AleaSoft Energy Forecasting, July 4, 2022. In the first half of 2022, European electricity markets prices rose and registered a half‑yearly record. In most markets, the price for the six months exceeded €200/MWh. Electricity futures also rose. These increases were caused by the maximums registered in gas and CO2 prices. The solar energy production for these six months was the highest in history in all markets and the hourly and daily historical record was reached in most of them during this period.

Photovoltaic and solar thermal energy production and wind energy production

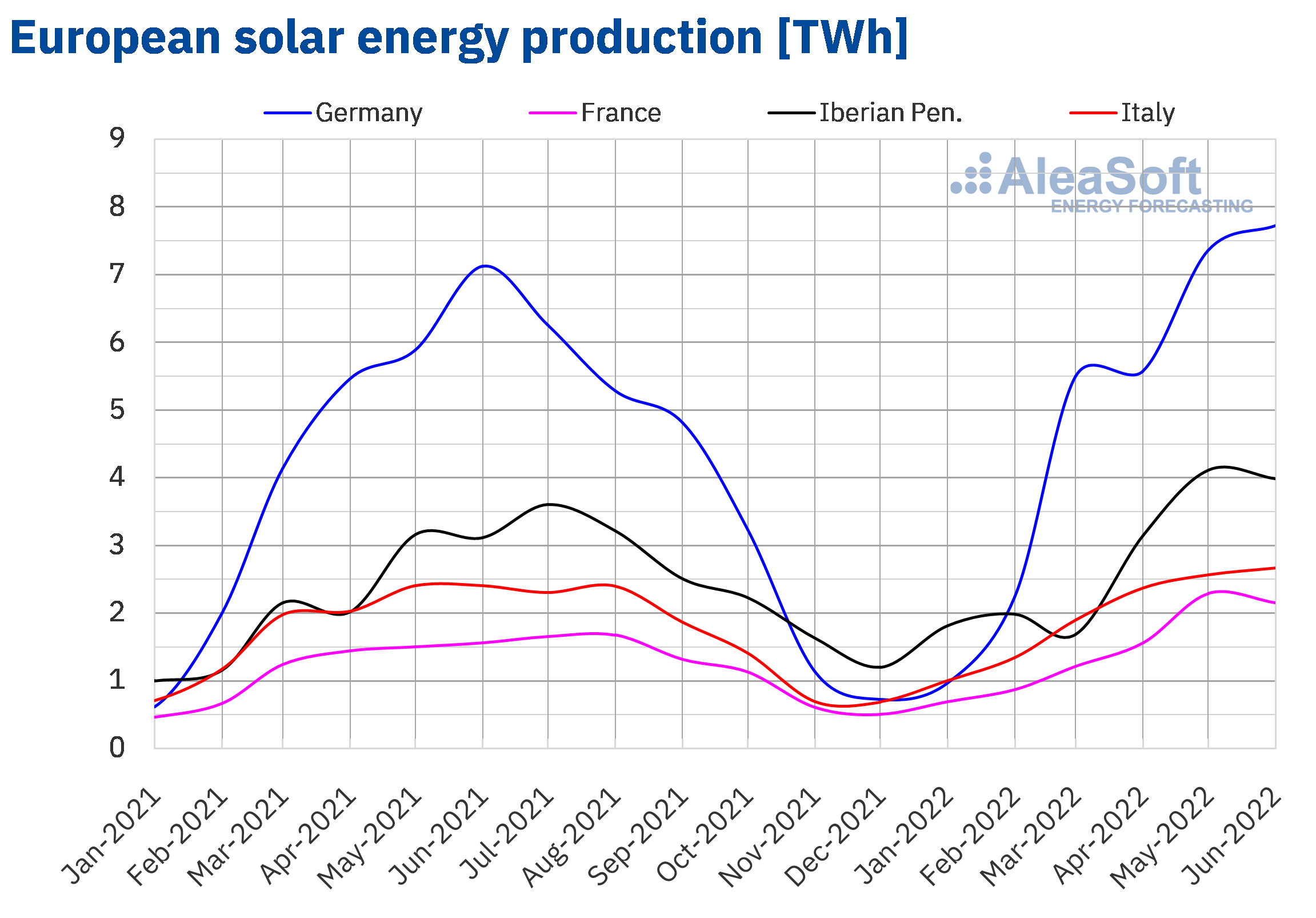

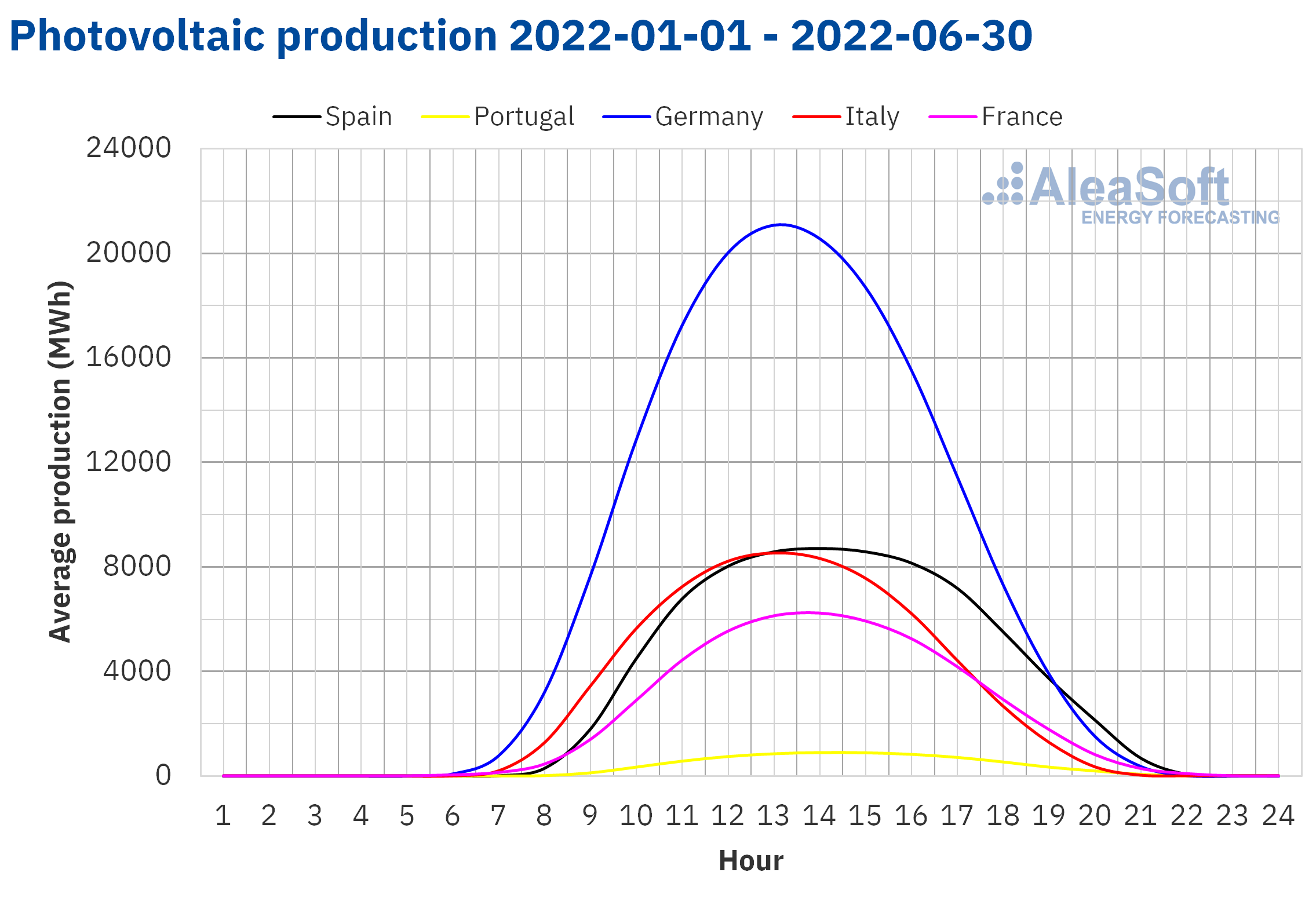

In the first half of 2022, all European markets analysed at AleaSoft Energy Forecasting registered the highest solar energy production for a half year in their history. In addition, except for Italy, all markets registered their historical record for hourly and daily solar energy production during this period. The most recent were those of Portugal and Germany. In Portugal, it was on June 27, when 11 GWh were added and at 13:00, Portuguese time, a solar energy production of 1232 MWh was registered. In Germany, the historical maximums so far were reached on June 15, with a total of 324 GWh and a maximum of 36 598 MW at 13:00. In Spain, the hourly maximum was reached on May 6 at 14:00, with a production of 14 032 MWh, and the daily maximum on May 27, when 151 GWh of solar photovoltaic energy and solar thermal energy were added. In France, the daily maximum was on May 28, with 89 GWh, and the hourly maximum on May 11 at 13:00, with 10 202 MWh.

The growths in solar energy production compared to the first half of 2021 were between 11% of Italy and 66% of Portugal. Comparing with the production registered in the last half of 2021, the increases were between 21% of Spain and 37% of Germany.

During the first half of 2022, 899 MW of solar photovoltaic energy were installed in Mainland Spain, currently totalling 15 841 MW, while the solar thermal energy capacity remains the same as at the end of 2021, 2304 MW. In the case of Portugal, between January and June 2022, 140 MW were installed, the total up to that time being 1538 MW.

