AleaSoft Energy Forecasting, October 1, 2021. The increase in fuels prices, which in the case of gas reached historical maximums, led to a general rise in European electricity markets prices in the current context of energy crisis. Prices for the third quarter of 2021 are the highest in history, a record that September occupies in the monthly analysis, and daily and hourly highs were registered. In turn, CO2 prices were the highest in history, also driving increases.

Photovoltaic and solar thermal energy production and wind energy production

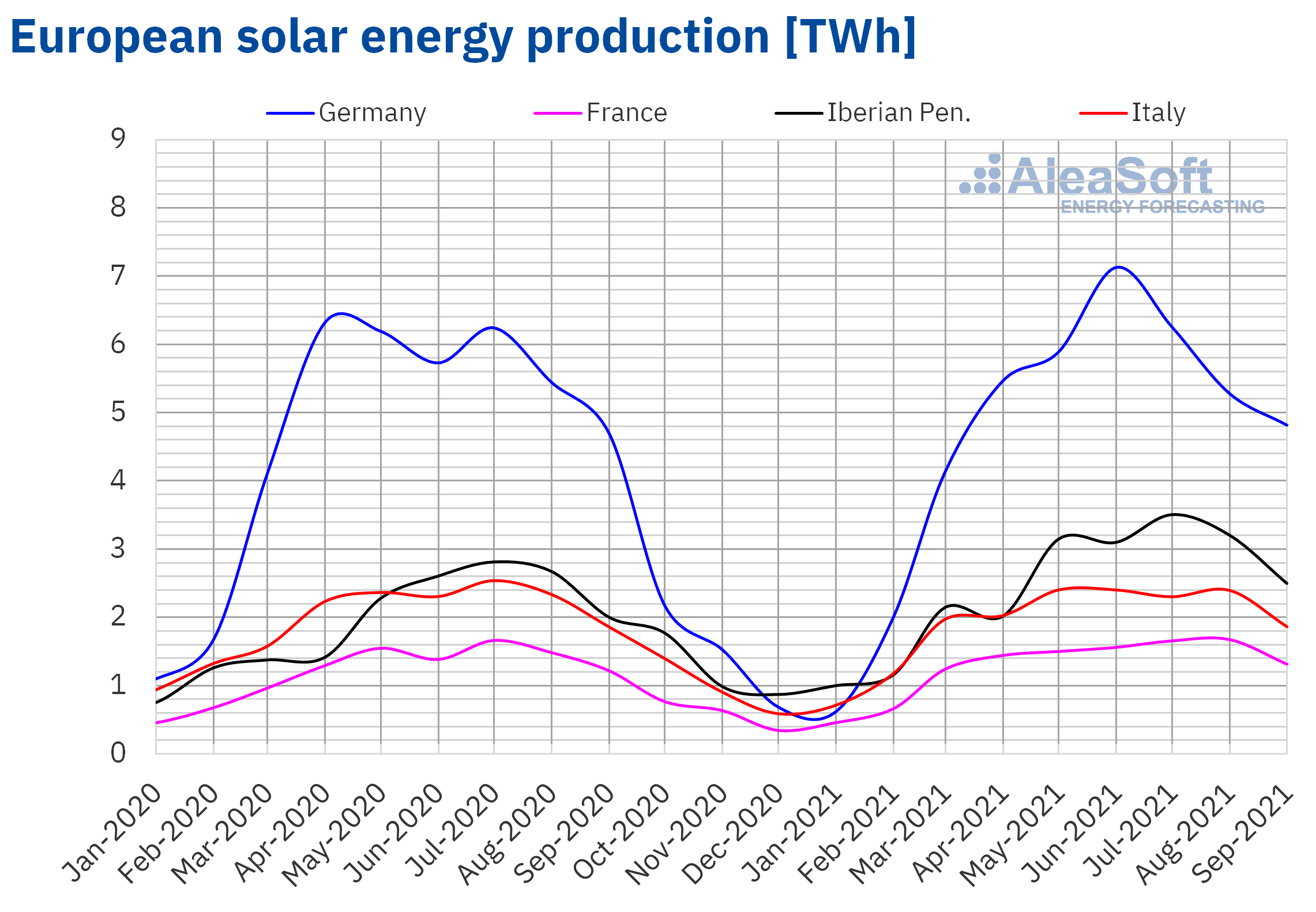

The solar energy production increased by 23% in the Iberian Peninsula during the third quarter of 2021 compared to the same quarter of 2020, while in the French market a 6.4% increase was registered. On the contrary, in the Italian market, the production with this technology was 2.5% lower and in the German market it ended up being very similar to that registered in the third quarter of 2020.

If the solar energy production of the third quarter of 2021 is compared to that of the previous quarter, it was 7.8% higher in the Iberian Peninsula. In the rest of the markets, the variation was negative, with the 14% reduction in the German market standing out. In the Italian market, the production fell by 6.9% and in the French it fell by 0.2%.

