AleaSoft Energy Forecasting, September 27, 2021. In the fourth week of September, the wind and solar energy production increased in most European markets and the electricity demand fell. This combination of factors allowed electricity market prices for the whole week to fall in several markets and in those where they rose, the increase did not exceed 6%. Even so, in some markets daily and hourly highs were registered. Electricity futures rose and gas and CO2 registered high records again.

Photovoltaic and solar thermal energy production and wind energy production

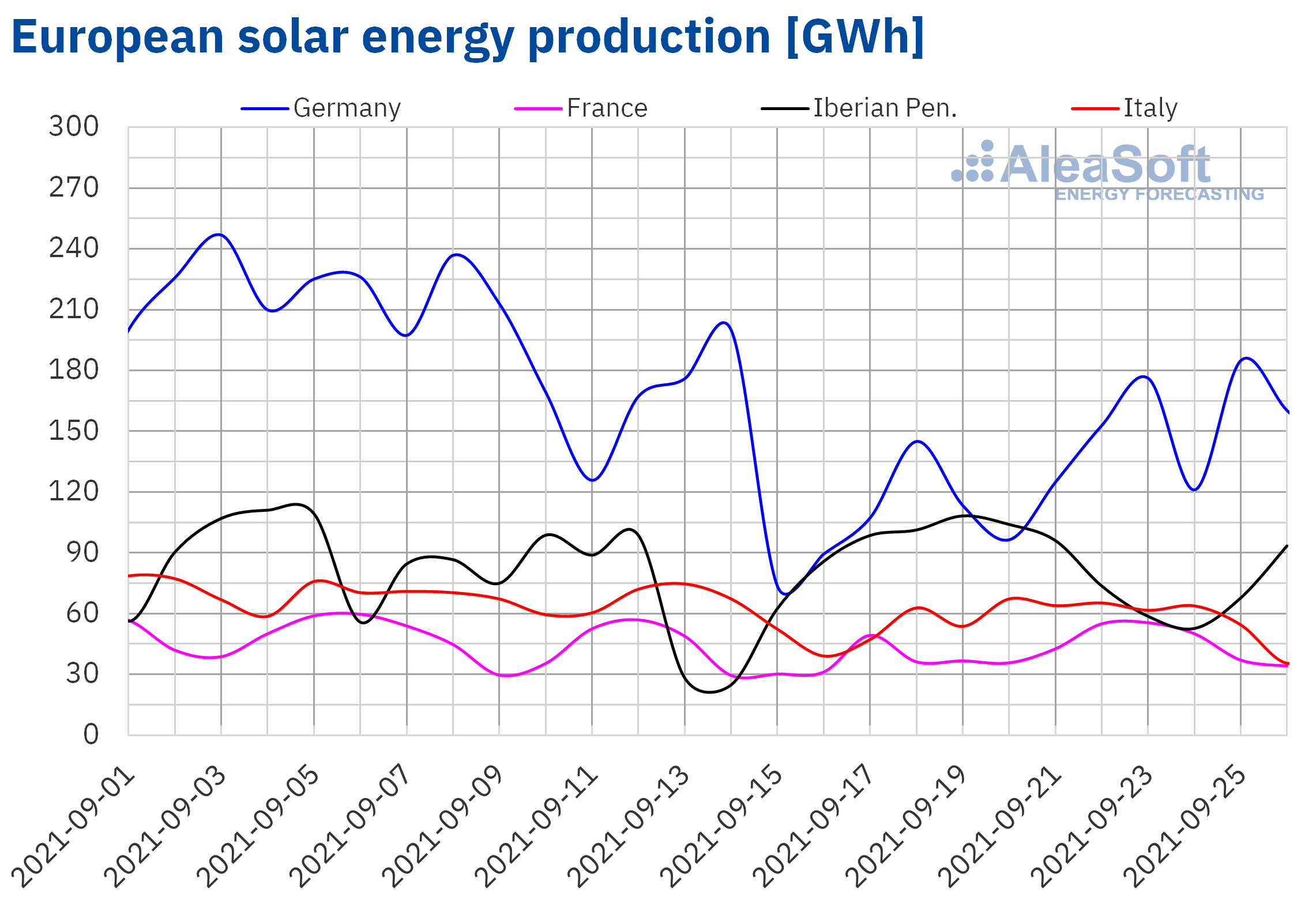

The solar energy production increased in all the European markets analysed at AleaSoft Energy Forecasting during the fourth week of September when compared to that registered during the third week of the month. The greatest variation was registered in the French market, with an increase of 18%. On the other hand, the smallest increase was 3.7% in the Italian market.

For the week of September 27, the AleaSoft Energy Forecasting‘s solar energy production forecasting points to a decrease in the Italian and German markets, while in the Spanish market the variation with respect to the previous week is expected to be small.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