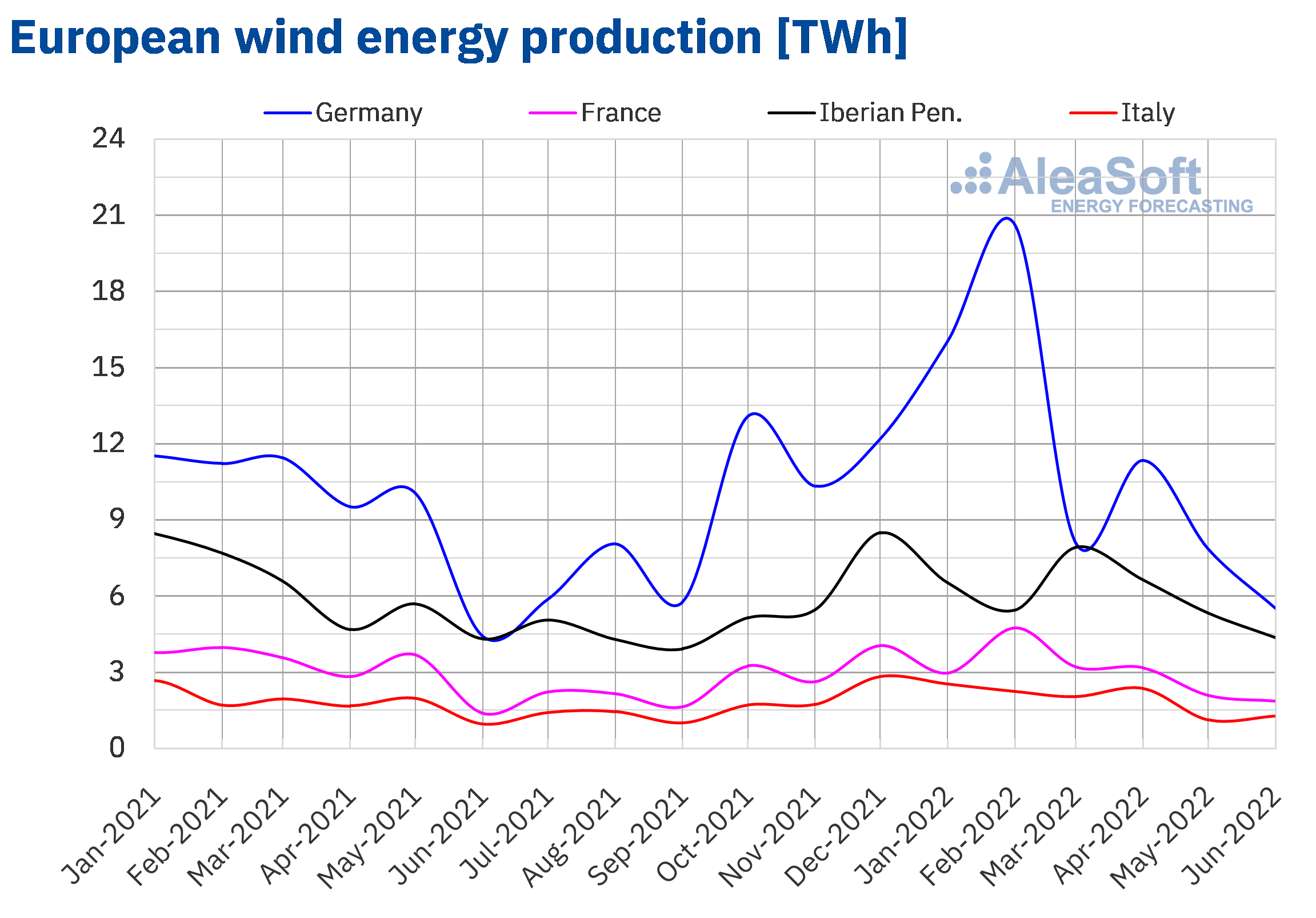

In the case of wind energy production, in the first half of 2022 there was a general increase compared to the previous half, with the largest rise in Germany, of 26%. However, if compared to the first half of 2021, the production with this technology only increased in Germany and Italy, by 19% and 5.9% respectively. In turn, in France, Spain and Portugal, the wind energy production decreased by ‑6.2%, ‑3.2% and ‑2.7% in each case.

In the first six months of 2022, 721 MWh of wind energy were installed in the peninsular territory of Spain, remaining this technology as the one with the highest installed capacity, with 28 757 MW.

