AleaSoft Energy Forecasting, August 6, 2025. During the month of July, prices in the main European electricity markets rose and remained above €70/MWh in most cases. The markets of the Iberian Peninsula were the exception, with year‑on‑year and month‑on‑month declines. Solar and wind energy production grew in most electricity markets, reaching historic records in Spain, France, Portugal and Italy. Demand increased in the Iberian Peninsula and France, while gas and CO₂ emission allowance futures prices fell compared to June.

Solar photovoltaic and wind energy production

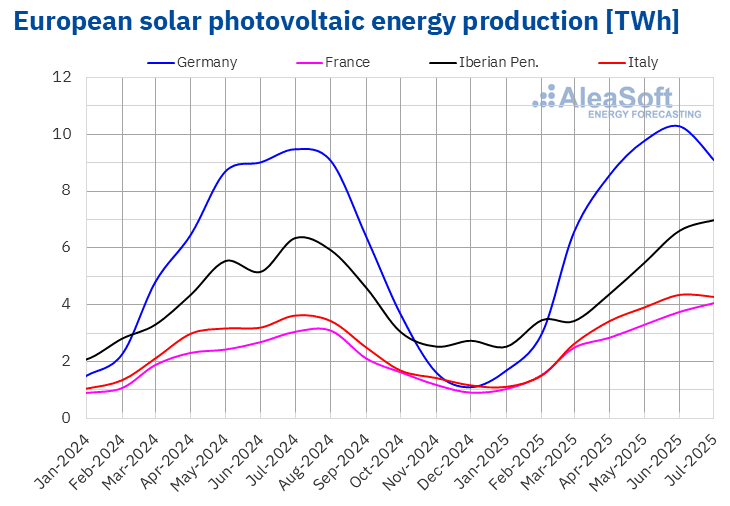

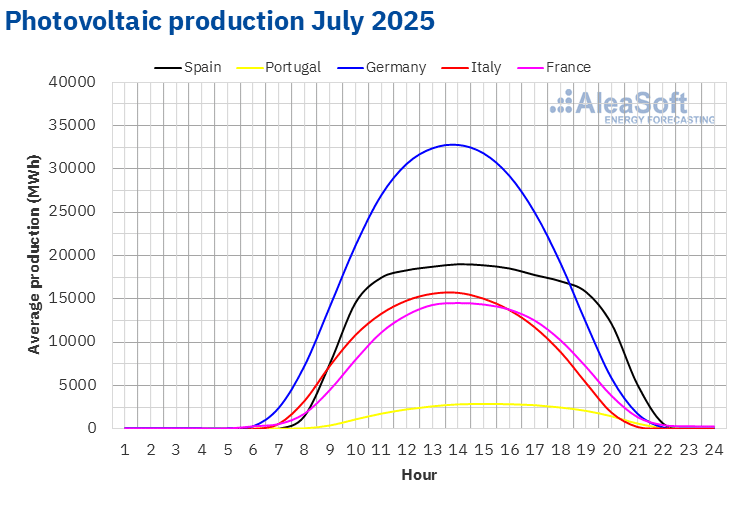

In July 2025, solar photovoltaic energy production increased in most major European electricity markets compared to the same month last year. The French market registered the largest increase, 33%. It was followed by the Portuguese and Italian markets, with year‑on‑year growth of 24% and 18%, respectively. The Spanish market registered the smallest increase, 8.3%. The German market was the exception, as its solar energy production decreased by 4.1% compared to July 2024.

When comparing solar photovoltaic energy production between July and June 2025, most European electricity markets showed increases. The Portuguese market led with an increase of 9.0%, while the French market ranked second with 4.8%. The Spanish market registered the lowest growth, 1.4%. In contrast, the German and Italian markets reduced their generation with this technology by 14% and 4.8%, respectively, compared to the previous month.

In addition, in July 2025, three markets set their all‑time records for monthly photovoltaic energy production. The Spanish market generated 6190 GWh. The French market produced 4072 GWh and the Portuguese market added 800 GWh, also reaching an all‑time high.