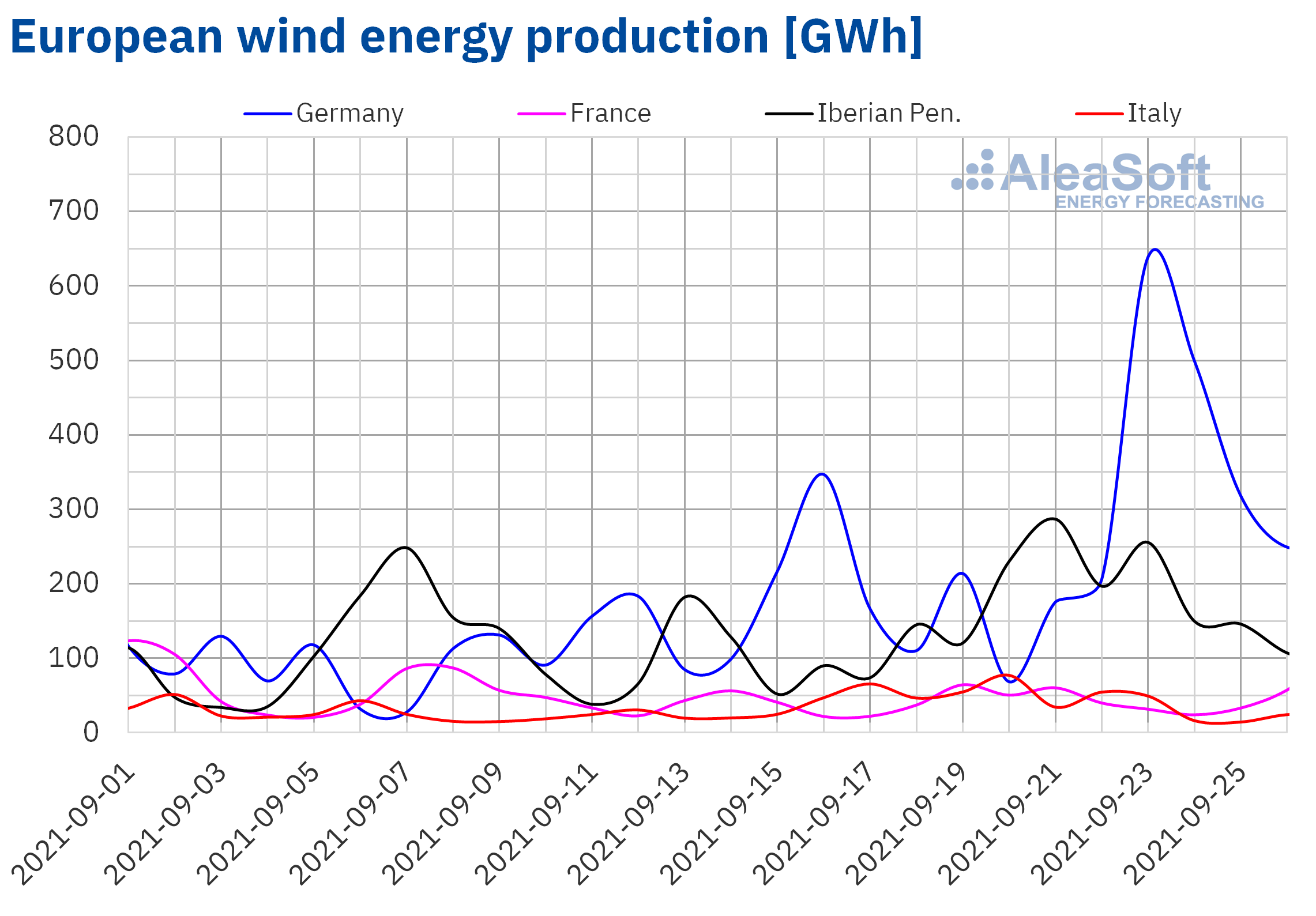

During the week of September 20, the wind energy production increased in most of the markets analysed at AleaSoft Energy Forecasting. The greatest variation in production was 80% in the Portuguese market, an increase that contrasts with the increase of only 3.9% in the French market. On the contrary, in the Italian market there was a decrease in production of 2.9%.

For the last week of September, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates that it will increase in the French market, but it is expected to be lower in the rest of the analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

