AleaSoft, April 5, 2021. In the first quarter of 2021 the prices of all European electricity markets increased. The increase in demand caused by the drop in temperatures, partly due to the effect of the storm Filomena, was one of the causes of the increase. Other factors that favoured this behaviour were the rise in gas and CO2 prices. The latter reached a record settlement price close to €43/t. The solar energy production increased in general and the wind energy production in the Iberian Peninsula and Italy.

Photovoltaic and solar thermal energy production and wind energy production

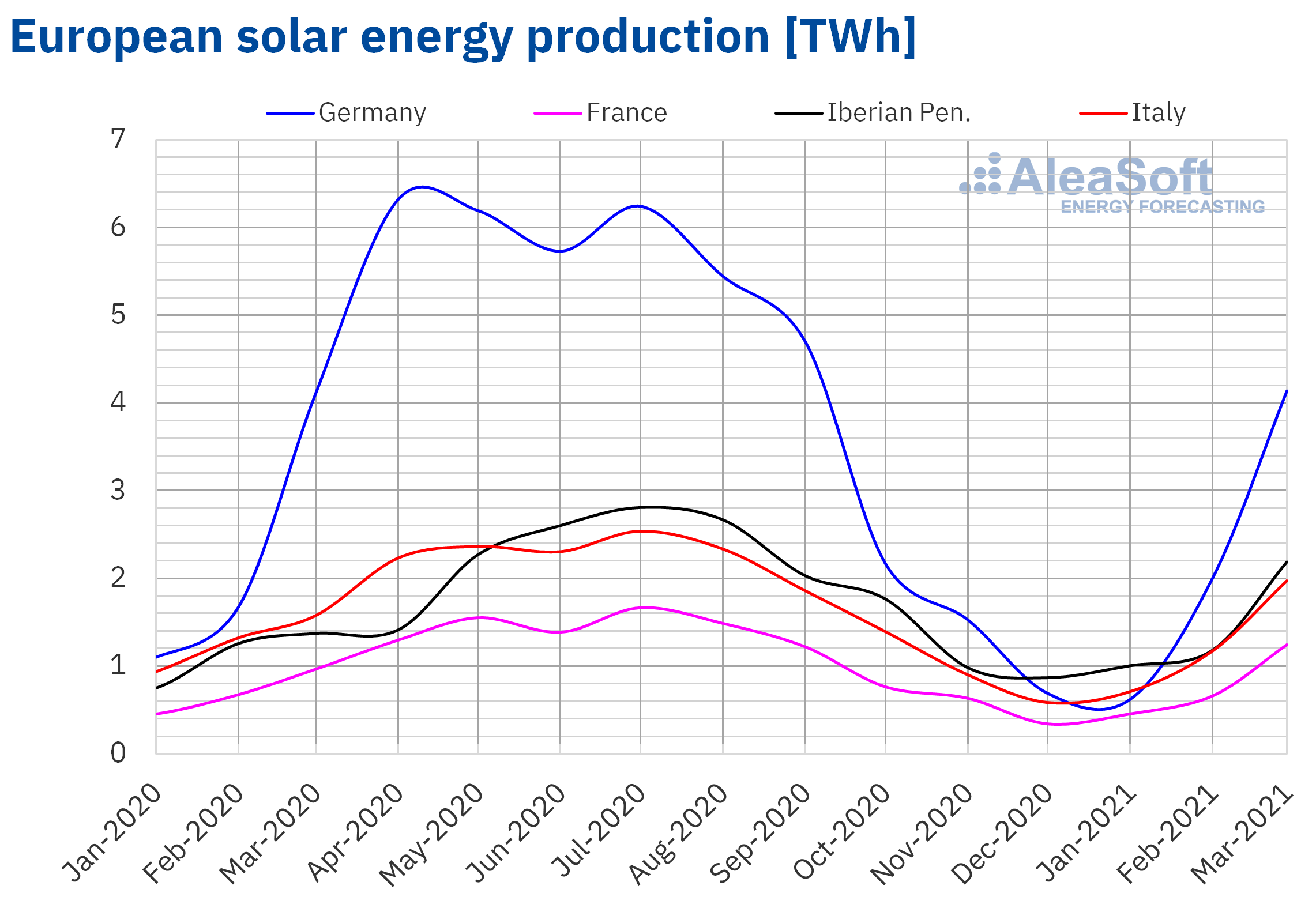

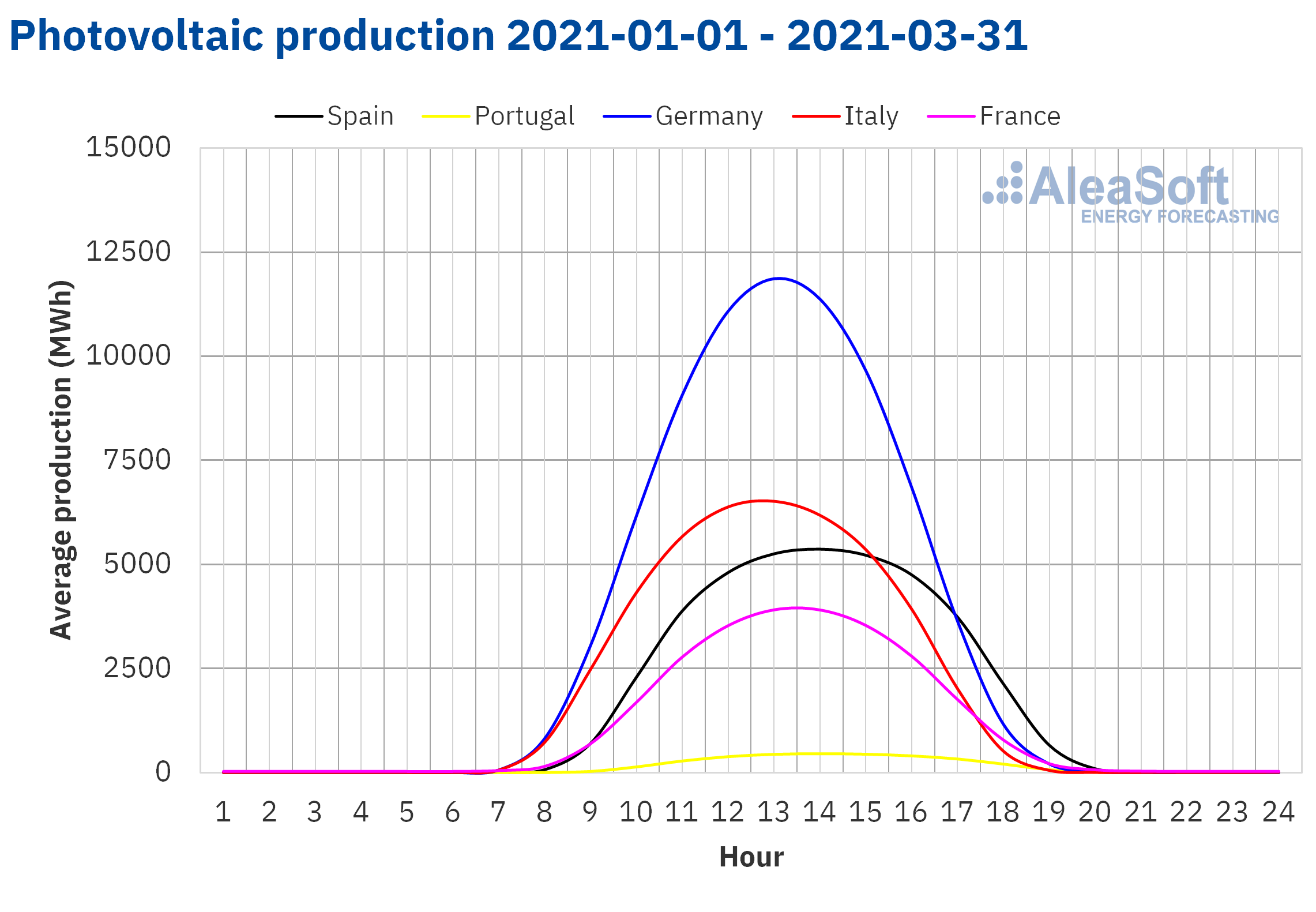

The solar energy production, which in the case of Spain includes the photovoltaic and solar thermal technologies, during the first quarter of 2021 increased by 28% in the Iberian Peninsula compared to the same quarter of 2020. In Mainland Spain, the explosive increase in photovoltaic energy capacity since 2019 caused a considerable increase in the generation with this technology, which during the first three months of 2021 exceeded the production registered in the first three months of 2020 by 35%. In the French market, the production also increased compared to the first quarter of 2020, registering an increase of 13%. In the case of the Italian market the variation was little, while in the German market it contracted by 2.0%.

