecasting of the prices in the long term, based on scientific, robust and coherent methodologies, is used, the difference in results in the estimation of the time necessary to recover the investment of that facility can vary over many years. Even if the project is a few kW, for an individual who has to make an investment of a few thousand Euros, it will not be the same to be able to recover the investment in 5 years than, for example, in 15 years.

The market prices forecasting for renewable energy projects

If this is the impact on a small self‑consumption project of a few thousand Euros, it is not difficult to see which the impact may be on a wind or photovoltaic energy project of hundreds of millions of Euros of investment. In this type of project, the long‑term market prices forecasting is a strategic input of the financial model that will have an impact on the estimation of the future cash‑flows, on the payment to the shareholders and on the repayment of the debt.

Another very important aspect of having solid forecasting is being able to correctly estimate the market prices risk to which the project will be exposed. This aspect will have a key impact on the financing conditions that the project can obtain.

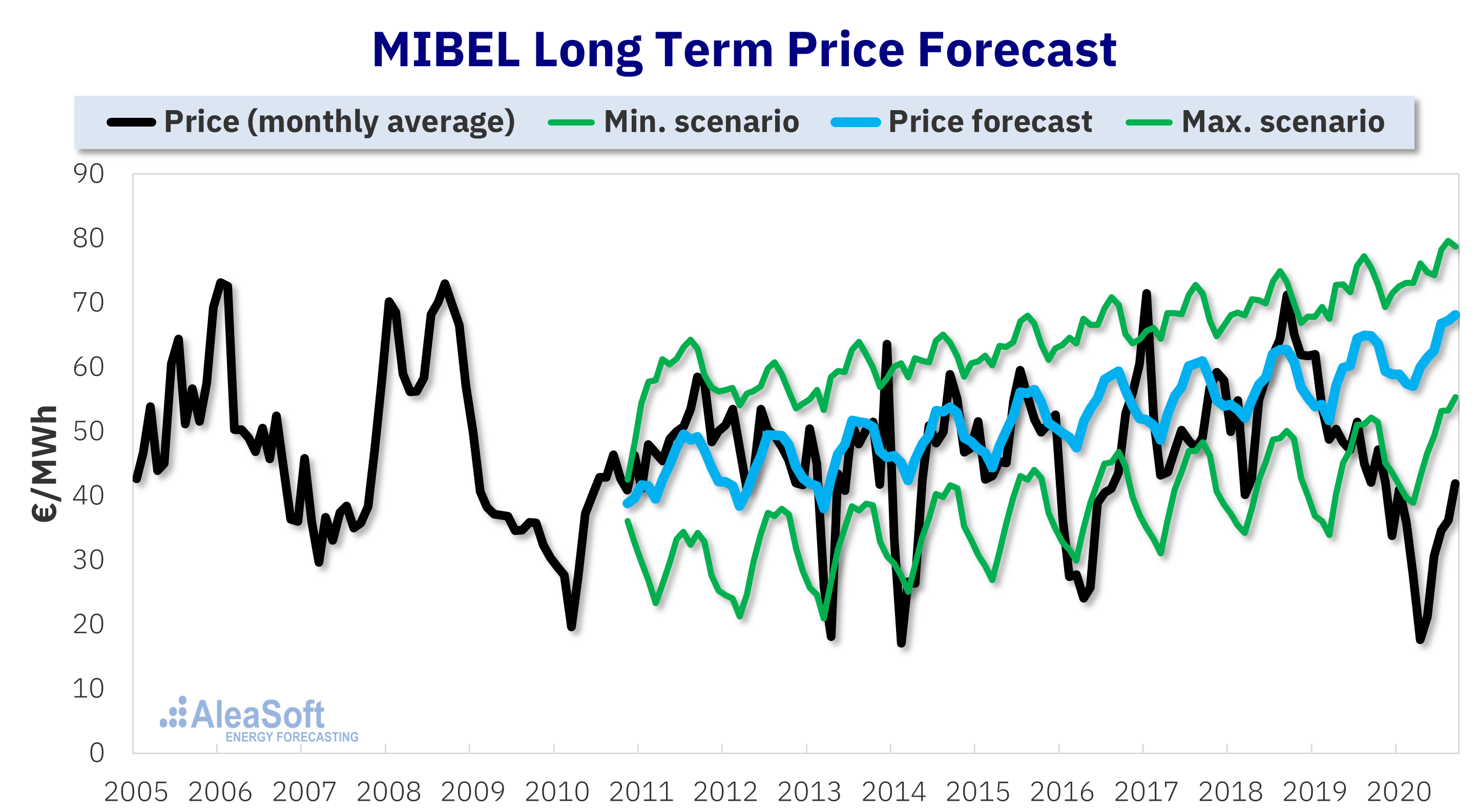

In the following graph it is possible to see a price forecasting for the Iberian electricity market MIBEL made at AleaSoft in October 2010, 10 years ago. The forecasting accurately projects the market balance price into the future and the confidence bands describe the price swings around it with a probabilistic metric.

In conclusion, accurate forecasting will make the valuations of the projects are more in line with what is expected to end up happening in the future. The more accurate the estimates, the less risk there is that the project will eventually end up being less profitable than expected. Now, more than at any other time, in a climate of uncertainty in the midst of the economic crisis and in a process of energy transition, these robust, scientific and, above all, coherent forecasts are going to be of paramount importance for the transition is economically sustainable.

Webinar of AleaSoft on Thursday, October 29, with the participation of Deloitte

The next webinar of AleaSoft will focus on these aspects of the prices forecasting in the long term, the needs of investment and financing of the renewable energy projects, the risks and the difficulty of preparing financial information. This webinar will be the second and last part of the series “Energy markets in the recovery from the economic crisis”, which will take place on October 29. This edition will feature the participation of two speakers from the consulting firm Deloitte, Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services and Carlos Milans del Bosch, Partner of Financial Advisory, as well as Oriol Saltó i Bauzà, Data Analysis and Modelling Manager at AleaSoft. As usual in these webinars, the evolution of the energy markets in Europe in this second wave of the COVID‑19 pandemic will also be reviewed.

Source: AleaSoft Energy Forecasting.