Electricity demand

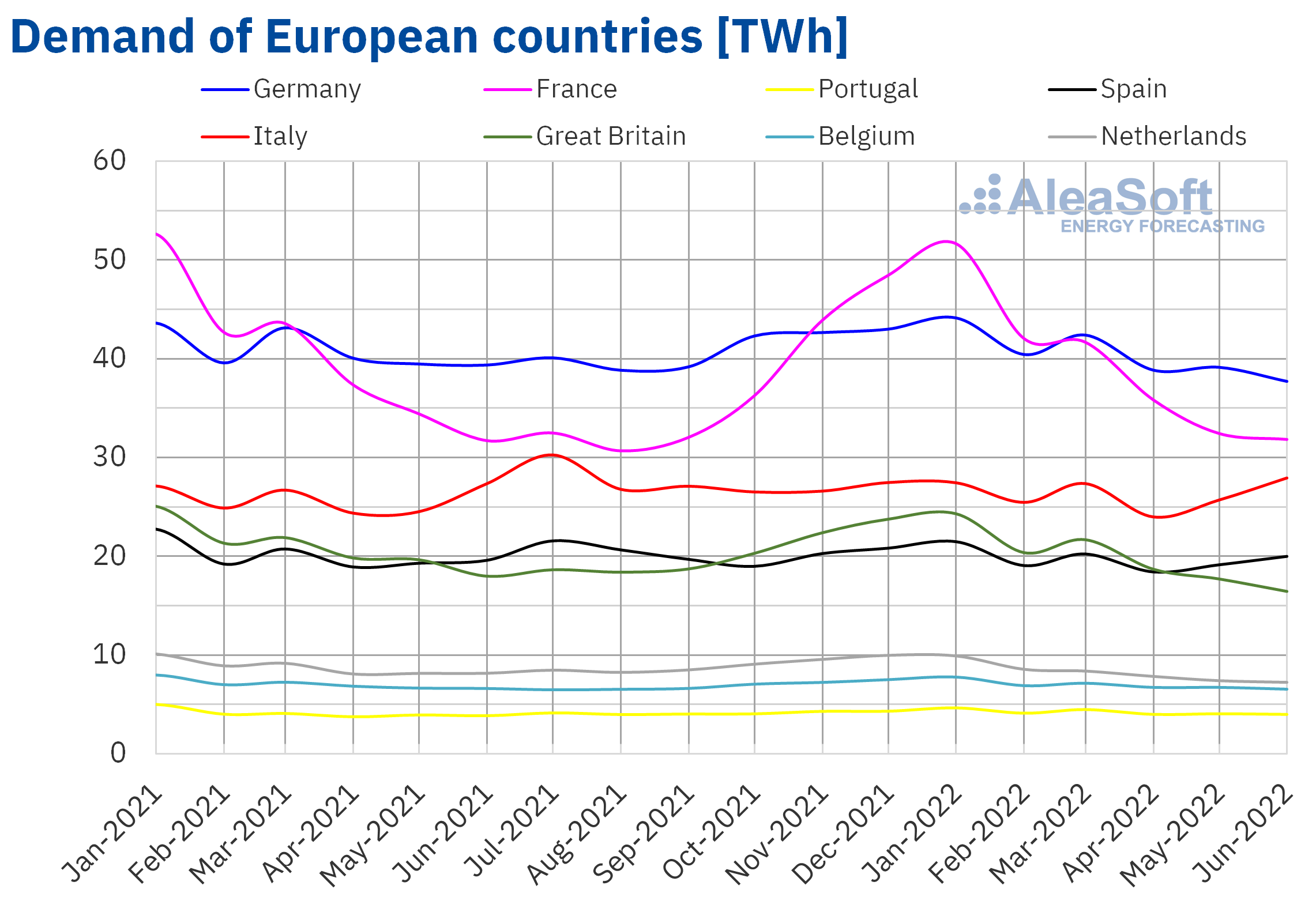

During the first half of 2022, the electricity demand decreased year‑on‑year in most of the analysed European markets. The largest variation was registered in the market of the Netherlands, where there was a decrease of 6.3%, followed by the British market, with a fall of 5.2%. In the markets of Germany, Belgium, Spain and France, the decreases were between 1.0% and 2.8%. The exceptions were the markets of Portugal and Italy where the demand increased by 2.6% and 1.9% respectively. Regarding the average temperatures of the first six months of 2022, there were generalised increases compared to the same period of 2021 that were between 0.5 °C and 1.8 °C.

