AleaSoft, May 4, 2021. The European electricity markets prices increased in a generalised way in April, reaching in several cases the highest monthly average for a month of April in at least the last eight years. The increase in CO2 and gas prices, which reached again record values during the fourth month of 2021, was the main cause of this rise, although lower wind energy production also contributed. The electricity futures prices also registered a general rise.

Photovoltaic and solar thermal energy production and wind energy production

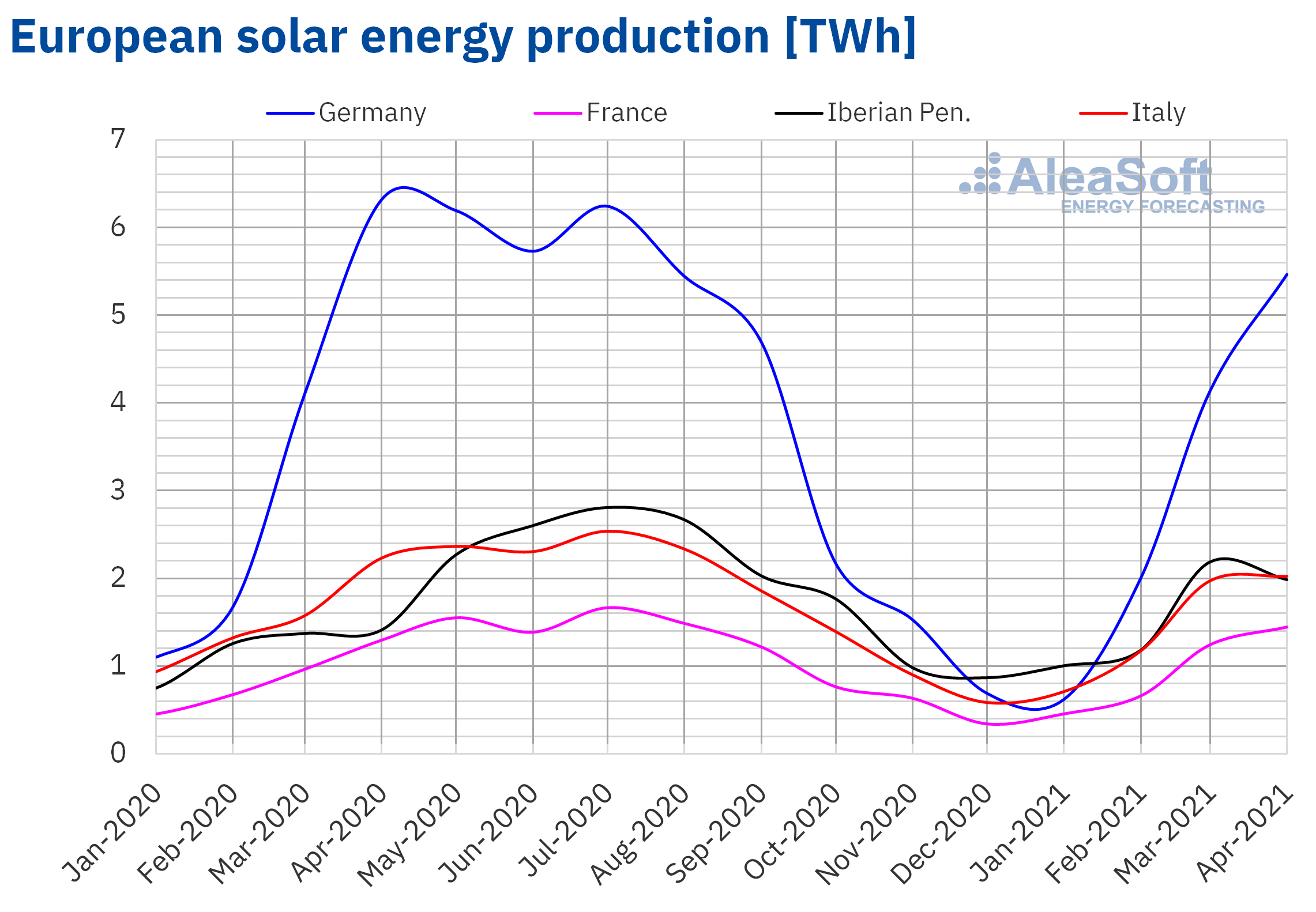

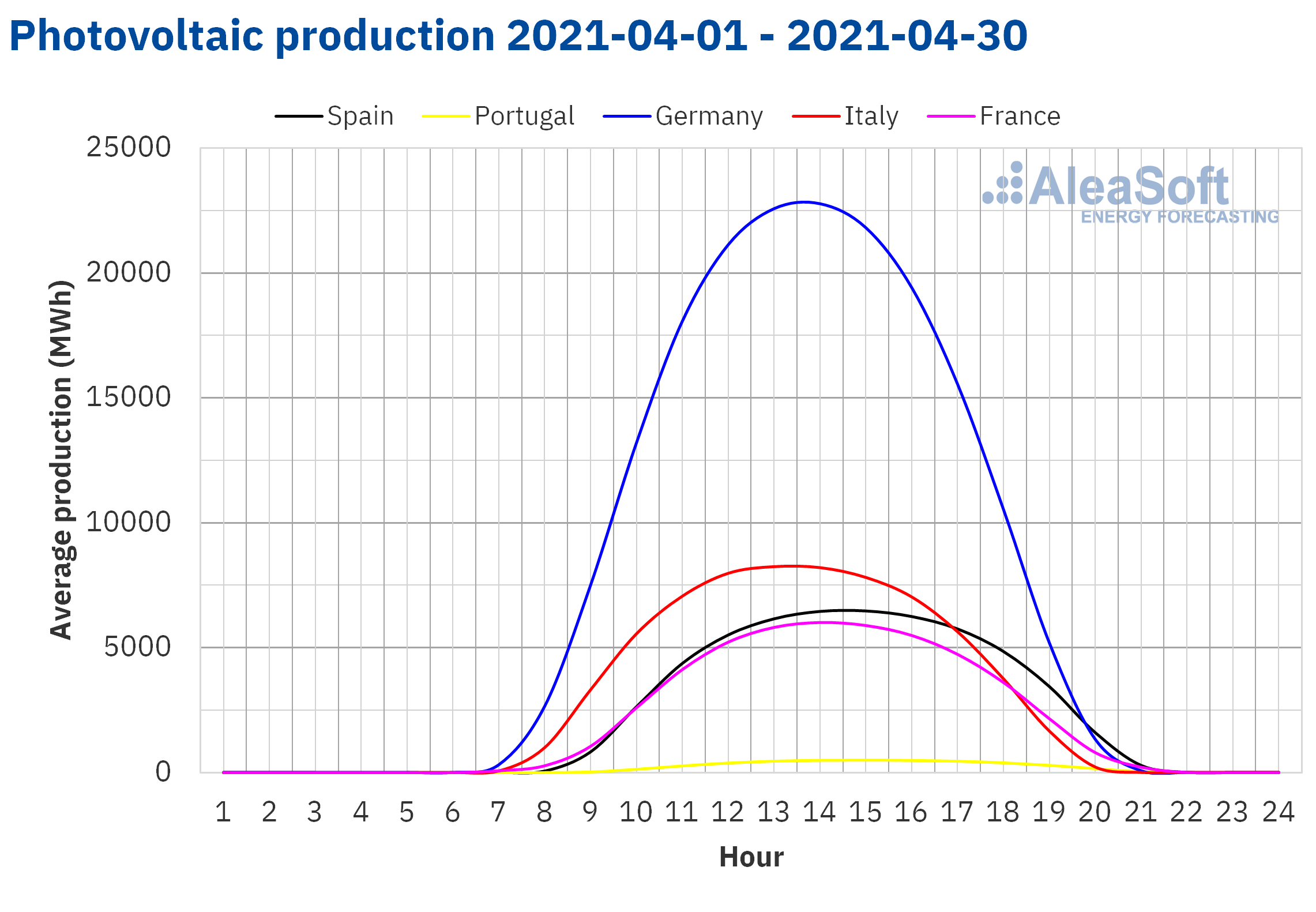

The solar energy production during the month of April increased in most of the European markets analysed at AleaSoft, compared to April 2020. In the Spanish market, the solar energy production, which includes the solar thermal and the photovoltaic technologies, increased by 36%. In Portugal it grew about 34% while in France the increase was 11%. By contrast, in the Italian and German markets, the production fell by 9.3% and 14% respectively.