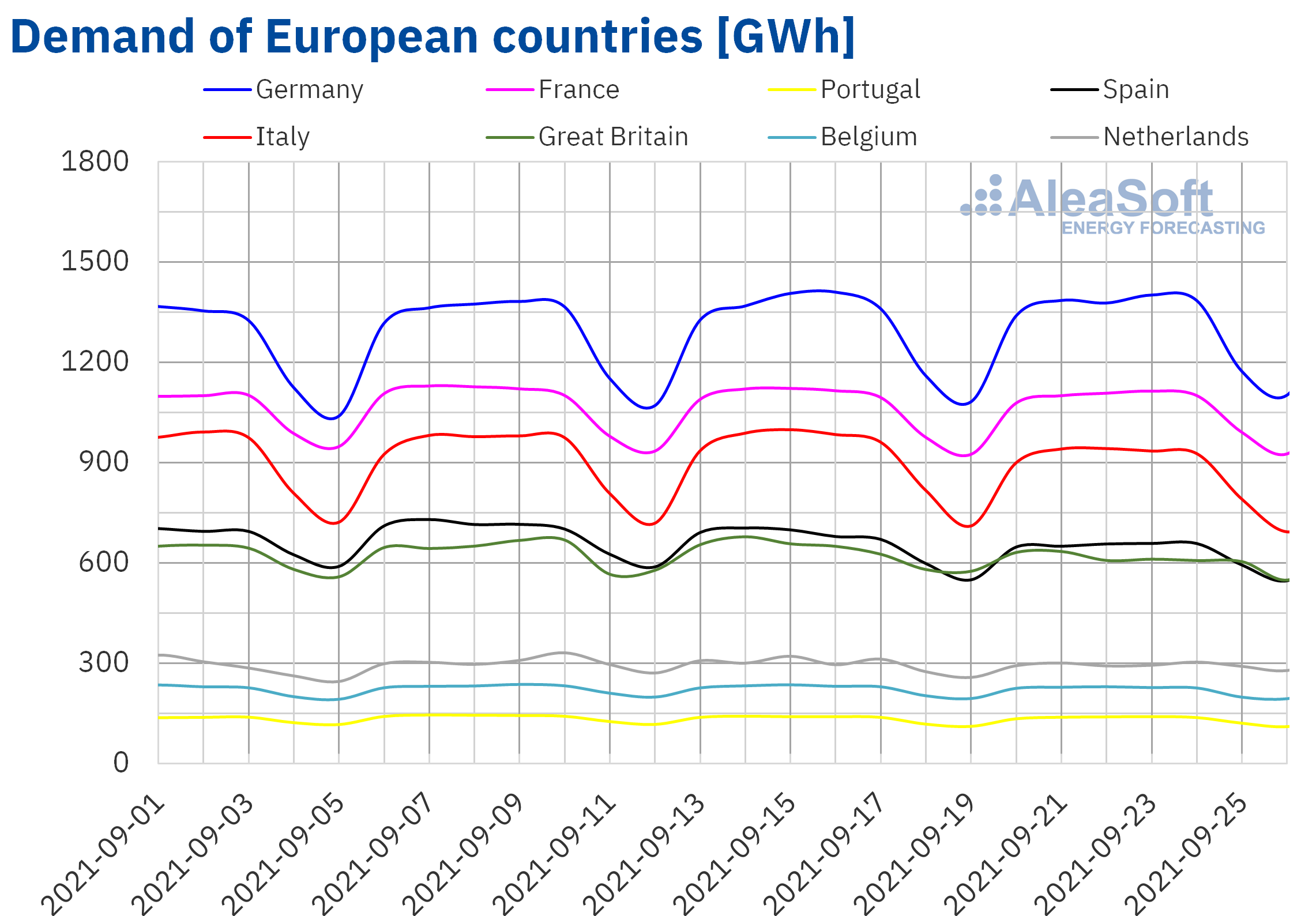

The electricity demand of the European markets fell in a generalised way during the week of September 20 compared to the previous week. The decrease in average temperatures was the main cause of this drop. For example, average temperatures dropped more than 2 °C in Italy and France. In the Spanish market, the demand fell by almost 4.0%, similar to the fall of the previous week. Others of the most notable falls were registered in the markets of Italy and Great Britain, with values higher than 4.0%. In the markets of France, Portugal and Belgium the falls were between 0.3% and 1.5%.

The AleaSoft Energy Forecasting’s forecasts indicate that in the week of September 27, the demand will continue to decline in several European markets, although recoveries are expected in Belgium, France, Great Britain and Portugal.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