If the comparison is made with respect to the fourth quarter of 2020, the solar energy production was higher in all the markets analysed at AleaSoft. The largest increase was registered in the German market, which produced 54% more. In the French market the increase was 35% and in the Italian market close to 34%. The Iberian Peninsula was where the lowest variation was registered, with an increase of 21% compared to the previous quarter.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

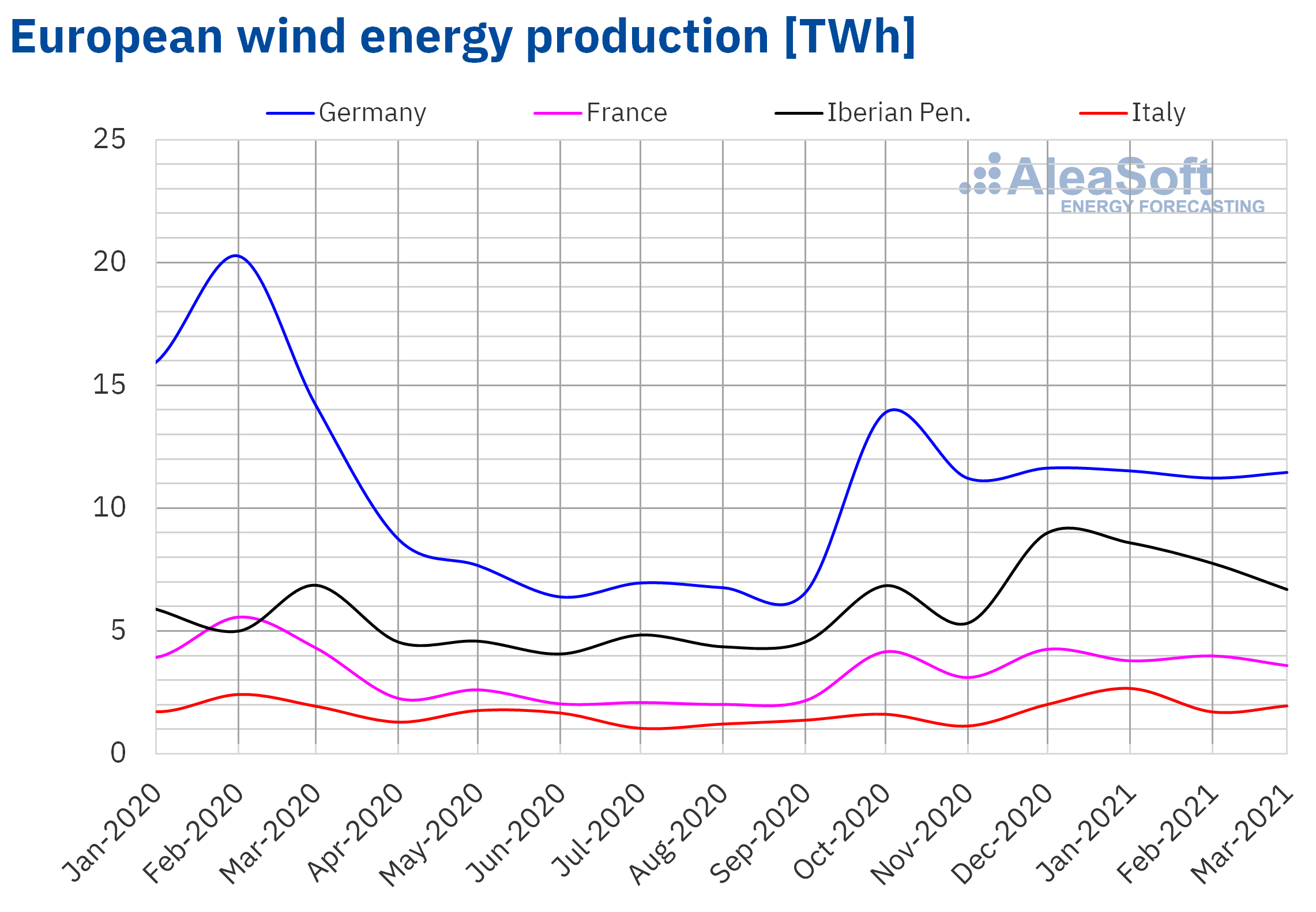

In the case of the wind energy production, there was a decline in the German and French markets during the first quarter of 2021 compared to the same quarter of 2020, of 32% and 18% respectively. On the contrary, in the Iberian Peninsula it increased by 29% and in the Italian market by 4.4%.