In the comparison between last April and the previous month, the solar energy production grew by 37% in the German market, 20% in the French market and 6.0% in the Italian market. However, in this period, the production with this technology decreased by 6.2% in the Iberian Peninsula.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

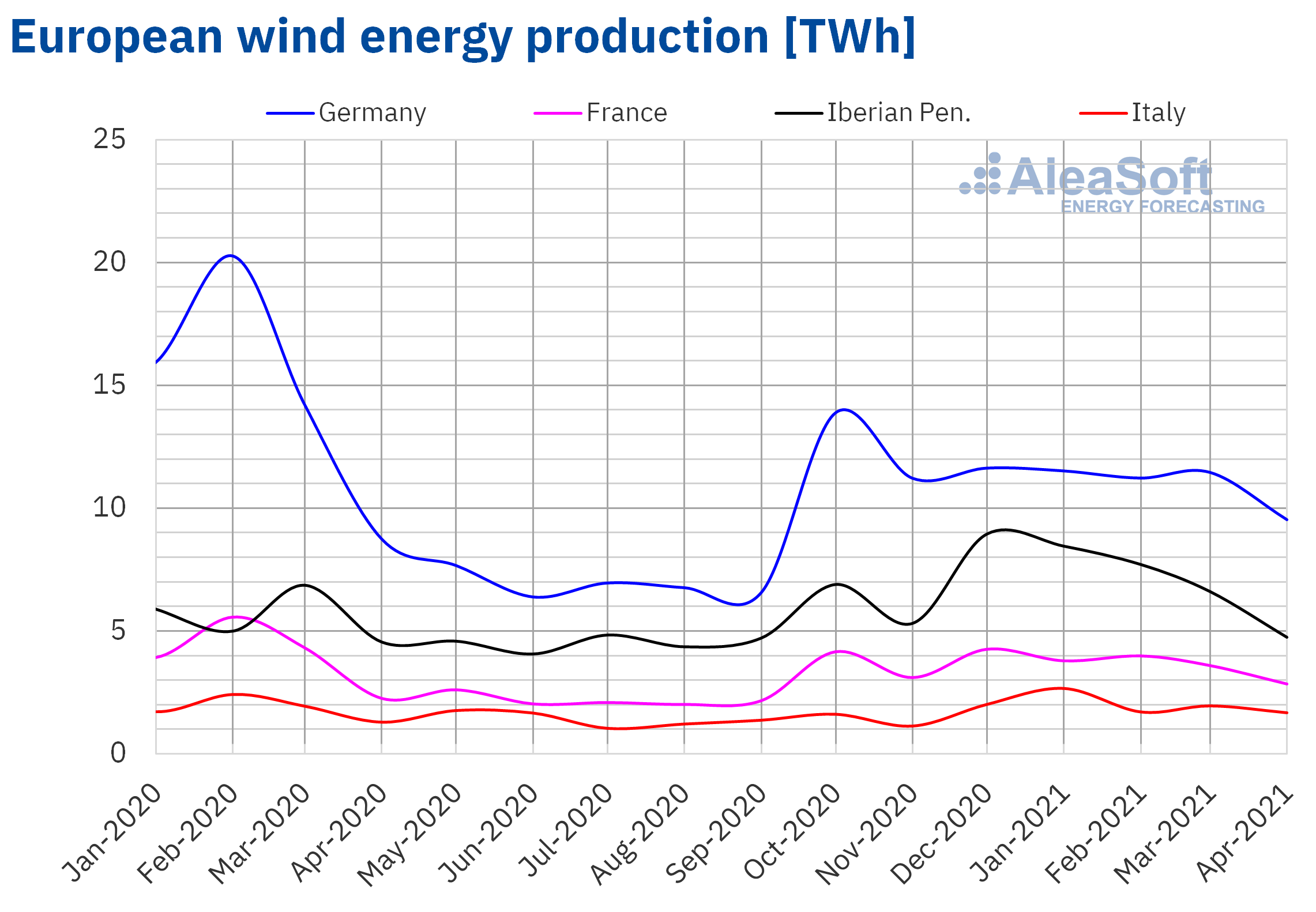

In the case of the wind energy production, during the month of April it decreased in all the markets analysed at AleaSoft compared to the previous month. The largest variation was registered in the Portuguese market with a fall of close to 39%. In the Spanish market, the production reduced by 24%. In the rest of the markets the falls were between 18% of France and 12% of Italy.

