AleaSoft Energy Forecasting, September 21, 2021. The mechanism by which RDL 17/2021 will reduce the revenues of non‑emitting plants may ultimately jeopardise the entire energy transition. The explanatory note of the Ministry provides some air to the renewable energy plants with a signed PPA, but the RDL continues to be a torpedo to the waterline of legal and regulatory security in Spain that discourages the investment necessary to achieve the decarbonisation.

The, already famous despite its young age, Royal Decree‑Law 17/2021, of September 14, shook the electricity sector in Spain at a time when it was already very unsettled due to the extraordinary situation of astronomical prices in the gas and electricity markets. The consensus is quite broad among professionals of the sector when it comes to pointing out the reduction in excess remuneration of the electricity market as the most negative aspect in the RDL.

The objective of this remuneration reduction mechanism is reducing the income of those infra‑marginal and non‑emitting generation plants that have an “excess of remuneration” due to the increase in prices in the electricity market as a consequence of the increase in costs of the technologies that mark the marginal price due to the increases in gas and CO2 emission rights prices. All this, with the ultimate goal of reducing the electricity costs for the end consumer.

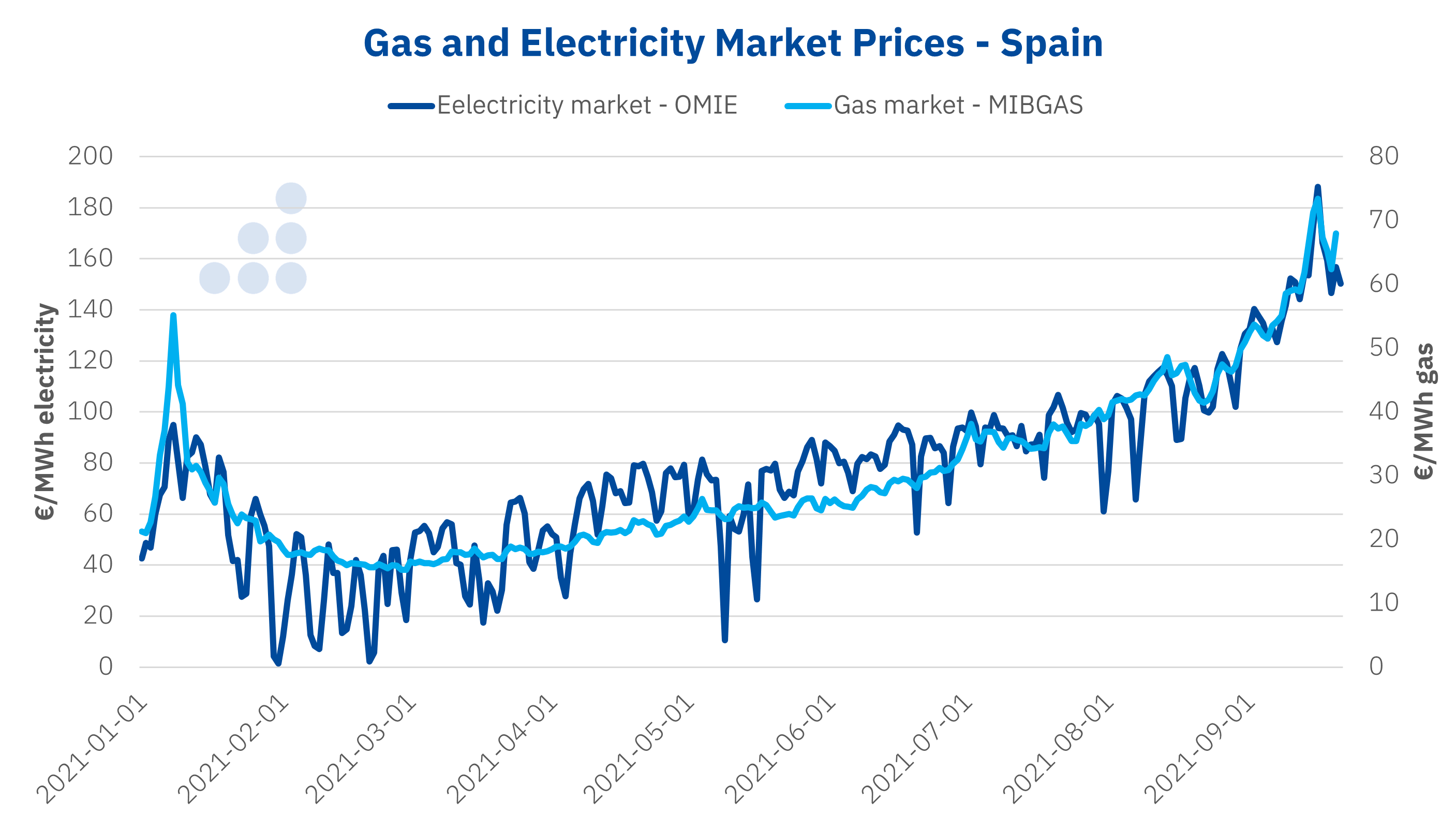

The RDL establishes that the excess remuneration will be determined on a monthly basis from the average price of gas in the Iberian market MIBGAS, when it exceeds €20/MWh, and from the number of hours in which the combined cycle gas turbine plants marked the marginal price of the electricity market. This remuneration reduction mechanism will be applicable until March 31, 2022.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE and MIBGAS.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE and MIBGAS.

The clarification of the Ministry for the Ecological Transition and Demographic Challenge

Such was the commotion and fear caused by the announcement and publication of the RDL, that the Ministry for the Ecological Transition and Demographic Challenge did not take five days to publish a clarifying note on which facilities and what energy will be subject to this remuneration reduction. The Ministry’s note still leaves many open ambiguities, but it clarifies one of the points that created the most astonishment in the sector.

According to the note, which is a response to a query from the system operator and which the Ministry undertakes to include in the BOE shortly, the energy exchanged under a PPA contract, a bilateral contract or a term coverage will not be subject to the remuneration reduction provided that it is at a fixed price, is not indexed to the pool price and was signed before the publication of the RDL. And, without this assumption, many plants with a signed PPA, most of them of renewable energy, could find themselves in the unusual situation of having to produce at a loss, paying to produce the energy committed in the contract.

The answer also makes it clear that, if the bilateral contract is between producing and consuming or retailing companies of the same business group, this energy will be subject to the reduction.

The complex reality of the electricity system

