AleaSoft Energy Forecasting, October 20, 2025. In the third week of October, prices in the main European electricity markets continued the upward trend of the previous week, with most markets reaching weekly averages above €90/MWh. Once again, most markets registered daily prices above €100/MWh and highs for recent months. In addition, the Dutch and German markets reached quarter‑hourly prices above €400/MWh, the highest values since the summer and the beginning of the year, respectively. The increase in electricity demand and the decline in wind and solar energy production in most markets favored the rise in prices.

Solar photovoltaic and wind energy production

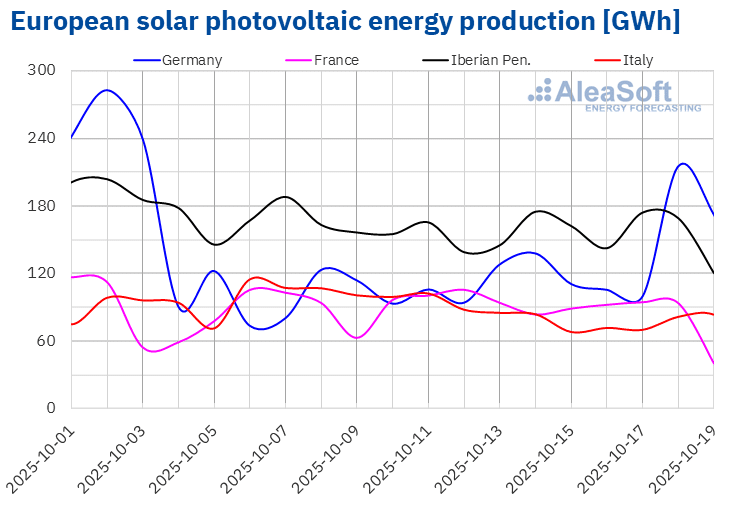

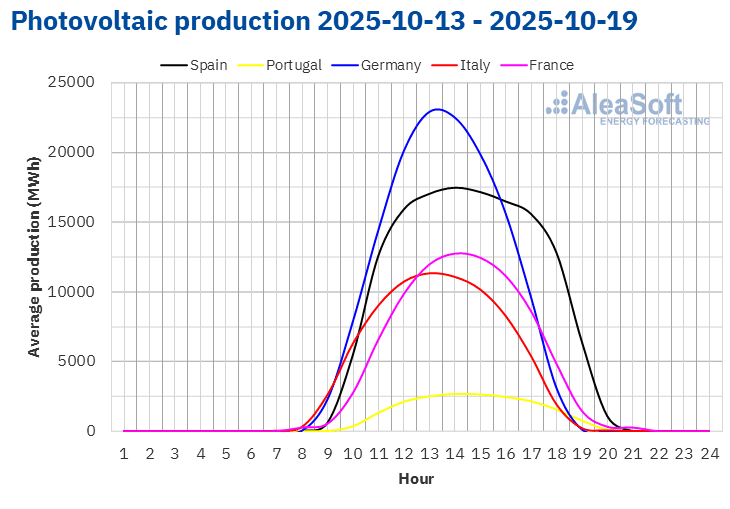

In the week of October 13, solar photovoltaic energy production decreased in most major European electricity markets compared to the previous week. After two weeks of increases, the Italian and French markets registered the largest declines, 24% and 12%, respectively. The Portuguese and Spanish markets continued the downward trend of the previous week, with decreases of 8.5% and 3.4%, respectively. This was the fourth consecutive week of declines for the Spanish market. The exception was the German market, which registered a 42% increase in photovoltaic energy production, thus reversing the downward trend of the previous week.

During the week of October 20, according to AleaSoft Energy Forecasting’s solar energy forecasts, the downward trend will continue and photovoltaic energy production will decrease in the Italian, German and Spanish markets.

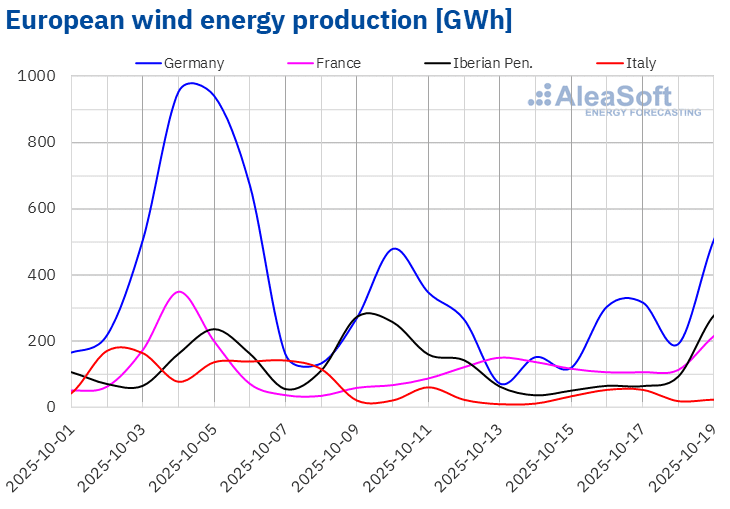

During the third week of October, wind energy production decreased in most major European markets compared to the previous week. The Italian market continued the downward trend of the previous week, registering the largest decline, 61%. It was followed by the Portuguese and Spanish markets with decreases of 47% and 44%, respectively. In both cases, the declines reversed the upward trend of the second week of October. The German market continued the downward trend of the previous week, but with the smallest drop, 28%. On the other hand, in the French market, wind energy production increased by 98%, reversing the downward trend of the previous week.

