AleaSoft, October 22, 2020. The prices fell during the first four days of the fourth week of October in most European electricity markets, due to the increase in wind energy production. Another factor that led to these lower prices was the decrease in CO2 prices, which fell below €24/t, something that did not happen since June. The gas prices exceeded €14.50/MWh during the week. The prices are expected to rise again in the last week of the month as wind energy production will decrease.

Photovoltaic and solar thermal energy production and wind energy production

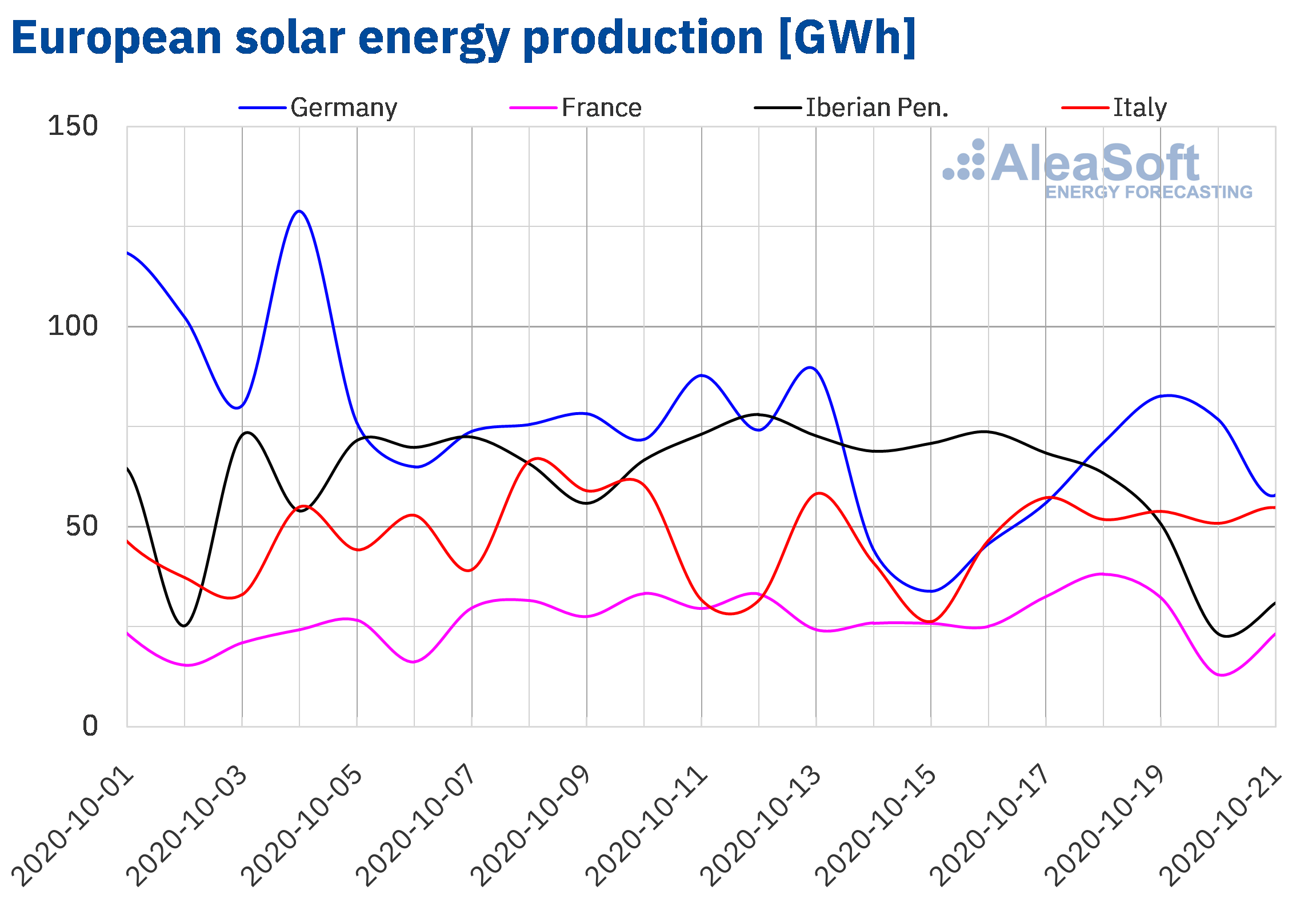

The average solar energy production between Monday and Wednesday of the fourth week of October increased by 23% in the German market and by 19% in the Italian market compared to the average of the previous week. On the contrary, in the Iberian Peninsula it decreased by 51% and in the French market by 22%.

Between October 1 and 21, the solar energy production grew by 48% in the Iberian Peninsula and by 8.7% in the French market, compared to the same days of 2019. During this period there was also an increase of 2.0% in the Italian market, while in the German market the solar energy production fell by 4.9%.

