AleaSoft, December 18, 2020. Account audits require documentation that accredits and justifies the investment decisions made. In this regard, the 30-year energy market hourly price forecasting is useful beyond the moment of the investment decision and the signing of the PPA, it is the support for the decision made.

The need for energy market prices forecasting is normally associated with making a decision, be it deciding an investment, negotiating the price of a PPA or closing a position in the futures markets. The usefulness of having a long-term price forecasting is evident when making a decision that will affect the profitability of an investment in the future: showing a clear vision of how the market will evolve and what will be the return or the consequences of making one or the other decision.

But, contrary to what may be thought, a price forecast does not lose its usefulness once those prices that were predicted can already be compared with the real prices that have been registered in the markets. That forecast that was used at that time as a support and justification for the decision made is what will prove to an audit whether that decision was reasonable.

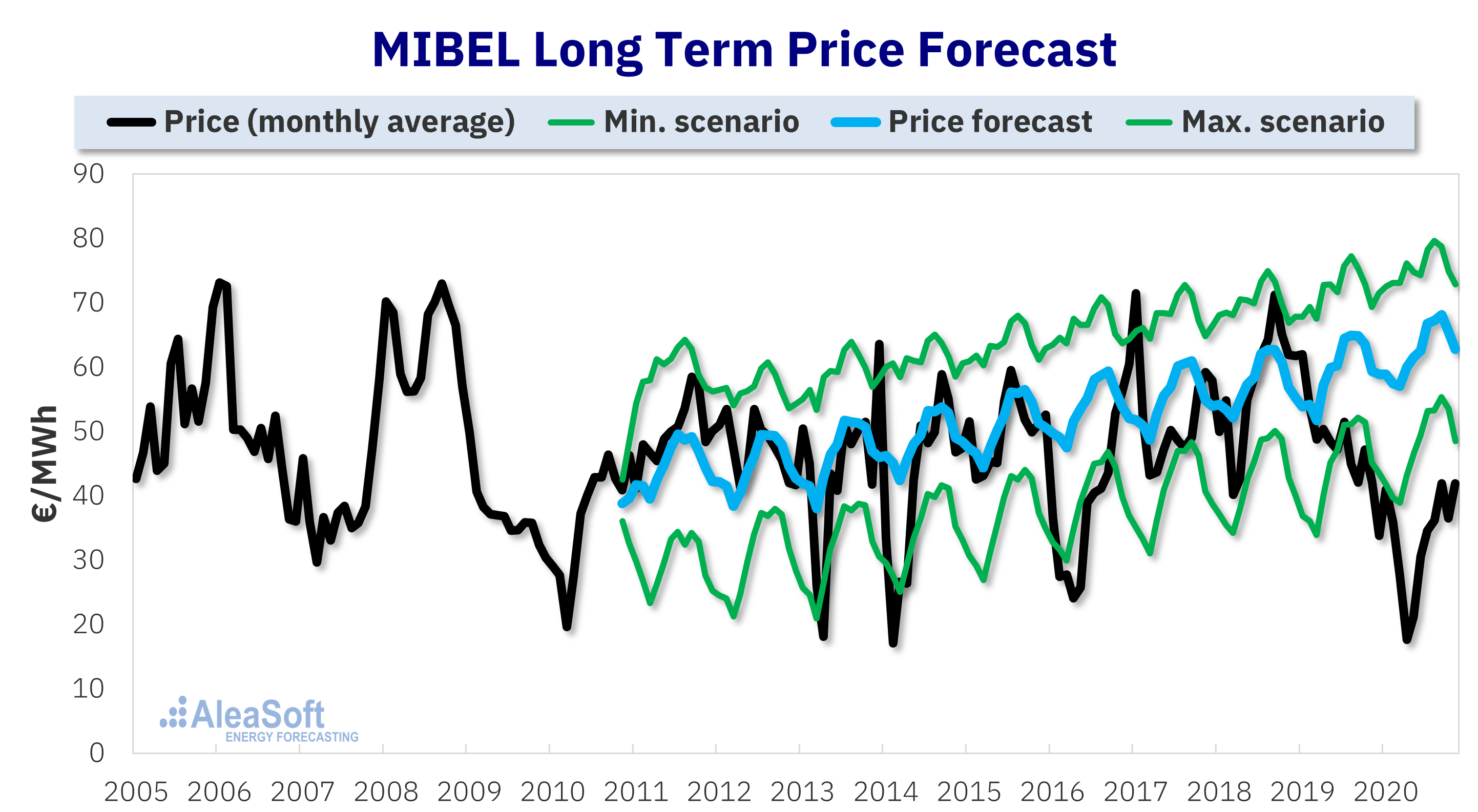

Long-term price forecast for the Iberian electricity market carried out in November 2010 by AleaSoft.

Long-term price forecast for the Iberian electricity market carried out in November 2010 by AleaSoft.