Comparing the production of April 2021 with that of April 2020, the increase of 30% in the Italian market and 26% in the French market stands out. While in the Iberian Peninsula and the German market, the production with this technology increased by 3.8% and 9.1% respectively.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

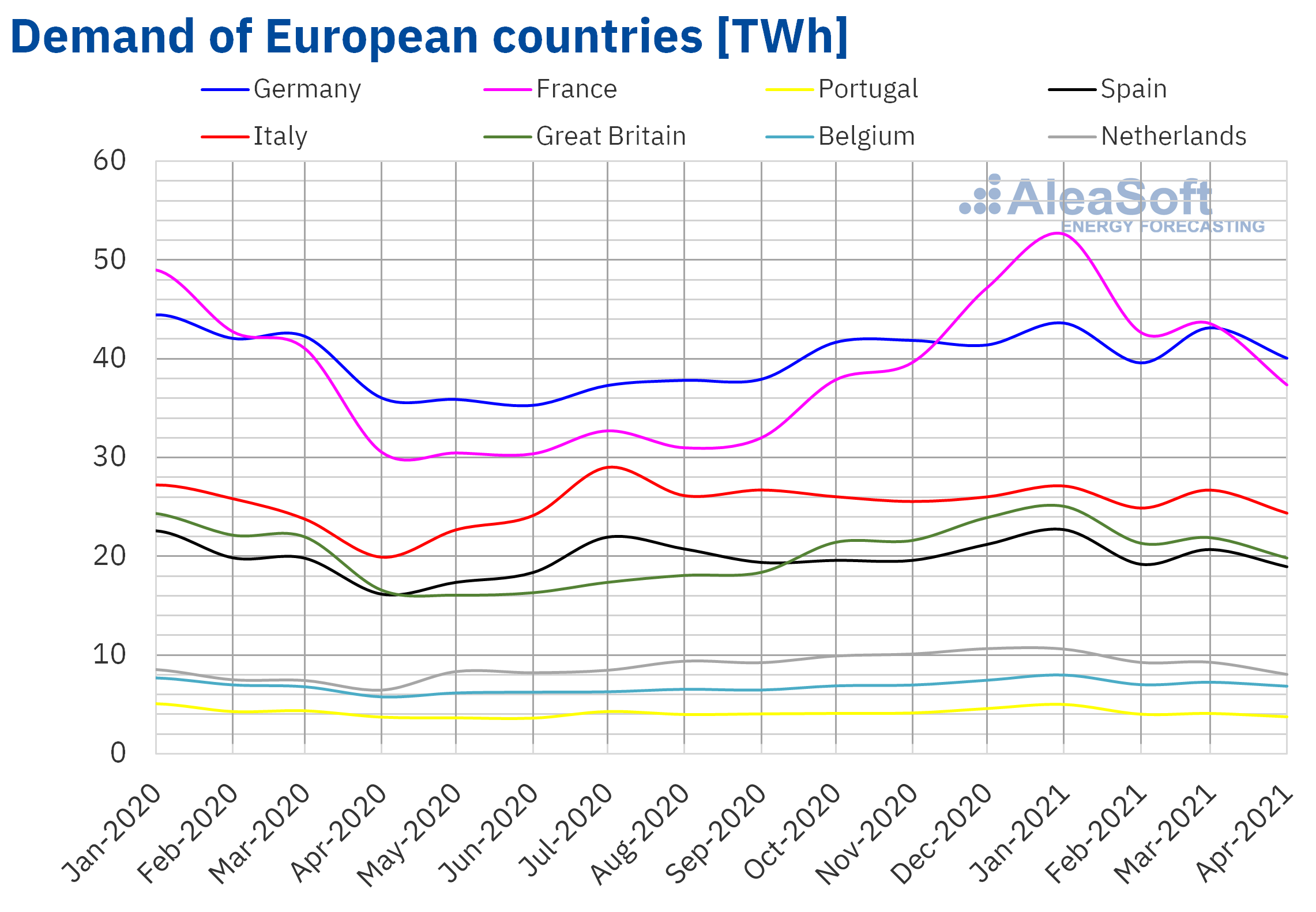

The electricity demand registered year‑on‑year increases in April in all European electricity markets. The main cause of this rise was the recovery of the labour and industrial activity during 2021 compared to the historical drop due to the effect of the pandemic in April 2020. Most markets registered increases in demand of more than 15%, which rose to 22% in the cases of France and Italy. On the other hand, the average temperatures were lower than those of April 2020, continuing the trend seen throughout 2021.

