AleaSoft, October 26, 2020. On October 25, some European electricity markets registered negative or very low hourly prices. The combination of high wind energy production on Sunday, when the demand is lower, was the main cause of these prices. In addition, the average prices of the fourth week of October were lower than those of the previous week in all markets. The gas continued to recover and exceeded €15/MWh, prices that were not seen in the spot market since the beginning of December 2019.

Photovoltaic and solar thermal energy production and wind energy production

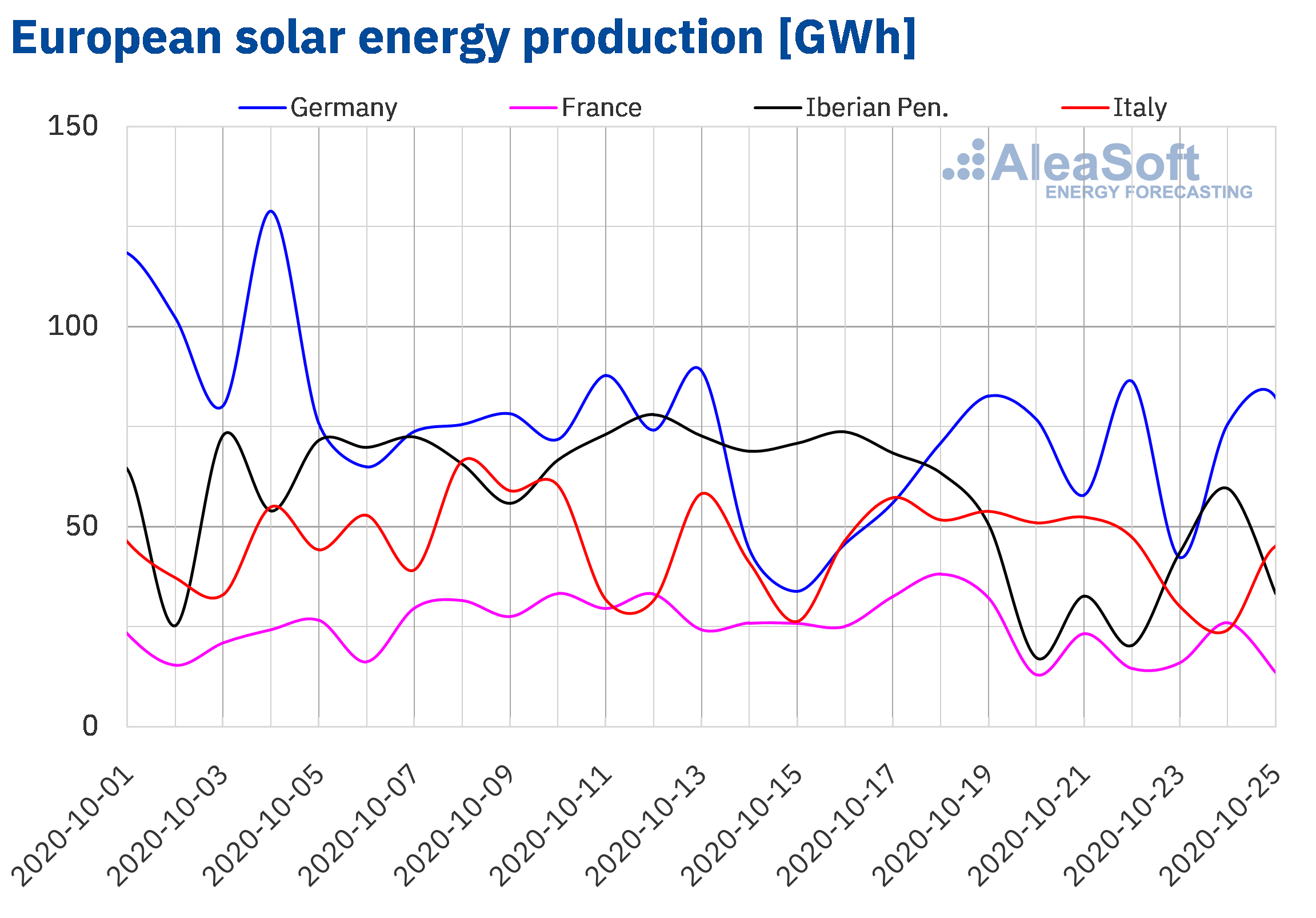

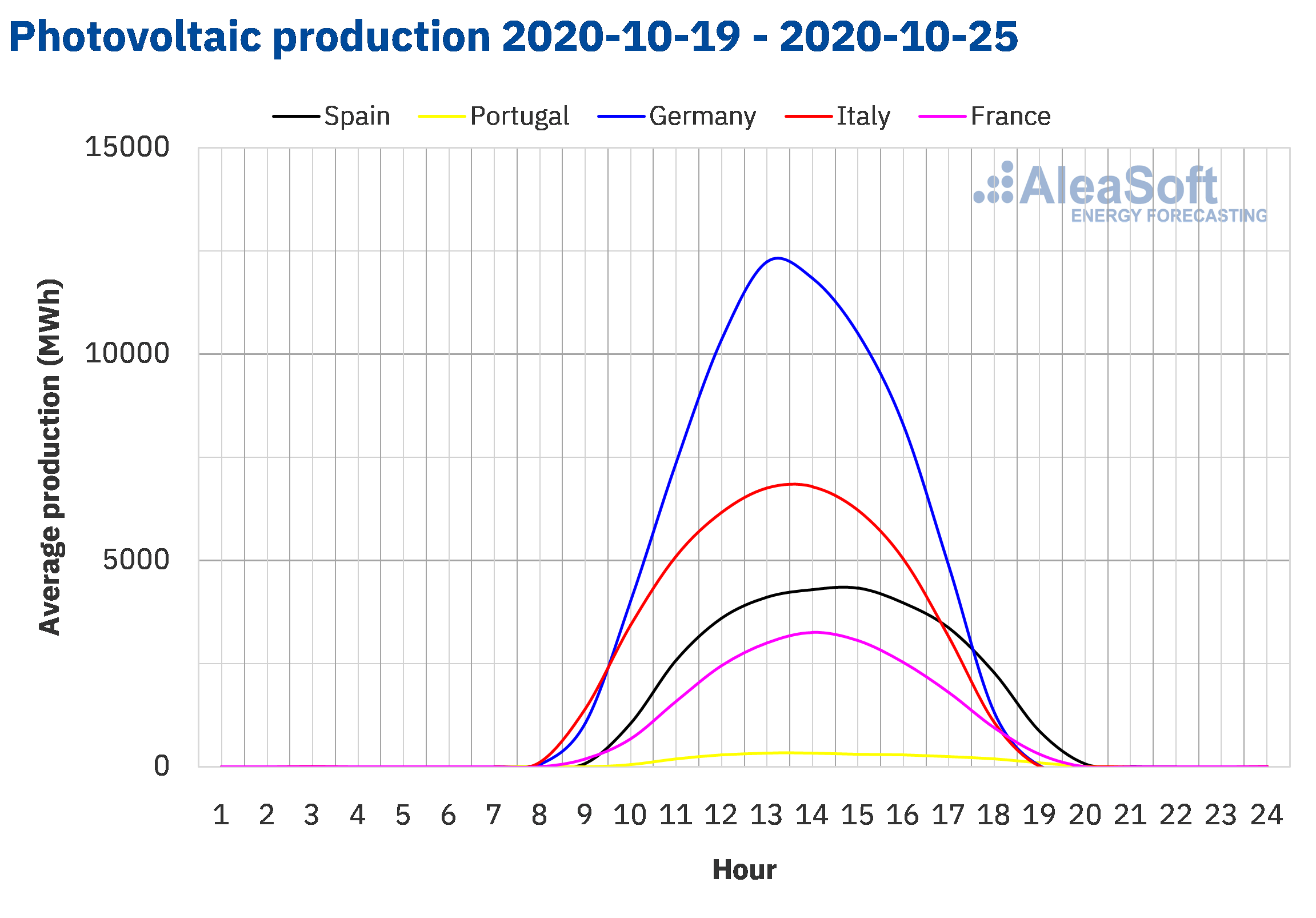

During the fourth week of October, the solar energy production in the German market increased by 22% compared to the previous week. On the contrary, in the rest of the analysed markets, the production with this technology decreased. The markets of Spain and Portugal registered the largest decreases, 48% and 50% respectively. In the French market, the solar energy production was 32% lower, while in the Italian market there was the lowest variation, with a production 2.7% lower than the previous week.

