AleaSoft Energy Forecasting, March 4, 2024. Interview by Ramón Roca, director of El Periódico de la Energía, with Antonio Delgado Rigal, PhD in Artificial Intelligence, founder and CEO of AleaSoft Energy Forecasting.

At the beginning of the year it seemed that there would be a lot of uncertainty, but the government approved the Royal Decree in which they approved a modification of the processing milestones, giving them more time to develop the projects and arrive on time. How did AleaSoft see this?

Well, it was the Royal Decree‑Law 8/2023 that was approved in January and it was very positive. The extension of the deadlines was fundamental. Otherwise we would have lost a lot of projects, some of them good, that would not have arrived on time. So all this energy, let’s say, is still alive and has a lot more time to arrive on time, get funded and be implemented.

The electricity markets are gradually recovering, and this February they closed below €45/MWh, which means going back to 21% VAT on the electricity bill. What is the reason for this drop in prices?

Yes, in February, as you mentioned, it went down. The first week we were at €70/MWh, the second week we were at €50/MWh and then we ended up at €30/MWh with all the wind that we had. And this is basically due to the drop in gas that we have seen especially since the end of October. Gas was above €50/MWh and at the end of February we see that we are at €23/MWh. In other words, we have broken the barrier of the floor of 25 euros per megawatt hour, which is a path in which we were historically before the COVID in gas. It fluctuated between €15/MWh and €25/MWh, and now we have returned to this path, which is positive. From October to now, not only has the TTF dropped by 50%, but also in the United States, and that is the reason for the sharp drop we had in February, both in the spot and futures markets. So we are kind of back to the pre-covid situation.

Have the drop in the price of CO2 emission rights and the drop in demand in Europe also had an impact?

In October, the price of CO2 was around 85 euros per ton. Now we are at €50/t. The ton has gone down 35 euros in four months. That is obviously a factor that has had an impact. Demand has been relatively low this winter. It has been a relatively mild winter compared to others we have had, and that also affects electricity and gas consumption. We’ve had, let’s say, a lot of gas in storage since the fall. We had storage during 2023, so we did not run out of gas like we did in 2021. And now the winter, which was relatively mild, has been well managed. The futures markets are heavily influenced by the sharp drop in spot. All these causes mean that we are in some way reaching pre-Covid prices.

This drop in prices will have some impact on long-term renewables or PPA contracts.

In terms of PPA, it is not good for developers, it is a disaster for sponsors. Now we are in a situation that we can say is critical because the off-takers, the ones who buy the PPA, are seeing very, very appetizing, low market prices. And they are saying, how am I going to commit to a 10-year PPA at a price that may not be as low as I want it to be when I already have low prices to go to the market at? So it is causing a lot of contracts that had been advanced to be frozen in some way.

And this can also affect the future development of renewable energy in the country.

This is serious because if the price signal that the off-takers, who are the buyers, see goes down, it is a moment when the PPA that can be offered to them is not viable from a financing point of view, so it can be complicated.

We have talked a lot about the importance of storage for the national energy system. We see that the large production of renewables in the market means that prices are very low, which means that the plants themselves are being cannibalized and cannot even cover their costs. So we see that there is a need to attract and inject storage, but it takes a long time, how do you see it from AleaSoft? When is this battery storage boom going to happen?

Batteries are the salvation of the market and of renewables and therefore of the transition. It is a critical aspect. In other words, it is as important to build photovoltaic and wind farms as it is to build storage. We are talking about energies that are not controllable, and the only way to do it is with the battery, with storage. So we hope that this year capacity payments can be implemented and that from 2025 we will see the first auctions. This is what the sector is expecting. It is essential that this vector, the storage vector, is promoted.

In your price forecasts for the arrival of storage, what might the price curve look like in Spain?

The fundamental revenue of storage is the arbitrage between day and night. So when there is more photovoltaic, the batteries start to store and the price does not drop as much. And at night, the battery starts to inject at night and the price does not go up as much, there is a balance that compensates these oscillations.

Do battery developers call you to find out more or less how much they can charge for their batteries?

We have created a division in the company for the whole storage issue, to create a set of tools to help with battery management in the short term, to see what revenue the battery is going to have, and to design the battery, how to use it, whether they are four-hour, two-hour or one-hour batteries. There are also stand-alone batteries and batteries as part of the hybridization of a park. We have a number of tools that we have developed to do these calculations. In other words, what is the best battery to put in? Or the capacity of the battery to put in to make it as cost effective as possible.

After the development of renewables and storage, what other vectors does AleaSoft see for this energy transition to move forward?

The other vector we have is the grid; we have to develop the grid, the transport grid, the distribution grid and the international exchanges. This is essential. For example, today we were talking to some of our customers who say that data centers can be installed in Madrid, but there is not enough capacity. The grid is not ready for so much renewable energy. The investments that have to be made in the grid are billions, but we are not seeing the dynamism that it should have.

