AleaSoft, February 6, 2020. At the beginning of this week, a year‑on‑year analysis of the European electricity markets in January was carried out at AleaSoft, in which it was seen that prices had fallen. On this occasion, the comparison was made with respect to December 2019. From this perspective, the prices of most markets rose, mainly due to the increase in demand and the decrease in wind energy production. This week there were records of solar energy production so far in 2020 in all markets.

Solar photovoltaic and solar thermal energy production and wind energy production

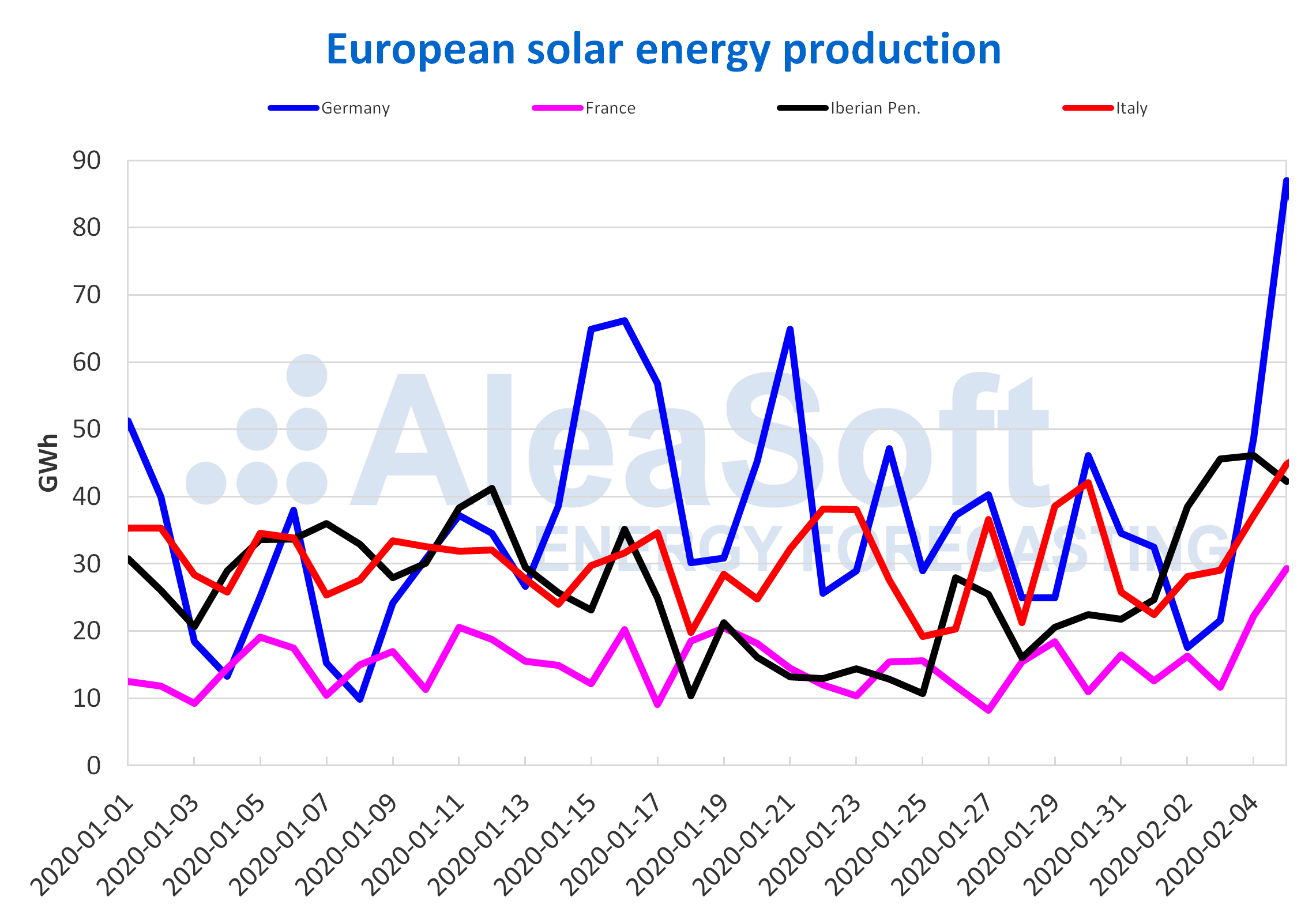

The European solar energy production in January of this year increased in all markets compared to December 2019, a behaviour that is repeated in the case of the year‑on‑year comparison. The largest increase compared to December was in the Italian market and was 45%. On the other hand, the market with the lowest growth was the Portuguese one, with 15%.