At the end of the week that began on Monday, October 19, the analysis carried out at AleaSoft indicates that the solar energy production in the German market and the Italian market will be higher than that registered in the week of October 12.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA. Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

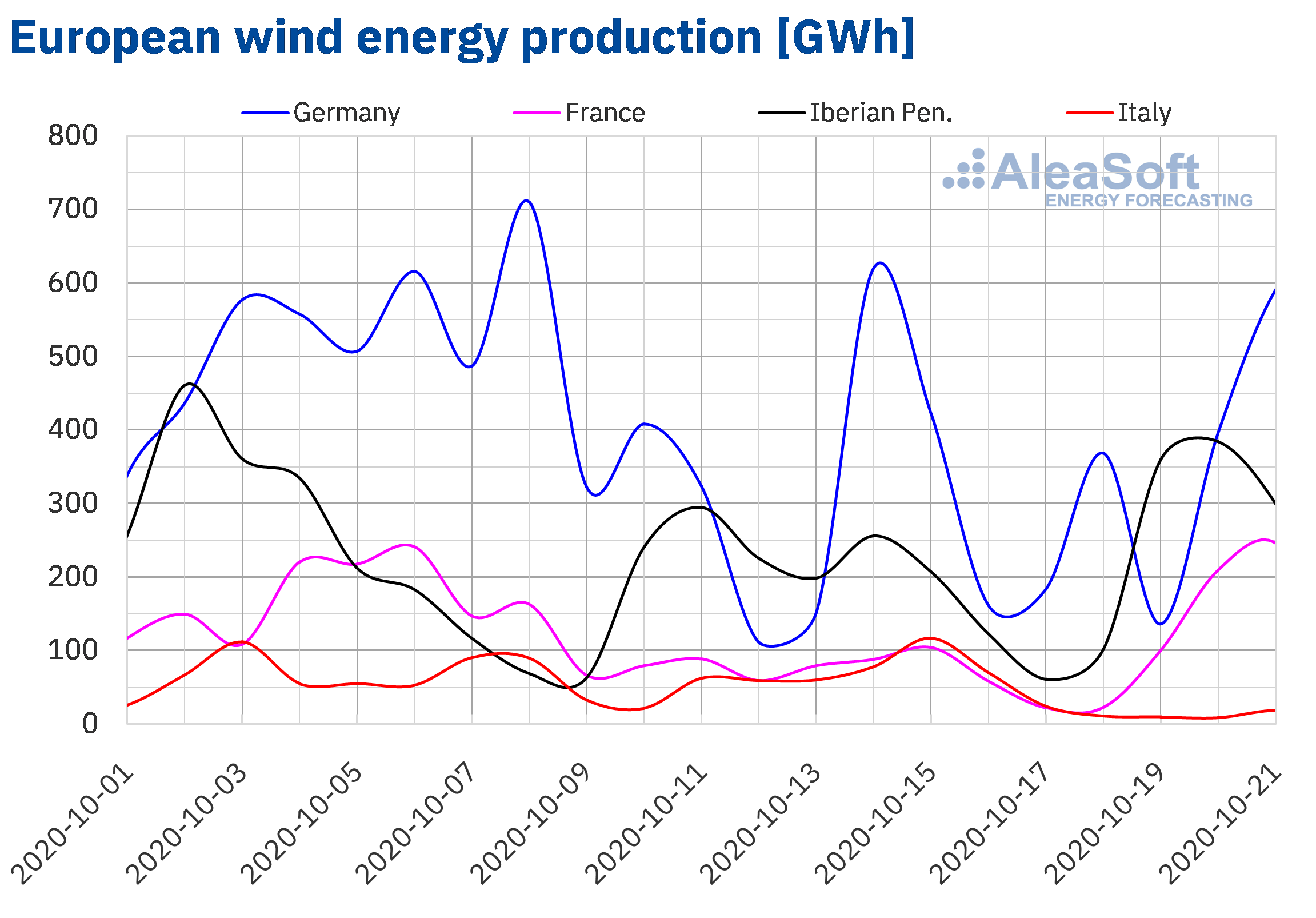

The average wind energy production during the first three days of the week of October 19 increased in most of the markets analysed at AleaSoft compared to the average production of the previous week. In the Iberian Peninsula, the production with this technology more than doubled, as in the French market, in which the average production was 198% higher. The growth in the German market was close to 30%, while, on the contrary, in the Italian market, the production decreased by 79%.

In the year‑on‑year analysis, during the first 21 days of October, the production with this technology increased in all the analysed European markets. The lowest percentage increase was registered in the German market, in which the production grew by 2.0%, while in the Iberian Peninsula it was 45% more than in 2019. In the Italian market, the production increased by 18%, while in the French it increased by 6.5%.