What Auditing Experts Recommend

According to audit experts, the ideal situation to successfully undertake an audit of accounts is to have long-term price forecasts for the last five years at least, on a quarterly basis, that is, a forecast per quarter. Regarding the characteristics of the forecasts, according to experts it is desirable that the price forecasts have hourly granularity.

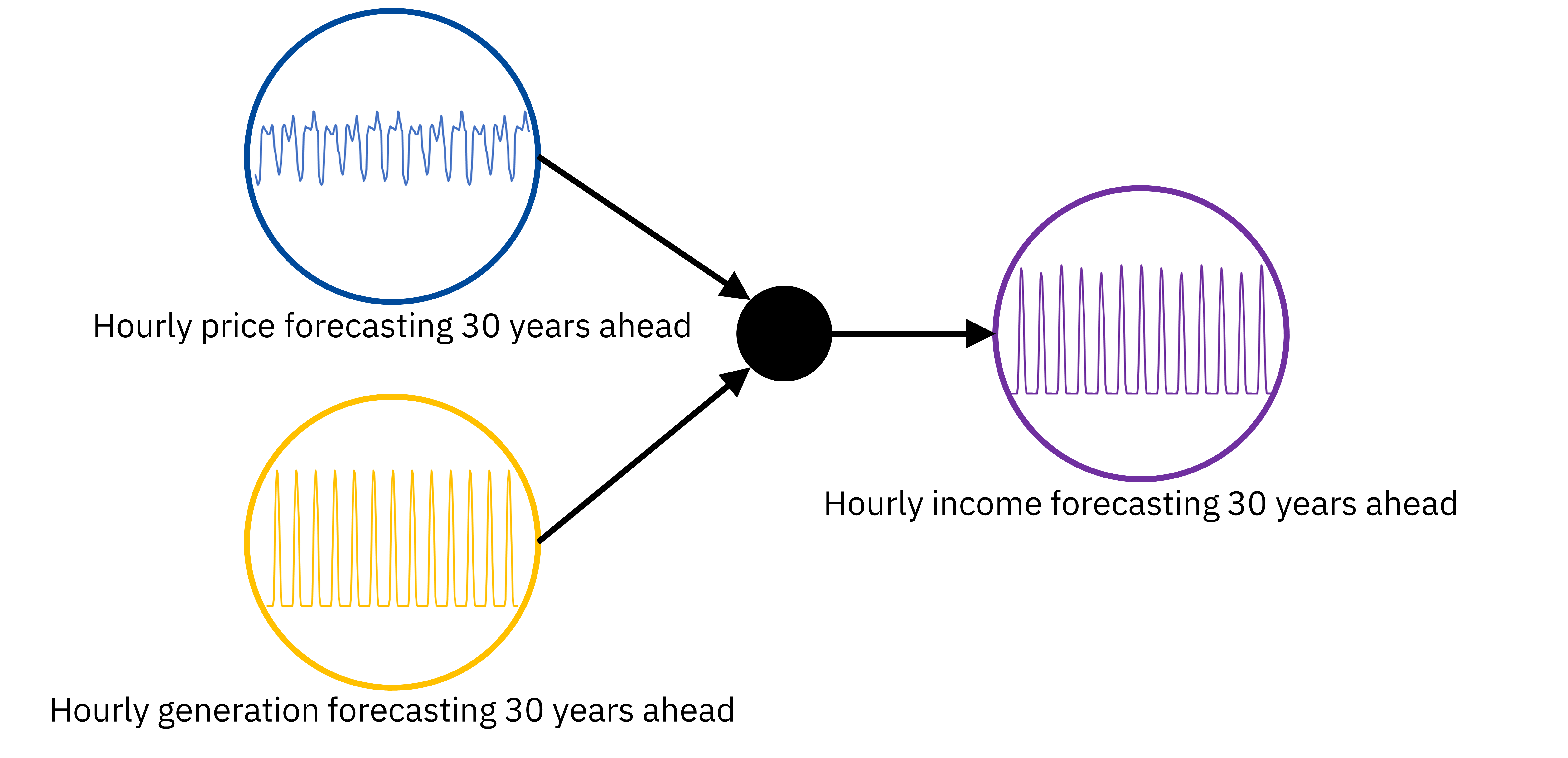

The long-term hourly price forecasting allows estimating the income from the sale of energy based on the technical characteristics of the generation plant, technical specifications of the photovoltaic panels or wind energy turbines and their geographical location.

Plant revenue forecasting from market price forecasting and plant production profile.

Plant revenue forecasting from market price forecasting and plant production profile.

It is also desirable that the forecasting had confidence bands. Since the bands are a metric of the probability associated with the possible variation in prices in the future, having them means being able to numerically measure the risk associated with making a decision, be it an investment, the price of a PPA or the price of a position in the futures markets.

