AleaSoft Energy Forecasting, September 20, 2021. In the third week of September, the price rises in the European electricity markets continued, once again registering daily and hourly highs. Electricity futures prices also increased. The main cause of these increases is the high prices of gas, which once again registered a record price, higher than €70/MWh, and of CO2. A drop in solar and wind energy production in most markets was added to this. Demand declined in most of the markets.

Photovoltaic and solar thermal energy production and wind energy production

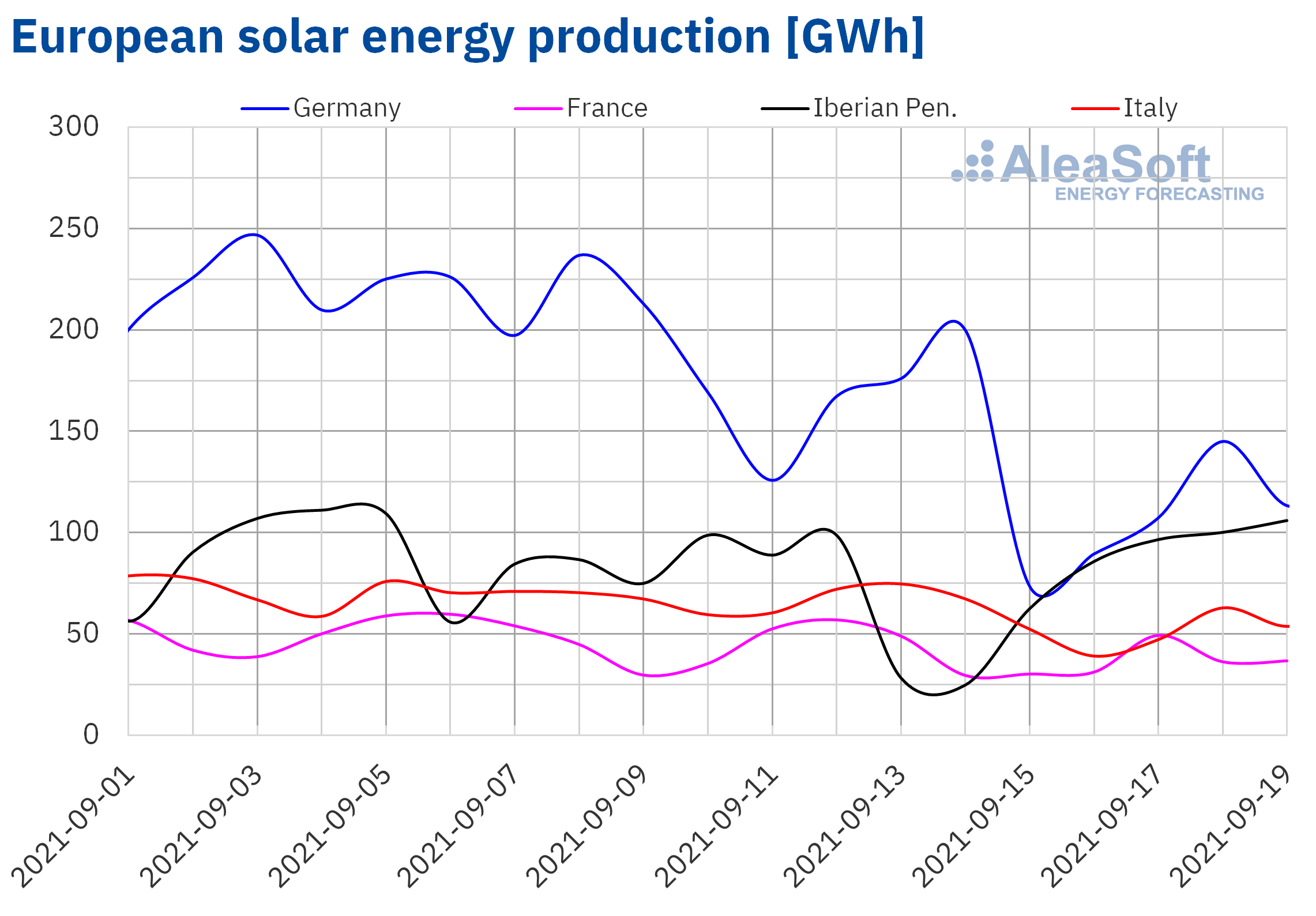

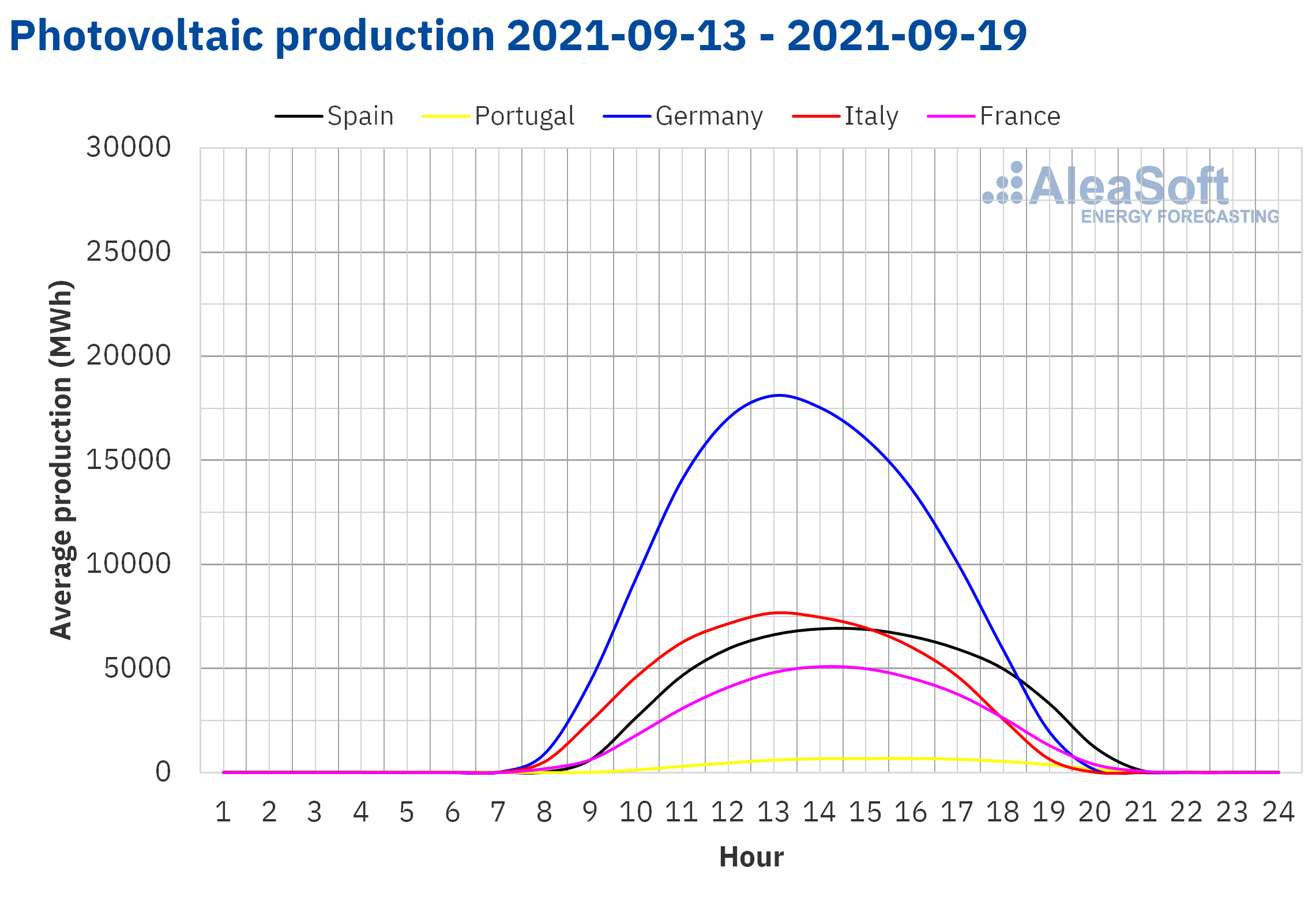

During the week of September 13, the solar energy production decreased in all European markets analysed at AleaSoft Energy Forecasting compared to the previous week. The largest decrease, of 32%, was registered in the German market, while in the Portuguese market there was the smallest decrease, of 5.6%. In the rest of the markets, the production with this technology decreased between 15% and 21%.