The outlook looks different when analysing the behaviour of April 2021 compared to the previous month. The spring was noted in the increases in temperatures in all markets, except in Great Britain and Belgium which registered falls below 0.5 °C. This behaviour of the temperatures favoured the decreases in electricity demand between 2.0% and 6.0% in most countries. The markets of France and the Netherlands closed the month of April with the largest setbacks in demand, which were 11% in both cases.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

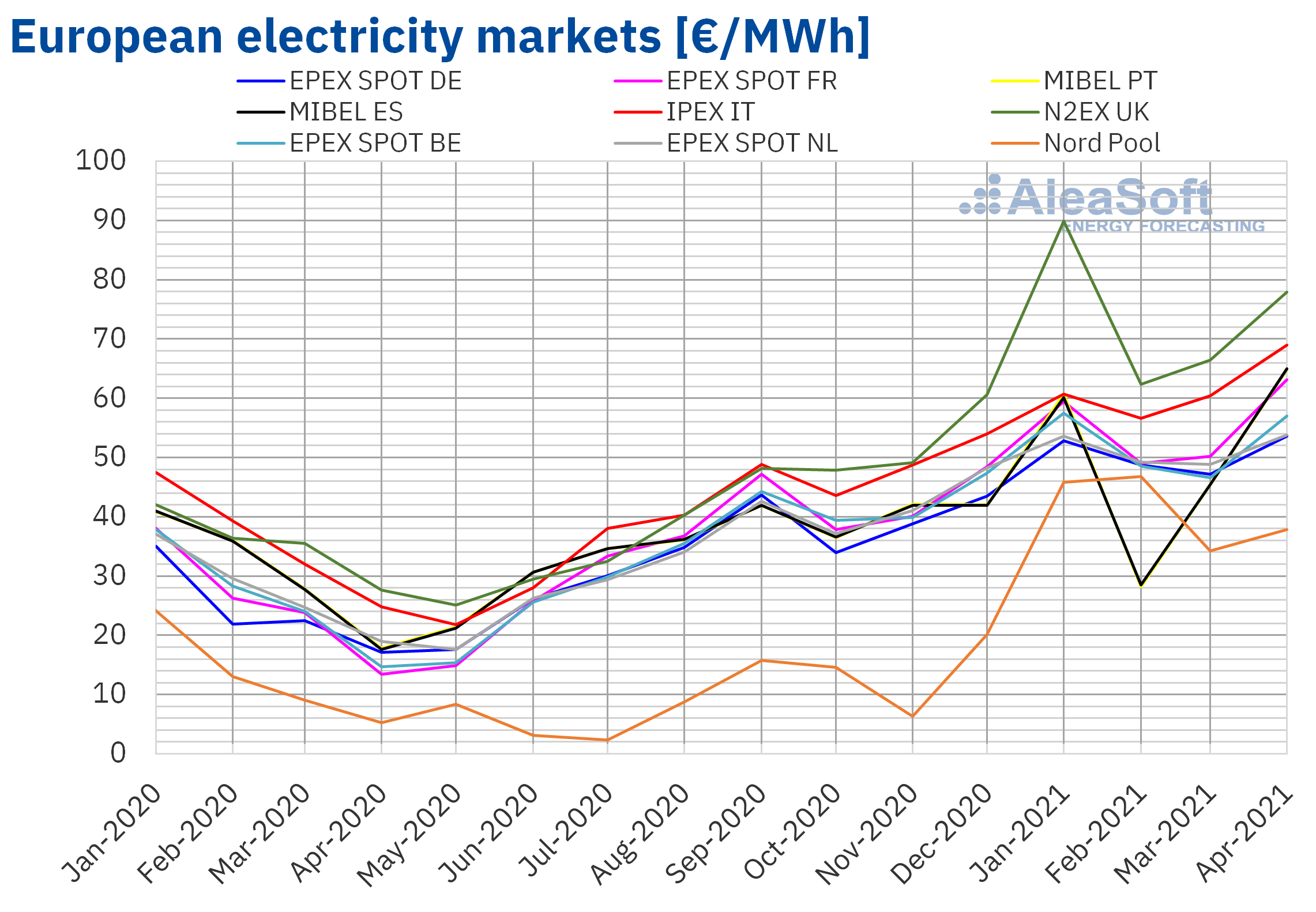

European electricity markets

In April 2021, the average monthly price was above €50/MWh in almost all the European electricity markets analysed at AleaSoft. The exception was the Nord Pool market of the Nordic countries, with an average of €37.86/MWh. On the other hand, the highest monthly average price, of €77.96/MWh, was that of the N2EX market of the United Kingdom, followed by that of the IPEX market of Italy, of €69.02/MWh. In the rest of the markets, the averages were between €53.61/MWh of the EPEX SPOT market of Germany and those of the MIBEL market, of €64.93/MWh in Portugal and €65.02/MWh in Spain.

These monthly average prices of the MIBEL market were the highest since October 2018 in this market. In addition, they were the highest for a month of April in its entire history.

In the case of the British market, the price of April 2021 was also the highest in a month of April in its entire history. The markets of Germany and France had the highest April price since 2008, Italy since 2012 and Belgium and the Netherlands since 2013.

Compared with the month of March 2021, in April, the average prices rose in all the European electricity markets analysed at AleaSoft. The largest price increases, of 43%, were registered in the MIBEL market of Spain and Portugal. The price increases in the French and Belgian markets, of 26% and 22% respectively, were also important. The rest of the markets had price increases between 10% of the market of the Netherlands and 17% of the market of the United Kingdom.