The year‑on‑year increase in solar energy production was mainly due to the increase in installed capacity. According to data from Red Eléctrica, between July 2024 and July 2025, the Spanish market added 6145 MW of photovoltaic energy capacity. In the same period, the Portuguese market added 1038 MW to the system, according to data from REN.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

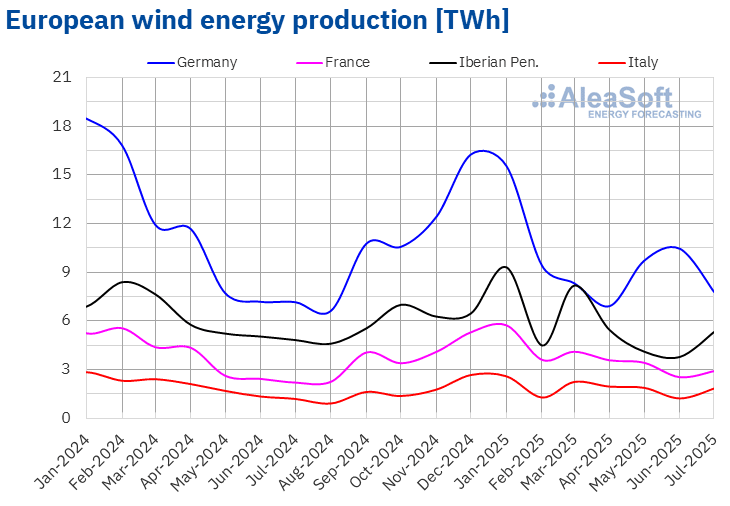

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.In July 2025, wind energy production increased in the main European energy markets compared to July 2024. The Italian market registered the largest increase, 53%. It was followed by the French and Portuguese markets, with growth of 32% and 30%, respectively. The German and Spanish markets showed the smallest increases, 8.8% and 6.5%, respectively.

Compared to the previous month, wind energy production also grew in most major electricity markets in Europe. The Italian market led the way again with an increase of 45%. The French market registered the smallest increase, 11%, while the markets of the Iberian Peninsula reached increases of 36%. On the other hand, the German market reduced its wind energy production by 28% compared to the previous month.

In July 2025, the Italian and Portuguese markets registered their highest wind energy production volumes for a July month, with 1824 GWh and 993 GWh, respectively.

The year‑on‑year increase in wind energy production was due to the increase in installed capacity. According to data from Red Eléctrica, between July 2024 and July 2025, the Spanish market added 1080 MW of wind energy capacity. During the same period, the Portuguese market added 18 MW to the system, according to data from REN.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.Electricity demand

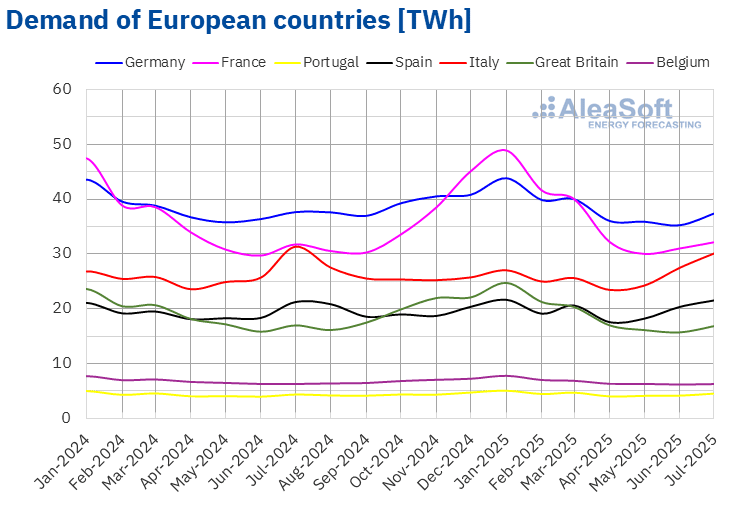

In July 2025, electricity demand increased in the Iberian and French electricity markets compared to the same month last year. The Portuguese market registered the largest increase, reaching 4.0%, while the French and Spanish markets registered increases of 1.2% and 1.4%, respectively. On the other hand, demand decreased in the Italian, Belgian, German and British markets in year‑on‑year terms. The Italian market registered the largest drop, 3.9%, and the Belgian market the smallest, 0.2%. In the German and British markets, the decreases were 0.7% in both cases.