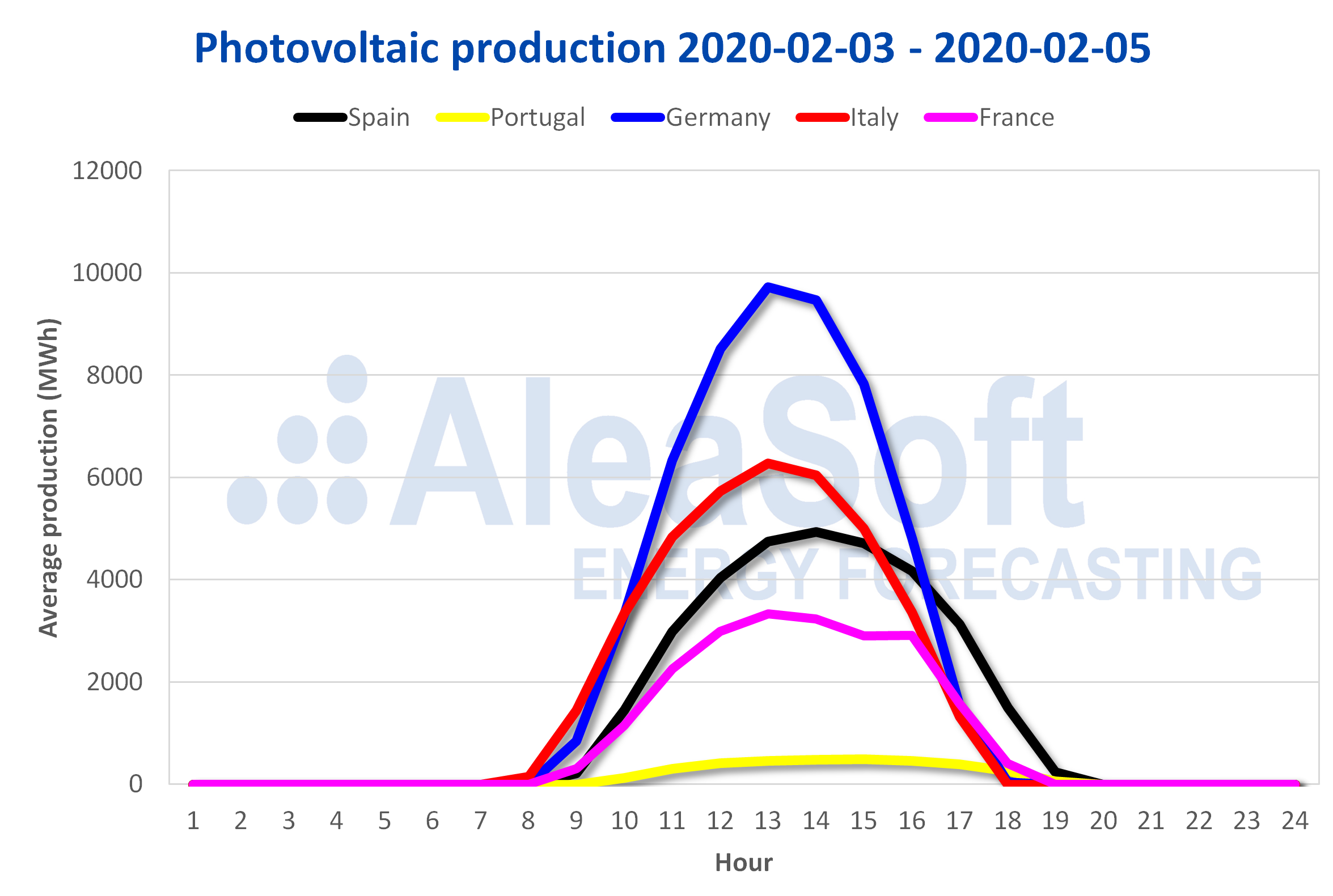

So far this week, the solar energy production increased significantly in all European markets compared to last week’s average. The behaviour was increasing from Monday to Wednesday in all markets, except in Spain where on Wednesday 5 the production was 4.0 GWh lower than that of Tuesday. This week there were daily production records for 2020 in all markets. In Portugal there was a daily generation record on February 3, of 3.6 GWh and, in addition, the average of the production of the first three days of this week doubled compared to the average of last week, with an increase of 106%. In Germany, France and Italy the average production increases from Monday to Wednesday of this week compared to the last week’s average were 66%, 50% and 21%, and there were daily production records of 87 GWh, 29 GWh and 45 GWh respectively, for Wednesday, February 5.

In the first five days of February the growing trend of the solar energy production was maintained in year‑on‑year terms. The increases were in the range between 25% and 36%, except for Portugal, which only reached 17%.

The AleaSoft‘s analysis of the generation with this technology for this week indicates that there will be increases in all markets compared to the previous week.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

