AleaSoft Energy Forecasting, January 12, 2026. In the second week of January, prices increased in most major European electricity markets compared to the previous week, driven by demand growth, the rise in CO2 prices, whose futures reached their highest settlement price at least since December 2023, and lower renewable energy production in some markets. By contrast, the Iberian market registered the lowest prices for most of the week thanks to the increase in wind energy production, which reached a historic daily record, as well as solar energy production. Italy also registered historic records for wind and photovoltaic energy production for a January day.

Solar photovoltaic and wind energy production

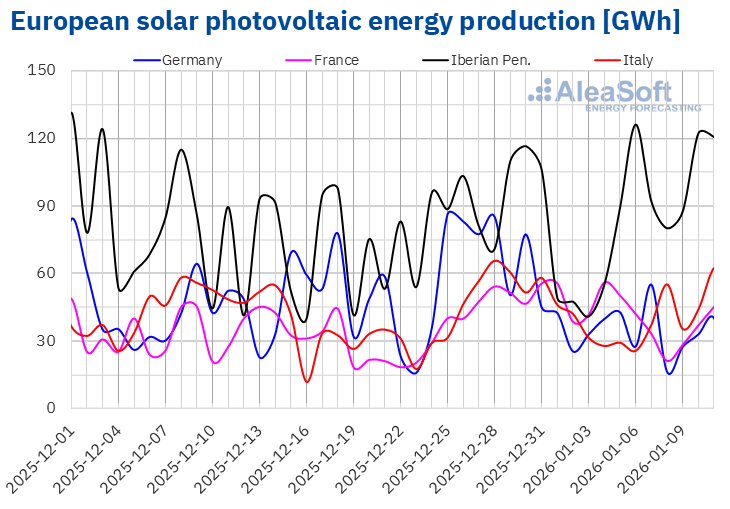

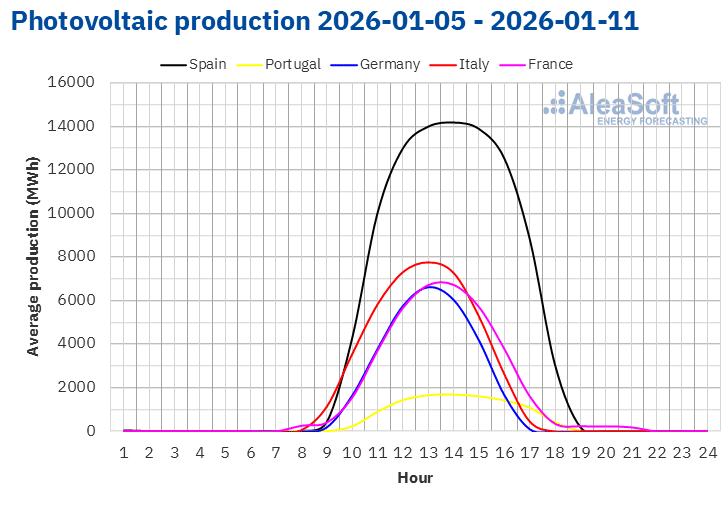

In the week of January 5, solar photovoltaic energy production increased in the markets of the Iberian Peninsula compared to the previous week. The Spanish market registered the largest increase, 39%, while in the Portuguese market the increase was 16%. By contrast, the Italian, German and French markets registered declines in production with this technology. Italy and France registered drops of 8.8% and 26%, respectively, after two weeks of increases. Germany, for its part, accumulated its second consecutive week of declines, with a drop of 23%.

During the week, the markets of Portugal, Italy and Spain reached historic records for photovoltaic energy production for a January day. On January 5, the Portuguese market achieved its second‑highest photovoltaic energy production on a January day, with generation of 16 GWh. The Italian market, for its part, reached its historic maximum for a January day on Sunday, the 11th, with production of 63 GWh. That same day, the Spanish market registered the third‑highest solar photovoltaic energy production in its history on a January day, with 115 GWh, after the values reached on January 18 and January 31, 2025, 115 GWh and 122 GWh, respectively.

For the week of January 12, according to AleaSoft Energy Forecasting’s solar energy forecasts, production will decrease in the German, Spanish and Italian markets compared to the previous week.