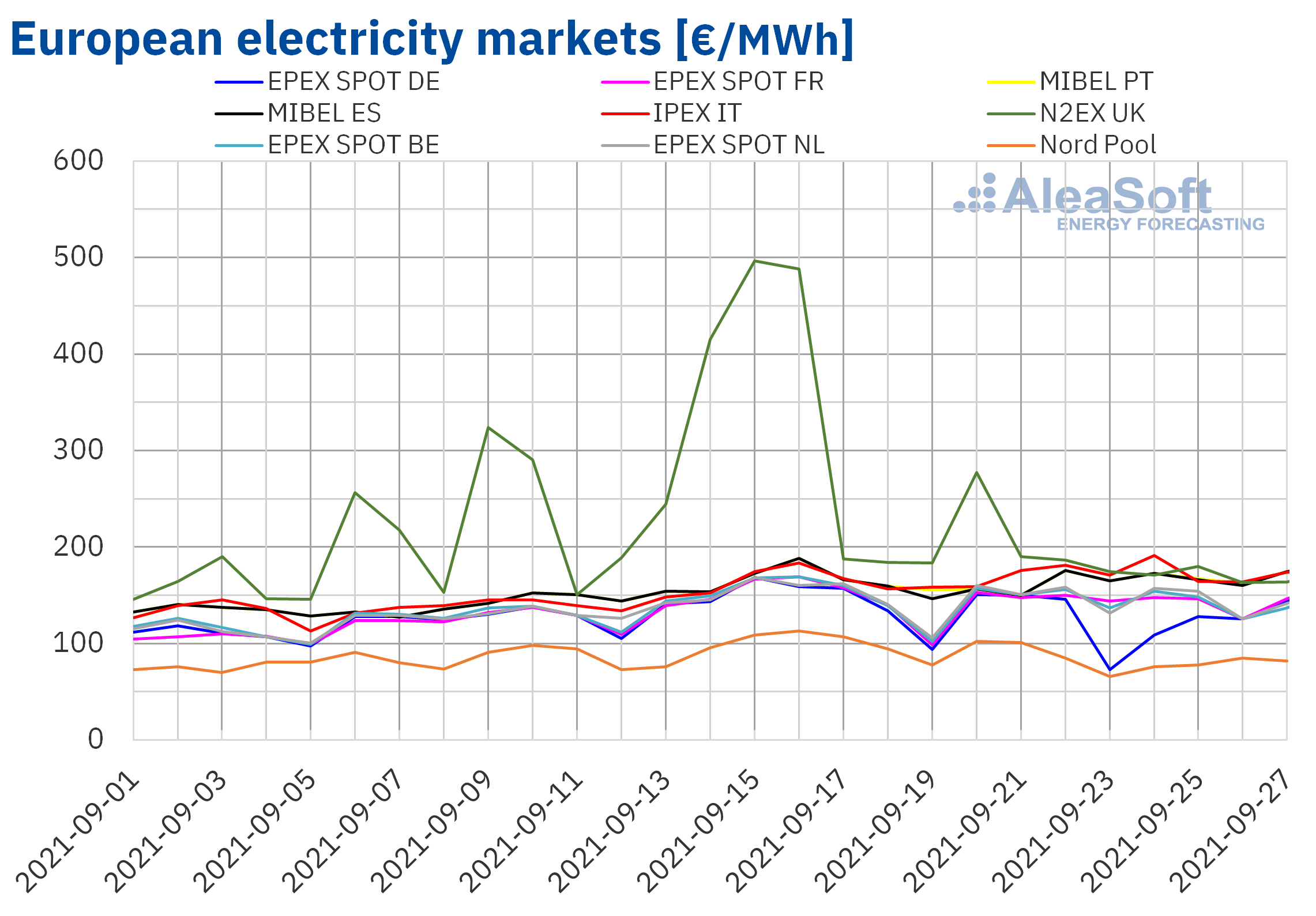

In the week of September 20, the behaviour of the prices of the European electricity markets analysed at AleaSoft Energy Forecasting was heterogeneous, because in some cases the weekly average price rose for another week and in others it fell. On the one hand, the largest price drop was that of the N2EX market of the United Kingdom, of 39%, followed by that of the Nord Pool market of the Nordic countries, of 12%, and that of the EPEX SPOT market of Germany, of 11%. On the other hand, the highest price increase was that of the IPEX market of Italy, of 5.8%, followed by that of the EPEX SPOT market of the Netherlands, of 1.2%. In the rest of the markets, the price variations were between ‑0.4% of the EPEX SPOT market of Belgium and 0.6% of the MIBEL market of Spain.

In the fourth week of September, the highest weekly average price was that of the N2EX market, of €191.69/MWh. On the other hand, the lowest average was that of the Nord Pool market, of €84.73/MWh. In the rest of the markets, prices were between €126.00/MWh of the EPEX SPOT market of Germany and €172.39/MWh of the IPEX market.

The highest daily price in the fourth week of September, of €277.15/MWh, was registered on Monday, September 20, in the British market, while the lowest, of €65.78/MWh, was that of Thursday, September 23, in the Nord Pool market. On the other hand, on Friday, September 24, a price of €191.20/MWh was reached in the Italian market, which was the highest in this market at least since January 2005.

Regarding hourly prices, for one hour of September 22 and two hours of September 24, a price of €250.00/MWh was reached in the Italian market. This was the highest hourly price in this market since August 2012. In the market of the Netherlands, on Wednesday, September 22, at 20:00, the price was €248.28/MWh, the highest at least since April 2011, while in Belgium on September 23 at 7:00 p.m., the price was €243.06/MWh, the highest since November 2018. In Germany, on September 22 at 8:00, a price of €213.81/MWh was reached, which was the highest price in the German market since November 2008. Finally, on Sunday, September 26, at 9:00 p.m., the MIBEL market price was €199.00/MWh, the highest hourly value so far.