For the week of September 20, the AleaSoft Energy Forecasting’s solar energy production forecasting points to a recovery in the markets of Spain, Italy and Germany.

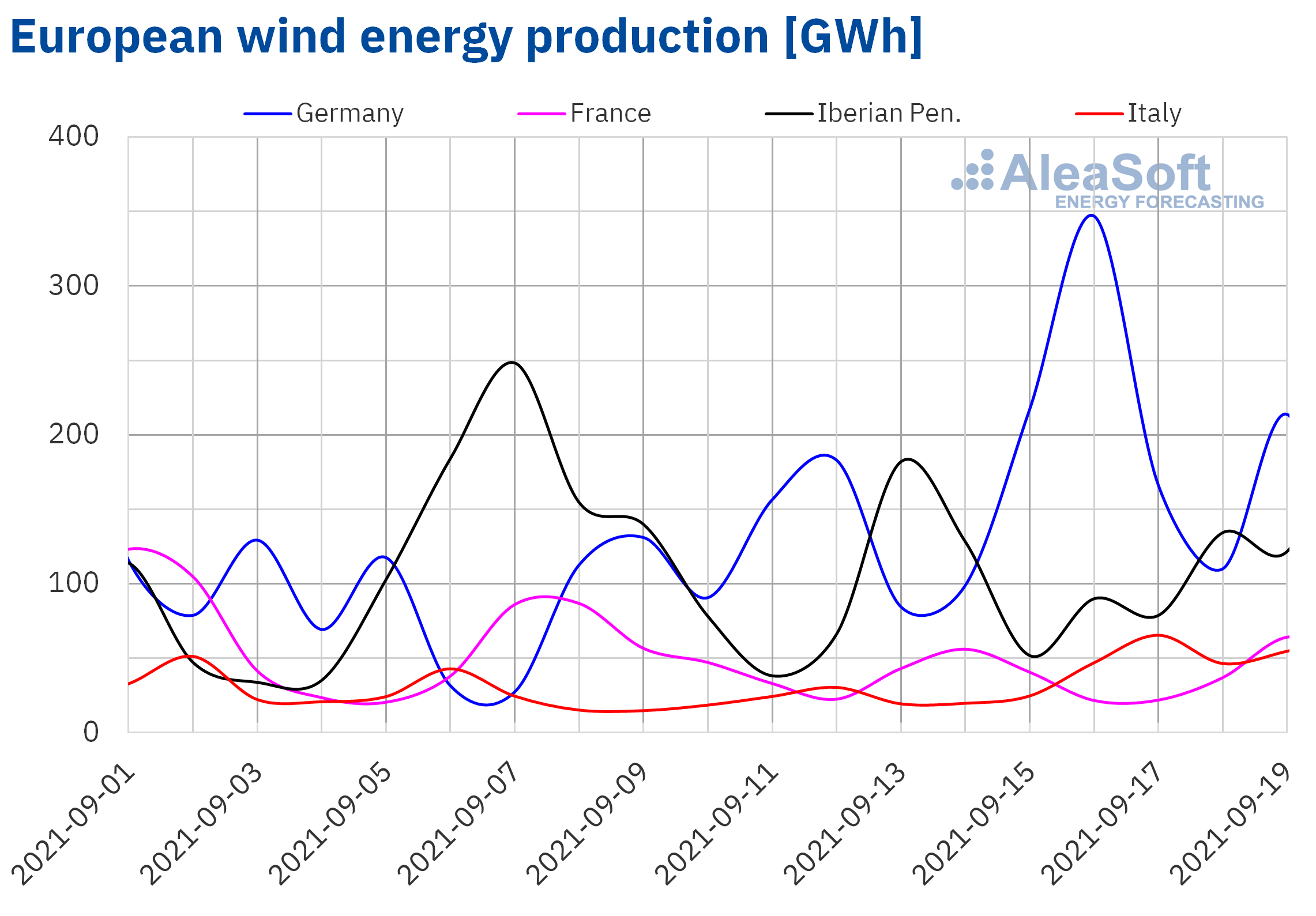

During the third week of September, the wind energy production decreased in most of the analysed markets. In the French market, the generation with this technology fell by 23%, while in the Iberian Peninsula the decrease was 13%. The exceptions were the markets of Germany and Italy, where the wind energy production increased by 69% and 63% respectively.