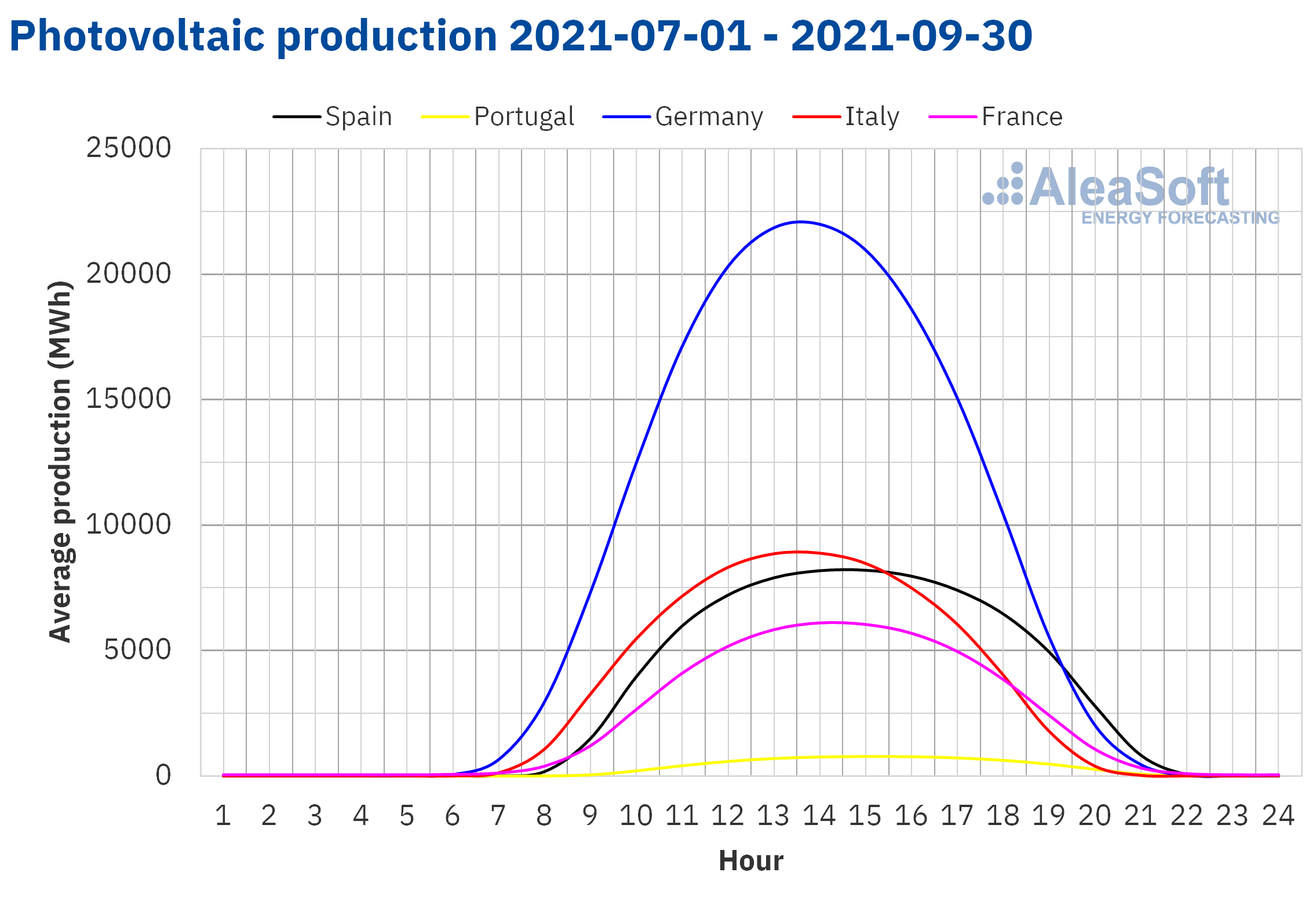

During the third quarter of 2021, the new historical hourly solar energy production record reached on August 6 at 2:00 p.m. in the Spanish market, of 11 GWh, stands out. Similarly, on August 8, an hourly record was registered in the Portuguese market, of 913 MWh at 1:00 p.m. local time.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