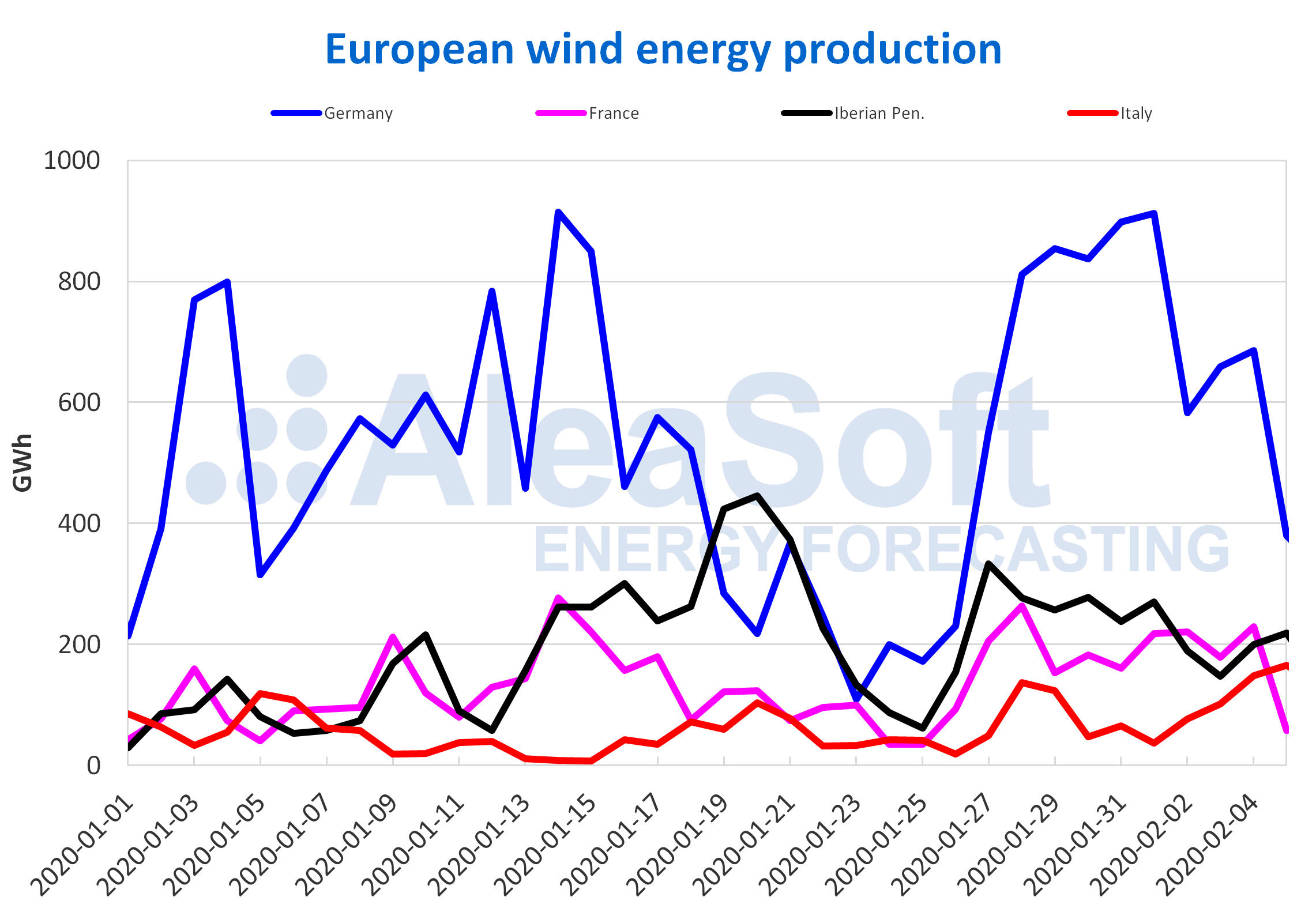

In the case of the wind energy, the production of January of this year was lower than that of December 2019 in almost all European markets except in the German one, where it increased by 6.4%. The largest decline occurred in the Italian market, being 34%. In the rest of the markets the fall was 12%.

As for the wind energy production records from February 3 to 5, they were much lower than the average level of last week in the electricity markets of Europe. Only Italy was out of this generalised fall, with an increase of 81%. The declines in the rest of the markets were between 23% and 34%.

Year‑on‑year increases were registered in the markets of France and Germany for the days elapsed of February. In both countries the production of this period almost doubled compared to that of 2019, with increases of 99% and 97% respectively. On the other hand, in the markets of Portugal and Italy the decrease was 19% and 4.2%.

At the end of this week, drops in wind energy production for the whole of this week in almost all European markets compared to last week and a recovery in the Italian market are expected. However, a significant increase in wind energy production in Germany is expected on Sunday.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Renewable energy auctions

Last Friday, January 31, the results of what is known as the world’s largest solar capacity auction were announced. This was launched in August 2019 in India and 1.2 GW of capacity was requested for projects with guaranteed peak power supply. 900 MW were tendered to the local company Greenko, for a pumping hydroelectric energy project with a weighted average rate of €51.61/MWh and a quoted maximum rate of €78.18/MWh. The other 300 MW were awarded to ReNew Power for battery storage capacity, whose average offer was €54.93/MWh and quoted maximum price of €87.50/MWh.

On the other hand, the Moroccan Agency for Sustainable Energy (MASEN) published a call for a tender of 400 MW of capacity for the construction of a solar power plant. This prequalification call will allow the promoters to send their offers until February 28, 2020.