In Mainland Spain a record of wind energy generation was registered during the first three months of 2021 with a production close to 19 000 GWh, 11% higher than in the last quarter of 2020. In the Italian market the increase was close to 34%. On the contrary, in the markets of Germany and France, the production with this technology was reduced by 6.9% and 1.3% respectively.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

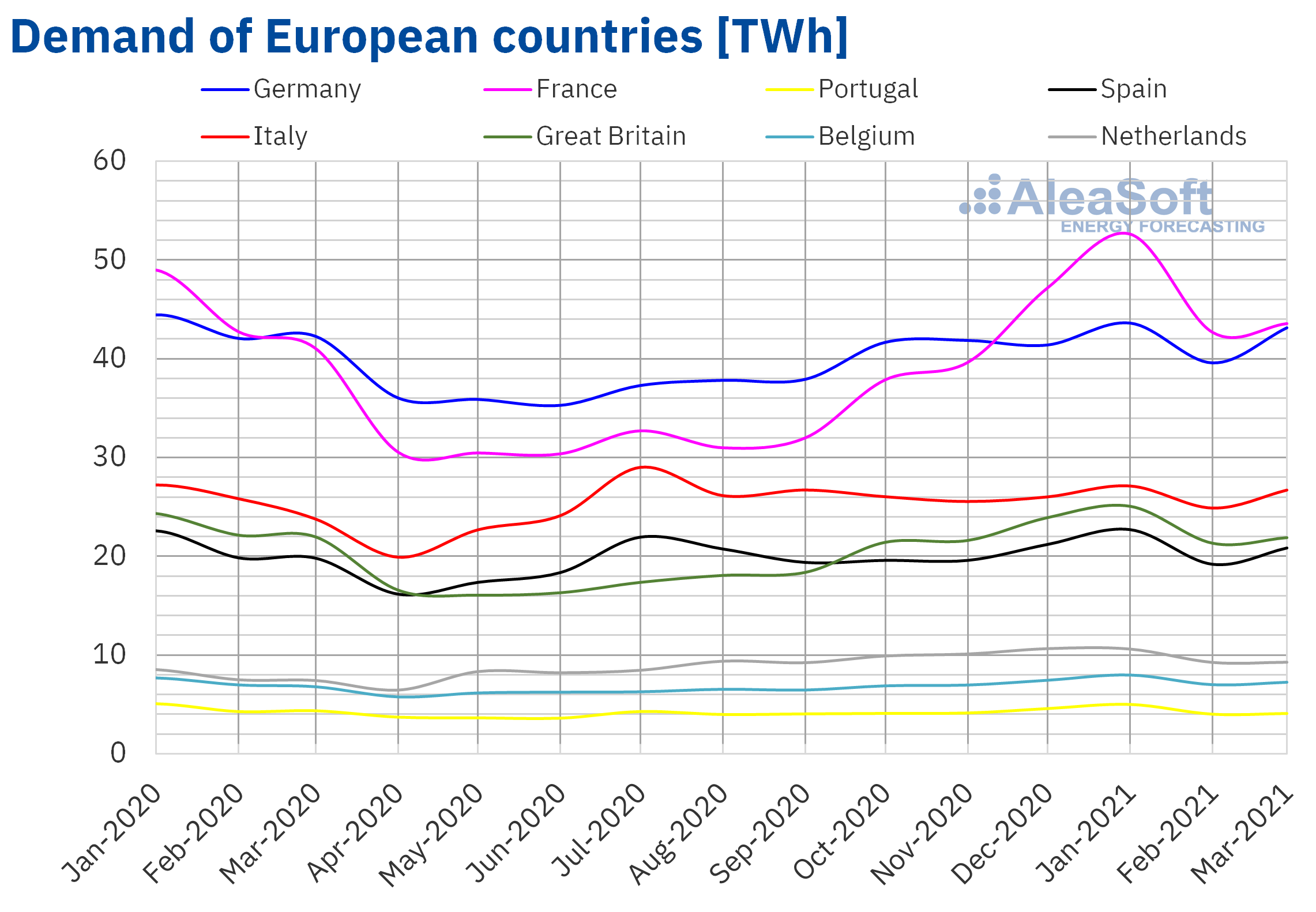

In general, the European electricity markets registered increases in electricity demand in the first three months of 2021 in year‑on‑year terms. The markets that registered the largest increases were those of France and Belgium, above 3.0% in each case. However, in some markets, the demand decreased, with the German market being the one with the greatest decrease, of 1.9%.