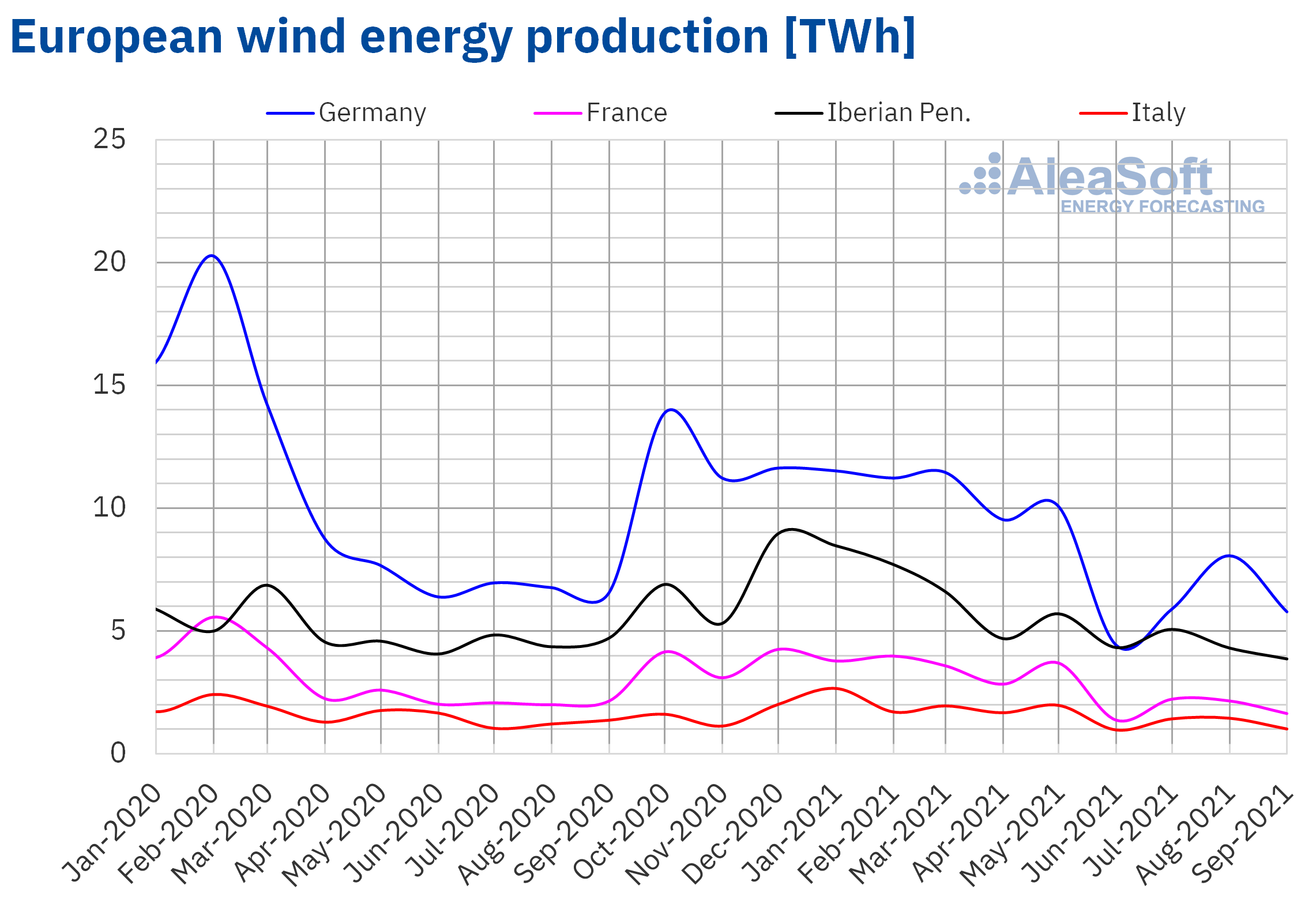

During the third quarter of 2021, the wind energy production increased by 7.4% in the Italian market compared to the third quarter of 2020. On the contrary, it fell by 4.8% in the Iberian Peninsula, 3.3% in the French market and 2.7% in the German market.

In the comparison between the third quarter of 2021 and the second quarter of the same year, the general reduction in production with this technology was notable in all markets analysed at AleaSoft Energy Forecasting. The smallest drop was 6.0% and it was registered in the Portuguese market, while the largest reduction was 26% in the French market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