In the year‑on‑year analysis, during the first 25 days of October, the solar energy production increased in most of the markets analysed at AleaSoft. In the Iberian Peninsula, the production during this period was 46% higher than that registered during the same days of 2019. In the French market it increased by 7.7% while in the Italian market it grew by 1.3%. The exception was the German market in which there was a decrease in production close to 4.3%.

For the last week of October, the AleaSoft‘s solar energy production forecasting indicates that it will decrease in the German market. On the contrary, an increase in production is expected in Spain and it is expected that in the Italian market it will vary little compared to the week that ended on Sunday, October 25.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

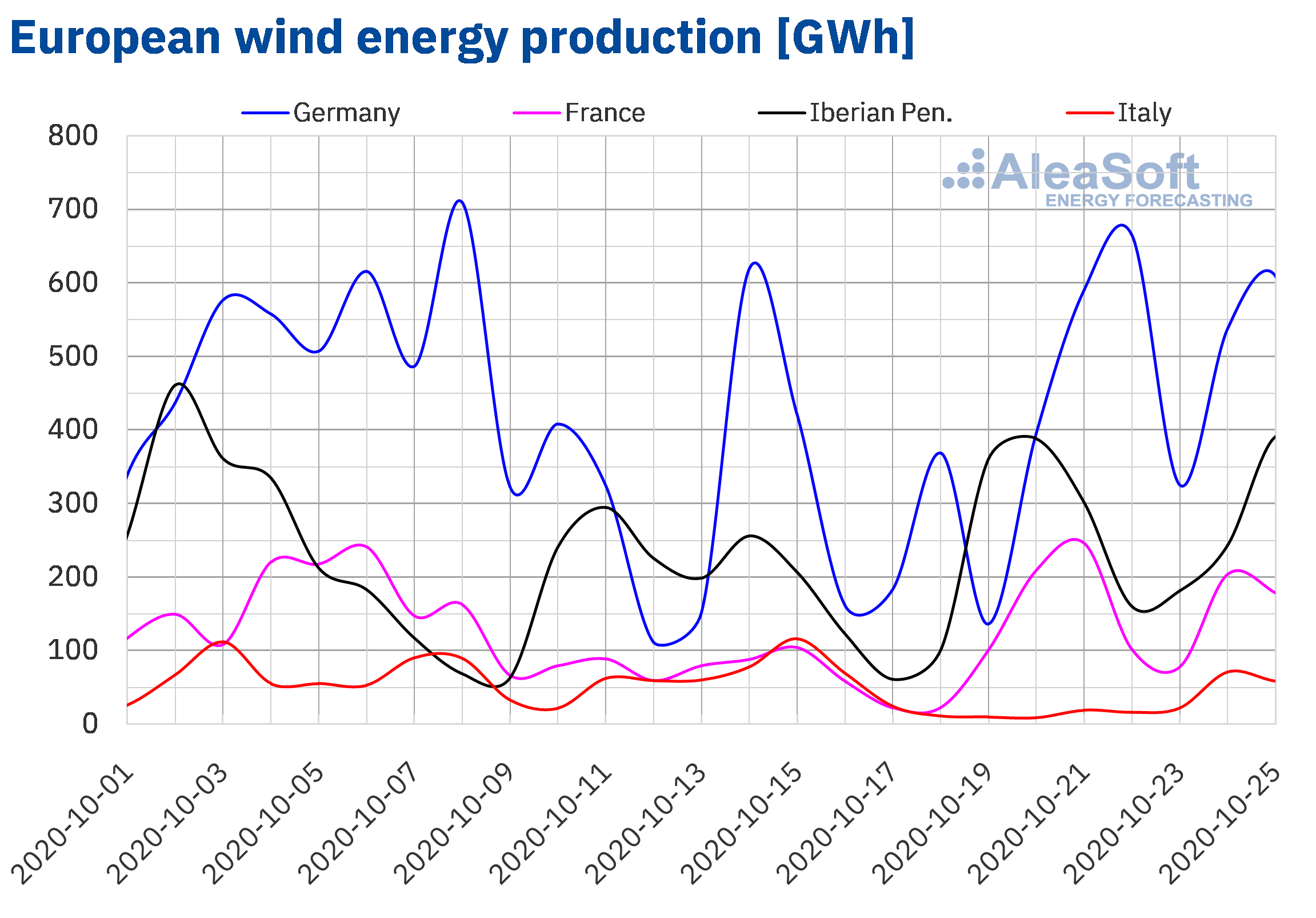

During the week of October 19, the wind energy production increased in most of the European markets analysed at AleaSoft. The Italian market was the only one where the production with this technology decreased by 51% compared to the previous week. Important increases were registered in the rest of the markets, with the French market standing out with an increase of 157%. In this market it also stands out that on Wednesday, October 21, a production of 246 GWh was registered, the highest since the end of March 2020. In the Spanish market, the production grew by 78%, while the increase was 51% in the Portuguese market and 62% in the German.

During the period between October 1 and 25, the wind energy production increased in all the markets analysed at AleaSoft compared to the same days of 2019. As in the case of the solar energy production, the production in the Iberian Peninsula, which increased by 44%, stands out. In the rest of the markets, the increases in production during the first 25 days of October were between 13% of the German market and 17% of the Italian market.