For the penultimate week of September, the AleaSoft Energy Forecasting’s forecasts indicate that the wind energy production will increase in most of the analysed markets, the exception being the Italian market, where a lower generation with this technology is expected.

Electricity demand

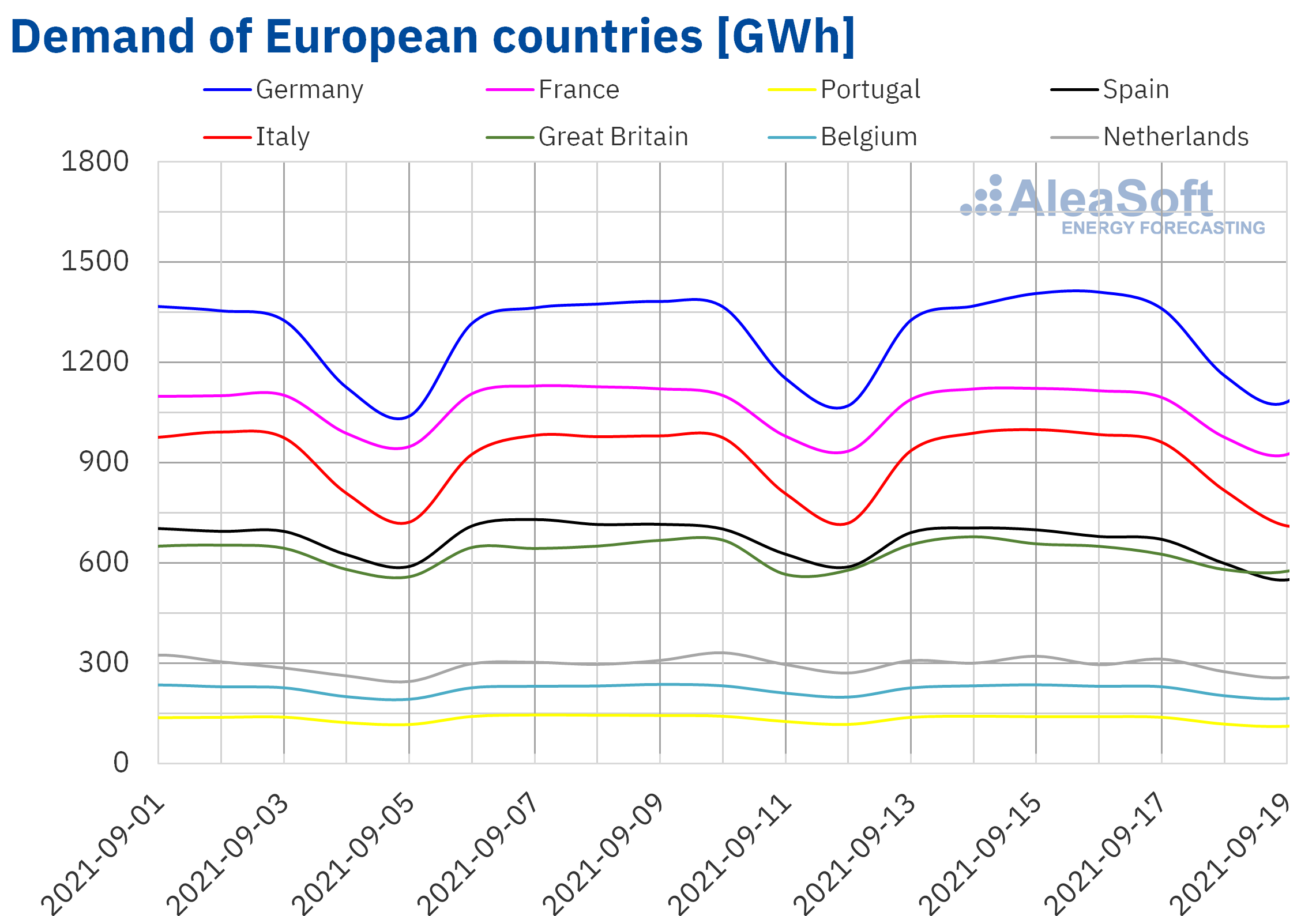

In the week of September 13, the electricity demand decreased in most European markets compared to the previous week, while similar values were registered in the rest. The drop in average temperatures in the last days of summer was one of the causes of these drops. The decrease in mean temperatures was between 1.9 °C and 2.8 °C. The most notable declines in demand were registered in the Iberian Peninsula, which were 3.2% and 4.1% in Portugal and Spain respectively. On the other hand, in the British market, the demand was almost identical to that of the previous week, where the accumulated demand was 4426 GWh, only 1 GWh higher than the previous week. The markets of Germany and Italy had increases of 1.0% and 0.5% in each case.