In the comparison with the previous six months, the demand of the first half of 2022 behaved unevenly. On the one hand, in the market of the Netherlands it fell by 8.5%, and there were also falls in the markets of Germany, Great Britain and Italy, which were between 1.4% and 4.2%. While, on the other hand, increases were registered in the markets of Belgium, Portugal, Spain and France of between 0.9% and 5.2%.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

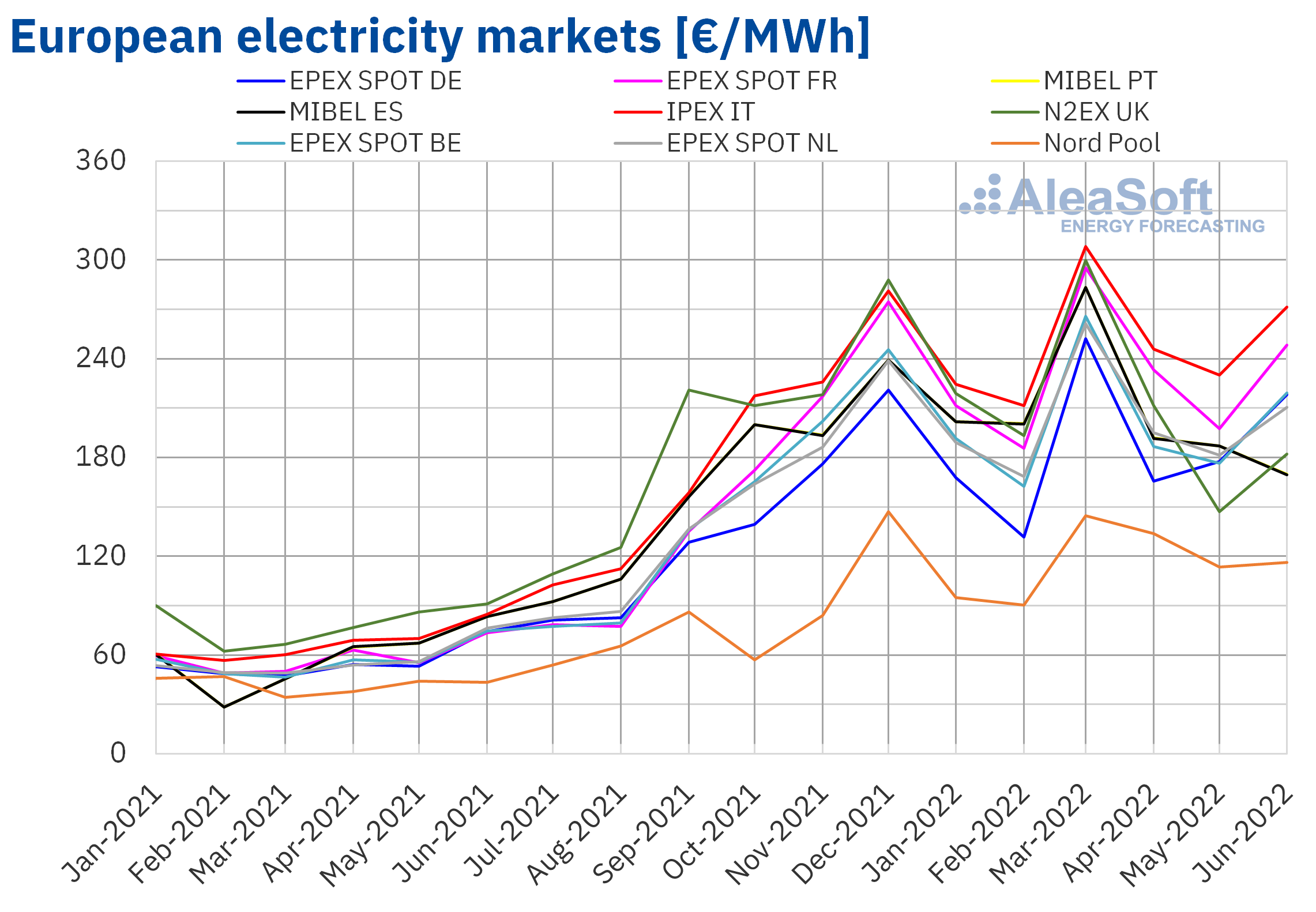

In the first half of 2022, the half‑yearly average price was above €200/MWh in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exceptions were the Nord Pool market of the Nordic countries and the EPEX SPOT market of Germany, with averages of €115.87/MWh and €186.24/MWh, respectively. In contrast, the highest half‑yearly average price, of €249.09/MWh, was that of the IPEX market of Italy, followed by that of the EPEX SPOT market of France, of €229.08/MWh. In the rest of the markets, the averages were between €200.93/MWh of the EPEX SPOT market of Belgium and €209.77/MWh of the N2EX market of the United Kingdom. These half‑yeraly prices so high were historical highs in all markets.

Compared to the second half of 2021, the largest price rise in the first half of 2022, of 44%, was registered in the French market, while the smallest increase was that of the British market, of 7.4%. The rest of the markets had price increases between 25% of the MIBEL market of Spain and Portugal and 41% of the Nord Pool market. In the case of the Iberian market, if the adjustment that some consumers must pay as compensation for the temporary mechanism for adjusting production costs that started to be applied on June 14 as part of the Iberian exceptionality is taken into account, the increase in prices of the first half of 2022 compared to the previous half rises to 30%.