When comparing the demand of the first quarter of 2021 with that of the last quarter of 2020, there was a general increase in the markets analysed at AleaSoft. Also in this case, the greatest increase was that of the French market, which was over 11%. Other significant increases were those of Belgium, of 4.3% and that of Spain, of 3.9%.

During the first quarter of 2021, the average temperatures were lower than those of the previous quarter and that of the same quarter of 2020, a decrease that was favoured in part by the effect of the storm Filomena during the first half of January.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

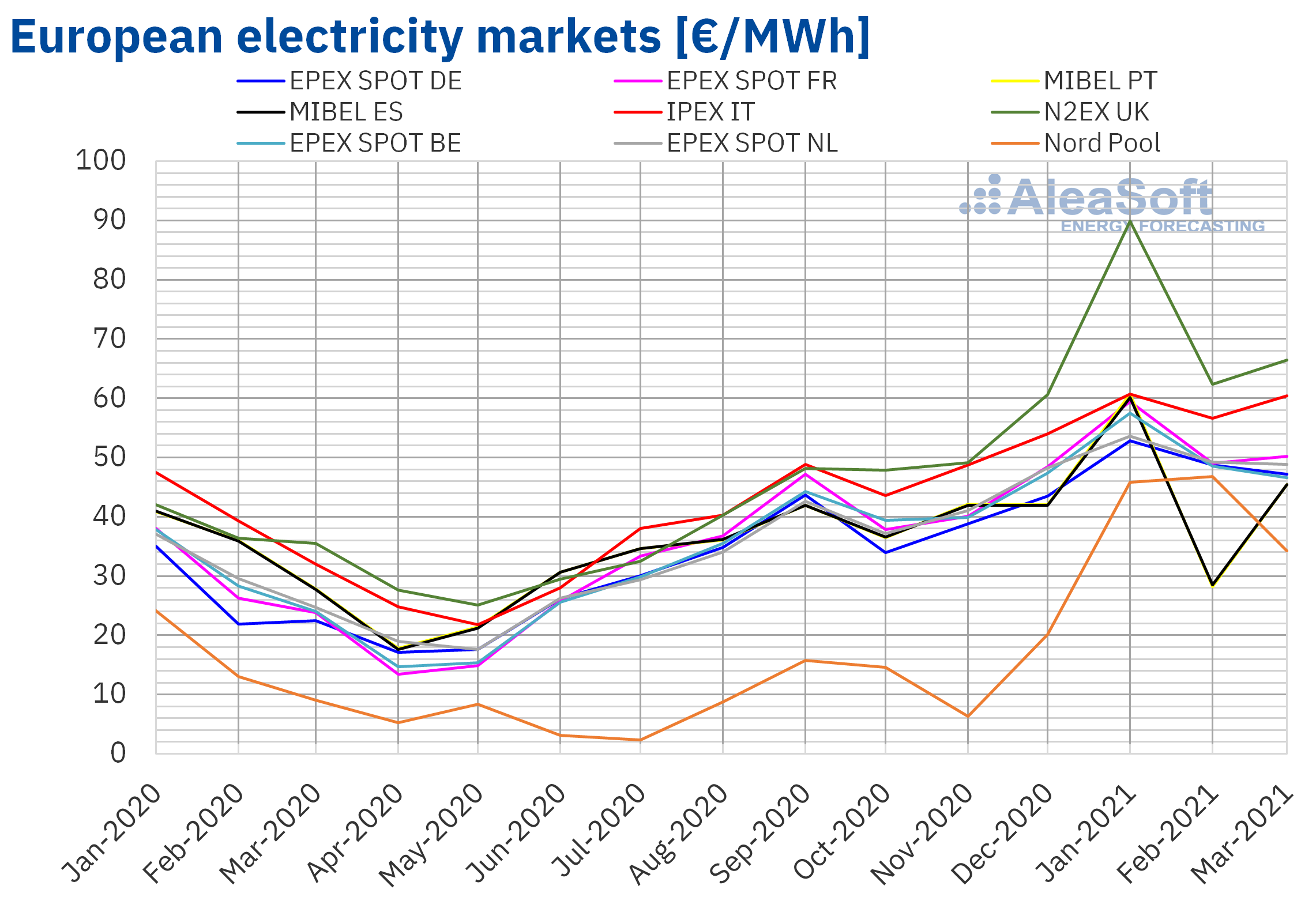

European electricity markets

In the first quarter of 2021, the quarterly average price was above €40/MWh in all the European electricity markets analysed at AleaSoft. The market with the lowest average, of €42.14/MWh, was the Nord Pool market of the Nordic countries, followed by the MIBEL market of Spain and Portugal, with averages of €45.24/MWh and €45.31/MWh, respectively. On the other hand, the highest quarterly average price, of €73.21/MWh, was that of the UK N2EX market. In the rest of the markets, the averages were between €49.59/MWh of the EPEX SPOT market of Germany and €59.31/MWh of the IPEX market of Italy.

Compared to the fourth quarter of 2020, the average prices increased in all European electricity markets analysed at AleaSoft. The largest price increase was that of the Nord Pool market, of 206%. On the other hand, the smallest increase, of 13%, was registered in the MIBEL market. The rest of the markets had price increases between 20% of the market of the Netherlands and 39% of the British market.

If the average prices of the last quarter are compared with those registered in the same quarter of 2020, there were also price increases in all markets. At the beginning of 2020, the gas and oil prices were on a marked downward trend and the impact of the COVID‑19 was beginning to be felt in the markets and the world economy. In this case, the largest increases also corresponded to the Nord Pool market and the N2EX market, which were 173% and 92% respectively. In the same way, the Iberian market was also the one with the lowest increase, with a rise of 30%. In the rest of the markets, the price increases were between 50% of the Italian market and 87% of the German market.

