AleaSoft Energy Forecasting, May 2, 2022. The first four‑month period of 2022 in the European electricity markets was marked by prices above €200/MWh and record values in most cases, driven by gas prices and the evolution that the conflict between Russia and Ukraine had in them, and those of CO2. Solar energy production increased year‑on‑year in a generalised way and wind energy in various markets and their influence led to negative values being registered in some hours and markets. Demand fell in most markets.

Photovoltaic and solar thermal energy production and wind energy production

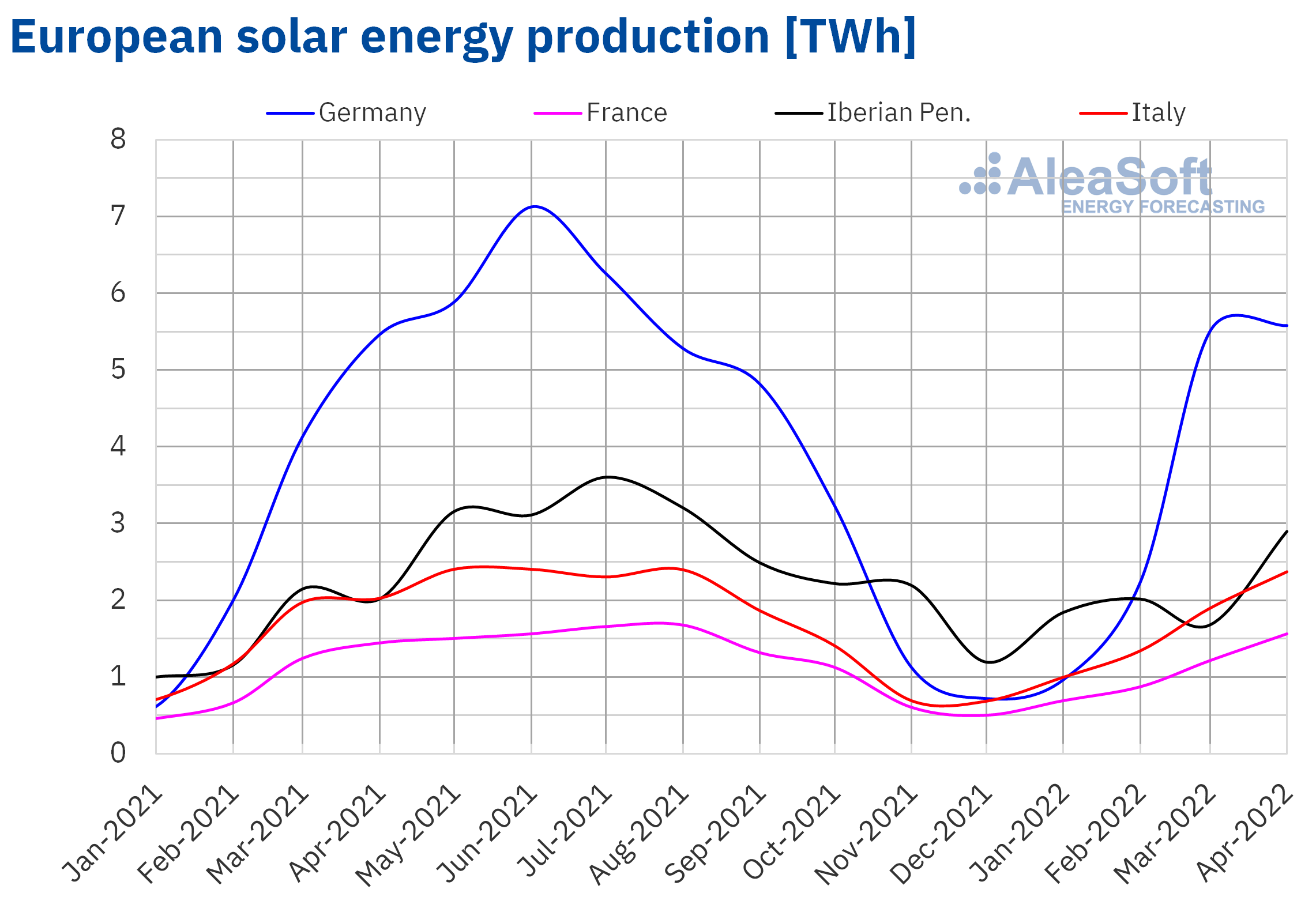

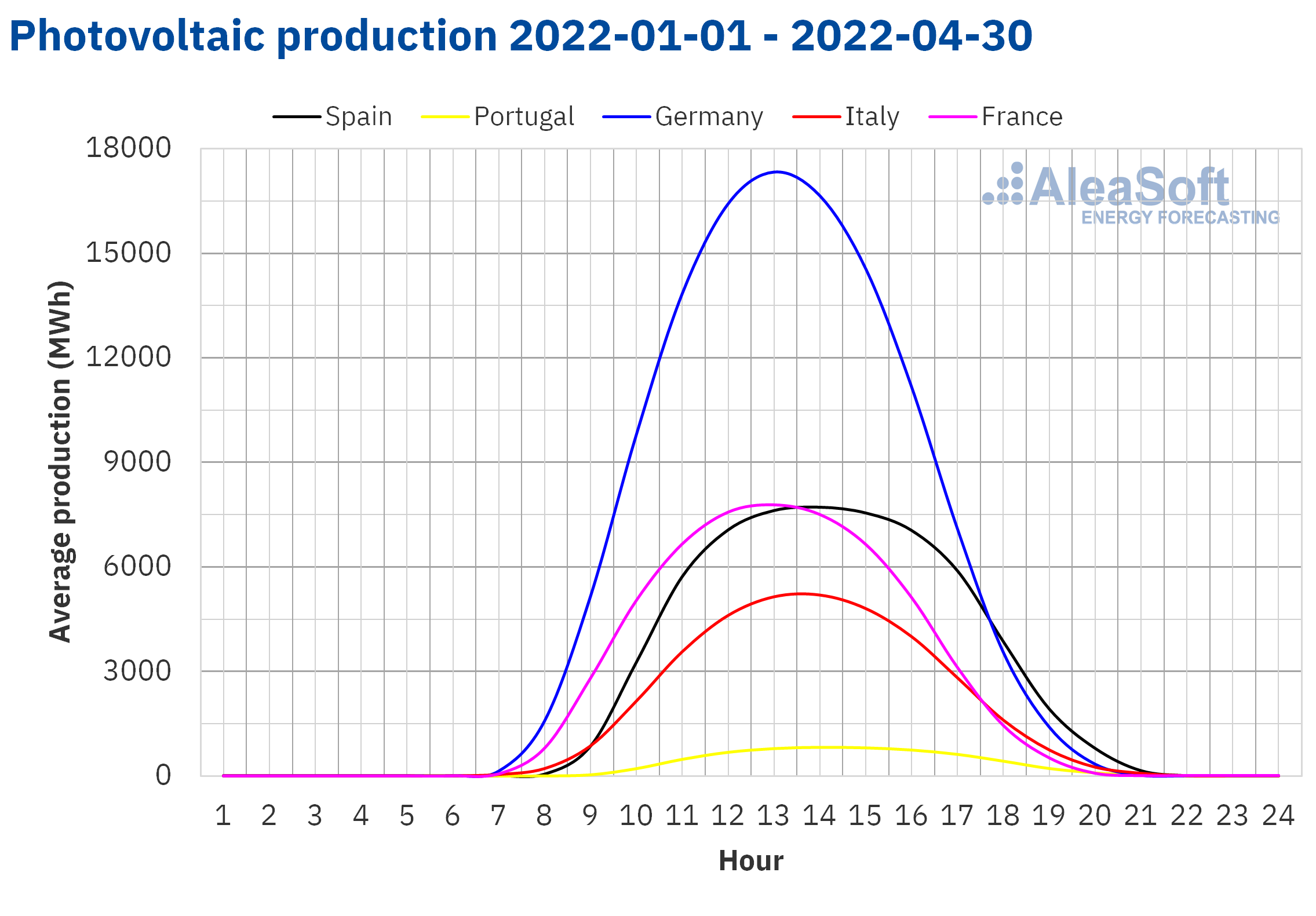

During the first four months of 2022, the solar energy production increased in all European markets analysed at AleaSoft Energy Forecasting compared to the homogeneous period of the previous year. Portugal was the market where the solar energy production increased the most, with an increase of 74%. Similarly, in Spain the production increased by 33% and in the Iberian Peninsula as a whole the increase in solar energy production was 36%, this rise also being above those of the rest of the analysed markets. This increase is due in part to the 661 MW increase in installed solar photovoltaic capacity in Spain, which began the period with 14 888 MW and now amounts to 15 549 MW, and to the increase in installed capacity in Portugal from 1 392 MW at 1 488 MW.