For the end of the fourth week of October, the AleaSoft‘s analysis indicates that the total wind energy production of the week will be higher in the Iberian Peninsula, France and Germany, while on the contrary, a reduction in production is expected in the Italian market.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

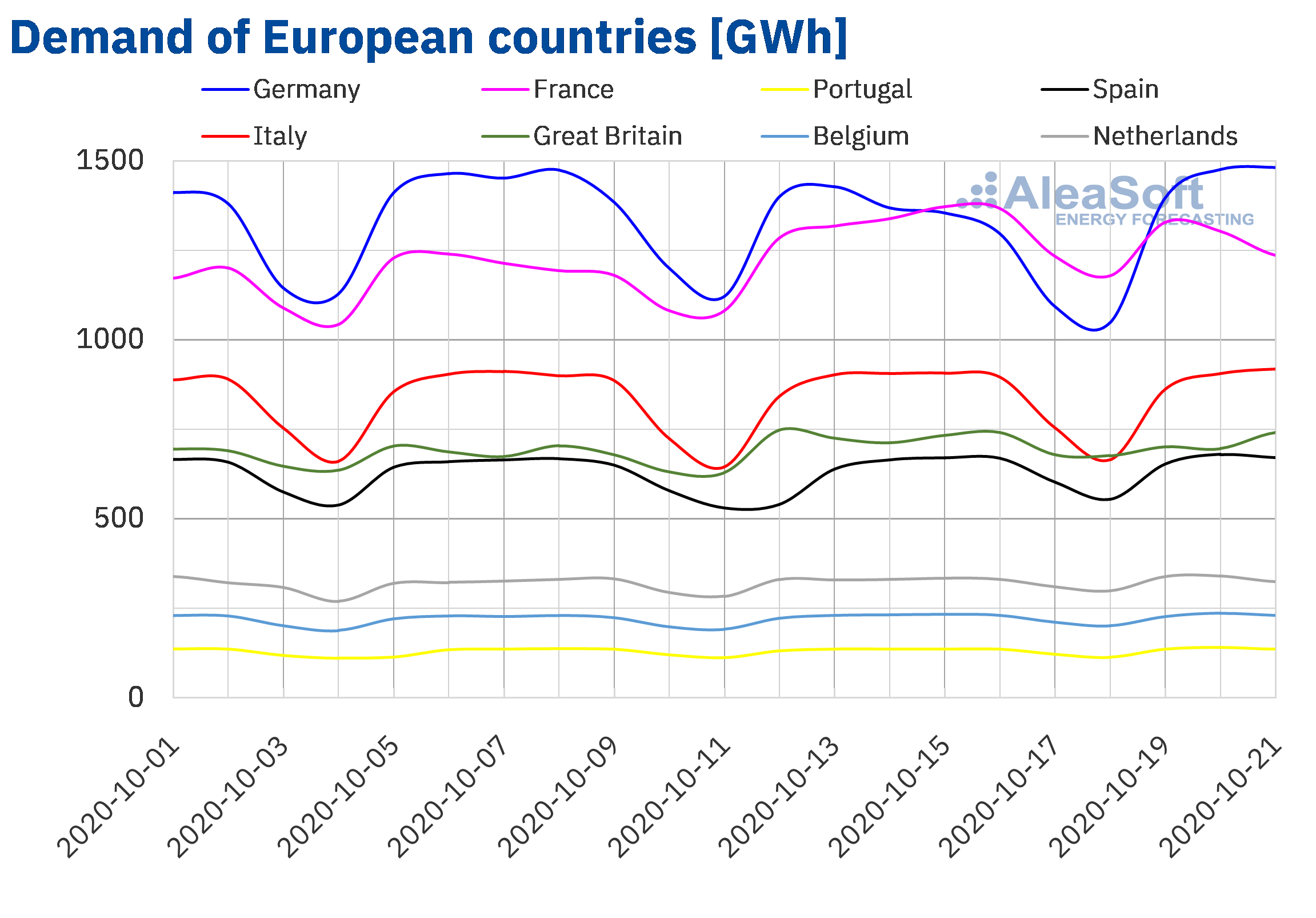

The electricity demand rose in most European markets in the first three days of the week of October 19 on a week‑on‑week basis. In Germany and Portugal the increases were 3.8% and 2.3% respectively. Slightly lower were those registered in Belgium, Italy and the Netherlands, of 1.7%, 1.4% and 1.3% in each case. On the other hand, in the markets of Great Britain and France there were falls of 2.1% and 1.8% respectively. In the latter market there was a significant decrease in demand on Wednesday 21 compared to the previous Wednesday, as shown in the AleaSoft‘s observatory of the French electricity market, due to a significant increase of 6.4 °C in temperatures between these two days.

At the end of the week of October 19, the AleaSoft‘s demand forecasting indicates that the total values will be higher than those of the previous week in the cases of Germany, Italy, Spain and Portugal, while in the rest they will be lower. Although the evolution of the demand will depend on the evolution of the measures adopted to stop the spread of the coronavirus in the different European countries.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