Electricity demand

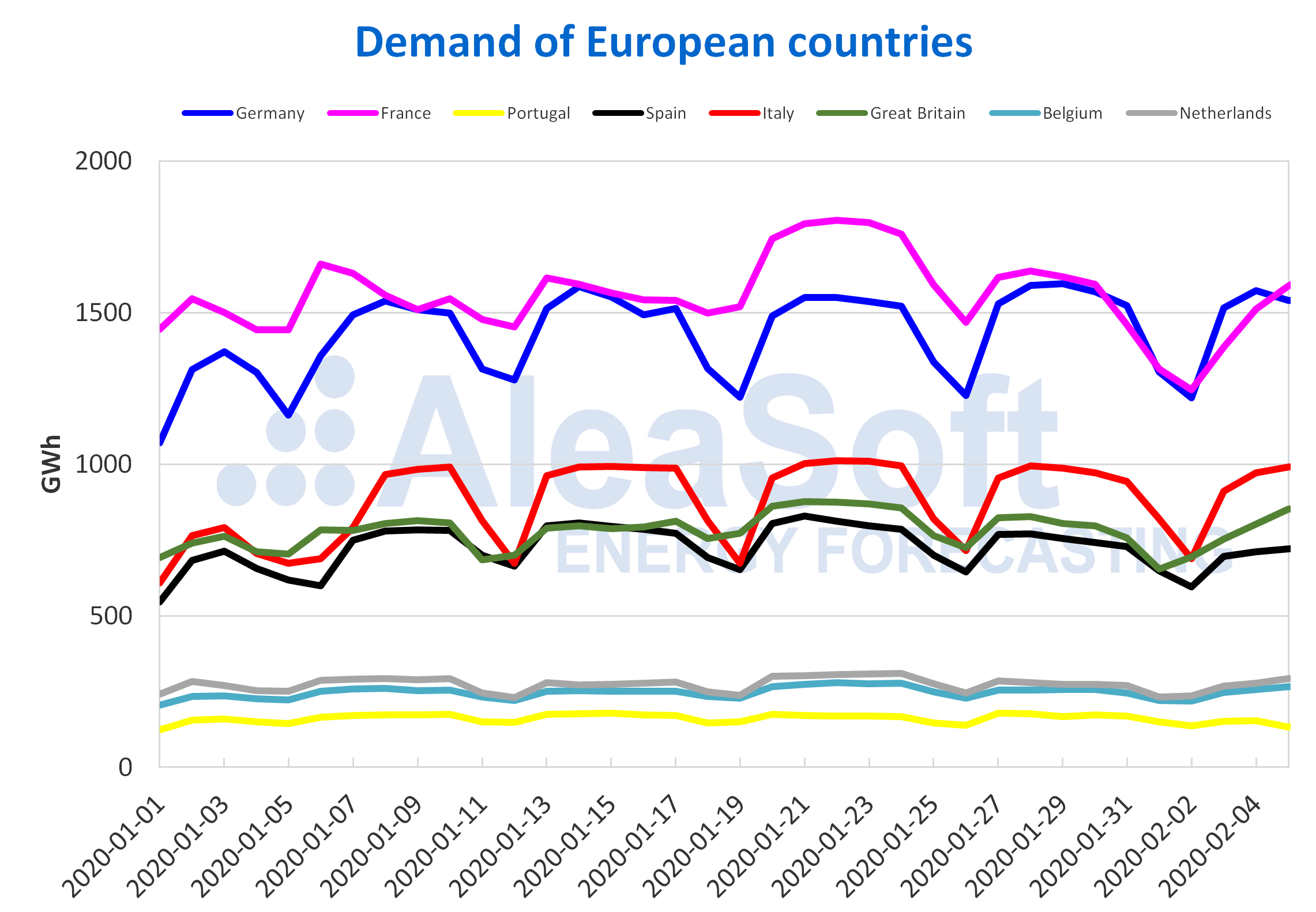

In January, the electricity demand rose in all electricity markets compared to the previous month. In addition to the fact that there are fewer holidays in January than in December, the temperatures were generally cooler in January than in December. The demand variations are between 0.8% in the Netherlands and 8.6% in Spain.

As a consequence of the less cold temperatures around Europe, the electricity demand fell in a general way in the days elapsed this week with respect to the same period of the previous one. In the French market, it fell 7.9%. The markets of Germany, Italy and Great Britain had similar falls close to 2.0%. Although on Monday and Tuesday the temperatures were less cold than those of last week, from Wednesday they began to fall and it is expected that the average of this week will be lower than that of the week of January 27. This will cause this week’s total demand to increase in several European markets compared to that of the previous week.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