On the other hand, the highest daily price of the quarter, of £198.79/MWh, was registered on January 13 in the British market. This price was the highest in this market since 2010. On the other hand, the lowest daily price was the one reached on March 11 in the Belgian market, of €0.25/MWh, which was the lowest in that market since May 2020.

However, at the end of January and during almost the entire month of February, the lowest daily prices were registered in the MIBEL market. The minimum daily price in this market, of €1.42/MWh, was that of January 31, which was the lowest registered in the Iberian market since the beginning of March 2014.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The increase in demand in Europe, both compared to the first and the fourth quarters of 2020, and the increase in gas and CO2 prices favoured the price increases registered in the European electricity markets in the first quarter of 2021. Moreover, the decrease in wind energy production in countries such as Germany and France also contributed to this behaviour. However, in the Iberian Peninsula and Italy, the renewable, wind and solar, energy production of the first quarter of 2021 increased both compared to the previous quarter and the same quarter of 2020, limiting the increase in prices in these markets.

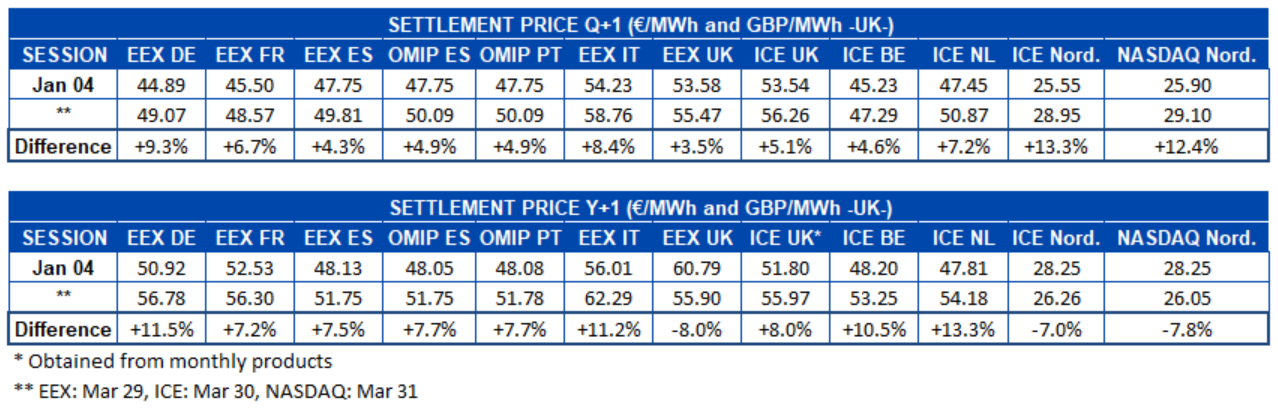

Electricity futures

When making an analysis of the electricity futures for the second quarter of 2021 that just began, negotiated during the first quarter of 2021, it is observed that in the last session the settlement prices of all the markets analysed at AleaSoft registered increases with respect to the first session of the quarter, held on January 4. The ICE market of the Nordic countries was the one with the highest increase, with 13%, followed closely by the NASDAQ market of the same region, with 12%. In the rest of the markets the increases were between 3.5% registered in the EEX market of the United Kingdom and 9.3% of the German EEX market.

