AleaSoft Energy Forecasting, December 19, 2022. In the week of December 12, prices of most European electricity markets fell compared to the previous week, although the weekly average exceeded €300/MWh in almost all of them. However, in the MIBEL market, prices including the adjustment for the gas cap remained below €150/MWh. At the end of the week, TTF prices registered the lowest value since November 17 and CO2 prices fell, while the electricity demand increased in all markets.

Solar photovoltaic and thermoelectric energy production and wind energy production

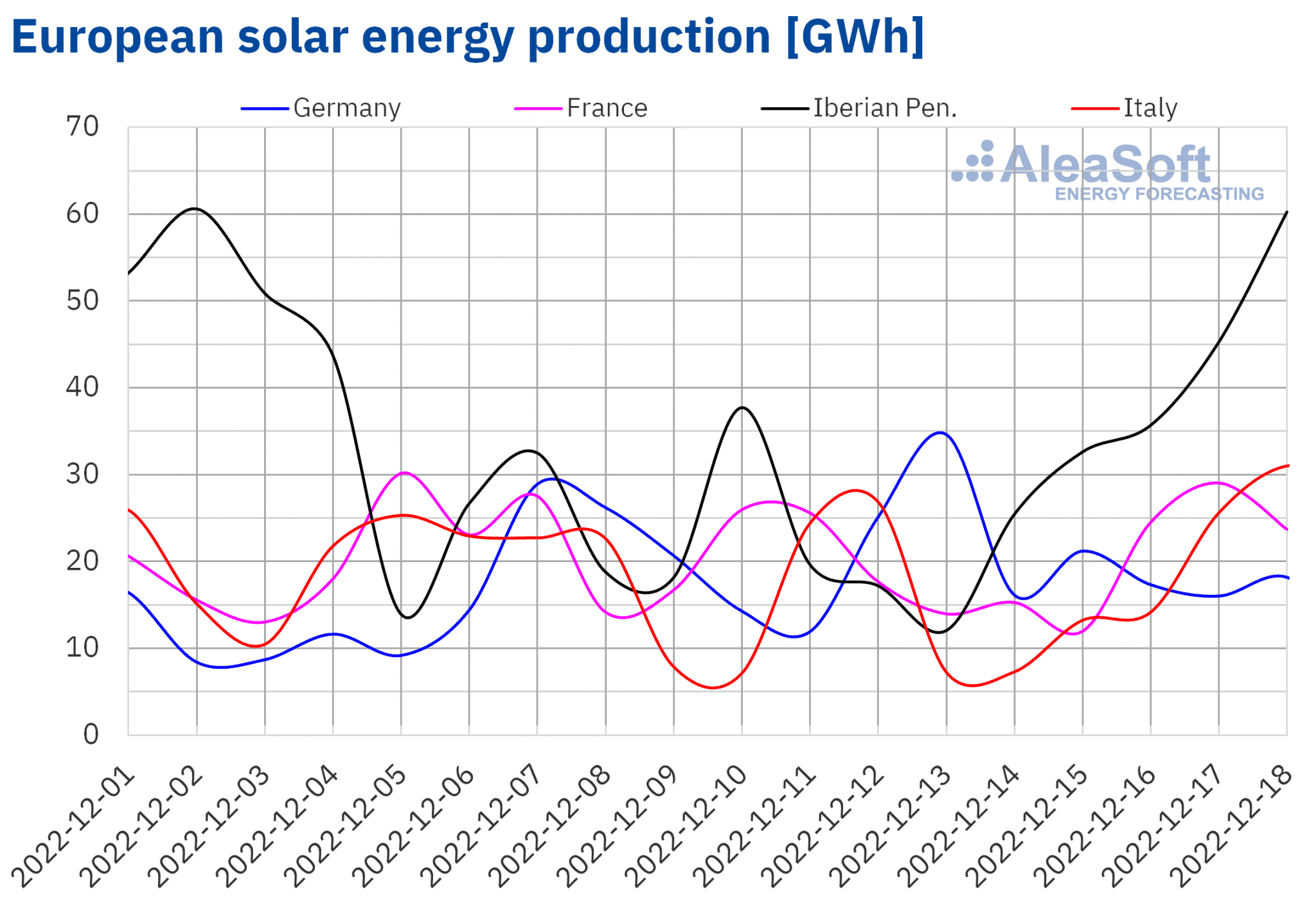