The other fundamental vector is also the demand for renewables. Renewable demand is fundamental. In other words, if we do not have a consumer of renewable energy, we have too much production. Here it is essential, for example, to develop renewable demand both in transport and in industry, that is, to eliminate all the fossil fuels that are still consumed, which are 60% of what is consumed. And that is why we can say that there are a lot of prospects for photovoltaic and wind energy, because there is a lot of renewable demand, that is, a lot of demand that is not renewable now, that can be met with these clean energy productions.

I also wanted to know how you at AleaSoft see the whole hydrogen issue? Do you see that moving forward?

We could say that green hydrogen is a fundamental vector of renewable demand for both transportation and industry. Now, with all these developments that we are thinking about, green hydrogen will become more important. Also to produce ammonia, to produce methanol, other types of fuels. It is a fundamental vector for large transportation, for trucks, ships or airplanes and, of course, for all industry, so all the demand that is not electrified.

How do you see at AleaSoft that Spain will be one of the few countries that want to abandon nuclear energy after the energy crisis we have experienced?

AleaSoft’s message is that power plants must be safe and profitable. That is the most important thing and the market will decide. What cannot happen is that we have plants that need, for example, €50/MWh and the price is €40/MWh. Because that nuclear power plant becomes a production NGO. If the nuclear plant is not profitable, it closes, and if it is not safe, it closes. It is not a regulatory issue of more time, less time, but as long as they are profitable and the owners want to keep them and they are safe, they should be kept for 50 or 60 years.

Let’s go back a little bit to the topic of PPA, because I know you have a PPA Marketplace and another one for renewable assets and projects.

We have 25 years of history, as you know, and we have worked or are working with large and medium‑sized companies, with the whole sector, both those that produce and those that consume. And organically we have brought them together, because they all use our forecasts, which are a reference at the Spanish level. They all use them. And then it is already a first step to agree on a PPA, which is a long‑term contract. If both see the same price for the next 10 or 15 years, it is easier to agree. Little by little, we have been bringing the off-takers into agreement with the sponsors.

But from the end of last year we said we are going to make it more massive, not only with our clients, but open it to other agents in the market. And we are succeeding. We have a lot of subscriptions now, and that has also allowed us to see the market from the inside. Before we saw the PPA from the outside, as you see it, a price more or less, but now we see how the price is formed, what the price variation is, what price everybody is offering both to buy and to sell. And that, well, gives us a deep insight into the subject.

You are one of the few price forecasting consultancies that have been using artificial intelligence for many years. I wanted to know if it was really a success and if this AI thing worked.

Artificial Intelligence is now in vogue. I think the year 2023 was a turning point in terms of Artificial Intelligence, its uses, its applications, and most importantly that people know about it, but Artificial Intelligence is much more than 50 years old. Now, with all the computing power that exists, plus the power of infinite data storage that can be analyzed, a qualitative leap is being made in Artificial Intelligence.

From the very beginning, we have used a methodology based on Artificial Intelligence, and it has worked in all markets and in all horizons. Yes, it has worked, it has been a great achievement, because in these 25 years we have managed to make the forecasts good, robust and stable over time.

How do you differentiate your services from the competition and what would you highlight about your forecasting models?

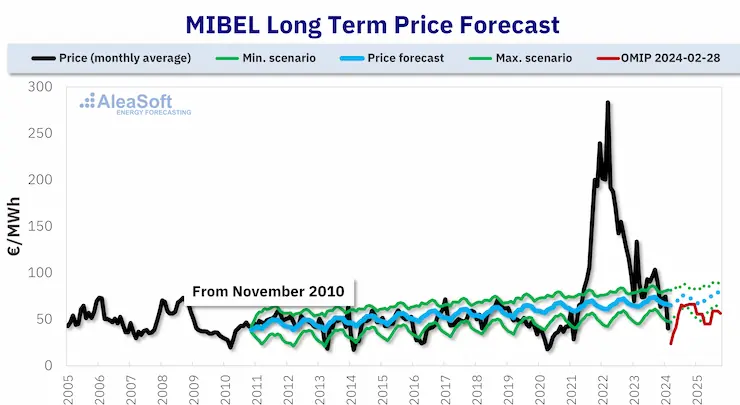

We have a scientific model that has high quality and coherency, which is the most important thing. We do forecasts that are neither optimistic nor pessimistic. We often mention a graph, we show a graph with a forecast that we did in October 2010 and we still see that it works. You see that it has worked and still has little variability for the present. In 2010, when we did it, we had coal, there was still fuel oil, there was less wind energy than there is now and the development of photovoltaics was still in its infancy in Spain.

Long-term price forecast of the Iberian electricity market MIBEL at the end of October 2010, made by AleaSoft.

Long-term price forecast of the Iberian electricity market MIBEL at the end of October 2010, made by AleaSoft.Source: AleaSoft Energy Forecasting.