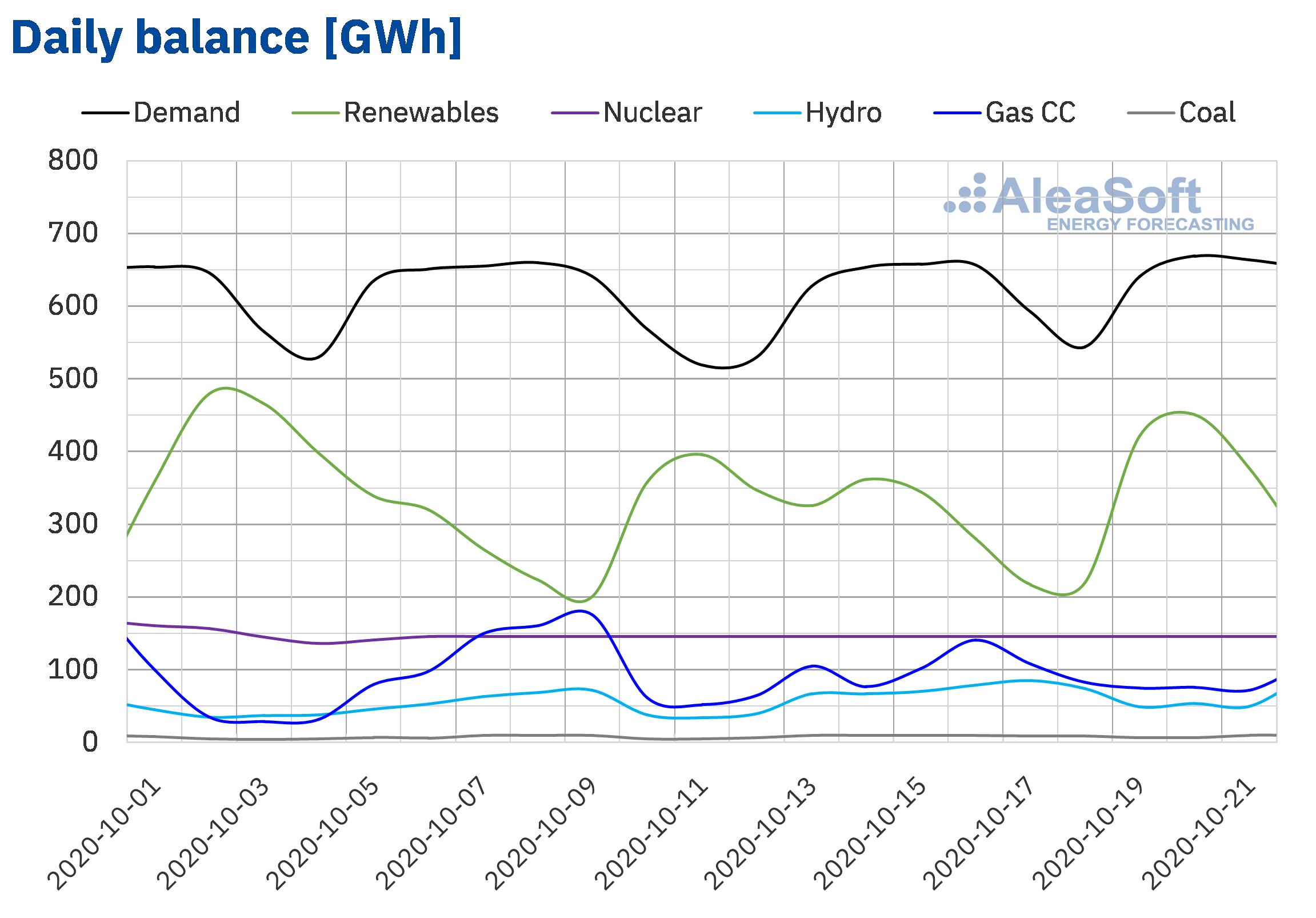

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

From October 19 to 21, the electricity demand in Mainland Spain rose by 8.7% compared to the same days of the previous week. When correcting the effect of the holiday of October 12, National Holiday of Spain, in the demand the increase was 3.3%. At the end of the week of October 19, at AleaSoft the demand of the Spanish market is expected to conclude with values higher than those of the previous week.

