AleaSoft, April 26, 2021. During the week of April 19, the photovoltaic and wind energy production increased in most of the European continent, which pushed the electricity markets prices down. On the contrary, in the Iberian Peninsula, the renewable energy production fell and the prices in Spain and Portugal registered maximums since January during the Filomena storm. With weak renewable energy production in the peninsula, the high CO2 and gas prices had no counterbalance in the wholesale electricity market.

Photovoltaic and solar thermal energy production and wind energy production

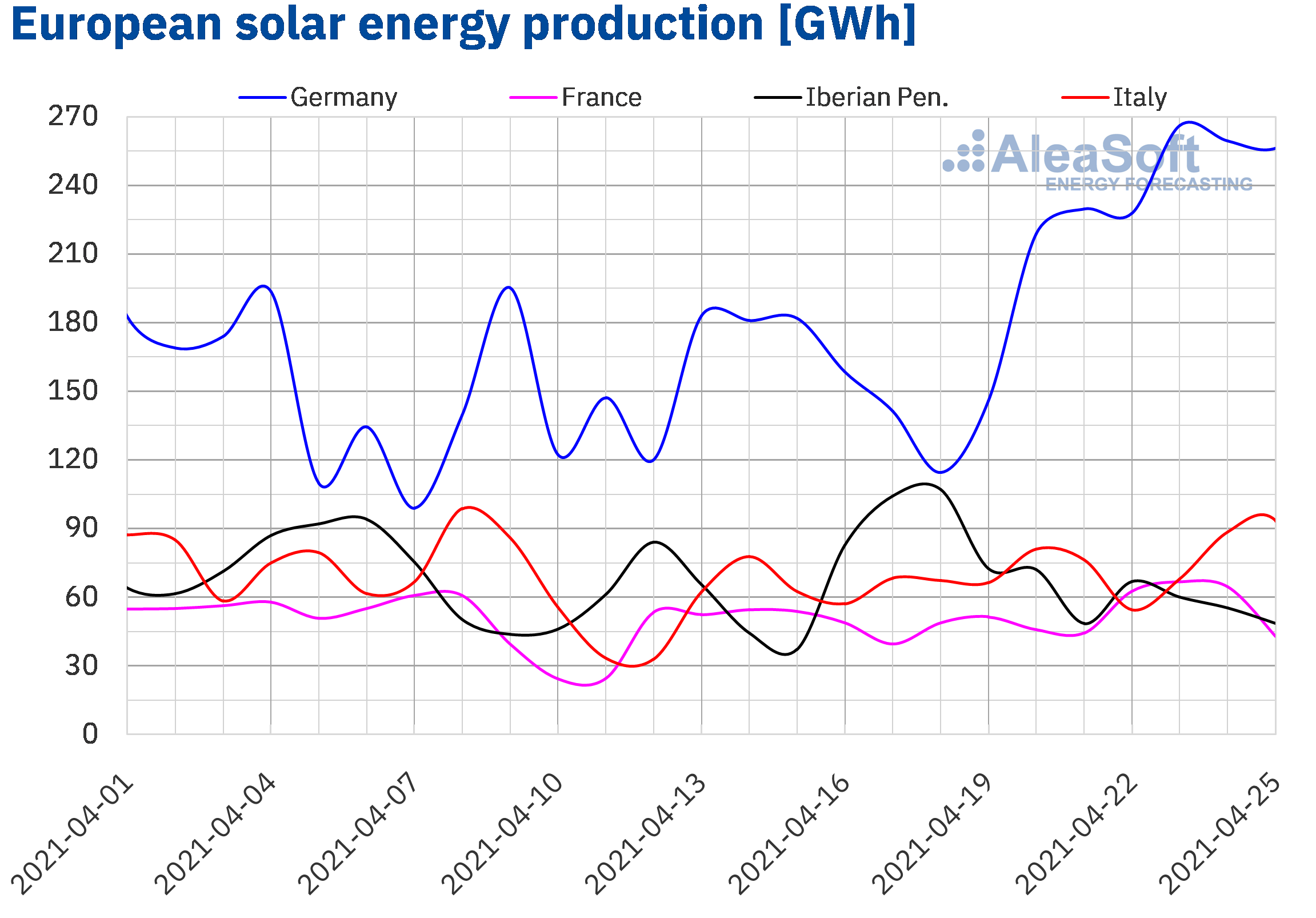