The monthly price increases were much more significant in all markets compared to the values registered in April 2020, when the markets registered low values due to the restrictions carried out to stop the spread of the COVID‑19 pandemic. The largest price increases were those of the Nord Pool market and the EPEX SPOT market of France, of 626% and 369% respectively. On the other hand, the lowest price increase, of 178%, occurred in the Italian market.

In April, in general, the lowest daily prices were those of the Nord Pool market. However, on April 5, Easter Monday, the German and Belgian markets registered the lowest daily prices, of ‑€17.00/ MWh and ‑€15.35/MWh respectively. Such low daily prices were not reached since April 2020 in Belgium and since May 2020 in Germany.

On the other hand, for almost the entire month of April, the market with the highest daily prices was the N2EX market. On April 13, this market reached the monthly maximum daily price, of €123.19/MWh, which was the highest in this market since January.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The increase in gas and CO2 emission rights prices favoured the rise in prices in the European markets in April. Although the demand decreased compared to the previous month, the general decrease in wind energy production also contributed to the prices being higher than those of March 2021.

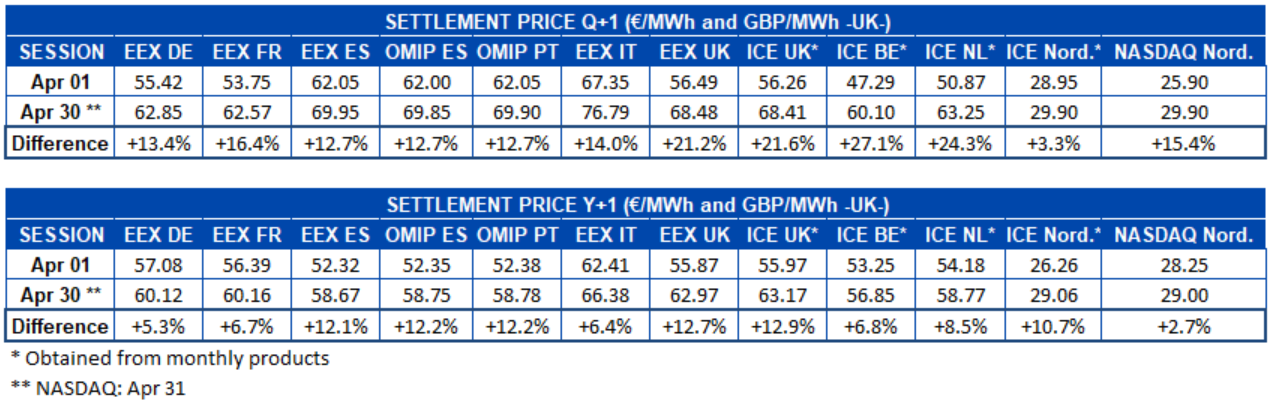

Electricity futures

If the first and the last sessions of the futures markets of the month of April are analysed, a generalised rise in prices for the next quarter, Q3‑21, can be clearly seen. The ICE market of Belgium was the one with the highest price increase between these sessions with an increase of 27%. On the other hand, the ICE market of the Nordic countries was the one with the lowest variation with a rise of 3.3%. In the rest of the markets the increases were between 12% and 25%.