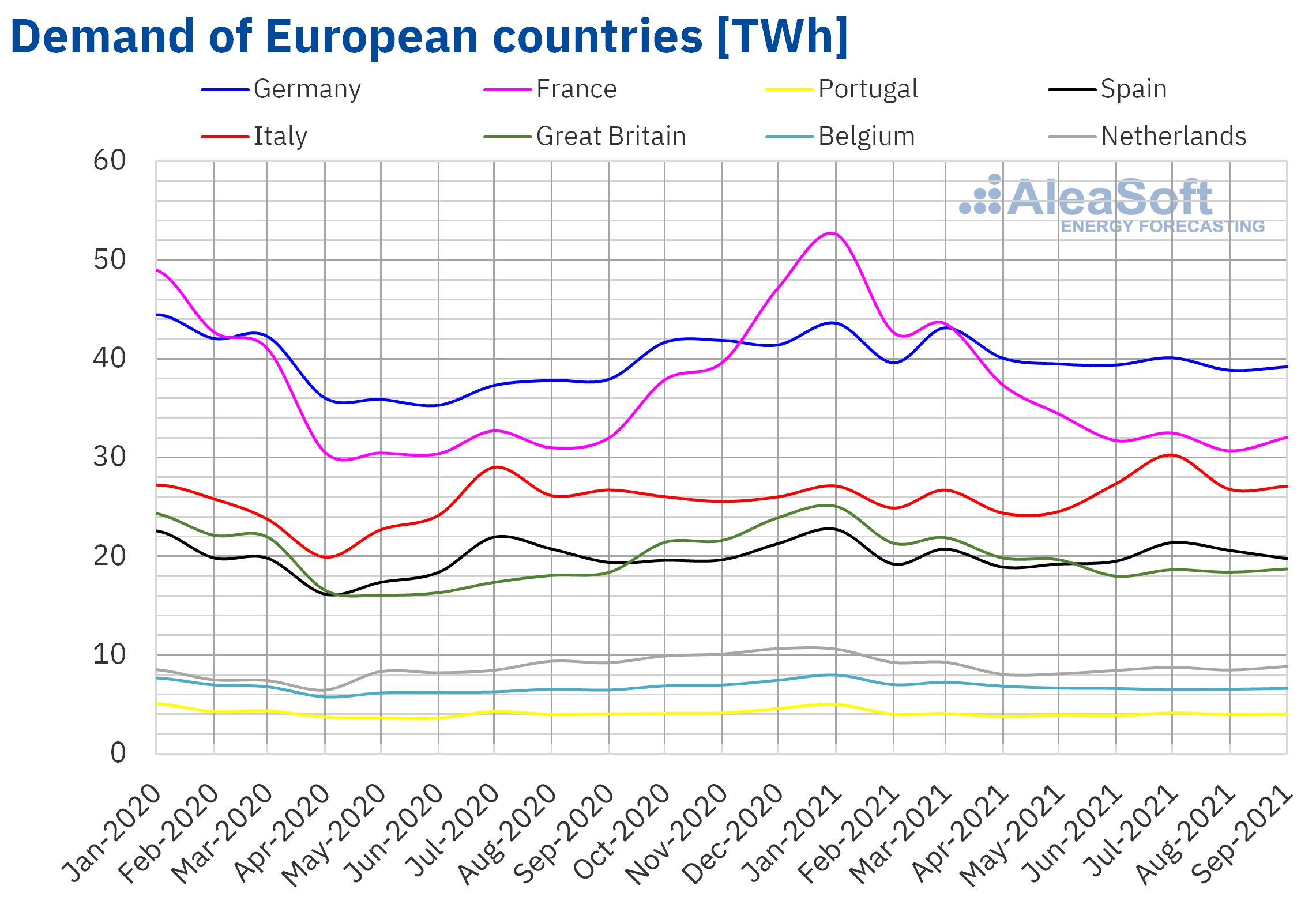

The electricity demand had a different behaviour in the third quarter of 2021 compared to the same quarter of the previous year in the European markets. On the one hand, the highest increases were registered in the markets of Germany and Great Britain, and were 4.5% and 3.6% respectively. While, on the other hand, the most notable falls were in the Netherlands and Portugal, of 3.6% and 1.3% in each case. In the French market, the year‑on‑year decline was 0.5%, maintaining the year‑on‑year downward trend for the third quarter that began in 2017. Average temperatures decreased in most European markets when comparing the values registered in the third quarter of 2021 with those of the same period of 2020, except in Great Britain and Italy where they increased to 0.5 °C. The year‑on‑year drops in average temperatures were between 0.3 °C and 1.3 °C.

Comparing with respect to the whole of the three previous months, in the months from July to September 2021 there were decreases in electricity demand in most of the European markets. The most notable decreases in demand in this period were registered in France and Great Britain, which were 11% and 6.1% respectively. As for the increases, the most important were registered in the markets of Italy and Spain, with variations of 6.8% and 3.5% respectively. Temperatures rose unsurprisingly during the summer, rising to 6.7 °C in Italy. In particular, historical maximum temperatures were registered in Spain and Italy during the second week of August.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