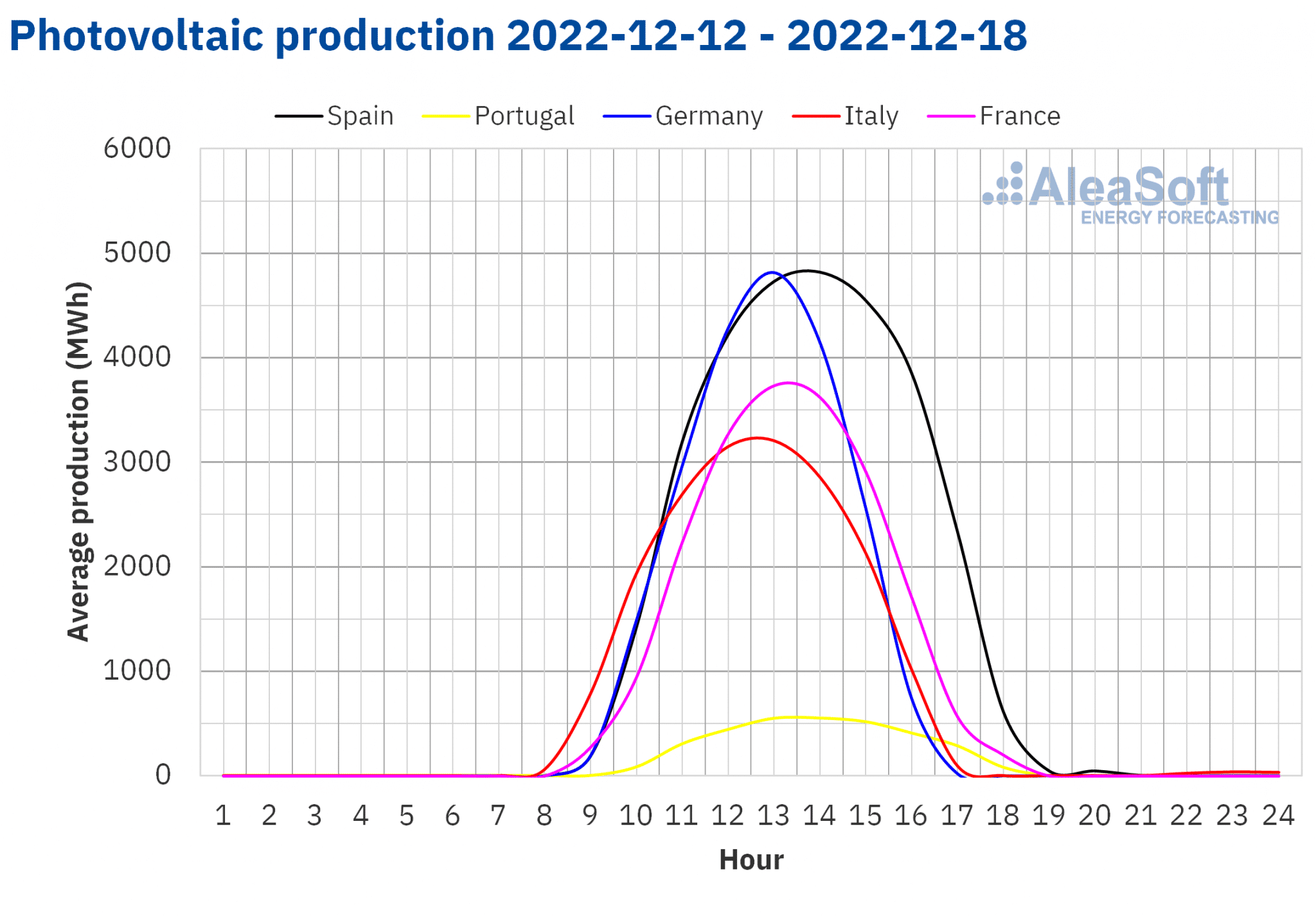

During the week of December 12 to 18, the solar energy production increased compared to the previous week in Germany, Portugal and Spain. The largest increase was registered in Spain, of 37%. On the other hand, in France and Italy the production with this technology reduced by 17% and 5.7% respectively.

The AleaSoft Energy Forecasting’s solar energy production forecasting indicates that increases in production with this technology are expected for the week of December 19 in Spain and Italy, while there will be a decrease in Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