For the fourth week of September, the demand is expected to continue decreasing in most electricity markets during the transition days between summer and autumn, according to the AleaSoft Energy Forecasting’s demand forecasting.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

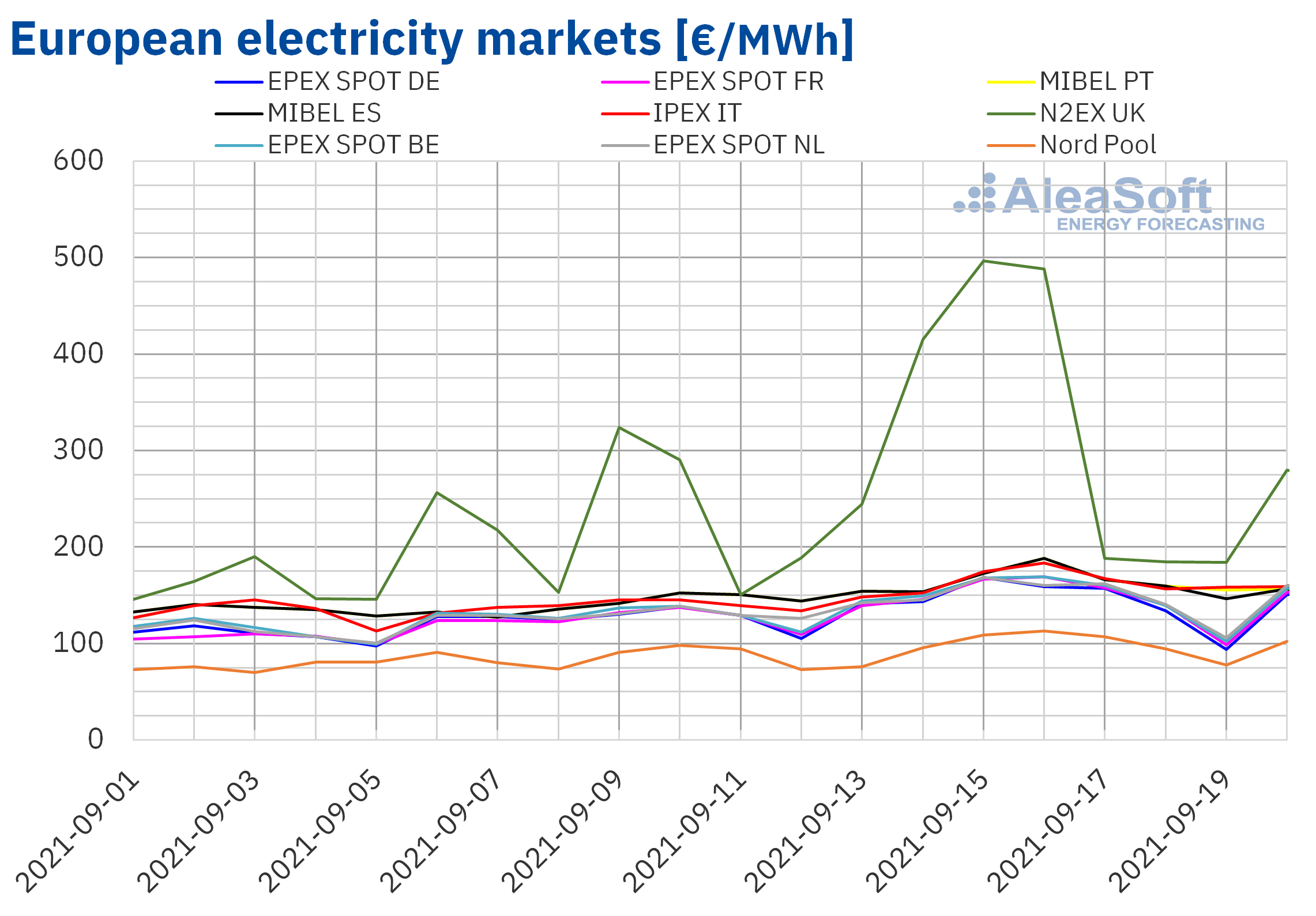

In the week of September 13, the prices of all the European electricity markets analysed at AleaSoft Energy Forecasting increased. The largest price rise was that of the N2EX market of the United Kingdom, of 39%, followed by those of the IPEX market of Italy and the MIBEL market of Portugal, of 17% in both cases. On the other hand, the lowest price increase was that of the Nord Pool market of the Nordic countries, of 12%. In the rest of the markets, the price increases were between 13% of the EPEX SPOT market of Germany and of the Netherlands and 16% of the French and Spanish markets.

In the third week of September, the highest weekly average price was that of the N2EX market, of €314.44/MWh. On the other hand, the lowest average was that of the Nord Pool market, of €96.05/MWh. In the rest of the markets, the prices were between €142.36/MWh of the EPEX SPOT market of Germany and €164.25/MWh of the MIBEL market of Portugal.

The highest daily price in the third week of September, of €496.56/MWh, was reached on Wednesday, September 15, in the British market and it was the highest price in this market at least since January 2010. That day, the prices of the markets of Germany and the Netherlands, of €168.21/MWh and €168.28/MWh respectively, were the highest in these markets since July 2006 and at least since April 2011 in each case.

The rest of the analysed markets reached their maximum daily prices of the week on Thursday, September 16. In the Nord Pool market, the price of €113.04/MWh was the highest at least since January 2011. The Belgian and French markets, with prices of €169.14/MWh and €169.36/MWh, registered that day their highest prices since November 2018 and February 2012 respectively. While the Italian market price, of €183.42/MWh, was the highest at least since January 2005. In the MIBEL market of Spain and Portugal, the price was €188.18/MWh, the highest in the history so far.