During the fourth week of September, although gas and CO2 prices remained high, the decrease in demand and the increase in wind and solar energy production allowed price increases to slow down and in some cases they fell.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the week of September 27, prices could increase in the markets of Germany, Spain, Italy and Portugal, influenced by the decrease in wind energy production. On the other hand, in markets such as France, where increases in production with this technology are expected, prices might fall.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Electricity futures

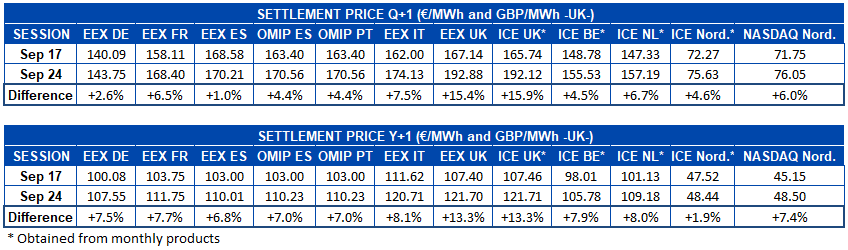

During the fourth week of September, electricity futures prices for the last quarter of 2021 registered a general increase in all the European markets analysed at AleaSoft Energy Forecasting, if the settlement prices of the session of September 24 are compared to those of the session of the 17th. The markets of the United Kingdom were those that registered the highest growth rates, with increases of over 15% in both the ICE market and the EEX market. On the other hand, the EEX market of Spain was where prices increased to a lesser extent, with a 1.0% difference compared to the settlement price of the previous week.

Regarding the electricity futures for the next year 2022, a very similar behaviour occurred. All markets registered increases between the two analysed sessions, being more pronounced in the markets of the United Kingdom, in this case with increases of over 13%. The ICE market of the Nordic countries was the one with the lowest variation, with a rise of 1.9%.

