AleaSoft Energy Forecasting, July 14, 2023. Experts agree that the appetite to invest in renewable energy has not diminished with the drop in electricity markets prices and that full merchant projects continue to be attractive. The lowering of long‑term price forecasts by some suppliers is affecting the IRR of the projects. Currently, long‑term price curves forecasts of AleaSoft Energy Forecasting are those that provide the highest IRR to renewable energy projects.

On Thursday, July 13, the 35th edition of the series of monthly webinars organised by AleaSoft Energy Forecasting and AleaGreen took place, with the participation of Banco Sabadell, Ecoener and the Ben Oldman investment fund in the Spanish version of the webinar. During the analysis table of the webinar in Spanish, the current situation of renewable energy projects financing in Spain was analysed. The recording of the event can be requested on the AleaSoft Energy Forecasting website.

The investor appetite: merchant vs PPA

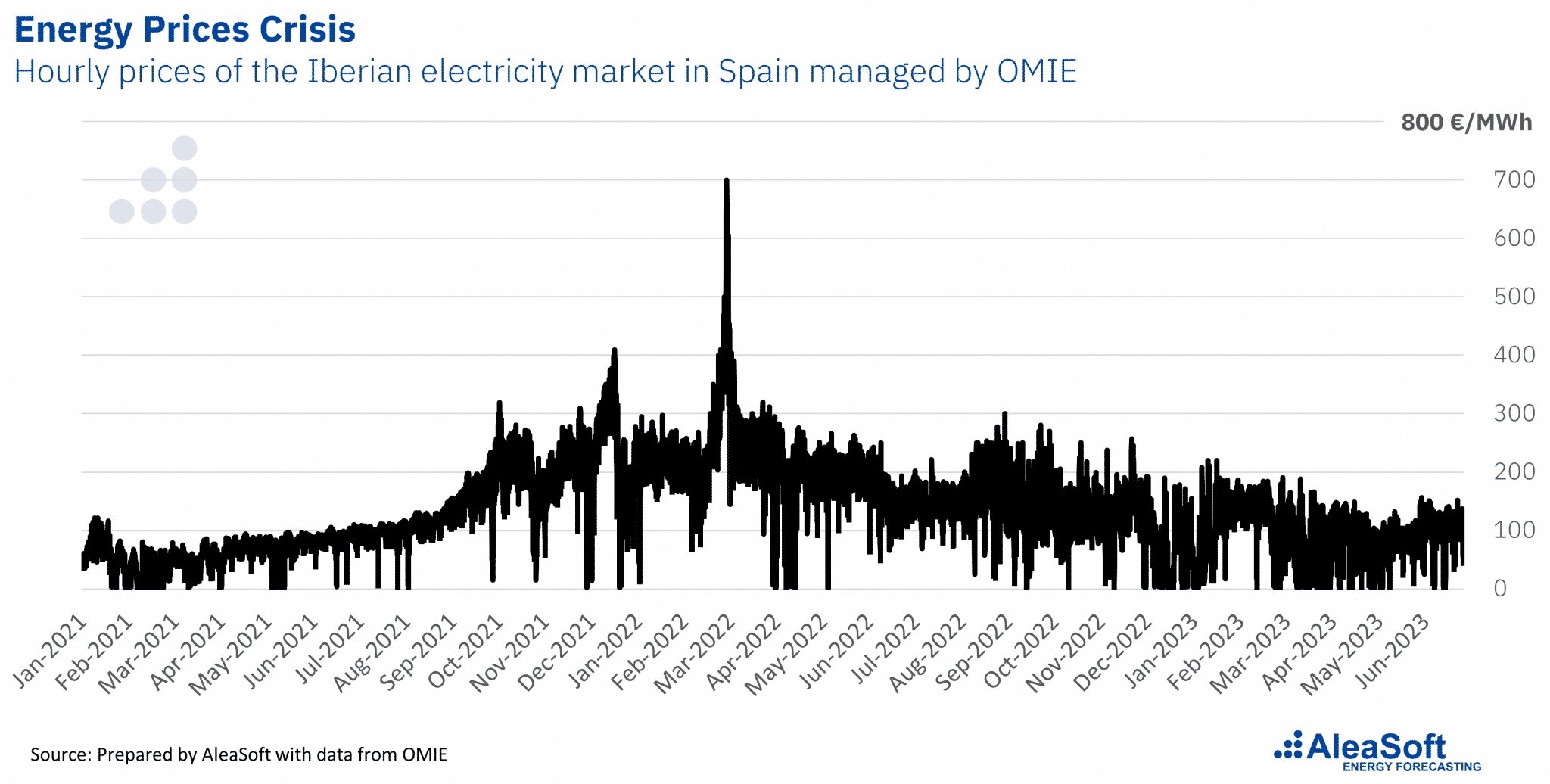

Opening the debate, Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasting, commented that he perceived certain nervousness among developers and financiers of renewable energies due to the fall in electricity markets prices and the abrupt reduction of long‑term price forecasts that some providers have done.