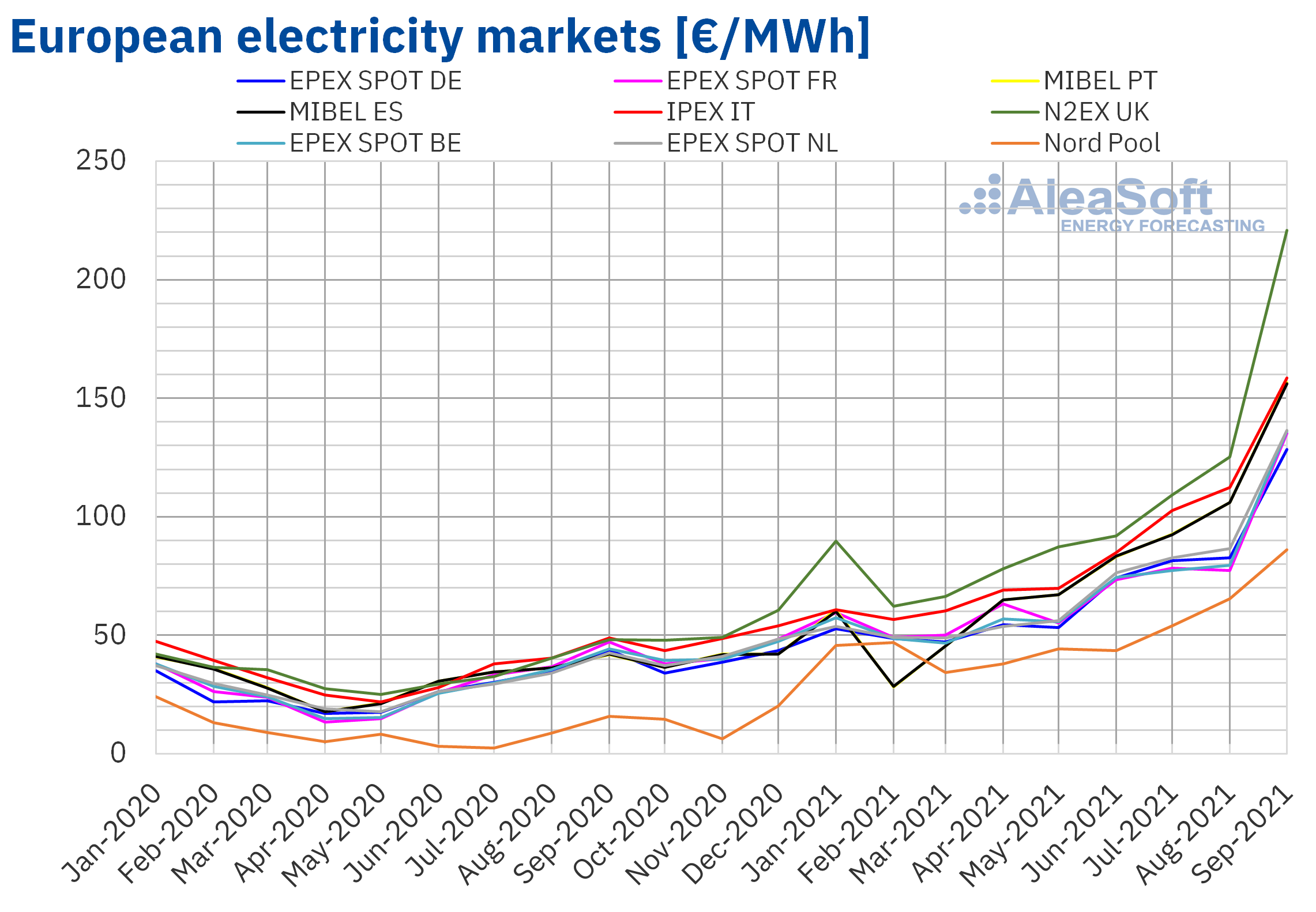

European electricity markets

In September 2021, maximum monthly price records were reached in all European markets. The monthly average price exceeded €125/MWh in almost all the European electricity markets analysed at AleaSoft Energy Forecasting. The exception was the Nord Pool market of the Nordic countries, with an average of €86.01/MWh. On the other hand, the highest monthly average price, of €220.94/MWh, was that of the N2EX market of the United Kingdom, followed by that of the IPEX market of Italy, of €158.59/MWh. In the rest of the markets, the averages were between €128.37/MWh of the EPEX SPOT market of Germany and €156.53/MWh of the MIBEL market of Portugal.

In the case of average prices for the third quarter of the year, they exceeded €100/MWh in several markets, and they were the highest in all quarters in history in all markets. The highest price, of €151.05/MWh, was reached in the N2EX market, while the lowest average was that of the Nord Pool market, of €68.27/MWh. The rest of the markets registered quarterly averages between €96.58/MWh of the French market and €124.18/MWh of the Italian market.

The prices of the third quarter of 2021 also increased in all the analysed European markets, both compared to the previous quarter and compared to the same quarter of 2020. Compared to the second quarter of 2021, the increases exceeded 50% in all markets and the highest was that of the British market, of 78%. Compared to the same quarter of 2020, all price increases exceeded 145% and the Nord Pool market had the largest rise, of 669%.