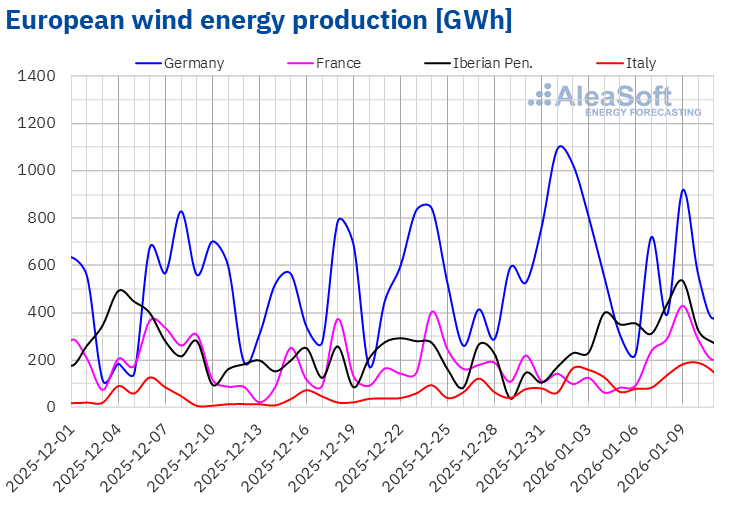

In the second week of January, wind energy production increased in most major European markets compared to the previous week. The Spanish market registered the largest increase, with generation exceeding that of the previous week by 119%. The French market followed, increasing wind energy production by 87%. The Portuguese and Italian markets registered increases of 21% and 24%, for the second and fourth consecutive week, respectively. The German market was the exception, as wind energy production decreased by 35% after two weeks of a positive trend.

In addition, the Spanish and Italian markets set historic records for wind energy production. In Spain, this milestone occurred on Friday, January 9, when wind energy production reached 453 GWh of generation. One day later, on January 10, wind energy production in Italy registered 188 GWh of generation. The French market, for its part, reached its second‑highest wind energy production in history for a January day, also on January 9, with generation of 429 GWh, after that registered on January 28, 2025, of 437 GWh.

For the second week of January, according to AleaSoft Energy Forecasting’s wind energy forecasts, production with this technology will increase in the German market. However, it will decrease in the Italian, Spanish, Portuguese and French markets, which will represent a change in trend compared to the previous week.

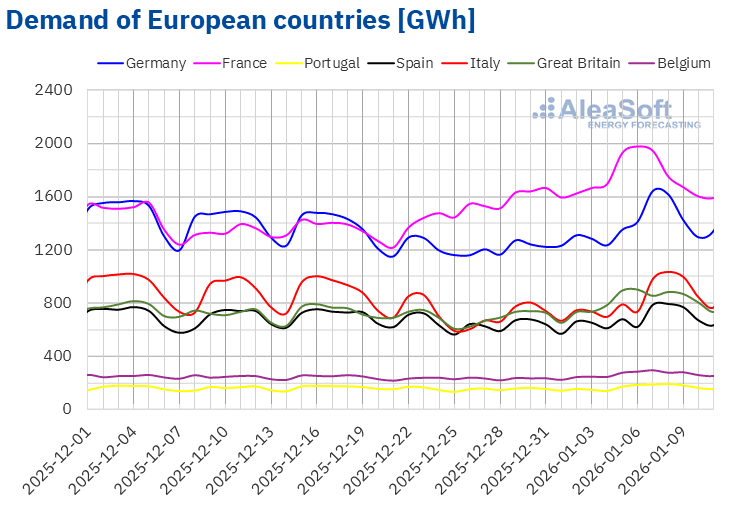

Electricity demand

In the first week of January, electricity demand increased in the main European markets compared to the previous week. The Italian market registered the largest increase, 19%. In the Spanish, German, Belgian, British and Portuguese markets, increases ranged from 11% in Spain to 17% in Portugal. Most of these markets maintained the upward trend for the second consecutive week, while the markets of the Iberian Peninsula changed trend after two weeks of declines. The French market registered the smallest increase, 8.2%, marking its fourth consecutive week of increases.

During the week, average temperatures decreased in most analyzed markets. The declines ranged from 0.2 °C in Great Britain to 1.8 °C in Germany, which favored the increase in electricity demand in most markets. By contrast, in France average temperatures were 0.5 °C less cold than in the previous week.

