AleaSoft, May 5, 2021. The high prices occurred in European electricity markets, such as the Iberian MIBEL, are causing obvious concern among the large consumers, who try to cover the electricity of 2022 in the futures markets at very high prices. The purchase of energy must be part of a robust and diversified strategy, based on market price forecasts, which allows obtaining energy in the best conditions in each time horizon.

The escalation of energy prices

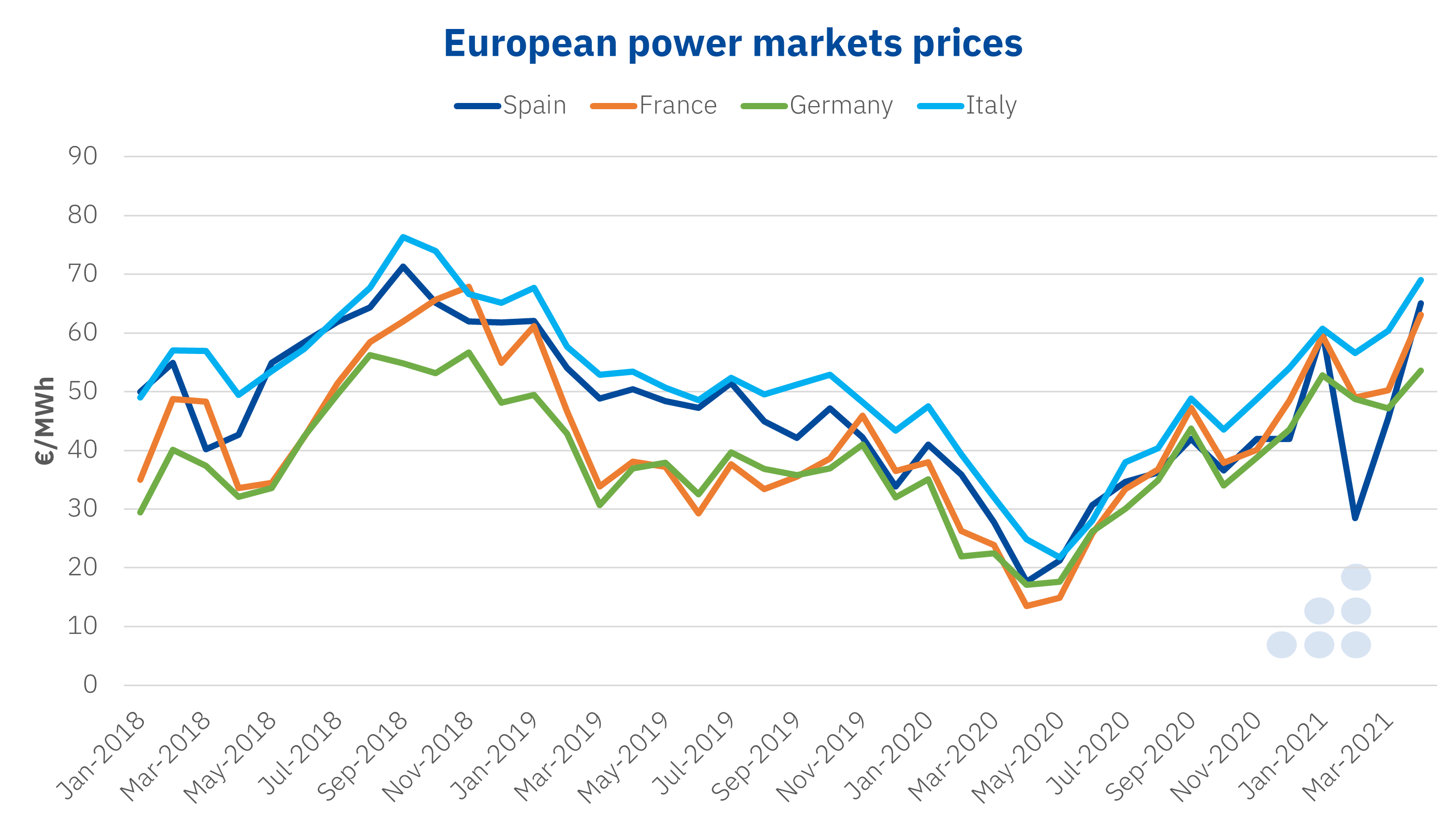

In recent months, there is an escalation of prices in the energy markets. This is a growth in line with the prices in various markets, including the electricity, gas and CO2 emission rights markets. The last episode of this upward trend so far was the close of April with record prices in various electricity markets in Europe. Among them, the Iberian MIBEL market, where the month of April with the highest average price in its history, of more than €65/MWh, was registered, that in a month of April that is usually moderately priced with the increase in renewable energy production and the drop in demand due to the arrival of the more pleasant spring temperatures.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT and GME.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT and GME.