On the other hand, the smallest of the year‑on‑year increases was that registered in Italy, where the production rose by 12% in the first four months.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

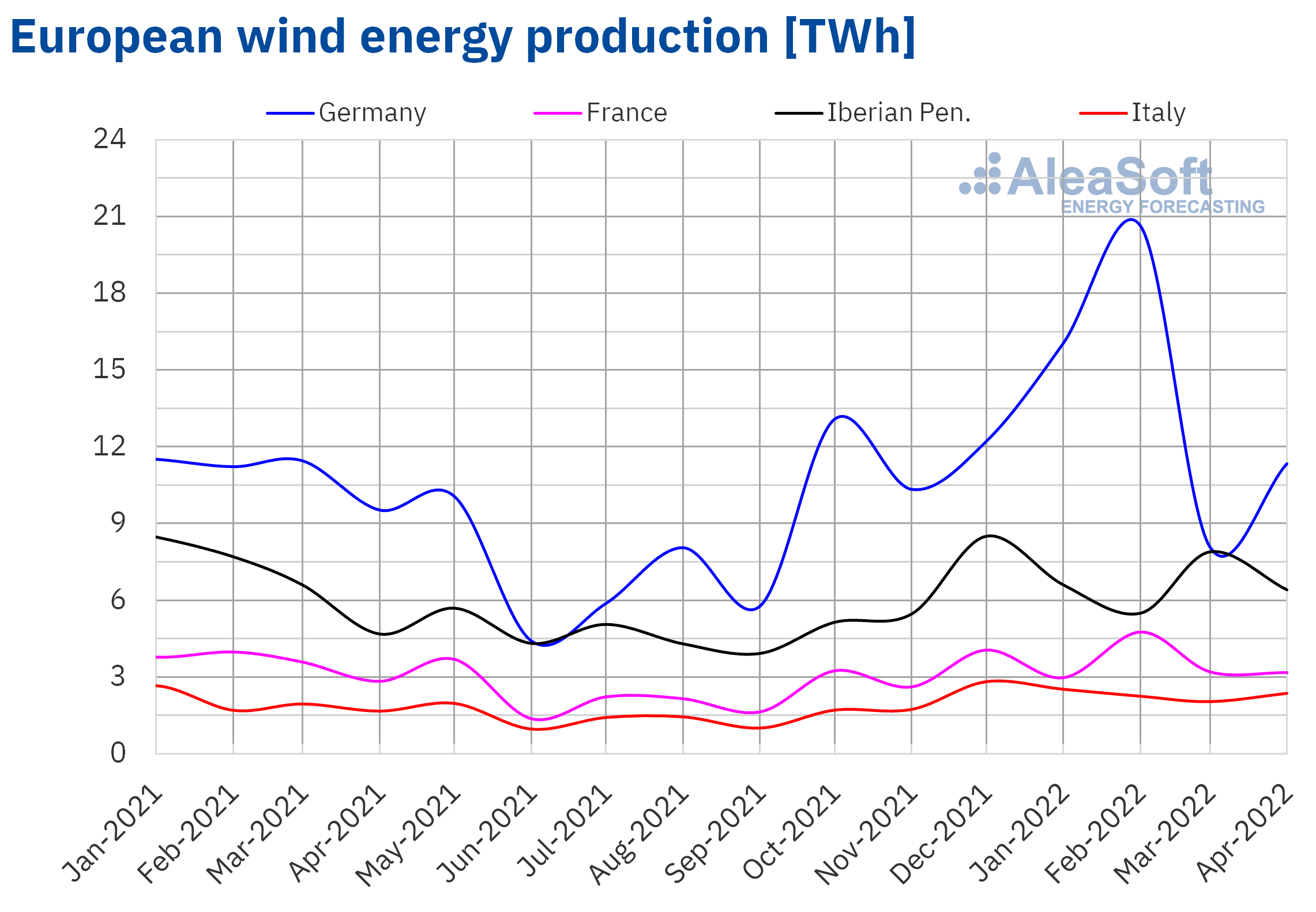

The wind energy production increased in most markets analysed at AleaSoft Energy Forecasting during the first four months of 2022 compared to the first four months of 2021. In the German market, the production grew by 28% compared to the first third of 2021, while in the Italian market the production with this technology increased by 15% and in the Portuguese market by 2.0%. In the case of the Spanish market, although the installed capacity increased by 223 MW during the four‑month period, the production fell by 5.0% compared to the same period of 2021. Similarly, in the French market, the production fell by 0.4% compared to the first third of 2021.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