In the week of October 20, according to AleaSoft Energy Forecasting’s wind energy forecasts, production from this technology will increase significantly in the main European markets.

Electricity demand

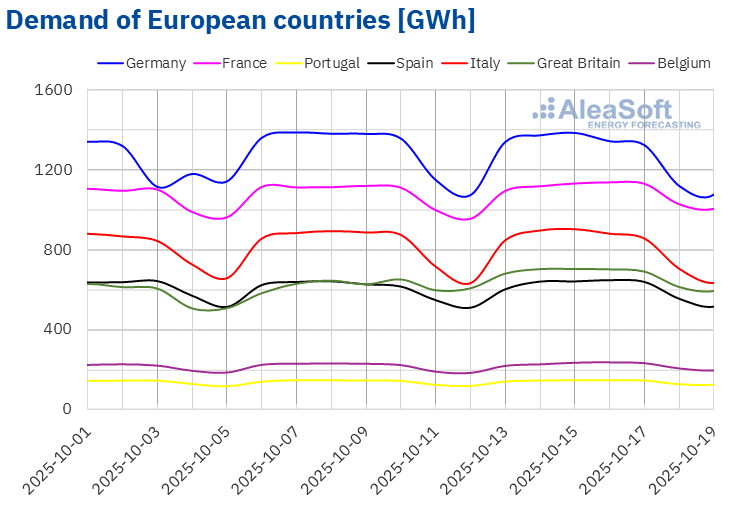

In the week of October 13, electricity demand increased in most major European markets compared to the previous week. The British market stood out with the largest increase in demand, 8.0%. Increases in the rest of the markets ranged from 0.9% in Spain to 2.7% in Belgium. The Spanish market reversed the downward trend of the previous week. The Portuguese market continued the upward trend for the third consecutive week, this time with an increase of 1.3%. In the British, Belgian and French markets, electricity demand grew for the second consecutive week. On the contrary, in the German and Italian markets, the upward trend registered the previous week reversed, with declines in demand of 1.4% and 0.4%, respectively.

During the week, average temperatures fell in most analyzed markets compared to the previous week. The decreases ranged from 0.2 °C in Italy to 2.4 °C in Germany. The Iberian Peninsula was the exception. In Portugal and Spain, average temperatures increased by 0.4 °C and 0.1 °C, respectively, compared to the week starting October 6.

For the week of October 20, according to AleaSoft Energy Forecasting’s demand forecasts, demand will increase in the main European markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

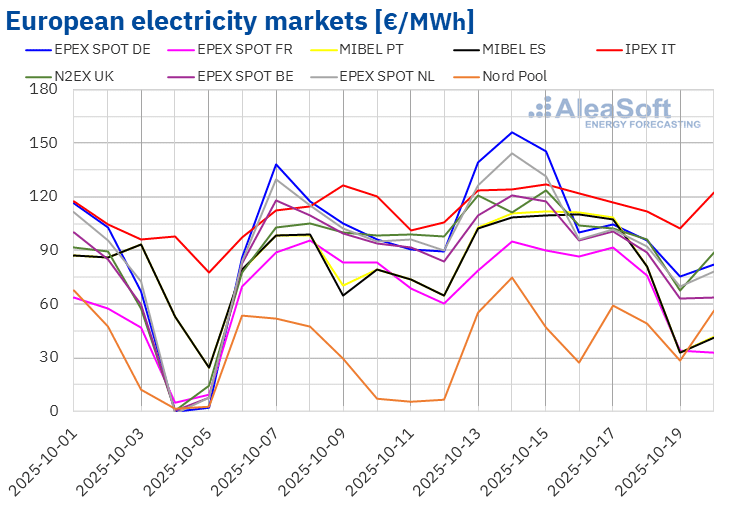

In the third week of October, the average prices of the main European electricity markets increased compared to the previous week. The EPEX SPOT market of France registered the smallest price increase, only 0.4%. On the other hand, the Nord Pool market of the Nordic countries registered the largest percentage price increase, 68%. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices increased between 2.5% in the EPEX SPOT market of Belgium and 17% in the MIBEL market of Portugal.

In the week of October 13, weekly averages were above €90/MWh in most European electricity markets. The exceptions were the Nordic and French markets, whose averages were €48.56/MWh and €78.78/MWh, respectively. In contrast, the German market and the IPEX market of Italy registered the highest weekly averages, €116.63/MWh and €118.22/MWh, respectively. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices ranged between €92.99/MWh in the Spanish market and €108.94/MWh in the Dutch market.