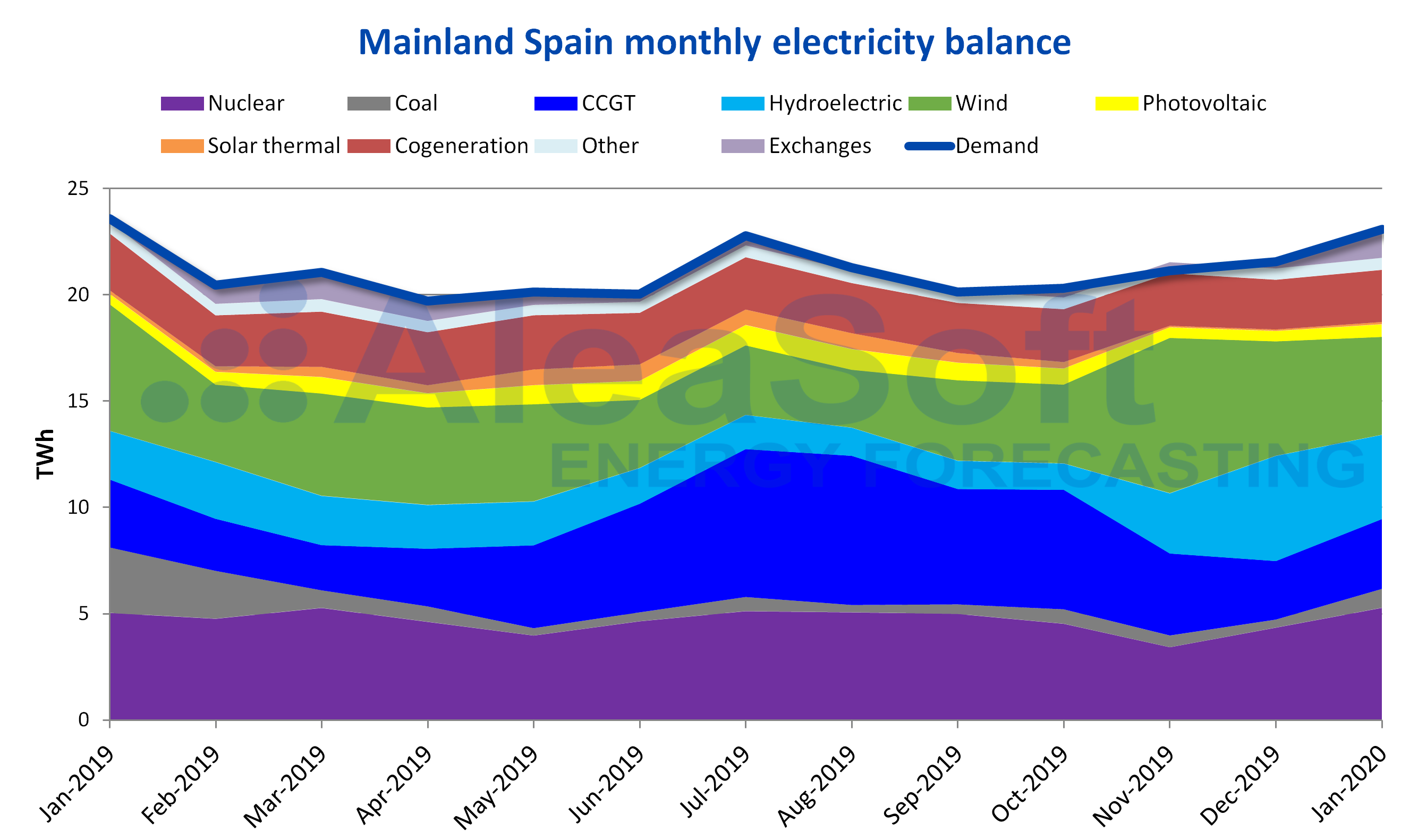

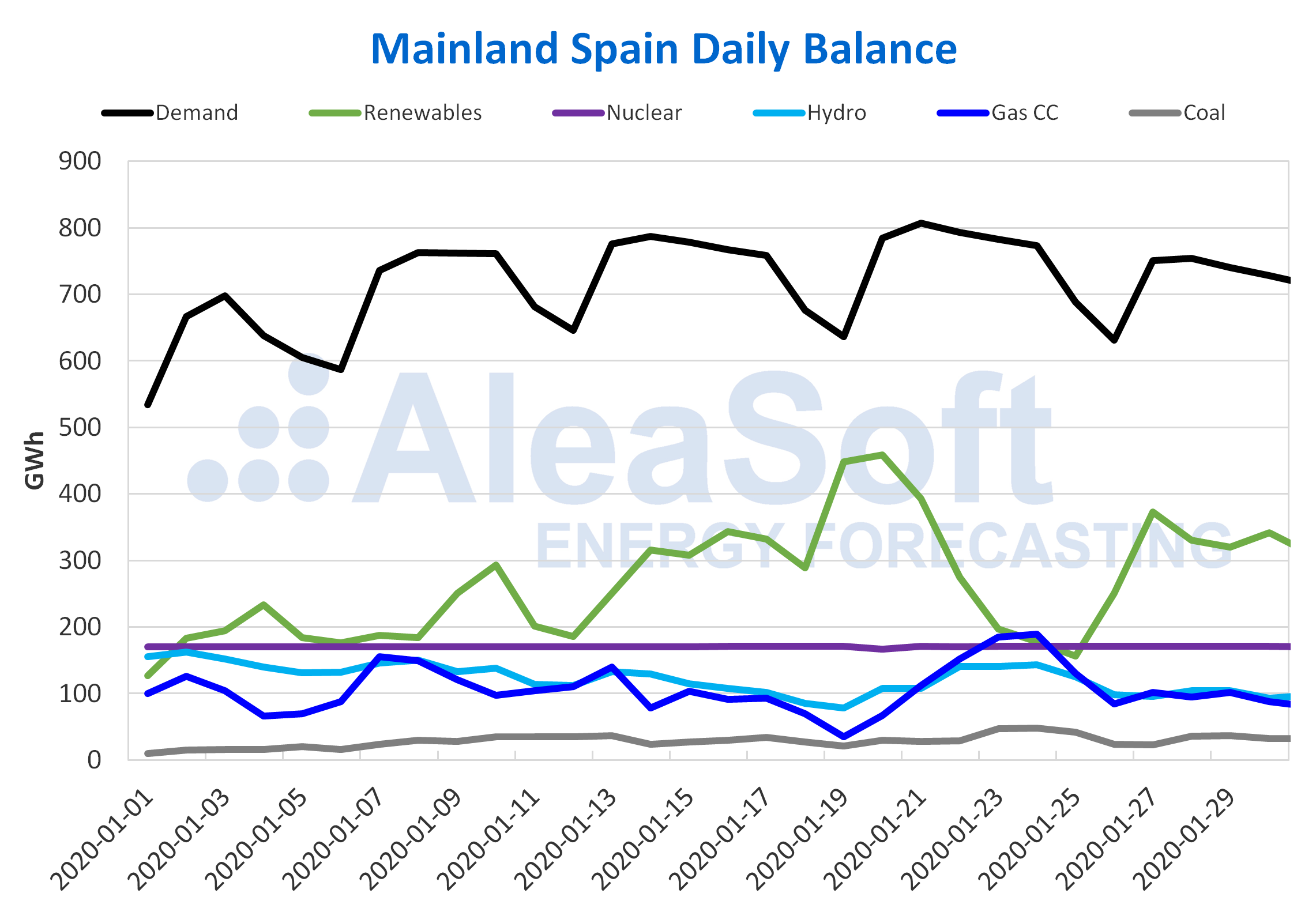

Mainland Spain, demand and productions

In January, the solar energy production in Mainland Spain was 26% higher than in December. The solar thermal energy production was the one that registered the greatest increase, of 50%. The growth of the solar photovoltaic energy production was 22%.