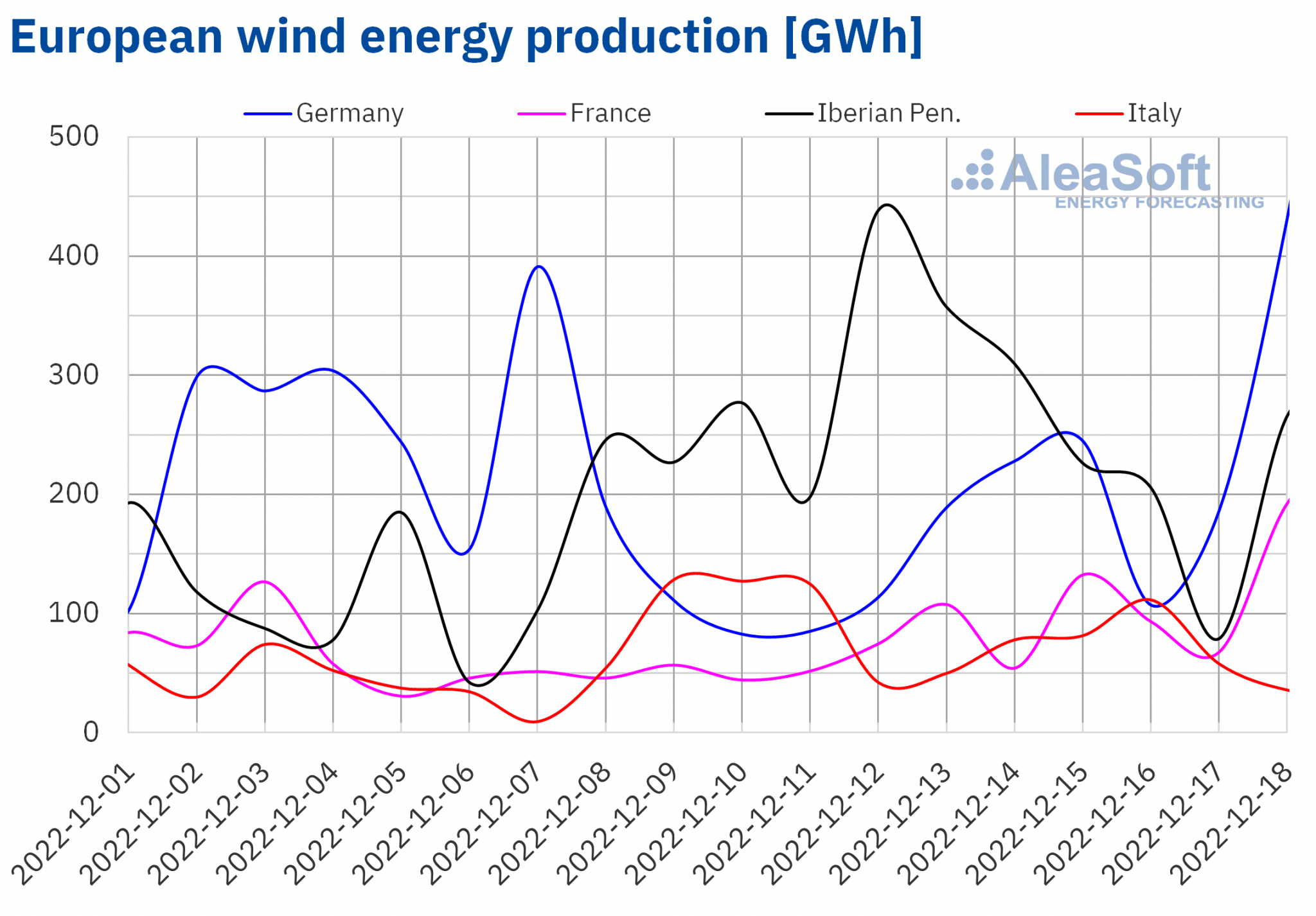

Regarding wind energy production, during the third week of December an increase was registered compared to the previous week in most markets analysed at AleaSoft Energy Forecasting, the largest increase being that of France, of 121%. The exception was Italy, where the production with this technology reduced by 12%.

According to the AleaSoft Energy Forecasting’s wind energy production forecasting, during the week of December 19 an increase in production with this technology is expected in Spain, France and Germany, mainly in the latter, while it will decrease in Portugal and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