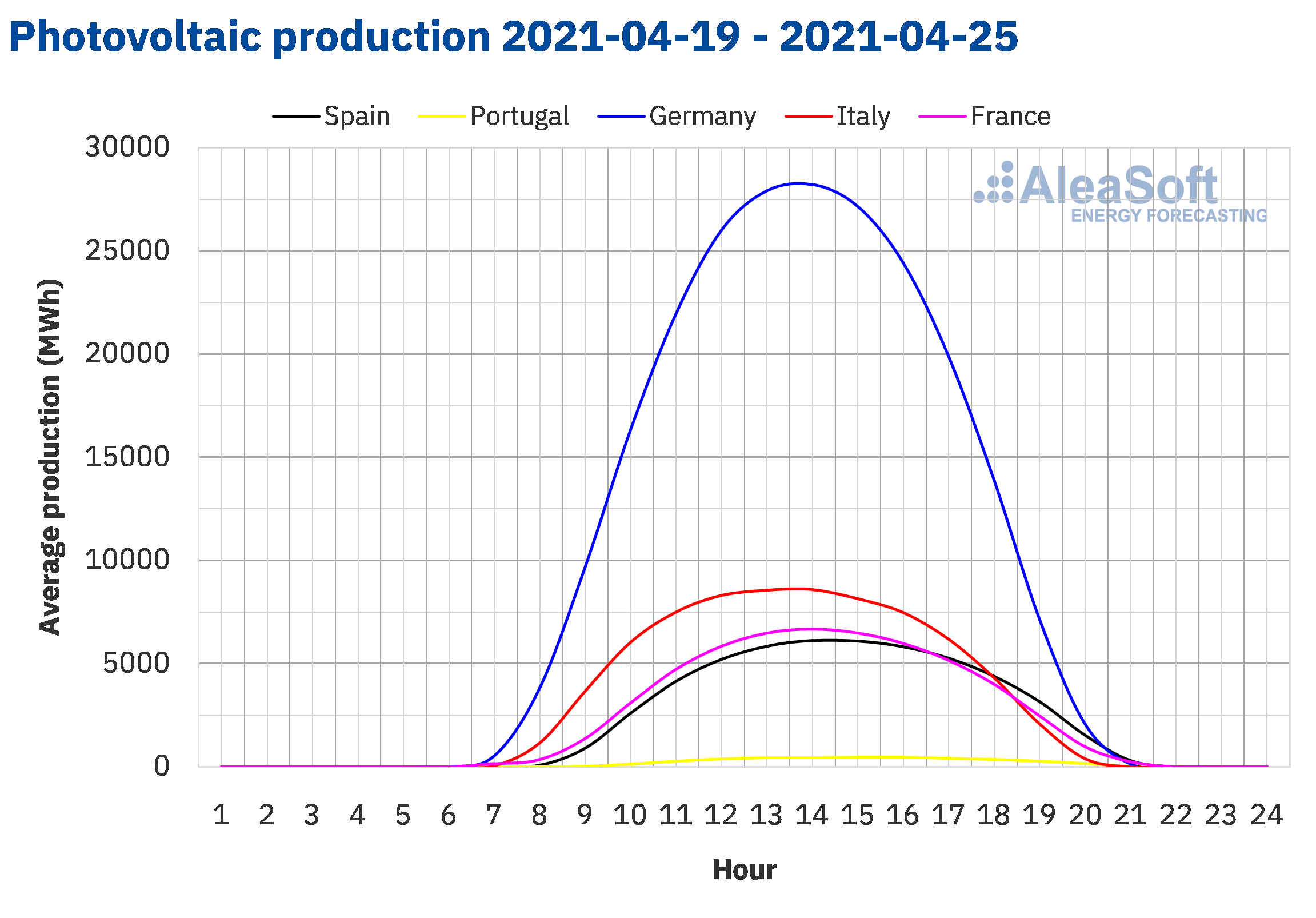

The solar energy production during the week 16 of 2021, from April 19 to 25, decreased by 19% in the Iberian Peninsula compared to the previous week. On the contrary, in the German market, the production with this technology increased by 49%, while in the Italian market and in the French market the increase was 23% and 7.8%, respectively.

For the week of Monday, April 26, the AleaSoft‘s solar energy production forecasting indicates a decrease in the markets of Spain, Germany and Italy compared to the previous week.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

