AleaSoft Energy Forecasting, September 29, 2025. In the fourth week of September, weekly prices rose in most major European electricity markets, with almost all surpassing €60/MWh. The arrival of autumn brought cooler temperatures that drove up demand in many markets, in addition to a decline in photovoltaic energy production. Wind energy generation also fell in several markets. In contrast, wind energy production increased in the Iberian Peninsula, and demand declined in Spain, Portugal and Italy, which led to price decreases in these markets.

Solar photovoltaic and wind energy production

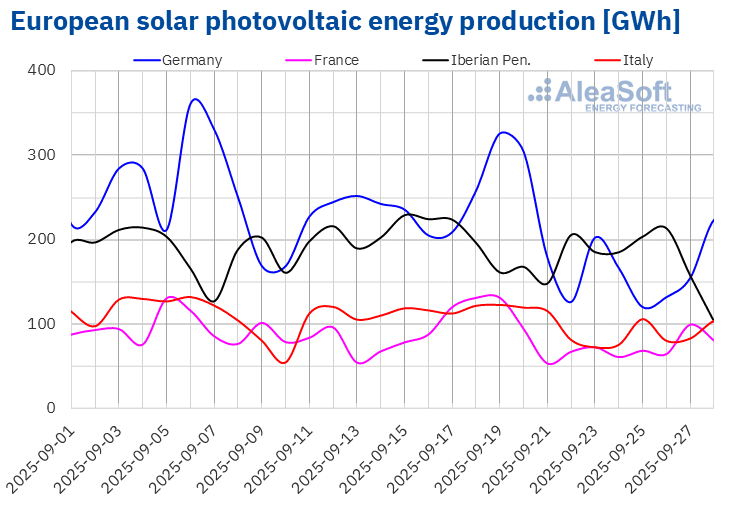

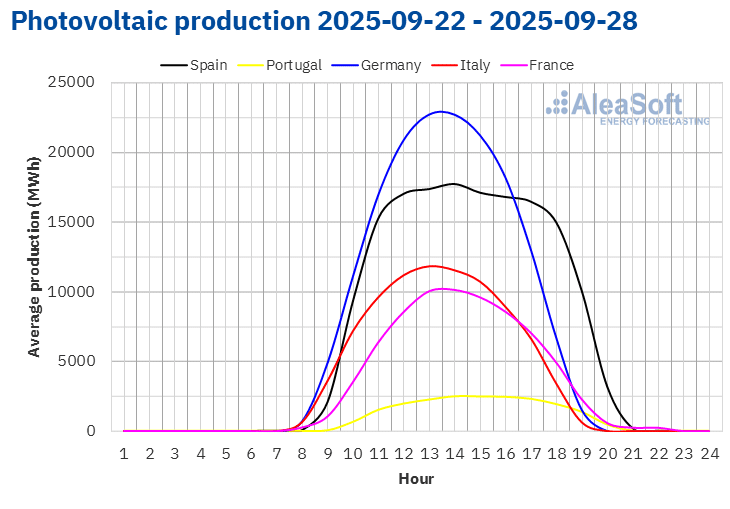

In the week of September 22, solar photovoltaic energy production decreased in the main European electricity markets compared to the previous week, reversing the upward trend of the previous week. The German market registered the largest drop, 34%. The Italian and French markets followed it, with decreases of 27% and 26%, respectively. The declines were relatively smaller in the Iberian Peninsula. In the Spanish market, photovoltaic energy generation fell by 7.5% and in the Portuguese market by 4.3%. In the latter case, this downward trend continued for the second consecutive week.

During the week of September 29, according to AleaSoft Energy Forecasting’s solar energy forecasts, the downward trend will reverse, with solar photovoltaic energy generation increasing in the Italian and German markets. However, the Spanish market will register a decrease in solar energy production.

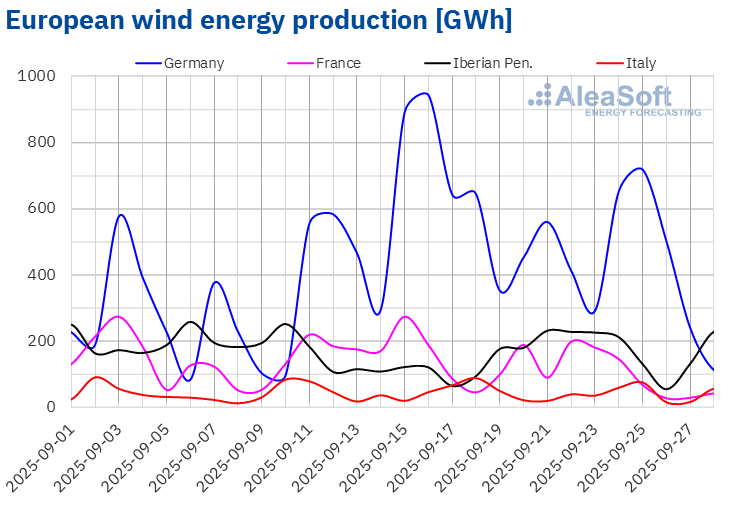

During the fourth week of September, wind energy production increased in the Iberian Peninsula compared to the previous week, breaking the downward trend registered then. In the Portuguese market, generation with this technology increased by 52%, while in the Spanish market it rose by 16%. In addition, on September 28, daily wind energy generation in the Portuguese market reached 74 GWh, a level last registered at the end of April 2025.