Roger Font, Director of Project Finance Energy at Banco Sabadell, explained that his bank continues to finance full merchant projects (projects fully exposed to electricity market prices), projects with a PPA (Power Purchase Agreement, a bilateral contract for energy purchase in the long term) and projects with feed‑in tariff. Roger Font agreed with Antonio Delgado Rigal that, with the drop in prices and forecasts of some suppliers, the development of new renewable energy projects slowed down, but they see that the investor appetite for renewable energy continues and is actually growing.

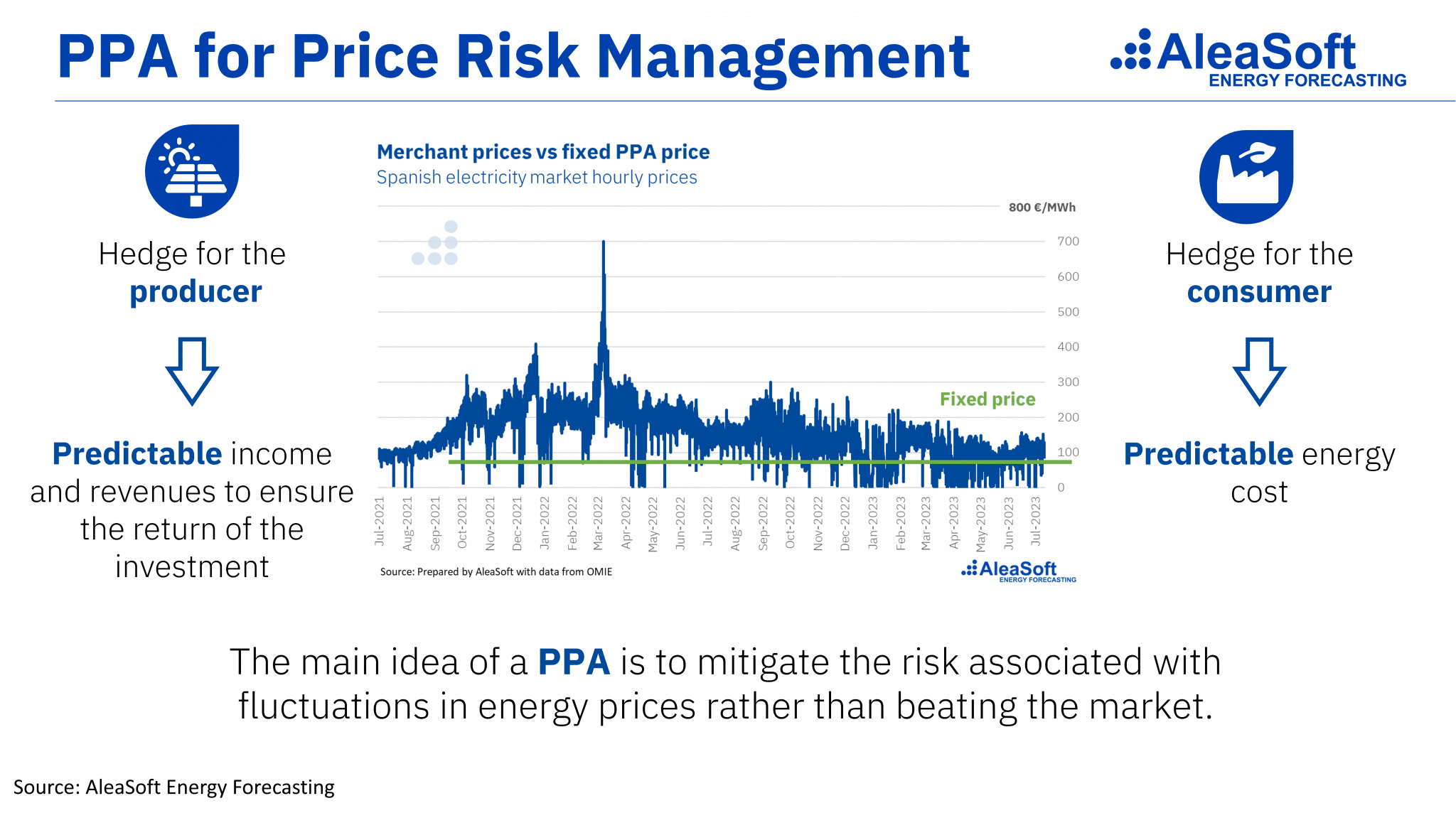

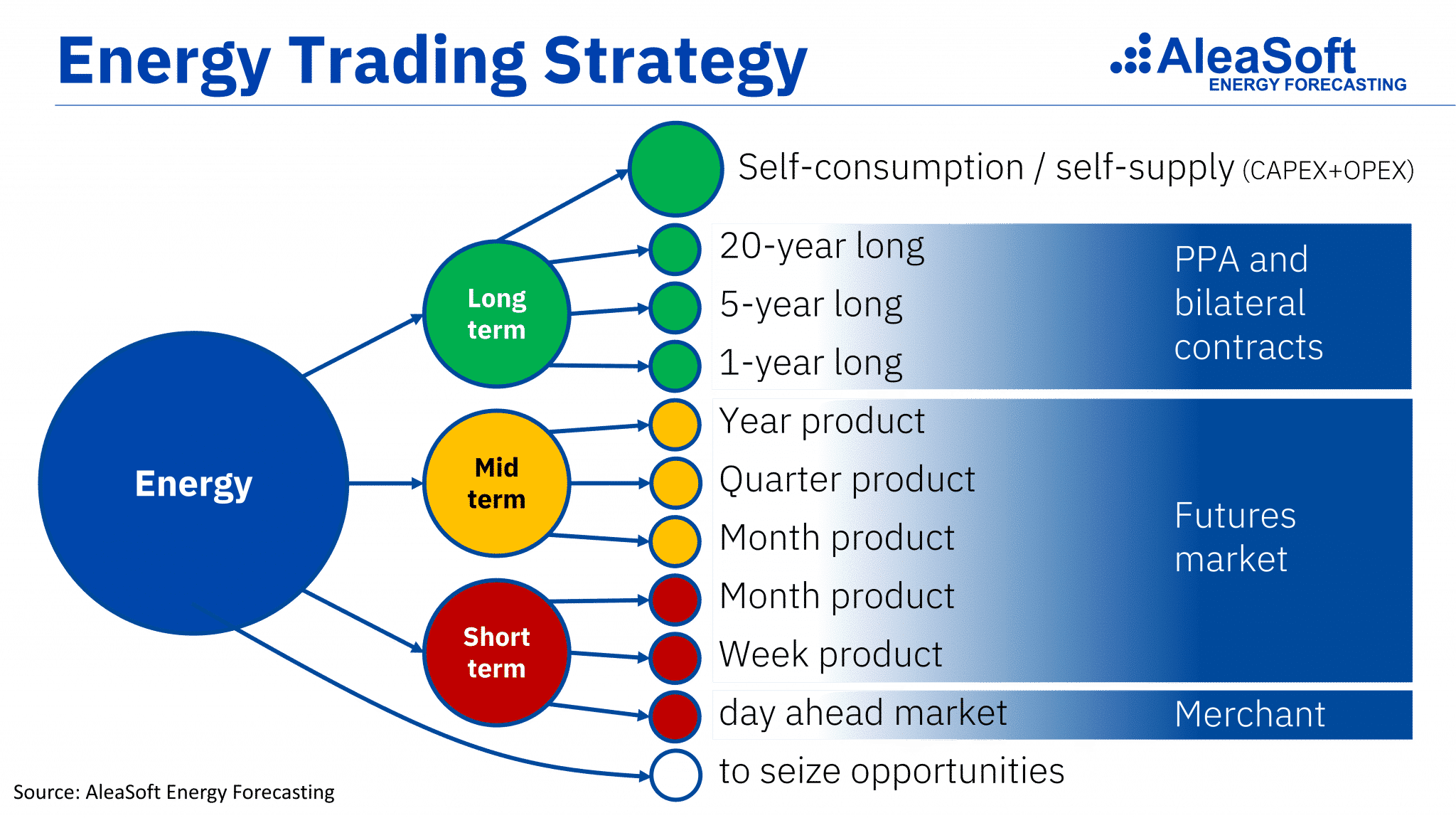

According to Roger Font, Banco Sabadell continues to want to finance both projects with PPA and full merchant projects. Traditionally, the number of financed full merchant projects has always been smaller than the number of projects that had a PPA, but this was a consequence of fewer projects of this type reaching them. But last year, 2022, the extraordinarily high prices seen in the markets caused that half of the projects that arrived were full merchant projects. Although the delays in the permit procedures meant that they could not get to finance them all. This year, with the drop in market prices, interest in projects with PPA has grown again.