At the end of the third quarter, the rise in prices led to record hourly and daily prices in almost all European markets in September. But, in the case of the MIBEL market, the records were surpassed by the historical maximum values reached on October 1. During three hours of that day, a record hourly price of €230/MWh was reached and the daily price was €216.01/MWh, the highest on that day among all the analysed European markets. However, this price is still significantly lower than the maximum daily price registered in the European markets in the third quarter, of €496.56/MWh. This price was reached on September 15 in the British market and it was the highest in that market at least since January 2010.

The price rises of the third quarter of 2021 were favoured mainly by the increase in gas and CO2 emission rights prices, but also by the decrease in quarterly wind energy production in markets such as Germany, Spain and France, as well as in solar energy production in Germany and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

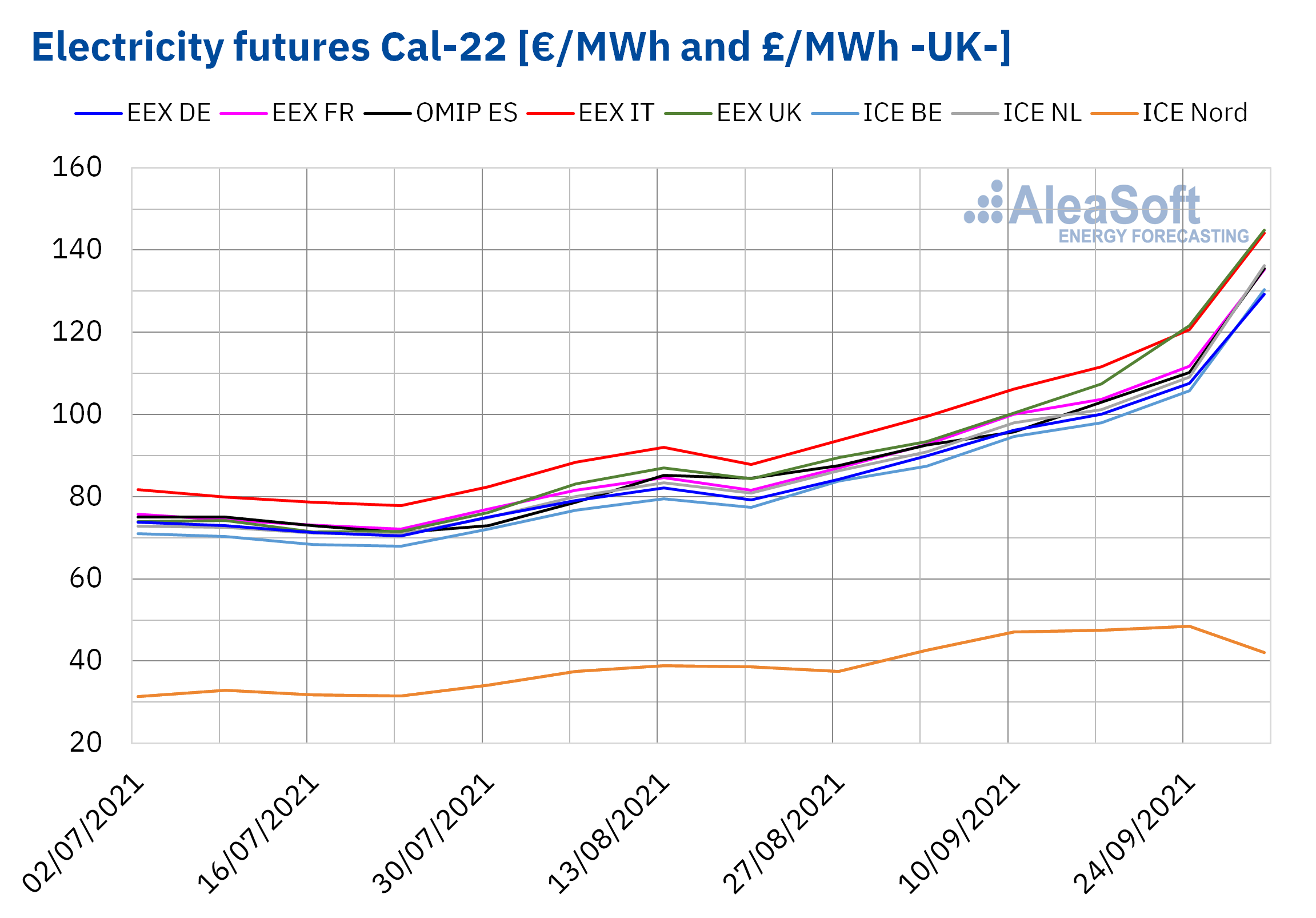

Electricity futures

During the third quarter of 2021, the European electricity futures prices for the next quarter registered an upward trend. Prices increased in all markets during the period. The ICE market of the United Kingdom was the one with the highest rise, with an increase of 138%, while the ICE market of the Nordic countries had the most moderate increase, rising 39%, mainly due to a decrease that it registered in the last days of the quarter. In general, the rise in all markets was notable. Leaving aside the markets of the Nordic region, in the rest the prices increased between the first and last sessions of the period by more than €60/MWh.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX, OMIP, ICE and NASDAQ.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX, OMIP, ICE and NASDAQ.