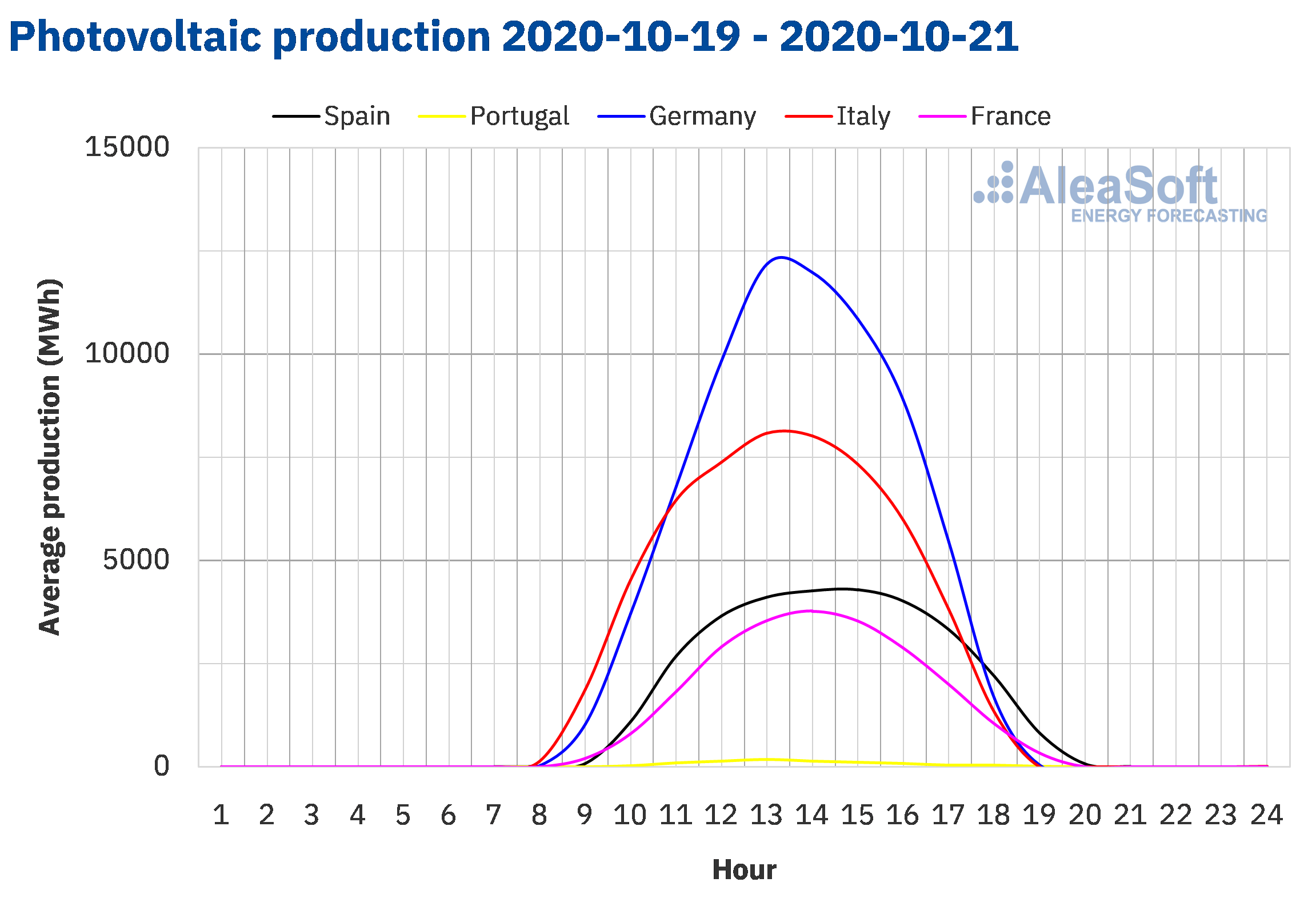

The average solar energy production of Mainland Spain, which includes the photovoltaic and solar thermal technologies, decreased by 48% between Monday and Wednesday of the week of October 19 compared to the average of the week of October 12. In the year‑on‑year comparison, the production with this technology between October 1 and 21 increased by 50%. At the end of the fourth week of October, at AleaSoft the total solar energy production is expected to be lower than that of the previous week.

The average level of the wind energy production in Mainland Spain of the first three days of the week that began on Monday, October 19, increased by 109% compared to the average of the previous week. In the year‑on‑year analysis, the production registered between the first day of October and the 21st of October increased by 51%. According to the analysis carried out at AleaSoft, for the week of October 19, it is expected that the production with this technology will be higher than that registered during the third week of the month.

The nuclear energy production continued to register a daily average close to 146 GWh between Monday, October 19, and Wednesday, October 21. This was happening since last October 3, the unit II of the Ascó nuclear power plant was disconnected from the grid due to a scheduled stop. The recharge is expected to conclude on November 5.

Sources: Prepared by AleaSoft using data from REE.

Sources: Prepared by AleaSoft using data from REE.

The hydroelectric reserves currently have 10 041 GWh stored, according to data from the Hydrological Bulletin of the Ministry for Ecological Transition and Demographic Challenge number 42, which represents a decrease of 207 GWh compared to the bulletin number 41.