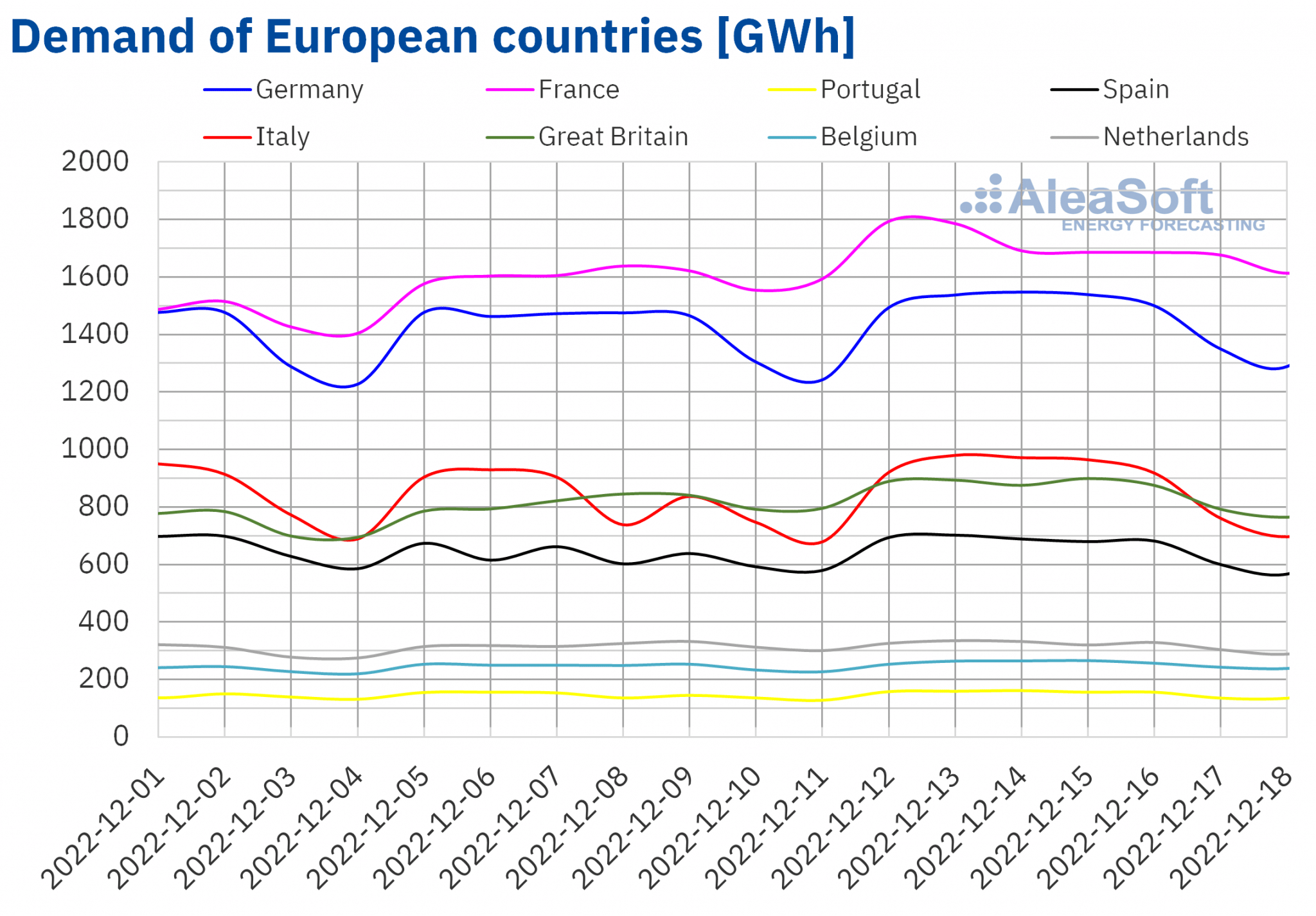

In the week of December 12, the electricity demand increased in all European markets analysed at AleaSoft Energy Forecasting compared to the week that preceded it. The largest increase was registered in the Italian market, which was 8.3%, followed by the 6.6% rise of the French market. In the markets of Spain, Great Britain and Portugal, the demand grew between 5.7% of the Spanish market and 5.0% of the Portuguese market. In addition, in the markets of Belgium and Germany the increase was 4.1% and 3.6% respectively. In the case of the market of the Netherlands, it was the one with the lowest increase in demand, of 0.7%.

In the markets of Italy, Spain and Portugal, the increase in demand was favoured by the recovery of labour after the holidays of the week of December 5. On the other hand, in the rest of the markets, the decrease in average temperatures compared to those registered during the previous week favoured the increase in demand for this period.

For the week of December 19, according to the demand forecasting made by AleaSoft Energy Forecasting, the demand is expected to decrease in the vast majority of the analysed European markets due to the fact that average temperatures will be higher than those registered in the previous week and to the drop in labour due to the start of Christmas. The exception will be the Portuguese market, where the demand is expected to increase slightly.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