As for the product of the next year 2022, a similar situation occurred. All European electricity futures markets registered increases. The ICE market of the United Kingdom was the one with the highest increase with a 13% rise, although closely followed by the EEX market also of the United Kingdom, by the OMIP market of Spain and Portugal and by the EEX market of Spain, which registered increases of more than 12%. In this case, it was the NASDAQ market of the Nordic countries the one that registered the lowest variation, with a rise of 2.7%.

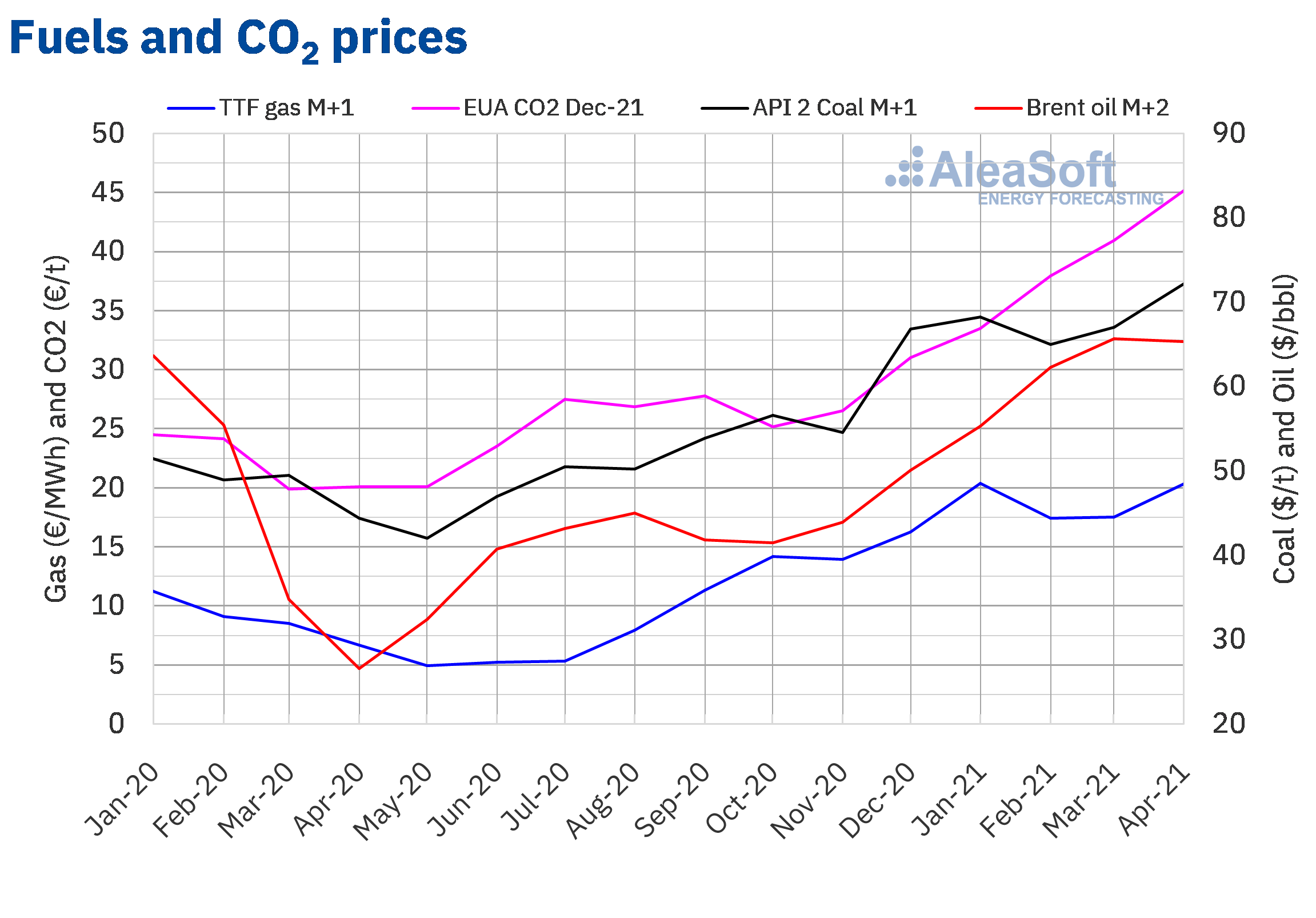

Brent, fuels and CO2

The settlement prices of the Brent oil futures for June 2021 in the ICE market, in April remained above $60/bbl. The monthly minimum settlement price, of $62.15/bbl, was registered on Monday, April 5. On the other hand, the monthly maximum settlement price, of $68.56/bbl, was reached at the end of the month, on Thursday, April 29.

On the other hand, the monthly average price was $65.33/bbl. This value is 0.6% lower than that reached by the futures for the month M+2 in March 2021, of $65.70/bbl. But, it is 145% higher than that corresponding to the M+2 futures traded in April 2020, of $26.63/bbl.

The month of April began with the OPEC+ meeting on the 1st, in which it was agreed to start increasing the production levels from May, assuming that the demand would continue to recover in the coming months. The prices reached their monthly minimum value in the following session. But the upward updates to the demand forecasts from the International Energy Agency and the OPEC favoured the rise in Brent oil futures prices in the first half of the month.

However, in April, the concerns about the increase in COVID‑19 infections and the effect of the restrictions to contain the pandemic on the demand continued, which had a downward influence on the prices.

In addition, in the second half of April, the stronger dollar and the negotiations between the United States and Iran on the Iranian nuclear program, which might result in the lifting of the sanctions on Iran’s oil exports, also exerted their downward influence on the prices.

On the other hand, the month of May begins with great concern about the serious situation of the COVID‑19 pandemic in India. This country is a major oil importer and its current situation may seriously affect the demand. This, together with the increase in OPEC+ production, will favour decreases in Brent oil futures prices.