So far this week the set of solar photovoltaic and solar thermal energy production increased significantly compared to the average values of the previous week, by 83%. In the Spanish peninsular territory there was a daily production record for 2020 of 43 GWh on Tuesday, February 4. In the case of the year‑on‑year comparison of the first five days of February, there was an increase of 29%.

In the case of the wind energy production, this time the data is not positive. In January, the production was reduced by 14% compared to December. The average production of the first three days of this week was 27% lower than last week’s average and there was also a 24% drop in year‑on‑year terms from February 1 to February 5.

The electricity demand in January was 8.6% higher than that of December 2019. The average temperature of January was 2 °C lower than that of December which, together with the effect of the holidays mentioned above, favoured the increase in demand. During the days elapsed of this week the demand was 7.2% below that of the same period of last week. This occurred mainly due to the increase in average temperature by 1.8 °C.

In January, the nuclear energy production was 21% higher than in December when the Cofrentes and Vandellós II nuclear power plants were stopped for a few days. Currently all nuclear power plants are in operation and the daily nuclear energy production is over 170 GWh.

In January, the coal energy production had an important increase of 137% compared to that of December of last year, totalling 885 GWh. During the first three days of this week it increased by 3.1% compared to the same days of last week and the daily values are between 29 GWh and 36 GWh.

The combined cycle gas turbine production also rose in January, although by a smaller percentage, of 19%. Between Monday and Wednesday of this week it dropped 11% compared to the first three days of this week and was between 79 GWh and 98 GWh daily.

The hydroelectric energy production of January fell by 18% compared to that registered in December. In the first three days of this week the daily values are between 90 GWh and 105 GWh, which on average represent a decrease of 3.0% compared to the production of the first three days of last week.

Sources: Prepared by AleaSoft using data from REE.

Sources: Prepared by AleaSoft using data from REE.

At the end of January, the level of the hydroelectric reserves was similar to that at the end of December 2019. This week the level increased by 3.7% and stands at 13 129 GWh. This value corresponds to 57% of the total capacity, according to data from the latest Hydrological Bulletin of the Ministry for Ecological Transition and Demographic Challenge.