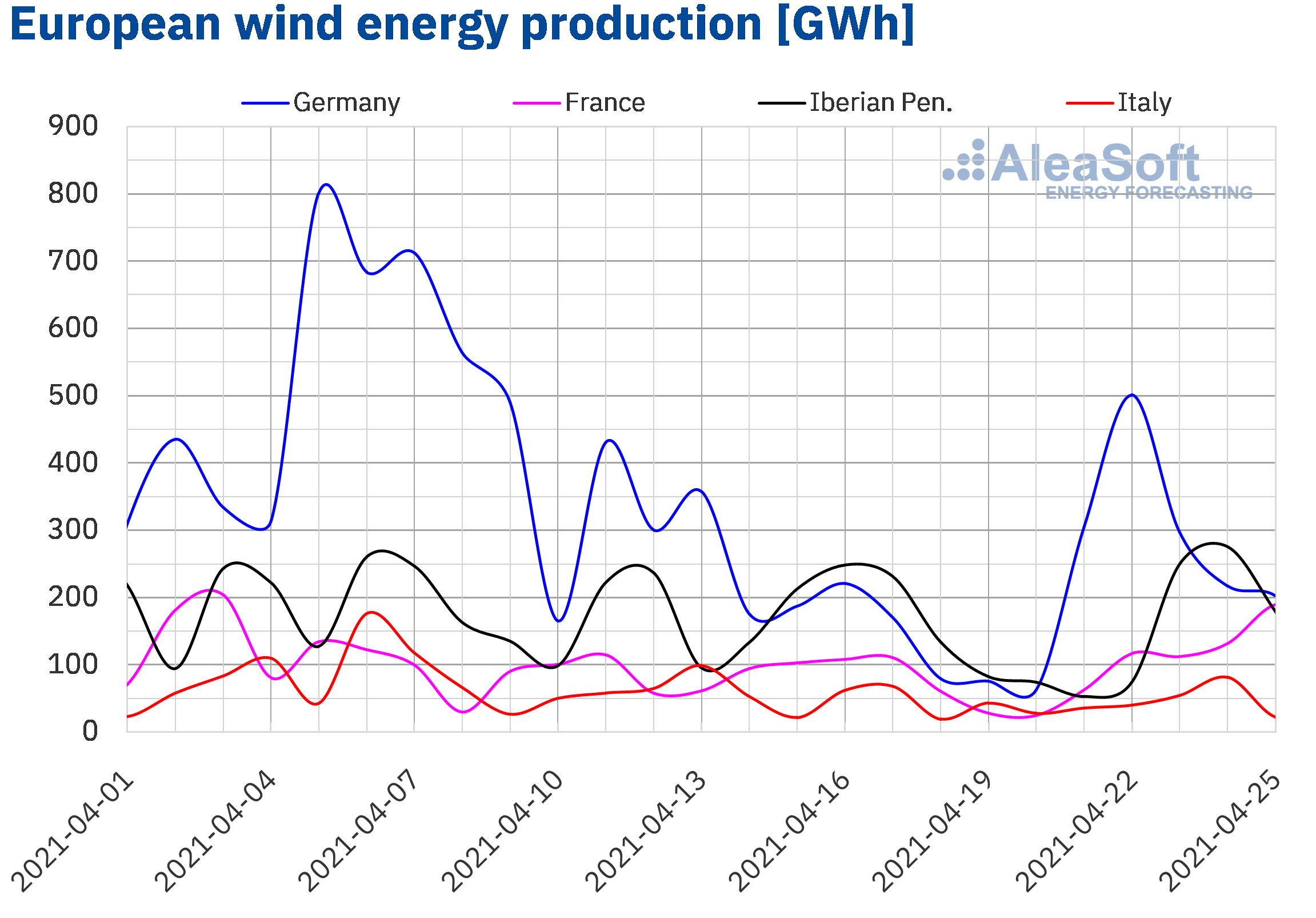

During the week ending on last Sunday, April 25, the wind energy production fell by 32% in the Spanish market and by 21% in the Italian market compared to the week ending on Sunday, April 18. On the other hand, in the Portuguese market, the production with this technology increased by 50%, while in the markets of Germany and France the increase was close to 11%.

For the week ending on next May 2, the AleaSoft‘s wind energy production forecasting indicates that the production will be lower than that registered the previous week in most of the analysed markets, except in the German market, where an increase in production with this technology is expected.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