For the week of January 12, according to AleaSoft Energy Forecasting’s demand forecasts, demand will continue its upward trend in the markets of Germany, Spain and Italy. In contrast, the markets of France, Portugal, Great Britain and Belgium will register decreases in demand.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

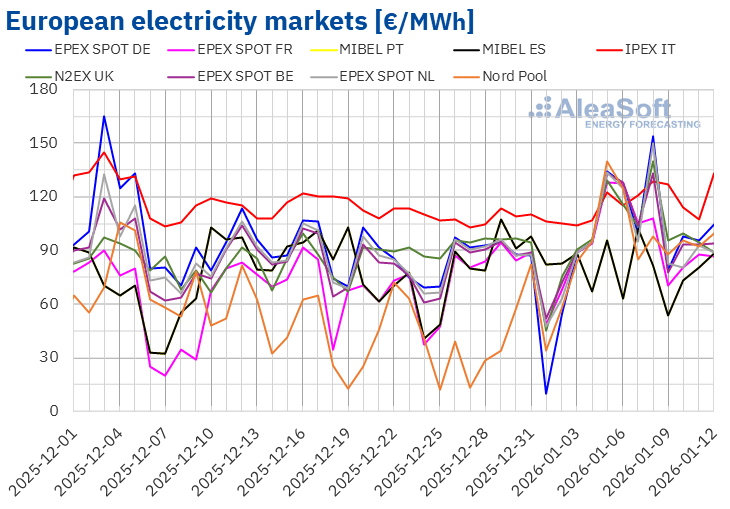

In the second week of 2026, prices in most major European electricity markets were higher than those of the previous week, especially during the first four days of the week. As a result, weekly average prices in most markets increased compared to the previous week. The exception was the MIBEL market of Spain and Portugal, which registered a decline of 11%. The Nord Pool market of the Nordic countries registered the largest percentage price increase, 63%. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices rose between 11% in the IPEX market of Italy and 52% in the EPEX SPOT market of Germany.

In the week of January 5, weekly averages were above €100/MWh in most European electricity markets. The exceptions were the Spanish and Portuguese markets, with averages of €78.47/MWh and €78.56/MWh, respectively. The Italian market registered the highest weekly average, €119.39/MWh. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices ranged between €101.14/MWh in the French market and €112.48/MWh in the German market.

The Iberian MIBEL market registered the lowest daily prices among the main European markets for most of the week. On Friday, January 9, the Spanish market reached the lowest average of the week among the markets analyzed, €53.40/MWh. That day, the Portuguese market registered the second‑lowest daily price of the week, €53.43/MWh. Daily prices in the rest of the markets analyzed remained above €70/MWh during the second week of January.

On the other hand, all markets analyzed at AleaSoft Energy Forecasting registered daily prices above €100/MWh in at least one session of the second week of January. The Italian market registered daily prices above €105/MWh throughout the entire week. However, the German market reached the highest daily average of the week among the markets analyzed, €154.12/MWh, on Thursday, January 8. That day, the Belgian, British, Italian and Dutch markets also registered their highest daily prices of the week, above €125/MWh. In the case of the N2EX market of the United Kingdom, the price was €139.74/MWh, its highest price since February 18, 2025. By contrast, the French and Nordic markets registered their highest daily prices of the week on Monday, January 5. That day, the French market reached its highest price since February 19, 2025, €128.21/MWh.

In the week of January 5, the increase in CO₂ emissions allowance prices, as well as higher demand, drove prices up in most European electricity markets. In addition, the drop in wind energy production in Germany, as well as the decrease in solar energy production in the German, French and Italian markets, contributed to the price increase in these markets. By contrast, the increase in wind and solar energy production in the Iberian Peninsula favored a decline in prices in the Spanish and Portuguese markets.

AleaSoft Energy Forecasting’s price forecasts indicate that, in the third week of January, prices will decline in most major European electricity markets, influenced by increased wind energy production in Germany and lower demand in some markets. However, the decrease in solar energy production in Spain and Italy and the drop in wind energy production in the Iberian Peninsula and Italy will favor higher prices in the Spanish, Italian and Portuguese markets.