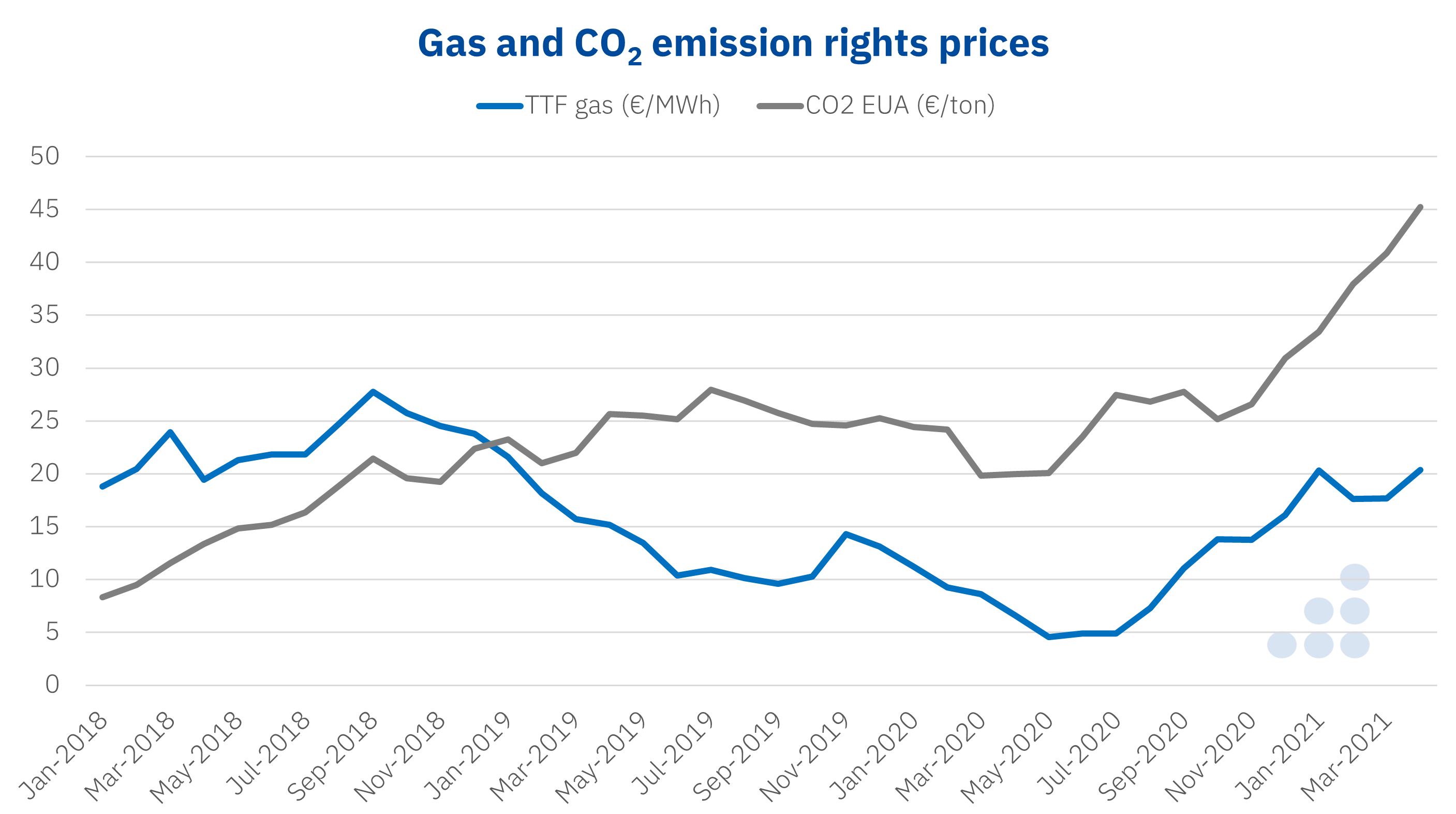

Behind this upward trend, there are factors such as the recovery of the economy and the demand, and the rise in prices in the gas and CO2 emission rights markets. The gas prices, like those of the electricity markets, had a continued growth from the lows registered during the most critical phase of the pandemic and the lockdowns during the second quarter of 2020. Since then the trend has been clearly upward and the prices of 2019 were already exceeded and they are close to those of 2018, another year of very high prices.

The case of the CO2 emission rights prices deserves a separate mention. Since December 2020, month after month, they were setting historical records and the daily prices are already close to €50 per tonne. This bullish rally and its true nature, temporary or structural, generates a lot of uncertainty about their future evolution. An uncertainty that casts its shadow on the electricity markets prices.

Source: Prepared by AleaSoft using data from PEGAS and EEX.

Source: Prepared by AleaSoft using data from PEGAS and EEX.

The concern of the large consumers

It is not difficult to see how the most affected in this episode of high prices in the electricity markets are the large consumers and the electro‑intensives. The uncertainty in the evolution of the prices in the medium and long term and the fear that the escalation of the CO2 and gas prices will continue is causing the consumers to buy electricity futures for 2022 to try to hedge against this rise, which is leading to a significant increase in prices in the futures markets.