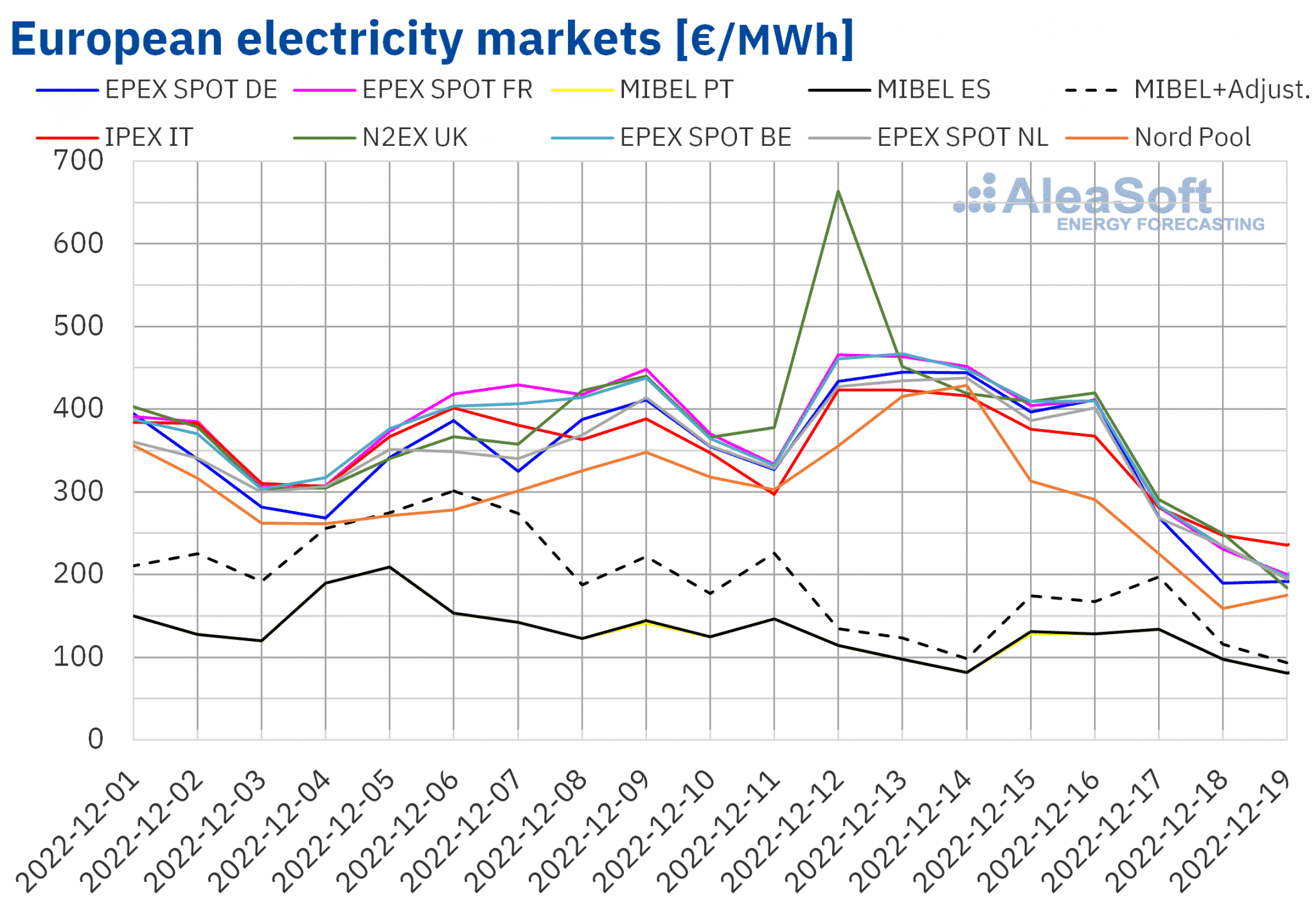

European electricity markets

In the week of December 12, prices of most European electricity markets analysed at AleaSoft Energy Forecasting fell compared to the previous week, but there were also increases in some markets. The largest price rise, of 8.8%, was that of the N2EX market of the United Kingdom, while the smallest increase was that of the Nord Pool market of the Nordic countries, of 2.0%. Regarding price decreases, the falls were between 0.4% of the IPEX market of Italy and 25% of the MIBEL market of Spain and Portugal.

In the third week of December, the highest average price, of €414.88/MWh, was that of the British market. On the other hand, the lowest weekly averages were those of the Portuguese and Spanish markets, of €111.70/MWh and €112.15/MWh, respectively. In the rest of the analysed markets, prices were between €312.40/MWh of the Nordic market and €387.56/MWh of the EPEX SPOT market of Belgium.

When taking into account the adjustment that some consumers have to pay due to the limitation of the gas price in the Iberian market, the average reached in the Spanish market, of €144.48/MWh, and in the Portuguese market, of 144.03 €/MWh, continued to be lower than 50% of the average value in the rest of the markets.

Regarding hourly prices, the highest price was reached in the British market. In this market, on December 12, from 18:00 to 19:00, a price of £1585.82/MWh was reached. This price is the highest in the N2EX market since November 15, 2021. On the other hand, on December 13 and 14, twelve hours were registered with prices below €5/MWh in the MIBEL market. The lowest price, of €1.80/MWh, was reached on December 14 from 3:00 to 4:00. This price was the lowest in this market since September 25.