Regarding the hourly prices, the highest in the third week of September, of £2500.01/MWh, was reached on Wednesday, September 15, in the N2EX market at 7:00 p.m. British time. This price was the highest registered in the market of the United Kingdom at least since January 2010. On the other hand, on Thursday, September 16, the markets of the Nordic countries, France and Italy reached the highest hourly prices since February 2021, September 2020 and August 2012, respectively. In the case of Italy, the price at 7 in the afternoon reached €212.00/MWh.

In the case of the MIBEL market of Spain and Portugal, that day there were nine hours with prices above €190/MWh. The highest price, of €198.85/MWh, was reached at 9 at night. This price was the highest in its history so far.

Regarding the markets of Germany, Belgium and the Netherlands, these reached their highest hourly prices, of €205.00/MWh, €209.40/MWh and €209.40/MWh respectively, at 7 in the afternoon of Monday, September 20. These were the highest hourly prices since February 2012 in Germany and the Netherlands and since November 2018 in Belgium.

During the third week of September, the high gas and CO2 emission rights prices continued to favour the price increases in the European electricity markets. The general decline in solar energy production and the drop in wind energy production in countries such as France, Spain and Portugal also contributed to this trend.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the week of September 20 the European electricity markets prices will decrease in a generalised way compared to those of the previous week, influenced by the increase in wind energy production in most markets and the recovery of the solar energy production in countries such as Germany, Spain or Italy.