Brent, fuels and CO2

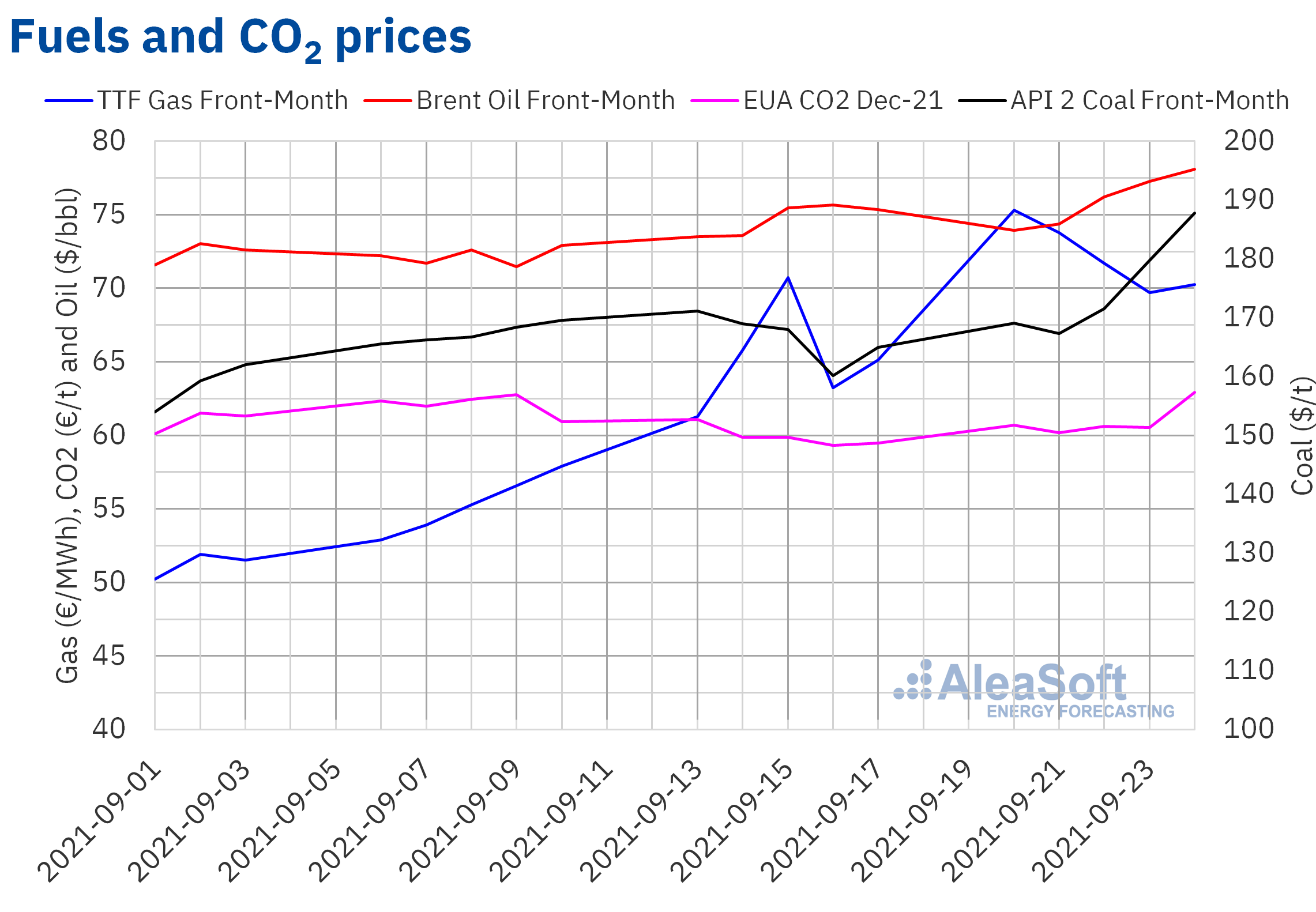

Brent oil futures prices for the Front‑Month in the ICE market, on Monday, September 20, fell to $73.92/bbl, influenced by the recovery in production levels in the Gulf of Mexico. But for the remainder of the fourth week of September, prices rose to reach a settlement price of $78.09/bbl on Friday, September 24. This price was 3.7% higher than that of the previous Friday and the highest since October 2018. In the fourth week of September, the recovery in demand continued to favour the increase in Brent oil futures prices.

As for the TTF gas futures prices in the ICE market for the Front‑Month, on Monday, September 20, they reached a record settlement price of €75.32/MWh. This price was more than €10/MWh higher than that of the last session of the previous week and 23% higher than that of the previous Monday. This price hike was influenced by Russia’s decision not to increase gas supply through Ukraine from October. But the following days of the fourth week of September, prices fell until registering a settlement price of €69.68/MWh on Thursday, September 23. This price was still 10% higher than that of the previous Thursday. On Friday, September 24, prices began to recover, reaching a settlement price of €70.24/MWh. The fact that reserve levels remain low and that the demand in Asia is high continue to favour the upward trend in gas prices.