If average prices of the first half of 2022 are compared with those registered in the same half of 2021, prices increased significantly in all markets. The highest price rise was that of the French market, of 292%, while the smallest increase was that of the British market, of 166%. In the rest of the markets, the price increases were between 176% of the Nordic market and 272% of the Italian market.

During the first half of 2022, the month in which the highest average prices were registered in the European electricity markets was March. That month, the averages reached record values in all analysed electricity markets, except in the Nord Pool market, where the second highest price after that of December 2021 was registered. In March, prices increased influenced by the start of the war in Ukraine that caused significant increases in the gas price.

Regarding hourly prices, most of the European electricity markets registered the maximum values of the period on March 8. That day the hourly prices reached record values around €700/MWh in various markets. However, in the British market, there were higher prices in January, when they exceeded £1100/MWh on three occasions. In the case of the French market, a higher hourly price, of €2987.78/MWh, was also registered on April 4, which was the highest since 2009 in that market. That high price was influenced by low temperatures and a lower level of nuclear energy production.

In the analysed period, half‑yearly gas and CO2 emission rights prices reached maximums due to the conflict between Russia and Ukraine. This led to an increase in European electricity markets prices, despite the general increase in solar energy production compared to both the first and second half of 2021.

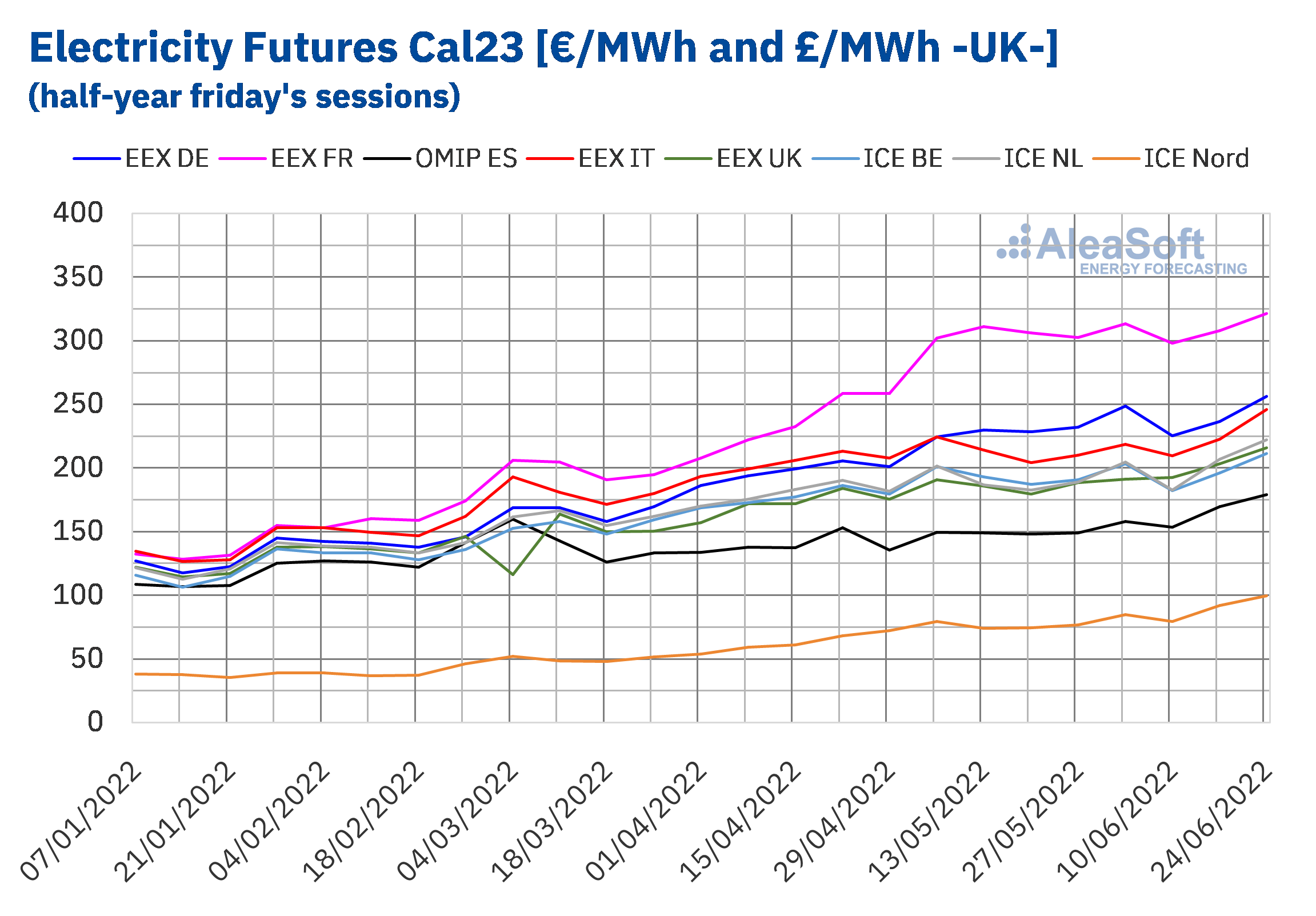

Electricity futures

During the first half of 2022, electricity futures prices for 2023 registered an upward behaviour. The tendency, moreover, was towards dispersion. Although the year began with most markets with prices between €100/MWh and €140/MWh, with the exception of the Nordic countries, after the session of the last Friday of the period, prices were in a much wider range, from €170/MWh to €330/MWh.