European electricity markets

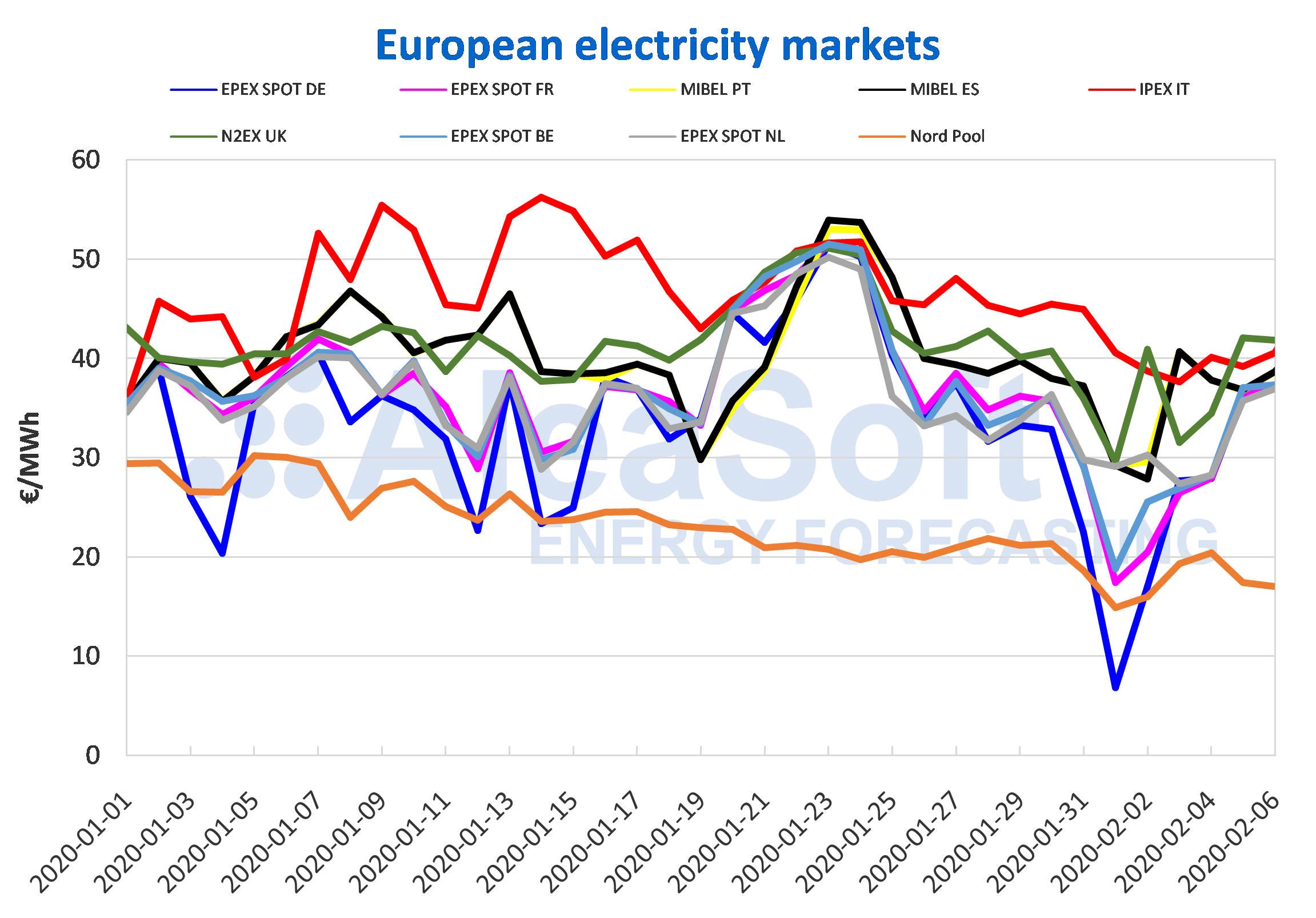

In January, the European electricity markets prices were generally higher than those of December 2019. The increases were between 4.2% of the EPEX SPOT market of Belgium and 21% of the MIBEL market of Spain and Portugal. This increase is mainly due to the increase in electricity demand and the decrease in wind energy production in most markets. However, in the EPEX SPOT market of the Netherlands, the N2EX market of Great Britain and the Nord Pool market of the Nordic countries, the prices fell 0.8%, 8.8% and 34% respectively.

During the first four days of this week, the prices of the European electricity markets decreased compared to the same days of last week. The MIBEL market of Spain and Portugal was the one with the lowest decrease, with a variation of around ‑1.0%. On the other hand, the IPEX market of Italy, despite being the market with the largest decline, of 14%, was the one with the highest average price so far this week, of €39.36/MWh. Meanwhile, the Nord Pool market of the Nordic countries was the second market with the largest variation, ‑13%, and the one with the lowest price, with an average of €18.54/MWh. The EPEX SPOT markets of Germany, France, Belgium and the Netherlands and the N2EX market of Great Britain showed decreases between 4.8% of the German market and 12% of the French market.

So far this week, the EPEX SPOT markets were the most coupled, averaging prices around €32/MWh and with daily values that moved between €26/MWh and €37/MWh. The rest of the European markets were quite decoupled, with daily prices ranging from €32/MWh to €42/MWh in some markets.

According to the analysis carried out by AleaSoft, the decrease in prices during this week is due to a lower electricity demand due to the less cold temperatures of the first days of this week together with an increase in solar energy production across the continent.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Despite the increase in prices of the first days of this week, at AleaSoft the weekly average is expected to be lower than that of last week, as the temperatures begin to be colder than those of the same days of the previous week, which will make the prices at the end of the week higher than those of the same days of the week of January 27. However, on Sunday, the prices may drop considerably in some markets such as the German, where high wind and solar energy production is expected, as well as lower demand for being a weekend.

Iberian market

In January, the average price of the MIBEL market in Spain and Portugal increased by 21% compared to December, this being the highest increase recorded in the prices of European markets. The main causes of this rise are the increase in electricity demand and a 14% decrease in renewable energy production, which led to the increase in production with technologies that offer higher prices such as coal and combined cycles.

As for the first four days of this week, the prices of the MIBEL market in Spain and Portugal had decreases of 1.0% and 1.1% respectively, compared to the same days of the previous week. With average prices of €38.48/MWh for Spain and €38.46/MWh for Portugal, they were the third and fourth markets in the ranking of the markets with the highest prices in Europe so far this week. A lower electricity demand due to less cold temperatures, together with an increase in solar energy production so far this week, lowered prices slightly compared to the same days last week.

At AleaSoft, prices are expected to increase during the rest of the week compared to those of the same days last week due to decreases in temperatures for the coming days that will increase demand. On the other hand, the price for next week it is expected to decrease as a result of increased wind energy production.

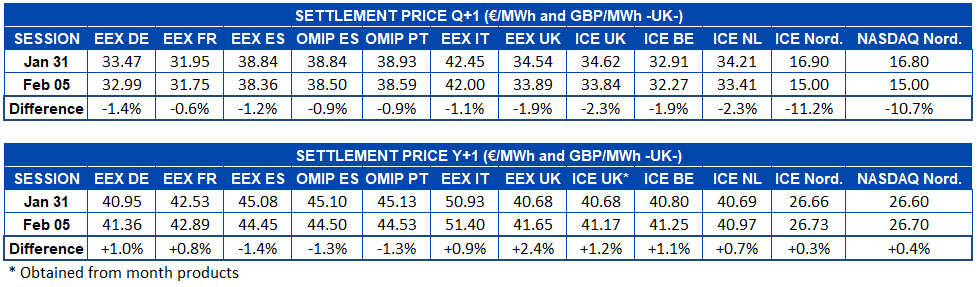

Electricity futures

The prices of the European electricity futures markets for the second quarter of 2020 so far this week had a downward behaviour. The Nordic region, both in the ICE market and in the NASDAQ market continues to surprise. In the session of Wednesday, February 5, the settlement price of both markets was exactly €15/MWh, thus being the markets with the greatest variation, with decreases of more than 10% in both cases. This is the lowest registered price for the Q2-2020 contract and it is because the weather forecasts continue to be very humid, temperate and windy. On the other hand, the EEX market in France was the one with the smallest variation which, when settling yesterday at €31.75/MWh, registered a 0.6% drop compared to Friday, January 31.

However, regarding the electricity futures for the 2021 calendar year, prices had a more heterogeneous behaviour. The Iberian Peninsula was the only region that registered declines, 1.4% in the EEX market of Spain and 1.3% in the OMIP market of Spain and Portugal. On the other hand, in the rest of the markets there were increases, the largest being that of the EEX market of Great Britain, of 2.4%.