European electricity markets

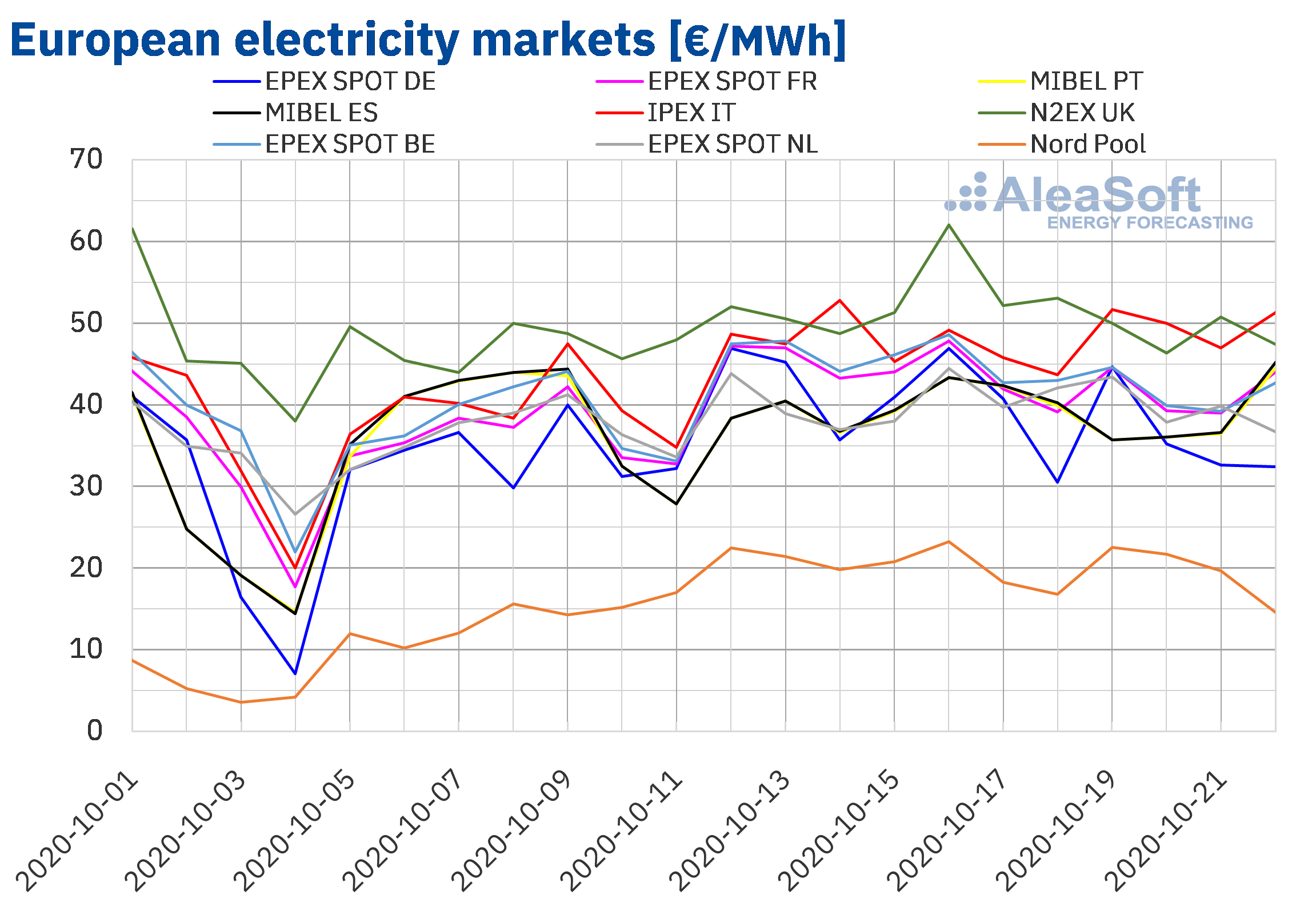

The first four days of the week of October 19, the prices decreased in almost all the European electricity markets analysed at AleaSoft compared to the same period of the previous week. The exceptions were the EPEX SPOT market of the Netherlands where the average price barely changed, only €0.01/MWh, and the IPEX market of Italy with an increase of 2.9%. On the other hand, the greatest drop in prices, of 14%, was that of the German market. Whereas the MIBEL market of Spain and Portugal registered the smallest price decreases, which were around 1.0%. In the rest of the markets, the price decreases were between 4.0% of the N2EX market of Great Britain and 10% of the EPEX SPOT market of Belgium.

During the first four days of the fourth week of October, the market with the lowest average price, of €19.63/MWh, was the Nord Pool market of the Nordic countries. On the other hand, the highest average price in this period, of €50.00/MWh, was that of the Italian market, followed by that of the British market, of €48.64/MWh. The averages of the rest of the markets were between €36.22/MWh of the German market and €41.73/MWh of the French market.

In the first four days of the fourth week of October, the markets with the highest daily prices were the British and the Italian. Instead, the lowest prices were those of the Nord Pool market, followed by those of the German market, except on Monday, when the MIBEL market prices were lower. In general, the prices of the rest of the markets were quite coupled.

Between October 19 and 22, the daily prices of the IPEX market and the N2EX market exceeded €50/MWh on several occasions. The highest daily price, of €51.67/MWh, was reached on Monday, October 19, in the Italian market. On the other hand, the lowest daily prices were those of the Nord Pool market, which remained below €25/MWh. The minimum daily price, of €14.54/MWh, was reached on Thursday, October 22.

Regarding the hourly prices, in the first four days of the week of October 19, negative hourly prices were not reached in the analysed electricity markets. On the other hand, the highest hourly price, of €86.20/MWh, was reached at the hour 20 of Thursday, October 22, in the British market.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The general increase in wind energy production favoured the price declines of the first days of the week of October 19 in most markets. While in Italy, where the production with this technology decreased, the prices increased. The decrease in CO2 prices registered in recent days also favoured the declines in the electricity markets.

The AleaSoft‘s price forecasting indicates that at the end of the fourth week the prices of most of the European markets will continue to be lower than those registered during the week of October 12, except in the Italian market where they will be higher. On the other hand, for the week of October 26, it is expected that the decrease in wind energy production in most markets will favour price increases.

Iberian market

In the MIBEL market of Spain and Portugal, the average price of the first four days of the week of October 19 decreased compared to that of the same period of the previous week. The fall was 0.9% in Spain and 1.2% in Portugal. In this period, the decrease in prices in the Spanish market was the smallest of those occurred in the European electricity markets analysed at AleaSoft.