But the forecast is good, and why? Because it is a model based on market equilibrium, and that equilibrium is how much a buyer is willing to pay and how much a producer is willing to sell for. That equilibrium is fundamental. Supply and demand, that is fundamental, and there is also the balance between profitable and unprofitable technologies.

Fuel oil did not come out by fiat. Fuel oil came out because it was getting more and more expensive and another technology came along, which was gas, and replaced it. Gas also replaced coal. Wind energy also has been replacing gas, so one technology replaces another, but the market balance is maintained. So the forecast that we did 13 years ago is still valid. And that is one of the things that differentiates us from our competitors. We look at the future and the variables of the future, but we also look at what has happened in the past and what is happening in the present, and that is the fundamental difference, that is the reason for our quality and our coherency.

As you mentioned, you will celebrate your 25th anniversary in 2024, 25 years that you have practically lived together with the electricity market, almost like a kind of marriage. How have you lived these 25 years or how has the electricity market changed during these 25 years? What have you noticed the most during this time and what do you think has marked the sector for the future?

When we started in 1999, in the last century, in the last millennium, the most important thing was the demand, because there were no renewables, and we had to make high quality demand forecasts. And we started with demand forecasting, then price forecasting, and little by little the agents started to come in. In other words, we have lived the market since its birth. We saw how wind energy started to blossom and we had to start doing short‑, mid‑ and long‑term wind energy forecasts. Before wind energy, the combined cycle gas turbines came, which were a revolution. They were our clients when they came out. Then wind energy came and the major companies that developed wind energy are our clients, then photovoltaics, and with renewables, long-term forecasting becomes much more important.

Also, the market has diversified a lot. When we started 25 years ago, there were very few agents, and now I think there are maybe 500 agents in the market buying and selling electricity.

I would like to know if the biggest challenge for the sector has been the entry of renewables into the market, i.e. moving from a purely thermal mix plus hydro, based on fossil fuels and with a fairly high generation capacity, to a mix dominated or characterized by renewables, which are more intermittent and need to be better managed. Was that the big challenge for the sector?

Twenty-five years ago, we had nuclear, which is the base, we had hydro, which is manageable, we had coal and then combined cycle gas turbines, which are also manageable, so it was a manageable market. Then wind energy comes in with more and more energy and it is already a problem because it is complicated for the grid manager. We are talking about a lot more wind or a lot less wind. That creates imbalances in the market, especially in the electricity system. You have to deal with balancing markets. And yes, it has been a big challenge, especially because of the poor manageability of these technologies.

That’s why we said we need batteries. We cannot stop having gas because right now gas is our battery. We have gas in a pipe or in a tank and when we need it at night we use it or when we need it in winter we use it. Which, by the way, this winter issue is another thing that we have always talked about, seasonal storage. If we don’t have gas, what are we going to do in the winter when we don’t have wind and we don’t have sun? We have to start thinking about that. We also have to look at hydrogen not only as a fundamental vector for the transportation industry, but also as a strategic storage vector for the winter. It will be produced when we have renewables, stored and used in winter, if we really believe in decarbonization and that we will not have combined cycle gas turbines if we do not have fossil fuels.

I did not want to leave without commenting with you on the subject of market reform, do you think it was necessary to make such a fuss when we have not made as much progress as they wanted to sell us? It was said that the market was broken and everyone was criticizing it. How did you see all this? Does the market need more changes or does it need some changes for the future?

As you know, we publish in your newspaper twice a week, and we have always said that the marginal market is what it was, what it is, and what it will be, because nothing better has been found. When COVID worked and then, now, with the Ukraine crisis, it has worked. People said it was poorly designed and the opposite has been seen.

On top of that, the speculation was in gas.

It was all the manipulation of Russia, which already in 2021 knew that it was going to invade Ukraine and started to cut the supply because they thought that if they put pressure on Europe with energy prices, Europe would not help Ukraine enough and would turn a blind eye, which of course was not the case, and therefore prices went up, but the market worked. The marginalist market works because not only does it work in the spot market, but that market is then the one that is taken as a reference for the next 20 years, the whole future.

And also in what people don’t see, in the adjustment markets, which are also marginalist. So everything is consistent and everything works. Also, it is an integrated market in Europe, the same market. So when the price went up, people talked about reforming it. Now that the price is going down, nobody is saying anything. That is to say, these days, when we have had zero prices for some hours, nobody is saying that the market needs to be reformed. We have to get used to the fact that there are times when prices are high and times when they are low, depending on the price of gas, the price of CO2 and the production of renewables.

Let’s end this interview with Antonio Delgado Rigal from AleaSoft by congratulating you on your twenty-fifth anniversary and what I’m curious about is how you’re going to celebrate it, are you planning to do anything?

We are talking to some people to see if they will help us to organize some kind of celebration activity in October, then we are managing this issue to celebrate it with our customers or potential customers.