As for daily prices, the highest was the one registered on December 12 in the British market, of £570.60/MWh. This price was the second highest in the history of this market, after the one registered on August 26 of this year. On the other hand, the lowest daily price of the third week of December, of €81.38/MWh, was registered on December 14 in the Iberian market. But on Monday, December 19, the price of this market was even lower, of €81.07/MWh.

During the week of December 12, the decrease in gas and CO2 emission rights prices compared to the previous week had a downward influence on European electricity markets prices. The increase in wind energy production in almost all markets also contributed to the price declines registered in most of them. Although the general increase in demand led to increases in some markets. In the case of the MIBEL market, the increase in solar energy production in the Iberian Peninsula also influenced prices downwards.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the fourth week of December prices might decrease in European electricity markets, influenced by the drop in demand in almost all markets. The increase in wind energy production in markets such as Germany, France and Spain and the increase in solar energy production in Spain and Italy might also contribute to this behaviour.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

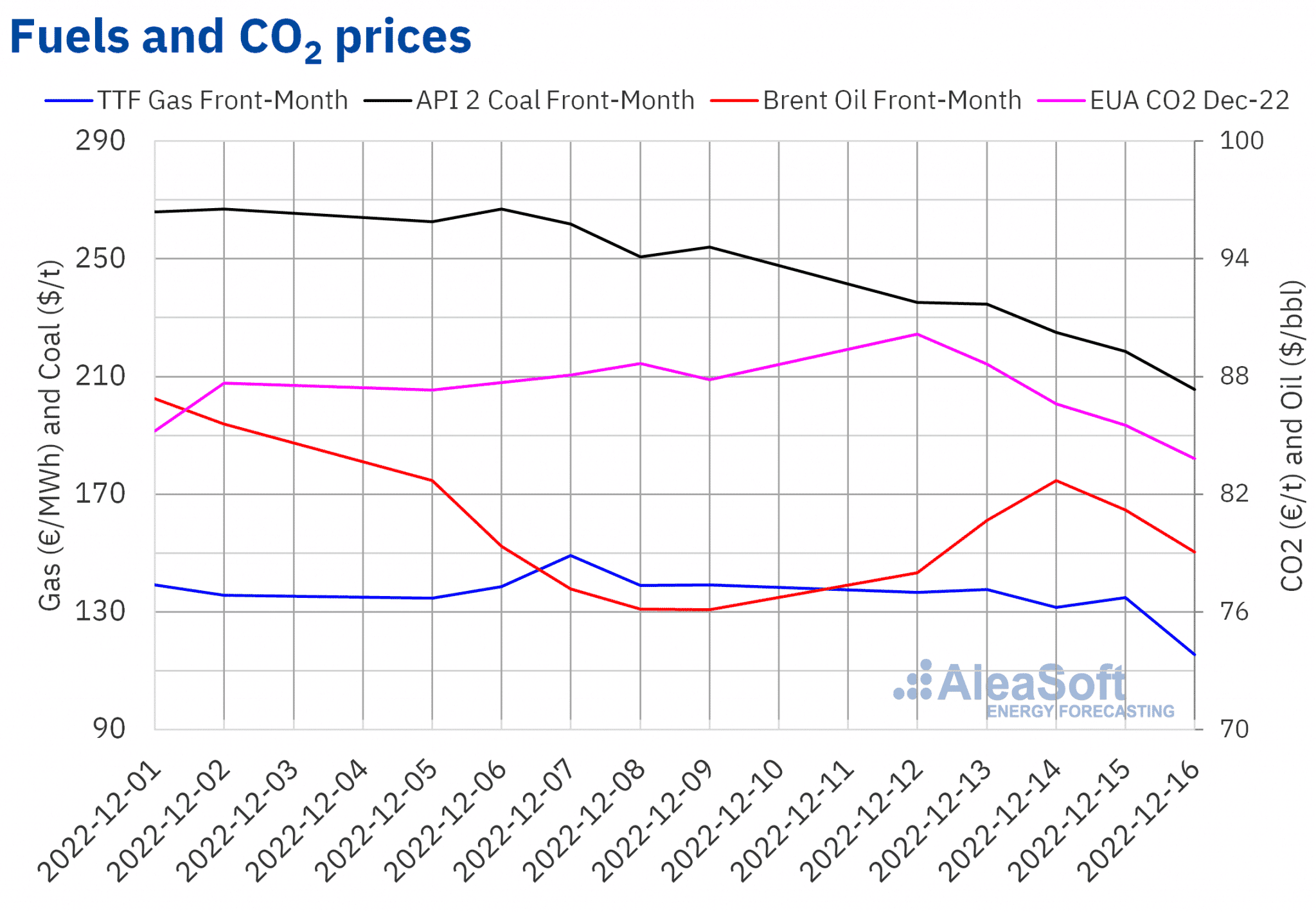

Brent, fuels and CO2

Settlement prices of Brent oil futures for the Front‑Month in the ICE market began the third week of December with an upward trend. This lasted until Wednesday, December 14, when the maximum settlement price of the week, of $82.70/bbl, was reached. This price was 7.2% higher than that of the previous Wednesday. But, subsequently, prices began to decline. As a result, the settlement price of Friday, December 16, was $79.04/bbl. This price was still 3.9% higher than that of the previous Friday.

Concern about the effects on the demand of a possible global economic recession persists. However, the expectations of a recovery in demand associated with the relaxation of the COVID‑19 control measures in China and the intention of the United States to replenish its strategic oil reserves might exert an upward influence on prices.