However, in the rest of the main European markets analyzed, wind energy production declined. In the German and French markets, it fell by 35% and 29%, respectively. In Germany, this decline came after three consecutive weeks of increases. In France, the downward trend continued for the third week. The Italian market registered the smallest decrease, 4.6%, reversing the upward trend of the previous two weeks.

For the week of September 29, according to AleaSoft Energy Forecasting’s wind energy forecasts, wind energy generation will increase in the Italian market and decrease in the German, French, Spanish and Portuguese markets.

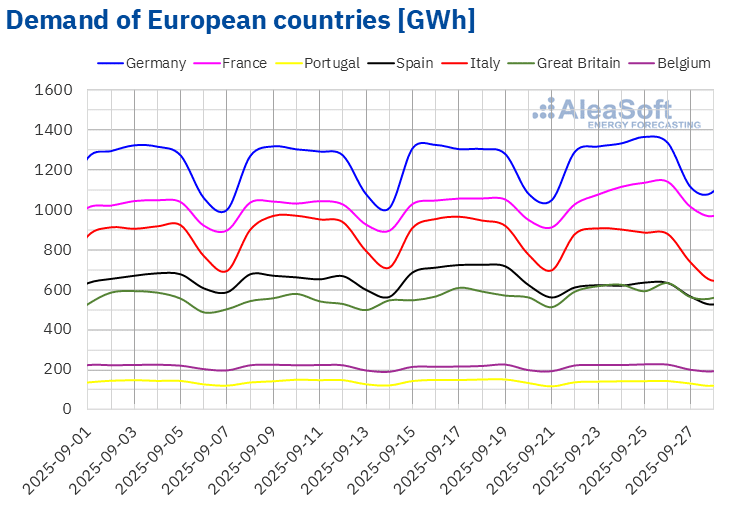

Electricity demand

In the week of September 22, electricity demand increased in most major European electricity markets compared to the previous week. The British and French markets registered the largest increases, 5.6% and 5.3% respectively, continuing the upward trend registered the previous week. The Belgian market registered the smallest increase, 2.2%, reversing the downward trend of the previous two weeks. By contrast, Southern European markets registered week‑on‑week decreases in electricity demand. The Spanish market registered the largest drop, 11%. The Italian and Portuguese markets registered decreases of 5.4% and 3.7%, respectively. In Italy, the downward trend continued for the second consecutive week. The Iberian markets reversed the upward trend of the previous week.

During the week, average temperatures decreased in the analyzed markets, with declines ranging from 3.2 °C in Italy to 6.4 °C in France.

For the week of September 29, according to AleaSoft Energy Forecasting’s demand forecasts, demand will fall in most major European markets, although it will increase in the British market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

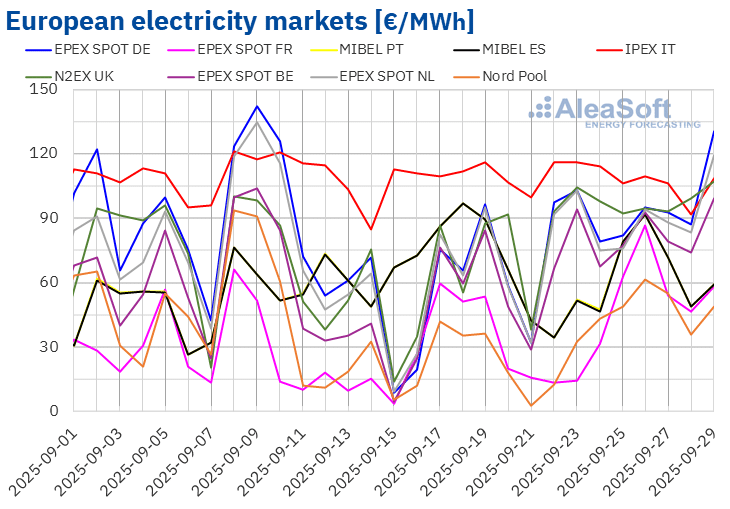

In the fourth week of September, average prices in most major European electricity markets rose compared to the previous week. The exceptions were the IPEX market of Italy, with a slight decrease of 0.9%, and the MIBEL market of Spain and Portugal, with a 18% drop. The EPEX SPOT market of France registered the smallest increase, 34%. In contrast, the Nord Pool market of the Nordic countries reached the largest percentage price increase, 92%. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices rose between 65% in the N2EX market of the United Kingdom and 78% in the EPEX SPOT market of Germany.