For the last week of October, the AleaSoft‘s wind energy production forecasting indicates an increase in production with this technology in Germany and Italy. For the rest of the markets, a reduction in production is expected compared to the week that ended on Sunday, October 25.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

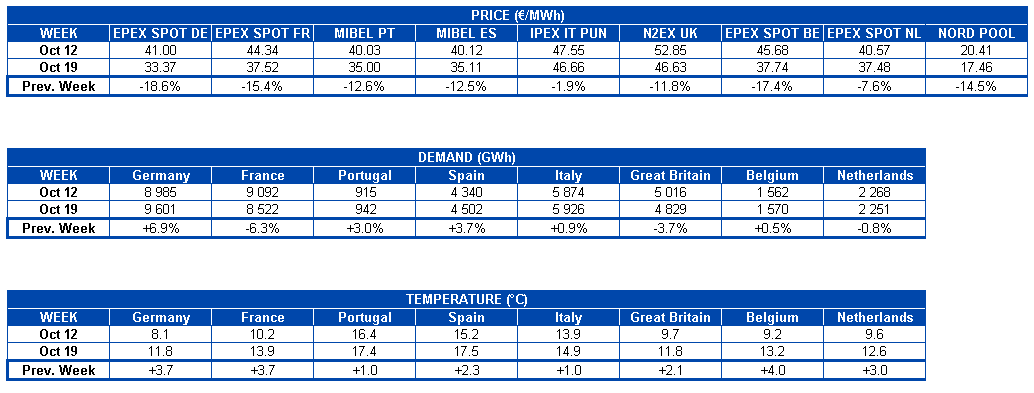

As indicated at AleaSoft in the analysis of the beginning of the week of October 19, the electricity demand for that week increased in the markets of Germany, Italy, Spain and Portugal compared to the previous week. In Germany and Spain the increases were 6.9% and 3.7% respectively. One of the influencing factors in the increase registered in the Spanish market was the effect of the October 12 holiday, National Holiday of Spain. When correcting this effect, the rise was 1.5%. In Italy and Portugal the increases were 0.9% and 3.0% in each case. On the other hand, the demand fell by 6.3% in the French market and in the British by 3.7%.

At the French market observatory at AleaSoft, the behaviour of the demand can be analysed daily. It should be noted the marked decrease as of Wednesday 21 compared to the first two days of the fourth week of October.

At AleaSoft, the demand is expected to recover during the week of October 26 compared to the previous one in France, Portugal and Great Britain, while in the rest of the markets the values will be similar to those of the fourth week of October. These results will be subject to the changes in the restrictions to stop the spread of COVID‑19, among which is the activation of the State of Alarm from Sunday, October 25, in Spanish territory.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA

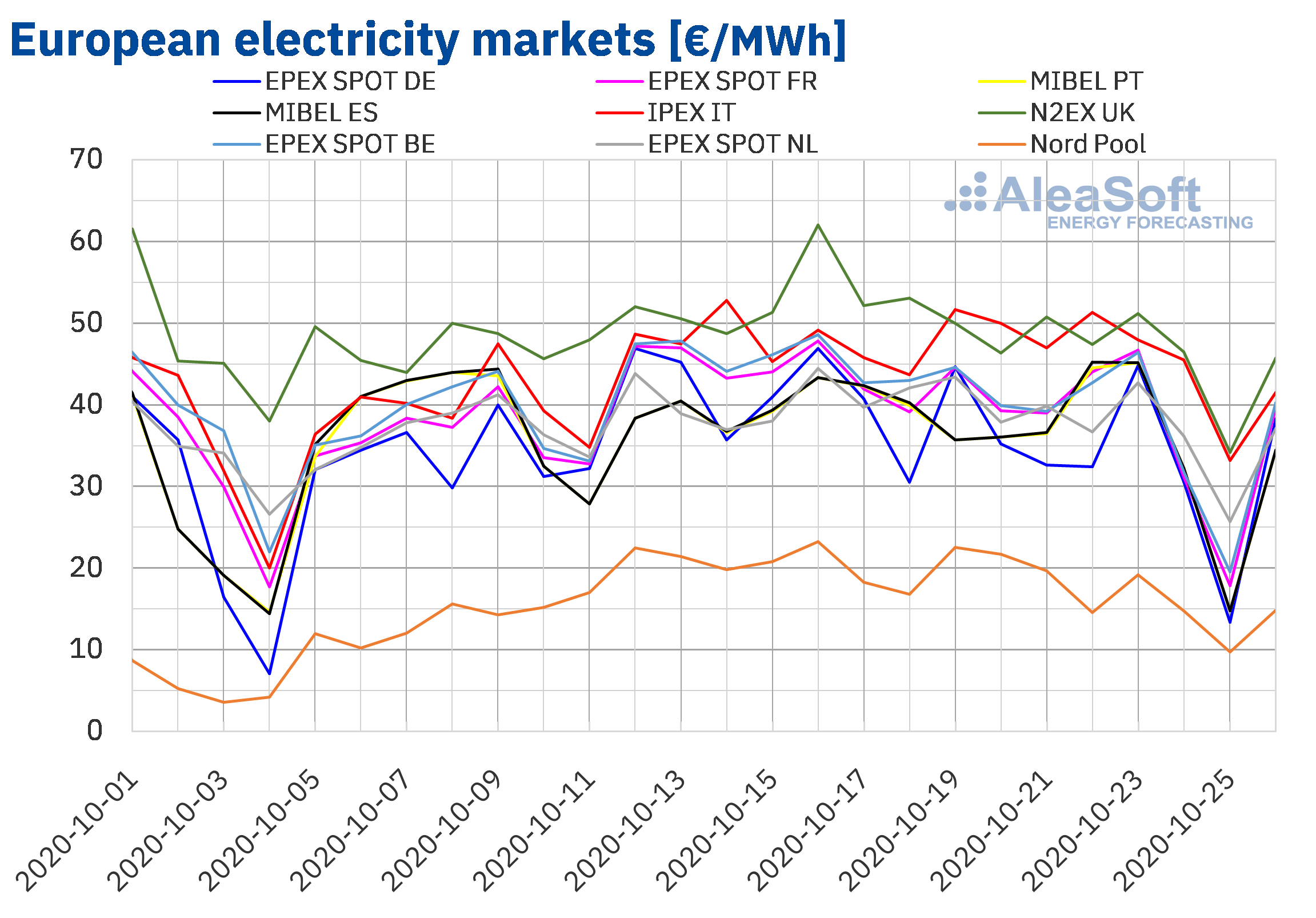

European electricity markets

The week of October 19, the prices of all the analysed European electricity markets fell compared to those of the previous week. The market with the largest price drop, of 19%, was the EPEX SPOT market of Germany. In contrast, the market with the smallest decline, of 1.9%, was the IPEX market of Italy. In the rest of the markets, the falls were between 7.6% of the EPEX SPOT market of the Netherlands and 17% of the EPEX SPOT market of Belgium.

During that week, weekly average prices below €40/MWh were reached in almost all the analysed European electricity markets. The exceptions were the Italian market and the N2EX market of Great Britain, with prices of €46.66/MWh and €46.63/MWh respectively. In contrast, the Nord Pool market of the Nordic countries had the lowest average price, of €17.46/MWh. In the rest of the markets, the prices were between €33.37/MWh of the German market and €37.74/MWh of the Belgian market.