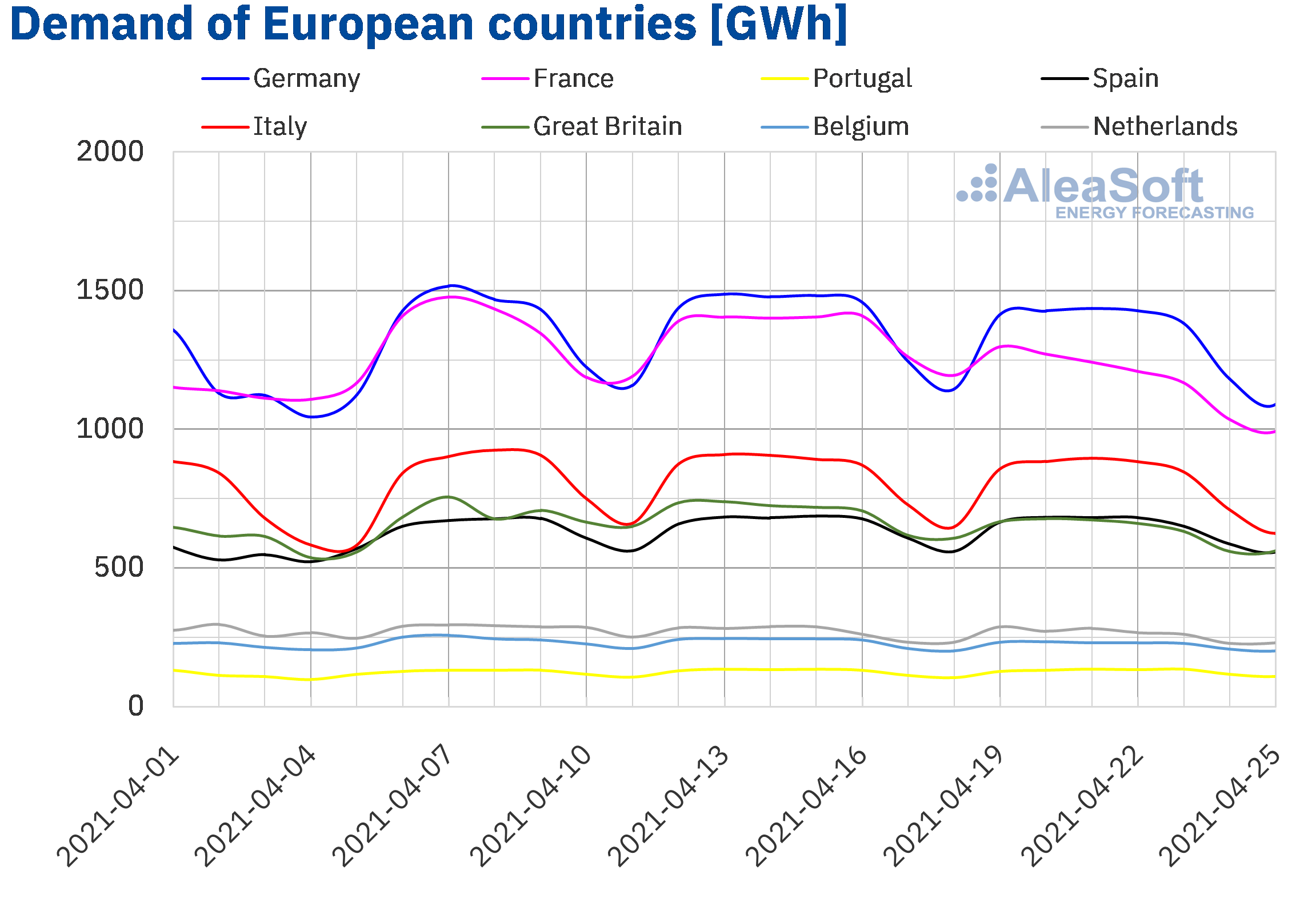

The electricity demand fell in all European markets during the week of April 19 to 25 compared to the previous period, except in Portugal where it rose a slight 1.0%. The main cause of these decreases was, as expected according to the AleaSoft‘s previous report, the increase in temperatures. The markets where the demand decreased the most were France, Great Britain and Belgium, the first two registering falls of over 8.5%. In particular, the French market registered the largest rise in average temperatures of the week, which was 4.4 °C, which, together with the high sensitivity to the temperatures, caused a 13% drop in demand. In the rest of the markets the decreases were below 3.0%.

The AleaSoft‘s demand forecasting indicates that it will maintain a decreasing behaviour in most European markets and that it will register similar values in the markets of the Iberian Peninsula.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