During the analysed period, the EEX market of France remained most of the time as the market with the highest prices in Europe, while the ICE market and the NASDAQ market of the Nordic countries were those with the lowest prices.

In general terms, the ICE market of the Nordic countries registered the largest rise during the period, with an increase of 163%. It is noteworthy that, also, the futures of Germany and France in the EEX market ended the first half of the year with prices of more than double their initial price. In absolute terms, the highest rise is that of France, of €189.03/MWh.

On the other hand, the futures of Spain and Portugal in the OMIP market and the EEX market were those with the smallest increase, with rises from 61% to 65%, due to the effect of the announcement and subsequent entry into operation of the Iberian exceptionality.

The last days of the period were characterised by large rises in markets prices. The EEX market of France was the protagonist, setting a settlement price of €365.67/MWh in the session of June 30. In the rest of the markets there were also notable price rises in the last week of the period, except in the markets of the Iberian Peninsula and the Nordic countries, where prices remained high, but without such a marked upward trend.

Brent, fuels and CO2

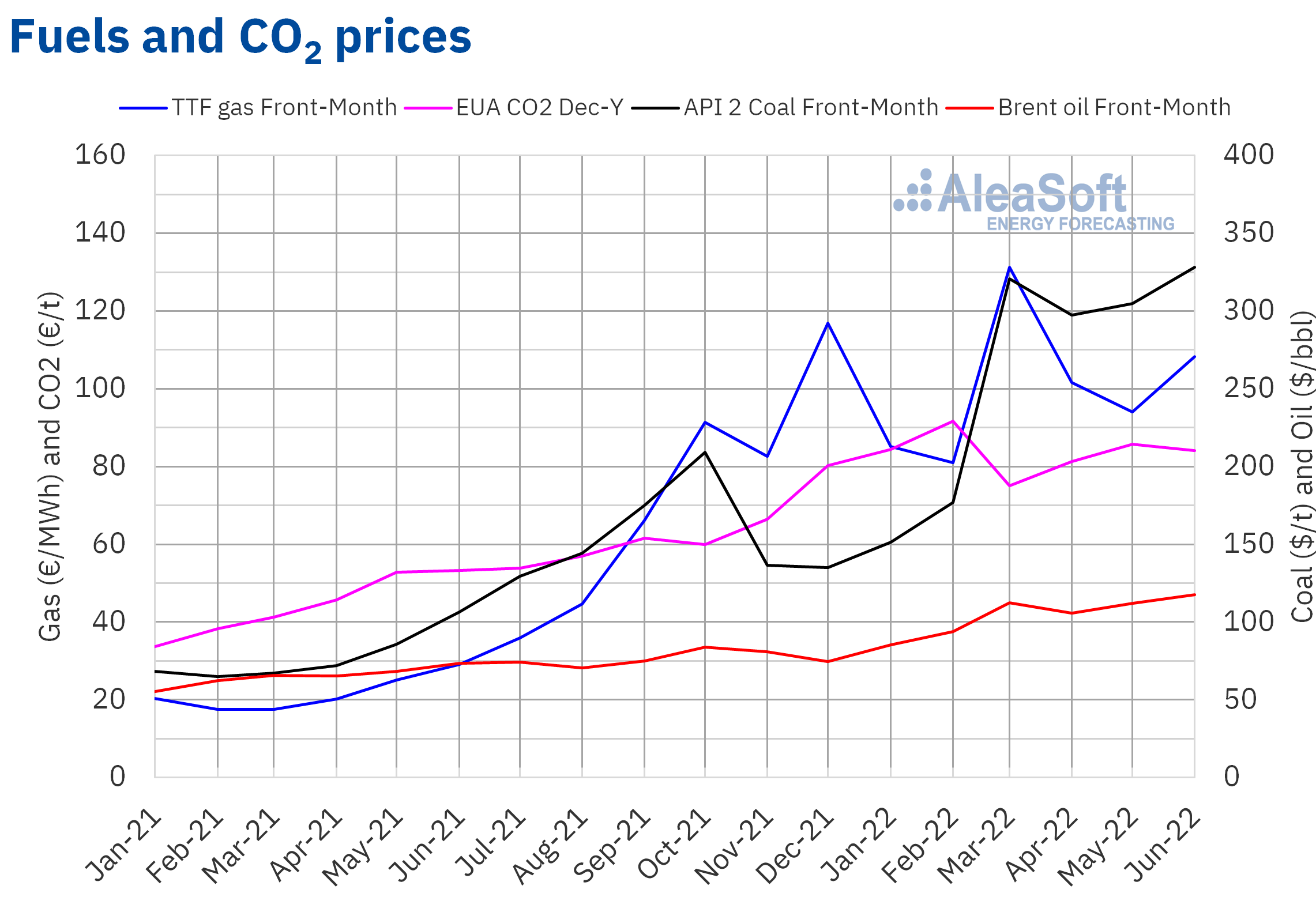

Brent oil futures for the Front‑Month in the ICE market registered a half‑yearly average price of $104.94/bbl in the first half of 2022. This value is 37% higher than that reached by the Front‑Month futures for the second half of 2021, of $76.44/bbl. It is also 61% higher than that corresponding to the Front‑Month futures traded in the first half of 2021, of $65.20/bbl. In addition, the price of the first half of 2022 was the highest half-yearly price since 2014.

In the first half of 2022, Brent oil prices were highly influenced by the evolution of the conflict in Ukraine, which led to a rise in prices, reaching a historical maximum settlement price of $127.98/bbl on March 8, the highest since July 2008.

However, concerns about the evolution of the economy and the new coronavirus outbreaks, which caused new lockdowns in China, exerted their downward influence on prices, especially in April. As a consequence, the average prices for April and May were lower than those for the month of March.

On the other hand, at the OPEC+ meeting of Thursday, June 30, the increases agreed for August were ratified, with which the levels prior to the pandemic would be recovered. However, some member countries have been having problems meeting the established quotas. Furthermore, in the case of Russia, the production will also decrease due to the sanctions on its exports. For these reasons, there are doubts that the agreed production levels will be reached. In addition, the lack of progress in the negotiations hinders the possibility of lifting sanctions on crude oil exports from Iran.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during the first half of 2022 was €101.00/MWh. Compared to that of the Front‑Month futures traded in the second half of 2021, of €73.04/MWh, the average increased by 38%. If compared to the Front‑Month futures traded in the first half of 2021, when the average price was €21.57/MWh, there was a 368% rise.