Due to these decreases, the average price from October 19 to 22 was €38.20/MWh in the Portuguese market and €38.39/MWh in the Spanish market. These were the third and the fourth lowest prices in the European markets after those of the Nord Pool market and the German market.

Regarding the daily prices of the MIBEL market, from Monday to Thursday the prices were increasing. The minimum price, of €35.71/MWh, was reached on Monday, October 19, in both the Spanish and Portuguese markets. While on October 22, the maximum daily price, of €45.22/MWh, was reached in the Spanish market.

During the first days of the fourth week of October, the significant increase in wind energy production in the Iberian Peninsula allowed the prices to fall in the MIBEL market.

For the rest of the fourth week of October, the daily prices are expected to decline again. But, the AleaSoft‘s price forecasting indicates that the week of October 26, the MIBEL market prices will increase favoured by a decrease in wind energy production in the Iberian Peninsula.

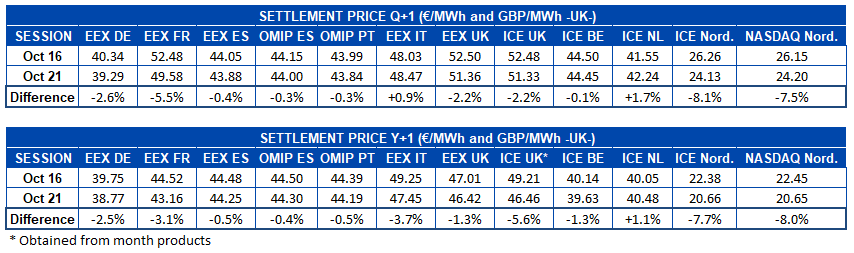

Electricity futures

In the first three days of the week of October 19, the European electricity futures markets analysed at AleaSoft registered predominantly downward changes in the prices of the product for the next quarter. In the comparison of the settlement of the session of Wednesday, October 21, with respect to the settlement price of October 16, the EEX market of Italy and the ICE market of the Netherlands were the only markets in which the prices increased, by 0.9% and 1.7% respectively. In the rest of the markets, the price drops were between 0.1% of the ICE market of Belgium and 8.1% of the ICE market of the Nordic countries.

In the case of the product for the calendar year 2021, the behaviour was similar. In this case, the ICE market of the Netherlands was the only one in which the prices increased between the analysed dates. In the rest of the markets the decreases were between 0.4% of the OMIP market of Spain and 8.0% of the NASDAQ market of the Nordic countries.