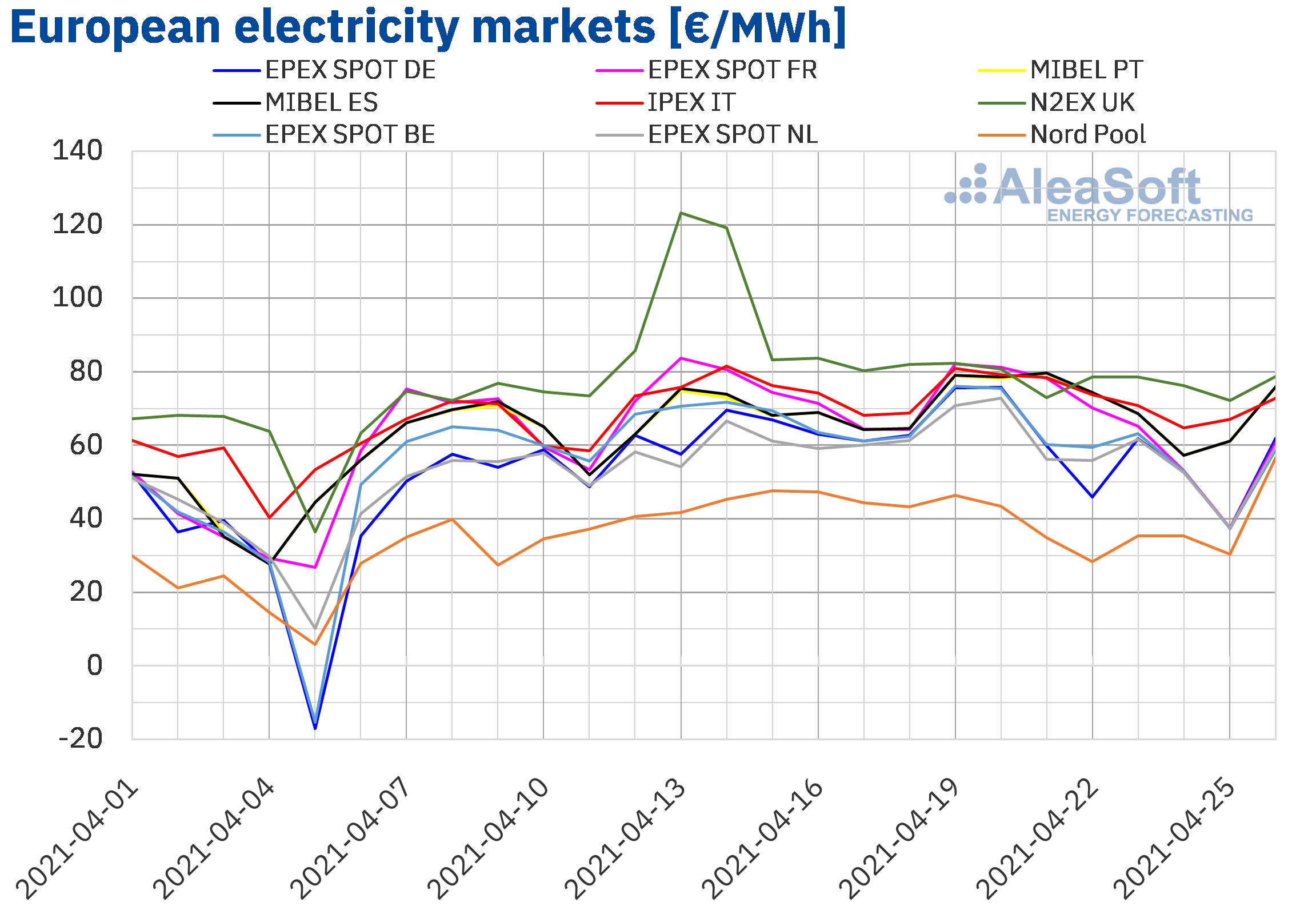

European electricity markets

In the week of April 19, the prices of almost all the European electricity markets analysed at AleaSoft decreased compared to those of the previous week. The exception was the MIBEL market of Spain and Portugal, with increases of 4.2% and 4.5%, respectively. On the other hand, the largest price drops, of 18%, were those of the Nord Pool market of the Nordic countries and the N2EX market of the United Kingdom. Meanwhile, the lowest price decrease, of 0.6%, occurred in the IPEX market of Italy. In the rest of the markets, the price drops were between 3.2% of the EPEX SPOT market of the Netherlands and 9.1% of the EPEX SPOT market of Belgium.

In the fourth week of April, the highest weekly average price was that of the N2EX market, of €77.38/MWh. While the lowest average was that of the Nord Pool market, of €36.32/MWh. In the rest of the markets, the prices were between €58.19/MWh of the EPEX SPOT market of the Netherlands and €73.56/MWh of the Italian market.

On the other hand, in the MIBEL market, on Wednesday, April 21, the highest daily prices since January were reached, of €79.60/MWh in Spain and €79.51/MWh in Portugal.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

During the fourth week of April, the general decline in electricity demand favoured the decrease in prices in the European electricity markets. The increase in wind energy production in countries such as Germany and France, as well as the rise in solar energy production in Germany, France and Italy also contributed to these price drops.

However, the decrease in wind and solar energy production in the Iberian Peninsula favoured the increase in prices in the MIBEL market. In addition, the average of the gas prices in the MIBGAS market was also higher than that of the previous week, which also contributed to the increase in prices in the MIBEL market.

The AleaSoft‘s price forecasting indicates that the week of April 26 the prices will fall in a generalised way in the European electricity markets, influenced by the decrease in demand in most markets and the increase in wind energy production in Germany.