In the first half of 2022, the war in Ukraine also exerted its influence on TTF gas futures prices. After the start of the invasion, the fear of interruptions in the supply led to a rapid increase in prices until reaching a historical maximum of €227.20/MWh on Monday, March 7. However, as gas flows from Russia continued and with the increase in imports of liquefied natural gas by sea, prices fell again.

But, as a response to the imposed sanctions, Russia demanded that the payment for the gas supply was made in roubles. Given the refusal to comply with this requirement, several European Union countries saw the gas supply from Russia cut in the second half of the period. In addition, in the last weeks of the half‑year, the flow through the Nord Stream 1 gas pipeline decreased due to technical difficulties. According to Gazprom, these could not be resolved due to the sanctions imposed on Russia. Since the end of the second week of June, the supply of liquefied natural gas was also affected by the temporary closure of a plant dedicated to its export from the United States.

On the other hand, the annual maintenance work of the Nord Stream 1 gas pipeline is scheduled to begin on July 11, for which the supply must be completely interrupted during ten days. In Germany there is a concern that the supply will not be restored after this period of time.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2022, they reached an average price in the first half of 2022 of €83.53/t, 32% higher than that of the previous half‑year for the reference contract of December 2021, of €63.31/t. If compared to the average of the first half of 2021 for the reference contract of December of that year, of €44.34/t, the average for the first half of 2022 was 88% higher. On February 8, 2022, the maximum settlement price in history, of €96.93/t, was reached.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

Coinciding with the start of the second half of the year, at AleaSoft Energy Forecasting and AleaGreen the long‑term price curves forecasting reports for all European electricity markets will be updated, incorporating the new changes that are occurring in the sector. These hourly forecasts are necessary for PPA, renewable energy assets valuation, cogeneration and for the development of batteries. Until July 15, a personalised special promotion of these reports is being offered. A promotion of short‑ and mid‑term price forecasts is also being offered.

At AleaSoft Energy Forecasting and AleaGreen, webinars are being held monthly to analyse the evolution of the energy markets and the most important issues of the present and future of the sector in Europe. The July edition will take place on July 14 and will focus on green hydrogen. To delve into this topic, there will be guest speakers from H2B2, a leading technology company specialised in renewable hydrogen, who will analyse hydrogen as a strategic vector: sectors, acceleration and national leadership, renewable hydrogen business models and existing references, aid and regulation.