On the other hand, in the fourth week of October, the N2EX market and the IPEX market registered the highest daily prices. Instead, the lowest prices were those of the Nord Pool market. For the rest of the markets, the prices started the week loosely coupled, but in the last days of the week the coupling increased as the prices fell.

From Monday to Friday of the fourth week of October, the daily prices exceeded €50/MWh on several occasions in the markets of Great Britain and Italy. The highest daily price of the week, of €51.67/MWh, was reached on Monday, October 19, in the Italian market. On the other hand, the lowest prices were reached on Sunday, October 25. That day, only the prices of the markets of the Netherlands, Italy and Great Britain exceeded €20/MWh. The lowest daily price, of €9.73/MWh, was that of the Nord Pool market, followed by that of the German market, of €13.83/MWh.

Regarding the hourly prices, the highest price of the week of October 19, of €86.20/MWh, was reached at 20:00 of Thursday, October 22, in the British market. On the other hand, for the early hours of Sunday, October 25, negative hourly prices were reached in the markets of Germany, Belgium, France, Great Britain and the Netherlands. The lowest hourly price, of ‑€8.37/MWh, was at 6:00 in the Belgian market. Also in the case of the MIBEL market of Spain and Portugal the prices were low in the early hours of Sunday. For six hours in a row the price was €1.95/MWh. This is the third lowest value of 2020 for this market. Also in the Spanish imbalances market on October 25, unusually low prices were reached, in this case negative. The upward imbalances collection price at 07:00 was ‑€110.84/MWh and in the period between 2:00 and 6:00 the prices were negative or zero.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

In the fourth week of October, the increase in wind energy production in most of Europe favoured the fall in prices in the electricity markets. This was also the cause of the negative prices of the 25th, which were also influenced by the lower demand as it was Sunday.

The AleaSoft‘s price forecasting indicates that the week of October 26, the prices will continue to decline in the markets of Germany and Italy, where the wind energy production will increase. On the other hand, in the markets of Belgium, Great Britain and the Iberian Peninsula a recovery in prices is expected.

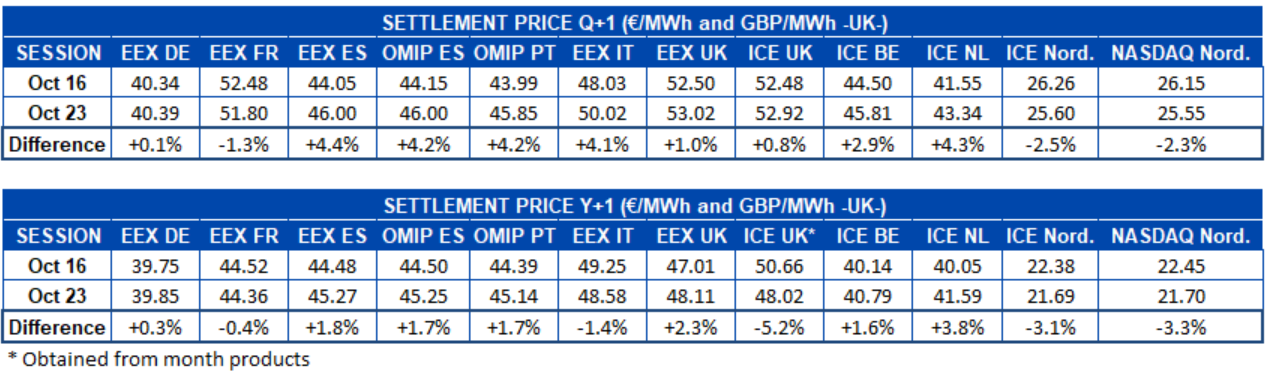

Electricity futures

The electricity futures prices for the first quarter of 2021 in the European electricity markets analysed at AleaSoft had a fundamentally upward behaviour during the fourth week of October, compared to the settlement prices of October 16. The exceptions were the EEX market of France, with a decrease of 1.3% and the ICE and NASDAQ markets of the Nordic countries, with decreases of 2.5% and 2.3% respectively. In the rest of the markets the increases were between 0.1% of the EEX market of Germany and 4.4% of the EEX market of Spain.