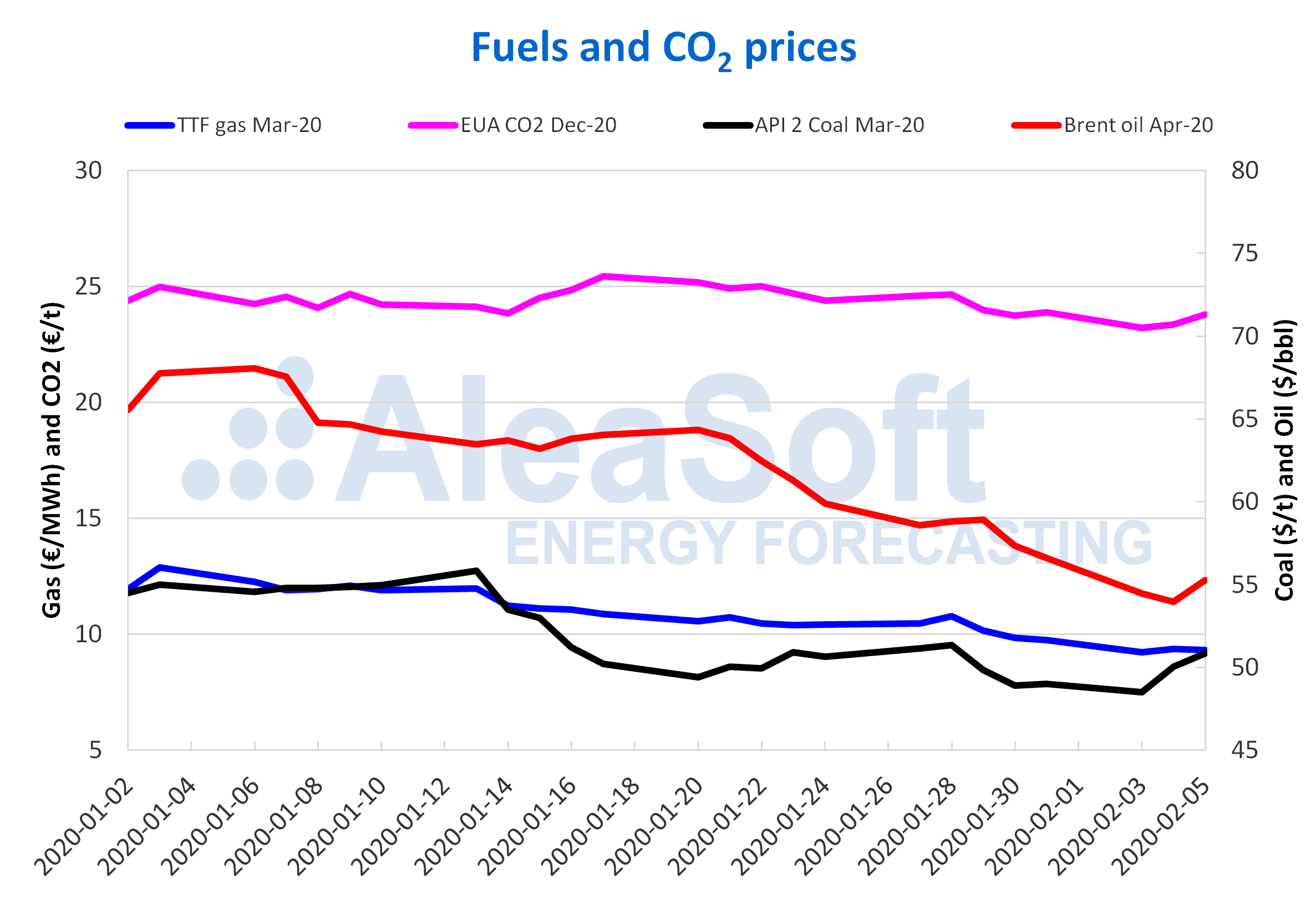

Brent, fuels and CO2

The prices of Brent oil futures for the month of April 2020 in the ICE market continued with the downward trend of previous days until Tuesday, February 4. That day a settlement price of $53.96/bbl was reached, the lowest since December 24, 2018 when a price of $52.78/bbl was registered. However, this Wednesday, February 5, the price increased by 2.4% over the previous day to reach $55.28/bbl.

This increase is influenced by the fact that OPEC+ is considering new production cuts, to counteract the declines in oil prices due to the decline in demand in China because of the coronavirus. The news about advances in the creation of a vaccine against coronavirus also brought some peace of mind to the markets.

The TTF gas futures in the ICE market for the month of March, 2020 registered on Monday, February 3, a settlement price of €9.21/MWh, the lowest in the last two years. The following days of this week, settlement prices stood stable below €9.40/MWh.

The prices of TTF gas in the spot market during the first days of this week have remained fairly stable at around €9.54/MWh. On Tuesday, February 4, the lowest index price of the week of €9.44/MWh was registered, which is also the lowest since mid-October 2019.

The API 2 coal futures in the ICE market for the month of March 2020 reached the lowest settlement price of the last two years on Monday, February 3, with a value of $48.50/t. However, on Tuesday prices started an upward trend and on Wednesday the registered settlement price was $50.85/t, 2.0% higher than the Wednesday of the previous week. In the coming days, this trend could be maintained, influenced by a possible increase in importation in China related to declines in local coal production due to the coronavirus outbreak.

The CO2 emission rights futures in the EEX market for the reference contract of December 2020 on Monday, February 3 reached a settlement price of €23.22/t, the lowest since those registered in the first half of October, 2019. This was influenced by the announcement made last Friday that UK emission rights auctions would resume as of March 4. However, the following days the prices recovered and on Wednesday, February 5 the settlement price was €23.78/t.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: AleaSoft Energy Forecasting.