The objective of the financial entities is that the project debt can be returned. If price forecasts change, financing terms can usually accommodate the new prospects. The most problematic for the sponsor of the project is the impact that a change in price forecasts can have on the IRR (Internal Rate of Return) of the project and that will affect the return on investment.

For Josep Montañés, Corporate General Manager at Ecoener, when seeking financing, the quality of a renewable energy project does not depend so much on whether it is a merchant or PPA project, but rather on the renewable resource available to the location and the expectation of prices to receive. In his company, they continue to observe a lot of interest in financing both projects with PPA and full merchant projects and they see that the financing options market is wide enough to find the financier that best fits each project.

Regarding the PPA market, they see that, currently, it has little depth and that pushes prices downwards, since the offtakers take advantage of the need of some projects that cannot obtain financing without a PPA. The pricing structure of PPA is also changing. Although years ago the most common structure was pay‑as‑produced, now most of the demand is for base‑load PPA, which is the reason why aspects such as the hybridisation of renewable energy production with battery storage are beginning to be very relevant, to adapt the production to the desired profile.

The webinar also included the participation of Jorge De Miguel, Managing Director at Ben Oldman, who explained that, together with the EIB (European Investment Bank), they designed a vehicle for financing full merchant plants of renewable energies, mainly wind and solar photovoltaic energy. The objective is to facilitate the financing of full merchant projects with very flexible structures that can be adapted to the volatility of electricity markets prices.

According to Jorge De Miguel, they understand the PPA as just one element within the strategy of the project developer, and not that it is a requirement to obtain financing, because that severely limits the capacity to develop new plants.

Jorge De Miguel is of the opinion that merchant strategies can be a very suitable option if they have sufficiently flexible and adapted financing, at least to start up the plants. Once the plant is up and running, it is the sponsor’s decision which exploitation strategy to carry out, whether it is to remain full merchant or close a PPA or combine different hedging strategies that can be very complex combining caps and floors in different horizons and time ranges.

According to his experience, there is still a lot of interest to invest in renewable energies in the long term and with different strategies.