Electricity futures

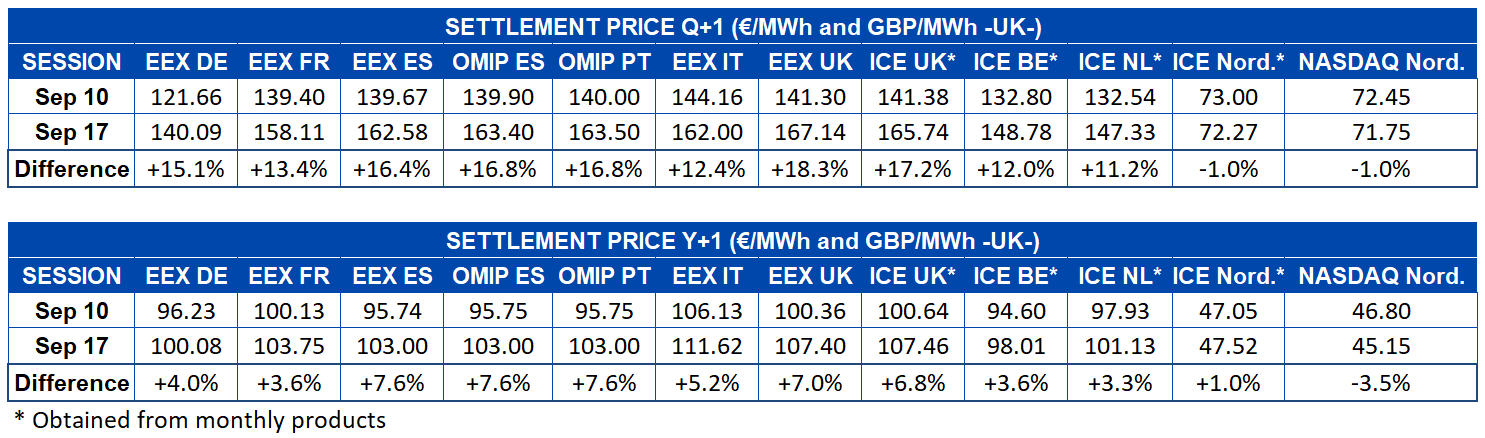

At the end of the third week of September, the European electricity futures prices for the next quarter continued to increase in most of the markets analysed at AleaSoft Energy Forecasting. The largest increases with respect to the settlement price of Friday of the previous week, September 10, were registered in the EEX market of the UK and Spain, the ICE market of the UK and the OMIP market of Spain and Portugal. These increases were between 16% and 18%. The exceptions were the ICE and NASDAQ markets of the Nordic countries in which prices decreased by 1.0% compared to the previous Friday. In the rest of the markets the variation was between 11% and 15%.

Electricity futures for 2022 also rose almost across the board. In this case, the largest increases were between 6.8% and 7.6% and were registered in the EEX market of the UK and Spain, the ICE market of the UK and the OMIP market of Spain and Portugal. Similar to what happened in the negotiation of the product for the next quarter, in the NASDAQ market of the Nordic countries the settlement price fell by 3.5%, contrary to the trend of the rest of the analysed markets. In the rest of the markets the increase was in the range between 1.0% and 5.2%.