As for the TTF gas futures in the ICE market for the month of May 2021, they registered their monthly minimum settlement price, of €18.94/MWh, on April 9. During the month, the prices generally rose and they reached their monthly maximum settlement price, of €22.50/MWh, on Thursday, April 29. This price of the futures for May 2021 was the highest in the last two years.

Regarding the average value registered during the month of April, this was €20.25/MWh. Compared to that of the futures for the month M+1 traded in March 2021, of €17.50/MWh, the average increased by 16%. If compared to the M+1 futures traded in April 2020, when the average price was €6.68/MWh, there was a 203% increase.

As for the CO2 emission rights futures in the EEX market for the reference contract of December 2021, on April 1, the monthly minimum settlement price, of €42.48/t, was registered. The prices increased during the month of April, especially in the second part of the month. As a result, the monthly maximum settlement price, of €48.84/t, was reached on Friday, April 30, which represented a new all‑time high.

On the other hand, the average price in April was €45.33/t, 11% higher than that of March 2021, of €40.96/t. If compared with the average for the month of April 2020 for the reference contract of December of that year, of €20.09/t, the average for April 2021 is 126% higher.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

The importance of the price forecasting for the development of the renewable energies and for the large consumers

For this month of May that just started, AleaSoft is organising a new webinar for the next Thursday the 13th aimed at companies interested in forecasts in the energy sector. During the webinar, it will be analysed how the European markets are currently immersed in the energy transition process and how, in this context, the long‑term price forecasting is essential when it comes to obtaining financing, whether through PPA, auctions or in pure merchant projects. Furthermore, as it is customary in the AleaSoft webinars, the evolution of the energy markets in recent months and their medium and long‑term prospects will also be analysed. The invitation to the webinar can be requested at the following link.

In a context such as the current one of very high prices in the energy markets, the need for the risk management in the purchase of energy by the large consumers, based on a strategy that protect them in unfavourable episodes like the current one, is made very clear. A robust energy purchasing strategy requires reliable and coherent price forecasting. AleaSoft showed in this online workshop how the price forecasting can be used for the risk management.