Regarding the futures prices for the calendar year 2021, the behaviour was more heterogeneous when comparing the sessions of October 16 and 23. The EEX markets of France and ICE and NASDAQ of the Nordic countries were joined by the EEX market of Italy in the price drops. In these cases, the decreases were between 0.4% and 3.3%. Also in the ICE market of Great Britain the prices were reduced by 5.2%, in this case it is a reference value obtained from the monthly products. In the British EEX market, where the annual product is traded, the variation was upwards, of 2.3%. In the rest of the markets, the prices increased between 0.3% and 3.8%.

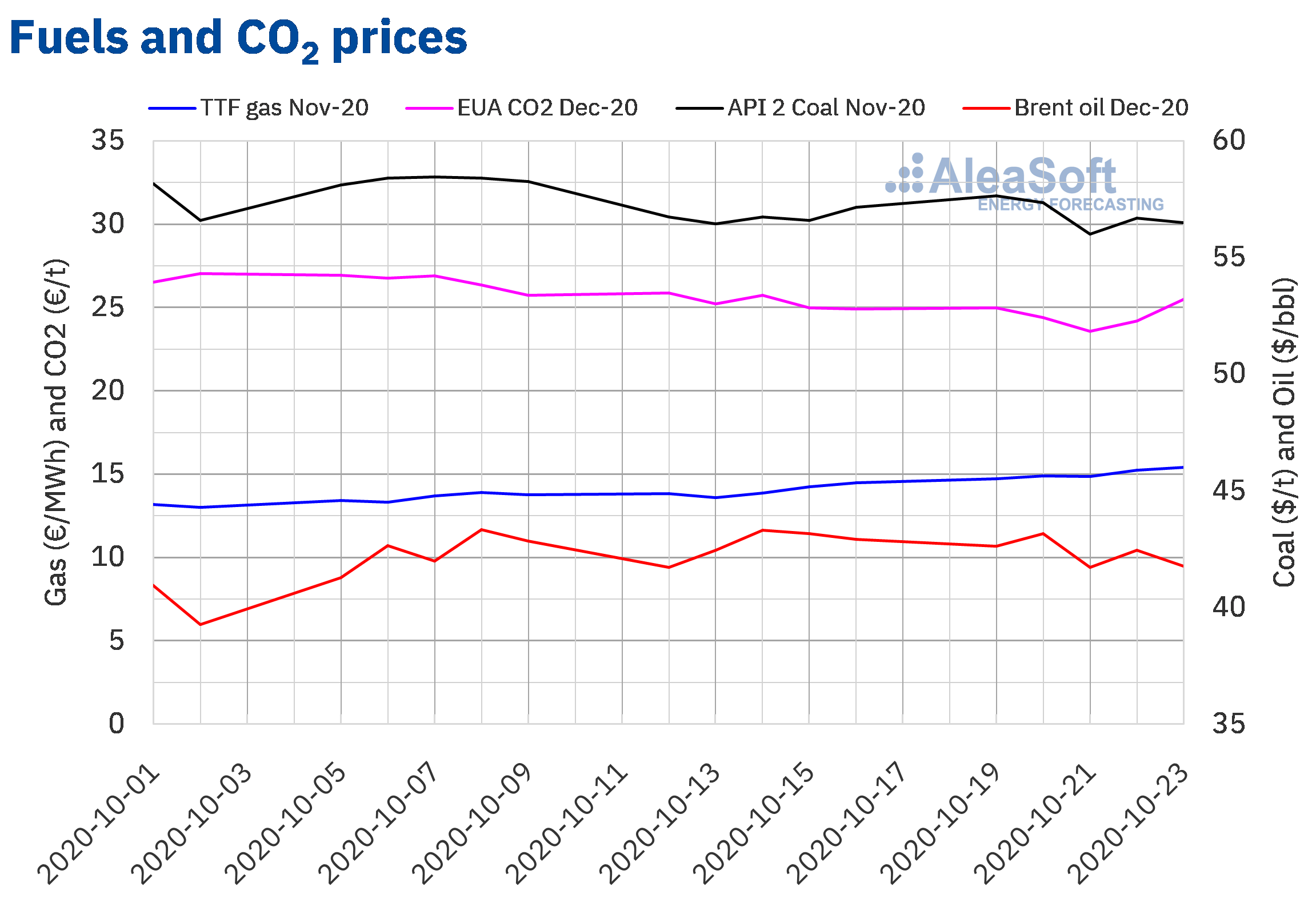

Brent, fuels and CO2

The settlement prices of the Brent oil futures for the month of December 2020 in the ICE market, the fourth week of October, ranged between $41.73/bbl of Wednesday, October 21, and $43.16/bbl of Tuesday, October 20. But, in the last three sessions of the week, the prices were lower than those of the same days of the previous week.

The concerns about the effects on the demand of the measures to control the spread of the COVID‑19 pandemic remain. These measures were increased during the fourth week of October in most European countries due to the increase in infections. Furthermore, the progressive increase in production in Libya will also exert its downward influence in the coming weeks. But, on the other hand, the tropical storm Zeta is expected to affect the production in the Gulf of Mexico in the coming days, which would help curb the downward trend.

As for the TTF gas futures prices in the ICE market for the month of November 2020, during the fourth week of October they continued to increase. On Friday, October 23, the maximum settlement price of the week, of €15.41/MWh, was reached. This price was 6.3% higher than that of the same day of the previous week and the highest since January.

Regarding the TTF gas prices in the spot market, on Wednesday and Thursday of the week of October 19 they fell slightly, but the rest of the days they increased. As a result, the index price of the weekend of October 24 and 25 was €15.24/MWh. On Monday, October 26, the growing trend continued and an index price of €15.46/MWh was reached, which is the highest since the beginning of December 2019.

On the other hand, the API 2 coal futures in the ICE market for the month of November 2020, on Monday, October 19, reached a settlement price of $57.65/t, 1.6% higher than that of the previous Monday. But on Tuesday and Wednesday, the prices fell and the settlement price of Wednesday was $56.00/t, 1.3% lower than that of the previous Wednesday. On Thursday, the prices recovered to $56.70/t, but later on Friday, October 23, they fell again by 0.4% to $56.50/t.