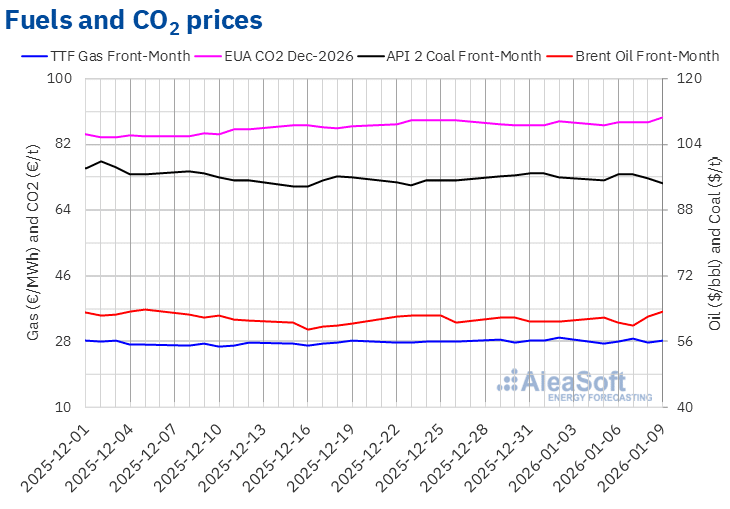

Brent, fuels and CO2

Settlement prices of Brent oil futures for the Front‑Month in the ICE market remained above $60/bbl for almost the entire second week of January, except on the 7th. On that day, these futures registered their weekly minimum settlement price, $59.96/bbl. By contrast, in the last sessions of the week prices increased. On Friday, January 9, these futures reached their weekly maximum settlement price, $63.34/bbl. According to the data analyzed at AleaSoft Energy Forecasting, this price was 4.3% higher than that of the previous Friday and the highest since December 6, 2025.

Geopolitical tensions exerted upward pressure on Brent oil futures prices in the second week of January. Uncertainty about Venezuela, the announcement of new US sanctions on countries buying Russian oil, as well as the possibility that instability in Iran could end up affecting oil supply from that country, contributed to prices exceeding $60/bbl for almost the entire week. However, the announcement that Venezuela would deliver between 30 and 50 million barrels of oil to the United States contributed to the decline in prices on January 7.

As for settlement prices of TTF gas futures in the ICE market for the Front‑Month, they began the second week of January with a drop of 5.5% compared to the last session of the previous week. Thus, on Monday, January 5, these futures registered their weekly minimum settlement price, €27.40/MWh. Subsequently, prices increased until January 7. On that day, these futures reached their weekly maximum settlement price, €28.78/MWh. By contrast, in the last two sessions of the week settlement prices were below €28.25/MWh. On Friday, January 9, the settlement price was €28.13/MWh. According to the data analyzed at AleaSoft Energy Forecasting, this price was 3.0% lower than that of the previous Friday.

Concerns about the effects on liquefied natural gas supply from the increase in geopolitical tensions, as well as about European storage levels, currently below 55%, exerted upward pressure on TTF gas futures prices in the second week of January. However, forecasts of milder temperatures for the coming days contributed to keeping prices below €29/MWh.

Regarding CO2 emission allowance futures in the EEX market for the reference contract of December 2026, on Monday, January 5, they registered their weekly minimum settlement price, €87.25/t. During the rest of the week, prices increased. As a result, on Friday, January 9, these futures reached their weekly maximum settlement price, €89.56/t. According to the data analyzed at AleaSoft Energy Forecasting, this price was 1.4% higher than that of the previous Friday and the highest at least since December 29, 2023.

AleaSoft Energy Forecasting’s analysis on the prospects for European energy markets, storage and demand

Next Thursday, January 15, AleaSoft Energy Forecasting will hold the 62nd edition of its monthly webinar series on European energy markets. This edition will feature the participation of speakers from PwC Spain for the sixth consecutive year. The webinar will address the prospects for European energy markets, energy storage and hybridization. In addition, it will analyze other topics such as the growth in electricity demand driven by Data Centers and industry electrification, the current state of regulation on PPA and renewable energy, as well as the evolution of virtual PPA and FPA (Flexibility Purchase Agreements).

Source: AleaSoft Energy Forecasting.