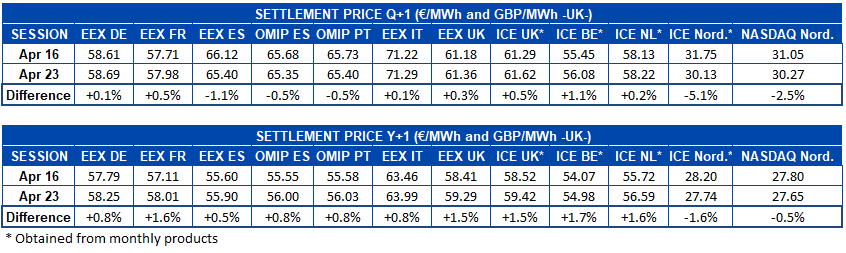

Electricity futures

During the fourth week of April, the electricity futures prices for the next quarter had a heterogeneous behaviour in the main European markets analysed at AleaSoft. On the one hand, in the Iberian Peninsula the prices fell, in the EEX market of Spain the settlement of the session of April 23 was 1.1% below the price of April 16. In the OMIP market of Spain and Portugal, the decreases were 0.5% in both countries. The Nordic region also reduced its prices, in the same period the ICE market of the Nordic countries reduced its price by 5.1% while the NASDAQ market of the same region did so by 2.5%. In the rest of the markets, the prices increased slightly, between 0.1% and 1.1%.

Regarding the electricity futures for the calendar year 2022, the prices only reduced in the Nordic region. The ICE market fell by 1.6% and the NASDAQ market by 0.5%. In the rest of the markets, the prices increased between 0.5% of the EEX market of Spain and 1.7% of the ICE market of Belgium, closely followed by the ICE market of the Netherlands with 1.6%.