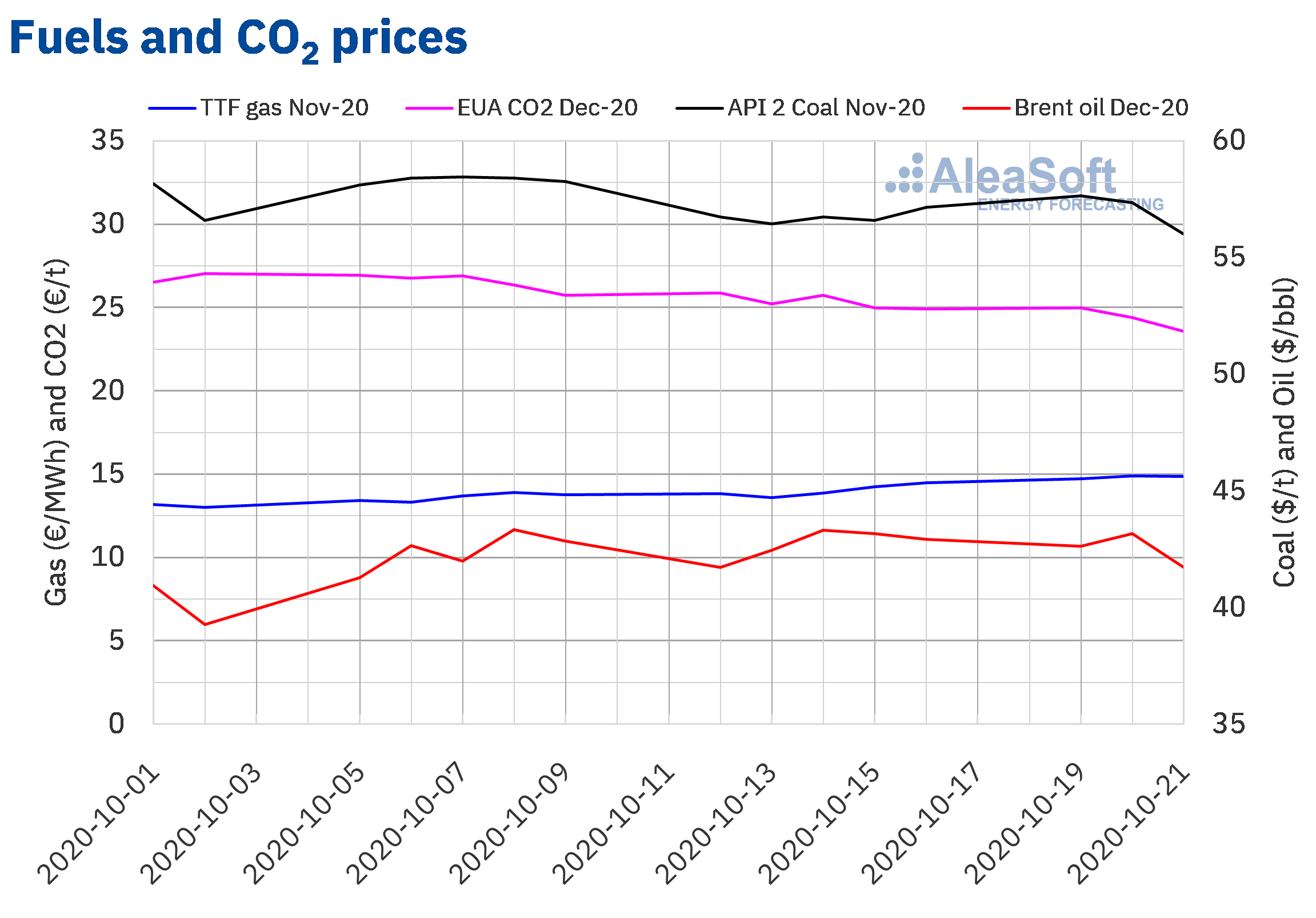

Brent, fuels and CO2

On Monday, October 19, the Brent oil futures prices for the month of December 2020 in the ICE market continued with the downward trend of the previous week and reached a settlement price of $42.62/bbl. On Tuesday, the prices recovered 1.3% to $43.16/bbl. But on Wednesday, October 21, they fell again and the settlement price was $41.73/bbl, 3.7% lower than that of the previous Wednesday.

Despite the drop in crude oil reserves of the United States, which could be due to the effects of Hurricane Delta, the data on the increase in oil production in Libya favoured the decline in prices. In addition, the concerns about the advance of the second wave of COVID‑19 and the effects it may have on the demand also exerted their downward influence on the prices.

On the other hand, the TTF gas futures prices in the ICE market for the month of November 2020, the first days of the fourth week of October, remained above €14.50/MWh. The maximum settlement price, of €14.89/MWh, was reached on Tuesday, October 20. This price was 9.6% higher than that of the same day of the previous week and the highest since February 2020.

Regarding the TTF gas prices in the spot market, they rose to reach an index price of €14.82/MWh on Tuesday, October 20, the highest since the beginning of December 2019. Later, the prices fall again to €14.75/MWh of October 22, influenced by the recovery of the supply levels from Norway, the rising temperatures and the concern for the demand due to the effects of the measures to fight the COVID‑19 pandemic.

As for the API 2 coal futures in the ICE market for the month of November 2020, on Monday, October 19, they registered a settlement price of $57.65/t, 0.9% higher than that of the last session of the previous week. But, subsequently, the prices began a downward trend. Thus, on Wednesday, October 21, a settlement price of $56.00/t was reached, 1.3% lower than that of the previous Wednesday and the lowest since the fourth week of September.

Regarding the CO2 emission rights futures prices in the EEX market for the reference contract of December 2020, from October 19 to 21, these fell. The settlement price of Wednesday, October 21, was €23.56/t. This price was 8.5% lower than that of the previous Wednesday and the lowest since June. In recent days, the uncertainty regarding the Brexit agreement and the effects of the second wave of the coronavirus in Europe on the demand exerted its downward influence on the prices. In addition, the high volume available at the auctions also contributed to the decline in prices. Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis of the evolution of the energy markets in the second wave of the pandemic

Europe is currently immersed in the second wave of the COVID‑19 pandemic, and the different governments are adopting measures to try to stop the increase in infections. This situation increases the already existing uncertainty about when the coronavirus will be eradicated and about how the measures will affect the economies that were already quite affected by the first wave of the pandemic. How this situation is affecting the energy markets and the prospects in the mid and long term are some of the topics that will be discussed in the next AleaSoft’s webinar “Energy markets in the recovery from the economic crisis (II)”. In addition, the impact on the financing of the renewable energy projects and the importance of the forecasting in the portfolio valuation and audits will be analysed. Two speakers from the consulting firm Deloitte, Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services and Carlos Milans del Bosch, Partner of Financial Advisory, will participate in the webinar, as well as Oriol Saltó i Bauzà, Manager of Data Analysis and Modelling at AleaSoft.

Having coherent and scientifically‑based long‑term forecasting allows having a vision of the future of the electricity market, also necessary to plan investments. At AleaSoft, the long‑term price curves of the main European electricity markets are periodically updated, taking into account the data of the evolution of the economy and the prospects for the recovery from the coronacrisis.

On the AleaSoft website, the energy markets observatories were enabled, which allow monitoring the evolution of the markets with daily updated data, something very useful to analyse the effects of the measures adopted during the second wave of the pandemic. In the observatories, the most important variables of the European electricity, fuels and CO2 markets are available.

Source: AleaSoft Energy Forecasting.