Regarding the CO2 emission rights futures in the EEX market for the reference contract of December 2021, during the fourth week of September, the settlement prices remained above €60/t. The maximum settlement price of the week, of €62.93/t, was reached on Friday, September 24. This price was 5.8% higher than that of the previous Friday and surpassed the previous record for the maximum price registered on September 9.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

On next October 7, at AleaSoft Energy Forecasting, the monthly webinars on current issues of the European energy sector will be resumed. Two speakers from the consulting firm Deloitte Spain will participate in this meeting: Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services and Carlos Milans del Bosch, Partner of Financial Advisory, who repeat almost a year after the webinar held in October 2020 with the participation of this company. These speakers, together with Oriol Saltó i Bauzà, Manager of Data Analysis and Modelling at AleaSoft Energy Forecasting, will give an updated view of the topics analysed on that occasion on the evolution of the European energy markets, the renewable energy projects financing and the importance of the forecasting in audits and portfolio valuation.

In the second part of the webinar in Spanish there will be an analysis table in which Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasting, will join the speakers to answer questions about the vision of future of Deloitte Spain and AleaSoft Energy Forecasting on the energy sector, the impact and consequences of Royal Decree‑Law 17/2021 approved by the Spanish Government, the need for long‑term electricity market prices forecasting for investments and for audits or any other topic of interest for the sector. Those interested can send their questions through the address webinar@aleasoft.com.