In the week of September 22, weekly averages were above €60/MWh in most European electricity markets. The exceptions were the Nordic and French markets, whose averages were €41.27/MWh and €44.17/MWh, respectively. The Italian market registered the highest weekly average, €108.67/MWh. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices ranged between €60.59/MWh in the Spanish market and €96.39/MWh in the British market.

Regarding daily prices, on Monday, September 22, the Nordic market reached the lowest average of the week among the analyzed markets, €12.49/MWh. The French market also registered daily prices below €15/MWh on September 22 and 23.

On the other hand, the Italian market continued to register daily prices above €100/MWh for almost the entire fourth week of September. On September 23, this market reached the highest daily average of the week, €116.20/MWh. On that day, the German, British and Dutch markets also registered daily prices above €100/MWh. On the other hand, on Monday, September 29, daily prices in these four electricity markets were above €100/MWh again. On that day, the German market registered the highest daily price, €130.57/MWh.

In the week of September 22, the decrease in solar and wind energy production in most markets, along with the increase in electricity demand in many of them, pushed prices up in most European electricity markets. However, the increase in wind energy production and the fall in demand in the Iberian Peninsula contributed to lower prices in the MIBEL market.

AleaSoft Energy Forecasting’s price forecasts indicate that, in the first week of October, prices will rise in most major European electricity markets, influenced by the decline in wind energy generation. In addition, some markets will register increases in electricity demand and solar energy production will decrease in the Spanish market.

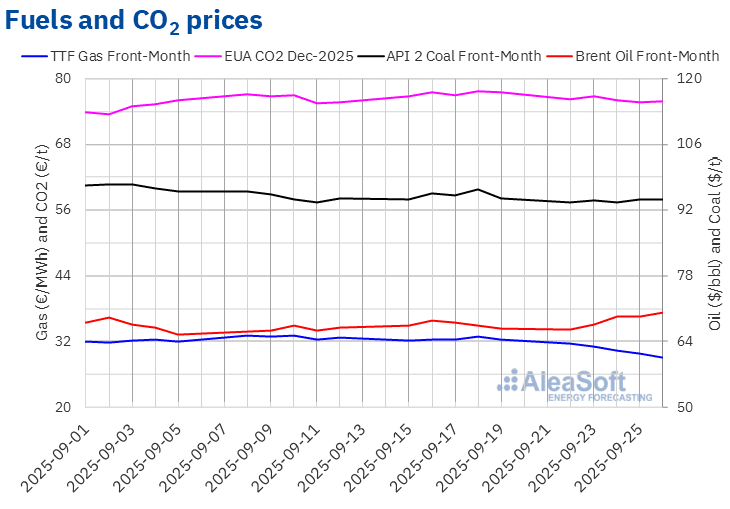

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered their weekly minimum settlement price, $66.57/bbl, on Monday, September 22. Subsequently, prices increased. As a result, on Friday, September 26, these futures reached their weekly maximum settlement price, $70.13/bbl. According to data analyzed at AleaSoft Energy Forecasting, this price was 5.2% higher than the previous Friday and the highest since August 1.

Concerns over supply caused by Ukrainian attacks on Russian energy infrastructure, as well as the decline in reserves in the United States, supported the increase in Brent oil futures prices in the fourth week of September. However, agreements reached to resume oil exports from Kurdistan, as well as expectations of new production increases at the next OPEC+ meeting, could put downward pressure on prices in the first week of October.

As for TTF gas futures in the ICE market for the Front‑Month, on Monday, September 22, they registered their weekly minimum settlement price, €31.84/MWh. Subsequently, prices were higher, but they remained below €33/MWh during the fourth week of September. On Friday, September 26, these futures reached their weekly maximum settlement price, €32.70/MWh. According to data analyzed at AleaSoft Energy Forecasting, this price was 1.2% higher than the previous Friday.

In the fourth week of September, TTF gas futures prices remained below €33/MWh, supported by abundant liquefied natural gas supply. Also contributing to this behavior were the levels of European reserves, whose average exceeds 80% and in some countries already stands above 90%.

Regarding CO2 emission allowance futures in the EEX market for the reference contract of December 2025, settlement prices remained above €76/t during the first three sessions of the fourth week of September. On Tuesday, September 23, they reached their weekly maximum settlement price, €76.81/t. By contrast, on Thursday, September 25, these futures registered their weekly minimum settlement price, €75.76/t. On Friday, September 26, the price was slightly higher, €75.97/t. Even so, according to data analyzed at AleaSoft Energy Forecasting, this price was 2.0% lower than the previous Friday.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing of renewable energy and storage projects

On Thursday, October 9, AleaSoft Energy Forecasting will hold the 59th webinar of its monthly webinar series. On this occasion, speakers from Deloitte will participate for the sixth consecutive year. The webinar will analyze the evolution and prospects of European energy markets for the winter 2025‑2026, the financing of renewable energy and energy storage projects, the prospects for batteries and hybridization, as well as the importance of forecasting in audits and portfolio valuation.

Source: AleaSoft Energy Forecasting.