As for TTF gas futures in the ICE market for the Front‑Month, during almost the entire third week of December, settlement prices were registered above €130/MWh. The weekly maximum settlement price, of €137.53/MWh, was reached on Tuesday, December 13. But on Friday, December 16, there was a 14% decrease compared to Thursday and a settlement price of €115.45/MWh was reached. This price was 17% lower than that of the previous Friday and the lowest since November 17.

This Monday, December 19, the European energy ministers should agree on a cap on the gas price, as well as details of the application conditions. The reached decisions might condition the evolution of TTF gas futures prices in the coming days.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2022, on Monday, December 12, the maximum settlement price of the week, of €90.17/t, was reached. This price was 3.3% higher than that of the previous Monday and the highest since August 26. But the rest of the week prices fell. As a result, the settlement price of Friday, December 16, was €83.82/t, 4.6% lower than that of the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe, the valuation of renewable energy projects and PPA

On Thursday, December 15, the last webinar of 2022 on European energy markets of the series of monthly webinars of AleaSoft Energy Forecasting and AleaGreen was held. In the webinar, the usual analysis of the evolution and prospects of European electricity markets and the vision of the future in the year 2050 was carried out. In addition, the tools offered by AleaSoft Energy Forecasting and AleaGreen for the risk and opportunity management, as well as for the renewable energy assets valuation for PPA and audits, were analysed, among which are the simulations of five‑year hourly price curves, the hourly forecasting of long‑term electricity markets prices and the studies aimed at defining strategies for hybrid systems of renewable energy and energy storage. At the analysis table of the Spanish version of the webinar, the invited speakers from Inti Ura and Meatze analysed solutions to avoid the price cannibalisation and renewable energy curtailments in poorly interconnected systems, showing examples of practical cases in LATAM. The recording of the webinar can be requested on the AleaSoft Energy Forecasting website.

The next webinar in this webinar series, and the first in 2023, will be on January 19. On this occasion, speakers form PwC will once again analyse the evolution of European energy markets and the prospects from 2023, in addition to the vision of the PPA market for the consumer in the current context.