As for the product of the calendar year 2022, the settlement prices increased in most markets, when comparing the values of the first and the last session of the quarter. The increases were between 7.2% of the EEX market of France and 13% of the ICE market of the Netherlands. On the other hand, in some markets there were decreases, the most pronounced being that of the EEX market of the United Kingdom, of 8.0%. The Nordic ICE and NASDAQ markets followed it closely with decreases of 7.0% and 7.8% respectively.

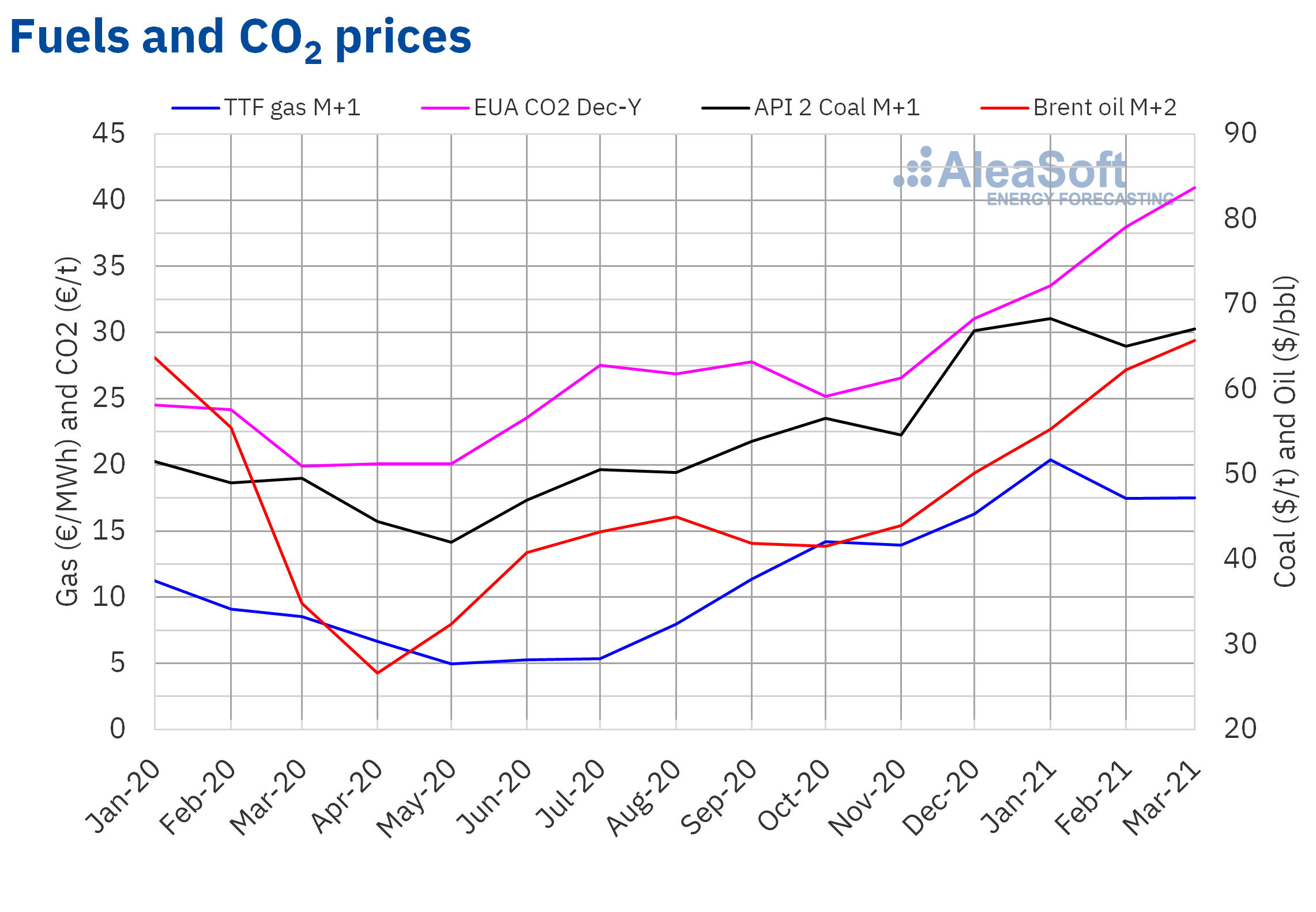

Brent, fuels and CO2

The Brent oil futures for the month M+2 in the ICE market began the first quarter of 2021 registering the quarterly minimum settlement price, of $51.09/bbl, on Monday, January 4. For most of the quarter, the prices rose until reaching the quarterly maximum settlement price, of $69.63/bbl, on Thursday, March 11. This price was the highest of these futures in the last two years. During the second half of March, the prices were somewhat lower, but they remained above $60/bbl.

On the other hand, the quarterly average price was $61.32/bbl. This value is 36% higher than that reached by the futures for the month M+2 in the fourth quarter of 2020, of $45.16/bbl. It is also 19% higher than that corresponding to the M+2 futures traded in the first quarter of 2020, of $51.72/bbl.

The successive OPEC+ agreements to adapt its production to the demand levels, as well as the expectations about the economic and health recovery, thanks to the government aids and the advance in vaccination against COVID‑19, favoured the increase in prices during the first quarter of 2021. The reductions in US production caused by the cold temperatures in February, the attacks on oil facilities in Saudi Arabia and the blockage of the Suez Canal in late March also contributed to the price increases.

However, the COVID‑19 pandemic is getting worse in Europe. For this reason, various countries had to tighten the mobility restrictions, which will affect the recovery in demand. On the other hand, the OPEC+ agreement of last April 1 to gradually increase the production between May and July of this year may also mean a brake on the recovery of the Brent prices.

As for the TTF gas futures in the ICE market for the month M+1, they reached their quarterly maximum settlement price, of €26.15/MWh, on Tuesday, January 12. This price was the highest in the last two years and was favoured by the low temperatures of the first half of January. But subsequently the prices fell and the quarterly minimum settlement price, of €15.53/MWh, was reached on March 3. In the last part of the quarter, the prices recovered and the settlement price of March 30 was €18.80/MWh.