Furthermore, according to provisional data from Red Eléctrica for July 2025, demand in the Spanish market could have reached 21 678 GWh, a level not seen since the summer of 2022.

Compared to June 2025, demand increased in most major European electricity markets. Italy registered the largest increase, 6.0%, while France showed the smallest increase, 0.3%. The Spanish, German and British markets registered increases of 2.5%, 2.6% and 3.7%, respectively. The Belgian market was the only exception, with a decline of 1.9%.

In most analysed markets, July 2025 was warmer than the same month in 2024. Increases in average temperatures ranged from 0.1 °C in Spain to 2.0 °C in Great Britain. In contrast, Germany and Italy registered decreases of 0.3 °C and 1.1 °C, respectively.

As the summer progressed, average temperatures in July exceeded those of June in most analysed countries. France was the exception, with a decrease of 0.1 °C compared to the previous month. In the other countries, average temperatures increased between 0.2 °C in Germany and 1.2 °C in the United Kingdom.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.European electricity markets

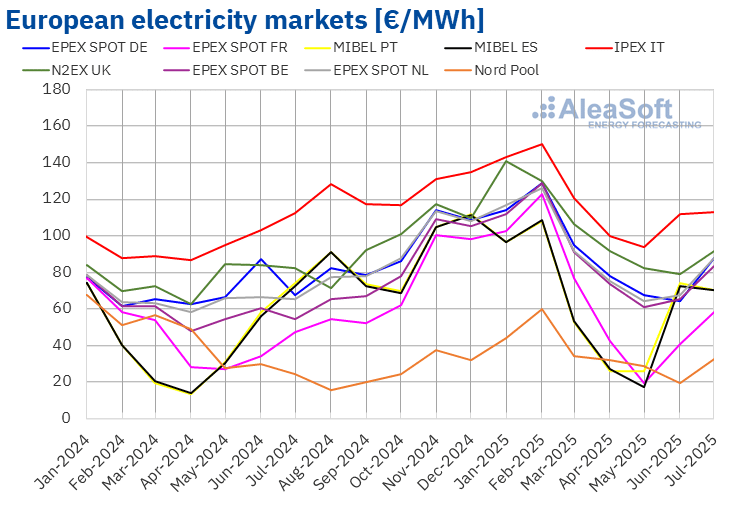

In July 2025, the monthly average price exceeded €70/MWh in most major European electricity markets. The exceptions were the averages for the Nord Pool market of the Nordic countries and the EPEX SPOT market of France, €32.32/MWh and €57.98/MWh, respectively. In contrast, the N2EX market of the United Kingdom and the IPEX market of Italy registered the highest monthly prices, €91.59/MWh and €113.13/MWh, respectively. In the rest of the European electricity markets analysed at AleaSoft Energy Forecasting, the averages ranged from €70.01/MWh in the MIBEL market of Spain to €87.80/MWh in the EPEX SPOT market of Germany.

Compared to June, average prices increased in most European electricity markets analysed at AleaSoft Energy Forecasting. The Spanish and Portuguese markets were the exceptions, with decreases of 3.6% and 5.5%, respectively. The Italian market registered the smallest increase, 1.2%. In contrast, the French and Nordic markets registered the highest percentage price increases, 42% and 68%, respectively. In the rest of the markets, prices rose between 16% in the British market and 37% in the German market.

Comparing average prices for July with those registered in the same month of 2024, prices also increased in most markets. The Spanish and Portuguese markets were also exceptions, with declines of 3.2% and 5.4%, respectively. In this case, the Italian market only increased slightly, by 0.7%. On the other hand, the Belgian market reached the highest percentage price increase, 52%. In the rest of the markets, price increases ranged from 11% in the British market to 35% in the Dutch market.

As a result of these price increases, in July 2025, the German, Belgian, British, French, Italian, Dutch and Nordic markets registered their highest monthly prices since April.