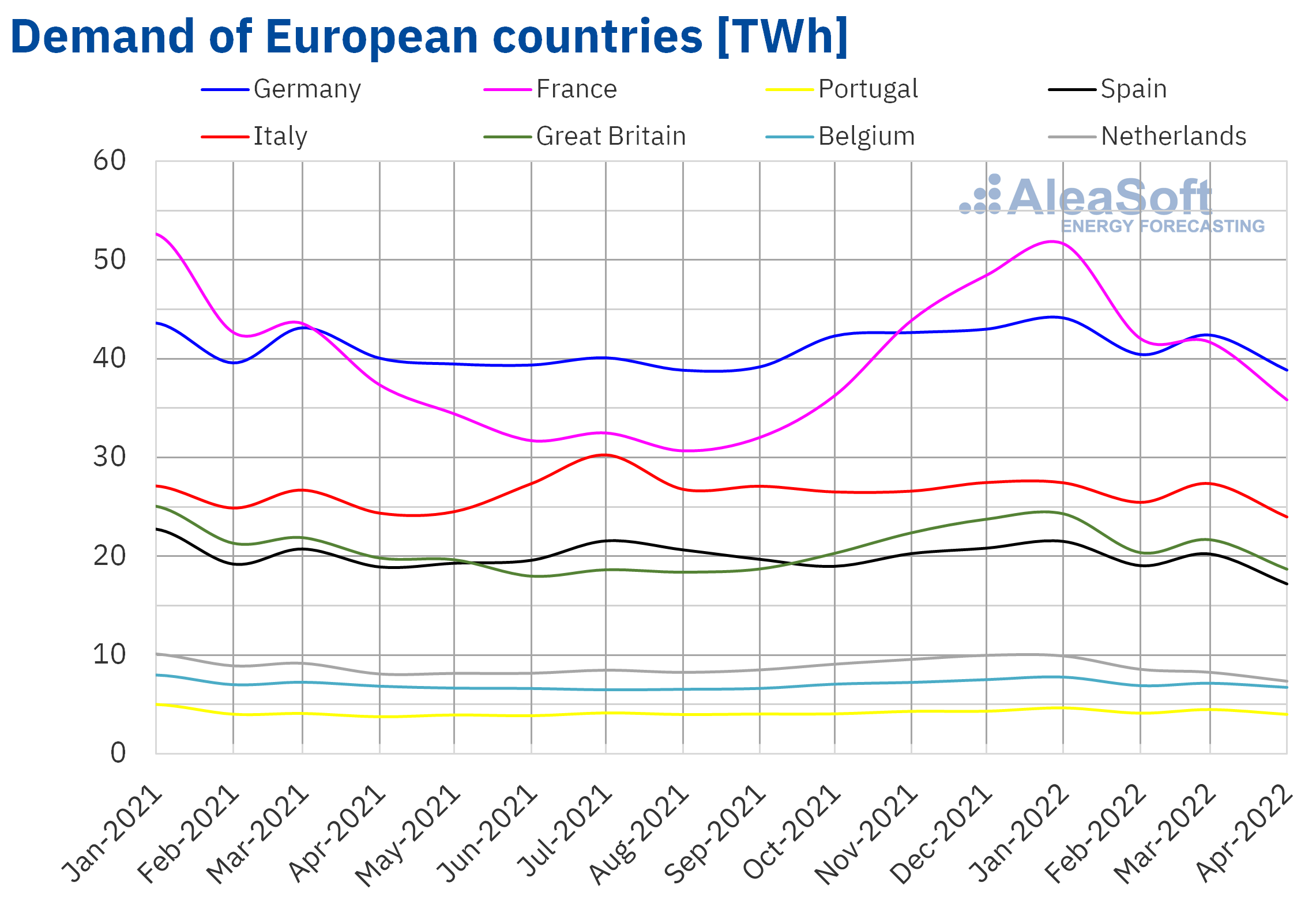

The temperatures registered in the first four months of 2022 were on average less cold than those of the same period of the previous year in most European markets. This favoured the fact that in the first four‑month period of the year the electricity demand fell in year‑on‑year terms in most markets. The largest decrease, of 6.1%, was registered in the Netherlands, which coincided with the fact that it was in this market where the average temperature increased the most, by 2.1 °C. In the markets of Spain and the United Kingdom, there were also significant drops in demand between January and April 2022 compared to the same months of 2021, of 4.4% and 3.5%, respectively. In Germany, Belgium and France the decreases were between 0.3% and 2.8%. The markets in which the demand increased in the first four months of 2022 in year‑on‑year terms were Portugal, by 2.3%, and Italy, by 1.1%.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