Regarding the average value registered during the first quarter of 2021, this was €18.40/MWh. Compared to that of the futures for the month M+1 traded in the fourth quarter of 2020, of €14.81/MWh, the average increased by 24%. If compared to the M+1 futures traded in the first quarter of 2020, when the average price was €9.66/MWh, there was a 91% increase.

As for the CO2 emission rights futures in the EEX market for the reference contract of December 2021, during the first quarter of 2021, they followed a generally upward trend. The quarterly minimum settlement price, of €31.62/t, was registered on Monday, January 18. Subsequently, the prices increased and on Wednesday, March 17, a historical record of €42.98/t was registered.

On the other hand, the average price in the first quarter of 2021 was €37.65/t, 37% higher than that of the last quarter of 2020, of €27.56/t. If compared with the average for the first quarter of 2020, of €22.82/t, the average for the first quarter of 2021 is 65% higher.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

Monitoring of the evolution of the energy markets

Monitoring the evolution of the energy markets is essential to understand their behaviour and have strategic information. AleaSoft offers an online data platform that centralises the data of the variables of interest of the energy markets throughout Europe.

In addition to the evolution of the markets, it is necessary to build a mid‑term vision of the markets situation and prices in order to coherently plan the coverage, maintenance, investments, etc. AleaSoft has three‑year hourly prices forecasts for the most important markets in Europe, based on a scientific methodology, which also provides probability distributions of the future prices, necessary for the risk management models. Another input for risk management strategies or for optimisation processes are the monthly prices simulations, also available at AleaSoft.

To keep up to date with the evolution and prospects for the energy markets in Europe and the most important and current issues in the sector, AleaSoft regularly organises webinars with the participation of experts from the most important companies in the sector. The next webinar will be held on April 15 and will be attended by speakers from Axpo, to analyse who will be the new players in the financial markets to absorb the demand for financing given the expected avalanche of installed capacity, the taking of positions against the climate change of the large stakeholders worldwide and the solutions for the industry and for the renewable energies offered by the corporate PPA.