Investments in renewable energy are profitable

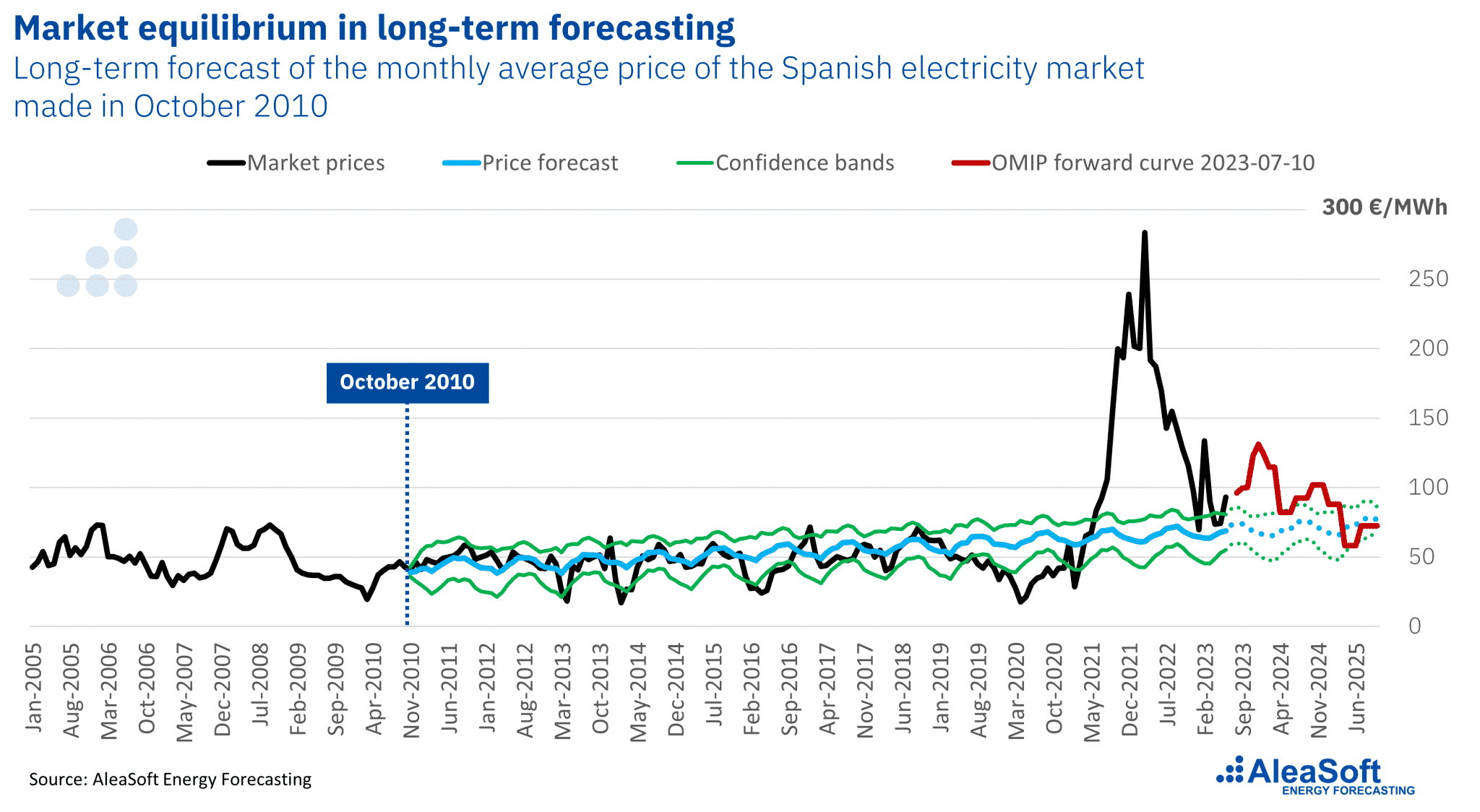

Antonio Delgado Rigal explained how the Alea forecasting methodology models market prices as a stochastic process with variability and an expected value that is a market equilibrium price. In the forecast made in 2010, it can be seen how prices fluctuate, but always around the equilibrium price that fixes the long‑term price forecast. According to Antonio Delgado Rigal, in the future there will be years with high prices and years with low prices, but in the long term, renewable energy projects will be profitable.

Regarding long‑term forecasts, Antonio Delgado Rigal commented that, currently, the AleaSoft Energy Forecasting’s price curves forecasts provide a higher IRR than that of other providers and allow raising more debt in the project. This situation has occurred because the forecasts of AleaSoft Energy Forecasting remained coherent for the long term during the period of the energy price crisis of 2022, so that now that electricity markets prices have fallen, the forecasts of AleaSoft Energy Forecasting have remained stable, while the rest of the providers have been obliged to lower their price expectations.

Jorge De Miguel explained that, for the investment fund he represents, it is very important to understand how the forecasts are built and that they represent a clear vision of the energy sector’s future and, therefore, they are very stable in the long term. In Ben Oldman fund, as a debt provider, when analysing a project, they focus on the probabilistic zones where the probability of being wrong is very low. This contrasts with the position of the project’s sponsor, who must seek the situations that provide the highest IRR to investors.

According to Jorge De Miguel, the high prices during 2022 generated the feeling that merchant projects could be financed with very high leverage, but that, with the drop in prices, the leverage levels for these projects have decreased.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

In the next edition, number 36, of the monthly webinars organised by AleaSoft Energy Forecasting and AleaGreen, the state of the PPA market for large electro‑intensive consumers will be analysed and the Director‑General of AEGE (Association of Companies with Large Energy Consumption), Pedro González, will be present in the Spanish version of the webinar.

Registration is also open for the 37th edition, which will take place on October 19 and will have the participation of Deloitte to analyse in depth the state of the renewable energy projects financing and the importance of forecasting in audits and portfolio valuation.

Source: AleaSoft Energy Forecasting.