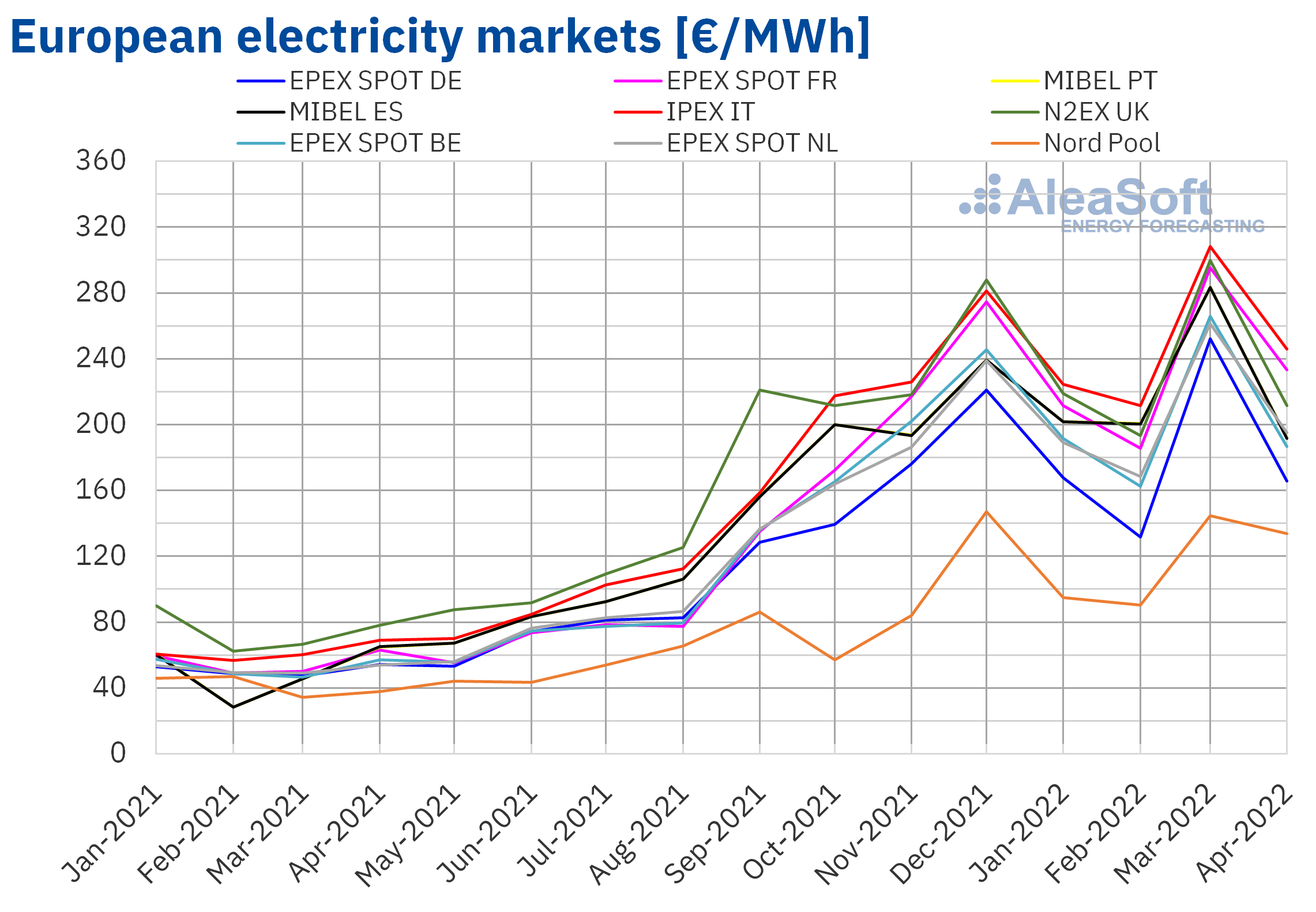

European electricity markets

In the first four months of 2022, the average price was above €200/MWh in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exceptions were the Nord Pool market of the Nordic countries and the EPEX SPOT market of Germany, with averages of €116.40/MWh and €180.55/MWh, respectively. In contrast, the highest four‑monthly average price, of €248.45/MWh, was that of the IPEX market of Italy, followed by that of the EPEX SPOT market of France, of €232.43/MWh. In the rest of the markets, the averages were between €202.66/MWh of the EPEX SPOT market of Belgium and €231.94/MWh of the N2EX market of the United Kingdom.