The electricity futures prices for the year 2022 also rose during the third quarter of 2021. The ICE market of the United Kingdom was also the one with the highest rise in this product, with an increase of 97%, and the NASDAQ market of the Nordic countries was the one that had the smallest increase, rising 34%. Most of the EEX, OMIP and ICE markets, except those of the Nordic countries, analysed at AleaSoft Energy Forecasting, ended the quarter with the next year’s product trading above €100/MWh.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX, OMIP, ICE and NASDAQ.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX, OMIP, ICE and NASDAQ.

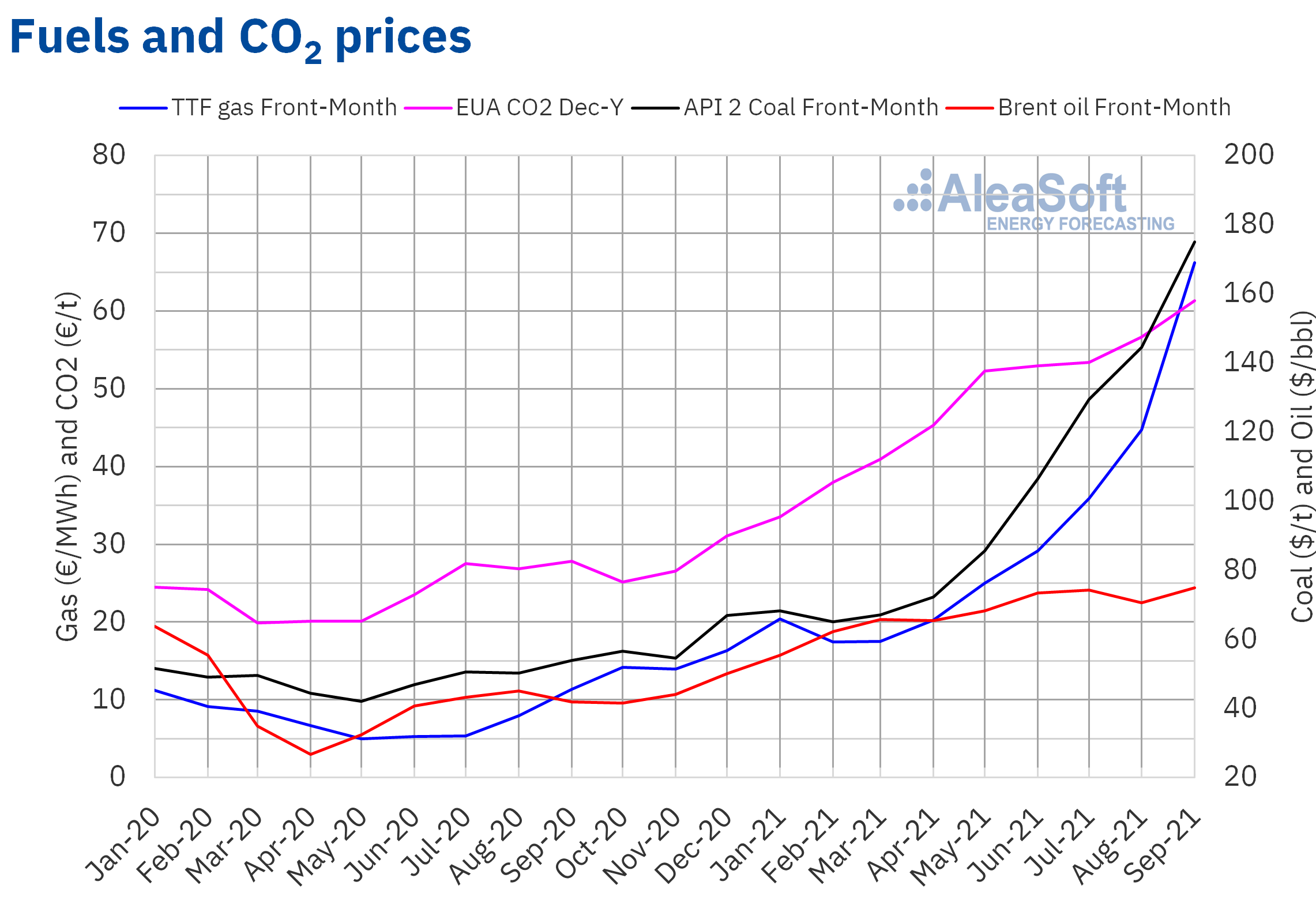

Brent, fuels and CO2

The Brent oil futures for the Front‑Month in the ICE market registered a quarterly average price of $73.23/bbl in the third quarter of 2021. This value is 6.0% higher than that reached by the Front‑Month futures in the second quarter of 2021, of $69.08/bbl, and 69% higher than that corresponding to the Front‑Month futures traded in the third quarter of 2020, of $43.31/bbl.