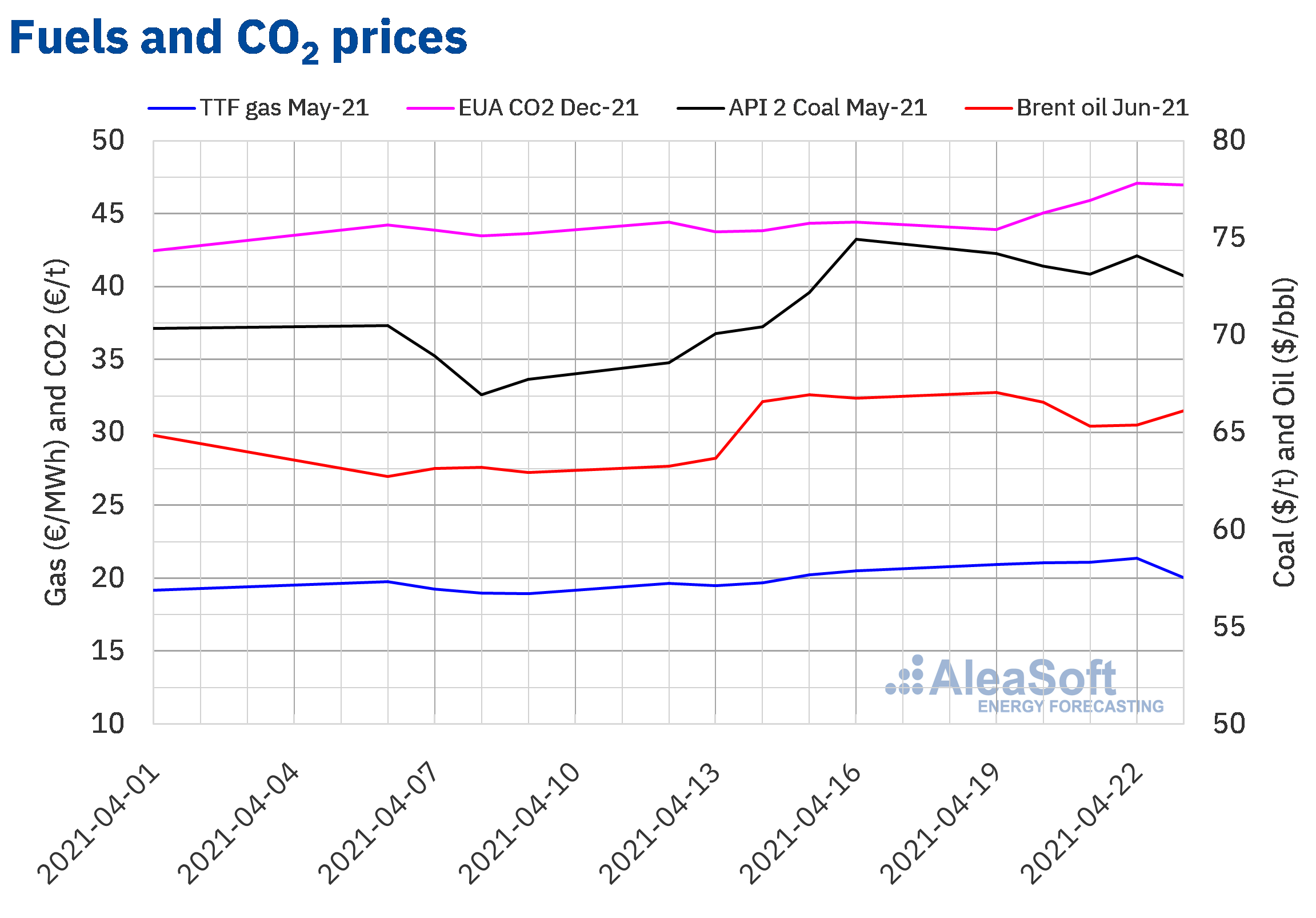

Brent, fuels and CO2

On Monday, April 19, the Brent oil futures prices for the month of June 2021 in the ICE market reached a settlement price of $67.05/bbl. This price was 6.0% higher than that of the previous Monday and the highest since mid‑March. Subsequently, the prices fell and the settlement price of Wednesday, April 21, was $65.32/bbl. But, in the last days of the week, the prices recovered to $66.11/bbl of Friday, April 23. Although this settlement price was still 1.0% lower than that of the previous Friday.

The concerns about the evolution of the COVID‑19 pandemic in India and Japan may favour declines in Brent oil futures prices. These countries are major oil importers and the recent increase in COVID‑19 cases that they are registering will predictably have consequences on the demand. On the other hand, the OPEC+ ministerial meeting of next Wednesday, April 28, will also exert its influence on the evolution of the prices in the coming days.

As for the TTF gas futures prices in the ICE market for the month of May 2021, in the fourth week of April, they registered an upward trend until reaching, on Thursday, April 22, a settlement price of €21.37/MWh, 5.5% higher than that of the previous Thursday and the highest in the last two years. However, on Friday, April 23, there was a 6.2% drop and the settlement price was €20.05/MWh.

Regarding the CO2 emission rights futures in the EEX market for the reference contract of December 2021, they began the fourth week of April with a drop in prices. However, from Tuesday to Thursday, the prices increased until reaching a settlement price of €47.09/t on Thursday, April 22, which was 6.2% higher than that of the previous Thursday and the highest ever registered for the CO2. On Friday, the settlement price was slightly lower, of €46.96/t.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

The concern of the large consumers about the high prices

The main affected in episodes such as the current one of high energy prices are, obviously, the consumers. Electro‑intensive companies or large energy consumers base a large part of their competitiveness on the purchase prices of the electricity. The new statute for the electro‑intensive industry supports the signing of long‑term supply contracts, but this must be part of a broader energy purchase strategy, where the diversification mitigates a large part of the market prices risks.

For the negotiation and signing of a long‑term PPA contract and, in general, for the design of an energy purchase strategy, a service of scientific and coherent market prices forecasts is necessary, to optimise the purchase in all time horizons. For this reason, many of these large consumers and electro‑intensives are turning to AleaSoft for medium and long‑term forecasts. AleaSoft showed in this online workshop how to use the prices forecasts for the risk management.