If the average prices of the first four‑month period of 2022 are compared with those registered in the same period of 2021, prices increased significantly in all markets. The highest price rise was that of the MIBEL market of Spain and Portugal, of 338%, while the smallest increase was that of the Nordic market, of 183%. In the rest of the markets, the price increases were between 213% of the British market and 318% of the French market.

With these price increases, in the first four months of 2022 the average prices reached historical maximums in all analysed markets, except in the British market. In this market, the second highest average in history was registered, after the one reached in the previous four‑month period.

Regarding the hourly prices reached during the four‑month period, in the markets of Germany, Belgium, Spain, France and the Netherlands, a price of €700.00/MWh was registered on Tuesday, March 8, from 19:00 to 20:00. This hourly price was the highest in history in Spain and at least since April 2011 in the Netherlands. In Germany and Belgium, it was the highest price since the end of April 2008 and March 2011, respectively. However, in the case of France, the low temperatures and a significant part of the country’s nuclear reactors out of operation contributed to a price of €2987.78/MWh being reached on April 4, from 8:00 to 9:00. This price was the highest since October 2009.

On the other hand, during the first four months of 2022, negative hourly prices were also registered. Among them, the prices registered on April 23 and 24 in Belgium and the Netherlands stand out. In Belgium, a price of ‑€100.00/MWh was reached on Sunday, April 24, from 13:00 to 14:00, which was the lowest since April 2020. Regarding the Netherlands, the price of Saturday, April 23, from 12:00 to 13:00, was ‑€222.36/MWh, the lowest since at least April 2011.

In the first four‑month period of 2022, the average price of CO2 emission rights exceeded twice the average of the same period of 2021, while the four‑monthly gas prices were more than five times higher than in the first four‑month period of 2021. This favoured the rise in prices in the European electricity markets, despite the decrease in demand in most markets, the general increase in solar energy production and the increase in wind energy production in some markets such as the German, the Portuguese or the Italian.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