The electricity system is very complex and the generated and consumed electricity is considerably more than that exchanged on the spot market. A large part of the electricity affected by the reduction in income that will be produced and consumed until March 31, 2022, is already committed to bilateral contracts, PPA, supply contracts or futures. Many of these contracts involve large companies vertically integrated with generation and commercialisation and that, ultimately, may have to pay to generate.

If, as it seems, the reduction in the excess remuneration of the RDL ends up affecting these companies, the consequences can be very negative. The Kingdom of Spain is exposed to a legal problem with massive long‑term litigation. Beyond the economic and resource cost that this may entail, perhaps the worst consequence will be the loss of confidence on the part of investors.

Investors in renewable energy projects need long‑term legal and regulatory stability. A rule change of this magnitude, which also means less income for new renewable energy plants, is a very bad sign for investors who will see greater risk for their investments and higher financing costs coupled with a decrease in expected income. The perfect cocktail for an investor to rethink.

Long‑term consequences

This situation of lower investment will end up bringing higher prices in the future, due to the lower installed capacity to produce and the fact that affected infra‑marginal generators stop producing to avoid losses.

In addition, large vertically integrated companies, renewable wind and photovoltaic energy companies, investment funds and banks are the main allies of the State to meet the long‑term strategic objectives. These goals include the reduction of greenhouse gas emissions by 2030 and 2050 and the achievement of the energy independence to become net exporters of renewable electricity and green hydrogen.

Spain has two assets for the energy transition. On the one hand, there is the solar and wind energy resource. This will always be there, but investment is needed to take advantage of it. And, on the other hand, there is the regulatory and legal security, essential for the investment that is needed to be attractive. Long‑term security is what investors look for and they are necessary to achieve the desired decarbonisation in the next thirty years.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

The impact of these measures on the prospects for electricity markets is a controversial and highly uncertain issue. This potential impact will be addressed in the next webinar organised at AleaSoft Energy Forecasting for October 7. This webinar is part of the series of monthly webinars, which with this edition launches a new course, where AleaSoft Energy Forecasting, together with the most important companies in the energy sector in Europe, analyse the energy markets, their evolution and long‑term prospects.

On this occasion, there will be the participation of two speakers from the consulting firm Deloitte. This webinar will take place almost a year after the webinar held in October 2020 with the same speakers. At this year’s meeting, there will be an update on the topics discussed on that occasion, relating to the evolution of the European energy markets in the last year, the renewable energy projects financing and the importance of the forecasting in audits and portfolio valuation.

Source: AleaSoft Energy Forecasting.