During the months of July, August and September, the Brent oil futures prices ranged between $68/bbl and $77/bbl most of the time. In this period, the increase in mobility and the economic recovery favoured the recovery of the demand and prices, although the increase in production by OPEC+ prevented further price increases. Precisely, the news about the negotiations of the producer group marked the evolution of prices in July. On the other hand, the consequences of Hurricanes Ida and Nicholas on the US production levels also had an influence on prices in August and September.

On the other hand, on Monday, September 27, the highest settlement price in the last three years, of $79.53/bbl, was reached, although prices fell in the last days of the quarter, influenced by the strength of the dollar and the increase in US reserves, as well as expectations about the next OPEC+ meeting. The decisions taken at this meeting, scheduled for Monday, October 4, will also influence prices. A possible increase in the supply planned by OPEC+ might curb the price rises.

As for the TTF gas futures prices in the ICE market for the Front‑Month, during the third quarter of 2021 they registered an upward trend, which was more pronounced in the month of September. As a consequence, the average for that month, of €66.20/MWh, was 48% higher than that of August and the highest in the last eight years. The settlement price of the last day of the quarter also reached a record value of €97.77/MWh.

Regarding the average value registered during the third quarter for these futures, it was €49.14/MWh, also the highest since at least October 2013. Compared to that of the Front‑Month futures traded in the second quarter of 2021, of €24.79/MWh, the average increased by 98%. If compared to the Front‑Month futures traded in the third quarter of 2020, when the average price was €8.17/MWh, there was a 501% increase.

Low levels of gas reserves and insufficient supply to meet the demand favoured the upward trend in gas futures prices throughout the third quarter of 2021. Russia’s decision not to increase gas supply to Europe across Ukraine from October also contributed to the rises at the end of the quarter.

At the beginning of the fourth quarter, the reserves levels are still low as winter approaches, which will continue to exert its upward influence on prices. This trend might change with the start‑up of the Nord Stream 2 gas pipeline, which would allow an increase in gas supply from Russia, although this is not expected to happen until early 2022.

Regarding the CO2 emission rights futures prices in the EEX market for the reference contract of December 2021, these increased from July to September. As a result, on Monday, September 27, a historical maximum settlement price, of €64.37/t, was reached.

In the third quarter of 2021, CO2 emission rights futures reached an average price of €57.12/t, the highest in history, which represents an increase of 14% compared to that of the second quarter of 2021, of €50.27/t. If compared with the average of the third quarter of 2020 for the reference contract of December of that year, of €27.41/t, the average for the third quarter of 2021 is 108% higher.

The increase in demand favoured the increase in emission rights prices in the third quarter of 2021. This upward trend was reinforced by speculative movements in the market. In addition, at the beginning of the quarter, news about the European Commission’s measures to boost the emissions reduction also contributed to the price increases. This also happened due to the decrease in the number of auctions in the first week of September.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

The current energy crisis and the situation of high fuels and electricity prices into which it resulted highlight what AleaSoft Energy Forecasting always commented on: the importance of defining an electricity purchase and sale strategy to minimise the risk posed by situations of instability in the markets. A strategy that includes the signing of PPA in addition to the participation in the spot and futures markets, and in which scientific and coherent markets prices forecasting with horizons that cover the short‑, mid‑ and long‑term are used as input.

On Thursday, October 7, the webinar “Energy markets in the recovery from the economic crisis one year later” will be held, organised by AleaSoft Energy Forecasting with the participation of two speakers from Deloitte Spain: Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services and Carlos Milans del Bosch, Partner of Financial Advisory, as well as Oriol Saltó i Bauzà, Manager of Data Analysis and Modelling at AleaSoft Energy Forecasting, who repeat almost a year after the webinar held in October 2020. In the webinar, an up‑to‑date view of the topics analysed on that occasion will be given: evolution of European energy markets in the economic recovery, renewable energy projects financing and importance of the forecasting in audits and portfolio valuation.

In the second part of the webinar in Spanish, an analysis table will be held based on the questions received, in which, in addition to the speakers, Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasting, will participate. The questions will be open although they may be related to current issues and the vision of the future of Deloitte Spain and AleaSoft Energy Forecasting on the energy sector, for example, on the impact and consequences of Royal Decree‑Law 17/2021 approved by the Spanish Government and on the need for long‑term prices forecasting in the electricity market for investments and audits. Questions can be sent to webinar@aleasoft.com. They will try to answer in the analysis table after the webinar or later by mail.