Brent, fuels and CO2

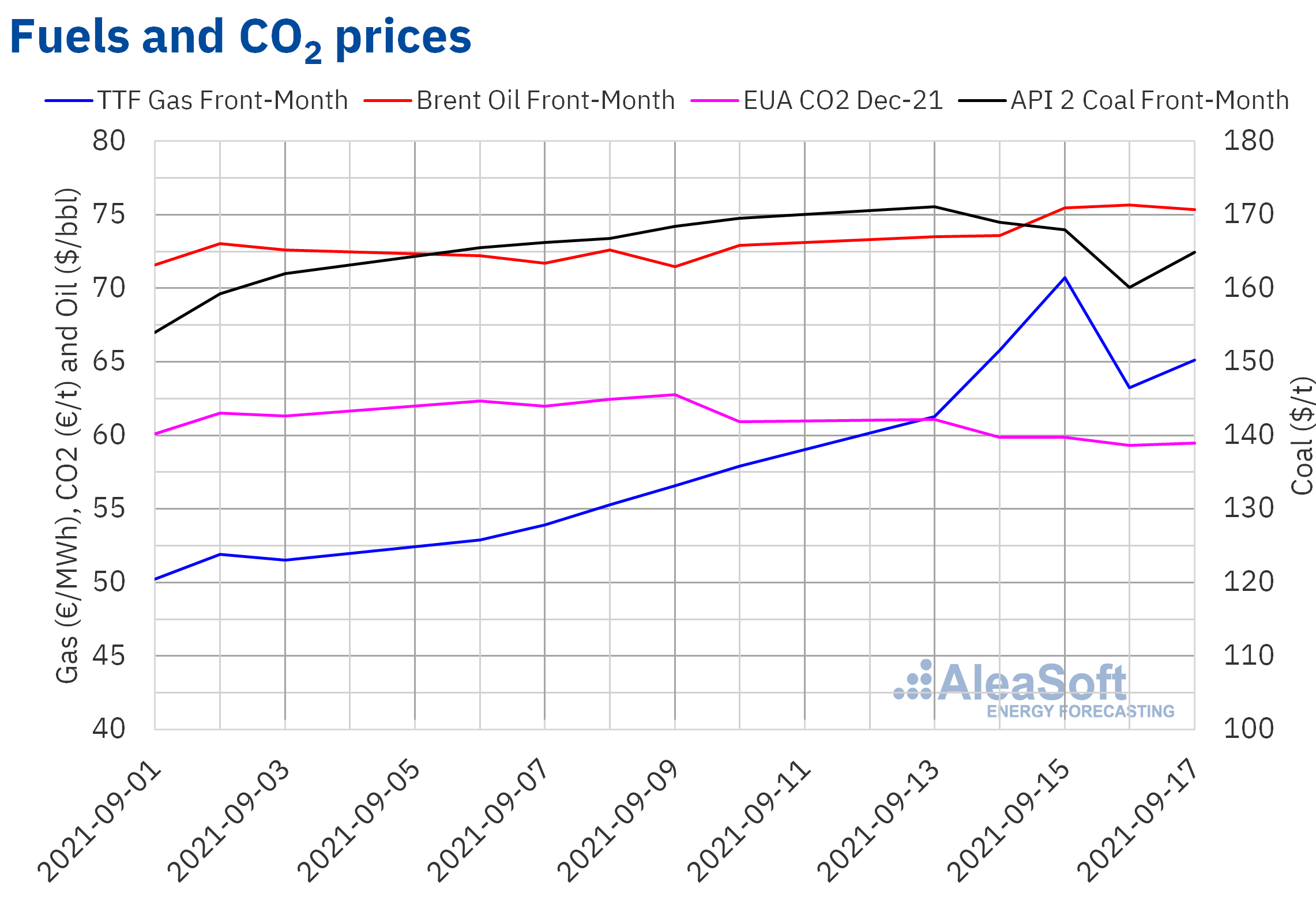

The Brent oil futures prices for the Front‑Month in the ICE market, during the third week of September, increased until reaching a settlement price of $75.67/bbl on Thursday, September 16. This price was 5.9% higher than that of the previous Friday and the highest since the end of July. On Friday, September 17, the settlement price fell slightly to $75.34/bbl, but it was still 3.3% higher than that of the previous Friday.

In the third week of September, the recovery of the demand continued to favour the increase in Brent prices. However, the recovery of the US production levels after Hurricane Nicholas pushed prices down on Friday. In the coming days, this recovery of the production in the Gulf of Mexico, together with a stronger dollar, might continue to exert its influence on prices and favour further declines.

As for the TTF gas futures prices in the ICE market for the Front‑Month, they continued their upward trend until Wednesday, September 15. On that day, they reached a settlement price of €70.71/MWh, 28% higher than that of the previous Wednesday and the highest since at least October 2013. However, on Thursday, September 16, they registered a drop of 11% to €63.25/MWh. On Friday, September 17, the prices recovered their upward trend, reaching €65.10/MWh, a price 12% higher than that of the previous Friday. The low levels of the reserves will continue to favour the upward trend in gas prices. But news about the expected gas supply from Russia might affect price developments.

Regarding the CO2 emission rights futures in the EEX market for the reference contract of December 2021, during the third week of September, the settlement prices were lower than those of the same days of the previous week. After reaching a settlement price of €61.07/t on Monday, September 13, the rest of the week the prices remained below €60/t. The minimum settlement price of the week, of €59.31/t, was registered on Thursday, September 16, and it was 5.5% lower than that of the previous Thursday.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

At AleaSoft Energy Forecasting it is considered that the current situation of tension in the gas markets is structural and that it will continue at least until the first quarter of 2022, a factor that is taken into account in the mid‑term forecasting with stochasticity of the European electricity markets.

The rises in gas prices and the prospects and consequences for the electricity market prices will be some of the topics that will be analysed in the AleaSoft Energy Forecasting’s webinar of October 7. On this occasion, there will be again the speakers from the consulting firm Deloitte who participated in the webinar held in October 2020, who will update the status of the issues addressed on that occasion related to the renewable energy projects financing and the importance of the forecasting in the portfolio valuation and audits.