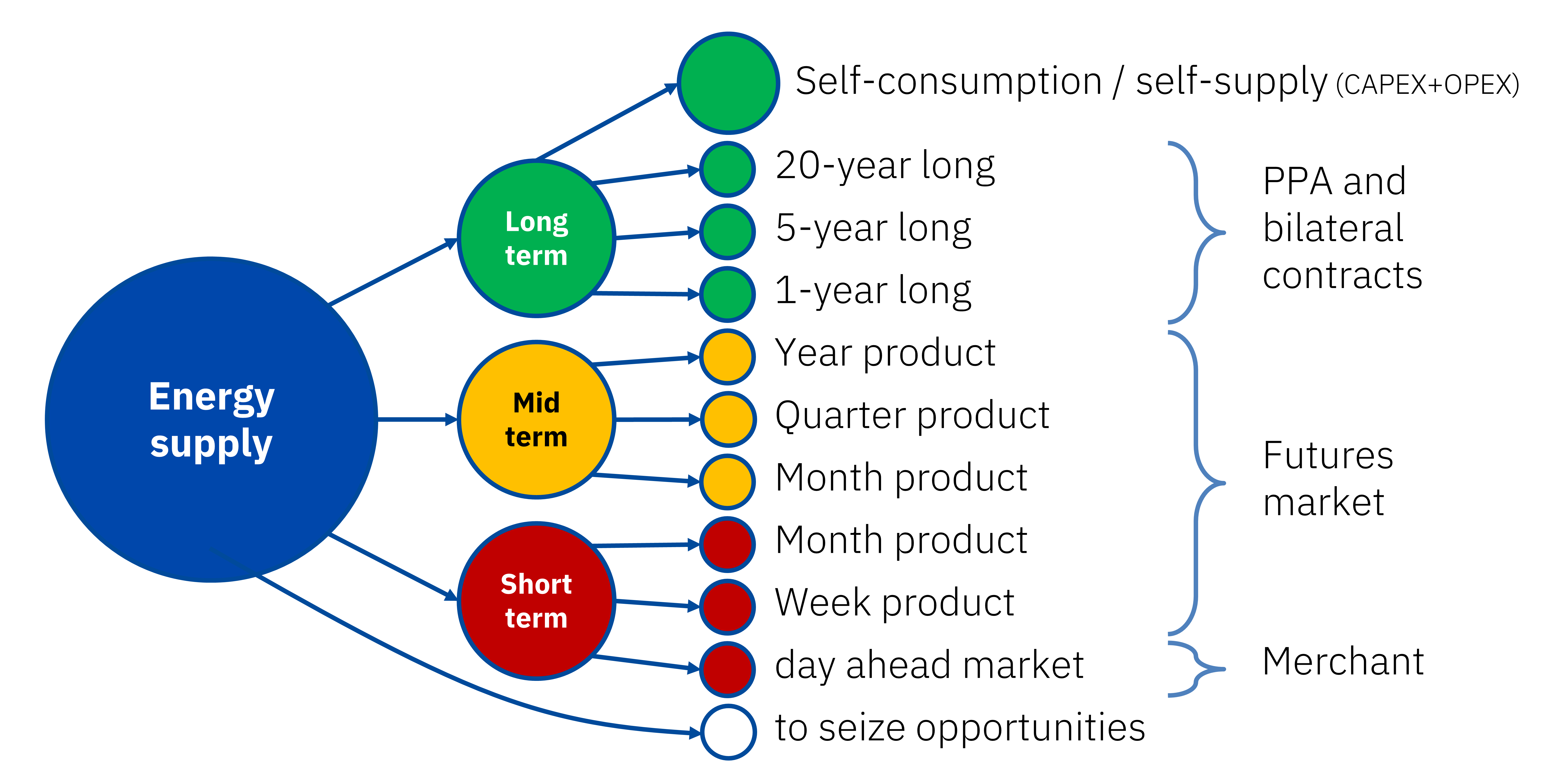

This situation is highlighting the importance of having a robust energy purchase strategy supported by reliable markets prices forecasts at all horizons. An effective strategy must be based on the diversification, placing fractions of the energy to be consumed in different horizons, each one where the conditions are more favourable in each case. This diversification can be very broad and can range from the self‑consumption and the long‑term PPA to the futures markets and the spot market in the medium and short term.

In this sense, the option of the PPA has an advantage in the case of the electro‑intensive consumers, which can have the state’s endorsement through the risk coverage mechanism in the acquisition of electricity, as established by the Statute of the electro‑intensive consumers. This will allow them to obtain more advantageous prices in long‑term contracts.

Diversification strategy in the purchase of energy. Source: AleaSoft.

Diversification strategy in the purchase of energy. Source: AleaSoft.

An opportunity for the renewable energies

The other side of the story of this episode of high prices is the electricity producers. For the renewable energies, high market prices can represent an opportunity to obtain better financing and an incentive for investments in new generation capacity. Generation capacities with renewable energies that in turn will help keep the prices in balance in the future.

Whether it is to obtain financing or to operate a renewable energy generation plant, a long‑term strategy is also needed for the sale of energy. In the same way that was seen in the case of the purchase of energy, for a sales strategy it is also important to diversify and place part of the energy in the long, medium and short term, taking advantage of the most favourable conditions in each case at each moment based on the inputs provided by the prices forecasts for each horizon.

Previsión de precios a largo plazo del mercado MIBEL realizada en octubre de 2010.

Fuente: AleaSoft.

The importance of the price forecasting for the development of the renewable energies and for the risk management of the large consumers

Given the need for the risk management in the purchase of energy based on a strategy that protects the consumers in unfavourable episodes such as the current one, it is important to emphasise that this strategy must be based on reliable and coherent prices forecasts in all horizons. AleaSoft showed in this online workshop how the prices forecasts can be used for the risk management. For the negotiation of PPA contracts, the long‑term vision of the electricity market based on prices forecasts is necessary for both the consumers and the renewable energy projects.

Topics such as this of the importance of the forecasts for the development of the renewable energies will be analysed in the next webinar that is being organised by AleaSoft for May 13, aimed at companies interested in forecasts in the energy sector. In addition to the usual analysis of the evolution of the energy markets in recent months and their medium and long‑term prospects, it will be discussed how, in a context such as the current one, the long‑term price forecasting is fundamental for the renewable energies when it comes to getting financing, through PPA, auctions or in pure merchant projects. The invitation to the webinar can be requested at the following link.