As for the CO2 emission rights futures in the EEX market for the reference contract of December 2020, most of the fourth week of October had prices below €25/t. The minimum settlement price of the week, of €23.56/t, was reached on Wednesday, October 21. This price was 8.5% lower than that of the previous Wednesday and the lowest since June. But on Thursday and Friday there were price increases of 2.6% and 5.4% respectively, and the settlement price of Friday, October 23, was €25.49/t.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis of the evolution of the energy markets in the second wave of the pandemic

Next Thursday, October 29, the second part of the webinar “Energy markets in the recovery from the economic crisis” organised at AleaSoft will be held. This meeting comes just when there is great uncertainty due to the consequences that the measures that the European governments are taking to stop the second wave of the COVID‑19 pandemic might have on the evolution of the economy. The webinar will analyse the effects on the energy markets in this context and the prospects in the mid and long term and it will be a continuation of the analyses carried out in the webinars that the consultancy carried out since the coronacrisis began. Other topics that will continue to be addressed are the financing of the renewable energy projects and the importance of the forecasting in the portfolio valuation and the audits. Two speakers from the consulting firm Deloitte will participate in the webinar, Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services and Carlos Milans del Bosch, Partner of Financial Advisory, as well as Oriol Saltó i Bauzà, Manager of Data Analysis and Modelling at AleaSoft.

Having coherent long‑term forecasting, based on a scientific model developed by consultants with extensive experience in the electricity sector, is essential in the renewable energy consulting. For example, during the negotiation of a PPA contract, for the portfolio valuation and audits and in the risk management and the development of hedges that allow minimising the risk. At AleaSoft, the long‑term price curves of the main European electricity markets are periodically updated, taking into account the evolution of the economy and the recovery scenarios from the economic crisis derived from the pandemic.

Another tool enabled at AleaSoft to report on the evolution of the energy markets since the coronavirus crisis began are the observatories, in which the behaviour of the last weeks can be visualised through graphs with hourly, daily and weekly data that are updated daily. The observatories include the main variables of the European electricity, fuels and CO2 emission rights markets.

Source: AleaSoft Energy Forecasting.