Long-term energy market price forecasting

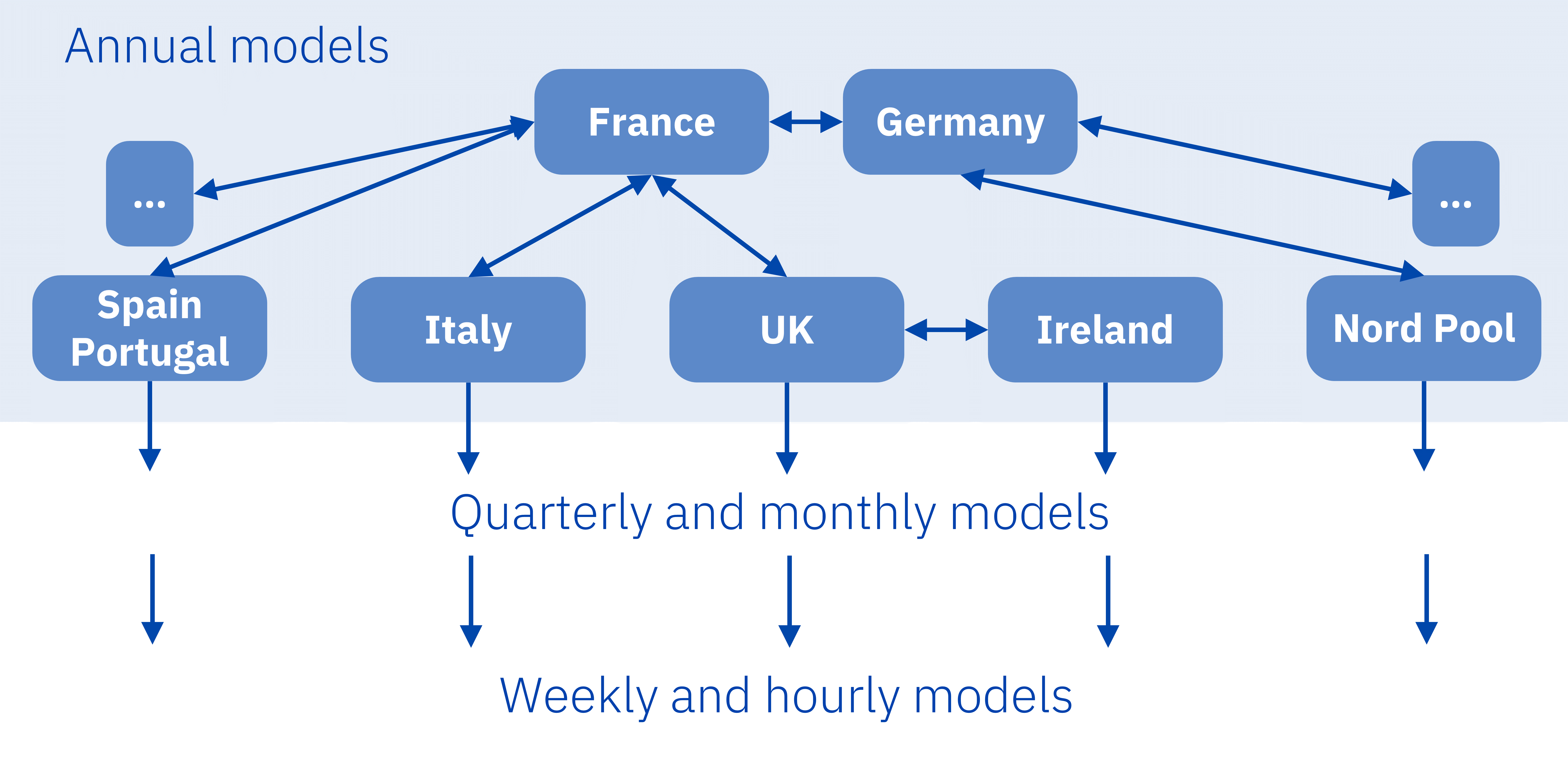

The AleaSoft‘s price forecasting models are hybrid models that combine classical statistical techniques such as timeseries analysis, regressions and econometric models, with Artificial Intelligence techniques such as neural networks and Machine Learning algorithms. They are statistical models that, due to their characteristics and scientific basis, allow obtaining hourly breakdowns of long-term prices, up to 30 years ahead or more, and confidence bands with probabilistic metrics. Furthermore, this methodology makes it possible to model all interconnected energy markets in Europe in a way that provides coherent forecasts over space and time. Some of these characteristics are not possible with forecasting techniques most used in the energy sector, based on fundamental type or unit dispatch models.

AleaSoft's integrated European electricity market price forecasting model.

AleaSoft's integrated European electricity market price forecasting model.

The future and evolution of energy markets in Europe

At AleaSoft, energy price forecasting for all horizons are available, also in the long term, as well as a wide variety of market reports for the energy sector.

AleaSoft is organizing a webinar for next January 14 that will feature the participation of speakers from the consulting firm PwC Spain, to analyse the status and vision of the PPA contract market for large consumers, its impacts and requirements, and the need for future electricity market price estimates.

Source: AleaSoft Energy Forecasting.