In July 2025, increased electricity demand compared to the previous month led to higher prices in European electricity markets. In addition, solar energy production fell in the Italian market, while both solar and wind energy production fell in the German market. In contrast, solar and wind energy production increased compared to June in Spain and Portugal, contributing to the price decline in the MIBEL market.

On the other hand, in July 2025, gas and CO2 emission allowance prices increased compared to July 2024, contributing to the year‑on‑year rise in prices in most European electricity markets. In the French market, in addition, electricity demand increased and in the German market, solar energy production fell. However, solar and wind energy production increased compared to July 2024 in the Iberian Peninsula, contributing to the decline in prices in the Spanish and Portuguese markets.

Brent, fuels and CO2

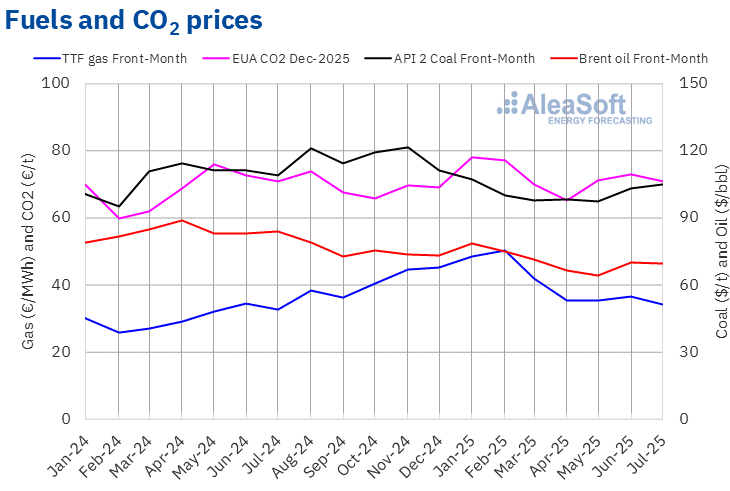

Brent oil futures for the Front‑Month in the ICE market registered a monthly average price of $69.55/bbl in July 2025. According to data analysed at AleaSoft Energy Forecasting, this value was 0.4% lower than that reached by Front‑Month futures of June 2025, $69.80/bbl. It was also 17% lower than that corresponding to Front‑Month futures traded in July 2024, $83.88/bbl.

Iran’s suspension of cooperation with the International Atomic Energy Agency, as well as Houthi attacks in the Red Sea and the possibility of new sanctions on Russian oil, exerted an upward influence on Brent oil futures prices in July. However, concerns about demand evolution and OPEC+ production increases offset this rise and contributed to the decline in prices.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during July 2025 for these futures was €33.96/MWh. According to data analysed at AleaSoft Energy Forecasting, this is the lowest monthly average since August 2024. Compared to the average of Front‑Month futures traded in June, €36.65/MWh, the July average fell by 7.3%. In contrast, when compared to Front‑Month futures traded in July 2024, when the average price was €32.68/MWh, there was an increase of 3.9%.

Increased demand in Asia due to a heatwave in the first half of July, problems with gas supplies from Norway at the end of the month and the possibility of new sanctions on Russian gas imports exerted an upward influence on TTF gas futures prices during July. However, supply levels and concerns about the effects of tariff policies on demand meant that the July average was below €34/MWh.

Regarding CO₂ emission allowance futures in the EEX market for the reference contract of December 2025, they reached an average price in July of €71.00/t. According to data analysed at AleaSoft Energy Forecasting, this monthly price fell by 2.8% compared to the average for June, which was €73.03/t. Compared to the average for July 2024, which was €70.85/t, the average for July 2025 was 0.2% higher.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

AleaStorage division of AleaSoft Energy Forecasting provides advanced solutions for the optimisation and management of energy storage systems. AleaStorage solutions are aimed at stand‑alone battery projects, hybrid systems of renewable technologies, such as wind or solar energy, with batteries, hybrid self‑consumption systems with batteries and other hybrid systems, such as hydraulics, cogeneration or consumption. AleaStorage services range from calculating the revenue and profitability of systems with energy storage to sizing the optimal storage in hybrid systems.

Source: AleaSoft Energy Forecasting.