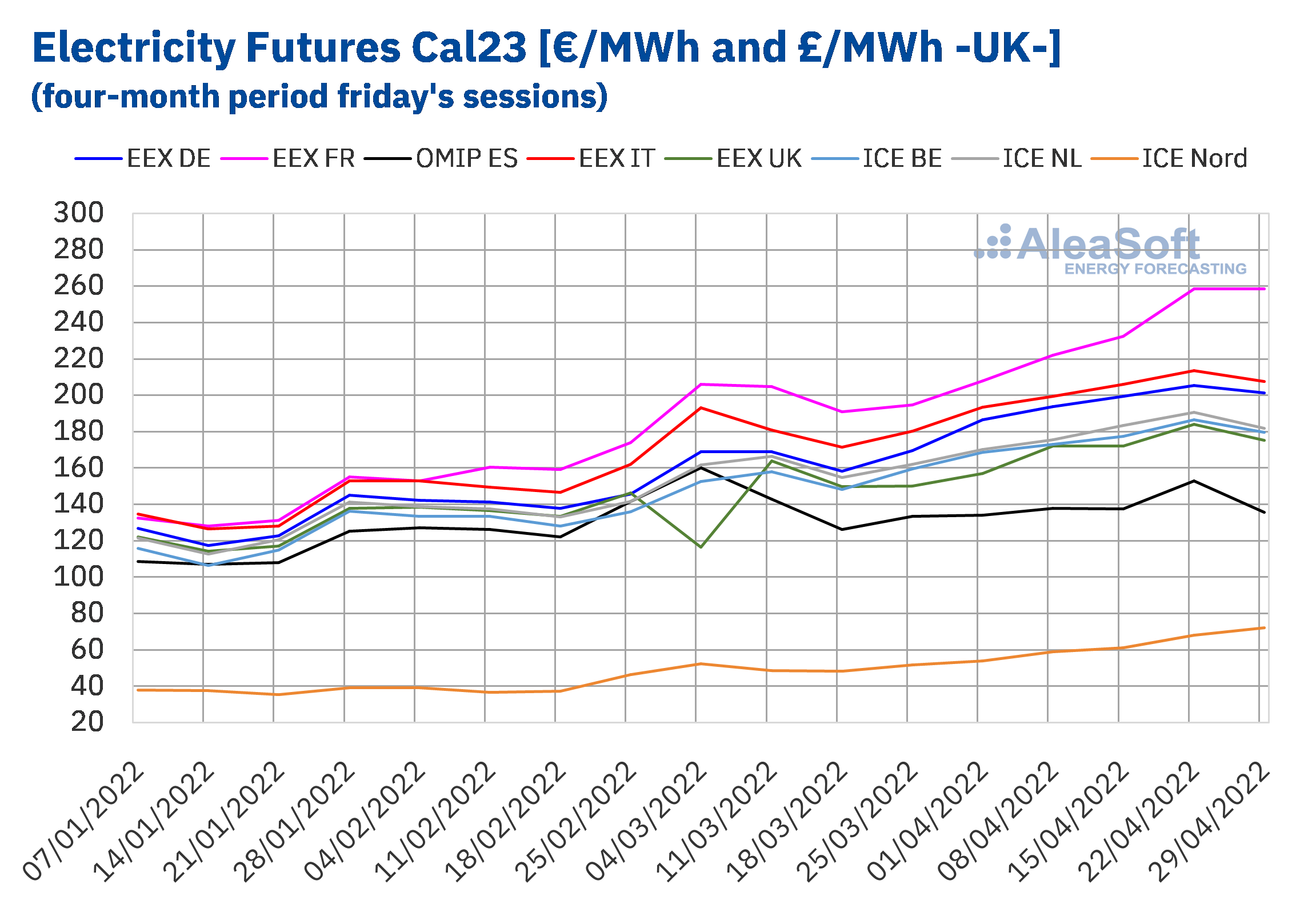

Electricity futures

During the first four months of 2022, the settlement prices of electricity futures for the next year registered a clear upward trend. Not only prices increased in all markets analysed at AleaSoft Energy Forecasting, but also differences between the markets prices became more notable. During this period, between the sessions of January 7 and April 29, the Spanish market was the one in which electricity futures prices for 2023 increased the least. The Iberian Peninsula is the only region where the rise in prices was lower than 25%. This behaviour has among its main causes, the effect of the announcement of the acceptance by the European Commission of the application of a cap on gas prices in the Iberian electricity market by which the gas price will be limited to an average €50/MWh for the next 12 months. On the other hand, in the EEX market of France there was the largest price increase, almost doubling its figures of the beginning of the year with a 95% increase.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX, OMIP and ICE.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX, OMIP and ICE.