Regarding daily prices, during the third week of October, most major European electricity markets registered daily prices above €100/MWh. The exceptions were the French and Nordic markets. The latter registered the lowest daily price of the week among the analyzed markets, €26.94/MWh, on Thursday, October 16. On the other hand, on Tuesday, October 14, the German market registered the highest daily average of the week, €156.14/MWh. This was its highest price since February 15. On October 15, the N2EX market of the United Kingdom registered its highest daily price since March 14, while the Portuguese market registered its highest price since June 21. The Italian and Spanish markets registered their highest daily prices since July 2 on October 15 and 16, respectively. On Tuesday, October 14, the Belgian and Dutch markets also registered their highest daily prices since July 2.

On the other hand, on Tuesday, October 14, the Dutch market registered a quarter‑hourly price of €437.97/MWh, while the German market registered a price of €508.38/MWh. Such high prices had not been registered in these markets since early July and late January, respectively.

In the week of October 13, the increase in demand and the fall in wind and solar energy production in most markets contributed to the rise in prices in the European electricity markets. However, the significant increase in wind energy production in France helped to limit the price increase in the French market.

AleaSoft Energy Forecasting’s price forecasts indicate that, in the fourth week of October, prices will fall in the European electricity markets, influenced by significant increases in wind energy production.

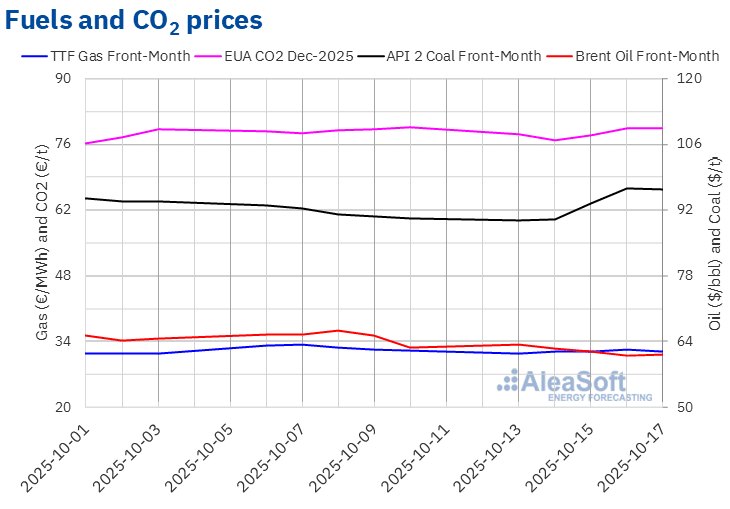

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market reached their weekly maximum settlement price, $63.32/bbl, on Monday, October 13. Subsequently, these futures registered a downward trend. As a result, on Thursday, October 16, these futures registered their weekly minimum settlement price, $61.06/bbl. According to the data analyzed at AleaSoft Energy Forecasting, this was the lowest price since May 6. On Friday, October 16, the settlement price was slightly higher, $61.29/bbl, but still 2.3% lower than the previous Friday.

Concerns about demand, influenced by trade tensions between China and the United States, the International Energy Agency’s forecasts on supply surpluses in 2026, as well as the easing of tensions in the Middle East, exerted downward pressure on Brent oil futures prices in the third week of October. The announcement by the US president of an upcoming meeting with his Russian counterpart to discuss ending the war in Ukraine also increased downward pressure on prices due to the possibility of greater oil availability in international markets in the event of lifted sanctions on Russia.

As for TTF gas futures in the ICE market for the Front‑Month, on Monday, October 13, they registered their weekly minimum settlement price, €31.48/MWh. Subsequently, prices increased. On Thursday, October 16, these futures reached their weekly maximum settlement price, €32.38/MWh. However, on Friday, October 17, after a 1.7% decrease compared to the previous day, the settlement price was €31.82/MWh. According to the data analyzed at AleaSoft Energy Forecasting, this price was 1.1% lower than the previous Friday.

The possibility of increased European gas exports to Ukraine during the winter as a consequence of the damage caused by the war to the country’s gas infrastructure exerted upward pressure on TTF gas futures prices. However, the high levels of European reserves and abundant supplies of both gas from Norway and liquefied natural gas helped to keep prices below those of the previous week.

Regarding CO2 emission allowance futures in the EEX market for the reference contract of December 2025, on Tuesday, October 14, they registered their weekly minimum settlement price, €76.94/t. Subsequently, prices increased. As a consequence, on Thursday, October 16, these futures reached their weekly maximum settlement price, €79.52/t. On Friday, October 17, the settlement price was slightly lower, €79.47/t. According to the data analyzed at AleaSoft Energy Forecasting, this price was 0.3% lower than the previous Friday.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing of renewable energy and storage projects

The 59th webinar in the monthly webinar series of AleaSoft Energy Forecasting took place on Thursday, October 9. In addition to the evolution and prospects of European energy markets for the winter 2025‑2026, the webinar analyzed the financing of renewable energy and storage projects, the prospects for batteries and hybridization, as well as the importance of forecasting in audits and portfolio valuation. On this occasion, the webinar featured the participation of speakers from Deloitte for the sixth consecutive year. Clients and collaborators of AleaSoft Energy Forecasting can request the recording of the webinar.

Source: AleaSoft Energy Forecasting.