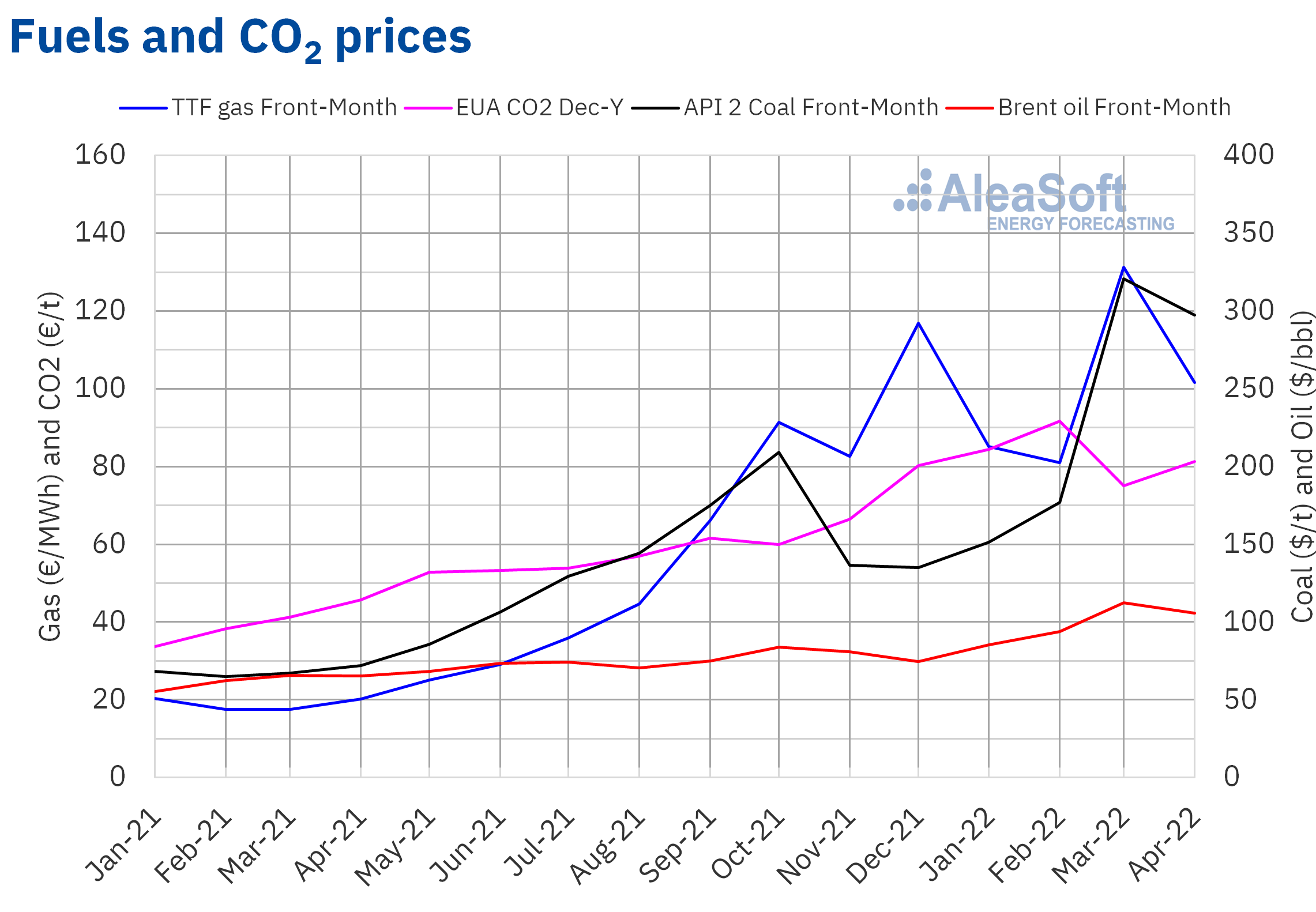

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered an average price of $99.81/bbl in the first four‑month period of 2022. This value is 60% higher than that reached by Front‑Month futures of the first four‑month period of 2021, of $62.32/bbl.

During the first four‑month period of 2022, the evolution of the conflict between Russia and Ukraine exerted its influence on Brent oil futures prices. The sanctions imposed on Russia and the fear of interruptions in supply favoured the increase in prices. As a result, a historical maximum settlement price of $127.98/bbl was reached on March 8, which was the highest since July 2008.

However, in April, settlement prices remained below $115/bbl. The new confinements in China due to the increase in coronavirus infections exerted their downward influence on prices. The effects of the war on the economy also contributed to increasing concern about the evolution of the demand.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during the first four‑month period of 2022 for these futures was €100.91/MWh. Compared to that of Front‑Month futures traded in the first four‑month period of 2021, of €18.87/MWh, the average increased by 435%.

During the first four‑month period of 2022, TTF gas futures prices were highly influenced by the conflict between Russia and Ukraine. The fear of interruptions in gas supply from Russia favoured the rise in prices. As a consequence, on Monday, March 7, a historical maximum of €227.20/MWh was reached. But, subsequently, prices fell and in the last session of the four‑month period, the settlement price was lower than €100/MWh.

However, Russia has already cut the gas supply to Poland and Bulgaria because they refused to pay in roubles. Meanwhile, other European countries are looking for ways to meet Russian demands without breaking European Union sanctions. For its part, Russia increased its gas supply to China in the first four months of 2022.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2022, they reached an average price in the first four‑month period of 2022 of €82.77/t. If compared to the average of the first four‑month period of 2021 for the reference contract of December of that year, of €39.81/t, the average of the first four‑month period of 2022 is 108% higher.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

On May 12, the next AleaSoft Energy Forecasting’s monthly webinar will be held, this time focused on energy market price forecasting and its importance for renewable energy developers, electro‑intensive consumers, investment funds and banks. The speakers will be Oriol Saltó i Bauzà and Alejandro Delgado, both Associate Partners at AleaGreen. The analysis table of the Spanish version of the webinar will have the participation of three experts with extensive experience in the energy sector, who have collaborated with AleaSoft Energy Forecasting for more than 15 years, who will explain some application cases of forecasts: Alberto Ceña Lázaro, CEO of BEPTE, S.L., Antonio Canoyra Trabado, associate professor at the Department of Electric Power at the Comillas Pontificial University (ICAI), and Francisco Del Río, energy management expert.

In the webinar, the current situation of the European markets, the new regulatory issues will also be analysed, the Alea Energy DataBase (AleaApp) for the compilation, visualisation and analysis of energy markets data will be explained and AleaGreen, the new division of AleaSoft Energy Forecasting, created in January 2022, will be presented, which is specialised in long‑term price curves forecasting reports for European markets.

Source: AleaSoft Energy Forecasting.